Global Crude Oil Market By Type (Light Distillates, Light Oils, Medium Oils, Heavy Fuel Oil), By Application (Transportation Fuel, Ethylene, Acrylic, Butadiene, Benzene, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147450

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

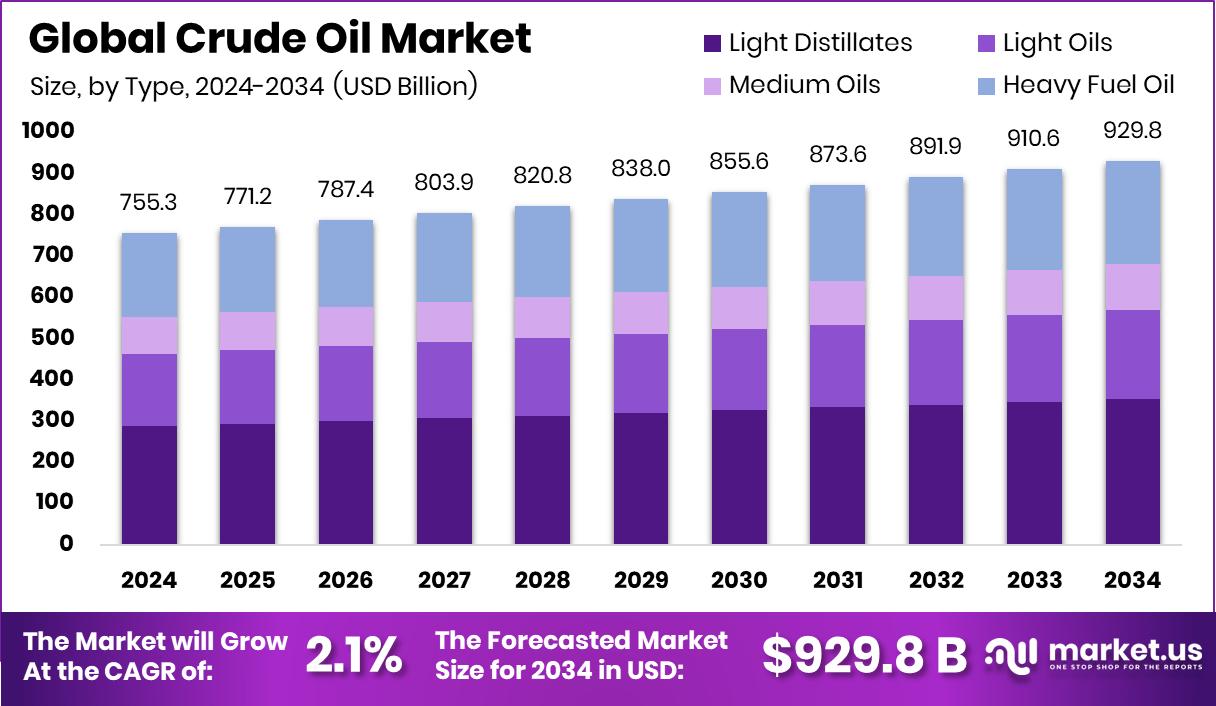

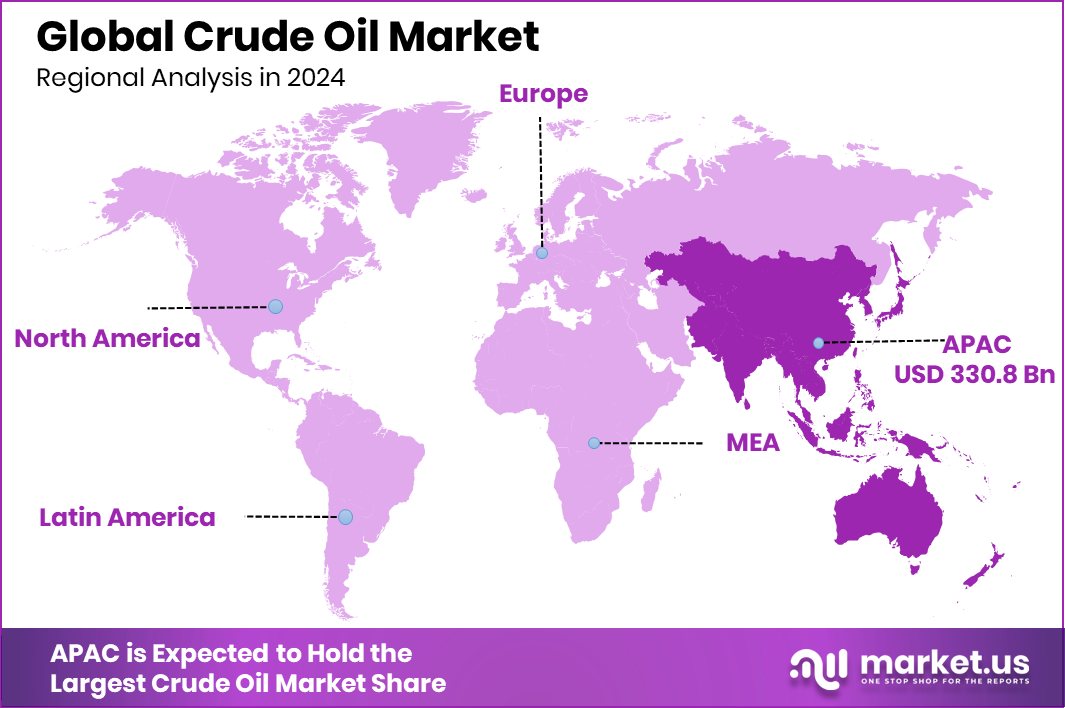

Global Crude Oil Market is expected to be worth around USD 929.8 billion by 2034, up from USD 755.3 billion in 2024, and grow at a CAGR of 2.1% from 2025 to 2034. Crude Oil Market in Asia-Pacific held 43.8% share, valued at USD 330.8 Bn.

Crude oil is a naturally occurring fossil fuel found deep underground, formed from ancient organic matter compressed over millions of years. It’s a thick, dark liquid composed mainly of hydrocarbons and is the raw material used to produce gasoline, diesel, jet fuel, heating oil, lubricants, and petrochemicals. Crude oil is extracted through drilling and must be refined before it becomes usable energy.

The crude oil market refers to the global network where crude oil is traded, bought, and sold. This market includes upstream activities like exploration, drilling, midstream transportation, and downstream refining and distribution. It operates through both spot and futures trading platforms, with prices often set by global benchmarks like Brent and WTI. The market is influenced by geopolitical tensions, production levels, supply chain disruptions, and international demand for fuel and petrochemical products.

Global energy demand continues to rise, especially in emerging economies, which heavily rely on oil for transport and power. Government investments in infrastructure, increased vehicle usage, and petrochemical expansion also push the need for crude. Additionally, advancements in drilling and extraction have made oil more accessible in previously unreachable areas.

The transportation sector is the biggest consumer of crude oil, accounting for a large share of global demand. Aviation, shipping, and freight logistics all depend on refined oil products. Additionally, the manufacturing sector uses oil derivatives for plastics, chemicals, and industrial applications, keeping demand strong despite cleaner energy goals.

Key Takeaways

- Global Crude Oil Market is expected to be worth around USD 929.8 billion by 2034, up from USD 755.3 billion in 2024, and grow at a CAGR of 2.1% from 2025 to 2034.

- Light distillates account for 38.1% of crude oil refining outputs globally.

