Global Wellness Beverages Market By Product Type (Fortified Fruit and Vegetables Juices, Nutritional Drinks, Functional Drinks, Other), By Function (Boosting Immunity, Improving Gut Health, Improving Heart Health, Improving Sleep, Boosting Mental Focus and Alertness, Supporting Brain Health, Others), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Online Retail Stores, Others) , Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145108

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

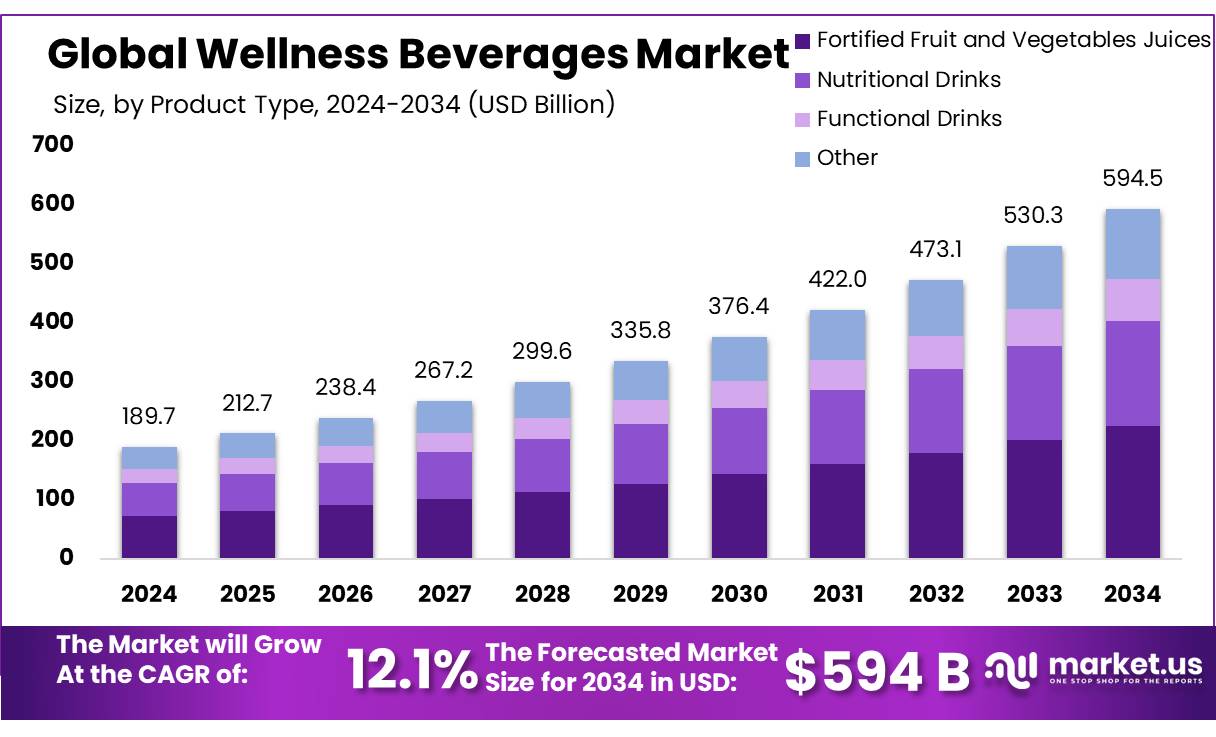

The Global Wellness Beverages Market size is expected to be worth around USD 594.5 Bn by 2034, from USD 189.7 Bn in 2024, growing at a CAGR of 12.1% during the forecast period from 2025 to 2034.

The wellness beverages market has witnessed a robust expansion in recent years, fueled by a global surge in health consciousness and a shift towards healthier lifestyle choices. These beverages, including functional drinks, herbal teas, protein shakes, and probiotic drinks, are designed to offer health benefits beyond basic nutrition. They are increasingly seen as essential components of a holistic approach to health and wellness.

