Global Ancient Grains Market By Crop Type (Gluten-Free Ancient Grains, Gluten Containing Ancient Grains), By Application (Food, Beverages, Animal Feed and Pet Food, Others), By Form (Whole Grains, Flour, Ready-to-Eat, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Health Food Stores, Online Retailers, Direct from Farmers, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143731

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

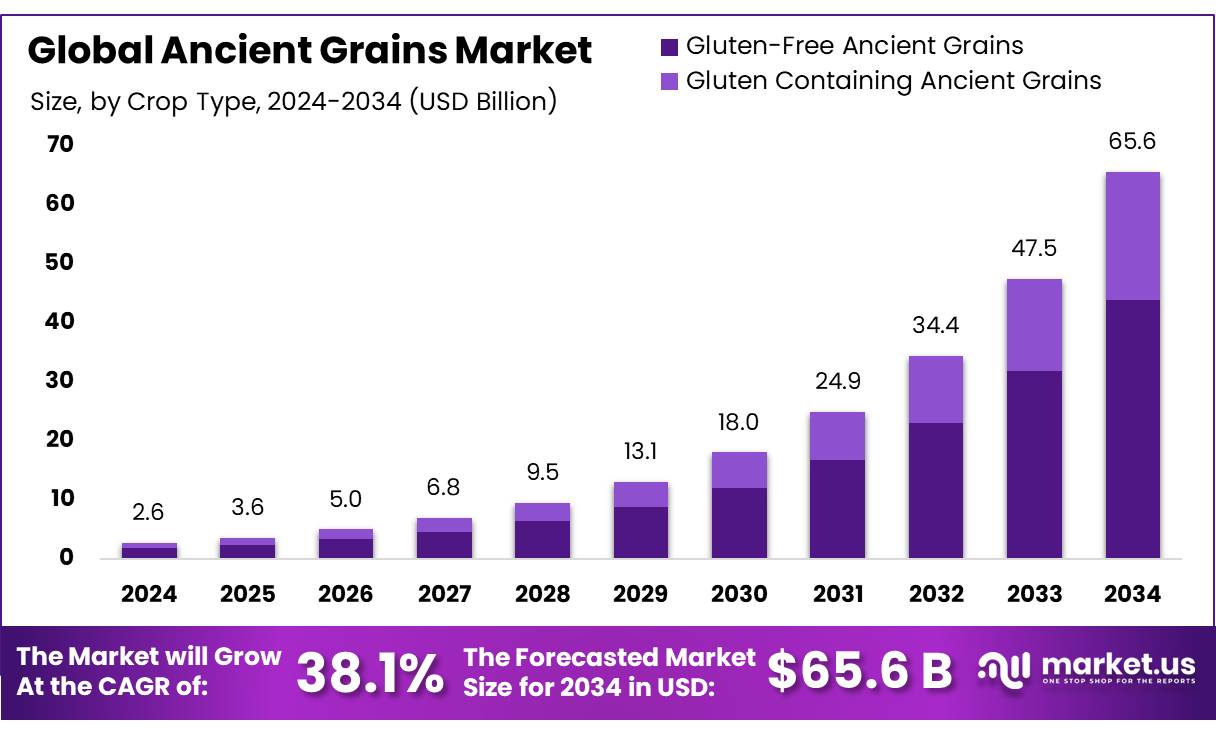

The Global Ancient Grains Market size is expected to be worth around USD 65.6 Bn by 2034, from USD 2.6 Bn in 2024, growing at a CAGR of 38.1% during the forecast period from 2025 to 2034.

Ancient grains, characterized by their minimal changes over centuries, are rapidly gaining prominence in the global food market. This category encompasses a variety of grains such as quinoa, amaranth, millet, and teff, which are lauded for their nutritional benefits and adaptability in diverse culinary applications. Unlike more common grains, these ancient varieties have not been extensively modified by modern agricultural practices, making them particularly appealing in health-conscious and sustainable farming contexts.

According to a report from Whole Foods Market, sales of products containing ancient grains have seen a rise of over 20% in the past two years alone. The market’s expansion is further supported by robust distribution networks and innovative product offerings across both developed and emerging regions. Major food processing companies and retailers are continually expanding their ancient grain product lines to meet growing consumer demand.

