Global Online Video Platforms Market Size, Share, Statistics Analysis Report By Component (Solution, Services), By Type (Video processing, Video management, Video distribution, Video analytics, Others), By Streaming Type (Live streaming, Video on demand), By End-user (Media & entertainment, BFSI, Retail, Education, IT and Telecom, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Mar 25

- Report ID: 143000

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Scope

- Key Takeaways

- Analyst’s Review

- Key Statistics

- Regional Analysis

- By Component

- By Type

- By Streaming Type

- By End-user

- Key Market Segments

- Driving Factor

- Restraining Factor

- Growth Opportunities

- Challenging Factors

- Growth Factor

- Emerging Trend

- Business Benefit

- Key Player Analysis

- Recent Developments

- Report Scope

Report Scope

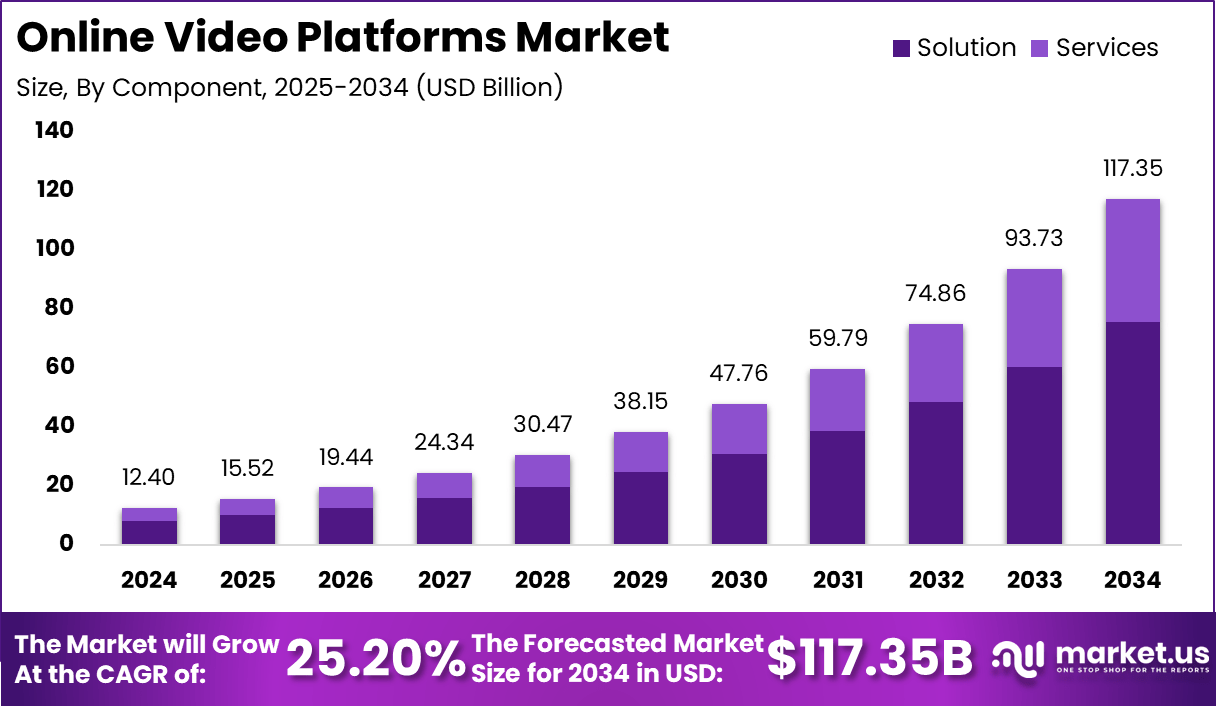

The Global Online Video Platforms Market is expected to be worth around USD 117.35 Billion by 2034, up from USD 12.4 Billion in 2024. It is expected to grow at a CAGR of 25.20% from 2025 to 2034.

