Global Plant Based Ice Cream Market Size, Share, Trends Analysis Report By Form (Blends, Singles), By Source (Coconut Milk Based, Soy Milk Based, Almond Milk Based, Cashew Milk, Rice Milk Based, Others), By Flavour (Fruits, Nuts, Herbs, Beans), By Packaging Type (Tubs, Cones, Bars, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Health Food Stores, Specialist Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143290

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

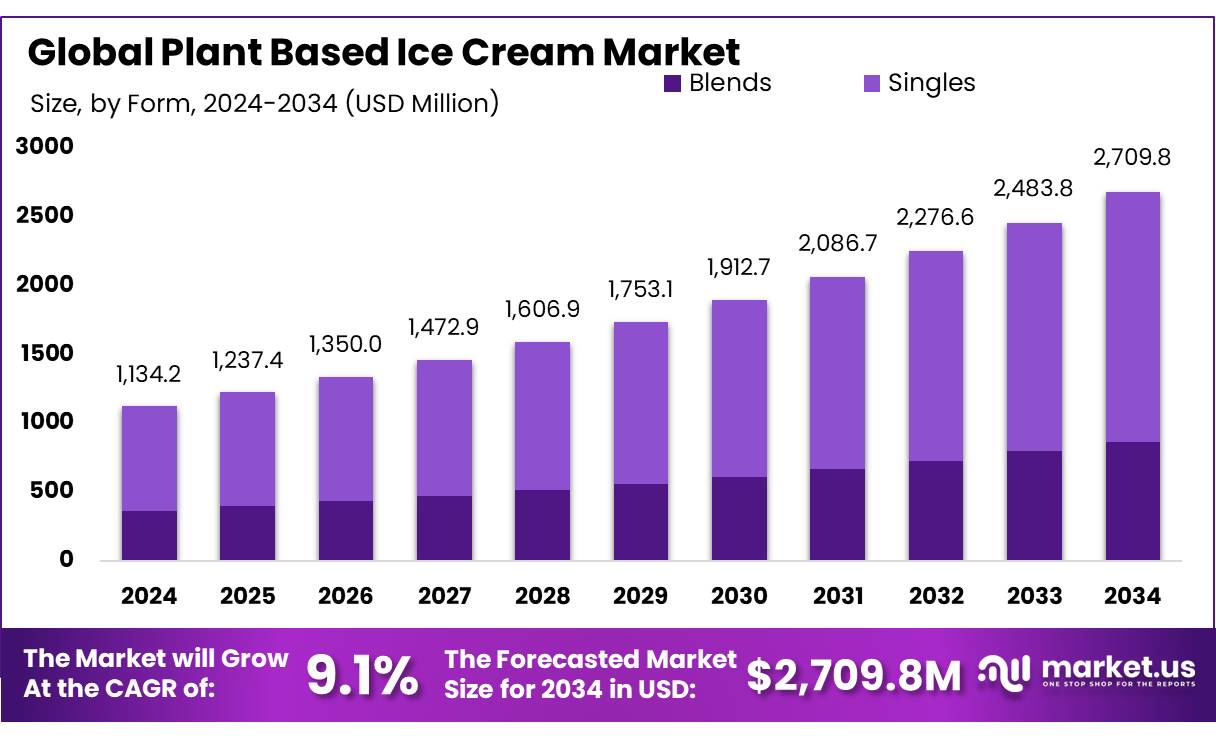

The Global Plant Based Ice Cream Market Size is expected to be worth around USD 2709.8 Mn by 2034, from USD 1134.2 Mn in 2024, growing at a CAGR of 9.1% during the forecast period from 2025 to 2034.

Plant-based ice cream, as a burgeoning segment within the broader ice cream market, has experienced significant growth over the past few years, driven by shifting consumer preferences towards vegan and non-dairy alternatives. This growth is not merely a trend but a reflection of a more profound shift in consumer behavior towards health-conscious eating, sustainability, and ethical concerns regarding animal welfare.

The plant-based ice cream has evolved with advancements in food technology and innovations in ingredient sourcing. Traditional dairy ingredients are being replaced by alternatives derived from almonds, coconuts, soy, oats, and cashews, which not only cater to lactose-intolerant consumers but also to those seeking lower-calorie options. According to the International Dairy Foods Association (IDFA), the non-dairy ice cream sector saw a year-over-year growth of 23.9% in 2024, significantly outpacing traditional ice cream products.

