Global White Pepper Market By Product Type (Organic, Conventional), By Form Type (Ground White Pepper, Whole White Pepper, Rough Cracked White Pepper), By Application (Food and Beverage, Personal care, Healthcare, Others), By Distribution Channel (Departmental Store, Grocery Store, Modern Trade, Online Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast: 2024-2033

- Published date: Dec 2024

- Report ID: 134712

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

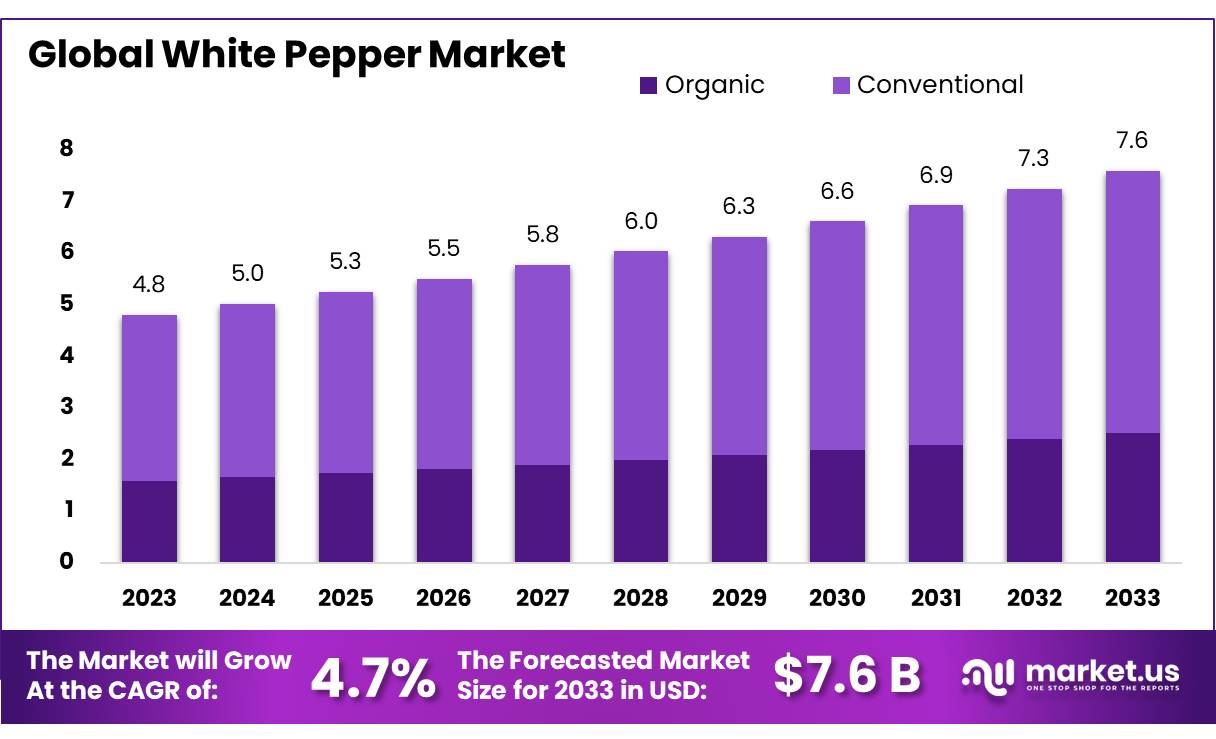

The Global White Pepper Market size is expected to be worth around USD 7.6 Bn by 2033, from USD 4.8 Bn in 2023, growing at a CAGR of 4.7% during the forecast period from 2024 to 2033.

White pepper is a spice made from the seeds of the Piper nigrum plant, which is the same plant that produces black pepper. The key difference between white and black pepper lies in the processing method. White pepper is obtained by removing the outer black skin of the peppercorn, leaving only the inner seed.

In terms of global production, Indonesia and India are among the largest producers of white pepper. Indonesia alone accounts for over 50% of global white pepper production. In 2022, global white pepper production was estimated to be around 70,000 tons, with demand steadily increasing in the food industry due to the growing popularity of ethnic and international cuisines.

White pepper is increasingly being used in food production, pharmaceuticals, and personal care products due to its milder flavor and potential health benefits. In 2022, global production of white pepper was approximately 70,000 tons, with Indonesia and India contributing more than 55% of the total output.