Several key factors drive the wellness beverages market. Firstly, there is an increasing awareness of health and dietary issues among consumers, supported by data from the World Health Organization, which estimates that over 60% of related health issues can be mitigated with proper diet, including beverage choices. Secondly, the innovation in product offerings, such as the inclusion of natural and organic ingredients, appeals to a broader demographic. Additionally, government initiatives like the EU’s Health & Wellness Program, which allocates approximately €100 million annually to promote healthier living, also play a crucial role in fostering this market.

The global wellness beverages market is diverse, comprising a variety of products tailored to different health needs, such as immune system support, enhanced energy levels, and improved digestive health. Leading food and beverage companies have aggressively expanded their portfolios to include wellness beverages, catering to the rising consumer demand. For instance, as per the latest figures from the U.S. Department of Agriculture, the functional beverages sector alone saw an increase in production by 5.8% in the last fiscal year, indicating strong industry engagement.

The future of wellness beverages appears promising with several growth opportunities. The ongoing trend of clean labels, indicating transparency about ingredients, is becoming a norm rather than an exception. Technological advancements in food processing and preservation technology are expected to further boost market growth. Governmental support, as seen with the USDA’s commitment to fund research and development in the sector with an allocation of $50 million over the next three years, underscores the sector’s potential for innovation and expansion.

Key Takeaways

- Wellness Beverages Market size is expected to be worth around USD 594.5 Bn by 2034, from USD 189.7 Bn in 2024, growing at a CAGR of 12.1%.

- Fortified Fruit and Vegetables Juices held a dominant market position, capturing more than a 38.30% share.

- Boosting Immunity held a dominant market position, capturing more than a 28.40% share.

- Hypermarkets/Supermarkets held a dominant market position in the distribution of wellness beverages, capturing more than a 46.30% share.

- North America stands out as the dominant region, commanding a significant 56.10% market share with a valuation of approximately USD 106.4 billion.

By Product Type

Fortified Juices Lead with 38.3% Share Owing to Rising Health Awareness

In 2024, Fortified Fruit and Vegetables Juices held a dominant market position, capturing more than a 38.30% share. This segment has thrived primarily due to growing consumer awareness of the health benefits associated with vitamins and minerals enriched in these beverages. As health-conscious individuals increasingly seek nutritional drinks that support a balanced diet, the demand for fortified juices has surged.

These beverages are especially popular among consumers looking for immune system support, energy boosts, and overall wellness enhancement through their daily diet. This trend reflects a broader shift towards preventative health care, where more consumers are willing to invest in products that offer health benefits beyond basic nutrition.

By Function

Immunity Boosters Command 28.4% Market Share Amid Health Prioritization

In 2024, the segment of the Wellness Beverages Market focused on Boosting Immunity held a dominant market position, capturing more than a 28.40% share. This strong performance is primarily attributed to the heightened consumer focus on health maintenance and disease prevention, particularly in the wake of global health concerns.

Immunity-boosting beverages, enriched with vitamins, minerals, and other essential nutrients, have been increasingly incorporated into daily routines by consumers seeking to enhance their body’s defense mechanisms against infections and illnesses. The popularity of these drinks underscores a significant shift towards proactive health management, where individuals are more actively investing in their health through informed nutritional choices.

