Global Plastic to Fuel Market Size, Share and Report Analysis By Plastic Type (Polyethylene, Polyethylene Terephthalate, Polypropylene, Polyvinyl Chloride, Polystyrene, and Others), By Technology (Pyrolysis, Depolymerization, and Gasification), By Source (Municipal Solid Waste, Commercial And Industrial Waste), By Fuel Type (Sulfur, Hydrogen, Crude Oil, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 176505

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

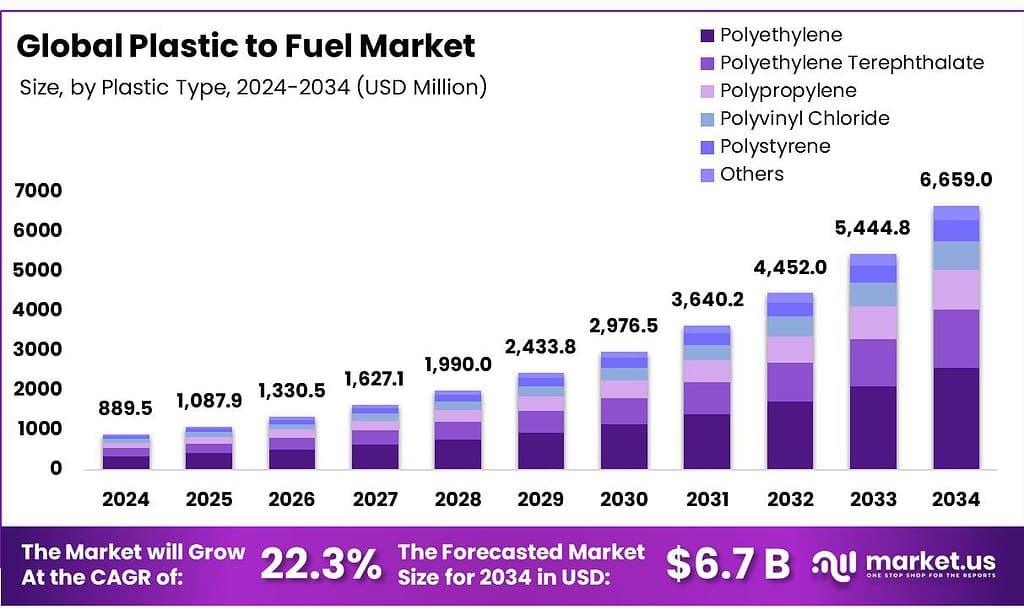

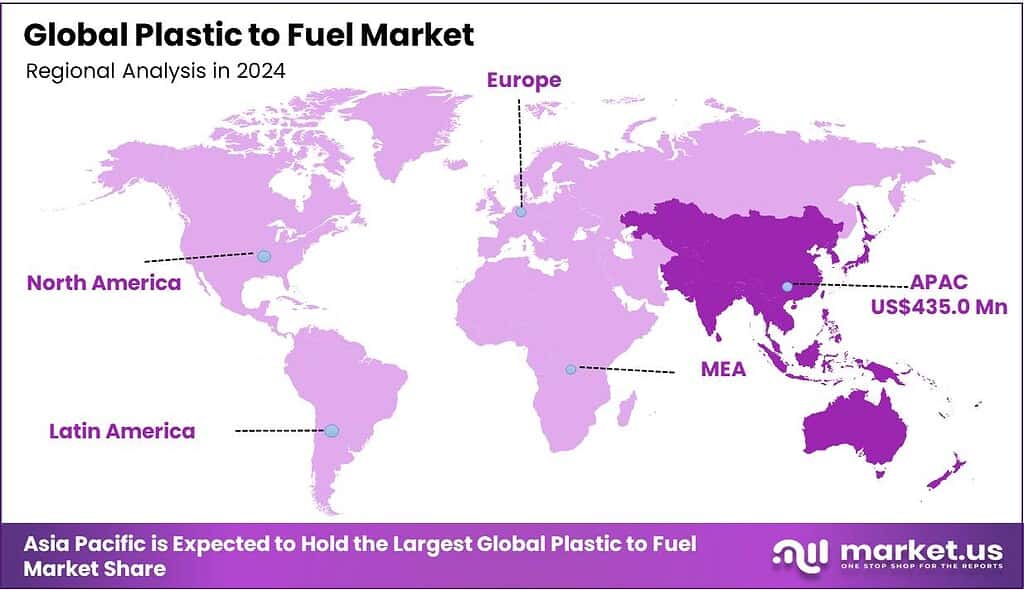

Global Plastic to Fuel Market size is expected to be worth around USD 6659.0 Million by 2034, from USD 889.5 Million in 2024, growing at a CAGR of 22.3% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 48.9% share, holding USD 435.0 Million in revenue.