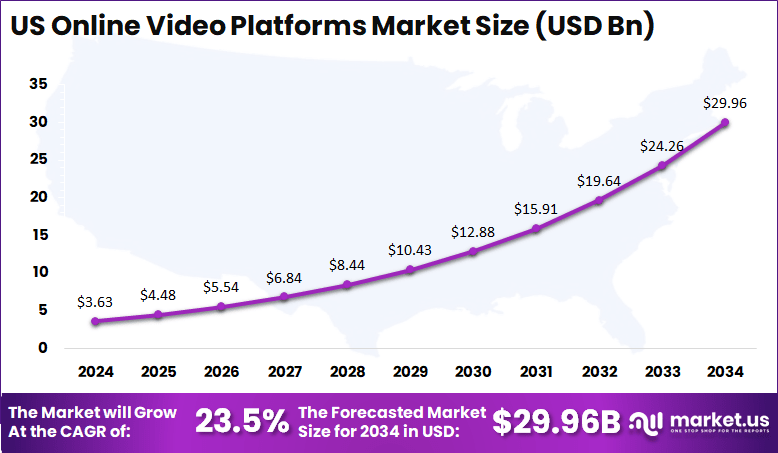

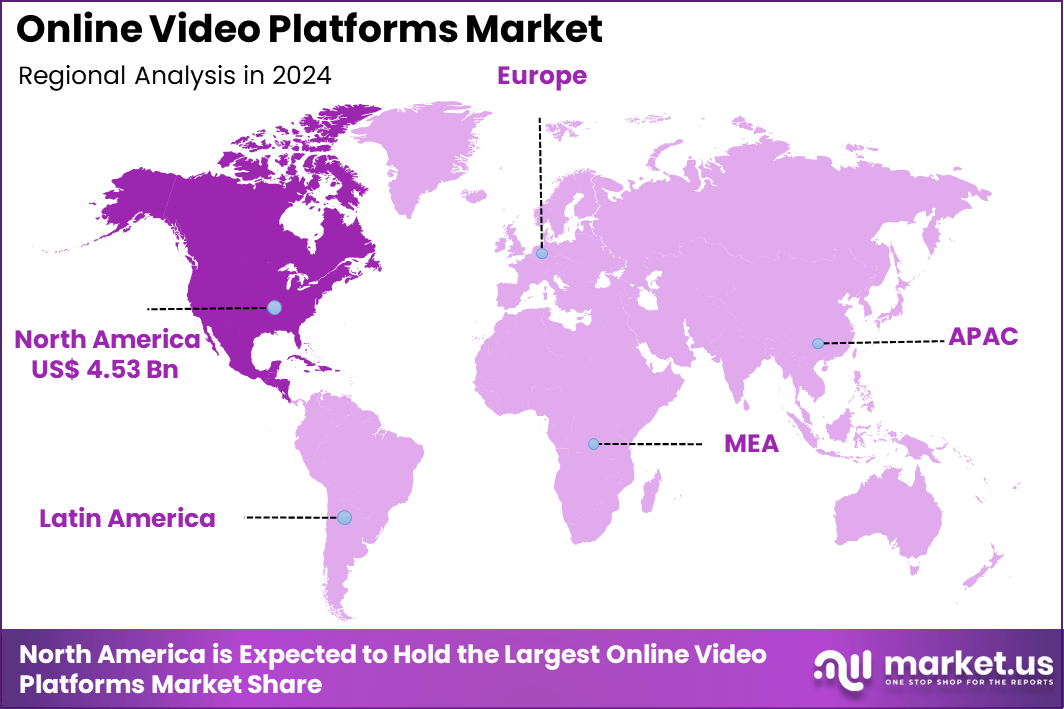

In 2024, North America held a dominant market position, capturing over a 36.6% share and earning USD 4.53 Billion in revenue. Further, the United States dominates the market by USD 3.63 Billion, steadily holding a strong position with a CAGR of 23.5%.

The Online Video Platforms (OVP) market has seen significant growth in recent years, driven by technological advancements and changing consumer preferences. OVPs are services that allow users to upload, manage, and stream video content over the internet, catering to a broad audience from individual creators to large businesses.

These platforms offer a range of features, such as live streaming, video monetization, and audience analytics, enabling content creators and companies to engage with their viewers effectively.

As internet access expands globally and more people adopt smartphones, the demand for online video content continues to rise. The shift from traditional media to online streaming, along with the increasing use of video in business communications and marketing, has also been a driving force.

Key Takeaways

- Market Value Growth: The market value is expected to grow from USD 12.4 Billion in 2024 to USD 117.35 Billion by 2034, indicating a significant increase.

