Global Stainless Steel Foil Market By Type (Hot Rolled, Cold Rolled), By Grade (200 Series, 300 Series (301, 304, 316, 321, Others), 400 Series, 900 series), By Thickness (Upto 0.05 mm, 0.06-0.09 mm, 0.1-0.3 mm, Greater than 0.3 mm), By End-Use (Electrical And Electronic, Automotive, Aerospace, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151180

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

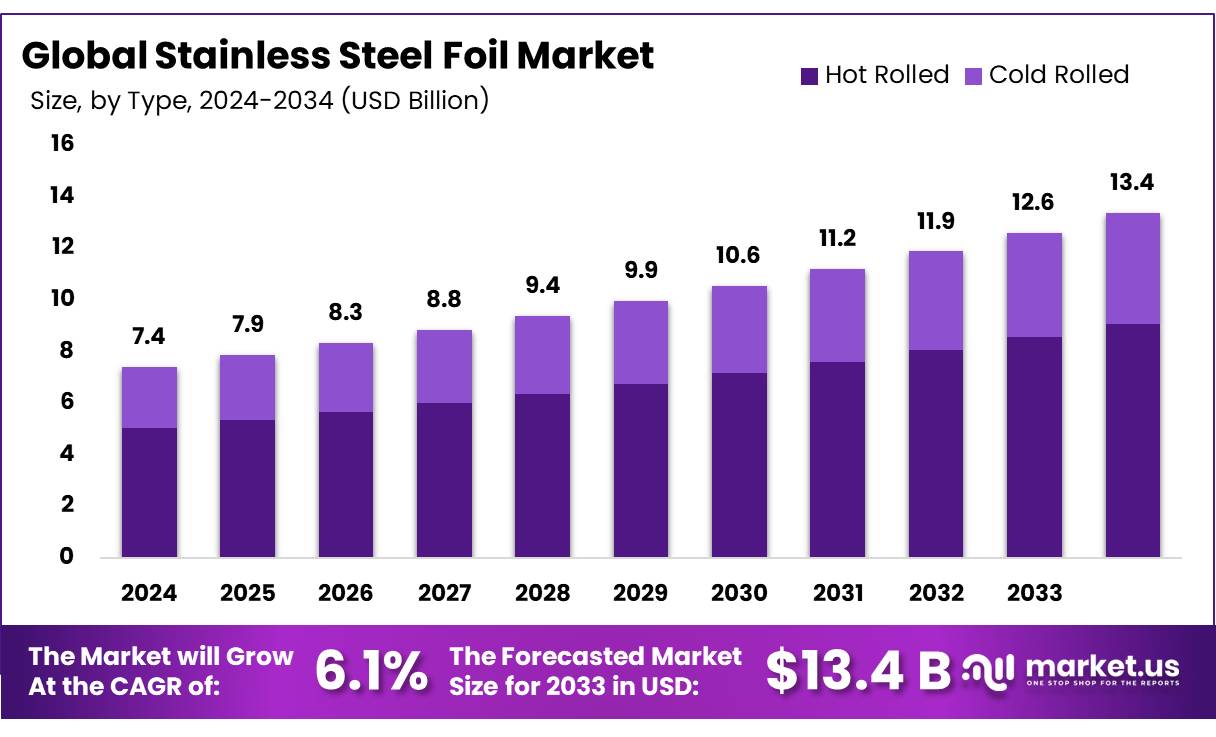

The Global Stainless Steel Foil Market size is expected to be worth around USD 13.4 Billion by 2034, from USD 7.4 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

Stainless steel foil also called stainless foil or tool wrap foil, is a thin sheet of stainless steel known for its high strength-to-weight ratio, exceptional corrosion resistance, and durability. This material is widely utilized across various industries, including aerospace, automotive, electronics, energy, and medical devices, owing to its ability to perform under extreme conditions.

It prevents oxidation during heat treatment, serving as a heat exchanger and insulator, and being incorporated into water, oil, and gas pipelines. Its lightweight yet robust nature makes it ideal for use in compact, high-performance systems such as fuel cells, flexible electronics, and surgical instruments. The global stainless steel foil market is being driven by rising demand for lightweight, high-strength materials in advanced technologies, growing investments in electric vehicles and renewable energy, and increasing miniaturization in the electronics and healthcare sectors.

