Global Organic Tea Market By Product Type (True Tea, Herbal Tea), By Form (Tea Bags, Loose Leaves and Powder, Ready-to-drink, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143703

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

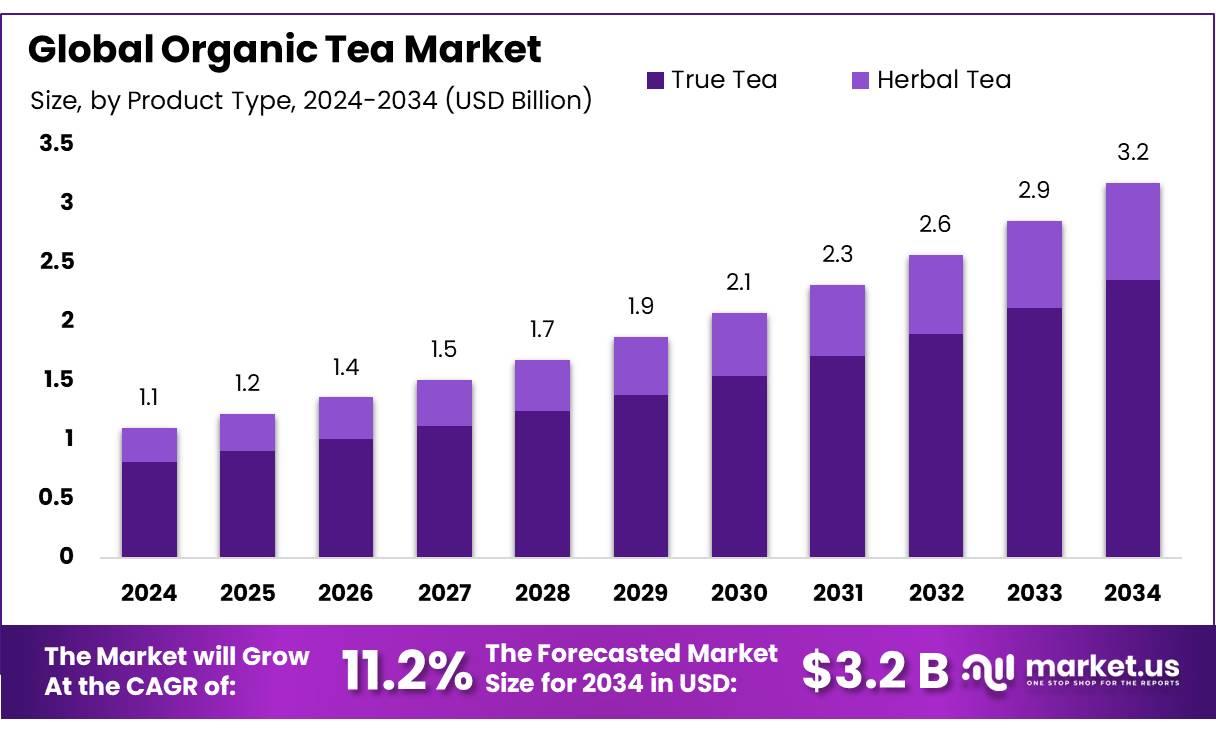

The Global Organic Tea Market size is expected to be worth around USD 3.2 Bn by 2034, from USD 1.1 Bn in 2024, growing at a CAGR of 11.2% during the forecast period from 2025 to 2034.

The global organic tea industry has emerged as a prominent segment within the broader health and wellness beverage market. Organic tea, grown without synthetic fertilizers, pesticides, or genetically modified organisms, aligns with increasing consumer demand for clean-label and sustainable products.

According to the Food and Agriculture Organization (FAO), global organic agricultural land reached over 76 million hectares in 2023, with tea being a significant contributor in countries like China, India, and Sri Lanka. Organic tea’s appeal lies in its perceived health benefits, including antioxidant properties, digestive aid, and stress relief, which has fostered notable growth in both mature and emerging markets.

