Global Plant-based Creamers Market Size, Share Analysis Report By Product Type (Soy-Based Creamers, Almond-Based Creamers, Oat-Based Creamers, Coconut-Based Creamers, Rice-Based Creamers, Others), By Form (Liquid Creamers, Powdered Creamers), By Flavor (Original/Unflavored, Vanilla, Hazelnut, Chocolate, Caramel, Others), By End Use (Coffee shops and cafes, Retail, Foodservice, Bakery and confectionery, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170292

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

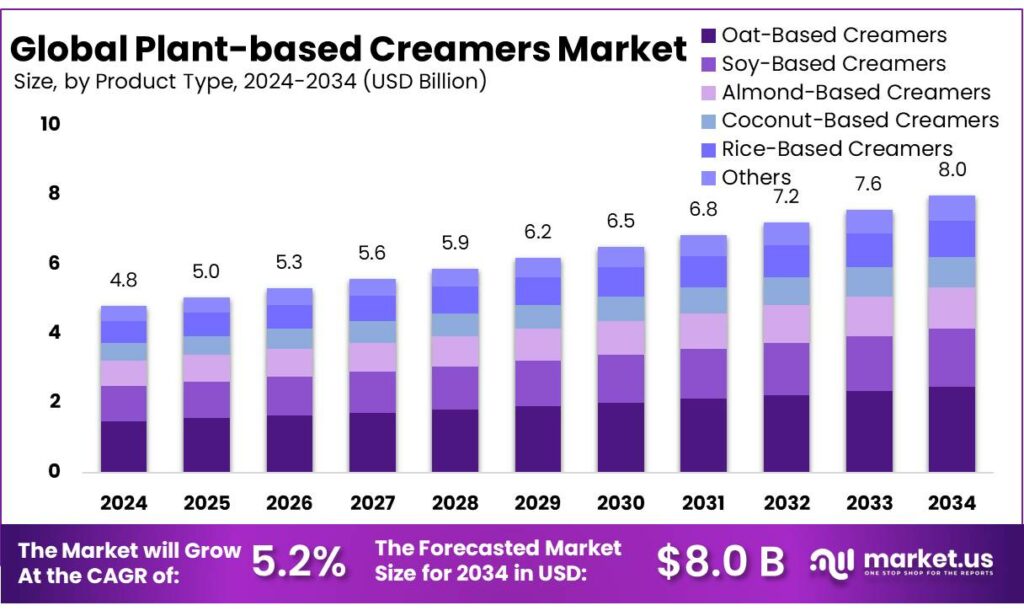

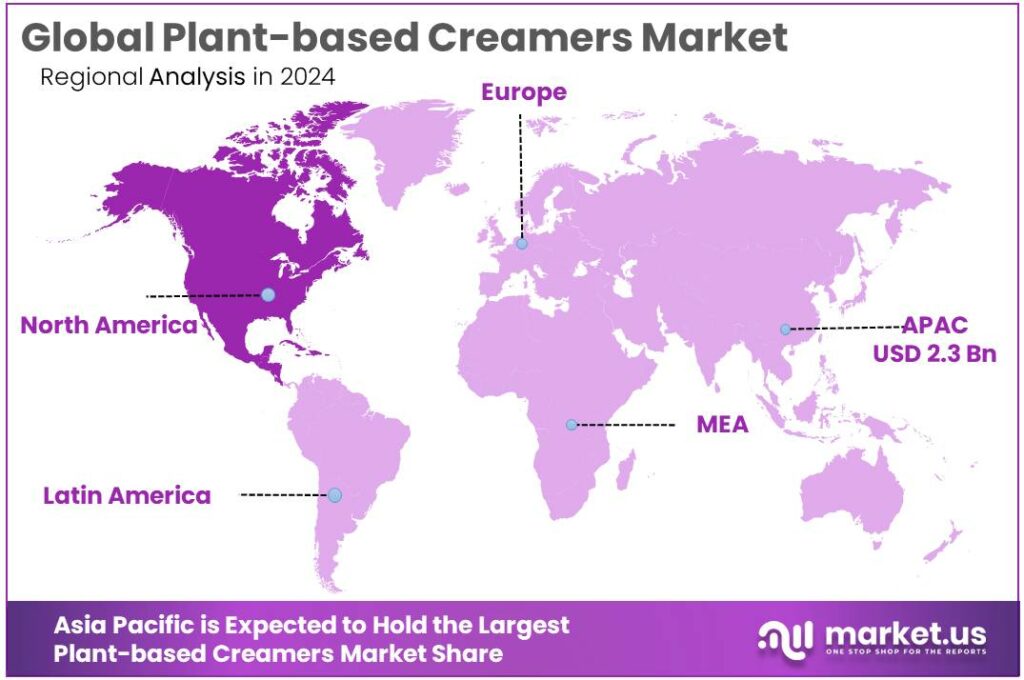

The Global Plant-based Creamers Market size is expected to be worth around USD 8.0 Billion by 2034, from USD 4.8 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 48.90% share, holding USD 2.3 Billion revenue.

Plant-based creamers are non-dairy fat-and-flavor systems designed to replicate (and often improve) the whitening, mouthfeel, and stability that dairy cream delivers in coffee, tea, and ready-to-drink beverages. Industrially, they sit at the intersection of plant-based dairy alternatives and the global “coffee occasions” economy—where even small shifts in formulations can scale quickly across cafés, offices, and retail shelves.

- In the U.S. alone, plant-based foods generated $8.1 billion in retail dollar sales in 2024, with 59% of households buying plant-based foods and 79% repeating purchases—signals of a large, replenishment-led base that supports everyday categories like creamers.

From an industrial scenario standpoint, today’s plant-based creamers are built around oils/fats, plant proteins or emulsifiers (for stability), sweeteners/flavors, and micronutrient strategies that help brands align with nutrition expectations. Ingredient choices are widening: oat, almond, soy, coconut, and blended bases are increasingly common as brands balance cost, taste, allergen considerations, and performance in hot and iced beverages.

