Global Ethylamine Market By Product Type (Monoethylamine (MEA), Diethylamine (DEA), and Triethylamine (TEA)), By Purity (Up to 99.5% and Above 99.5%), By Applications (Agrochemicals, Pharmaceuticals, Chemical Synthesis, Rubber & Plastics, Textiles and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 133881

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

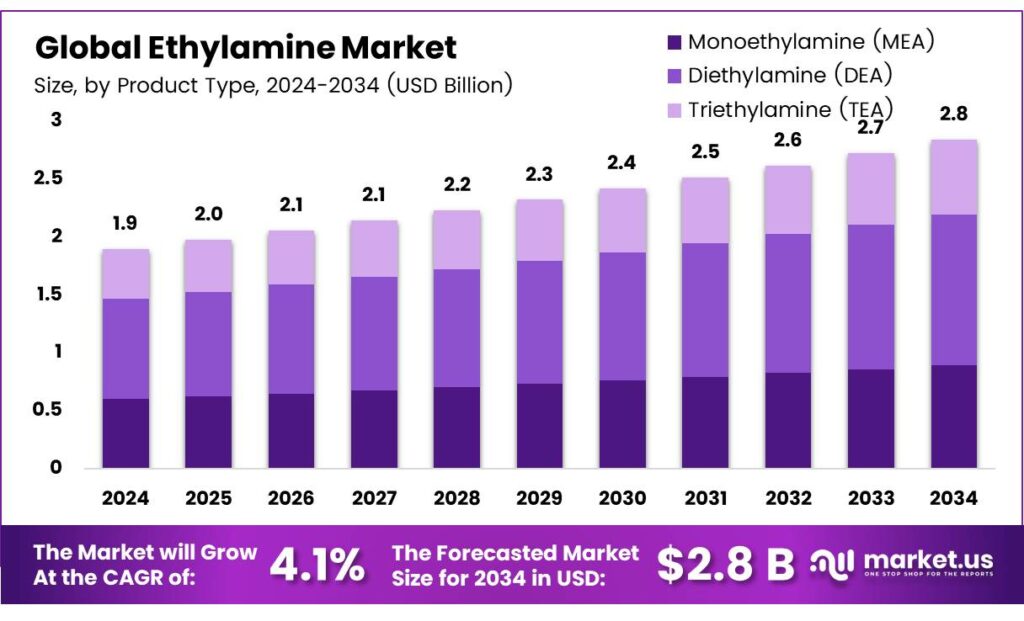

In 2024, the Global Ethylamine Market was valued at USD 1.9 billion, and between 2025 and 2034, this market is estimated to register a CAGR of 4.1%, reaching about USD 2.8 billion by 2034.

Ethylamine is an organic chemical compound, which is a colorless liquid or gas at room temperature, known for its ammonia-like odor. It’s a primary amine attached to a nitrogen atom bonded to two hydrogen atoms. It finds diverse applications as a chemical intermediate in various industries, such as in the production of herbicides, pharmaceuticals, dyes, and resins.

Additionally, it serves as a solvent, a stabilizer for rubber latex, and in the manufacturing of corrosion inhibitors. The major driver of the market is its application in the agrochemical industry. Apart from the agrochemical industry, in recent years, its applications in the pharmaceutical, polymer, and electronics industries have created several opportunities for the players. Ethylamine is a hazardous substance and is highly monitored by various regulatory organizations. This compliance, which increases operational costs significantly, might be a challenge for the market.

Key Takeaways

- The Global Ethylamine Market was valued at USD 1.9 billion in 2024.

- The global ethylamine market is projected to grow at a CAGR of 4.1% and is estimated to reach USD 2.8 billion by 2034.

- Based on product types, diethylamine (DEA) dominated the market in 2024, comprising about 6% share of the total global market.

- Among the purity of ethylamine in which they are commercially available, up to 99.5% pure ethylamines dominated the market in 2024, accounting for around 2% of the market share.

- Based on applications of ethylamine, in 2024, the agrochemicals sector led the market with a market share of approximately 3%.

- North America was the largest market for ethylamine in 2024 due to its established chemical processing industry for agrochemicals, pharmaceuticals, and more.

Product Type Analysis

Diethylamine (DEA) Dominated the Market Due to Its Chemical Properties.

On the basis of product type, the ethylamine market is segmented into monoethylamine (MEA), diethylamine (DEA), and triethylamine (TEA). Diethylamine dominated the market in 2024 with a market share of 44.6%. DEA serves as a vital intermediate in pharmaceuticals, corrosion inhibitors, rubber processing, and wastewater treatment chemicals. The chemical is known for its strong basicity and liquid-phase handling advantages.