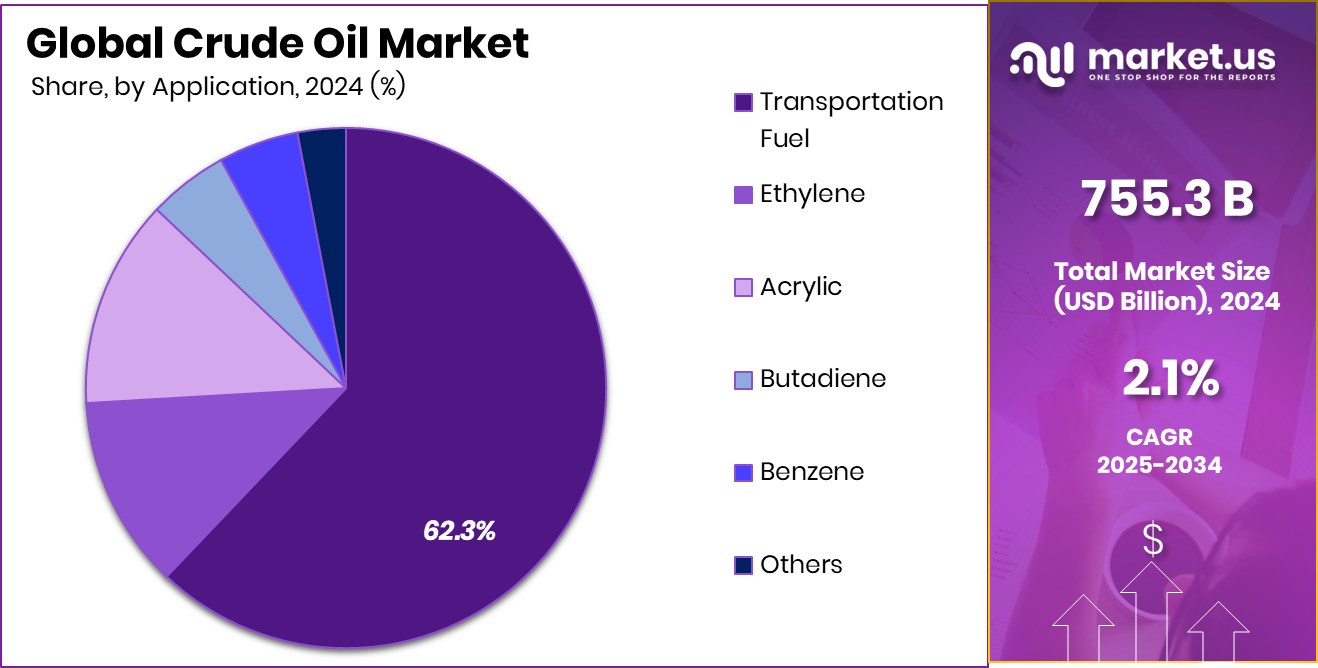

- Transportation fuel holds a dominant 62.3% share in the crude oil market.

- In 2024, Asia-Pacific’s crude oil demand reached USD 330.8 Bn, dominating globally.

By Type Analysis

Light distillates held a dominant 38.1% market share due to increased gasoline and naphtha consumption.

In 2024, Light Distillates held a dominant market position in the By Type segment of the Crude Oil Market, with a 38.1% share. This dominance reflects the growing demand for lighter petroleum fractions such as gasoline, naphtha, and liquefied petroleum gas (LPG), which are primarily used in transportation and petrochemical applications.

The increased consumption of gasoline in urban centers and rising vehicular traffic contributed significantly to the segment’s high share. Additionally, refinery advancements have allowed better yields of light distillates from crude oil, making their production more efficient and economically viable.

The 38.1% market share of Light Distillates also indicates their strategic importance in energy transition scenarios, where cleaner-burning fuels are preferred over heavier alternatives. The consistent demand for naphtha as a petrochemical feedstock in plastics and synthetic fiber manufacturing added further momentum to the segment’s growth.

By Application Analysis

Transportation fuel accounted for 62.3% of the market share, led by rising road and aviation fuel needs.

In 2024, Transportation Fuel held a dominant market position in the By Application segment of the Crude Oil Market, with a 62.3% share. This strong foothold highlights the continued reliance of global mobility systems on petroleum-based fuels such as gasoline, diesel, and jet fuel. The high share is primarily driven by the sheer scale of global transportation infrastructure, including road networks, aviation, and maritime trade, all of which continue to consume significant volumes of refined crude oil products.

