Global Natural Rubber Market Size, Share, Analysis Report By Type (Ribbed Smoked Sheet Type, Solid Block Rubber Type, Concentrated Latex Type, Others), By Application (Automotive Components, Surgical Gloves, Conveyor Belts, Foot Wear, Latex Products, Rubber Pipes , Others), By End-use (Chemical Industry, Textile industry, Automotive Industry, Food Industry, Pharmaceutical Industry, Others), By Distribution Channel (Direct Sales, Distributors/Wholesalers, Online Retail, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: December 2024

- Report ID: 134574

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

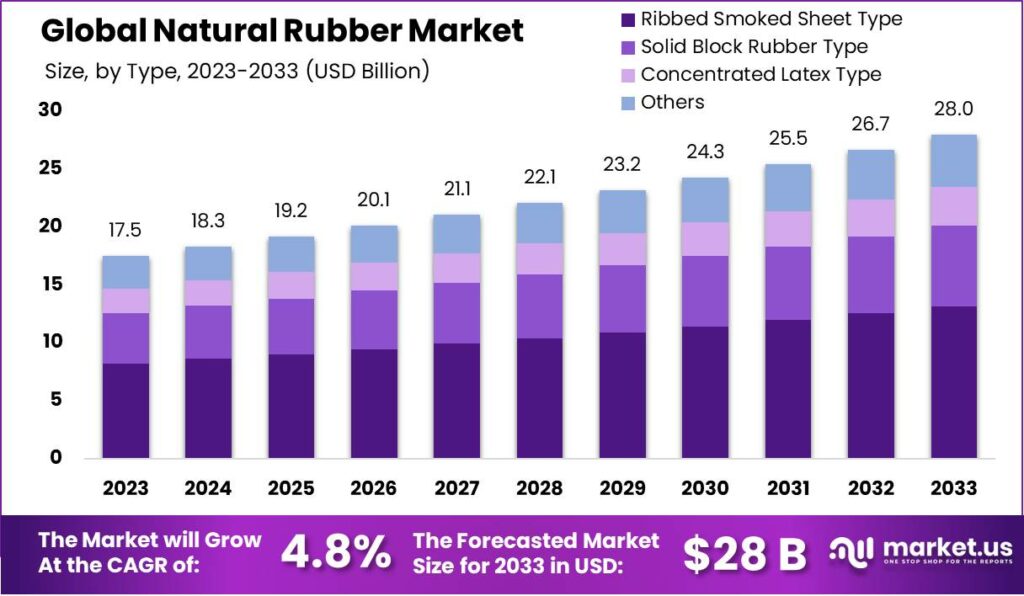

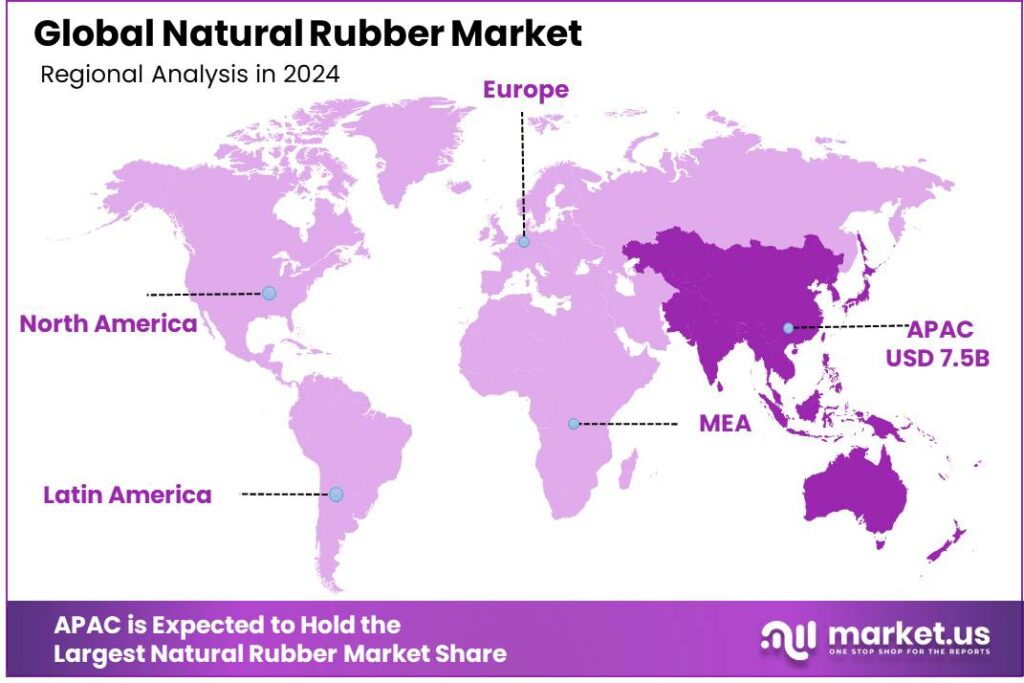

The Global Natural Rubber Market is expected to be worth around USD 28.0 billion by 2033, up from USD 17.5 billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033. In 2023, Asia Pacific held a dominant market position in the global natural rubber market, capturing more than 43.1% of the total market share, valued at approximately USD 7.5 billion.

The Natural Rubber Market is experiencing steady growth, driven by its essential role in a wide range of industries, from automotive tires to medical devices. The primary source of natural rubber, the rubber tree, is predominantly grown in Southeast Asia, with Thailand, Indonesia, and Vietnam being the largest producers.

Despite challenges like price fluctuations and supply chain disruptions, the market continues to thrive, supported by the rising global demand for renewable and sustainable raw materials.

The automotive industry is the largest driver of natural rubber demand, particularly for tires, seals, and belts. With global vehicle ownership on the rise, especially in emerging markets, the need for natural rubber is expected to grow further.