In pharmaceuticals, it is used in products, such as ointments and painkillers. In wastewater treatment, it plays a role via compounds such as diethylaminoethanol, enhancing cleaning and corrosion inhibition performance. Moreover, its dominance is attributed to its favorable physical and chemical properties, making it broadly applicable across industrial processes. It is a liquid at room temperature, which is easier to handle than gaseous MEA.

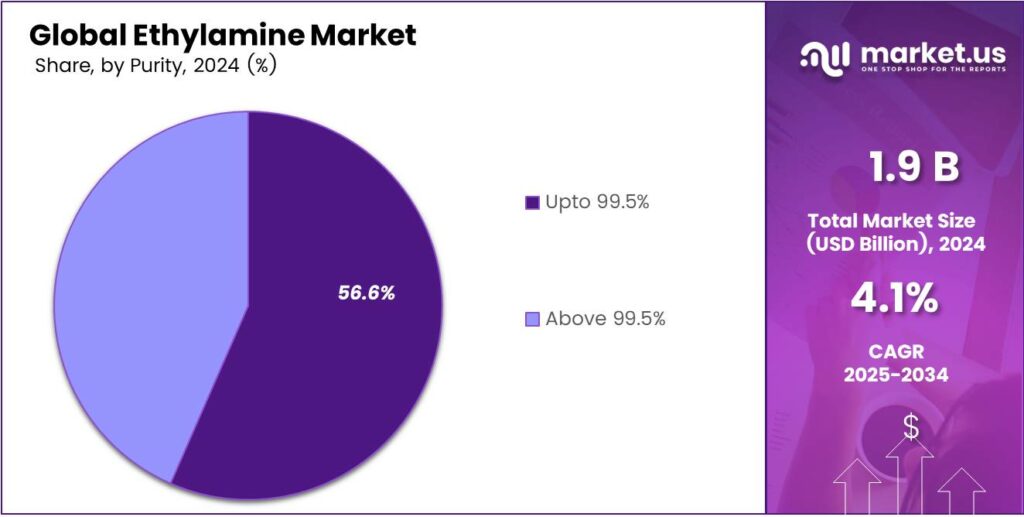

Purity Analysis

Ethylamine With Purity Up to 99.5% led the Market in 2024.

Based on the purity of ethylamine, the market is divided into up to 99.5% and above 99.5% pure ethylamine. In 2024, the ethylamines with purity of up to 99.5% dominated the market, comprising around 56.2% of the total market share. This dominance of the chemical is due to cost-effectiveness and performance. They are used in various industrial manufacturing, including agrochemicals, surfactants, dyes, and rubber additives, without imposing the hefty costs tied to further purification.

In contrast, 99.9% pure ethylamines are used in pharma, biotech, and research uses where trace impurities could undermine quality outcomes, as lower-purity grades, though cheaper, can fall short where consistent intermediate reactivity and product quality are required. During the purification of ethylamines, it is often reported that the last 10% takes 90% of the time.

Application Analysis

In 2024, the Agrochemicals Industry dominated the Ethylamine Market due to Widespread Use of the Product in the Industry.

In 2024, agrochemicals emerged as the largest end-use sector for ethylamine, accounting for nearly 44.3% of the compound’s global consumption, outpacing sectors such as pharmaceuticals, chemical synthesis, textiles, and rubber & plastics.

The chemical plays an essential role in synthesizing herbicides, insecticides, and fungicides, and serves as a foundational building block in the crop protection chemicals market. Another major sector is pharmaceutical applications due to ethylamine’s utility in API synthesis and medicinal chemistry.

As global food production needs grow, reliance on effective agrochemicals grows, and thus, it is the biggest end-use sector for ethylamine. Its versatility, cost-efficiency, and centrality to high-volume pesticide manufacturing make agrochemicals the clear leader in driving ethylamine demand.

Key Market Segments

By Product Type

- Monoethylamine (MEA)

- Diethylamine (DEA)

- Triethylamine (TEA)

By Purity

- Up to 99.5%

- Above 99.5%

By Application

- Agrochemicals

- Pharmaceuticals

- Chemical Synthesis

- Rubber & Plastics

- Textiles

- Others

Drivers

Demand for Ethylamine for Manufacturing of Agrochemicals Drives the Market.

Ethylamine plays a pivotal role in meeting expanding demands for agrochemicals, as it serves as a building block for vital herbicides, pesticides, and fungicides. It is a precursor in the synthesis of widely used compounds such as atrazine and simazine.

Ethylamine‑based formulations are increasingly favored due to their effectiveness in enhancing crop protection and yield, particularly under precision‑farming techniques and rising food‑security needs. According to the World Population Prospects report by the United Nations in 2024, the world’s population is expected to continue growing over the coming 50 or 60 years, reaching a peak of around 10.3 billion individuals in the mid-2080s, up from 8.2 billion in 2024.

As the world population grows, the demand for food security grows, which in turn increases the reliance of the agriculture industry on chemicals. Due to this reliance on agrochemicals, the demand for intermediate compounds, such as ethylamines, during the manufacturing of fertilizers or pesticides grows.