Driving factors for this market include the increasing prevalence of dairy allergies and lactose intolerance. Studies from the National Institutes of Health indicate that approximately 65% of the human population has a reduced ability to digest lactose after infancy. Furthermore, the rise in veganism has also propelled the demand for plant-based ice creams. For instance, a report from The Vegan Society highlighted that the number of vegans in the U.S. increased by 300% over the last five years, creating a burgeoning consumer base for these products.

Government initiatives have also supported the growth of this industry. In regions such as Europe and North America, governments have promoted plant-based diets as part of sustainability programs aimed at reducing carbon footprints associated with animal farming. For example, the European Union’s Farm to Fork Strategy explicitly supports the transition to sustainable food systems, which indirectly benefits the plant-based ice cream sector by fostering a favorable regulatory environment.

Key Takeaways

- Plant Based Ice Cream Market Size is expected to be worth around USD 2709.8 Mn by 2034, from USD 1134.2 Mn in 2024, growing at a CAGR of 9.1%.

- Blends dominated the plant-based ice cream market, capturing a significant 67.20% share.

- Coconut milk-based ice cream held a dominant market position, capturing more than a 42.30% share.

- Fruit flavors held a dominant market position in the plant-based ice cream sector, capturing more than a 38.30% share.

- Tubs held a dominant market position in the plant-based ice cream packaging segment, capturing more than a 57.30% share.

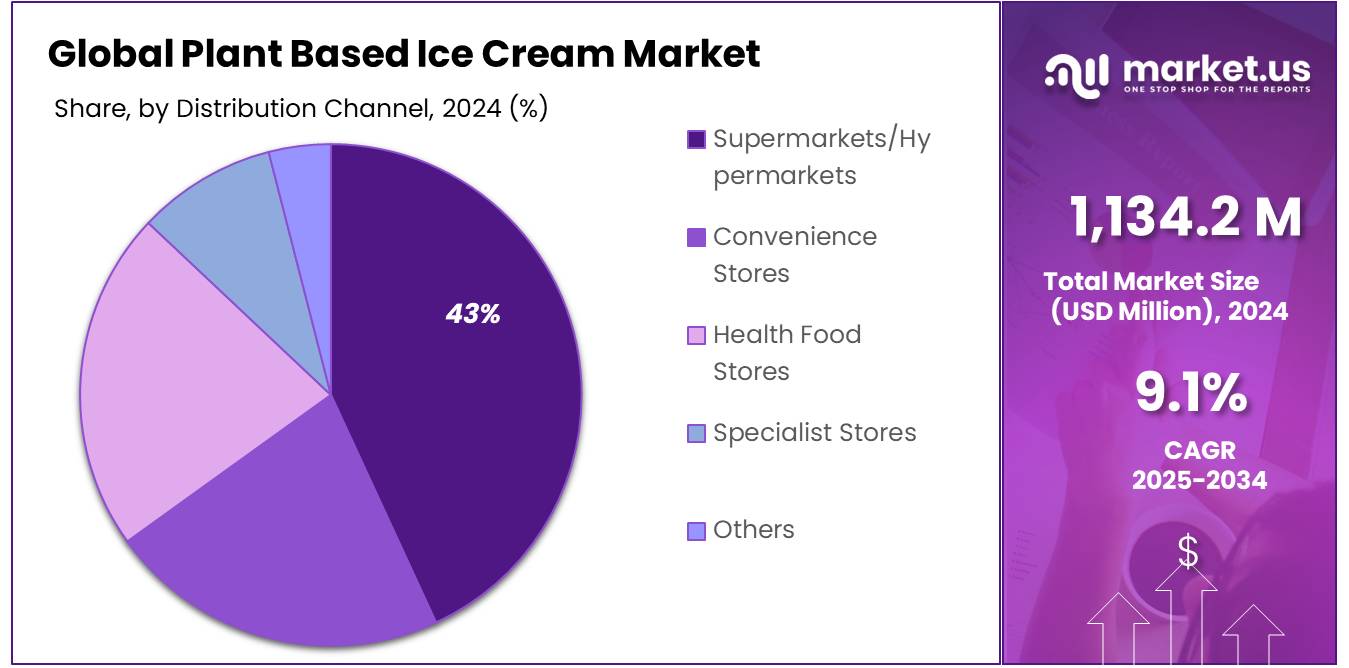

- supermarkets and hypermarkets held a dominant market position in distributing plant-based ice cream, capturing more than a 43.20% share.