Additionally, increasing consumer preference for eco-friendly products has positioned natural rubber as an attractive alternative to synthetic rubber, given its biodegradable and renewable properties. This trend is particularly strong in developing economies where the automotive and construction sectors are expanding rapidly.

A key opportunity for the market lies in developing more sustainable farming practices. Innovations in rubber tree breeding and cultivation methods can boost yields without requiring more land. Furthermore, new partnerships between rubber producers and eco-friendly product manufacturers are creating additional market opportunities. The rise of electric vehicles, which still rely on natural rubber for tires, is also contributing to market growth.

Geographically, the natural rubber market is diversifying, with new cultivation areas being explored in Africa and South America, reducing reliance on Southeast Asia. Government initiatives, such as Thailand’s Rubber Plantation Development Policy, are focused on improving yield and reducing environmental impact.

In addition, substantial investments are being made in sustainable rubber production. For example, the Thai government allocated $200 million in 2022 to support rubber farmers, and companies like Goodyear and Michelin committed over $500 million in research for sustainable tire production in 2023.

Key Takeaways

- The Global Natural Rubber Market is expected to be worth around USD 28.0 billion by 2033, up from USD 17.5 billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

- Ribbed Smoked Sheet Type dominated the Natural Rubber Market with 47.1%.

- Automotive Components dominated the Natural Rubber Market By Application with 48.1%.