Several factors contribute to the rising popularity of ancient grains. Primarily, the health benefits associated with these grains, such as high fiber content, essential amino acids, and antioxidants, make them a preferred choice for health-conscious consumers. Furthermore, the versatility of ancient grains allows for their incorporation into a variety of dietary patterns, catering to gluten-free, vegan, and whole-food based diets, which have surged in popularity. Additionally, the sustainable aspect of ancient grain cultivation, which often requires fewer resources compared to conventional grains, appeals to environmentally aware consumers.

Governmental bodies and international food organizations have also played crucial roles in promoting ancient grains. For instance, the Food and Agriculture Organization of the United Nations (FAO) has initiated several programs to encourage the cultivation and consumption of quinoa, particularly in regions prone to food insecurity. These initiatives often include training for farmers, support for sustainable farming practices, and marketing assistance to help integrate these grains into local and global markets.

Key Takeaways

- Ancient Grains Market size is expected to be worth around USD 65.6 Bn by 2034, from USD 2.6 Bn in 2024, growing at a CAGR of 38.1%.

- Gluten-Free Ancient Grains held a dominant market position, capturing more than a 67.30% share.

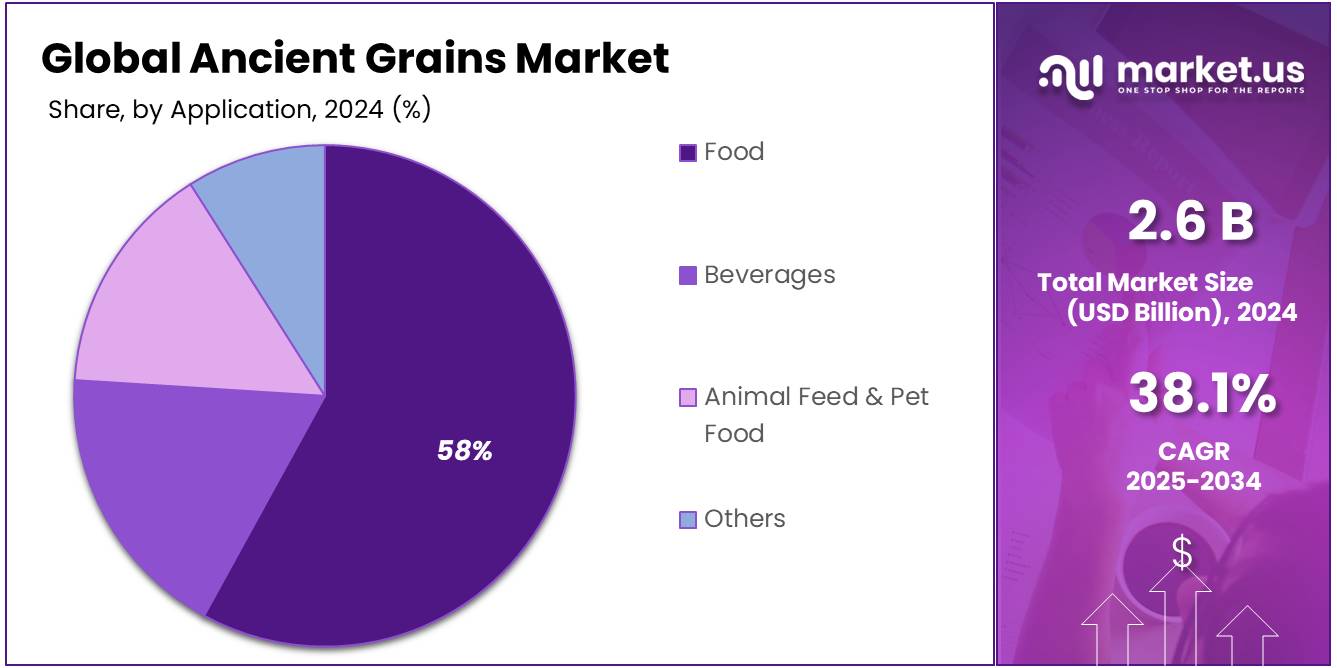

- Food held a dominant market position, capturing more than a 58.20% share of the Ancient Grains market.