According to FAOSTAT, Indonesia is the largest exporter, accounting for over 40% of global white pepper exports, followed by India, which holds a share of about 15%. The demand for white pepper in food production is driven by the growing popularity of Asian and ethnic cuisines, as well as its applications in sauces, soups, and health products.

In terms of regulatory measures, the Food and Drug Administration (FDA) in the United States monitors the quality and safety of spices, including white pepper, ensuring that products meet hygiene and safety standards.

Additionally, the European Union has set maximum residue limits (MRLs) for pesticides in spices, including white pepper, as part of its Regulation (EC) No 396/2005, which helps control the quality and safety of imported white pepper. These regulations are significant in shaping both the export and import markets for the spice, affecting prices and trade flows.

From an innovation perspective, companies in the spice industry are increasingly focusing on improving production techniques and expanding their product offerings. For instance, PT. Indofood Sukses Makmur Tbk, a major player in Indonesia, invested USD 50 million in 2023 to enhance its spice processing capabilities, with a focus on expanding its white pepper product line.

Partnerships and mergers also play a key role in the market’s growth. In 2023, Ajinomoto Co., a major food company, entered into a strategic partnership with Vietnam-based spice producer, Vinasoy to strengthen its white pepper supply chain and meet growing demand in Asian markets.

Furthermore, government initiatives in India under the National Mission on Sustainable Agriculture are helping to improve the production and export quality of white pepper, providing farmers with subsidies and modern agricultural techniques. These factors, combined with a steady increase in global demand, suggest strong growth prospects for the white pepper market.

Key Takeaways

- White Pepper Market size is expected to be worth around USD 7.6 Bn by 2033, from USD 4.8 Bn in 2023, growing at a CAGR of 4.7%.

- Conventional white pepper held a dominant market position, capturing more than a 67.4% share of the global market.

- Ground White Pepper held a dominant market position, capturing more than a 57.3% share of the global market.

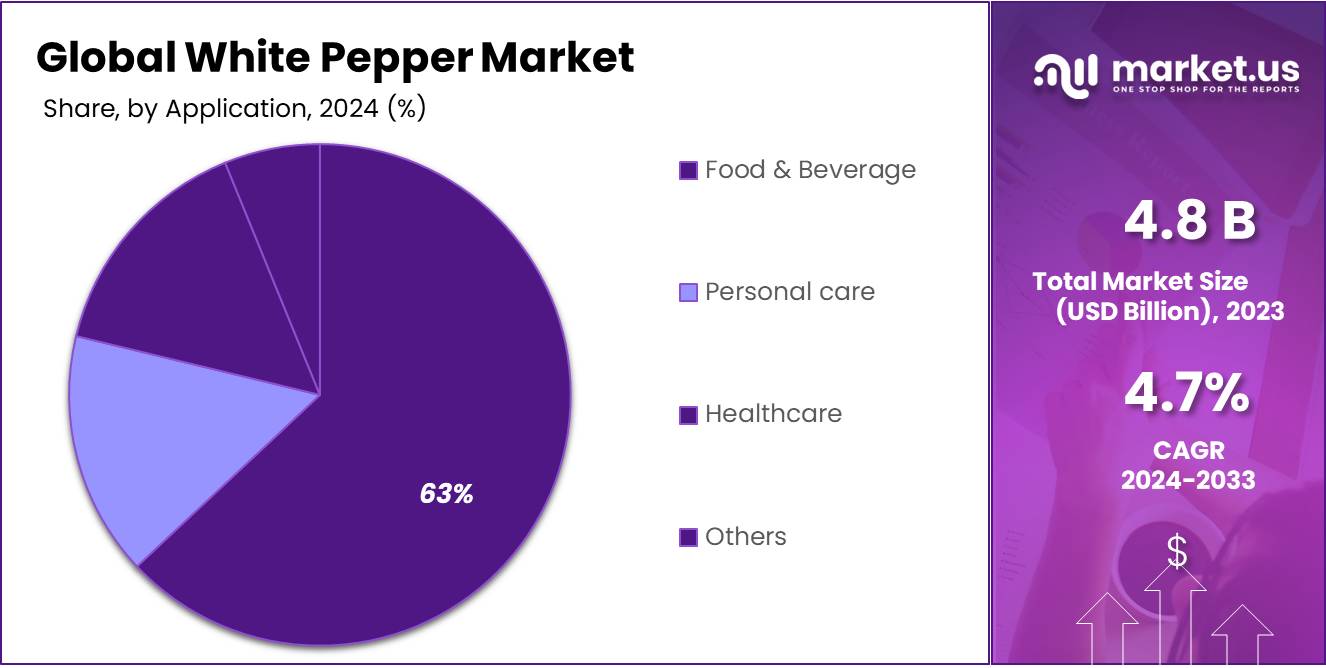

- Food & Beverage held a dominant market position, capturing more than a 66.4% share of the global white pepper market.