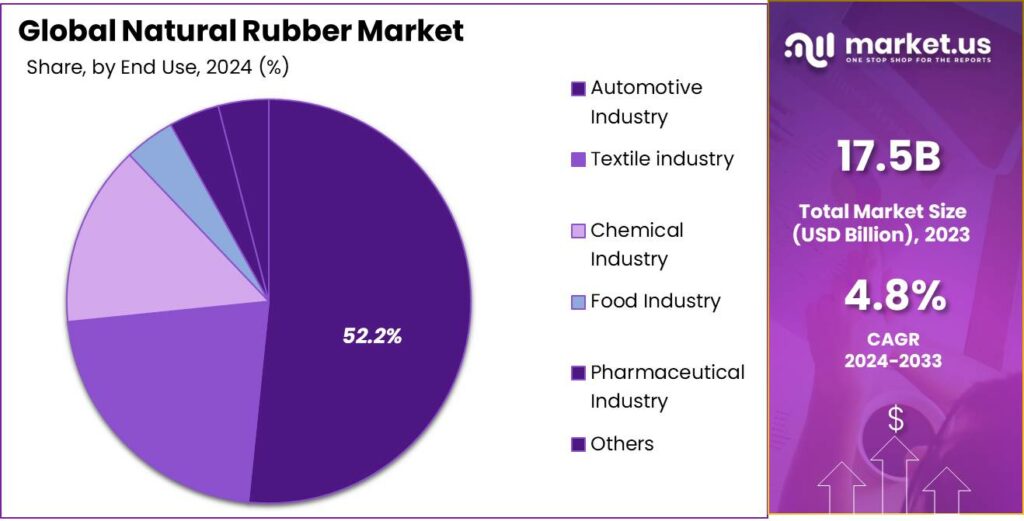

- The Automotive Industry dominated the Natural Rubber Market By End-use with 52.2% in 2023.

- Direct Sales led the Natural Rubber Market Market By Distribution Channel with a 46.1% share in 2023.

- Asia Pacific dominated the natural rubber market with a 43.1% share, valued at USD 7.5 billion.

By Type Analysis

In 2023, Ribbed Smoked Sheet Type held a dominant market position in the “By Type” segment of the Natural Rubber Market, capturing more than 47.1% share. This segment’s strong performance can be attributed to its widespread use in a variety of applications, including automotive tires, footwear, and industrial products. The Ribbed Smoked Sheet Type is favored for its excellent durability, quality, and ease of processing, which makes it the preferred choice in many industries.

Following closely, Solid Block Rubber Type accounted for a significant portion of the market. While not as popular as Ribbed Smoked Sheet, Solid Block Rubber is used primarily in the production of high-performance tires and technical rubber goods due to its superior mechanical properties. This segment held a notable share due to the growing demand for premium rubber products.

Concentrated Latex Type, known for its versatile applications in manufacturing products like gloves, balloons, and rubber bands, maintained a steady market presence in 2023. It represented a smaller yet growing share as industries focused on eco-friendly and sustainable production methods.

By Application Analysis

In 2023, Automotive Components held a dominant market position in the “By Application” segment of the Natural Rubber Market, capturing more than 48.1% share. This is primarily driven by the automotive industry’s ongoing demand for high-quality rubber materials for tires, seals, gaskets, and other critical components. The growing automotive production and the rise in demand for durable, high-performance rubber in vehicle manufacturing continue to bolster the dominance of this application segment.

Surgical Gloves, holding the second-largest market share, remain a critical application in the healthcare sector. Natural rubber’s inherent elasticity and comfort make it a preferred material for disposable gloves, contributing to its continued strong presence in the market. The demand for surgical gloves surged during the COVID-19 pandemic and remains robust due to rising healthcare standards and hygiene awareness worldwide.

Conveyor Belts, used across a variety of industries, also hold a substantial share. Natural rubber’s resilience and resistance to wear and tear make it ideal for use in heavy-duty conveyor systems. Industries such as mining, manufacturing, and logistics continue to drive growth in this segment, particularly in emerging economies where infrastructure development is accelerating.

Footwear, another significant segment, benefits from natural rubber’s flexibility and cushioning properties. The demand for high-quality rubber footwear, especially in the sports and casual wear sectors, continues to drive this segment’s growth.

Latex Products, including items like balloons and elastic bands, also play a key role in the market, benefiting from natural rubber’s stretchability and low cost.