Retail performance data also shows why manufacturers keep investing in this segment: the Plant Based Foods Association reported that plant-based creamer grew 24% in dollar sales and 12% in units in 2022, while animal-based creamer units declined 1.4%—a strong indicator that shoppers were actively trialing and re-buying plant-based options during mainstream category shopping.

- Key driving factors are now coming from foodservice adoption and “default option” behavior at cafés. In U.S. broadline distributor foodservice, plant-based creamer dollar sales grew 5% in 2024, and plant-based creamer reached a 31% share of total creamer pound sales—an unusually high penetration rate that highlights how quickly a barista-added ingredient can gain share once it’s stocked and promoted.

Regulation and public-sector activity are also shaping the runway. In the U.S., FDA has published guidance work on naming and labeling expectations for plant-based milk alternatives and related voluntary nutrient statements—important because clearer labeling reduces friction at shelf and supports repeat purchase.

- On the innovation side, governments are funding “future foods” capabilities: Singapore’s SFA committed $42 million to drive breakthroughs in future foods and food safety, while USDA’s NIFA invested $6.8 million in 16 grants supporting novel foods and innovative manufacturing—signals that process scale-up, safety science, and functionality improvements are policy-relevant, not just commercial bets.

Key Takeaways

- Plant-based Creamers Market size is expected to be worth around USD 8.0 Billion by 2034, from USD 4.8 Billion in 2024, growing at a CAGR of 5.2%.

- Oat-Based Creamers held a dominant market position, capturing more than a 31.6% share.

- Liquid Creamers held a dominant market position, capturing more than a 68.3% share.

- Original/Unflavored held a dominant market position, capturing more than a 34.9% share.

- Retail held a dominant market position, capturing more than a 39.5% share.