Several factors are driving the momentum of the organic tea industry. Firstly, rising awareness regarding the health implications of chemical-laden beverages has prompted a consumer shift towards organically sourced options. Secondly, certifications such as USDA Organic, EU Organic, and India Organic lend credibility, making products more appealing to health-conscious and environmentally-aware buyers.

Additionally, the rapid growth of functional beverages and herbal infusions has led to increased demand for variants such as organic green tea, chamomile, and matcha. As per the Organic Trade Association (OTA), U.S. organic beverage sales grew by 13.5% in 2023, with organic tea constituting a substantial share.

Government initiatives have further supported organic tea cultivation and distribution. India’s Paramparagat Krishi Vikas Yojana (PKVY) promotes organic farming through financial incentives and cluster-based approaches, benefitting over 1.4 million hectares.

Similarly, the European Union’s “Farm to Fork Strategy” aims to expand organic farming to 25% of total farmland by 2030, indirectly supporting organic tea producers in the region. China, too, has ramped up national standards for organic certification and traceability to boost international exports.

The industry presents significant growth opportunities through product innovation, sustainable packaging, and digital retail platforms. Premium blends, wellness infusions, and ready-to-drink organic teas are expected to gain traction. Investments in transparent sourcing and carbon-neutral production practices will further enhance brand value. As global demand for organic beverages continues to rise, the organic tea industry stands poised for sustained and diversified expansion.

Key Takeaways

- Organic Tea Market size is expected to be worth around USD 3.2 Bn by 2034, from USD 1.1 Bn in 2024, growing at a CAGR of 11.2%.

- True Tea held a dominant position in the organic tea market, capturing an impressive 74.30% share.

- Loose Leaves & Powder segment commanded a dominant market position within the organic tea market, securing a 54.40% share.

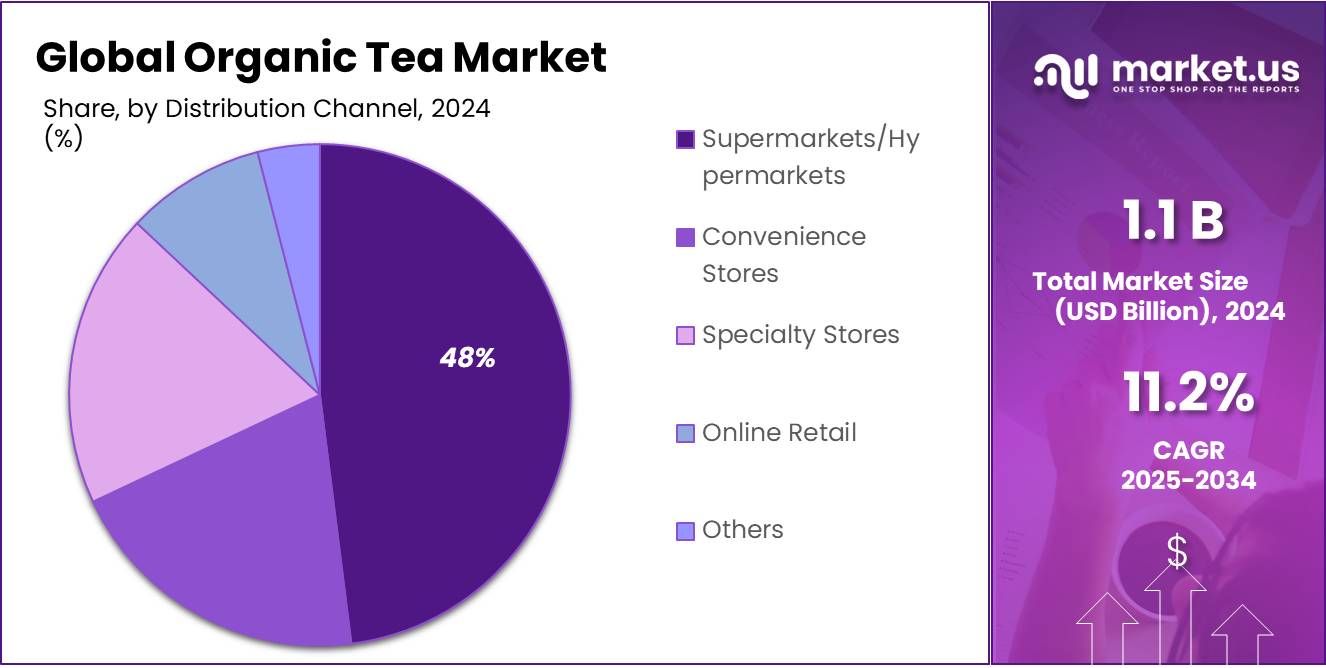

- Supermarkets/hypermarkets held a dominant position in the distribution of organic tea, capturing more than a 48.40% market share.