Restraints

Regulatory Compliance and Health Concerns Might Hamper the Growth of the Ethylamine Market.

Regulatory and safety challenges could significantly hinder the growth of the ethylamine market. It is a colorless liquid or gas with a strong ammonia-like odor. It is on the hazardous substance list due to its highly flammable and corrosive nature.

It is regulated by the Occupational Safety and Health Administration (OSHA), and is cited by the National Institute for Occupational Safety and Health (NIOSH) and the American Conference of Governmental Industrial Hygienists (ACGIH). According to OSHA, the legal airborne permissible exposure limit (PEL) is 10 ppm averaged over an 8-hour work shift.

Similarly, according to NIOSH, the recommended airborne exposure limit is 10 ppm averaged over a 10-hour work shift. The acute health effects include severe irritation to the eyes, skin, and respiratory tract. The exposure to 600 ppm of ethylamine is immediately dangerous to life and health. The compliance demands investments in safety infrastructure, from advanced ventilation systems and airtight storage to rigorous handling protocols and employee training, raising operational costs and complexity.

Opportunity

Rising Application in the Pharmaceutical Industry Boosts the Ethylamine Market.

Ethylamine is increasingly vital to the pharmaceutical industry as a versatile chemical intermediate, playing key roles in the synthesis of active pharmaceutical ingredients (APIs). It serves as a precursor in the production of antihistamines, anti-inflammatory agents, and anesthetics, underlining its importance in medicinal chemistry through its reactivity with acyl chlorides, aldehydes, and ketones.

Its high-purity variants, notably 99.9% grade, are preferred for drug manufacturing due to strict quality requirements, ensuring minimal impurities in sensitive pharmaceutical formulations. In regions like the Asia Pacific, where countries such as India produce over 500 APIs, comprising 57% of the World Health Organization’s prequalified list, the demand for ethylamine is especially pronounced, bolstered by a robust local pharma manufacturing base. In the post‑pandemic era, there is a heightened awareness regarding health and medicines, which creates opportunities for ethylamines in the market.

Trends

Demand for Ethylamines in the Dyes and Resins Industry.

Ethylamines continue to maintain robust demand across the dyes and resins sectors due to their versatility as chemical intermediates. It is used as a dye intermediate and is used to synthesize or modify dyes. It is used in the production of certain types of dyes, including those used in textiles and printing. Additionally, ethylamine is used in the synthesis of various resins, including epoxy resins and alkyd resins.

It acts as a curing agent or catalyst in resin formulations, contributing to the final properties of the resin. It is a key ingredient in the production of ion exchange resins. Similarly, it’s a raw material in the production of some thermosetting plastics, such as alkyd resins, improving their thermal stability and chemical resistance.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Ethylamine Market.

Geopolitical tensions have increasingly affected the ethylamine market by disrupting its supply chains. Export restrictions on key inputs such as ammonia and ethanol have hindered ethylamine production, as the chemical’s synthesis depends critically on this petrochemical feedstock.

For instance, the Russia-Ukraine conflict significantly affected ammonia supply routes, particularly the Togliatti-Odesa pipeline, a major conduit for Russian ammonia to global markets. Tensions in the Middle East have led to disruptions in urea and ammonia production in countries like Iran, impacting global supplies and contributing to price volatility.

Similarly, in early August 2025, the United States imposed an additional 50% tariff on Brazilian goods, including ethanol. Additionally, most amine derivatives are transported through shipping routes of the Strait of Malacca and the South China Sea, both of which are highly exposed to regional conflicts. These geopolitical frictions have created cost and compliance hurdles in cross-border commerce of amines.