- Whole Grains held a dominant market position, capturing more than a 45.80% share of the Ancient Grains market.

- Supermarkets & Hypermarkets held a dominant market position, capturing more than a 39.10% share.

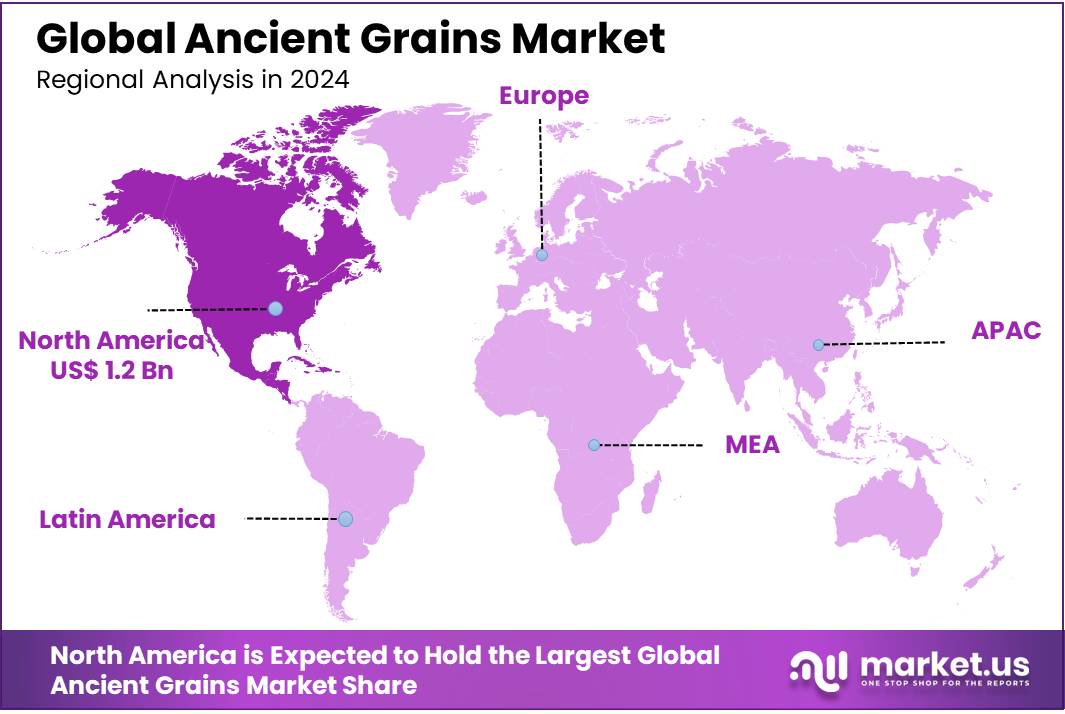

- North America demonstrated a robust performance, commanding a substantial 46.20% share, which translates to approximately USD 1.2 billion in value.

By Crop Type

Gluten-Free Ancient Grains Lead with Over Two-Thirds Market Share

In 2024, Gluten-Free Ancient Grains held a dominant market position, capturing more than a 67.30% share of the Ancient Grains market. This segment’s popularity has been driven by the growing consumer preference for healthier dietary options and the rising awareness of gluten intolerance and celiac disease. Consumers are increasingly opting for gluten-free ancient grains such as quinoa, amaranth, and buckwheat, which are not only nutritious but also versatile in various culinary applications.

The demand is further bolstered by the grains’ compatibility with vegan and paleo diets, making them a staple in households that prioritize natural and minimally processed foods. This trend is expected to continue, with projections suggesting a steady increase in market penetration, positioning gluten-free ancient grains as a key component of the health-food sector in 2025 and beyond.

By Application

Food Applications Command Over Half the Ancient Grains Market

In 2024, Food held a dominant market position, capturing more than a 58.20% share of the Ancient Grains market. This significant market share reflects the expanding integration of ancient grains like quinoa, millet, and sorghum into everyday diets, driven by their nutritional benefits and versatility in food preparation. Consumers are drawn to these grains for their high fiber content, essential amino acids, and gluten-free properties, which cater to health-conscious individuals and those with dietary restrictions.

