Global Sodium Iodide Market By Grade (Industrial Grade, Pharmaceutical Grade, Food Grade), By Formulation (Crystalline, Liquid, Powder, By Purity Level (High Purity, Medium Purity, Low Purity), By Application (Medical Imaging, Nuclear Medicine, Industrial Applications, Research and Development, Others), By End Use (Food Industry, Pharmaceutical Industry, Agrochemical Industry, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 134394

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Grade Analysis

- By Formulation Analysis

- By Purity Level Analysis

- By Application Analysis

- By End-Use Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

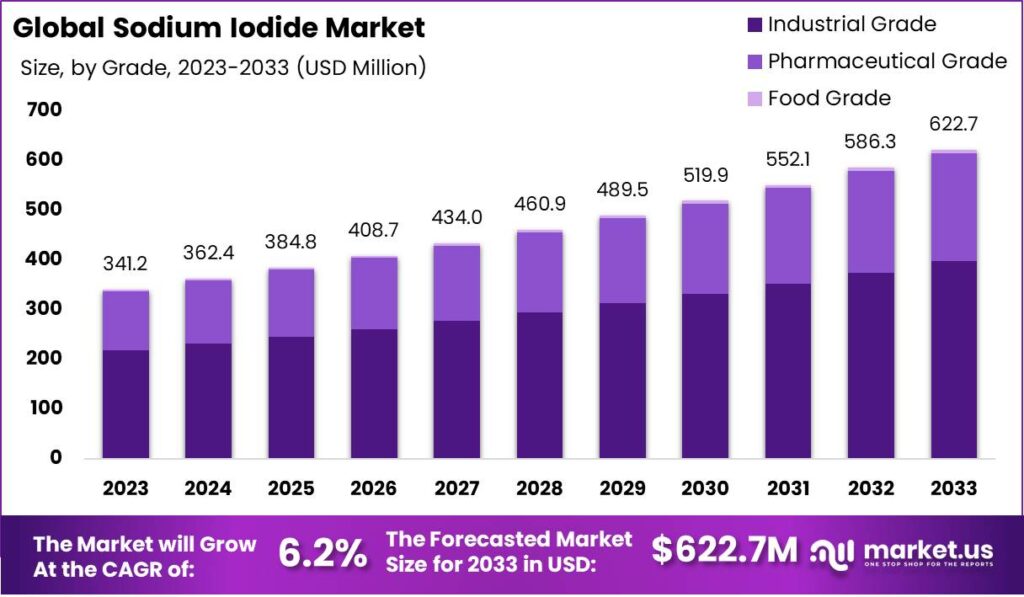

The Global Sodium Iodide Market is expected to be worth around USD 622.7 million by 2033, up from USD 341.2 million in 2023, and grow at a CAGR of 6.2% during the forecast period from 2024 to 2033.

The Sodium Iodide Market has experienced consistent growth, driven largely by its critical role in pharmaceuticals, healthcare, and nuclear applications. Sodium iodide, a chemical compound containing iodine, is vital in diagnostic imaging and radiation therapy. As medical technologies advance, there has been a notable rise in the demand for diagnostic and therapeutic products that incorporate sodium iodide.

In addition to healthcare applications, sodium iodide is also utilized in industries such as polymer manufacturing, dyes, and analytical chemistry, further reinforcing its importance in the global market.

The growth in demand can be attributed to the increasing emphasis on healthcare advancements, particularly in nuclear medicine. Sodium iodide is a key ingredient in iodine-based contrast agents used in medical imaging, which are crucial for non-invasive diagnoses.

The rising global population, particularly the aging demographic, and increasing healthcare awareness have increased the demand for diagnostic tools and treatments that use sodium iodide. As healthcare systems continue to develop and adopt new technologies, the need for specialized medical products has also risen, pushing the market forward.

The popularity of sodium iodide has surged due to its essential role in both diagnostic procedures and nuclear medicine. Many healthcare institutions, including hospitals and research centers, continue to adopt sodium iodide-based solutions for treatment and diagnosis. In nuclear medicine, it is particularly valuable for radioactive iodine therapy, commonly used for thyroid-related conditions. Additionally, sodium iodide’s inclusion in imaging agents ensures its demand remains strong across various medical and scientific sectors.

