Global Zein Protein Market Size, Share, And Industry Analysis Report By Grade (Food Grade, Pharma Grade, Industrial Grade), By Form (Powder, Liquid, Granular), By Function (Emulsifier, Coating Agent, Binding Agent, Controlled-Release Agent, Others), By Application (Food and Beverages, Personal Care and Cosmetics, Pharmaceuticals, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172641

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

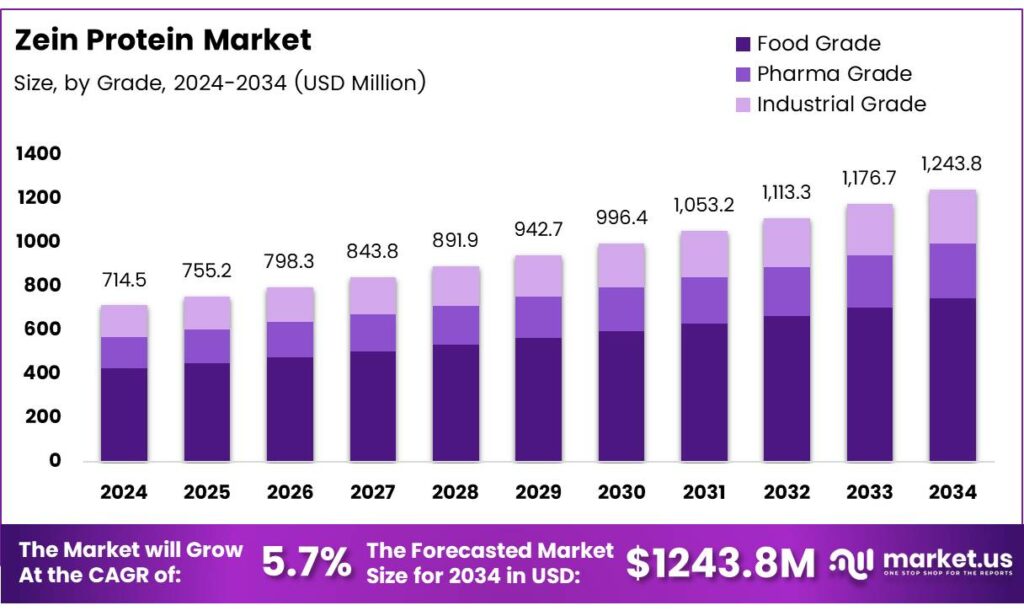

The Global Zein Protein Market size is expected to be worth around USD 1243.8 million by 2034, from USD 714.5 million in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

The Zein Protein Market is the commercial ecosystem built around corn-derived zein protein used in food, pharma, nutraceuticals, agriculture, and sustainable packaging. Importantly, zein supports clean-label positioning, bio-based materials, and controlled-release technologies, driving steady commercial relevance across emerging and mature economies.

Demand accelerates as formulators shift toward plant-based proteins with functional performance. Consequently, zein protein benefits from its film-forming ability, biodegradability, and compatibility with encapsulation systems. Moreover, rising interest in antimicrobial coatings, edible films, and active packaging strengthens long-term market expansion opportunities across food safety and crop protection applications.

From a functional science standpoint, zein’s hydrophobic nature underpins its strong market value. Zein is soluble in over 10% ethanol, enabling efficient encapsulation of hydrophobic bioactives. Delivery efficiency improves, supporting nutraceutical, preservative, and flavor-protection uses within regulated food and pharmaceutical applications.

- Encapsulation efficiency exceeded 99.9% at 6 °C and 99.8% at 20 °C for carvacrol-loaded nanoparticles over 90 days. Meanwhile, thymol-loaded systems maintained 92.4% efficiency, with nanoparticle sizes ranging from 108–122 nm and zeta potential between +9 and +30 mV, indicating strong dispersion stability.

Antimicrobial and coating innovations further expand zein’s application scope. Zein-based nanoparticles showed MIC values of 135 µg/mL and 270 µg/mL against plant pathogens, achieving 95.50% encapsulation efficiency. Additionally, polydopamine-coated systems reached particle sizes near 725 nm with 81.3% efficiency, positioning zein as a scalable bio-encapsulation platform.