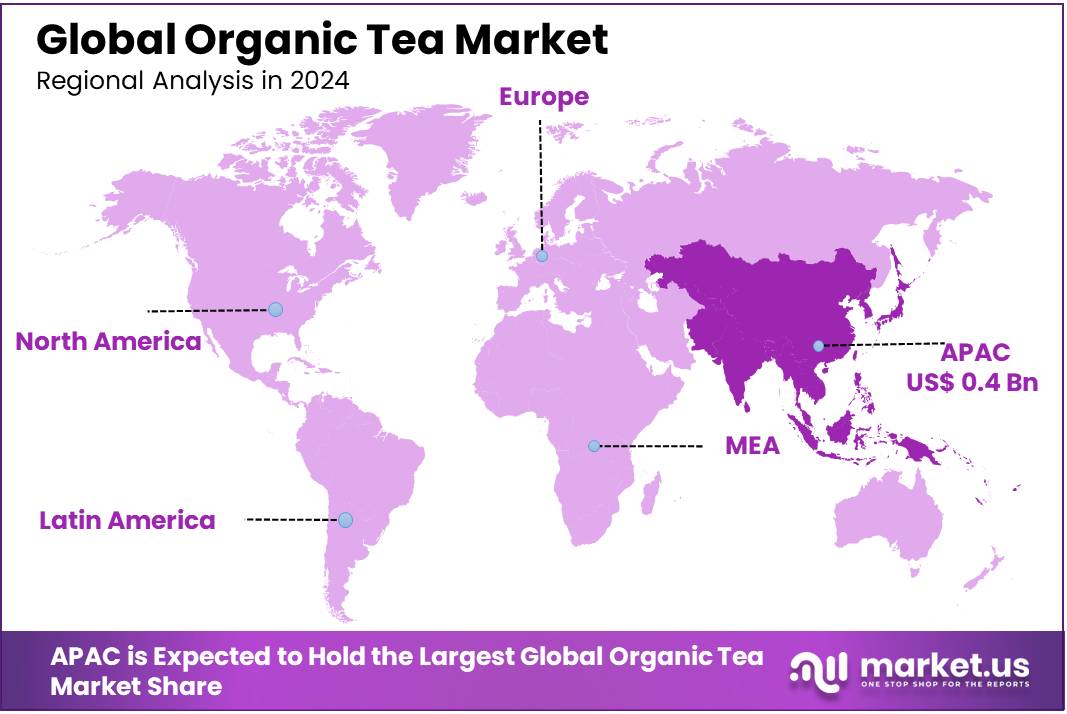

- Asia-Pacific (APAC) region emerged as a powerhouse in the organic tea market, commanding a substantial 38.40% share, which translates to an impressive revenue generation of USD 0.4 billion.

By Product Type

True Tea Dominates with a 74.30% Market Share

In 2024, True Tea held a dominant position in the organic tea market, capturing an impressive 74.30% share. This segment, which includes varieties such as black, green, white, and oolong teas, has remained a consumer favorite due to its authentic flavors and well-documented health benefits. The popularity of true tea is reinforced by its long-standing cultural significance and the growing consumer preference for organic products.

This trend reflects an increasing awareness of health and wellness, which has steered consumers towards products perceived as natural and beneficial. The sustained preference for true tea is expected to continue, with similar market dynamics projected into 2025, as more consumers choose organic options for their health and environmental benefits.