By Form

Blends Lead the Plant-Based Ice Cream Market with a 67.20% Share in 2024

In 2024, blends dominated the plant-based ice cream market, capturing a significant 67.20% share. This segment’s leadership can be attributed to its widespread appeal among consumers seeking alternative dietary choices that do not compromise on taste or texture. Blends, which combine multiple non-dairy milk sources like almond, coconut, and oat, have gained traction due to their creamy consistency and rich flavor profiles, closely mimicking traditional dairy ice cream. As consumer preferences continue to shift towards sustainable and health-conscious eating, the demand for plant-based ice cream blends shows promising growth potential.

By Source

Coconut Milk-Based Ice Cream Takes the Lead with a 42.30% Market Share in 2024

In 2024, coconut milk-based ice cream held a dominant market position, capturing more than a 42.30% share. This segment’s strong performance is largely due to its creamy texture and distinct flavor, which makes it a preferred choice among plant-based ice cream lovers. Coconut milk is highly valued for its rich, creamy consistency that closely resembles that of traditional dairy ice creams, making it an ideal base for a variety of flavors. Additionally, coconut milk is a naturally lactose-free option, catering to both vegan diets and lactose-intolerant consumers. The growing awareness and acceptance of coconut milk’s health benefits, such as its high content of medium-chain triglycerides (MCTs), have also contributed to its popularity in the plant-based ice cream market.

By Flavour

Fruit Flavors Command a Leading 38.30% of the Plant-Based Ice Cream Market in 2024

In 2024, fruit flavors held a dominant market position in the plant-based ice cream sector, capturing more than a 38.30% share. This substantial market share reflects the strong consumer preference for natural and refreshing tastes in their desserts. Fruit-flavored ice creams, made from a variety of fruits like strawberries, mangoes, and berries, offer a naturally sweet and vibrant taste that appeals to health-conscious consumers looking for guilt-free indulgence.

The popularity of these flavors is also bolstered by the increasing trend towards clean label products, where consumers seek out ice cream made with real fruit and without artificial additives. As more individuals lean towards plant-based diets, fruit flavors continue to be a leading choice for their freshness and perceived health benefits.

By Packaging Type

Tubs Lead Plant-Based Ice Cream Packaging with a 57.30% Market Share in 2024

In 2024, tubs held a dominant market position in the plant-based ice cream packaging segment, capturing more than a 57.30% share. This packaging type’s popularity stems from its convenience and family-friendly size, making it a preferred choice for consumers looking to enjoy ice cream at home. Tubs offer an economical and practical solution for those who seek value in their purchases, allowing multiple servings from a single package.

Additionally, the sturdy design of tubs protects the ice cream during transport and storage, ensuring the product remains in optimal condition. As plant-based diets continue to gain traction, tubs remain a staple in the freezer aisle, appealing to consumers who prioritize both sustainability and convenience in their shopping choices.

By Distribution Channel

Supermarkets/Hypermarkets Dominate Plant-Based Ice Cream Distribution with a 43.20% Share in 2024

In 2024, supermarkets and hypermarkets held a dominant market position in distributing plant-based ice cream, capturing more than a 43.20% share. This segment’s leadership can be attributed to their extensive reach and ability to offer a wide variety of products under one roof, making them a convenient choice for consumers. Supermarkets and hypermarkets are typically accessible and offer the advantage of immediate gratification for shoppers looking to purchase plant-based ice cream alongside their regular grocery shopping.

Their robust distribution systems and strategic placement in both urban and suburban areas enhance their appeal to a broad customer base, helping to maintain their significant share of the market. As consumer interest in plant-based options continues to grow, these retail giants remain pivotal in making plant-based ice cream readily available to a large audience.