- Departmental Stores held a dominant market position, capturing more than a 29.5% share of the white pepper market.

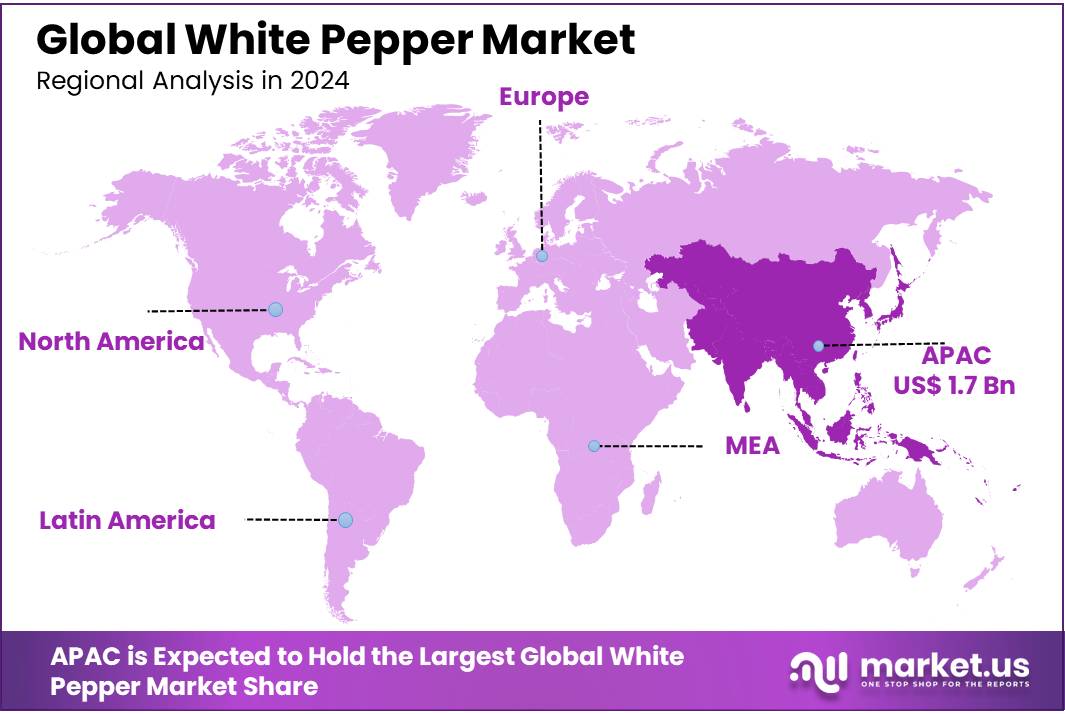

- Asia Pacific (APAC) region dominated the white pepper market, holding a substantial share of 37.2%, valued at approximately USD 1.7 billion.

By Product Type

In 2023, Conventional white pepper held a dominant market position, capturing more than a 67.4% share of the global market. This segment is widely preferred due to its affordability and established availability. Conventional white pepper is produced using traditional farming methods, and it remains a key choice for both large-scale food manufacturers and retailers.

The Organic white pepper segment has been growing steadily, driven by the increasing consumer demand for natural and pesticide-free products. Organic white pepper accounted for the remaining market share in 2023. As health-conscious consumers become more aware of the benefits of organic products, this segment is expected to grow at a faster pace in the coming years.

By Form Type

In 2023, Ground White Pepper held a dominant market position, capturing more than a 57.3% share of the global market. Ground white pepper is widely used in food processing and cooking due to its convenience and ease of use. It is a popular choice for both households and food manufacturers, contributing to its strong market presence.