Market opportunities for sodium iodide are expanding, especially with ongoing advancements in medical imaging technologies. The growth of molecular imaging techniques is expected to further enhance the role of sodium iodide in radiopharmaceuticals, opening new growth avenues.

As emerging markets improve their healthcare infrastructure, the demand for diagnostic and therapeutic solutions incorporating sodium iodide is expected to rise. Partnerships between pharmaceutical companies and healthcare providers to create more effective and less invasive treatments may also drive further market growth.

Governments are playing a critical role in supporting the market. In 2021, the U.S. government allocated USD 4.5 billion to nuclear medicine research, indirectly benefitting the sodium iodide market. Similarly, China committed USD 200 million to enhancing healthcare infrastructure, driving the adoption of sodium iodide in advanced imaging technologies.

Several strategic investments have been made to boost production. In 2022, Deepak Fertilisers invested USD 10 million to expand its sodium iodide production by 20%. Furthermore, in 2021, General Electric (GE) formed a USD 50 million joint venture to develop advanced iodine-based radiopharmaceuticals, including sodium iodide, which will improve availability in emerging markets. These efforts are expected to contribute significantly to market growth.

Recent innovations in sodium iodide-based applications, such as its use in treating metastatic thyroid cancer, approved by the FDA in 2023, have further strengthened its market position. This new treatment, with a 70% five-year survival rate, opens up additional opportunities for sodium iodide suppliers, ensuring continued growth in the market.

Key Takeaways

- The Global Sodium Iodide Market is expected to be worth around USD 622.7 million by 2033, up from USD 341.2 million in 2023, and grow at a CAGR of 6.2% during the forecast period from 2024 to 2033.

- Industrial Grade dominated the Sodium Iodide Market, capturing 64.7% share by grade segment.

- Crystalline dominated the Sodium Iodide Market, capturing 56.8% of the share by formulation segment.

- High Purity dominated the Sodium Iodide Market by purity Level segment, capturing 48.4% of the share.

- Medical Imaging dominated the Sodium Iodide Market by application segment, capturing 34.5% of the share.

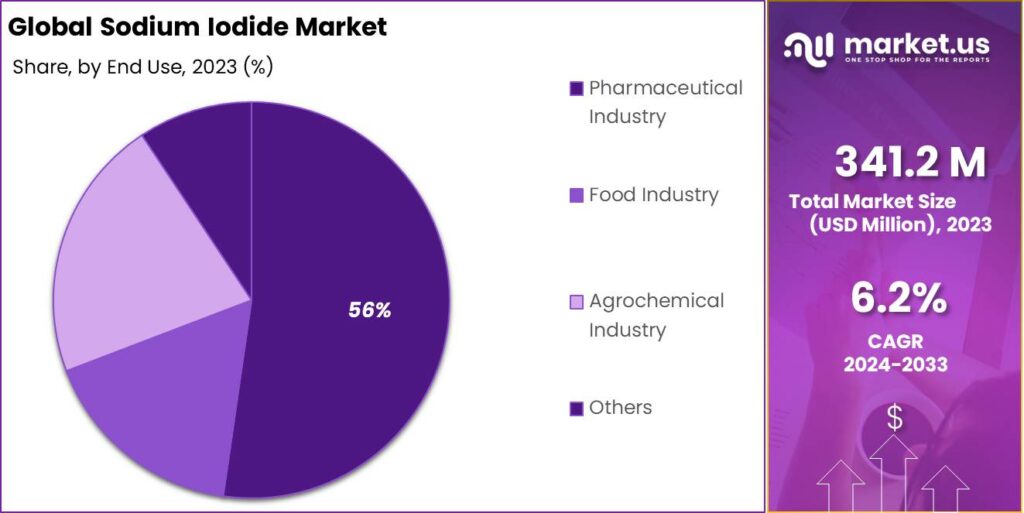

- The Pharmaceutical Industry dominated the Sodium Iodide Market, capturing 56.4% share by end-use segment.

- APAC dominated the Resistant Starch Market with a 45.4% share, earning USD 154.5 million.