Key Market Segments

By Form

- Blends

- Singles

By Source

- Coconut Milk Based

- Soy Milk Based

- Almond Milk Based

- Cashew Milk

- Rice Milk Based

- Others

By Flavour

- Fruits

- Strawberry

- Banana

- Orange

- Raspberry

- Pomegranate

- Lemon

- Others

- Nuts

- Coconut

- Almond

- Hazelnut

- Others

- Herbs

- Cinnamon

- Mint

- Peppermint

- Others

- Beans

- Vanilla

- Chocolate

- Coffee

- Others

- Others

By Packaging Type

- Tubs

- Cones

- Bars

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Health Food Stores

- Specialist Stores

- Others

Drivers

Health Awareness and Dietary Shifts Propel Plant-Based Ice Cream Market Growth

One of the major driving factors for the growth of the plant-based ice cream market is the increasing consumer awareness regarding health, wellness, and dietary choices. Over recent years, a significant shift towards vegan and plant-based diets has been observed globally, fueled by health concerns and environmental awareness. According to the World Health Organization, reducing intake of animal products can decrease the risk of chronic diseases such as heart disease, diabetes, and obesity, encouraging more consumers to opt for plant-based alternatives.

Moreover, the rise in lactose intolerance and milk allergies among the global population has also contributed significantly to the demand for plant-based ice cream. Studies from leading food health organizations indicate that about 68% of the global population has some form of lactose intolerance. This widespread prevalence has led many consumers to seek non-dairy alternatives that align with their dietary restrictions without sacrificing taste or texture.

Governments and trusted health organizations worldwide have begun supporting these shifts through various initiatives. For instance, nutritional guidelines have been updated in several countries to include plant-based options as part of a healthy diet. Public health campaigns often promote the benefits of reducing animal product consumption, not only for health but also for environmental sustainability. The United Nations has also highlighted plant-based diets as a key component in addressing climate change and food security issues.

Restraints

High Cost of Production and Pricing Challenges Limit Plant-Based Ice Cream Market Expansion

A significant restraining factor for the plant-based ice cream market is the high cost of production, which often leads to higher retail prices compared to traditional dairy ice creams. The primary ingredients used in plant-based ice creams, such as almond milk, coconut milk, and cashew milk, are typically more expensive than cow’s milk. These costs are further compounded by the use of natural and organic ingredients, which are often pricier due to more costly farming practices and lower yields.

According to data from the Food and Agriculture Organization, the price of almonds, a common base for non-dairy ice cream, has been consistently higher than that of dairy milk. The cost per liter of almond milk can be up to twice that of regular cow’s milk, impacting the final price of almond-based ice cream products. This price disparity can make plant-based ice creams less accessible to average consumers, particularly in regions with lower economic power.

Additionally, the production process for plant-based ice creams can be more complex and resource-intensive. The need to replicate the creamy texture and mouthfeel of traditional ice creams without the use of dairy requires innovative manufacturing techniques and additional ingredients, which can drive up costs.

Government initiatives and subsidies aimed at supporting sustainable agricultural practices could help reduce these costs over time. However, until such measures are widely implemented, the high production costs remain a significant barrier to the widespread adoption of plant-based ice creams. This economic challenge may slow market growth, as consumers might hesitate to pay a premium for these products, despite their interest in healthier and more sustainable options. The ongoing development of more cost-effective production technologies and supply chain improvements could eventually help mitigate these issues, making plant-based ice creams more competitive in the broader ice cream market.

Opportunity

Expansion into Emerging Markets Presents Major Growth Opportunities for Plant-Based Ice Cream

One of the most significant growth opportunities for the plant-based ice cream market lies in its expansion into emerging markets. As global awareness of health, wellness, and environmental issues increases, so does the interest in plant-based diets across diverse demographic and geographic segments. In regions such as Asia, Africa, and Latin America, rapid urbanization, rising disposable incomes, and the growing influence of Western eating habits are contributing to a surge in demand for plant-based products.

Despite the prevalence of lactose intolerance, which affects about 65% of the global population after infancy according to the National Institutes of Health, many emerging markets have historically had limited access to plant-based alternatives. However, with economic growth and better access to global markets, these regions now present a fertile ground for the introduction of plant-based ice creams.