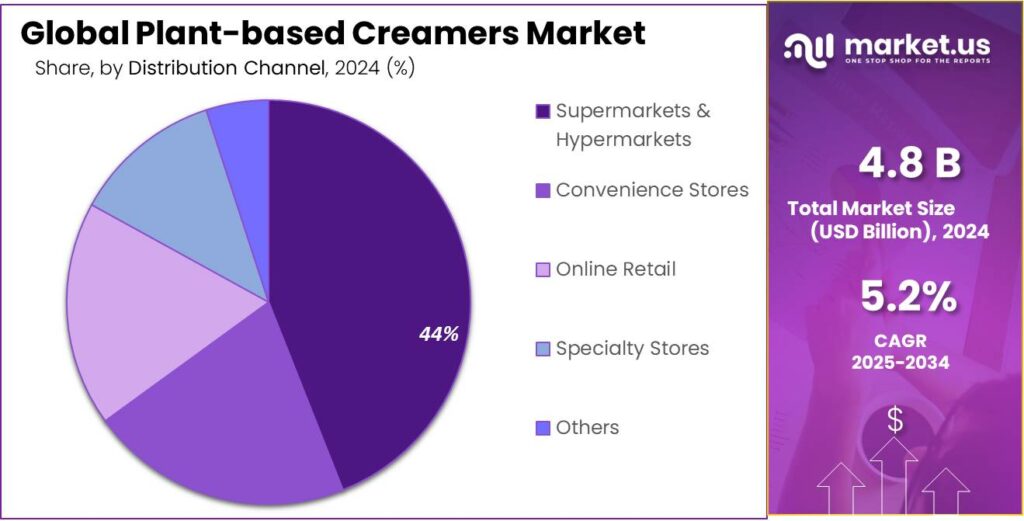

- Supermarkets & Hypermarkets held a dominant market position, capturing more than a 44.7% share.

- Asia Pacific held a commanding regional position in the plant-based creamers market, accounting for 48.90% of global value and generating roughly USD 2.3 billion.

By Product Type Analysis

Oat-based creamers lead with 31.6% as taste, texture and clean-label appeal drive adoption.

In 2024, Oat-Based Creamers held a dominant market position, capturing more than a 31.6% share. This performance was driven by widespread consumer preference for creamy mouthfeel combined with plant-based and allergen-friendly positioning, which made oat formulations the go-to choice for coffee shops, retail-ready mixers and foodservice chains. Manufacturers benefited from scalable oat processing and from formulations that balance stability with sensory quality, so procurement in 2024 favoured suppliers able to deliver consistent viscosity, heat stability and shelf life.

The product’s versatility across ready-to-drink beverages, instant mixes and culinary applications increased volume uptake, while marketing that emphasised sustainability and simple ingredient lists reinforced shopper trust. Into 2025, the oat segment was expected to retain momentum as incremental product innovation and broader retail placement continued to expand its footprint across mainstream and specialty channels.

By Form Analysis

Liquid Creamers dominate with 68.3% as convenience and shelf stability drive widespread use.

In 2024, Liquid Creamers held a dominant market position, capturing more than a 68.3% share. This leadership was supported by the format’s ready-to-use convenience, broad compatibility with coffee and foodservice operations, and superior shelf-life performance under commercial cold-chain logistics. Preference for liquid formats was reinforced by strong demand from cafes, retail ready-to-drink launches and institutional buyers who prioritised consistent mouthfeel and simple preparation.

Procurement decisions in 2024 often favoured suppliers able to deliver stable emulsions, reliable sourcing and scalable production volumes, which reduced formulation risk and shortened time to market. The segment’s dominance was expected to persist into 2025 as manufacturers continued to invest in formulation stability and packaging innovations that support on-premise and retail channels.

By Flavor Analysis

Original/Unflavored leads with 34.9% as its clean, versatile profile suits broad applications.

In 2024, Original/Unflavored held a dominant market position, capturing more than a 34.9% share. This preference was driven by manufacturers and foodservice operators favouring a neutral base that can be easily reformulated or paired with coffees, teas and culinary applications without altering intended flavour profiles. Adoption was supported by the format’s perceived naturalness and by procurement practices that prioritised multi-use SKUs to reduce inventory complexity.

Clean-label trends and demand for simple ingredient lists reinforced shelf-space allocation for original variants, while manufacturers emphasised stability, mouthfeel and heat tolerance to meet barista and industrial requirements. Reformulation efforts in 2024 focused on improving texture and emulsification without added flavouring, and the original/unflavoured segment was expected to retain prominence into 2025 as brands and foodservice operators continued to prioritise flexibility, cost control and broad consumer acceptance.

By End Use Analysis

Retail dominates with 39.5% as consumer reach and shelf visibility drive purchase.

In 2024, Retail held a dominant market position, capturing more than a 39.5% share. This outcome was underpinned by wide supermarket and grocery distribution, strong private-label activity, and frequent promotional programmes that increased trial and repeat purchase of plant-based creamers. The retail channel was favoured for its ability to deliver consistent pack formats, reliable cold-chain logistics for chilled SKUs, and easy consumer access that supported mainstream adoption in both urban and suburban markets.