By Grade Analysis

In 2023, Industrial Grade held a dominant market position in the Sodium Iodide Market’s By Grade segment, capturing more than a 64.7% share. The widespread adoption of industrial-grade sodium iodide across various applications, such as radiation detection and chemical synthesis, contributed significantly to this dominant market position. This grade of sodium iodide is preferred due to its cost-effectiveness and sufficient purity for industrial applications, driving its widespread demand in sectors such as nuclear energy and manufacturing.

Pharmaceutical-grade sodium iodide, accounting for a smaller yet notable portion of the market, follows with significant application in medical imaging and diagnostics. The higher purity levels required for pharmaceutical use make it essential for applications like iodine therapy and diagnostic imaging, though it represents a more specialized segment compared to industrial-grade sodium iodide. This grade is projected to grow steadily, driven by increasing healthcare demands globally.

Food-grade sodium iodide, which is primarily used in nutritional supplements and food fortification, holds the smallest share of the market. Despite this, it is expected to grow due to the rising consumer demand for iodine-enriched food products, especially in regions with iodine deficiency. However, the food-grade segment faces stringent regulatory standards, which can limit its broader market penetration.

By Formulation Analysis

In 2023, Crystalline held a dominant market position in the Sodium Iodide Market’s Formulation segment, capturing more than a 56.8% share. The crystalline form is widely favored due to its stable structure, high purity, and ease of handling, making it ideal for applications in radiation detection and medical diagnostics. This form’s suitability for large-scale production and its cost-efficiency further drive its market leadership, especially in industries like nuclear energy, where precise measurements and stable performance are critical.

The Liquid form of sodium iodide, accounting for a smaller portion of the market, is primarily used in applications where quick dissolution or a solution state is required. It is commonly found in medical imaging and pharmaceutical applications, where liquid formulations offer convenience and versatility. Despite holding a smaller share, the liquid segment is projected to grow steadily due to increasing demand for diagnostic procedures and the ongoing development of new medical imaging technologies.

Powdered sodium iodide, though representing the smallest share of the market, finds its primary use in research and specialized applications. The powder form is used in laboratories for experiments and in certain chemical processes, where precise quantities of iodide are needed. Despite its limited share, the powdered segment is expected to see growth driven by advancements in the research and chemical processing industries.

By Purity Level Analysis

In 2023, High Purity held a dominant market position in the Sodium Iodide Market’s By Purity Level segment, capturing more than a 48.4% share. High-purity sodium iodide is highly sought after in industries requiring precise and reliable performance, such as medical imaging, radiation detection, and pharmaceutical applications. The elevated purity level ensures minimal impurities, enhancing the quality and accuracy of diagnostic tools and radiation-based treatments. This makes high-purity sodium iodide especially crucial for sectors like healthcare, where safety and precision are paramount.

Medium Purity sodium iodide, accounting for a smaller share of the market, is primarily used in industrial and chemical applications where extremely high purity is not essential. It finds applications in manufacturing processes and certain research domains where cost efficiency is a key consideration. The medium purity segment is expected to grow as demand rises in sectors that balance cost with performance, such as chemical synthesis and certain low-cost diagnostic procedures.

Low Purity sodium iodide, while holding the smallest share in the market, is utilized in bulk chemical applications and industrial processes where impurity levels are not critical. It is typically used for non-sensitive applications in the manufacturing and waste treatment industries. Despite its limited share, the low-purity segment is expected to see growth driven by the expanding industrial demand and the increasing need for lower-cost alternatives in specific applications.

By Application Analysis

In 2023, Medical Imaging held a dominant market position in the Sodium Iodide Market’s By Application segment, capturing more than a 34.5% share. Sodium iodide, particularly in its high-purity form, is widely used in medical imaging for diagnostic purposes, such as in scintigraphy, where it is used in combination with radiation to provide clear and precise images of internal organs. The increasing demand for advanced diagnostic tools and the rising prevalence of chronic diseases that require imaging, such as cancer and cardiovascular conditions, are key factors driving this segment’s growth.

Nuclear Medicine, accounting for a significant portion of the market, follows closely in share. Sodium iodide is essential in the field of nuclear medicine, particularly for thyroid treatments and diagnostic procedures involving radioactive isotopes. The growing adoption of targeted radiation therapies, such as iodine-131 for thyroid cancer, is expected to contribute to the sustained growth of this segment.