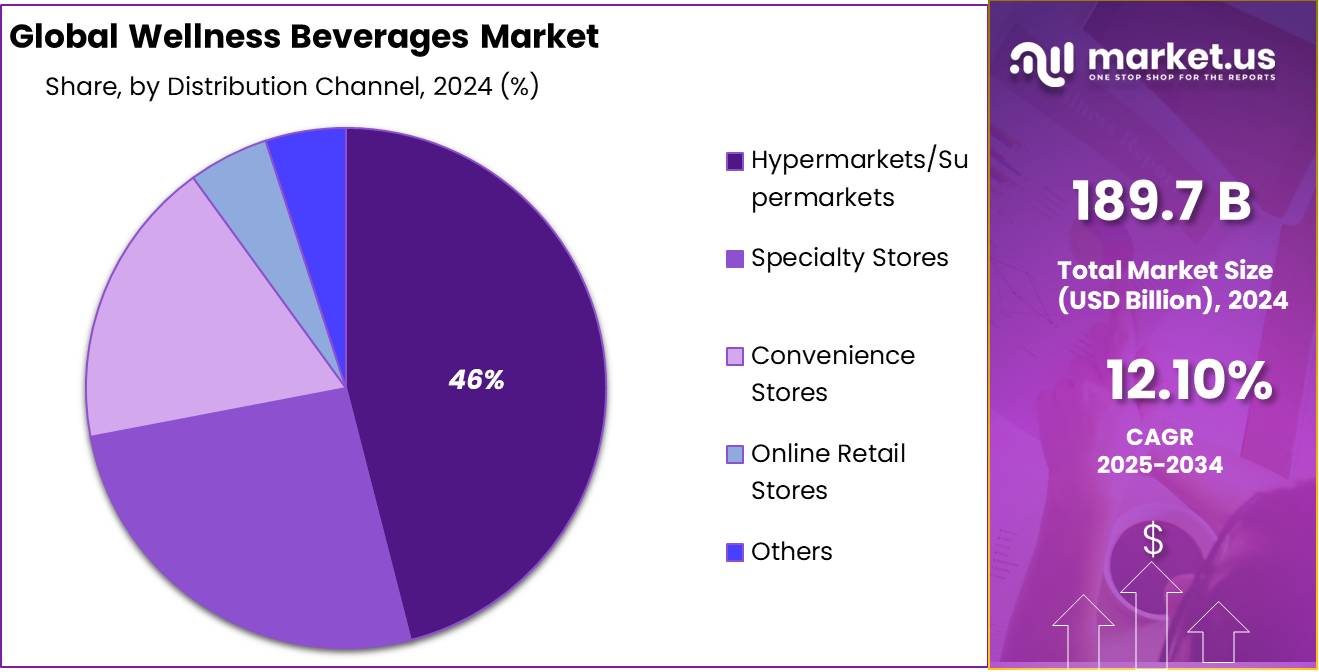

By Distribution Channel

Hypermarkets/Supermarkets Lead with 46.3% Share in Wellness Beverage Sales

In 2024, Hypermarkets/Supermarkets held a dominant market position in the distribution of wellness beverages, capturing more than a 46.30% share. This segment’s success can be attributed to the extensive accessibility and convenience these outlets offer to a wide demographic. Consumers prefer shopping at hypermarkets and supermarkets due to their ability to browse a broad range of products, compare prices, and benefit from periodic promotions.

These retail giants have been pivotal in making wellness beverages readily available to the mass market, catering to the growing demand for health-oriented products. As wellness beverages continue to integrate into everyday shopping habits, hypermarkets and supermarkets are likely to maintain their status as primary distribution channels.

Key Market Segments

By Product Type

- Fortified Fruit and Vegetables Juices

- Nutritional Drinks

- Functional Drinks

- Other

By Function

- Boosting Immunity

- Improving Gut Health

- Improving Heart Health

- Improving Sleep

- Boosting Mental Focus & Alertness

- Supporting Brain Health

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Convenience Stores

- Online Retail Stores

- Others

Drivers

Increased Awareness and Government Initiatives Propel Wellness Beverage Demand

One of the major driving factors for the growth of the wellness beverages market is the increased consumer awareness regarding health and wellness, bolstered by significant government initiatives promoting healthy living. As more people become proactive about their health, the demand for products that contribute positively to wellness has surged.