Procurement in 2024 was driven by shelf-space efficiency and multi-SKU merchandising strategies, and retailers prioritised suppliers able to provide stable volumes, clear labelling and compliant shelf-life performance. From a year-on-year perspective: 2024 recorded the 39.5% share, and the retail channel was expected to remain the leading outlet into 2025 as brand visibility, in-store promotions and distribution depth continued to support volume growth.

By Distribution Channel Analysis

Supermarkets & Hypermarkets lead with 44.7% as wide reach and strong merchandising drive sales.

In 2024, Supermarkets & Hypermarkets held a dominant market position, capturing more than a 44.7% share. This outcome was driven by the channel’s broad consumer reach, prominent shelf space and frequent promotional activity which together supported trial and repeat purchases of plant-based creamers. Retail buyers favoured suppliers able to deliver consistent pack sizes, clear labelling and reliable cold-chain performance for chilled SKUs, so procurement prioritised volume capability and predictable lead times. The category benefited from end-cap displays, private-label introductions and multipack offers that simplified consumer decision-making and reduced unit price barriers.

In 2024, large grocery chains also influenced product formulation through technical requirements for shelf-life and heat stability, prompting suppliers to standardise emulsions and stabilisers to meet store performance criteria. Looking into 2025, Supermarkets & Hypermarkets are expected to remain the primary distribution channel in value terms as national rollouts, promotional calendars and retailer merchandising strategies continue to favour mainstream placement, while convenience and online channels complement growth by addressing niche and impulse purchases.

Key Market Segments

By Product Type

- Soy-Based Creamers

- Almond-Based Creamers

- Oat-Based Creamers

- Coconut-Based Creamers

- Rice-Based Creamers

- Others

By Form

- Liquid Creamers

- Powdered Creamers

By Flavor

- Original/Unflavored

- Vanilla

- Hazelnut

- Chocolate

- Caramel

- Others

By End Use

- Coffee shops and cafes

- Retail

- Foodservice

- Bakery and confectionery

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- Others

Emerging Trends

plant-based creamers ride the wave of mainstream dairy alternatives

One of the most noticeable and human-centred trends in plant-based creamers today is how they are no longer niche products for a small segment of people with specific diets but part of everyday life for many consumers. Some want gentler options for digestion, others care about sustainability, and many simply like the taste or texture they add to their daily coffee. This shift is real, and numbers from trusted sources show just how mainstream plant-based dairy alternatives have become — with direct implications for plant-based creamers.

- For example, in the U.S., 14% of households bought plant-based creamers in 2024, and 66% of those were repeat buyers. This high repeat rate tells us that once people try a plant-based creamer and it fits their morning routine, many come back for more.

For instance, plant-based milk had the highest penetration of plant-based dairy options, and consumers increasingly use these alternatives in coffee, smoothies, and cooking. This is a crystallizing trend as it broadens the use cases for plant-based creamers, which are often made from the same bases as milks such as oat, almond, or soy.

Another compelling trend comes from the rise in global interest in plant-led lifestyles and conscientious eating. Movements like Veganuary, which encourages people to try vegan eating in January each year, highlight this cultural shift. In 2025, participation in Veganuary jumped to approximately 25.8 million people worldwide — a dramatic increase from earlier years and a good sign that plant-based choices are entering more households and conversations than ever before.

Government and policy initiatives also support this mainstreaming trend — not by mandating plant-based choices, but by providing clearer frameworks and safer markets for them. For example, the FDA has issued draft guidance on how plant-based milk alternatives should be labelled, helping reduce confusion for shoppers and giving companies clearer rules to work within.

Drivers

Coffee-led everyday routines are pulling plant-based creamers forward

One major driver for plant-based creamers is simple: coffee is a daily habit for a huge share of consumers, and “how people take their coffee” keeps getting more personalized. In the U.S., 66% of adults drink coffee each day, and the average coffee drinker has about 3 cups per day, which creates a large, repeat-use moment where creamers naturally compete for attention. That routine matters because creamers are not an occasional purchase—if someone finds a taste and texture they like, the product becomes part of their morning autopilot.