- CAGR: The market is projected to experience a Compound Annual Growth Rate (CAGR) of 25.20% over the forecast period.

- By Component: The solution segment holds the largest share at 64.5%, highlighting the dominance of software and service-based solutions in the OVP market.

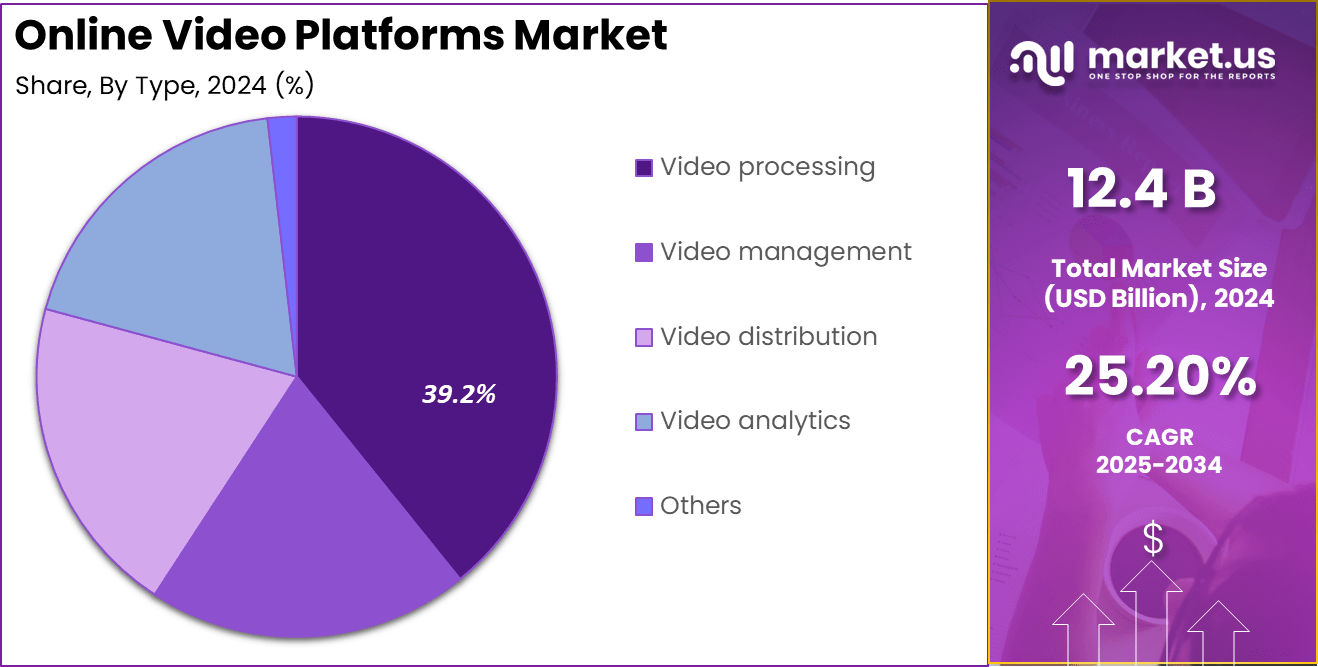

- By Type: Video processing accounts for 39.2%, indicating its importance in the functioning of OVPs.

- By Streaming Type: Live streaming is the leading streaming type with 76.4% of the market share, showing its growing popularity.

- By End-user: The media & entertainment sector represents the largest end-user segment, with a share of 37.2%, demonstrating the key role of this industry in driving OVP demand.

- North America Market Share: North America holds a 36.6% share of the global market, reflecting its dominant position in the OVP industry.

- US Market: The US is valued at USD 3.63 Billion within the OVP market.

- US CAGR: The US segment is projected to grow at a CAGR of 23.5%, showing strong growth potential within the region.

Analyst’s Review

The demand for OVP services is being fueled by several factors. The rise of content creators, who are looking for platforms to host their videos and monetize their work, has contributed to the market’s growth. Enterprises are increasingly adopting video for corporate communication, training, and marketing purposes, recognizing its effectiveness in engaging customers.

Additionally, educational institutions are turning to OVPs for e-learning and virtual classrooms, which has further increased the demand for these platforms. As video consumption becomes a central part of people’s daily lives, OVP providers must meet the diverse needs of these users.