By Form

Loose Leaves & Powder Lead with a 54.40% Market Share

In 2024, the Loose Leaves & Powder segment commanded a dominant market position within the organic tea market, securing a 54.40% share. This preference underscores the traditional tea enthusiasts’ inclination towards more authentic and pure forms of tea, such as loose leaves, which offer a richer flavor and more aromatic experience compared to bagged teas.

Additionally, the powdered forms of organic tea, such as matcha, have gained traction among health-conscious consumers seeking high antioxidant levels and other health benefits. The trend towards these forms of tea is driven by their perceived purity and the enhanced control over strength and flavor they offer, making them a preferred choice. As we move into 2025, Loose Leaves & Powder are expected to maintain their lead, fueled by growing consumer awareness of the health advantages and the cultural authenticity they represent in the organic tea market.

By Distribution Channel

Supermarkets/Hypermarkets Command a 48.40% Share in Organic Tea Sales

In 2024, supermarkets/hypermarkets held a dominant position in the distribution of organic tea, capturing more than a 48.40% market share. This channel’s dominance is attributed to its extensive reach and the convenience it offers to consumers who appreciate the ability to explore a variety of organic tea options under one roof.

Supermarkets and hypermarkets have effectively catered to consumer preferences with wide-ranging selections, competitive pricing, and strategic placement of organic products to attract health-conscious shoppers. Their role as key distribution points is supported by their widespread presence and the ease with which they allow consumers to integrate organic tea purchases into their regular shopping habits.

Key Market Segments

By Product Type

- True Tea

- Black Tea

- Green Tea

- Oolong Tea

- Pu-erh Tea

- White Tea

- Others

- Herbal Tea

- Chamomile Herbal Tea

- Peppermint Herbal Tea

- Ginger Herbal Tea

- Lemongrass Herbal Tea

- Mint Herbal Tea

- Others

By Form

- Tea Bags

- Loose Leaves & Powder

- Ready-to-drink

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Drivers

Increasing Health Consciousness Drives Organic Tea Consumption

One of the major driving factors for the growth in the organic tea market is the increasing health consciousness among consumers globally. This trend is supported by a surge in awareness regarding the health benefits associated with the consumption of organic products. For instance, according to a report by the Food and Agriculture Organization (FAO), there is a growing preference for organic foods due to their perceived health benefits and the absence of synthetic pesticides and fertilizers in their production.

Consumers are increasingly opting for organic tea due to its antioxidant properties, which are believed to improve health and prevent various diseases. Organic tea is also often associated with better taste and quality in comparison to non-organic options, which resonates well with today’s more health-conscious consumers who are willing to invest in premium products for their health benefits. Moreover, the market sees a direct influence from lifestyle trends that promote wellness and natural products, which further enhances the demand for organic tea.

Furthermore, government initiatives and support for organic farming have played a crucial role in boosting the organic tea market. For example, several governments have introduced subsidies and incentives for organic farming, which reduce the barriers for entry for new farmers and decrease the production costs for existing farmers. This governmental support not only helps increase the availability of organic products but also assures consumers about the quality and authenticity of the organic foods they consume.

Restraints

High Cost of Organic Tea Limits Market Growth

One significant restraining factor for the growth of the organic tea market is the high cost associated with organic products. Organic tea is often priced higher than its non-organic counterparts due to the more labor-intensive agricultural practices and the stringent regulations governing organic certification. This price disparity can be a significant barrier, particularly in price-sensitive markets.

The cost of organic certification, which involves maintaining strict adherence to organic farming methods without the use of chemical fertilizers, pesticides, or genetically modified organisms, adds to the overall production expenses. For instance, according to data from the International Federation of Organic Agriculture Movements (IFOAM), organic farming typically incurs higher costs, about 20-30% more than conventional farming, due to the need for more manpower and the lower intensities of farm yields.

Moreover, the logistics involved in maintaining the integrity of organic products throughout the supply chain further contribute to the cost. Organic teas require separate processing and handling facilities to prevent cross-contamination with non-organic products, increasing operational costs. These factors combined make organic tea less accessible to a broader audience, particularly in developing regions where consumers are more price-sensitive.