Additionally, the culinary world’s growing appreciation for diverse and culturally rich grains has further propelled their use in a variety of food products from bakery goods to ready-to-eat meals. Looking into 2025, the food segment is anticipated to maintain its robust growth as more consumers opt for healthier and more sustainable food choices, ensuring that ancient grains remain a dietary staple.

By Form

Whole Grains Lead Ancient Grains Market with Strong Presence

In 2024, Whole Grains held a dominant market position, capturing more than a 45.80% share of the Ancient Grains market. This leadership reflects a growing consumer trend towards whole food consumption, driven by the pursuit of natural and unprocessed dietary options. Whole grains such as spelt, farro, and freekeh are valued for their nutritional integrity, providing essential nutrients, fiber, and antioxidants that are often lost in refined grains.

This form appeals particularly to health-conscious consumers who prioritize whole, unmodified foods for their health benefits, including improved digestion and better heart health. The trend is projected to gain momentum into 2025 as awareness and education about the benefits of whole grains continue to increase, suggesting a stable and promising growth trajectory in the Ancient Grains market.

By Distribution Channel

Supermarkets & Hypermarkets Take the Lead in Ancient Grains Distribution

In 2024, Supermarkets & Hypermarkets held a dominant market position, capturing more than a 39.10% share of the Ancient Grains market. This segment’s strong performance is attributed to the convenience and wide range of products offered, making it easier for consumers to access a variety of ancient grains such as teff, quinoa, and amaranth under one roof.

These outlets have become key destinations for health-conscious shoppers due to their ability to offer extensive product selections, including organic and gluten-free options, which cater to diverse dietary needs and preferences. As consumer demand for nutritious and versatile food options grows, supermarkets and hypermarkets are expected to continue their prominence in the distribution of ancient grains through 2025, supported by strategic shelf placements and targeted marketing campaigns.

Key Market Segments

By Crop Type

- Gluten-Free Ancient Grains

- Amaranth

- Fonio

- Millet

- Sorghum

- Teff

- Others

- Gluten Containing Ancient Grains

- Barley

- Einkorn

- Emmer

- Farro

- Freekeh

- Kamut

- Spelt

- Others

By Application

- Food

- Bars and Snacks

- Culinary

- Baked Goods

- Cereals & Granolas

- Meat and Meat Alternatives

- Dairy and Dairy Alternatives

- Others

- Beverages

- Animal Feed & Pet Food

- Others

By Form

- Whole Grains

- Flour

- Ready-to-Eat

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Health Food Stores

- Online Retailers

- Direct from Farmers

- Others

Drivers

Increasing Health Awareness Fuels Demand for Ancient Grains

One of the major driving factors for the growth of the ancient grains market is the increasing consumer awareness of health and wellness. This trend is evidenced by a significant uptick in the consumption of foods that support a healthy lifestyle. According to the Food and Agriculture Organization (FAO), grains such as quinoa have seen a surge in popularity due to their high nutrient content, including essential amino acids, fiber, vitamins, and minerals that are often lacking in more processed grains.

The rise in popularity of ancient grains is also bolstered by government and non-governmental health initiatives that promote whole grains as part of a balanced diet. For instance, the U.S. Department of Agriculture (USDA) and the Department of Health and Human Services (HHS) recommend increasing whole grain intake as part of their dietary guidelines. These recommendations are reflected in public health campaigns and nutritional guidelines that aim to reduce chronic disease prevalence associated with poor diet.

Moreover, the global movement towards plant-based diets has played a crucial role in the elevated demand for ancient grains. The Vegetarian Resource Group reports that the number of people adopting vegetarian and plant-based diets has grown, with ancient grains being a preferred source of plant protein. These grains fit well into such diets because they offer a high-protein alternative to meat and other animal products.

Consumer preferences are shifting not only towards healthier food options but also towards more sustainable and environmentally friendly choices. Ancient grains require less water and are often suitable for growing in harsh conditions where other crops might fail, making them a sustainable choice in the face of climate change.