Key Takeaways

- The Global Zein Protein Market is projected to grow from USD 714.5 million in 2024 to USD 1243.8 million by 2034, at a CAGR of 5.7%.

- Food Grade is the leading grade segment, accounting for a dominant 52.8% market share due to clean-label and plant-based food demand.

- Powder Form dominates the market with a share of 49.1%, supported by ease of storage, transport, and formulation flexibility.

- Emulsifier Applications hold the largest share at 34.5%, driven by zein’s effectiveness in stabilizing hydrophobic compounds.

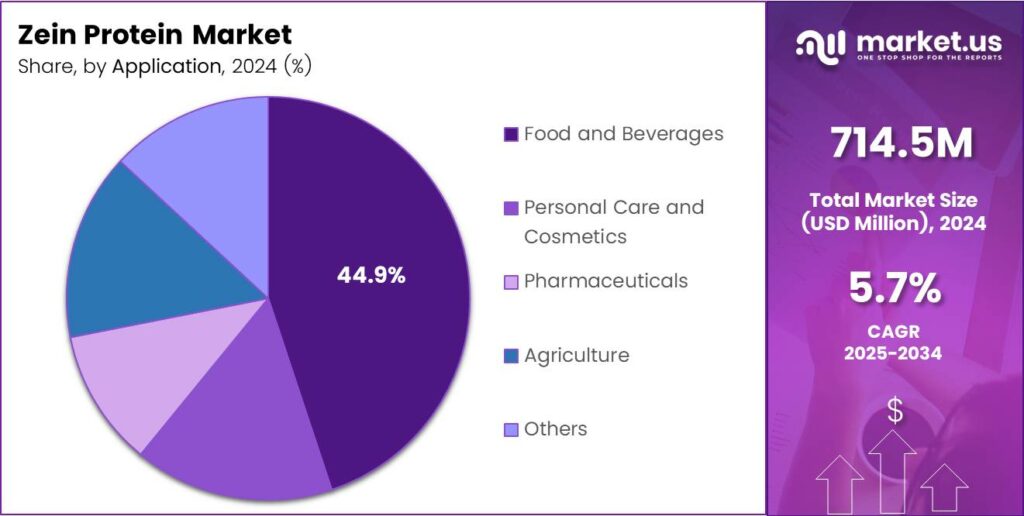

- Food and Beverages represent the largest application segment with a market share of 44.9%, led by edible coatings and encapsulation uses.