Industrial Applications, though representing a smaller share, are steadily growing due to the use of sodium iodide in radiation detection and chemical processing. Its reliability in detecting and measuring radiation makes it valuable in nuclear power plants and environmental monitoring systems.

By End-Use Analysis

In 2023, The Pharmaceutical Industry held a dominant market position in the Sodium Iodide Market’s By End Use segment, capturing more than a 56.4% share. Sodium iodide is widely utilized in the pharmaceutical industry, particularly in diagnostic imaging, drug formulation, and thyroid treatments. Its high purity is essential for pharmaceutical applications, ensuring both safety and effectiveness in medical procedures.

The growing demand for nuclear medicine, including iodine-based therapies such as iodine-131 for thyroid cancer, has significantly contributed to the pharmaceutical industry’s dominance. Additionally, sodium iodide is used in the synthesis of radiopharmaceuticals, a critical component in medical imaging.

The Food Industry, which accounts for a smaller but growing share of the market, uses sodium iodide primarily in food fortification. It is commonly added to salt to prevent iodine deficiency, a major health concern in many regions. The rising awareness of the importance of iodine in maintaining thyroid health has led to an increase in demand for iodized salt, driving growth in this segment.

The Agrochemical Industry, though holding a smaller portion of the market, uses sodium iodide in various agricultural applications, such as pest control and soil treatment. The use of sodium iodide in this sector is expected to grow due to advancements in agricultural technology.

Key Market Segments

By Grade

- Industrial Grade

- Pharmaceutical Grade

- Food Grade

By Formulation

- Crystalline

- Liquid

- Powder

By Purity Level

- High Purity

- Medium Purity

- Low Purity

By Application

- Medical Imaging

- Nuclear Medicine

- Industrial Applications

- Research and Development

- Others

By End Use

- Food Industry

- Pharmaceutical Industry

- Agrochemical Industry

- Others

Driving factors

Growing Demand in Medical Applications

The increasing use of sodium iodide in medical applications is one of the key drivers for the market. Sodium iodide is widely used in nuclear medicine, particularly in diagnostic imaging and therapeutic treatments. Its ability to form a stable, radioactive isotope, iodine-131, plays a crucial role in the treatment of thyroid conditions, such as hyperthyroidism and certain types of thyroid cancer.

The demand for non-invasive diagnostic imaging techniques has increased significantly as healthcare providers focus on more effective and less risky procedures for patients. Sodium iodide is often used as a radiopharmaceutical, allowing physicians to monitor and diagnose conditions like cancer, heart disease, and neurological disorders.

The aging global population further fuels the demand for sodium iodide in healthcare, as older individuals are more likely to require medical imaging and diagnostic tests. Additionally, advancements in nuclear medicine and radiotherapy are expanding the use of sodium iodide in other therapeutic areas. As the global healthcare industry grows and more people require precise and early detection of diseases, the demand for sodium iodide will likely continue to rise, supporting its growth in the market.

Restraining Factors

Regulatory Challenges and Safety Concerns

One of the major challenges facing the sodium iodide market is stringent regulatory requirements and safety concerns. Sodium iodide, particularly when used as a radiopharmaceutical, falls under strict regulatory controls due to its radioactive nature. Governments and regulatory bodies, like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), impose tight safety standards for the production, handling, and distribution of sodium iodide products.

This includes rigorous testing, approval procedures, and documentation to ensure that they meet safety and efficacy standards. The long approval timelines and compliance costs can delay market entry for new sodium iodide-based products.

Additionally, safety concerns regarding radiation exposure can make some patients and healthcare providers hesitant to embrace sodium iodide for medical treatments, especially in the context of potential long-term health risks associated with radiation exposure. The market must navigate public perception and address concerns about the potential side effects of radioactive isotopes in medical treatments. Regulatory hurdles, along with safety concerns and the need for constant monitoring, represent significant restraints on the growth of the sodium iodide market.

Growth Opportunity

Expansion in Emerging Markets

There is a significant opportunity for sodium iodide in emerging markets, where the demand for medical treatments and diagnostic services is growing. As countries in regions like Asia-Pacific, Latin America, and Africa continue to develop their healthcare infrastructure, the need for advanced diagnostic tools and therapies increases. Sodium iodide’s applications in nuclear medicine make it highly relevant in these regions, where healthcare providers are striving to offer better treatment options to their growing populations.