Restraints

Supply Chain Complexities Hinder Ancient Grains Market Growth

A significant restraining factor for the growth of the ancient grains market is the complexity of their supply chains. Ancient grains such as amaranth, teff, and millet are often grown in specific regions that do not always have the infrastructure to support large-scale agricultural practices. This situation is compounded by the small-scale nature of many farms that cultivate these grains, which can lead to inconsistencies in supply and quality.

According to a report from the United Nations Food and Agriculture Organization (FAO), the logistical challenges associated with transporting these grains from remote areas to global markets add substantial costs and time delays to their distribution. These factors make it difficult for producers to meet the growing demand effectively and can discourage large retailers and food manufacturers from incorporating ancient grains into their product lines due to the risk of supply shortages and higher prices.

Moreover, the lack of modern agricultural techniques in the cultivation of ancient grains can lead to lower yields compared to more commonly grown crops like wheat and corn. This inefficiency is highlighted in discussions at agricultural summits, where experts emphasize the need for research and development in sustainable farming practices that could improve the productivity of ancient grain crops without compromising their nutritional value.

Government initiatives aimed at improving agricultural infrastructure can play a crucial role in mitigating these challenges. For instance, investment in rural development and farming technologies specifically tailored to the needs of ancient grain producers could help stabilize the supply chain and make these nutritious grains more accessible to a wider market.

Opportunity

Expansion into Gluten-Free and Plant-Based Markets Presents Major Growth Opportunity for Ancient Grains

The expansion of the gluten-free and plant-based product markets presents a significant growth opportunity for the ancient grains sector. As reported by the World Health Organization (WHO), the rise in consumer awareness regarding celiac disease and gluten sensitivity has notably increased the demand for gluten-free products. Ancient grains such as quinoa, amaranth, and buckwheat, which naturally do not contain gluten, are becoming popular alternatives to traditional wheat-based products.

Additionally, the plant-based movement is gaining momentum, supported by consumers’ growing concerns about health, environment, and animal welfare. According to statistics from the Plant Based Foods Association (PBFA), sales of plant-based foods have seen a consistent upward trend, growing at a rate that substantially outpaces that of general food sales. Ancient grains are well-positioned to benefit from this trend due to their high protein content and essential amino acids, making them excellent ingredients in a variety of plant-based foods.

Governments and health organizations are also encouraging the consumption of diverse grains through dietary guidelines and public health initiatives. For example, the U.S. Department of Agriculture (USDA) promotes whole grains as a critical component of a healthy diet, which aligns with the nutritional profile of ancient grains.

Leveraging these trends, companies in the ancient grains market can tap into new consumer segments by developing and marketing products that cater to gluten-free and plant-based diets. This strategic alignment not only broadens their market reach but also enhances brand reputation by associating with health and sustainability.

Trends

Ancient Grains Making a Comeback in Modern Diets

One of the latest trends in the food industry is the resurgence of ancient grains in modern diets, a movement driven by consumer demand for more nutritious and sustainable food choices. This trend is supported by data from the International Food Information Council (IFIC), which indicates that more consumers are prioritizing the inclusion of whole and nutrient-dense ingredients in their diets, with ancient grains such as quinoa, millet, and sorghum seeing increased popularity due to their health benefits.

Ancient grains are being recognized not only for their health advantages, such as high fiber, proteins, and essential minerals, but also for their environmental benefits. They are often praised for their ability to grow in poor soil conditions with lower water and fertilizer requirements than conventional crops. This sustainable aspect is increasingly important to consumers who are concerned about the environmental impact of their food choices.

The culinary flexibility of ancient grains is another factor contributing to their growing popularity. From salads and soups to breads and desserts, ancient grains are being incorporated into a wide variety of dishes, catering to the creative desires of chefs and home cooks alike. This versatility has led to their increased presence on restaurant menus and in recipe books, further fueling their popularity among food enthusiasts.

Government health organizations globally are also supporting this trend by promoting diverse grain consumption as part of national dietary guidelines. For example, the USDA’s MyPlate guidelines encourage making at least half of the grains consumed whole grains, which include ancient varieties.