Rubber Pipes and “Others” cover niche applications but have seen steady demand due to the versatility and reliability of natural rubber in various specialized products, such as industrial seals and hoses.

By End-use Analysis

In 2023, the Automotive Industry held a dominant market position in the “By End-use” segment of the Natural Rubber Market, capturing more than 52.2% of the share. The automotive sector’s high demand for natural rubber, primarily in the production of tires, seals, gaskets, and vibration dampers, continues to be the key driver. As global vehicle production increases and automotive manufacturers shift towards more sustainable materials, the need for natural rubber, known for its durability and performance, remains crucial for the industry’s growth.

The Chemical Industry, while holding a smaller share, is another significant consumer of natural rubber. Rubber’s chemical stability and resistance to heat make it essential in the production of various rubber-based chemicals, lubricants, and coatings. As industrial manufacturing and chemical processing expand, this sector continues to show steady demand for natural rubber.

The Textile Industry also plays a notable role, albeit a smaller one compared to automotive. Natural rubber is used in the production of elastic fibers, threads, and other textile products. As the global demand for elastic fabrics, particularly in the fashion and sportswear industries, rises, the use of natural rubber in textile manufacturing has been gradually increasing.

The Food and Pharmaceutical Industries, while contributing less to the overall market, continue to rely on natural rubber in specific applications such as packaging, medical gloves, and rubber stoppers. Natural rubber’s high elasticity and non-reactivity are ideal for these sensitive industries, ensuring product integrity and safety.

By Distribution Channel Analysis

In 2023, Direct Sales held a dominant market position in the “By Distribution Channel” segment of the Natural Rubber Market, capturing more than 46.1% share. Direct sales remain the preferred distribution method due to the strong relationships between manufacturers and large-scale buyers, such as tire manufacturers and industrial producers. This channel provides greater control over pricing, logistics, and quality assurance, making it particularly valuable in the B2B (business-to-business) sector where bulk orders are common.

Distributors and Wholesalers accounted for a significant portion of the market, serving as intermediaries between manufacturers and end-users. This channel plays a crucial role in reaching smaller, regional markets and industries that do not require direct sourcing from producers.

Distributors and wholesalers provide flexibility and faster access to natural rubber, especially for companies with lower-volume needs or those operating in areas where manufacturers may have limited reach.

Online Retail, though still a smaller segment, has been gaining traction in recent years. With the growing digitalization of the supply chain, many smaller businesses and even individual consumers are turning to online platforms for purchasing rubber materials. This shift has been particularly evident in niche markets, such as crafting and small-scale manufacturing.

Key Market Segments

By Type

- Ribbed Smoked Sheet Type

- Solid Block Rubber Type

- Concentrated Latex Type

- Others

By Application

- Automotive Components

- Surgical Gloves

- Conveyor Belts

- Foot Wear

- Latex Products

- Rubber Pipes

- Others

By End-use

- Chemical Industry

- Textile industry

- Automotive Industry

- Food Industry

- Pharmaceutical Industry

- Others

By Distribution Channel

- Direct Sales

- Distributors/Wholesalers

- Online Retail

- Others

Driving factors

Increasing Demand in the Automotive Industry

The growing demand for natural rubber in the automotive industry is a key driver of market growth. Rubber is a critical material in the manufacturing of tires, and as global automobile production continues to rise, so does the need for high-quality rubber. The demand for eco-friendly and sustainable materials has further fueled this trend, as natural rubber is biodegradable, unlike synthetic alternatives.

As the automotive industry increasingly adopts sustainable practices, natural rubber has emerged as a preferred material for tire production due to its lower environmental impact. Additionally, the rising demand for electric vehicles (EVs) and advanced tire technologies, such as airless and self-healing tires, is expected to contribute to the continued demand for natural rubber in automotive manufacturing.