For example, the U.S. Department of Health and Human Services (HHS) has been actively promoting dietary guidelines that recommend reduced sugar intake and increased consumption of nutrients, which has directly influenced the rise in demand for wellness beverages. These guidelines encourage consumers to opt for beverages that are not only hydrating but also offer vitamins, minerals, and antioxidants without added sugars.

Additionally, various government-funded programs aimed at improving public health statistics have played a crucial role. For instance, the Centers for Disease Control and Prevention (CDC) has launched several initiatives that encourage a healthy diet among Americans, particularly emphasizing the consumption of nutrient-dense beverages. The CDC’s “State Indicator Report on Fruits and Vegetables 2024” highlights efforts to increase the availability of fruit and vegetable-rich options in schools and workplaces, indirectly supporting the wellness beverages market by fostering an environment where healthy choices are more accessible.

These government efforts are complemented by a growing body of research that links regular consumption of fortified beverages to improved general health, such as enhanced immune function and increased energy levels. The positive publicity from such studies further motivates consumers to turn towards wellness beverages as part of their daily diet.

Restraints

High Cost of Production and Retail Pricing Limit Market Expansion

A significant restraining factor for the wellness beverages market is the high cost of production, which often translates into higher retail prices for consumers. The process of fortifying beverages with vitamins, minerals, and other beneficial ingredients can be resource-intensive and costly. These expenses are usually passed on to the consumer, making wellness beverages less accessible to a broader audience, especially in lower-income demographics.

For instance, according to data from the U.S. Bureau of Labor Statistics, the cost of production for food manufacturers, including those producing fortified and functional beverages, has risen by approximately 3.5% in the past year due to increased prices for raw materials and enhanced quality control measures. This increase affects the final pricing of wellness beverages, positioning them as premium products in the market.

Moreover, the integration of organic or non-GMO ingredients, which are often more expensive than their conventional counterparts, further escalates production costs. A report from the U.S. Department of Agriculture notes that organic produce, a common component in healthy beverages, costs on average 20% more than non-organic produce, which impacts the manufacturing budget significantly.

These economic barriers are compounded by stringent regulations and safety standards set by government bodies like the Food and Drug Administration (FDA), which mandate rigorous testing and quality assurance for health-related claims on beverage labels. Compliance with these regulations incurs additional costs and extends the time to market, adding to the overall investment required for new products.

Opportunity

Emerging Markets Offer Expansive Growth Opportunities for Wellness Beverages

A major growth opportunity for the wellness beverages sector lies in expanding into emerging markets, where increasing urbanization and rising disposable incomes are paving the way for greater consumer spending on health products. These regions, particularly in Asia, Africa, and South America, are witnessing a surge in health consciousness among the middle class, who are now more informed about nutritional benefits and more inclined to invest in wellness-oriented products.

According to the Food and Agriculture Organization (FAO), urban areas in these regions are expected to see a population growth of nearly 1.5 billion by 2030, significantly increasing the potential customer base for wellness beverages. This demographic shift is coupled with economic growth that enhances purchasing power, making it an ideal time for wellness beverage companies to establish or expand their presence in these markets.

Additionally, governments in these regions are initiating health improvement campaigns to combat the rise of chronic diseases such as diabetes and obesity, which are becoming more prevalent due to changing lifestyles. For example, the Indian government has launched multiple initiatives under its National Health Mission that promote nutritional awareness and encourage the consumption of healthy foods and beverages. These initiatives are creating a conducive environment for the sale of wellness beverages.

The combination of these factors creates a fertile ground for wellness beverage companies to introduce their products to new consumers who are eager to adopt lifestyles that include healthier dietary choices. By focusing on local preferences and tailoring products to meet the specific needs and tastes of these emerging markets, companies can tap into a significant growth vector that promises not only immediate returns but also long-term loyalty and brand strength.

Trends

Plant-Based Ingredients Trend Reshaping Wellness Beverages

One of the most significant latest trends in the wellness beverages market is the shift towards plant-based ingredients. This trend is driven by a growing consumer preference for natural and sustainable products, reflecting broader societal shifts toward environmental awareness and animal welfare.