Emerging markets, with their expanding middle class and increasing healthcare investments, are also attracting foreign investments in healthcare services. As these countries invest in upgrading their healthcare facilities, sodium iodide will play an essential role in improving the quality of diagnostic imaging and cancer treatment.

The World Health Organization (WHO) and other international bodies are supporting the expansion of radiological services in these regions, which will likely drive demand for sodium iodide-based products. As a result, companies that can navigate these markets effectively may find growth opportunities in providing sodium iodide for both diagnostic and therapeutic purposes.

Challenge

Environmental Impact and Waste Disposal

One of the significant challenges facing the sodium iodide market is the environmental impact of its radioactive waste. The disposal of radioactive materials, including sodium iodide used in medical applications, poses significant environmental and public health risks if not managed correctly. As sodium iodide is used in diagnostic imaging and therapeutic treatments, its waste products must be handled with care, often requiring specialized disposal methods to avoid contamination. The long half-life of iodine isotopes in waste can complicate disposal efforts, making it an ongoing challenge for healthcare facilities and waste management companies to safely manage the disposal of sodium iodide-based materials.

Furthermore, the need for costly disposal methods can lead to higher operational costs for healthcare providers and waste management companies, which may limit the widespread adoption of sodium iodide in medical applications. In many regions, regulations surrounding the safe disposal of radioactive waste are stringent, and healthcare providers must invest in waste management infrastructure to comply with these regulations.

This challenge can create barriers for smaller healthcare facilities and emerging markets, where regulatory compliance may be more difficult to enforce. The environmental concerns around waste disposal, combined with the high costs associated with proper management, make this a significant challenge for the sodium iodide market.

Emerging Trends

Emerging Trends in Sodium Iodide Market

The Sodium Iodide market has experienced notable shifts as demand for this compound in various applications continues to grow. One of the most significant emerging trends is its increasing use in medical imaging and diagnostics, particularly in radiopharmaceuticals. Sodium Iodide, due to its high efficiency in emitting radiation, is widely used in thyroid treatments and certain cancer therapies.

With advancements in nuclear medicine, the usage of Sodium Iodide in diagnostic imaging, especially in positron emission tomography (PET) and single-photon emission computed tomography (SPECT), has seen a rise. These trends are aligned with growing investments in the healthcare and pharmaceutical sectors, which are focusing on more precise and targeted treatments.

Another emerging trend in the Sodium Iodide market is its growing role in the electronics industry, especially in the production of flat-panel displays and LED lighting. The compound’s use in these applications is expected to rise due to its unique properties that enhance the brightness and energy efficiency of these devices. Furthermore, the rise of green technologies, such as solar panels, is also driving the demand for Sodium Iodide, as it plays a key role in the production of high-quality semiconductor materials.

Moreover, innovations in the chemical and manufacturing sectors have led to more sustainable production processes for Sodium Iodide. Environmental concerns are pushing the industry toward greener practices, where manufacturers are exploring ways to reduce waste and improve energy consumption during the production phase. These trends are anticipated to foster a more sustainable and cost-efficient market environment in the coming years.

Business Benefits

Business Benefits of Sodium Iodide

Sodium Iodide offers several business advantages, making it an attractive option for industries ranging from healthcare to electronics. One of the primary benefits is its role in the healthcare sector, where it is used for diagnostic imaging and therapeutic purposes. With increasing demand for diagnostic imaging in hospitals and medical facilities, companies that produce or supply Sodium Iodide benefit from a stable and growing market. As the global population ages, the need for advanced diagnostic solutions increases, creating long-term opportunities for business growth.

In addition to healthcare, Sodium Iodide’s role in the electronics industry provides another significant business benefit. It is a critical material in the production of energy-efficient devices like LEDs, which are in high demand due to the global shift toward energy-efficient solutions. This trend presents a lucrative opportunity for businesses involved in the production of Sodium Iodide to expand their product offerings and tap into the growing green technology market.