According to industry sources, global automobile production is expected to increase by approximately 3% annually, creating a corresponding increase in demand for natural rubber. Consequently, the natural rubber market is set to benefit from the automotive sector’s growth, with tire manufacturers and automakers focusing more on sustainable, high-performance products.

Restraining Factors

Volatile Prices Due to Supply Chain Issues

One of the significant restraints for the natural rubber market is the volatility of rubber prices, often driven by disruptions in supply chains. Natural rubber is predominantly produced in Southeast Asia, with Thailand, Indonesia, and Malaysia being the largest producers. However, these regions are highly susceptible to climate fluctuations, disease outbreaks, and political instability, which can disrupt production and supply.

For instance, unpredictable weather patterns like droughts and floods can significantly affect rubber yield, causing fluctuations in price. Moreover, the COVID-19 pandemic and recent geopolitical tensions have further exacerbated supply chain issues, leading to price volatility and uncertainty in the market. Natural rubber, being a commodity, is also influenced by global market trends, making it vulnerable to swings in demand and speculation.

These factors make it difficult for producers and consumers alike to plan for future costs, potentially impacting profitability. As a result, businesses in industries reliant on natural rubber, such as automotive and footwear, may face challenges in managing costs and maintaining price stability in the long term.

Growth Opportunity

Advancements in Sustainable Rubber Production

An emerging opportunity within the natural rubber market lies in the development of sustainable production methods. As environmental concerns continue to grow, there is increasing pressure on industries to adopt eco-friendly practices. Advances in sustainable rubber farming, such as reforestation projects and improvements in rubber tapping techniques, present significant opportunities for both producers and consumers.

For instance, some companies are experimenting with bio-based alternatives and precision farming to increase yields while minimizing environmental damage. Furthermore, the use of recycled rubber in combination with natural rubber offers another avenue for sustainability.

Recycling rubber from used tires to produce new products is gaining traction, as it reduces waste and lessens the dependence on virgin rubber. By transitioning to sustainable practices, producers can not only contribute to environmental preservation but also appeal to the growing market segment that values eco-conscious products.

The global push toward sustainability is expected to increase consumer demand for products made with responsibly sourced natural rubber, particularly in industries such as automotive, footwear, and consumer goods. This presents a unique opportunity for stakeholders to invest in innovation and capitalize on the shift toward a more sustainable future.

Challenge

Environmental and Social Concerns

The natural rubber market faces a significant challenge in addressing environmental and social concerns associated with its production. The expansion of rubber plantations in tropical regions has led to deforestation and habitat loss, contributing to biodiversity decline. Additionally, labor conditions in some rubber-producing regions have raised ethical concerns, with reports of poor working conditions and low wages for rubber tappers.

As the demand for natural rubber increases, stakeholders must ensure that the production process does not exacerbate environmental degradation or human rights issues. Increasingly, consumers and governments are demanding that companies adopt more responsible sourcing practices. This challenge has prompted industry players to explore more sustainable and ethical alternatives, such as certified sustainable rubber and fair trade initiatives.

However, transitioning to these practices often requires significant investment in technology and infrastructure, which may be a barrier for smaller producers. Furthermore, these changes may not always be immediately visible to end consumers, making it challenging for companies to differentiate themselves in the marketplace. Despite these challenges, addressing the environmental and social concerns in rubber production is essential for long-term market stability and growth.

Emerging Trends

The natural rubber industry is evolving with sustainability, alternative sources, and digitalization innovations.

The natural rubber industry is undergoing significant transformations driven by evolving technological innovations, environmental concerns, and changing market demands. One of the most notable emerging trends is the growing emphasis on sustainability. As the global push for eco-friendly practices intensifies, the rubber industry is exploring ways to reduce its environmental footprint. Companies are increasingly investing in sustainable rubber farming practices, such as agroforestry, where rubber trees are grown alongside other crops, minimizing deforestation.