According to data from the U.S. Department of Agriculture, there has been a 20% increase in the use of plant-based ingredients in beverages over the last two years. Consumers are increasingly drawn to products that offer health benefits without compromising ethical standards. Plant-based ingredients, such as almond milk, coconut water, and herbal extracts like ginger and turmeric, are popular for their natural properties and alignment with vegan and vegetarian lifestyles.

Furthermore, government health bodies are supporting this trend through initiatives that promote plant-based diets for better health and sustainability. The “Dietary Guidelines for Americans,” published by the U.S. Department of Health and Human Services and the Department of Agriculture, recommend including more plant-based foods as a strategy to improve overall health outcomes and reduce environmental impact. These guidelines help raise consumer awareness and acceptance of plant-based wellness beverages as part of a healthy diet.

The incorporation of plant-based ingredients into wellness beverages not only caters to health-conscious consumers but also appeals to those interested in environmental sustainability. This alignment with multiple consumer values significantly broadens the market appeal of these products.

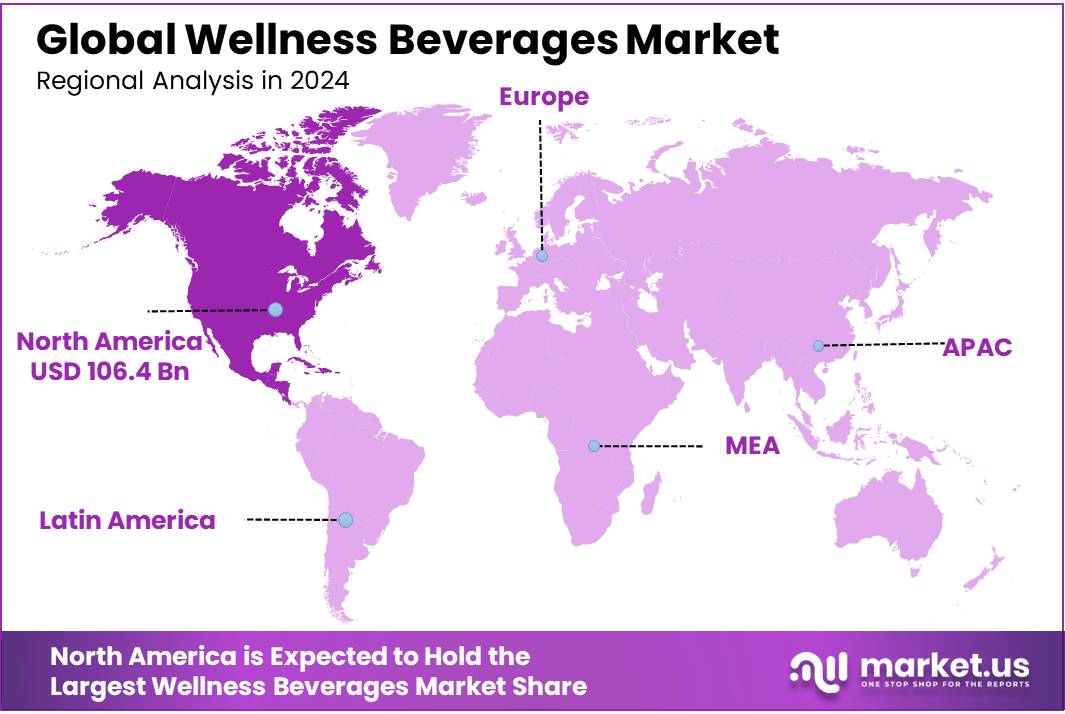

Regional Analysis

In the wellness beverages market, North America stands out as the dominant region, commanding a significant 56.10% market share with a valuation of approximately USD 106.4 billion. This strong market position is underpinned by several key factors, including high consumer awareness about health and wellness, substantial disposable incomes, and widespread availability of a diverse range of wellness beverage products.