Plastic-to-fuel is a chemical recycling process that converts non-recyclable plastic waste into usable energy carriers, such as synthetic crude oil, gasoline, diesel, and hydrogen. This technology primarily targets plastics that are difficult to recycle mechanically, such as multilayer packaging films and contaminated materials.

- According to the United Nations Environment Programme (UNEP), global plastic consumption reached 516 million tons in 2025 and will rise to over 1.2 billion tons annually by 2060.

- Around 130 million tons of plastic currently pollute the environment annually, a figure projected to more than double to 280 million tons by 2040 without systematic intervention.

The plastic-to-fuel (PTF) market is driven by the growing need to address plastic waste and enhance energy security. Pyrolysis technology dominates the sector due to its simplicity, efficiency, and ability to process various plastic types, especially polyethylene, which is abundant and easier to convert into fuel. Most plastic for fuel production is sourced from commercial and industrial waste, as it is more homogeneous and free from contaminants compared to municipal solid waste.

- According to the International Energy Agency’s (IEA) World Energy Outlook 2025 report, global energy demand grew by 2.2% in 2024, faster than the average rate over the past decade, creating demand for innovations in the fuel industry, such as plastic-to-fuel.

Additionally, crude oil is the primary product of PTF processes due to its chemical similarity to the hydrocarbons in plastic. While technological advancements, such as catalytic upcycling, are improving conversion efficiency and reducing environmental impacts, the market faces challenges related to emissions and energy consumption. The PTF market is an integral part of efforts to manage plastic waste and reduce reliance on fossil fuels.

- In August 2025, according to the US-China research team, formed by the US Department of Energy-funded Pacific Northwest National Laboratory, Columbia University, the Technical University of Munich, and East China Normal University (ECNU), they have developed a one-step method to convert mixed plastic waste into petrol at room temperature and ambient pressure, achieving more than 95% efficiency.

Key Takeaways

- The global plastic to fuel market was valued at USD 889.5 million in 2024.

- The global plastic to fuel market is projected to grow at a CAGR of 22.3% and is estimated to reach US$ 6659.0 Million by 2034.

- On the basis of types of plastic, polyethylene dominated the plastic-to-fuel market, constituting 38.6% of the total market share.

- Based on the technology, pyrolysis dominated the plastic-to-fuel market, with a substantial market share of around 75.8%.

- Based on the source of plastic, commercial & industrial waste led the plastic to fuel market, comprising 58.9% of the total market.

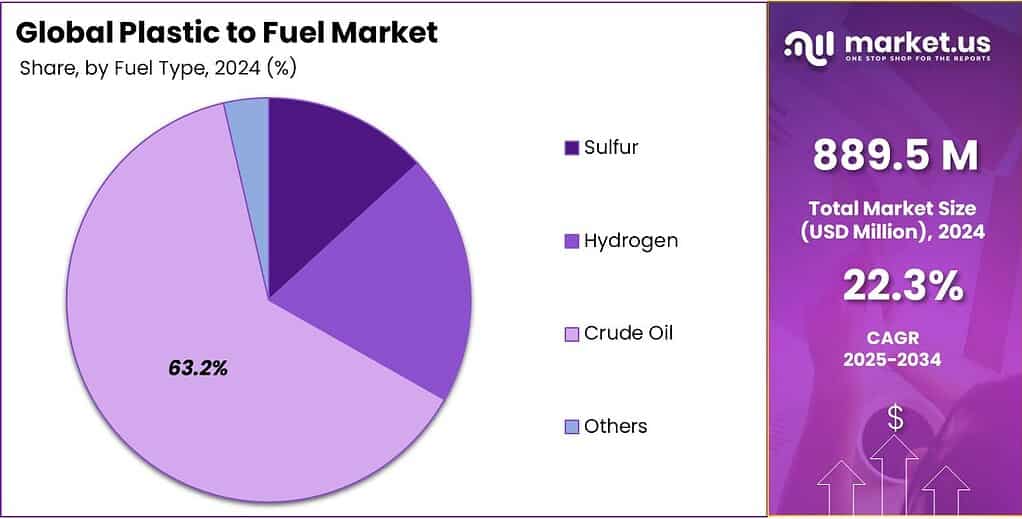

- Among the fuel types, crude oil held a major share in the plastic-to-fuel market, 63.2% of the market share.