Additionally, while government initiatives in many countries support organic farming through subsidies and incentives, the availability and extent of these supports can vary significantly between regions. In some cases, insufficient government support can hinder the affordability and production of organic tea, slowing down its market growth.

Opportunity

Expansion into Emerging Markets Presents Major Growth Opportunity for Organic Tea

A significant growth opportunity for the organic tea market lies in its expansion into emerging markets. These regions, which are currently experiencing rapid economic growth, urbanization, and increasing consumer awareness about health and wellness, present fertile ground for the introduction and acceptance of organic tea products.

Emerging markets such as China, India, and countries in Southeast Asia have traditionally been large consumers of tea. However, with the rising middle class and greater exposure to global health trends, there’s a noticeable shift towards organic products. According to a study by the United Nations Conference on Trade and Development (UNCTAD), the demand for organic food and beverages is climbing in these regions, with annual growth rates expected to exceed those in more developed markets.

Government initiatives across these emerging economies are also playing a crucial role in this growth. Many governments are actively promoting organic farming through subsidies and training programs, recognizing the dual benefits of supporting sustainable agricultural practices and improving food safety standards. For instance, India’s government has implemented several schemes under its National Programme for Organic Production (NPOP), which not only certifies organic products but also supports producers to access global markets.

Furthermore, the health benefits associated with organic tea, such as higher antioxidant content and lower pesticide residues, are becoming more widely recognized and valued in these markets. As urbanization continues and disposable incomes rise, consumers in emerging markets are increasingly willing to pay a premium for products that offer health benefits, align with global trends, and support environmental sustainability.

Trends

Specialty Blends and Functional Ingredients Trend in Organic Tea

One of the latest trends in the organic tea market is the growing popularity of specialty blends and functional ingredients. This trend reflects a shift toward personalization and health-focused products that cater to specific dietary needs and lifestyle choices.

Consumers are increasingly looking for organic teas that offer more than just a refreshing taste; they are seeking products that provide functional benefits, such as improved digestion, better sleep, enhanced energy levels, and stress reduction. This has led to the introduction of organic teas infused with herbs like turmeric, ginger, peppermint, and ashwagandha, which are known for their medicinal properties. According to the World Health Organization, there is a rising global trend in the adoption of natural and herbal ingredients, which has been amplified by the wellness movement and a growing body of research supporting the health benefits of these components.

Moreover, the demand for these functional teas is being driven by both aging populations looking for natural health solutions and younger demographics who are proactive about their health and well-being. The inclusion of functional ingredients in organic teas not only aligns with these health trends but also adds value to the product, encouraging consumers to choose these options over traditional teas.

Additionally, governments and health organizations are supporting this trend by promoting the use of natural ingredients in food and beverages. For instance, several national health services recommend natural dietary options for health improvement before turning to pharmaceutical solutions, thereby indirectly supporting the market for functional organic teas.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region emerged as a powerhouse in the organic tea market, commanding a substantial 38.40% share, which translates to an impressive revenue generation of USD 0.4 billion. This dominance is largely attributed to the deep-rooted tea culture in countries such as China, India, and Japan, where tea is not just a beverage but a significant part of the social fabric and traditional practices. These nations are not only major consumers but also among the largest producers of tea globally, which gives the APAC region a strategic advantage in the organic tea market.

The surge in demand within APAC is propelled by a growing middle class, increased health awareness, and higher disposable incomes. Consumers in this region are increasingly drawn to organic products due to their perceived health benefits and safety from pesticides and other chemicals commonly used in conventional farming. This shift is supported by governmental efforts to promote organic agriculture, with initiatives aimed at boosting organic farming practices and certifying organic products to meet both domestic and international demand.

Furthermore, the export potential of organic tea produced in APAC countries has seen a significant uptick, fueled by the global demand for high-quality, sustainable, and traceable products. Countries like South Korea and Australia are also contributing to regional growth with their increasing consumption of organic herbal and green teas, driven by health trends and Western influences on dietary habits.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Associated British Foods plc is a diversified international food, ingredients, and retail group with a robust presence in the organic tea market. Their portfolio includes a variety of organic and ethically sourced teas, appealing to a broad consumer base looking for quality and sustainability. The company leverages its global distribution capabilities to ensure wide availability of its products, enhancing its competitive edge in the organic tea sector.