Foodservice adoption is another concrete pull. In broadline distributor channels tracked by GFI, plant-based creamer dollar sales grew 5% in 2024, and plant-based creamer reached a 31% share of the total creamer market in that tracked foodservice distribution view. That matters because cafés, offices, and quick-service operators act like “trial engines.” When a customer tries plant-based creamer in a latte and likes the performance, it reduces the risk of buying it for home later.

At retail, the story is also about repeat behavior, not just first-time trial. GFI reports that 14% of households purchased plant-based creamers in 2024, and 66% of those households were repeat purchasers—one of the stronger repeat rates among plant-based categories. Even though plant-based creamer faced a tougher year in 2024, the repeat-purchase base shows that once consumers find a plant-based creamer that performs well in coffee, they often stick with it.

- Policy and trusted public institutions are also helping this driver by reducing friction and supporting innovation. On the technology side, USDA’s NIFA invested $6.8 million across 16 grants for novel foods and innovative manufacturing—funding that strengthens formulation science, processing, and scale-up capabilities that can directly benefit texture and stability improvements in products like plant-based creamers.

Restraints

Price pressure and “good-enough” dairy options slow plant-based creamer gains

A major restraining factor for plant-based creamers is value pressure at the shelf, especially when shoppers feel the price gap versus conventional creamer or half-and-half. When everyday groceries are still moving up, people often simplify choices and return to familiar options that feel cheaper and “safe.” In the U.S., the Bureau of Labor Statistics reported the food at home index was up 2.7% over the 12 months ending September 2025, and nonalcoholic beverages were up 5.3% over the same period.

This pressure shows up clearly in category performance. The Good Food Institute notes that plant-based creamer declined in 2024, with both dollar and unit sales down 4%, after several years of growth. That is a real restraint because creamers are typically repeat-use products. If a buyer sees a higher price and feels the taste or texture is only “close enough,” they can switch back quickly. At the same time, conventional products are not standing still. In GFI’s U.S. retail tracking, conventional creamer grew 6% in dollar sales and 3% in unit sales in 2024, which means the mainstream creamer aisle is still expanding while plant-based brands fight harder for space and promotions.

Cost is not only a consumer issue—it is also an industrial formulation challenge. Plant-based creamers need to stay stable in hot coffee, mix smoothly, and deliver a consistent mouthfeel. Achieving that often requires multiple ingredients and processing steps, which can raise production costs and complicate label goals. When retailers are cautious and shoppers are price-sensitive, brands may be forced into discounting cycles. That can protect volume in the short term but makes it harder to fund steady upgrades in taste, texture, and functionality.

There is also a compliance and messaging drag that slows momentum. The U.S. FDA has issued draft guidance on naming and labeling for plant-based milk alternatives and recommendations for voluntary nutrient statements, reflecting ongoing attention to how these products are presented to consumers. For companies, this kind of guidance is helpful long-term, but in the near term it can create extra work: packaging updates, nutrition communication choices, and tighter internal review processes. Those costs are manageable for large brands, but they can be heavy for smaller innovators trying to scale.

Opportunity

Next-wave opportunity: better “performance + nutrition” creamers for daily coffee

One major growth opportunity for plant-based creamers is building products that perform like dairy in hot coffee and deliver clearer nutrition benefits—because coffee is already an everyday ritual, and consumers are upgrading what goes into the cup.

- In the U.S., the National Coffee Association reports 66% of adults drink coffee daily, and specialty coffee reached 45% of adults in the past day. That combination creates a steady “trial engine” for new creamers: when people are already experimenting with café-style drinks at home, they become more open to creamers that offer better taste, smoother texture, and specific claims they can understand.

The foodservice channel is where this opportunity can scale fastest. In tracking cited by the Good Food Institute, plant-based creamer dollar sales in U.S. foodservice distribution grew 5% in 2024, and plant-based creamer reached a 31% share of the total creamer market in that view. That’s meaningful because foodservice acts like sampling at industrial scale: if a plant-based creamer holds up in a busy café (no splitting, consistent mouthfeel), it strengthens brand trust and pulls retail take-home demand behind it.

Retail behavior supports the case for investment too—especially around repeat purchase. GFI notes 14% of households bought plant-based creamers in 2024, and 66% of those households were repeat purchasers. This tells manufacturers where the “unlock” is: the product works for a meaningful base of users, but growth depends on converting more first-time buyers and making the value proposition easier to justify.