Despite ongoing shifts toward alternative energy sources, traditional fuel remains the backbone of mobility, especially in emerging markets where electric vehicle adoption is still in early stages. The 62.3% share held by transportation fuel in 2024 underscores the segment’s critical role in powering commercial fleets, passenger vehicles, and freight systems across continents. Moreover, post-pandemic recovery in travel and logistics contributed to a surge in fuel demand, further reinforcing its dominant status.

Key Market Segments

By Type

- Light Distillates

- Light Oils

- Medium Oils

- Heavy Fuel Oil

By Application

- Transportation Fuel

- Ethylene

- Acrylic

- Butadiene

- Benzene

- Others

Driving Factors

Rising Transportation Needs Drive Crude Oil Demand

One of the top driving factors for the crude oil market is the rising demand from the transportation sector. As more people use cars, buses, planes, and ships across the world, the need for fuels like gasoline, diesel, and jet fuel continues to grow. Developing countries, especially in Asia and Africa, are experiencing rapid urbanization and increasing vehicle ownership.

This directly boosts the demand for crude oil-based fuels. Even with the rise of electric vehicles, a large part of the global transport system still runs on petroleum products. This steady and large-scale need for fuel keeps the crude oil market strong and helps maintain its critical role in global energy supply.

Restraining Factors

Growing Renewable Energy Limits Crude Oil Use

One of the major restraining factors for the crude oil market is the global shift toward renewable energy. Countries around the world are increasing their investments in solar, wind, and hydropower to reduce their dependence on fossil fuels. Governments are also promoting clean energy through subsidies, stricter emission rules, and carbon taxes.

As more industries and consumers adopt electric vehicles and greener technologies, the demand for crude oil is gradually slowing down. This change is especially noticeable in developed countries where environmental awareness is high. As the world continues moving toward sustainability, the crude oil market may face pressure, limiting its long-term growth and reducing its share in the future energy mix.

Growth Opportunity

Expanding Petrochemical Industry Boosts Oil Demand

A major growth opportunity in the crude oil market comes from the expanding petrochemical industry. Crude oil is a key raw material for producing petrochemicals like ethylene, propylene, and benzene, which are used to make plastics, fertilizers, textiles, and packaging materials. As consumer goods, construction, and agriculture industries grow globally, especially in Asia, so does the need for petrochemical products.

Even if fuel demand slows due to electric vehicles, the need for petrochemical feedstocks remains strong. Developing countries are building more petrochemical plants, creating a steady demand for crude oil. This shift allows oil producers to diversify beyond fuels and tap into industrial growth, making petrochemicals a promising area for long-term market expansion.

Latest Trends

Rising Use of AI in Oil Trading

In 2024, a key trend in the crude oil market is the increasing use of Artificial Intelligence (AI) and advanced data analytics in oil trading and forecasting. Companies are now using AI tools to predict crude oil price movements, optimize trading strategies, and manage supply chain operations more effectively. These smart systems analyze global demand, geopolitical tensions, weather data, and shipping patterns in real time.

This trend is helping oil firms reduce risks and make quicker decisions. AI is also improving operational efficiency by identifying equipment issues before they lead to breakdowns. As oil price volatility continues, using AI gives companies a big advantage in staying ahead in a highly competitive and fast-moving market.

Regional Analysis

Asia-Pacific led the Crude Oil Market with 43.8% share, worth USD 330.8 Bn.

In 2024, the Asia-Pacific region held a dominant position in the global Crude Oil Market, accounting for 43.8% of the total market share, with a value of USD 330.8 billion. This leadership can be attributed to high energy consumption across industrial, transportation, and power generation sectors in countries such as China, India, Japan, and South Korea.