Whole White Pepper followed as the second-largest segment, known for its longer shelf life and better flavor preservation. It is commonly preferred in culinary applications where fresh grinding is preferred for optimal flavor. This segment is also seeing steady demand in high-end restaurants and spice markets.

Rough Cracked White Pepper, although a smaller segment, has been gaining popularity in recent years. This form is preferred for its unique texture and ability to provide a more intense pepper flavor in certain culinary applications, such as in marinades and seasoning mixes. While it remains a niche product, its market share is expected to grow gradually, driven by the increasing trend for premium and gourmet food products.

By Application

In 2023, Food & Beverage held a dominant market position, capturing more than a 66.4% share of the global white pepper market. The food industry remains the largest consumer of white pepper, driven by its use as a key spice in both cooking and processed food products. Its strong presence is supported by the increasing demand for flavored and spicy foods worldwide.

The Personal Care segment is also growing, though it represents a smaller share of the market. White pepper is used in some skincare and cosmetic products due to its antioxidant and anti-inflammatory properties. This segment is expected to expand gradually, as consumers seek natural ingredients in personal care items.

In the Healthcare sector, white pepper is valued for its potential health benefits, including digestive aid and anti-inflammatory effects. However, this segment currently holds a minor share of the market. Demand is expected to rise slightly as interest in natural remedies and holistic health solutions increases.

By Distribution Channel

In 2023, Departmental Stores held a dominant market position, capturing more than a 29.5% share of the white pepper market. These stores remain a popular choice for consumers due to their wide product variety and convenience. Departmental stores often carry a range of spice brands, making them a preferred shopping destination for many households.

Grocery Stores also play a significant role, accounting for a large portion of white pepper sales. With their focus on daily essentials and proximity to customers, grocery stores continue to be a key channel for purchasing white pepper, particularly for local and regional brands.

Modern Trade, including supermarkets and hypermarkets, is another important distribution channel. This segment benefits from the trend of larger retailers offering a broader selection of products under one roof. As consumer spending on premium and branded spices increases, modern trade outlets are seeing growing demand for white pepper.

Online Retail has been gaining momentum, driven by the convenience of shopping from home and the rise of e-commerce. The online market allows consumers to easily compare products and prices, making it a fast-growing channel, especially for niche and organic varieties of white pepper.

Key Market Segments

By Product Type

- Organic

- Conventional

By Form Type

- Ground White Pepper

- Whole White Pepper

- Rough Cracked White Pepper

By Application

- Food & Beverage

- Personal care

- Healthcare

- Others

By Distribution Channel

- Departmental Store

- Grocery Store

- Modern Trade

- Online Retail

- Others

Drivers

Rising Consumer Demand for Spices in the Food Industry

One of the major driving factors for the white pepper market is the increasing consumer demand for spices in the food industry. According to the Food and Agriculture Organization (FAO), global spice consumption has been steadily rising, with spices being integral to food preparation across various cuisines. White pepper, as a key spice, benefits from this broad consumption trend.

White pepper is widely used in processed foods, sauces, soups, and ready-to-eat meals. The growing popularity of gourmet, organic, and health-conscious food products is also fueling demand for premium spices like white pepper.

The FAO’s data shows that the consumption of processed foods and fast foods has seen an uptick globally, particularly in developed regions such as North America and Europe, where consumers are more inclined to experiment with diverse flavors. This trend has directly benefited white pepper, as its mild and unique flavor profile is favored for a wide array of culinary applications, from high-end dining to everyday meals.

Shift Toward Organic and Clean Label Products

Another significant driving factor is the growing preference for organic and clean-label products. Consumers are increasingly looking for food items that are free from artificial additives, preservatives, and chemicals.

The demand for organic foods, which is part of this clean-label movement, has been rising rapidly in recent years. In 2021, the global organic food market was valued at USD 185.7 billion and is expected to grow at a CAGR of 14.56%, reaching USD 533.0 billion by 2030, the Organic Trade Association.

White pepper, especially in its organic form, is gaining popularity due to its perceived health benefits. Organic white pepper is grown without the use of synthetic pesticides or fertilizers, aligning with the increasing consumer preference for natural and sustainable food products.

The organic segment of the white pepper market is witnessing faster growth compared to conventional varieties. The growing awareness about the health benefits of organic spices, coupled with the rise in organic food sales, has contributed significantly to the expansion of the white pepper market.