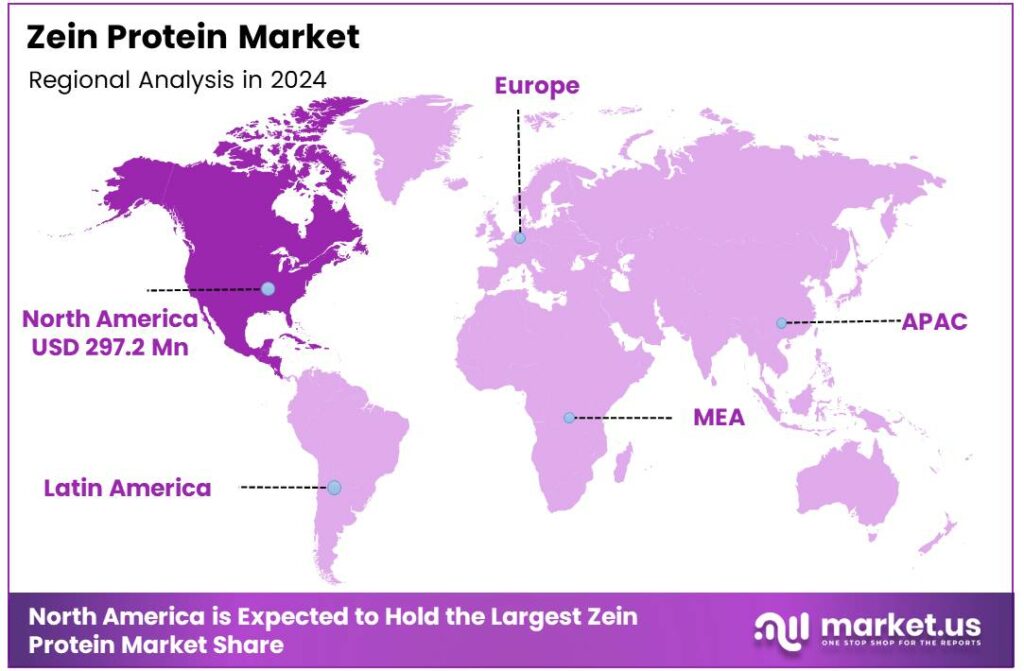

- North America is the dominant regional market, holding a 41.6% share and valued at USD 297.2 million in 2024.

By Grade Analysis

Food Grade dominates with 52.8% due to its wide use in clean-label food and nutrition products.

In 2024, Food Grade held a dominant market position in the By Grade Analysis segment of the Zein Protein Market, with a 52.8% share. This leadership is driven by rising demand for plant-based coatings, encapsulation systems, and protein enrichment in food and beverage formulations, where natural origin and regulatory acceptance are critical.

Pharma Grade zein plays a specialized role in controlled-release drug delivery and nutraceutical encapsulation. Its film-forming and hydrophobic properties support oral dosage stability. Although smaller in share, growth remains steady due to expanding interest in bio-based excipients and advanced delivery technologies.

Industrial-grade zein is mainly used in adhesives, inks, coatings, and biodegradable materials. While it holds a comparatively limited market presence, it benefits from sustainability-driven material substitution and increasing research into bio-based industrial polymers.

By Form Analysis

Powder dominates with 49.1% owing to ease of handling and formulation flexibility.

In 2024, Powder held a dominant market position in the By Form Analysis segment of the Zein Protein Market, with a 49.1% share. Its long shelf life, stable transport characteristics, and compatibility with dry blending make it the preferred choice across food, pharmaceutical, and industrial applications.

Liquid zein supports ready-to-use coatings, emulsions, and spray applications. It enables faster processing and uniform application, particularly in food glazing and pharmaceutical film formation. However, storage sensitivity limits its adoption compared to powder formats.

Granular zein serves niche processing needs where controlled dissolution and reduced dust formation are required. While adoption remains limited, it finds relevance in specialty manufacturing environments seeking improved handling safety and consistency.

By Function Analysis

Emulsifier dominates with 34.5% due to strong performance in stabilizing hydrophobic compounds.

In 2024, Emulsifier held a dominant market position in the By Function Analysis segment of the Zein Protein Market, with a 34.5% share. Zein’s hydrophobic nature supports stable emulsions in functional foods, nutraceuticals, and flavor systems, ensuring improved dispersion and shelf stability.

Coating Agent applications benefit from zein’s excellent film-forming ability. It is widely used to protect food ingredients, pharmaceuticals, and agricultural inputs, enhancing moisture resistance and controlled release while maintaining a natural profile.

Binding Agent functionality supports tablet integrity, food structuring, and material cohesion. Zein improves mechanical strength and product uniformity, although its usage is often application-specific. Controlled-Release Agent use is expanding in pharmaceuticals and agriculture. Zein enables gradual active ingredient release, supporting efficacy and reduced dosing frequency.

By Application Analysis

Food and Beverages dominate with 44.9% driven by clean-label and plant-based demand.

In 2024, Food and Beverages held a dominant market position in the By Application Analysis segment of the Zein Protein Market, with a 44.9% share. Zein is widely used for edible coatings, flavor encapsulation, and protein fortification, aligning with natural and allergen-free product trends.

Personal Care and Cosmetics applications leverage zein for film formation and ingredient protection. It enhances product texture and stability, particularly in sustainable and bio-based cosmetic formulations. Pharmaceuticals utilize zein for drug delivery, tablet coatings, and nutraceutical encapsulation. Its biocompatibility supports safe and effective dosage forms.

Agriculture applications focus on controlled-release fertilizers and crop protection systems, where zein improves efficiency and reduces environmental impact. Others include industrial and research uses, contributing steady demand through innovation-driven adoption.