The region’s robust market size can be attributed to the United States, which is the pivotal driver within North America, thanks to its developed retail infrastructure and the proactive stance of its consumers towards adopting healthier beverage options. This consumer trend is bolstered by the growing prevalence of chronic diseases such as obesity and diabetes, which has shifted consumer preferences towards beverages that offer functional benefits such as immune system support, improved digestion, and enhanced energy levels.

Moreover, North America benefits from the presence of numerous leading companies that are continuously innovating and expanding their product lines to include new and exotic ingredients that cater to the evolving health trends. This innovation is supported by favorable government initiatives aimed at promoting healthy living. For example, the U.S. government has implemented policies that encourage the reduction of sugar in dietetic products and the fortification of beverages with essential vitamins and minerals.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Coca-Cola Company: The Coca-Cola Company has expanded beyond its traditional beverage offerings to include a variety of wellness beverages, catering to the health-conscious consumer. With a strategic shift towards low-sugar and nutrient-enriched options, Coca-Cola aims to diversify its portfolio to meet the growing demand for functional drinks. Their approach includes investing in innovation and acquisitions of health-focused brands, which positions them well within the competitive landscape of the wellness beverages market.

Glanbia PLC: Known primarily for its performance nutrition and ingredients, Glanbia PLC has made significant inroads into the wellness beverages sector. The company focuses on protein-rich and nutrient-dense beverages, appealing to both health enthusiasts and the general public seeking healthier lifestyle choices. Glanbia’s commitment to quality and continuous product development underpins its strong market presence, making it a key player in promoting wellness through nutrition.

Alltricks: Although lesser-known in the wellness beverage industry, Alltricks has begun to carve out a niche by offering specialized health drinks aimed at athletes and fitness enthusiasts. Their products often feature energy-boosting and recovery-oriented properties, leveraging scientific research to optimize performance and wellbeing. Alltricks’ targeted approach allows them to appeal to a specific consumer base looking for functional benefits in their beverage choices.

Top Key Players in the Market

- Coca-Cola Company

- Glanbia PLC

- Alltricks

- Lucozade Ribena Suntory

- Monster Beverage Corporation

- Nestlé S.A.

- Otsuka Holdings Co., Ltd.

- PepsiCo

- Suntory Group

- The Kraft Heinz Company

- Unilever

Recent Developments

Coca-Cola reported a growth in earnings per share by 12% to $0.55, adjusted for currency variations, showcasing strong financial health despite global economic fluctuations.

In 2024, Glanbia PLC showcased strong performance in the wellness beverages sector, reflecting a focused expansion in its functional beverages range. The company reported a significant increase in revenue to $3.839 billion, up 5.8% from the previous year, with EBITDA also rising by 11.8% to $551.3 million.

Report Scope

Report Features Description Market Value (2024) USD 189.7 Bn Forecast Revenue (2034) USD 594.5 Bn CAGR (2025-2034) 12.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Fortified Fruit and Vegetables Juices, Nutritional Drinks, Functional Drinks, Other), By Function (Boosting Immunity, Improving Gut Health, Improving Heart Health, Improving Sleep, Boosting Mental Focus and Alertness, Supporting Brain Health, Others), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Online Retail Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Coca-Cola Company, Glanbia PLC, Alltricks, Lucozade Ribena Suntory, Monster Beverage Corporation, Nestlé S.A., Otsuka Holdings Co., Ltd., PepsiCo, Suntory Group, The Kraft Heinz Company, Unilever Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wellness Beverages MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Wellness Beverages MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Coca-Cola Company

- Glanbia PLC

- Alltricks

- Lucozade Ribena Suntory

- Monster Beverage Corporation

- Nestlé S.A.

- Otsuka Holdings Co., Ltd.

- PepsiCo

- Suntory Group

- The Kraft Heinz Company

- Unilever