Health and Wellness Trends Boosting Demand for Natural Spices

As functional foods gain traction, the demand for spices like white pepper, which are rich in bioactive compounds, is also expected to increase. In particular, white pepper is used in various herbal formulations and dietary supplements due to its antioxidant properties.

Restraints

Volatility in Global Pepper Production

One of the key restraining factors for the white pepper market is the volatility in global pepper production. According to the Food and Agriculture Organization (FAO), the production of pepper (including white and black pepper) is highly dependent on climatic conditions, with changes in weather patterns significantly affecting crop yields.

In 2022, global pepper production was estimated at around 450,000 tons, but the crop is highly sensitive to factors such as temperature changes, rainfall patterns, and pest infestations. For instance, the pepper harvest in Vietnam, which is the world’s largest pepper producer, has been negatively impacted by adverse weather conditions such as droughts and floods.

The production disruptions have led to fluctuating prices and limited supply, affecting the white pepper market. According to the FAO, the global pepper price index has seen significant fluctuations in recent years, with prices reaching USD 7,000 per ton in 2021, only to drop to around USD 5,500 per ton in 2023.

This volatility poses challenges for producers and manufacturers, leading to higher production costs and, in some cases, supply shortages. These disruptions impact both domestic and international trade, as pepper-producing countries face difficulties meeting export demand. Such instability in production and pricing could limit the growth potential of the white pepper market, especially as manufacturers look for more stable alternatives.

High Price Compared to Black Pepper

According to the International Pepper Community (IPC), in 2023, the average price of white pepper was approximately USD 7,000 per ton, compared to black pepper, which was priced at around USD 3,500 per ton. This price difference is due to the more labor-intensive process of producing white pepper, which involves soaking the fully ripe peppercorns, removing the outer shell, and then drying the inner seed.

For many consumers and manufacturers, the higher price of white pepper is a deterrent, especially in price-sensitive markets. This price discrepancy limits the use of white pepper in mass-market food products, as companies may opt for black pepper or other cost-effective alternatives.

According to the FAO, black pepper accounts for more than 70% of the global pepper market, while white pepper holds a smaller share. The higher cost of white pepper also affects its competitiveness in the food service industry, where businesses often prioritize cost efficiency. As a result, the price difference between black and white pepper could hinder the expansion of the white pepper market in regions where price sensitivity is a major concern.

Competition from Other Pepper Varieties and Substitutes

The white pepper market also faces strong competition from other pepper varieties, such as black pepper and green pepper, as well as from substitute spices like chili powder, paprika, and various pepper blends.

According to the International Spice Organization (ISO), global pepper consumption is growing, but black pepper remains the dominant choice due to its versatility, affordability, and wider availability. Black pepper is used in a broader range of food applications, from everyday home cooking to high-scale food manufacturing, making it the primary choice in many regions.

Additionally, substitutes like chili powder, which provides a spicier kick, or paprika, which offers a milder, smoky flavor, are often used in place of white pepper in food products. These alternatives are not only less expensive but also cater to evolving consumer preferences for heat and flavor variety.

The FAO’s data on global spice trade patterns indicates that the global trade value of chili peppers surpassed USD 4 billion in 2022, positioning them as a strong competitor to traditional pepper varieties like white pepper. This competition from alternative spices poses a significant challenge to the white pepper market, limiting its market share in both domestic and international markets.

Opportunity

Rising Popularity of Organic and Clean Label Products

One major growth opportunity for the white pepper market is the increasing demand for organic and clean-label products. Consumers are increasingly becoming health-conscious, and there is a growing trend toward natural, pesticide-free food products. This is especially prominent in developed regions such as North America and Europe.

According to the Organic Trade Association (OTA), the U.S. organic food market reached USD 61.9 billion in 2021, growing by 12.4% compared to 2020. As part of this organic food trend, consumers are shifting toward organic spices, including white pepper, due to their perceived health benefits.

In fact, the global organic spice market is expected to grow at a CAGR of 8.2% from 2023 to 2030, according to the FAO. This trend offers a significant opportunity for white pepper producers to capitalize on the expanding organic food sector.

Expansion of the Food and Beverage Industry in Emerging Markets

Another growth opportunity for the white pepper market lies in the expansion of the food and beverage (F&B) industry in emerging markets, particularly in regions such as Asia-Pacific, Latin America, and Africa. As urbanization accelerates in these regions, so does the demand for processed and convenience foods, which often contain spices such as white pepper.