Key Market Segments

By Grade

- Food Grade

- Pharma Grade

- Industrial Grade

By Form

- Powder

- Liquid

- Granular

By Function

- Emulsifier

- Coating Agent

- Binding Agent

- Controlled-Release Agent

- Others

By Application

- Food and Beverages

- Personal Care and Cosmetics

- Pharmaceuticals

- Agriculture

- Others

Emerging Trends

Innovation in Bio-Based Materials Shapes Market Trends

One of the key trending factors in the zein protein market is innovation in bio-based and biodegradable materials. Manufacturers are increasingly using zein to replace synthetic polymers in coatings, films, and packaging applications. Zein in clean-label food reformulation.

- Food brands are reducing artificial additives and turning to natural proteins like zein to achieve texture, gloss, and protection in snacks and confectionery products. The U.S. produced over 389 million metric tonnes of corn, ensuring a stable and scalable raw material base for zein extraction. This abundant supply makes zein attractive for food manufacturers seeking cost-controlled bio-materials.

In nutraceuticals, nano-delivery systems using zein are gaining attention. Zein nanoparticles for improved stability and controlled release of active compounds. Customization of zein blends is also trending. Companies are modifying zein with other biopolymers to improve solubility and functionality, expanding its usability across industries.

Drivers

Rising Demand for Plant-Based and Clean-Label Proteins Drives Market Growth

The zein protein market is mainly driven by the global shift toward plant-based and clean-label ingredients. Zein, derived from corn, fits well with food manufacturers seeking natural, non-animal proteins that meet vegan and vegetarian preferences. Its plant origin also supports non-GMO and allergen-friendly positioning in many formulations.

- Zein’s functional performance. Its natural film-forming, binding, and emulsifying properties make it valuable in food coatings, confectionery, and snack applications. The USDA shows that corn accounts for roughly 31% of total U.S. crop production value, highlighting its economic importance and processing infrastructure.

Growth in nutraceuticals and functional foods also supports demand. Zein is widely used for encapsulating sensitive bioactive ingredients, such as flavors, vitamins, and antioxidants. This protects actives during processing and improves controlled release in the body.

Restraints

Limited Solubility and Higher Processing Costs Restrain Market Expansion

One of the key restraints in the zein protein market is its limited solubility in water. Zein dissolves mainly in alcohol-based systems, which restricts its direct use in many aqueous food and beverage formulations. This creates formulation challenges for manufacturers aiming for broader applications.

- The USDA’s BioPreferred Program has already helped label more than 16,000 bio-based products, encouraging food companies to replace petroleum-based coatings with plant-derived alternatives. In parallel, the European Union’s Farm to Fork strategy targets a 50% reduction in food waste by 2030, indirectly supporting natural preservation technologies.

Processing complexity is another concern. Extracting and purifying zein requires controlled conditions and specialized equipment, increasing production costs. These higher costs can limit adoption among small and mid-sized manufacturers.

Growth Factors

Expanding Use in Encapsulation and Controlled Release Creates New Opportunities

A major growth opportunity for the zein protein market lies in advanced encapsulation technologies. Zein’s ability to form stable nanoparticles makes it suitable for protecting sensitive ingredients such as probiotics, essential oils, and nutraceutical compounds.

Rising demand for functional foods and dietary supplements supports this opportunity. Consumers increasingly look for products with improved bioavailability and longer shelf life, both of which zein-based encapsulation can provide. Regulatory and labeling requirements can further slow market growth. In some regions, strict food and pharmaceutical regulations increase approval timelines, especially for new applications.

Pharmaceutical applications also present strong potential. Zein is being explored for controlled drug release systems due to its biodegradability and compatibility with the human body. This opens doors for its use in oral drug coatings and targeted delivery solutions.

Regional Analysis

North America Dominates the Zein Protein Market with a Market Share of 41.6%, Valued at USD 297.2 Million

North America leads the zein protein market due to strong demand for plant-based ingredients across food, nutraceuticals, and pharmaceutical applications. In 2024, the region accounted for a dominant 41.6% share, reaching a market value of USD 297.2 million. High awareness of clean-label formulations, advanced food processing infrastructure, and steady R&D activity support consistent adoption.