Key Takeaways

- The global stainless steel foil market was valued at USD 7.4 billion in 2024 and is projected to grow at a CAGR of 6.1% and is estimated to reach USD 13.4 billion by 2034.

- Among types, hot rolled accounted for the largest market share of 67.9%.

- Among grades, 300 Series accounted for the majority of the market share at 53.1%.

- By thickness, 1-0.3 mm accounted for the largest market share of 38.8%.

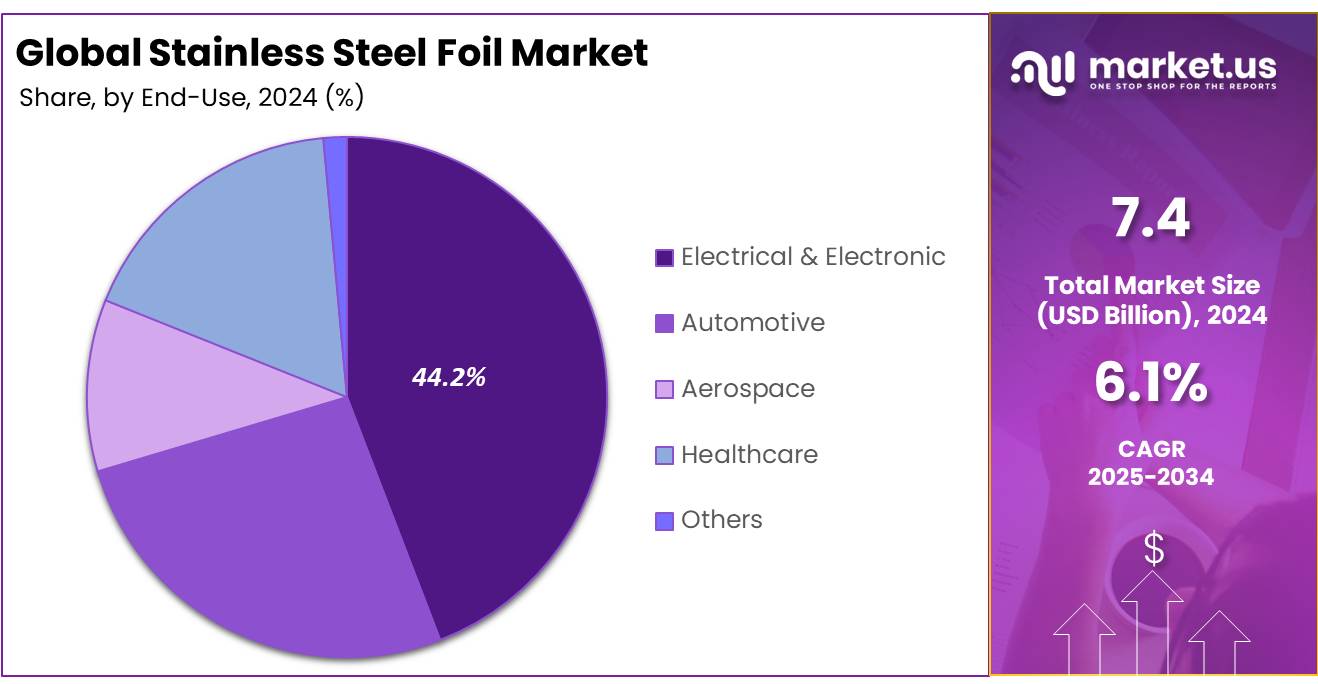

- By end-use, electrical & electronic accounted for the majority of the market share at 45.5%.