The market also presents numerous growth opportunities. One of the most promising is the integration of artificial intelligence (AI), which can enhance user experience through better video recommendations, automated content moderation, and improved engagement tracking. Interactive video features, such as clickable links and quizzes, are gaining popularity, offering new ways for content creators to engage with their audiences.

There are also opportunities in niche content platforms, which cater to specific communities or genres, and enhanced monetization models, such as subscriptions or ad-supported content, that provide creators with more ways to generate revenue. These opportunities highlight the evolving landscape of the OVP market and its innovation potential.

Technological advancements are crucial to the continued success of the OVP market. Adaptive streaming technologies, such as Adaptive Bitrate Streaming, allow videos to play smoothly across different internet speeds and device types, ensuring a seamless experience for viewers.

Cloud integration has also become essential for scalable storage and global content distribution, enabling platforms to serve a larger audience without compromising performance. Advanced analytics tools are helping content creators and businesses track viewer behavior, assess content performance, and optimize engagement strategies. These technological innovations are shaping the future of the OVP market, making it more accessible and efficient for both creators and consumers alike.

Key Statistics

User Statistics

- YouTube has over 2.70 billion monthly active users as of February 2025, representing 52% of the global social media user base.

- Facebook, the only platform surpassing YouTube, has 3.06 billion users.

- In 2023, YouTube’s user base was approximately 2.68 billion, indicating a growth of 20 million users (0.74% increase) from the previous year.

Video Consumption

- In 2023, 92% of internet users watched online videos.

- Video content accounts for 65% of total internet traffic.

- The average adult in the U.S. spends approximately 58.4 hours monthly on TikTok, while YouTube users spend about 48.7 minutes per session.

Adoption of Video Marketing

- By 2025, 89% of businesses are expected to utilize video as a marketing tool.

- 95% of video marketers consider video an essential part of their marketing strategy.

- Ad spending on short-form videos is predicted to reach $111 billion in 2025.

Content Engagement

- Engagement rates for short-form videos (under 1 minute) average around 50%.

- Live video content is utilized by 36% of marketers.

Video Streaming Market Value

- The global video streaming market was valued at approximately $677.91 billion in 2024 and is expected to increase to about $776.07 billion in 2025.

- By 2037, this market size is projected to exceed $4.49 trillion, growing at more than a CAGR of 17.9%.

Regional Analysis

United States Market Size

In North America, the United States dominates the market size by USD 3.63 Billion, holding a strong position steadily with a robust CAGR of 23.5%. This growth is driven by increasing demand for online video platforms, primarily within the media and entertainment sector. The rise of streaming services, especially live streaming, has fueled this demand as consumers seek on-demand and live content.

The adoption of video processing solutions is also a significant contributor to the growth of the OVP market, with technology improvements enabling smoother and more efficient content delivery. Furthermore, advancements in streaming technology, particularly live streaming, have made it easier for businesses, content creators, and media houses to engage with a broader audience. This shift is further amplified by the growing preference for digital content consumption over traditional television and cable.

With the entertainment sector leading in end-users, the demand for online video platforms in North America continues to rise, driven by a blend of technological innovations, content availability, and the increasing reliance on video for both professional and personal engagement. As the market continues to expand, the US remains a key player in shaping the future of the OVP industry.

North America Market Size

In 2024, North America held a dominant market position, capturing more than a 36.6% share of the Online Video Platforms (OVP) market, with USD 4.53 Billion in revenue. This leadership is driven by the high adoption rate of streaming services, robust technological infrastructure, and a strong presence of major players such as YouTube, Vimeo, and Twitch.

North America’s dominance can also be attributed to the increasing consumption of online video content across various industries, particularly in media and entertainment, where platforms like Netflix and Hulu are thriving. Furthermore, the region benefits from a mature digital economy and high internet penetration, enabling smooth content delivery and increased accessibility for users.

North America also leads due to the high demand for live streaming services, which account for the largest share of streaming types in the region. The growing popularity of social media influencers and live events has pushed platforms to invest in scalable, high-quality streaming technology. As a result, live streaming in the US is projected to continue growing significantly. Additionally, the increasing use of video for business communications, training, and marketing further strengthens the region’s market position.