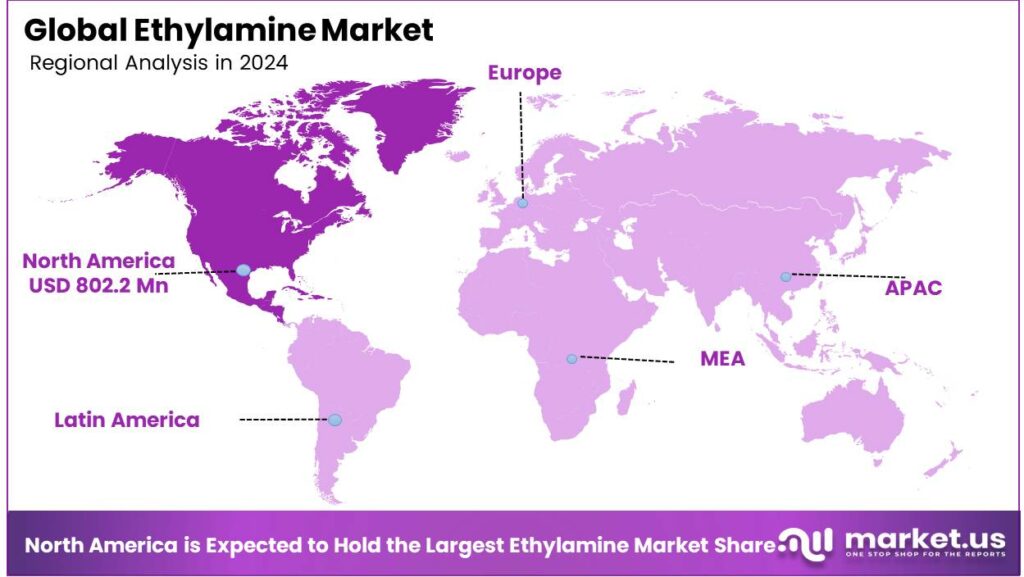

Regional Analysis

North America was at the Forefront of the Global Ethylamine Market in 2024.

North America held the major share of the global ethylamine market with a 38.2%, led by the United States, valued at around USD 802.2 million. The dominance of the region is attributed to its strong chemical-manufacturing base and technological innovation across key end‑use sectors.

For instance, in May 2025, Huntsman announced its E-grade portfolio, which provides high-purity, low-trace metal amines, including quaternary amines and amine oxides, essential for semiconductor chip manufacturing.

Additionally, major firms such as Dow Chemicals ramped up capacity by investing in automation and sustainability upgrades for their Texas-based ethylamine facilities. Regulatory stability, advanced research and development infrastructure, and the presence of leading manufacturers contribute to the robust supply chain of ethylamine in North America.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

There are several global key players in the ethylamine market, such as Arabian Amines, BASF, Delamines, Diamines and Chemicals, Dow Chemicals, Fisher Chemical, Huntsman International, Oriental Union Chemical Corporation (OUCC), Sadara Chemical, Arkema, Eastman Chemical, and Balaji Amines Ltd. As the ethylamine market is very niche, many players put efforts into strategic activities, such as product development, mergers, partnerships, and investments.

- BASF is a global leader in the ethylamine market. The company operates in over 90 countries with numerous production sites, and has experienced consumer trust and brand reputation.

- Delamine is a Dutch chemical company specializing in the production and supply of ethylene amines. It operates as a joint venture between Nouryon and Tosoh Corporation, and is known for prioritizing sustainability (including safety, health, and environmental safety) and strong relationships with suppliers and clients.

- Huntsman is a significant producer of various amines, including ethylamines. They are known as a world-leading supplier of semiconductor-grade amines used in electronics manufacturing.

The Major Players in The Industry

- Arabian Amines Company

- BASF SE

- Delamines BV

- Diamines and Chemicals Ltd.

- Dow Chemicals

- Fisher Chemical

- Huntsman International LLC

- Nouryon

- Oriental Union Chemical Corporation (OUCC)

- Sadara Chemical Company

- Arkema S.A.

- Eastman Chemical Company

- Alkyl Amines Chemicals Ltd.

- Balaji Amines Ltd.

- Other Key Players

Key Developments

- In July 2025, Dow Chemical implemented a price increase on all grades and packaging types of its ethanolamine products in North America, including monoethanolamine (MEA), diethanolamine (DEA), and triethanolamine (TEA), with an increase of US$0.05/lb.

- In September 2024, BASF inaugurated a world-scale production plant for alkyl ethanolamines at its Verbund site in Antwerp, Belgium, to increase the company’s global annual production capacity for alkyl ethanolamines, including dimethyl ethanolamine (DMEOA) and methyl diethanolamine (MDEOA).

Report Scope

Report Features Description Market Value (2024) USD 1.9 Billion Forecast Revenue (2034) USD 2.8 Billion CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Monoethylamine (MEA), Diethylamine (DEA), Triethylamine (TEA)), By Purity (Up to 99.5%, Above 99.5%), By Applications (Agrochemicals, Pharmaceuticals, Chemical Synthesis, Rubber & Plastics, Textiles, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arabian Amines Company, BASF SE, Delamines BV, Diamines and Chemicals Ltd., Dow Chemicals, Fisher Chemical, Huntsman International LLC, Nouryon, Oriental Union Chemical Corporation (OUCC), Sadara Chemical Company, Arkema S.A., Eastman Chemical Company, Alkyl Amines Chemicals Ltd., Balaji Amines Ltd., Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Arabian Amines Company

- BASF SE

- Delamines BV

- Diamines and Chemicals Ltd.

- Dow Chemicals

- Fisher Chemical

- Huntsman International LLC

- Nouryon

- Oriental Union Chemical Corporation (OUCC)

- Sadara Chemical Company

- Arkema S.A.

- Eastman Chemical Company

- Alkyl Amines Chemicals Ltd.

- Balaji Amines Ltd.

- Other Key Players