- In 2024, the Asia Pacific was the dominant region in the plastic-to-fuel market, accounting for 48.9% of the total global consumption.

Plastic Type Analysis

Polyethylene Plastic Type is a Prominent Segment in the Plastic to Fuel Market.

The plastic to fuel market is segmented based on types of plastics into polyethylene (PE), polyethylene terephthalate (PET), polypropylene (PP), polyvinyl chloride (PVC), polystyrene (PS), and others. The polyethylene led the plastic to fuel market, comprising 38.6% of the market share, primarily due to its chemical structure and physical properties. PE is simpler and more homogeneous, making it easier to break down in the pyrolysis process compared to more complex plastics, which require higher temperatures and more energy to process due to their aromatic structure.

Additionally, PE has a lower melting point, enabling more efficient conversion to fuel. Furthermore, its widespread use in packaging, such as plastic bags, bottles, and films, leads to large volumes of PE waste, making it a prominent target for plastic-to-fuel technologies focused on addressing growing plastic waste streams.

- According to the Plastics Europe 2025 report, around 19% of total plastics produced, which was 430.9 million metric tons, in 2024 was PP, 12.1% was PE, 6.2% was PET, 5.1% was PS, and 12.8% was PVC.

Technology Analysis

Pyrolysis Dominated the Plastic to Fuel Market.

On the basis of the technology, the plastic-to-fuel market is segmented into pyrolysis, depolymerization, and gasification. The pyrolysis technology dominated the plastic-to-fuel market, comprising 75.8% of the market share, due to its relative simplicity, cost-effectiveness, and versatility in handling various plastic types. Pyrolysis operates at lower temperatures compared to gasification, making it more energy-efficient and easier to scale.

In addition, it does not require the complex catalysts or high-pressure environments often needed in depolymerization processes, which are better suited for specific plastics such as PET. Similarly, pyrolysis is capable of processing mixed plastic waste, including polyethylene and polypropylene, which are more common in the waste stream. This makes it a practical and accessible technology for large-scale plastic waste management. The flexibility and lower operational costs of pyrolysis make it the preferred choice for many waste-to-fuel applications.

Source Analysis

Plastic for Plastic to Fuel Industry is Mostly Sourced from Commercial & Industrial Waste.

Based on the source of plastic, the plastic to fuel market is divided into municipal solid waste (MSW) and commercial & industrial waste. The commercial & industrial waste dominated the plastic to fuel market, with a notable market share of 58.9%, due to the higher quality and consistency of the material. Commercial and industrial waste, such as packaging from factories or warehouses, tends to be more homogeneous and free from contaminants such as food waste or organic materials that are common in MSW.

Additionally, plastics in commercial and industrial waste are often higher in volume and more readily available in bulk, providing a steady supply. In contrast, MSW contains a mix of materials, including non-recyclable waste, which can complicate processing and reduce the efficiency of conversion technologies. This makes commercial and industrial waste more suited for large-scale plastic-to-fuel operations.

Fuel Type Analysis

Crude Oil Held a Major Share of the Plastic to Fuel Market.

Among the fuel types, 59.4% of the total global consumption in plastic to fuel products is of crude oil. Most plastic-to-fuel technologies convert plastic waste into crude oil rather than sulfur, hydrogen, or other fuels, as the chemical composition of plastics, particularly hydrocarbons such as polyethylene and polypropylene, closely resembles that of crude oil. Plastics are primarily made up of carbon and hydrogen atoms, which are the key components of crude oil. During pyrolysis, these hydrocarbon chains break down into smaller liquid hydrocarbons, which can be refined into synthetic crude oil.

Crude oil is a versatile and valuable fuel, easily processed into gasoline, diesel, or kerosene, making it a practical and efficient end product. In contrast, converting plastic to sulfur or hydrogen requires more complex processes, often resulting in lower yields or less versatile fuel types. The crude oil is the most efficient and economically viable option for large-scale fuel production.

Key Market Segments

By Plastic Type

- Polyethylene

- Polyethylene Terephthalate

- Polypropylene

- Polyvinyl Chloride

- Polystyrene

- Others

By Technology

- Pyrolysis

- Depolymerization

- Gasification

By Source

- Municipal Solid Waste

- Commercial & Industrial Waste

By Fuel Type

- Sulfur

- Hydrogen

- Crude Oil

- Others

Drivers

Rising Plastic Waste and Pressures to Manage It Sustainably Drive the Plastic to Fuel Market.