According to the World Bank, emerging economies in Asia-Pacific are expected to see their middle class grow by 1.7 billion people by 2030, driving consumption across a wide range of food products, including spices.

In 2022, the Asia-Pacific region was responsible for nearly 60% of the global spice consumption, driven by the rising demand for convenience foods, ethnic cuisines, and spicy flavors. The Food and Agriculture Organization (FAO) predicts that the global food consumption in developing economies will grow by 3.4% annually, with spices such as white pepper benefiting from this trend.

Health Benefits and Medicinal Uses of White Pepper

White pepper is gaining attention not only for its culinary use but also for its potential health benefits and medicinal applications. It contains compounds such as piperine, which is believed to have antioxidant, anti-inflammatory, and digestive properties.

According to a study published by the National Institute of Health (NIH), piperine has shown potential in improving nutrient absorption and enhancing metabolism, which can be beneficial for individuals seeking weight management and improved digestion.

The global market for functional foods, which includes products enhanced with spices like white pepper, was valued at USD 267.4 billion in 2020 and is projected to grow at a CAGR of 7.2% by 2027. The expanding interest in natural health solutions offers a significant opportunity for the white pepper market to tap into the growing health and wellness trend.

Trends

Increasing Preference for Organic and Chemical-Free Products

The shift toward organic and chemical-free white pepper is part of a broader trend where consumers are becoming more health-conscious. According to the FAO, the global organic food market reached a value of $125 billion in 2021, with a steady annual growth rate of 10-15%.

This trend extends to spices, including white pepper, as consumers prefer products that are grown without synthetic pesticides and fertilizers. Organic white pepper, which is typically more expensive than its conventional counterparts, is seeing a 5-7% growth annually in markets such as the U.S. and the EU.

In countries like Germany, organic products make up about 8-10% of total food sales, with spices, including white pepper, being part of this growing demand. The shift in demand is supported by growing awareness of the health benefits of consuming pesticide-free and non-GMO foods.

Consumers’ willingness to pay a premium for organic options is influencing farmers and producers to shift towards organic farming practices. Moreover, government initiatives promoting organic farming are also contributing to this trend. In the U.S., the National Organic Program (NOP) by the USDA has been instrumental in certifying organic farms, making organic white pepper more accessible and increasing its availability in international markets.

Surge in Usage in Gourmet and Premium Culinary Sectors

White pepper is increasingly popular in the gourmet and premium culinary sectors, particularly in fine dining and professional kitchens, where chefs prefer it for its milder, less pungent flavor compared to black pepper. The rising demand in the premium culinary space is also linked to an increase in high-end restaurant openings and the growing foodservice sector.

According to the National Restaurant Association (NRA), the foodservice industry in the U.S. saw a market size of $900 billion in 2023, with upscale restaurants driving a significant portion of the demand for high-quality ingredients such as white pepper.

In 2023, the global spice market was valued at over $14.7 billion, with white pepper representing a considerable share due to its preference in Asian and European cuisines. The increasing popularity of Asian and fusion cuisines, which utilize white pepper for its delicate heat and flavor, is contributing to this surge in demand.

The growing number of food festivals, cooking shows, and social media influencers showcasing recipes with white pepper is further promoting its use in everyday cooking and as a key ingredient in gourmet dishes. This shift is particularly noticeable in countries like India and China, where white pepper is gaining ground in both traditional and modern recipes.

Expansion of the White Pepper Market in Asia-Pacific

The Asia-Pacific region remains the largest producer and consumer of white pepper, with Vietnam, Indonesia, and India being the dominant players in both production and export. Vietnam alone accounted for around 40% of the world’s white pepper production in 2022, exporting over 45,000 metric tons to markets globally.

The increasing demand from both local and international markets is pushing producers to expand their capacity. The Asian market has seen steady growth in the white pepper sector, with the industry expanding at a rate of approximately 4-5% annually.

Regional Analysis

In 2023, the Asia Pacific (APAC) region dominated the white pepper market, holding a substantial share of 37.2%, valued at approximately USD 1.7 billion. This dominance is primarily driven by the region’s major pepper-producing countries, including Vietnam and India, which together account for a large percentage of global production.