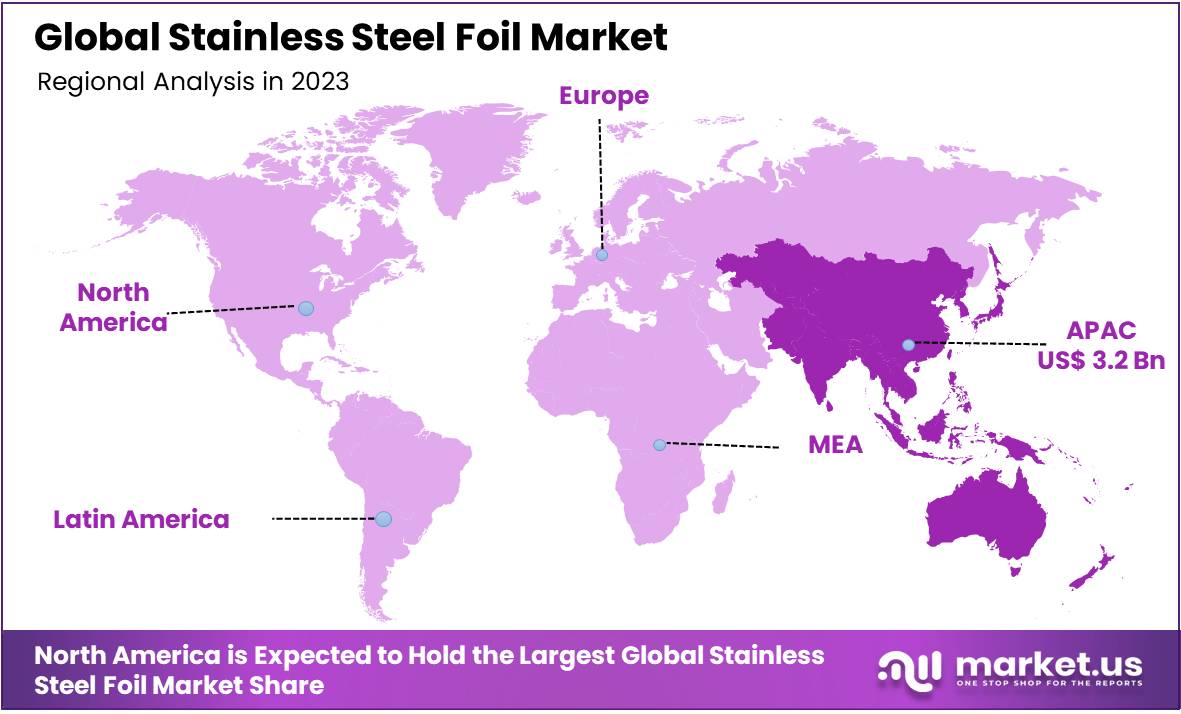

- Asia Pacific is estimated as the largest market for stainless steel foil with a share of 43.7% of the market share.

Type Analysis

The Hot Rolled Segment Dominate The Global Stainless Steel Foil Market

The Stainless Steel Foil market is segmented based on type into hot rolled, and cold rolled. In 2024, the hot rolled segment held a significant revenue share of 67.9%. Due to their cost-effectiveness, high strength, and suitability for large-scale industrial applications.

Hot rolled stainless steel foil is widely used in construction, automotive, and heavy machinery sectors where precise surface finish is less critical but mechanical durability and bulk production are essential. Its ability to withstand high temperatures and pressures also makes it ideal for structural and heat-resistant components, contributing to its dominant market position.

Grade Analysis

The 300 Series, Commanding Substantial Growth In Global Stainless Steel Foil Market

Based on grade, the market is further divided into 200 series, 300 series, 400 series, and 900 series. The predominance of the 300 Series, commanding a substantial 53.1% market share in 2024. Due to its superior corrosion resistance, excellent formability, and high-temperature strength. Grades such as SUS304 and SUS316 within this series are widely used across critical applications in the automotive, aerospace, medical, and food processing industries. Their versatility and reliability in both harsh and sanitary environments make the 300 Series the preferred choice for manufacturers requiring high-performance stainless steel foil.

Thickness Analysis

The 0.1-0.3 Mm Held A Dominant Position In Global Stainless Steel Foil Market

Among thicknesses, the stainless steel market is classified into up to 0.05 mm, 0.06-0.09 mm, 0.1-0.3 mm, and Greater than 0.3 mm. In 2024, 0.1-0.3 mm held a dominant position with a 38.8% share. Due to its broad applicability across various industries. This thickness range offers an optimal balance between flexibility and mechanical strength, making it ideal for use in automotive components, industrial insulation, electronics, and medical devices. Its compatibility with precision forming and machining processes further enhances its adoption in high-performance and durable applications.

End-Use Analysis

The Electrical & Electronic Segment Driving The Growth Of Global Stainless Steel Foil Market

By end-use, the market is categorized into electrical & electronics, automotive, aerospace, healthcare, and others. The electrical & electronics segment emerging as the dominant channel, holding 45.5% of the total market share in 2024. Due increasing demand for high-performance materials in components such as shielding layers, sensors, battery parts, and flexible circuits stainless steel foil provides a suitable material for the production of these components.