In comparison, Europe and APAC are showing strong growth, but North America remains ahead due to its advanced technological infrastructure and early adoption of digital trends. As the demand for online video content continues to rise globally, North America’s market share is expected to maintain a leading position through 2034, further fueled by the shift from traditional media to digital content consumption.

By Component

In 2024, the Solution segment held a dominant market position in the Online Video Platforms (OVP) market, capturing more than 64.5% of the share. This segment’s leadership is driven by the increasing reliance on software solutions that enable businesses and content creators to efficiently upload, manage, and monetize video content.

OVP solutions provide key features like video hosting, encoding, transcoding, content management, and analytics, all of which are crucial for delivering high-quality, engaging content to audiences. As demand for digital content continues to surge, companies are investing heavily in robust video solutions to stay competitive and meet consumer expectations.

The Solution segment’s dominance is further supported by the growing use of on-demand video services across various industries, including media, entertainment, and education. These solutions allow organizations to scale their video content delivery, enhance user experience, and optimize performance.

In contrast, the Services segment, while important, accounts for a smaller market share as it primarily includes maintenance, support, and consultancy services. As such, the Solution segment remains the primary driver of growth in the OVP market.

By Type

In 2024, the Video processing segment held a dominant market position in the Online Video Platforms (OVP) market, capturing more than 39.2% of the share. This segment leads due to the essential role video processing plays in ensuring smooth and efficient video delivery to users.

Video processing encompasses a variety of tasks such as encoding, transcoding, compression, and optimizing video quality for different devices and internet speeds. As the demand for high-definition and ultra-high-definition content grows, the need for advanced video processing technologies becomes even more critical.

The Video processing segment is further boosted by the increasing adoption of live streaming, which requires real-time video encoding and processing to ensure seamless transmission. Additionally, as platforms strive to provide the best user experience, the processing capabilities for adaptive bitrate streaming are becoming indispensable, allowing videos to play smoothly across various network conditions.

While other segments such as Video management, Video distribution, and Video analytics also contribute to the OVP ecosystem, Video processing remains the foundational element driving overall platform performance and user satisfaction.

By Streaming Type

In 2024, the Live streaming segment held a dominant market position in the Online Video Platforms (OVP) market, capturing more than 76.4% of the share. This segment leads due to the growing demand for real-time, interactive content, which is becoming a staple across industries such as entertainment, sports, education, and corporate communications.

Live streaming allows users to engage with content as it unfolds, fostering a sense of immediacy and connection that on-demand videos cannot replicate. The popularity of live streaming is fueled by its ability to reach large audiences instantaneously, making it a key tool for events like sports matches, concerts, webinars, and gaming broadcasts.

Additionally, the rise of social media platforms and content creators has significantly contributed to the segment’s dominance, as influencers and businesses increasingly turn to live streaming to engage with their followers in real time. While Video on demand remains a popular choice for users seeking flexibility in content viewing, the interactive and engaging nature of live streaming has made it the dominant segment in the OVP market.

By End-user

In 2024, the Media & Entertainment segment held a dominant market position in the Online Video Platforms (OVP) market, capturing more than 37.2% of the share. This leadership is largely due to the massive demand for streaming services, which has become a cornerstone of the media and entertainment industry.

The rise of platforms like Netflix, Disney+, Amazon Prime, and YouTube has revolutionized how people consume entertainment, making on-demand video a preferred choice for millions of users worldwide. The Media & Entertainment sector’s dominance is also driven by the increasing consumption of video content in various formats, including movies, TV shows, live events, and sports broadcasts.

With consumers increasingly preferring online streaming over traditional TV, media companies are investing heavily in OVPs to deliver high-quality, personalized, and accessible content. Additionally, the growing trend of user-generated content and live streaming in social media platforms has further strengthened this segment’s position.

While sectors like BFSI, Education, and Retail also use OVPs, the massive scale of media consumption and the continuous shift toward digital platforms make Media & Entertainment the leading end-user in the OVP market.

Key Market Segments

By Component

- Solution

- Services

By Type

- Video processing

- Video management

- Video distribution

- Video analytics

- Others

By Streaming Type

- Live streaming

- Video on demand

By End-user

- Media & entertainment

- BFSI

- Retail

- Education

- IT and Telecom

- Others

Driving Factor

Rising Demand for Video Content

The surge in demand for video content is a primary driver of growth in the Online Video Platforms (OVP) market. This trend is influenced by several factors, including the increasing consumption of digital media, the popularity of streaming services, and the widespread use of mobile devices.