- Government-backed innovation is also expanding the toolkit for the next generation of creamers. In the U.S., USDA’s NIFA invested $6.8 million across 16 grants under its Novel Foods and Innovative Manufacturing program to improve food quality, safety, and nutrition through new science and processing approaches. In Singapore, the Singapore Food Agency awarded $42 million to 11 Future Foods and Food Safety projects under Phase Two of the Singapore Food Story R&D Programme, including work focused on improving the nutrition and functionality of alternative protein products.

Regional Insights

Asia Pacific dominates with 48.90% share and approx. USD 2.3 billion in 2024

In 2024, Asia Pacific held a commanding regional position in the plant-based creamers market, accounting for 48.90% of global value and generating roughly USD 2.3 billion; this leadership was supported by rapid urbanisation, rising disposable incomes, and strong consumer acceptance of plant-based dairy alternatives across key markets such as China, India, Japan and Australia. Regional manufacturing scale—spanning oat, soy and pea processing facilities and integrated pack-assembly lines—helped secure competitive pricing and high fill-rates for both domestic retail and export channels, shortening lead times for major retailers and foodservice operators.

Demand drivers in 2024 included increased café penetration of plant-milk-based beverages, private-label rollouts by supermarket chains, and growth in ready-to-drink launches that used plant-based creamers for taste and stability; these use cases amplified volume uptake in both liquid and powdered formats. Policy incentives and health-driven consumer trends supported reformulation efforts focused on clean labels and allergen-friendly claims, while technical investment in emulsification and shelf-stability enabled chilled and ambient SKUs to scale. E-commerce and modern retail distribution amplified market reach, and upstream supply-chain integration between cell-processors, packagers and logistics providers reduced distribution friction.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Chobani, headquartered in the United States, is a prominent supplier of plant-based creamers, yogurts, and dairy alternatives. In 2024, the company generated approximately USD 1.9 billion in revenue, leveraging strong retail distribution and innovative product launches. Its focus on oat and almond-based creamers supported market share growth while maintaining consistent quality and brand recognition in North America.

Greek Gods specializes in Greek-style yogurt and plant-based creamers. In 2024, the company generated around USD 235 million in revenue. Its plant-based offerings focus on almond and oat formulations, supporting retail and foodservice demand with premium positioning and clean-label appeal.

La Yogurt operates primarily in North America, offering yogurt and plant-based creamers. In 2024, the company generated approximately USD 105 million in revenue. Its product line emphasizes quality, clean-label ingredients, and retail distribution, capturing niche consumer segments interested in plant-based alternatives.

Top Key Players Outlook

- Chobani

- Danone

- Fage

- General Mills

- Greek Gods

- La Yogurt

- Lifeway Foods

- Nestlé

- Valio

- Yoplait

Recent Industry Developments

In fiscal 2024, General Mills, Inc. reported consolidated net sales of USD 19.9 billion, with net earnings around USD 2.5 billion, reflecting the company’s broad food portfolio and scale across retail and foodservice channels.

In 2024, The Greek Gods brand remained a niche player within The Hain Celestial Group portfolio, estimated annual revenue in the range of USD 25–100 million and noted for its Greek‑style dairy products including yogurt and kefir rather than plant‑based creamers specifically.

Report Scope

Report Features Description Market Value (2024) USD 4.8 Bn Forecast Revenue (2034) USD 8.0 Bn CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Soy-Based Creamers, Almond-Based Creamers, Oat-Based Creamers, Coconut-Based Creamers, Rice-Based Creamers, Others), By Form (Liquid Creamers, Powdered Creamers), By Flavor (Original/Unflavored, Vanilla, Hazelnut, Chocolate, Caramel, Others), By End Use (Coffee shops and cafes, Retail, Foodservice, Bakery and confectionery, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Chobani, Danone, Fage, General Mills, Greek Gods, La Yogurt, Lifeway Foods, Nestlé, Valio, Yoplait Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Plant-based Creamers MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Plant-based Creamers MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Chobani

- Danone

- Fage

- General Mills

- Greek Gods

- La Yogurt

- Lifeway Foods

- Nestlé

- Valio

- Yoplait