The ongoing miniaturization of electronic devices, along with the expansion of consumer electronics, renewable energy systems, and semiconductor manufacturing, has significantly boosted the adoption of stainless steel foil in the electrical & electronics sector.

Key Market Segments

By Type

- Hot Rolled

- Cold Rolled

By Grade

- 200 Series

- 300 Series

- 301

- 304

- 316

- 321

- Others

- 400 Series

- 900 series

By Thickness

- Upto 0.05 mm

- 0.06-0.09 mm

- 0.1-0.3 mm

- Greater than 0.3 mm

By End-use

- Electrical & Electronic

- Automotive

- Aerospace

- Healthcare

- Others

Drivers

Growing Adoption Of Lightweight Material In the Transportation Industry

The increasing adoption of lightweight materials across transportation industries is emerging as a key driver of growth in the global stainless steel foil market. Sectors such as aerospace, automotive, and advanced defense manufacturing are progressively transitioning toward lightweight solutions, with stainless steel foil gaining traction due to its superior strength-to-weight ratio and excellent corrosion resistance compared to traditional materials it protects against extreme heat in engines and catalytic converters, while also serving as a precise and durable material for gaskets and seals in high-pressure environments. These foils contribute significantly to weight reduction in both structural and interior components and their formability into various shapes enhances their importance, making stainless steel foil a key material in transportation engineering.

- According to reports published by the U.S. Department of Energy a 10% reduction in vehicle weight can result in a 6%-8% fuel economy improvement.

Additionally, Stainless steel foil is increasingly adopted in commercial and aerospace sectors due to its lightweight, durability, and resistance to extreme conditions, supporting the shift toward fuel-efficient and sustainable materials. It is widely used in applications such as air taxis, aircraft structures, and defense equipment. The rise of electric vehicles has further accelerated demand for lightweight materials to offset battery weight and enhance efficiency. This trend reflects the growing focus on high-performance, cost-effective solutions across the automotive, aerospace, rail, and marine industries.

- The U.S. Federal Aviation Administration (FAA) reports state that modern commercial aircraft use approximately 50% composite materials by weight, including stainless steel foil, to achieve weight reduction and enhanced fuel efficiency.

- The International Energy Agency (IEA) also emphasizes that the adoption of lightweight composites is essential for decarbonizing the transport sector, projecting that lightweight materials could reduce global CO2 emissions by up to 1 gigaton annually by 2040.

Furthermore, the advancement of smart manufacturing technologies and increased R&D investments are accelerating the adoption of stainless steel foil, especially in aerospace. Due to its excellent high-temperature resistance, mechanical strength, and formability, stainless steel foil is utilized in complex engine components, interior structures, and air duct systems.

Its ability to meet strict manufacturing tolerances and aesthetic requirements makes it suitable for both functional and decorative applications. These attributes, combined with wear resistance and load-bearing capabilities, position aerospace as a key driver in the growing global demand for stainless steel foil.

Restraints

High Manufacturing Cost

The high manufacturing cost of stainless steel is one of the important factors restraining their growth on a global level. The production of stainless steel foil requires specialized, expensive manufacturing processes, including cold and hot rolling processes, which contribute significantly to their overall cost. Additionally, the raw materials used in stainless steel foil, such as iron, chromium, and nickel, are also costly, these raw materials’ high prices increase the overall production and manufacturing cost.

This high cost limits the widespread adoption of stainless steel foil especially in industries with limited budgets. Furthermore, another challenge is the complex and lengthy manufacturing process required to produce high-quality stainless steel foil.

Achieving necessary material properties, such as high-temperature resistance, durability, and flexibility, demands highly controlled production environments and an extensive quality checks system. These high-quality manufacturing requirements increase the overall production time of stainless steel foil further lowering production volumes, as demand for these materials rises in many industries including automotive, electronics, and healthcare medical devices these production limitation affects the market growth and further increase the costs as manufacturers seek alternative material which limits the global stainless steel market growth.

- For instance, stainless steel foil typically has a higher upfront cost, ranging from $20 to $50 per roll, compared to aluminum foil, which costs around $1 to $5 per roll. While stainless steel foil offers long-term cost efficiency due to its superior durability and reusability, its higher initial cost can be a limiting factor for market growth, particularly in cost-sensitive applications. This price disparity poses a challenge to broader adoption, especially in industries where single-use, lower-cost alternatives like aluminum are sufficient.