North America followed with a strong market presence, supported by robust production capacities in the United States and Canada. Europe maintained a moderate share, driven by refining operations and stable import activity despite gradual shifts toward renewable energy. The Middle East & Africa region contributed steadily, benefiting from abundant crude oil reserves and export-driven economies.

Latin America recorded a comparatively smaller market share, influenced by political instability and limited infrastructure investment in some nations. Despite this, countries like Brazil and Venezuela remained key contributors. Overall, the Asia-Pacific region’s dominance reflects both high demand and strategic refining capabilities, positioning it as a central hub in the global oil trade.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Royal Dutch Shell continued to play a significant role in the global crude oil market through its extensive upstream and downstream operations. Shell maintained strong exploration and production activities across regions like the North Sea, Nigeria, and the U.S. Gulf of Mexico. The company focused on improving its oil output while gradually integrating lower-carbon technologies to align with long-term climate goals.

BP plc demonstrated a balanced strategy in 2024 by maintaining its upstream oil operations while accelerating its diversification efforts. The company continued production in major basins, including the North Sea and U.S. shale assets, while actively reducing flaring and improving carbon efficiency. BP’s strategic capital investments in exploration helped stabilize its crude oil output during a period of price volatility.

Chevron Corporation showcased strong operational discipline and capital efficiency in 2024, particularly in the Permian Basin and other core upstream areas. The company’s emphasis on high-margin barrels and cost control supported profitability even amid price fluctuations. Chevron focused on maintaining steady production levels, enhancing asset reliability, and improving well productivity.

Top Key Players in the Market

- Saudi Aramco

- ExxonMobil Corporation

- Royal Dutch Shell

- BP plc

- Chevron Corporation

- TotalEnergies SE

- Gazprom

- China National Petroleum Corporation (CNPC)

- PetroChina Company Limited

- Kuwait Petroleum Corporation

- Abu Dhabi National Oil Company (ADNOC)

- Rosneft

- ENI

- Petronas

- Equinor

- ConocoPhillips

- Lukoil

- Occidental Petroleum Corporation

- Sinopec

Recent Developments

- In April 2025, Aramco, in collaboration with Sinopec and Yanbu Aramco Sinopec Refining Company (Yasref), signed a Venture Framework Agreement to expand the petrochemical facilities at the Yasref refinery in Yanbu, Saudi Arabia. The planned expansion includes a new, fully-integrated petrochemical complex featuring a large-scale mixed feed steam cracker and an aromatics complex.

- In December 2024, ExxonMobil announced its Corporate Plan to 2030, aiming to increase upstream production to 5.4 million oil-equivalent barrels per day, with over 60% from advantaged assets. The plan includes investing up to $30 billion in lower-emission projects and pursuing $20 billion in earnings growth and $30 billion in cash flow.

Report Scope

Report Features Description Market Value (2024) USD 755.3 Billion Forecast Revenue (2034) USD 929.8 Billion CAGR (2025-2034) 2.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Light Distillates, Light Oils, Medium Oils, Heavy Fuel Oil), By Application (Transportation Fuel, Ethylene, Acrylic, Butadiene, Benzene, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Saudi Aramco, ExxonMobil Corporation, Royal Dutch Shell, BP plc, Chevron Corporation, TotalEnergies SE, Gazprom, China National Petroleum Corporation (CNPC), PetroChina Company Limited, Kuwait Petroleum Corporation, Abu Dhabi National Oil Company (ADNOC), Rosneft, ENI, Petronas, Equinor, ConocoPhillips, Lukoil, Occidental Petroleum Corporation, Sinopec Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Saudi Aramco

- ExxonMobil Corporation

- Royal Dutch Shell

- BP plc

- Chevron Corporation

- TotalEnergies SE

- Gazprom

- China National Petroleum Corporation (CNPC)

- PetroChina Company Limited

- Kuwait Petroleum Corporation

- Abu Dhabi National Oil Company (ADNOC)

- Rosneft

- ENI

- Petronas

- Equinor

- ConocoPhillips

- Lukoil

- Occidental Petroleum Corporation

- Sinopec