Another emerging trend is the rise of alternative sources of natural rubber. Researchers are exploring plants other than the traditional rubber tree (Hevea brasiliensis) that can produce natural rubber, such as the guayule plant and dandelion species. These plants are seen as potential alternatives to traditional rubber, particularly for regions that face land constraints or environmental challenges.

Furthermore, advancements in rubber processing technologies are helping improve the performance and efficiency of rubber products, especially in automotive applications, where manufacturers are increasingly focusing on producing tires that are more durable and fuel-efficient.

Digitalization is also influencing the natural rubber market. Technologies such as the Internet of Things (IoT) and blockchain are being used to monitor rubber plantations, ensuring quality control and traceability of rubber from source to end product. These advancements not only improve supply chain transparency but also offer consumers more confidence in the sustainability of the products they purchase.

Business Benefits

Natural rubber offers durability, cost stability, and sustainability benefits, enhancing brand image and performance.

Natural rubber offers several distinct business benefits, especially in industries such as automotive, manufacturing, and consumer goods. One of the primary advantages is its unique physical properties. Natural rubber is known for its high elasticity, resilience, and durability, which make it a preferred choice in the production of tires, footwear, and industrial products. In the automotive industry, natural rubber is widely used in tire production due to its ability to offer better grip, durability, and fuel efficiency compared to synthetic alternatives.

Another business benefit of natural rubber is its potential for cost-effectiveness, particularly in the context of rising synthetic rubber prices. While synthetic rubber is often cheaper to produce, fluctuations in petroleum prices, the key raw material for synthetic rubber, can lead to unpredictable costs. In contrast, natural rubber, derived from renewable sources, offers a more stable supply chain and predictable pricing over time, especially when grown in regions with favorable climates for rubber cultivation.

Additionally, the growing consumer preference for sustainable products presents an opportunity for businesses to align their brand with eco-conscious values. By utilizing natural rubber, which is biodegradable and produced with less environmental impact compared to synthetic rubber, companies can enhance their brand image and appeal to consumers who prioritize sustainability. This trend is especially important as companies face increasing pressure from both consumers and governments to reduce their environmental impact.

Regional Analysis

Asia Pacific dominated the natural rubber market with a 43.1% share, valued at USD 7.5 billion.

In 2023, Asia Pacific held a dominant market position in the global natural rubber market, capturing more than 43.1% of the total market share, valued at approximately USD 7.5 billion. This region’s supremacy can be attributed to the significant production capacity of countries like Thailand, Indonesia, and Malaysia, which together contribute over 70% of the global natural rubber supply.

The demand for natural rubber in the Asia Pacific is driven primarily by the automotive, construction, and industrial sectors, with China and India emerging as key consumers due to rapid industrialization and urbanization.

The automotive sector is one of the major drivers in Asia Pacific, especially with the growing demand for tires in countries like China and India. As automotive production increases, so does the need for high-quality rubber, which Asia Pacific is well-positioned to supply. Furthermore, the expanding infrastructure in developing economies like India and Vietnam increases the demand for rubber in construction and manufacturing applications.

North America and Europe follow as the second and third-largest regions in terms of market share, but they are relatively smaller in comparison. The U.S. and European countries have limited natural rubber production capacity, relying more on imports. However, the demand for automotive manufacturing, particularly in the U.S., remains strong, contributing to market growth in these regions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global natural rubber market remains highly competitive, with several key players continuing to shape its dynamics. Among these companies, Halcyon Agri Corporation Limited stands out as a leading force in rubber production and processing. As a major supplier, it has built a significant presence through its vast production network across Southeast Asia.

Halcyon Agri’s strategic acquisitions and its strong commitment to sustainability make it a key player in meeting the rising demand for eco-friendly rubber products, which is becoming a critical trend in the market.

Another prominent company is Firestone Natural Rubber Company, a subsidiary of Bridgestone, which has developed a strong footprint in rubber plantations, particularly in Liberia. The company’s focus on sustainable production methods, such as its use of high-quality, high-yielding rubber trees, contributes to both environmental and operational efficiency, positioning it as a key player in the high-demand automotive sector.