Rising plastic waste and the increasing pressure to manage it sustainably are critical drivers for the growing interest in the market. According to the Europe Plastics 2025 report, approximately 89.8% of total plastic production in 2024 was plastic produced from fossil fuels, leading to significant environmental and disposal challenges.

Consequently, various countries have adopted policies aimed at reducing plastic waste. For instance, the European Commission is set to adopt a Circular Economy Act in 2026 to double circularity rates to 24% by 2030, while simultaneously banning plastic waste exports to non-OECD countries starting in November 2026, pushing industries to find sustainable alternatives to landfilling and incineration.

- Despite growing awareness, only 9% of plastic is successfully recycled globally, and it is estimated that just 21% of plastic produced is economically recyclable, meaning the value of recycled materials covers the costs of collection, sorting, and processing.

Additionally, in the U.S., states such as New Hampshire and Wisconsin have introduced Extended Producer Responsibility (EPR) legislation in early 2026 to shift management burdens to producers. These stringent recovery targets and export restrictions necessitate chemical recycling technologies, such as pyrolysis, to process non-mechanical grade plastics into fuel and feedstock.

Restraints

Environmental Challenges Might Hinder the Growth of the Plastic to Fuel Market.

The production of plastic-to-fuel technologies faces significant environmental challenges that impact the broader adoption of such processes. The primary concern is the emissions associated with the conversion of plastic waste into fuel. According to the U.S. Environmental Protection Agency (EPA), plastic waste contains high amounts of carbon, and when processed in PTF systems, it can release greenhouse gases and other air pollutants, including volatile organic compounds (VOCs) and particulate matter, contributing to air quality degradation.

The combustion of plastics can produce hazardous chemicals such as dioxins, furans, heavy metals, and per- and polyfluoroalkyl substances (PFAS), which pose risks to human health and ecosystems. In January 2026, the European Commission’s draft regulation on end-of-waste criteria explicitly excluded pyrolysis oil used for energy or fuel production from being classified as recycled material, potentially limiting its inclusion in circular economy targets.

Additionally, plastic waste often contains additives such as flame retardants and plasticizers, which can release toxic substances during the PTF process. This complicates the production of clean, usable fuel and may lead to harmful byproducts, as detailed in research by the European Commission’s Joint Research Centre (JRC). These environmental hurdles necessitate further technological advancements to reduce the adverse impacts of PTF processes.

Opportunity

Rising Demand for Energy Security Creates Opportunities in the Plastic to Fuel Market.

The growing demand for energy security presents a significant opportunity for the plastic-to-fuel market. Due to increasing global energy volatility, governments are prioritizing energy diversification and domestic fuel production. The International Energy Agency (IEA) reports that global oil demand has risen by an average of 1.3 million barrels per day annually since 2000, creating pressure on traditional fossil fuel supply chains.

Consequently, several countries have turned to alternative fuel production methods, including PTF technologies, to reduce reliance on imported oil and bolster national energy resilience. For instance, the U.S. Department of Energy (DOE) has emphasized the role of waste-to-energy technologies in enhancing energy security, noting that the conversion of non-recycled plastics into fuel could contribute to the domestic energy supply.

Similarly, in Europe, the European Commission’s Circular Economy Action Plan includes initiatives that support energy recovery from waste, including plastic. With the global ongoing efforts to transition to cleaner energy while addressing waste management issues, PTF technologies may play a role in mitigating energy shortages and improving energy self-sufficiency. These trends underscore the potential for PTF processes to contribute to national energy security objectives.

Trends

Focus on Technological Advancements in Conversion Technology

Technological advancements in plastic-to-fuel conversion methods, such as catalytic upcycling, are becoming central to improving the efficiency and environmental performance of waste-to-fuel technologies. Catalytic upcycling refers to the process of using catalysts to break down plastics into valuable fuels, often at lower temperatures and with higher efficiency compared to traditional pyrolysis methods. The catalytic upcycling could reduce the formation of harmful byproducts, such as dioxins and furans, commonly associated with conventional plastic-to-fuel methods.

In addition, the U.S. Environmental Protection Agency (EPA) has funded projects to optimize catalytic processes, indicating its potential for achieving economic and environmental goals. According to EPA studies, catalysts can improve the selectivity and efficiency of plastic breakdown, making it a more sustainable method compared to incineration or landfilling. These advancements are seen as critical to addressing key challenges in the PTF sector, including the need for cleaner fuel production and reduced environmental impact.

Geopolitical Impact Analysis

Geopolitical Uncertainties Have Affected Global Energy Supply Chains.