Furthermore, the compound’s unique properties also make it valuable in the field of semiconductors and solar panels, where it enhances product performance and quality. As businesses across various sectors look for ways to improve product quality and reduce production costs, the inclusion of Sodium Iodide in manufacturing processes can lead to more competitive pricing and higher margins.

Lastly, as industries move toward more environmentally friendly practices, Sodium Iodide producers benefit from a focus on sustainable production methods. By adopting greener manufacturing techniques, companies can not only reduce their carbon footprint but also meet the growing consumer demand for sustainable and eco-friendly products, positioning themselves as leaders in a rapidly evolving market.

Regional Analysis

APAC dominated the Resistant Starch Market with a 45.4% share, earning USD 154.5 million.

In 2023, APAC held a dominant market position in the global Resistant Starch Market, capturing more than 45.4% of the share, with a revenue of USD 154.5 million. This leading position can be attributed to several key factors, including the region’s growing demand for health-conscious food products, expanding awareness of gut health benefits, and an increasing number of consumers shifting toward functional foods.

Countries like China, India, and Japan have witnessed substantial growth in the consumption of resistant starch due to rising health concerns, particularly related to digestive health and diabetes management. Moreover, APAC’s robust food processing industry and the adoption of innovative dietary supplements contribute significantly to the market’s expansion.

The demand for resistant starch is also driven by its inclusion in staple food items, particularly in countries with large populations like India, where rice and wheat-based products are integral to the diet. As consumers in these regions become more aware of the health benefits of resistant starch such as its ability to support weight management and improve gut microbiota the market for such functional ingredients has flourished. Additionally, favorable government policies supporting health and wellness trends are further accelerating the market growth in APAC.

North America holds the second-largest market share, benefiting from an increasingly health-conscious population and a strong presence of established food and beverage manufacturers that are integrating resistant starch into a variety of products. The U.S. and Canada have seen a surge in the demand for resistant starch in dietary supplements, gluten-free products, and diabetic-friendly foods.

In contrast, Europe, while a significant player in the global resistant starch market, faces slower growth compared to APAC and North America. The European market’s growth is more gradual, driven by the rising demand for clean and natural ingredients, along with increasing research into the health benefits of resistant starch. The market in Latin America, the Middle East, and Africa remains relatively small but is expected to grow gradually as awareness of healthy foods increases.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the global Sodium Iodide Market is experiencing significant growth, driven by key players that are shaping the landscape with their innovative approaches and strong market presence. Four key companies stand out due to their contributions to this sector: Honeywell International Inc., Merck KGaA, TCI Chemicals Pvt. Ltd., and Thermo Fisher Scientific Inc.

Honeywell International Inc. is a leader in the chemical industry with a strong portfolio in the iodine and its derivatives market. The company leverages its extensive R&D capabilities to provide high-quality Sodium Iodide products used in various applications, including nuclear medicine and analytical chemistry. Honeywell’s strong distribution network and global presence further enhance its market position.

Merck KGaA, a leading global player in life sciences, is another prominent contributor. The company offers a wide range of iodide compounds, including Sodium Iodide, catering to pharmaceutical and diagnostic sectors. Merck’s consistent investments in R&D and its commitment to sustainability are key factors driving its growth in the Sodium Iodide market. Their products are widely trusted for purity and quality, which solidifies their strong reputation in the industry.

TCI Chemicals Pvt. Ltd. offers Sodium Iodide as part of their vast catalog of fine chemicals, primarily used in the pharmaceutical, research, and chemical industries. The company is renowned for its consistent supply of high-grade chemicals, competitive pricing, and customer service. TCI’s expansive network and strategic partnerships contribute significantly to its influence in the market.

Thermo Fisher Scientific Inc., a global leader in scientific instrumentation and chemicals, plays a critical role in the Sodium Iodide market. Known for its cutting-edge analytical instruments, Thermo Fisher provides high-purity Sodium Iodide used in radiopharmaceuticals, medical diagnostics, and chemical analysis. Their commitment to quality control and their strong customer base positions them as a key player in the market.

Market Key Players

- Ajay-SQM

- American Elements

- Boyuan Pharmaceutical & Chemical

- Carl Roth

- CDH Fine Chemical

- Cole-Parmer

- GFS Chemicals Inc.