Regional Analysis

In 2024, the Ancient Grains market in North America demonstrated a robust performance, commanding a substantial 46.20% share, which translates to approximately USD 1.2 billion in value. This region’s dominance in the ancient grains market is primarily attributed to the increasing consumer inclination towards health and wellness, coupled with a surge in the popularity of organic and non-GMO food products. The U.S. and Canada are leading contributors, where heightened awareness about dietary health and sustainable agriculture drives significant demand.

The market’s growth in North America is also bolstered by the integration of ancient grains into mainstream food products. Supermarkets and health food stores across the region are expanding their ancient grain offerings, which include products like quinoa, amaranth, and millet, available in various forms such as whole grains, flours, and ready-to-eat meals. The rise in plant-based and gluten-free diets among North American consumers further supports the demand, as ancient grains provide an excellent alternative to traditional gluten-containing cereals.

Moreover, the presence of well-established food and beverage industries, which are continuously innovating and expanding their product lines to include ancient grains, has also played a pivotal role in market growth. These companies are actively promoting the health benefits of ancient grains, which resonates well with the region’s health-conscious demographic.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Annie’s Homegrown Inc., renowned for its organic and natural food products, has successfully integrated ancient grains into its range of offerings. The company focuses on providing healthier snack and meal options, featuring ancient grains in cereals, baking mixes, and meal kits. Annie’s commitment to non-GMO and organic ingredients appeals to health-conscious consumers, strengthening its market position in the ancient grains sector.

Archer Daniels Midland Company (ADM) As a global leader in food processing and commodities trading, Archer Daniels Midland Company leverages its vast distribution network to supply ancient grains across various markets. ADM offers a diverse portfolio of ancient grains, which includes sorghum, quinoa, and teff, catering to the rising demand for gluten-free and high-nutritional-value foods. Their strategic focus on sustainable and ethical sourcing further enhances their competitive edge.

Bob’s Red Mill is at the forefront of the ancient grains movement, offering an extensive array of products such as spelt, barley, and millet. Known for its commitment to quality, the company ensures that all grains are processed in their traditional form, preserving their nutritional value. Bob’s Red Mill’s dedication to non-GMO and organic products makes it a popular choice among health-aware individuals.

Cargill incorporates a strategic approach to tapping into the ancient grains market by providing a broad spectrum of grains, including amaranth, buckwheat, and more. Their global presence and robust supply chain capabilities allow them to meet the growing demand efficiently. Cargill also invests in research and development to innovate and improve the quality of their grain products, catering to health-conscious consumers worldwide.

Top Key Players in the Market

- Annie’s Homegrown Inc.

- Archer Daniels Midland Company

- Bob’s Red Mill

- Cargill

- Eden Foods

- Glanbia Nutritionals Inc.

- GoodMills Innovation GmbH

- Great River Organic Milling Inc.

- Hain Celestial

- King Arthur Flour

- Nature’s Path Foods

- Quinoa Corporation

Recent Developments

2024, ADM has focused on expanding its portfolio to include a variety of ancient grains, recognizing the growing consumer interest in healthier, more sustainable food options.

Bob’s Red Mill stands out for its commitment to providing a variety of ancient grains, like quinoa, millet, and amaranth, which are all known for their health benefits.

Report Scope

Report Features Description Market Value (2024) USD 2.6 Bn Forecast Revenue (2034) USD 65.6 Bn CAGR (2025-2034) 38.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Crop Type (Gluten-Free Ancient Grains, Gluten Containing Ancient Grains), By Application (Food, Beverages, Animal Feed and Pet Food, Others), By Form (Whole Grains, Flour, Ready-to-Eat, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Health Food Stores, Online Retailers, Direct from Farmers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Annie’s Homegrown Inc., Archer Daniels Midland Company, Bob’s Red Mill, Cargill, Eden Foods, Glanbia Nutritionals Inc., GoodMills Innovation GmbH, Great River Organic Milling Inc., Hain Celestial, King Arthur Flour, Nature’s Path Foods, Quinoa Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Annie’s Homegrown Inc.

- Archer Daniels Midland Company

- Bob's Red Mill

- Cargill

- Eden Foods

- Glanbia Nutritionals Inc.

- GoodMills Innovation GmbH

- Great River Organic Milling Inc.

- Hain Celestial

- King Arthur Flour

- Nature's Path Foods

- Quinoa Corporation