American Phoenix Inc., though smaller, is notable for its specialization in producing premium rubber products for niche industries, including medical and consumer goods. This specialization allows the company to compete effectively in markets that require high-quality and customized rubber solutions, offering a competitive edge in an increasingly demanding marketplace.

Finally, Sri Trang Agro-Industry Public Company Ltd is a major player, particularly strong in the production of natural rubber latex and solid rubber. With a robust supply chain, Sri Trang has positioned itself as a reliable and consistent supplier for various industries, especially in Asia, where demand for natural rubber continues to rise.

Market Key Players

- American Phoenix Inc.

- Apcotex Industries Ltd.

- China Hainan Rubber

- Coloplast A/S

- Cooper Standard ISG

- Farms Group Co., Ltd

- Firestone Natural Rubber Company

- Halcyon Agri

- Halcyon Agri Corporation Limited

- Hanna Rubber Company

- Hua Rubber Public Company Ltd

- Num Rubber & Latex Co., Ltd

- Sinochem Group Co. Ltd.

- Southland Rubber Co., Ltd

- Sri Trang Agro-Industry Public Company Ltd

- Thai Rubber Latex Group

- Von Bundit Co., Ltd

- Yunnan State

Recent Development

- In January 2024, Sri Trang Agro-Industry is expanding its natural rubber processing capacity by 10%, adding 50,000 tons annually at its Thailand facility, bringing the total capacity to 500,000 tons.

- In March 2024, Halcyon Agri Corporation acquired a 25,000-hectare rubber plantation in Indonesia, increasing its acreage by 15%. This acquisition will boost production by 40,000 tons annually, strengthening its supply chain and market share in Southeast Asia.

- In April 2024, Firestone Natural Rubber Company reported a 12% increase in rubber production from its Liberian plantations, reaching 180,000 tons in 2024, driven by sustainable farming and high-yielding rubber tree varieties.

Report Scope

Report Features Description Market Value (2023) USD 17.5 Billion Forecast Revenue (2033) USD 28.0 Billion CAGR (2024-2032) 4.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Ribbed Smoked Sheet Type, Solid Block Rubber Type, Concentrated Latex Type, Others), By Application (Automotive Components, Surgical Gloves, Conveyor Belts, Foot Wear, Latex Products, Rubber Pipes, Others), By End-use (Chemical Industry, Textile Industry, Automotive Industry, Food Industry, Pharmaceutical Industry, Others), By Distribution Channel (Direct Sales, Distributors/Wholesalers, Online Retail, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Keyur Industries, JYOT Overseas Pvt. Ltd., Atlas Industries, Satnam Psyllium Industries, Abhyuday Industries, Shree Mahalaxmi psyllium Pvt. Ltd., Rajganga Agro Product Pvt.Ltd., Jyotindra International, Ispasen Remedies, Shubh Psyllium Industries, Now Health Group, Inc., Nature’s Sunshine, Patanjali Ayurveda, Dabur India Ltd., Rama Gum Industries (India) Limited, Procter & Gamble, Nature’s Bounty Co. (Puritan’s Pride), Reckitt Benckiser Group plc, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- American Phoenix Inc.

- Apcotex Industries Ltd.

- China Hainan Rubber

- Coloplast A/S

- Cooper Standard ISG

- Farms Group Co., Ltd

- Firestone Natural Rubber Company

- Halcyon Agri

- Halcyon Agri Corporation Limited

- Hanna Rubber Company

- Hua Rubber Public Company Ltd

- Num Rubber & Latex Co., Ltd

- Sinochem Group Co. Ltd.

- Southland Rubber Co., Ltd

- Sri Trang Agro-Industry Public Company Ltd

- Thai Rubber Latex Group

- Von Bundit Co., Ltd

- Yunnan State