Opportunity

Development Of Foil Based Hydrogen Fuel Cell Component

The development of stainless steel foil-based components for hydrogen fuel cells is creating significant growth opportunities in the global stainless steel market. Stainless steel foil is increasingly used in critical fuel cell elements particularly bipolar plates due to its corrosion resistance, electrical conductivity, mechanical strength, and cost-effective manufacturability.

Advancements such as surface-treated foils, integrated micro-sensors, and the adoption of ferrite stainless steels have enhanced performance in both Polymer Electrolyte Fuel Cells (PEFCs) and Solid Oxide Fuel Cells (SOFCs). Its suitability for high-volume production and ability to reduce stack size and weight make stainless steel foil a preferred material in the expanding hydrogen energy sector.

- For instance, In January 2020, the US Fuel Cell and Hydrogen Energy Association (FCHEA) released an updated version of the U.S. Hydrogen Roadmap, outlining ambitious national targets for hydrogen adoption. The roadmap proposed the sale of 150,000 fuel cell vehicles by 2025 and 1.2 million by 2030, alongside the construction of 1,000 hydrogen fueling stations by 2025 and 4,300 stations by 2030. These goals reflect a strong commitment to advancing hydrogen mobility infrastructure and fuel cell technology across the United States. As hydrogen infrastructure expands, stainless steel foil will play a critical role in fuel cell components such as bipolar plates.

Trends

Rising Used Of Ultra-Thin Stainless Steel Foil In Electronic Devices

The increasing use of ultra-thin stainless steel foil in electronic devices is emerging as a notable trend contributing to the growth of the global stainless steel foil market. Typically, ultra-thin foil is defined as foil with a thickness below 0.05 mm and in some advanced cases, as thin as 0.005 mm these materials are becoming essential in high-precision electronic applications.

Their exceptional combination of mechanical strength, flexibility, and corrosion resistance makes them particularly suitable for components such as shielding layers, micro-connectors, sensors, and flexible circuits.

As the electronics industry continues to advance toward miniaturization and high-performance devices, the demand for ultra-thin materials capable of withstanding complex manufacturing processes and environmental stressors has intensified. This shift is especially prominent in next-generation technologies like wearables, smartphones, medical devices, and flexible displays, where every micron of thickness can impact performance.

The ability of ultra-thin stainless steel foil to provide structural integrity without adding bulk makes it a preferred material in these evolving applications, positioning it as a key driver of innovation and market expansion in the stainless steel foil sector.

Geopolitical Impact Analysis

Geopolitical Tensions, Trade Policies, And Raw Material Supply Disruptions Significantly Impact The Global Stainless Steel Foil.

Geopolitical factors have emerged as significant influences on the global stainless steel foil market, primarily through their impact on trade policies, raw material supply chains, and regional market dynamics. The frequent adjustment of tariff policies by the United States, particularly targeting exports from major producers such as China, has affected trade flows and contributed to uncertainty in the stainless steel sector. As a key manufacturing hub, China’s stainless steel exports are vulnerable to such policy shifts, leading to supply chain disruptions and price volatility.

Additionally, the stainless steel foil market is heavily dependent on critical raw materials such as nickel and chromium elements with limited global production, primarily concentrated in regions like Russia, China, and Canada. Geopolitical instability or sanctions involving these countries can severely affect supply availability and raise production costs. For instance, trade restrictions on Russian or Chinese exports, or geopolitical conflicts involving major producers, can constrain raw material access and disrupt global distribution networks.

Furthermore, regional conflicts such as the Iran-Israel dispute increase the risk of shipping disruptions through strategic maritime corridors like the Strait of Hormuz and the Red Sea. These routes handle a significant portion of global oil and LNG shipments, and any escalation may lead to increased freight costs and delays, directly affecting the global distribution of stainless steel foil. In addition, evolving trade agreements such as the U.S.-Mexico-Canada Agreement (USMCA) and shifting European Union trade policies can either ease or complicate the cross-border movement of stainless steel foil, thereby influencing global market accessibility and competitiveness.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Stainless Steel Foil Market

In 2024, Asia Pacific dominated the global stainless steel foil market, accounting for 43.7% of the total market share, driven by rapid economic expansion in countries such as China, India, and those across Southeast Asia, the Asia Pacific region is experiencing accelerated urbanization and industrial growth, leading to a significant rise in demand for stainless steel foil. Increasing investments in healthcare have further fueled this demand, as stainless steel foil is valued for its biocompatibility and micro-fabrication capabilities, making it essential in diagnostic instruments, surgical tools, and implantable components.