Vietnam, as the world’s leading exporter of black and white pepper, plays a pivotal role in the regional and global supply chains. The high consumption of white pepper in Asian cuisine, particularly in China and Southeast Asia, further supports the strong market position of APAC.

Europe stands as the second-largest market for white pepper, benefiting from its established demand in food processing and culinary applications. The European market is expected to grow steadily, fueled by the increasing popularity of premium spices in Western cooking.

The region’s demand for clean-label and organic food products is also contributing to a rise in white pepper consumption, especially in countries like Germany, France, and the UK. Europe’s market is projected to expand at a CAGR of 4.5% through 2028.

North America, particularly the U.S., is another significant market for white pepper, valued at USD 450 million in 2023. Rising health consciousness and the demand for organic spices are key drivers of market growth in the region. Latin America and the Middle East & Africa represent smaller but emerging markets, with growing interest in white pepper driven by increasing culinary diversification and health-focused trends.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The white pepper market is highly competitive, with key players contributing significantly to both production and distribution globally. Companies like Ajinomoto, McCormick & Company, and Olam International lead the market in terms of brand recognition and market share. Ajinomoto is a prominent player, known for its diverse range of spices and seasonings, including white pepper.

Its vast distribution network across North America, Asia, and Europe allows it to cater to a broad consumer base. Similarly, McCormick, a major spice producer globally, offers white pepper through both its branded products and bulk supplies for food manufacturers, positioning itself as a key player in the market. Olam International, a leading global supplier of agricultural products, has strong operations in pepper farming and processing, contributing significantly to the market with both conventional and organic white pepper.

Other notable players in the market include Akay Spices Pvt. Ltd., Everest Spices Company, and MDH Pvt. Ltd., all of which are well-established spice manufacturers in India and have expanded their reach internationally. Kancor Ingredients Ltd. and Hexa Food Sdn.Bhd. focus on providing high-quality white pepper for industrial food production and culinary applications, further solidifying their market positions.

Regional players like The British Pepper and Spice Co. Ltd., Unispice, and United Spice Co.Ltd. cater to specific regional demands, leveraging their local knowledge and distribution networks to maintain a competitive edge in the market. Vitagreen Products Pvt. Ltd., focusing on organic and sustainable pepper farming, addresses the rising demand for organic spices, a growing niche segment within the industry.

Top Key Players

- Ajinomoto

- Akay Spices Pvt. Ltd.

- Everest Spices Company

- Hexa Food Sdn.Bhd.

- Kancor Ingredients Ltd.

- Maxrotth Global Foods Pvt Ltd

- McCormick & Company

- MDH Pvt. Ltd.;

- Olam International

- Olam International Limited.

- The British Pepper and Spice Co. Ltd.

- Unispice

- United Spice Co.Ltd

- Vitagreen Products Pvt. Ltd.

Recent Developments

In 2023, Ajinomoto reported annual sales of approximately USD 11.5 billion, with its food products accounting for nearly 70% of total revenue.

In 2024, Akay Spices aims to increase its production capacity by 10%, enhancing its market share in the global white pepper industry.

Report Scope

Report Features Description Market Value (2023) USD 4.8 Bn Forecast Revenue (2033) USD 7.6 Bn CAGR (2024-2033) 4.7% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Organic, Conventional), By Form Type (Ground White Pepper, Whole White Pepper, Rough Cracked White Pepper), By Application (Food and Beverage, Personal care, Healthcare, Others), By Distribution Channel (Departmental Store, Grocery Store, Modern Trade, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ajinomoto, Akay Spices Pvt. Ltd., Everest Spices Company, Hexa Food Sdn.Bhd., Kancor Ingredients Ltd., Maxrotth Global Foods Pvt Ltd, McCormick & Company, MDH Pvt. Ltd.;, Olam International, Olam International Limited., The British Pepper and Spice Co. Ltd., Unispice, United Spice Co.Ltd, Vitagreen Products Pvt. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ajinomoto

- Akay Spices Pvt. Ltd.

- Everest Spices Company

- Hexa Food Sdn.Bhd.

- Kancor Ingredients Ltd.

- Maxrotth Global Foods Pvt Ltd

- McCormick & Company

- MDH Pvt. Ltd.;

- Olam International

- Olam International Limited.

- The British Pepper and Spice Co. Ltd.

- Unispice

- United Spice Co.Ltd

- Vitagreen Products Pvt. Ltd.