- Glentham Life Sciences

- Haffner GmbH & Co. KG

- Honeywell International Inc.

- International Isotopes Inc.

- Ise Chemicals Corporation

- Jiangxi Shengdian S&T

- Jindian Chemical

- lofina

- Matrix Fine Chemicals

- Merck KGaA

- Molekula Group

- Nanjing Taiye Chemical

- Oakwood Chemical

- Santa Cruz Biotechnology Inc.

- Sisco Research Laboratories Pvt. Ltd.

- Taixing Youlian Fine Chemical

- TCI Chemicals Pvt. Ltd.

- Thermo Fisher Scientific Inc.

- Tocean lodine Products

Recent Development

- In April 2024, International Isotopes announced a new partnership with a leading pharmaceutical company to supply Sodium Iodide for radiopharmaceutical production. The agreement, valued at $25 million, aims to supply 2 tons of Sodium Iodide annually for use in medical imaging and cancer treatment applications. This partnership positions International Isotopes as a key supplier for the growing medical diagnostics sector.

- In March 2024, Honeywell announced the expansion of its production capacity for Sodium Iodide at its manufacturing facility in the United States. The company increased its output by 15%, aiming to meet the growing demand for Sodium Iodide used in medical diagnostics, particularly for thyroid imaging. This expansion is expected to increase the company’s annual revenue in the Sodium Iodide segment by approximately $50 million in the next three years.

- In February 2024, American Elements launched a new line of high-purity Sodium Iodide for use in the semiconductor industry. This new product is designed to enhance the efficiency of semiconductor devices and has a purity level of 99.999%. The company anticipates a 20% increase in demand from semiconductor manufacturers, with expected sales growth of $30 million over the next 12 months.

- In January 2024, Merck KGaA expanded its research and production capabilities for Sodium Iodide, particularly for use in high-energy research applications. The company invested €10 million (USD 11 million) to develop a more efficient production process, increasing capacity by 25%. This move is part of Merck’s strategy to diversify its portfolio and enhance its position in both the medical and chemical sectors.

Report Scope

Report Features Description Market Value (2023) USD 341.2 Million Forecast Revenue (2033) USD 622.7 Million CAGR (2024-2032) 6.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Grade (Industrial Grade, Pharmaceutical Grade, Food Grade), By Formulation (Crystalline, Liquid, Powder, By Purity Level (High Purity, Medium Purity, Low Purity, By Application (Medical Imaging, Nuclear Medicine, Industrial Applications, Research and Development, Others, By End Use (Food Industry, Pharmaceutical Industry, Agrochemical Industry, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Ajay-SQM, American Elements, Boyuan Pharmaceutical & Chemical, Carl Roth, CDH Fine Chemical, Cole-Parmer, GFS Chemicals Inc., Glentham Life Sciences, Haffner GmbH & Co. KG, Honeywell International Inc., International Isotopes Inc., Ise Chemicals Corporation, Jiangxi Shengdian S&T, Jindian Chemical, lofina, Matrix Fine Chemicals, Merck KGaA, Molekula Group, Nanjing Taiye Chemical, Oakwood Chemical, Santa Cruz Biotechnology Inc., Sisco Research Laboratories Pvt. Ltd., Taixing Youlian Fine Chemical, TCI Chemicals Pvt. Ltd., Thermo Fisher Scientific Inc., Tocean Lodine Products Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ajay-SQM

- American Elements

- Boyuan Pharmaceutical & Chemical

- Carl Roth

- CDH Fine Chemical

- Cole-Parmer

- GFS Chemicals Inc.

- Glentham Life Sciences

- Haffner GmbH & Co. KG

- Honeywell International Inc.

- International Isotopes Inc.

- Ise Chemicals Corporation

- Jiangxi Shengdian S&T

- Jindian Chemical

- lofina

- Matrix Fine Chemicals

- Merck KGaA

- Molekula Group

- Nanjing Taiye Chemical

- Oakwood Chemical

- Santa Cruz Biotechnology Inc.

- Sisco Research Laboratories Pvt. Ltd.

- Taixing Youlian Fine Chemical

- TCI Chemicals Pvt. Ltd.

- Thermo Fisher Scientific Inc.

- Tocean lodine Products