Moreover, government initiatives in many of these countries are beginning to support healthier lifestyles through public health campaigns. For instance, India’s National Health Mission has emphasized the importance of reducing dairy and meat consumption as part of its strategy to combat chronic diseases such as diabetes and hypertension. Such policies encourage the consumption of plant-based products, including ice creams, which align with these health directives.

Investing in local production facilities, adapting flavors to local tastes, and leveraging existing distribution channels can significantly reduce costs and increase the accessibility of plant-based ice creams in these markets. The potential for rapid growth in these regions is enhanced by the relatively young population, increasing internet penetration, and growing familiarity with e-commerce, which can be utilized to market and distribute these products effectively.

Trends

Innovative Flavors and Functional Ingredients Trending in Plant-Based Ice Cream

A major trend in the plant-based ice cream market is the introduction of innovative flavors and the inclusion of functional ingredients. As consumers become more experimental with their food choices, they are increasingly seeking unique and diverse flavors that also offer health benefits. This trend is reflected in the emergence of plant-based ice creams featuring superfoods, adaptogens, and probiotics, which cater to health-conscious consumers looking for indulgence without guilt.

For example, recent product launches have seen flavors such as turmeric ginger, matcha green tea, and even activated charcoal becoming popular. These ingredients are not only novel but are also known for their health benefits, such as anti-inflammatory properties and detoxification support. According to a survey by the International Food Information Council, over 70% of consumers say they are interested in foods that offer health benefits beyond basic nutrition.

Furthermore, the trend towards functional foods is supported by several governmental health initiatives that promote nutritional innovation as part of a broader public health strategy. For instance, the U.S. Department of Agriculture has funded research into functional foods as part of its agricultural marketing service, encouraging the development of products that can help improve public health outcomes.

Regional Analysis

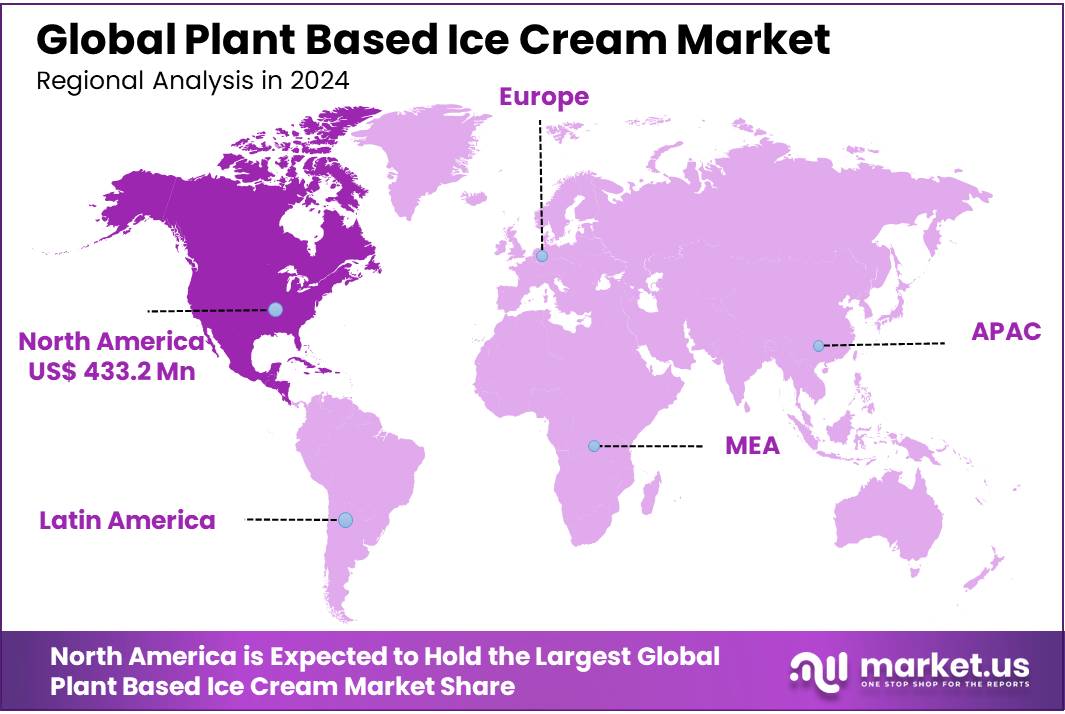

In the plant-based ice cream market, North America emerged as a dominant region in 2024, capturing a substantial 38.20% market share, valued at approximately $433.2 million. This strong market position can be attributed to a growing consumer base that is increasingly inclined towards vegan and health-conscious diets, combined with high levels of lactose intolerance among the population. North American consumers are progressively seeking dairy-free alternatives that do not compromise on taste or texture, driving demand for plant-based ice cream.