The geopolitical tensions, particularly those arising from conflicts and trade disputes, have significant implications for the plastic-to-fuel market. For instance, the ongoing war in Ukraine has disrupted global energy markets, leading to increased prices and supply chain instability for traditional fuels. Russia’s invasion of Ukraine led to a sharp reduction in Russian oil exports, forcing many European countries to seek alternative energy sources, including domestically produced fuels. This shift has prompted greater interest in PTF technologies as a means of reducing reliance on imported fossil fuels.

Moreover, trade tensions and tariffs on plastics between major economies, such as the U.S. and China, have exacerbated plastic waste management challenges. China’s ban on plastic waste imports pushed Western countries to increase their domestic waste processing capacities. This change has accelerated the push for alternative waste-to-energy solutions, including PTF technologies, to handle growing plastic waste locally. Additionally, geopolitical uncertainties affect global energy supply chains, making countries more inclined to invest in energy independence through technologies such as PTF.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Plastic-to-Fuel Market.

In 2024, the Asia Pacific dominated the global plastic-to-fuel market, holding about 48.9% of the total global consumption, driven by the region’s vast plastic waste generation and growing demand for alternative energy sources. Countries such as India and Japan are increasingly investing in PTF technologies as part of national waste management strategies. The Indian Government’s Ministry of Environment, Forest, and Climate Change has emphasized waste-to-energy solutions, including plastic recycling, as part of its circular economy framework.

- According to the Plastics Europe 2025 report, Asia Pacific plastic production represented 57.2% of the total global production of plastics, reaching approximately 246.5 million metric tons.

- China alone accounted for 34.5% of global plastic production in 2024, with large volumes of waste requiring processing.

Additionally, Japan, a leader in waste management, has been using advanced recycling technologies to convert plastic waste into energy, with the Japanese Ministry of the Environment highlighting the importance of such technologies in achieving national recycling and sustainability targets. These efforts underscore the growing role of PTF technologies in addressing waste management and energy security in the Asia Pacific region.

- According to a 2025 report by the IEA, emerging and developing economies accounted for over 80% of global energy demand growth in 2024. China saw the largest demand growth in absolute terms of any country, and India saw the second-largest rise in energy demand in absolute terms, more than the increase in all advanced economies combined.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Manufacturers of plastic-to-fuel technologies invest heavily in research and development (R&D) to improve the efficiency and environmental sustainability of conversion processes, such as enhancing catalytic upcycling or pyrolysis technologies. Additionally, companies often focus on securing partnerships with governments and municipal bodies to align with waste management policies and circular economy initiatives. Furthermore, they prioritize scaling production capabilities and reducing operational costs to make PTF solutions more commercially viable.

Similarly, some manufacturers emphasize localizing production to meet regional energy security and plastic waste management needs. Moreover, strategic investments in automation and process optimization further enhance productivity and market position.

The Major Players in The Industry

- Plastic2oil

- Alterra Energy

- Neste

- Nexus Circular

- BRADAM Group, LLC

- Brightmark LLC

- Klean Industries

- Beston (Henan) Machinery Co., Ltd.

- Plastic Energy

- Agilyx Inc.

- Other Key Players

Key Development

- In December 2025, Abundia Global Impact Group, Inc. announced significant progress in its licensing agreement with Alterra Energy aimed at developing a technology and commercialization platform to transform discarded plastic into renewable fuels and chemical products.

- In February 2025, Neste, one of the largest producers of biobased and recycled-plastic-based materials, announced to shift its focus from renewable and circular chemicals to renewable fuels.

Report Scope

Report Features Description Market Value (2024) US$889.5 Mn Forecast Revenue (2034) US$6659.0 Mn CAGR (2025-2034) 22.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Plastic Type (Polyethylene, Polyethylene Terephthalate, Polypropylene, Polyvinyl Chloride, Polystyrene, and Others), By Technology (Pyrolysis, Depolymerization, and Gasification), By Source (Municipal Solid Waste, Commercial & Industrial Waste), By Fuel Type (Sulfur, Hydrogen, Crude Oil, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Plastic2oil, Alterra Energy, Neste, Nexus Circular, BRADAM Group, LLC, Brightmark LLC, Klean Industries, Beston (Henan) Machinery Co. Ltd., Plastic Energy, Agilyx Inc., and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Plastic2oil

- Alterra Energy

- Neste

- Nexus Circular

- BRADAM Group, LLC

- Brightmark LLC

- Klean Industries

- Beston (Henan) Machinery Co., Ltd.

- Plastic Energy

- Agilyx Inc.

- Other Key Players