Additionally, the region’s growing automotive and aerospace industries supported by population growth, rising disposable incomes, and government initiatives promoting sustainable materials have contributed to increased usage of stainless steel foil in commercial, passenger, and heavy-duty vehicles. Its durability, lightweight nature, and heat resistance make it ideal for electric vehicles and fuel-efficient technologies.

Furthermore, governments across the Asia Pacific are implementing strict environmental regulations and sustainability initiatives that encourage the use of eco-friendly construction materials. Stainless steel foil, known for its high energy efficiency and low carbon footprint, is being increasingly adopted in applications ranging from shielding components to sensor housings in both automotive and aerospace projects, further boosting market growth in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key Players In The Stainless Steel Foil Market Dominate The Market Through Technological Advancements And Product Innovation.

Leading players in the global stainless steel market, including Nippon Steel Corporation, Kobe Steel Ltd., Ulbrich Stainless Steels & Special Metals, Inc., and Milesi Srl, maintain their dominance through product innovation and the adoption of sustainable industrial practices. These companies supply a wide range of stainless steel foil products across various industries.

For instance, Nippon Steel Corporation is a leader in high-precision stainless steel foil production, serving the electronics, automotive, and industrial sectors. Kobe Steel Ltd. is renowned for its advanced rolling technology, while Ulbrich Stainless Steels & Special Metals, Inc. focuses on manufacturing high-quality foils and fostering partnerships with the healthcare sector to meet the growing demand in aerospace and medical device applications.

The Major Players in The Industry

- NIPPON STEEL Chemical & Material Co., Ltd.

- Posco Group

- Yaoyi Stainless Steel

- All Foils, Inc.

- Riddhi Siddhi Impex

- Kobe Steel, Ltd.

- Outokumpu

- Wieland Rolled Products

- Bhandari Group

- Ulbrich Stainless Steels and Special Metals Inc.

- Milesi Srl

- Hollinbrow Precision Products (UK) Ltd

- Jindal Stainless Limited

- Huaxiao Stainless Steel

- Beall Industry Group

- Other Key Players

Recent Development

- In August 2024 – NIPPON KINZOKU Co., Ltd. developed high-precision, wide-width stainless steel foil with large unit weight, featuring advanced surface finishes Bright Surface (BS) and White Surface (WS) to enhance functionality and meet diverse industry needs in automotive, battery, and semiconductor applications.

Report Scope

Report Features Description Market Value (2024) USD 7.4 Bn Forecast Revenue (2034) USD 13.4 Bn CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hot Rolled, Cold Rolled), By Grade (200 Series, 300 Series (301, 304, 316, 321, others), 400 Series, 900 series), By Thickness (Upto 0.05 mm, 0.06-0.09 mm, 0.1-0.3 mm, Greater than 0.3 mm), By End-use (Electrical & Electronic, Automotive, Aerospace, Healthcare, Others), Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape NIPPON STEEL Chemical & Material Co., Ltd., Posco Group, Yaoyi Stainless Steel, All Foils, Inc., Riddhi Siddhi Impex, Kobe Steel, Ltd., Outokumpu, Wieland Rolled Products, Bhandari Group, Ulbrich Stainless Steels and Special Metals Inc., Milesi Srl, Hollinbrow Precision Products (UK) Ltd, Jindal Stainless Limited, Huaxiao Stainless Steel, Beall Industry Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Stainless Steel Foil MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Stainless Steel Foil MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- NIPPON STEEL Chemical & Material Co., Ltd.

- Posco Group

- Yaoyi Stainless Steel

- All Foils, Inc.

- Riddhi Siddhi Impex

- Kobe Steel, Ltd.

- Outokumpu

- Wieland Rolled Products

- Bhandari Group

- Ulbrich Stainless Steels and Special Metals Inc.

- Milesi Srl

- Hollinbrow Precision Products (UK) Ltd

- Jindal Stainless Limited

- Huaxiao Stainless Steel

- Beall Industry Group

- Other Key Players