The region’s market growth is further supported by robust distribution networks and the presence of key industry players who are continuously innovating in terms of flavors and ingredients. These companies are tapping into the trend of clean label products, which are free from artificial additives and preservatives, resonating well with the health preferences of the North American market.

Moreover, the increasing environmental awareness among consumers in this region is playing a crucial role. The shift towards plant-based diets is often motivated by the desire to reduce the environmental impact of traditional dairy farming, including reducing greenhouse gas emissions and water usage. This environmental concern is significantly influencing consumer choices, making plant-based ice cream an increasingly popular option.

In addition to these factors, North America benefits from numerous health initiatives and campaigns by governments and health organizations promoting the benefits of reducing animal product consumption. These initiatives are effectively raising awareness and making plant-based diets more mainstream, thereby supporting the growth of the plant-based ice cream market in this region. As North America continues to lead in terms of market share and innovation, it sets a benchmark for other regions in embracing plant-based alternatives in the ice cream sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Alpro has established itself as a leading player in the plant-based ice cream market, leveraging its expertise in dairy-free products. Known for its commitment to sustainability and health, Alpro offers a variety of flavors made from soy, almond, and coconut bases. The company focuses on innovation and environmental responsibility, appealing to health-conscious consumers who value ethical production practices.

Barry Callebaut As a giant in the chocolate industry, Barry Callebaut has extended its reach into the plant-based ice cream sector by providing high-quality, sustainable cocoa products. Their offerings cater to manufacturers looking to create luxurious, vegan-friendly ice creams. The company’s strong focus on sustainable cocoa farming practices adds significant value to its brand, aligning with the growing consumer demand for responsible sourcing.

Cado Ice Cream distinguishes itself by being the first to market avocado-based ice cream, offering a unique alternative to traditional and other plant-based ice creams. Their products are known for being rich in healthy fats and naturally dairy-free, catering to both health enthusiasts and those with dietary restrictions. Cado’s innovative approach to using avocado as a base ingredient has set them apart in a crowded market.

Top Key Players

- Alpro

- Barry Callebaut

- Cado Ice Cream

- Danone

- DSM

- Froneri International

- Kerry Group plc

- Lallemand Inc.

- Lonza

- Nadamoo

- Nestle

- Probi

- Protexin

- Saffron Ice Cream Company

- Siri Millets

Recent Developments

Barry Callebaut’s strategy includes leveraging its expertise in chocolate to create innovative plant-based ice cream products that feature high-quality, sustainable ingredients.

In 2024, Alpro continued to expand its market presence by not only enhancing its product range but also by implementing strategic sustainability initiatives.

Report Scope

Report Features Description Market Value (2024) USD 1134.2 Mn Forecast Revenue (2034) USD 2709.8 Mn CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Blends, Singles), By Source (Coconut Milk Based, Soy Milk Based, Almond Milk Based, Cashew Milk, Rice Milk Based, Others), By Flavour (Fruits, Nuts, Herbs, Beans), By Packaging Type (Tubs, Cones, Bars, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Health Food Stores, Specialist Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alpro, Barry Callebaut, Cado Ice Cream, Danone, DSM, Froneri International, Kerry Group plc, Lallemand Inc., Lonza, Nadamoo, Nestle, Probi, Protexin, Saffron Ice Cream Company, Siri Millets Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Plant Based Ice Cream MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Plant Based Ice Cream MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alpro

- Barry Callebaut

- Cado Ice Cream

- Danone

- DSM

- Froneri International

- Kerry Group plc

- Lallemand Inc.

- Lonza

- Nadamoo

- Nestle

- Probi

- Protexin

- Saffron Ice Cream Company

- Siri Millets