Impact of Digital Media Consumption

As internet penetration deepens globally, more users are accessing digital content, leading to a significant rise in video consumption. Platforms like YouTube, Netflix, and TikTok have seen exponential growth, attracting billions of users worldwide. This shift towards online video consumption has prompted businesses and content creators to adopt OVPs to reach their target audiences effectively.

Popularity of Streaming Services

The proliferation of streaming services has revolutionized how audiences access video content. Services such as Netflix, Amazon Prime Video, and Disney+ offer vast libraries of on-demand content, catering to diverse viewer preferences. This accessibility has led to increased subscription rates and a shift away from traditional cable television, further fueling the demand for OVPs.

Proliferation of Mobile Devices

The widespread adoption of smartphones and tablets has made it easier for users to access video content anytime, anywhere. High-speed internet connectivity and advanced mobile technologies have enhanced the streaming experience, contributing to the growing consumption of online videos. This trend presents significant opportunities for OVPs to optimize their platforms for mobile users.

Restraining Factor

High Deployment and Maintenance Costs

Despite the growth prospects, the OVP market faces challenges, notably the high deployment and maintenance costs associated with these platforms. Small and medium-sized enterprises (SMEs) often find it financially burdensome to invest in robust video infrastructure, limiting their ability to leverage OVPs effectively.

Financial Barriers for SMEs

Implementing a comprehensive OVP requires substantial initial investments in technology and infrastructure. Additionally, ongoing maintenance, updates, and security measures incur continuous expenses. For SMEs operating with limited budgets, these costs can be prohibitive, hindering their participation in the digital video landscape.

Resource Allocation Challenges

Allocating resources to support OVP operations necessitates diverting funds from other critical business areas. This reallocation can strain financial and human resources, affecting overall business performance. SMEs must carefully evaluate the return on investment when considering OVP adoption, balancing potential benefits against financial constraints.

Growth Opportunities

Integration of Artificial Intelligence (AI) in Video Platforms

Integrating AI technologies into video platforms offers significant growth opportunities, enhancing user experiences and operational efficiencies. AI-driven features such as personalized content recommendations, automated video editing, and advanced analytics are transforming the OVP landscape.

Personalized Content Delivery

AI algorithms analyze user behavior and preferences to deliver tailored content recommendations, increasing viewer engagement and retention. Platforms that leverage AI to curate personalized experiences can attract and retain subscribers more effectively, driving growth in a competitive market.

Automated Video Production

AI-powered tools enable automated video editing and production, reducing the time and cost associated with content creation. This automation allows creators and businesses to produce high-quality videos at scale, meeting the increasing demand for fresh and engaging content.

Advanced Analytics for Strategic Insights

AI enhances analytics capabilities, providing deep insights into viewer behaviors, content performance, and market trends. These insights inform strategic decisions, such as content development, marketing strategies, and monetization models, fostering growth and profitability.

Challenging Factors

Intense Competition and Market Saturation

The OVP market is highly competitive, with numerous players offering a variety of services. This saturation poses challenges for platforms to differentiate themselves and maintain profitability.

Difficulty in Differentiation

With a multitude of platforms available, distinguishing unique value propositions becomes challenging. Platforms must innovate continuously, offering exclusive content, superior user experiences, or advanced features to stand out in a crowded market.

Profitability Pressures

The abundance of free and low-cost video platforms exerts pressure on pricing strategies, impacting profitability. Platforms must balance competitive pricing with sustainable revenue models, navigating challenges such as ad-supported content, subscription fatigue, and piracy concerns.

User Acquisition and Retention Challenges

Attracting and retaining users amidst numerous alternatives require significant marketing efforts and resources. Platforms must invest in user acquisition strategies, loyalty programs, and community-building initiatives to maintain and grow their user bases.

Growth Factor

Integration of Artificial Intelligence (AI) in Video Platforms

The integration of Artificial Intelligence (AI) into online video platforms has significantly accelerated market growth, enhancing user experiences and operational efficiencies. AI technologies, such as machine learning and data analytics, are being leveraged to personalize content, optimize video delivery, and streamline content creation processes.