Europe represents a mature and steadily growing zein protein market, supported by rising preference for natural excipients and bio-based coatings. Food, pharmaceutical, and personal care industries increasingly use zein for encapsulation and controlled-release applications. Strong sustainability regulations and demand for non-synthetic ingredients continue to shape product development.

Asia Pacific shows strong growth potential due to expanding food processing industries and rising adoption of plant-based proteins. Increasing demand for nutraceuticals, functional foods, and edible coatings supports zein protein usage. Improving manufacturing capabilities and growing health awareness contribute to market expansion. The region benefits from a large consumer base and evolving dietary preferences.

The Middle East and Africa market is at a developing stage, driven by gradual growth in food fortification and pharmaceutical formulation activities. Demand is supported by increasing interest in natural stabilizers and coatings. While adoption remains limited compared to developed regions, improving food safety standards and import reliance support gradual market penetration.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Roquette Frères in 2024 is positioned as a formulation-first supplier, using its plant-protein know-how to support zein adoption in food, nutraceutical, and functional ingredient systems. Its strength is helping customers move from “ingredient purchase” to “performance outcome,” especially where film-forming, binding, and controlled-release behavior matter. The company’s broad technical service approach supports faster qualification cycles for brands that need consistent specs and documentation.

Cargill, Incorporated, remains a scale-and-access player in 2024, benefiting from deep relationships across food and beverage, feed, and industrial customers. In zein-related applications, it tends to win where buyers value supply reliability, risk management, and the ability to integrate across corn-based value chains. Cargill’s customer-facing innovation pipelines because they can pull zein into new use cases like edible coatings, encapsulation, and texture systems.

Global Protein Products Inc. is viewed in 2024 as a focused specialist, leaning on narrower portfolios and application-driven selling to compete effectively. Its practical advantage is responsiveness—supporting small-to-mid buyers that need tailored grades, flexible order quantities, and quick turnaround for R&D trials. This kind of agility can be a differentiator as zein demand grows beyond mainstream food uses into cosmetics and specialty industrial formulations.

Flo Enterprises LLC is typically assessed as a niche operator in 2024, serving customers who prioritize consistency, straightforward procurement, and dependable lot-to-lot performance. From a market viewpoint, it benefits when demand is fragmented across many small applications, coatings, binders, and specialty blends—where personalized service and stable quality can outweigh pure scale.

Top Key Players in the Market

- Roquette Frères

- Cargill, Incorporated

- Global Protein Products Inc.

- Flo Enterprises LLC

- BIOZEIN TECHNOLOGY CORP. LTD.

- Nordmann Rassmann GmbH

- Haihang Industry Co., Ltd

- ZeinPharma

Recent Developments

- In 2024, the FDA responded with a no-questions letter to Cargill’s GRAS Notice 1069 for ethanol-extracted corn protein, derived from corn gluten meal and primarily composed of zein and glutelin proteins. This product is approved for use as a binder in meat/poultry and as a protein source, stabilizer, thickener, formulation aid, or emulsifier in other foods.

- In 2024, Roquette primarily focuses on other plant-based proteins, such as pea protein isolates, which have been supplied for government-funded research on vitamin D3-fortified plant-based meat analogs. Their involvement in starch and protein processing is noted in older USDA reports.

Report Scope

Report Features Description Market Value (2024) USD 714.5 Million Forecast Revenue (2034) USD 1243.8 Million CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Food Grade, Pharma Grade, Industrial Grade), By Form (Powder, Liquid, Granular), By Function (Emulsifier, Coating Agent, Binding Agent, Controlled-Release Agent, Others), By Application (Food and Beverages, Personal Care and Cosmetics, Pharmaceuticals, Agriculture, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Roquette Frères, Cargill, Incorporated, Global Protein Products Inc., Flo Enterprises LLC, BIOZEIN TECHNOLOGY CORP. LTD., Nordmann Rassmann GmbH, Haihang Industry Co., Ltd, ZeinPharma Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Roquette Frères

- Cargill, Incorporated

- Global Protein Products Inc.

- Flo Enterprises LLC

- BIOZEIN TECHNOLOGY CORP. LTD.

- Nordmann Rassmann GmbH

- Haihang Industry Co., Ltd

- ZeinPharma