Bigelow Tea Company is renowned for its commitment to quality and innovation in the tea industry. Their range of organic teas includes a variety of flavors and blends that cater to the health-conscious consumer. Bigelow maintains a strong emphasis on sustainability practices throughout its operations, from sourcing to packaging, making it a trusted name among organic tea enthusiasts.

Bombay Burmah Trading Corporation Ltd has a historic foothold in the tea industry, with a growing focus on organic tea. Their offerings include premium organic teas sourced from their own tea gardens, ensuring control over quality and sustainability. The company’s dedication to ethical practices and high-quality products positions it well within the competitive organic tea market.

Davidson’s Organics leads with a commitment to organic and sustainable tea production. They offer a vast array of organic teas, from traditional blends to exotic flavors, all certified organic. Davidson’s strengths lie in its sustainable sourcing and direct relationships with growers, ensuring high-quality, fresh, and pure teas that appeal to organic consumers worldwide.

Top Key Players in the Market

- Associated British Foods plc

- Bigelow Tea Company

- Bombay Burmah Trading Corporation Ltd

- Celestial Seasonings Inc

- Davidson’s Organics

- Ecotone

- Hain Celestial Group

- Hälssen & Lyon GmbH

- Harney & Sons Fine Teas

- Little Red Cup Tea Co.

- Mighty Leaf Tea

- Newman’s Own, Inc.

- Numi, Inc.

- Organic India Pvt. Ltd.

- PepsiCo

- Republic of Tea

- Shangri-la Tea

- Stash Tea Company

- Tata Global Beverages Limited

- Tazo Tea Company

- The Coca‑Cola Company

- The Stash Tea Company

- Tielka

- Vahdam Teas

Recent Developments

Celestial Seasonings Inc., a subsidiary of The Hain Celestial Group, has significantly contributed to the organic tea market. In fiscal year 2024, The Hain Celestial Group reported net sales of $1.736 billion, a 3% decrease from the previous year.

Bombay Burmah Trading Corporation Ltd (BBTC), a member of the Wadia Group, has a longstanding presence in India’s organic tea sector. As of March 31, 2023, BBTC reported annual revenues of ₹17,100 crore (approximately $2.13 billion).

Report Scope

Report Features Description Market Value (2024) USD 1.1 Bn Forecast Revenue (2034) USD 3.2 Bn CAGR (2025-2034) 11.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (True Tea, Herbal Tea), By Form (Tea Bags, Loose Leaves and Powder, Ready-to-drink, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Associated British Foods plc, Bigelow Tea Company, Bombay Burmah Trading Corporation Ltd, Celestial Seasonings Inc, Davidson’s Organics, Ecotone, Hain Celestial Group, Hälssen & Lyon GmbH, Harney & Sons Fine Teas, Little Red Cup Tea Co., Mighty Leaf Tea, Newman’s Own, Inc., Numi, Inc., Organic India Pvt. Ltd., PepsiCo, Republic of Tea, Shangri-la Tea, Stash Tea Company, Tata Global Beverages Limited, Tazo Tea Company, The Coca‑Cola Company, The Stash Tea Company, Tielka, Vahdam Teas Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Associated British Foods plc

- Bigelow Tea Company

- Bombay Burmah Trading Corporation Ltd

- Celestial Seasonings Inc

- Davidson's Organics

- Ecotone

- Hain Celestial Group

- Hälssen & Lyon GmbH

- Harney & Sons Fine Teas

- Little Red Cup Tea Co.

- Mighty Leaf Tea

- Newman's Own, Inc.

- Numi, Inc.

- Organic India Pvt. Ltd.

- PepsiCo

- Republic of Tea

- Shangri-la Tea

- Stash Tea Company

- Tata Global Beverages Limited

- Tazo Tea Company

- The Coca‑Cola Company

- The Stash Tea Company

- Tielka

- Vahdam Teas