Personalized Content Recommendations

AI algorithms analyze user behavior and preferences to deliver tailored content suggestions, increasing engagement and retention rates. Platforms like YouTube have reported that personalized recommendations account for over 70% of the videos watched, underscoring the effectiveness of AI-driven personalization.

Enhanced Video Quality and Delivery

AI-powered tools enable real-time video enhancement, such as upscaling resolution and improving audio clarity, providing viewers with superior content quality. Additionally, AI optimizes video delivery by adjusting streaming quality based on network conditions, ensuring smooth playback and reducing buffering instances.

Streamlined Content Creation and Management

AI assists content creators by automating tasks like video editing, tagging, and metadata generation, significantly reducing production time and costs. For example, Vimeo’s acquisition of Magisto, an AI-driven video creation platform, has enabled users to produce professional-quality videos with minimal effort.

Emerging Trend

Shift Towards Live Streaming and Interactive Content

Live streaming has emerged as a dominant trend in the online video landscape, offering real-time engagement and interactive experiences. This shift is driven by technological advancements and changing consumer preferences.

Real-Time Engagement

Live streaming allows creators and brands to connect with audiences in real time, fostering a sense of immediacy and community. Platforms like Twitch and YouTube Live have seen substantial growth, with Twitch reporting over 2.5 million concurrent viewers at peak times, highlighting the popularity of live content.

Interactive Features

Incorporating interactive elements such as live chats, polls, and Q&A sessions enhances viewer participation and engagement. This interactivity not only enriches the user experience but also provides valuable feedback and data for content creators.

Integration with E-commerce

Live streaming has been successfully integrated with e-commerce, particularly in markets like China, where platforms such as Taobao Live enable real-time product demonstrations and direct purchases. This fusion of live content and shopping has opened new revenue streams and marketing opportunities.

Business Benefit

Enhanced Advertising Revenue through Targeted Marketing

Online video platforms offer significant business benefits, particularly in enhancing advertising revenue through targeted marketing strategies. The vast user bases and rich data analytics capabilities of these platforms enable advertisers to reach specific audiences effectively.

Precise Audience Targeting

Advanced data analytics allow advertisers to segment audiences based on demographics, interests, and viewing behaviors. This precision ensures that advertisements are relevant to viewers, increasing the likelihood of engagement and conversion.

Diverse Advertising Formats

Platforms support various advertising formats, including pre-roll ads, banner ads, and sponsored content, providing flexibility for advertisers to choose the most effective methods for their campaigns.

Measurable Advertising Performance

Robust analytics tools provide detailed insights into ad performance, enabling advertisers to assess effectiveness and optimize future campaigns. This data-driven approach leads to better ROI and more strategic marketing decisions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Akamai Technologies, a leader in content delivery and cloud services, has actively expanded its capabilities through strategic acquisitions. In December 2024, Akamai acquired select assets of Edgio, a content delivery network (CDN) company that had filed for Chapter 11 bankruptcy. This acquisition aimed to enhance Akamai’s CDN offerings and solidify its position in the evolving online video platform market.

Brightcove Inc., a prominent online video platform provider, has undergone significant changes recently. In November 2024, the company was acquired by Italian app developer Bending Spoons for $233 million. This acquisition was part of Bending Spoons’ strategic expansion, marking its sixth acquisition within the year. Brightcove’s expertise in video streaming solutions complemented Bending Spoons’ portfolio, indicating a strategic move to enhance digital media offerings.

Comcast, a major player in cable communications, has been actively enhancing its enterprise services. In December 2024, Comcast Business announced an agreement to acquire Nitel, a U.S.-based managed services provider specializing in advanced networking, cloud services, and cybersecurity solutions. This acquisition aimed to bolster Comcast’s capabilities in serving enterprise clients, particularly in sectors like financial services, healthcare, and education, by offering comprehensive connectivity and security solutions.

Top Key Players in the Market

- Akamai Technologies

- Brightcove Inc.

- Comcast Cable Communications Management, LLC

- Endavo Media.

- Frame.io, Inc.

- Kaltura, Inc.

- Limelight Networks

- Longtail Ad Solutions, Inc. (JW PLAYER)

- MediaMelon Inc

- Ooyala Inc. (Telstra)

- Panopto

- SpotX, Inc.

- Wistia Inc. Inc.

- Others

Recent Developments

- In 2024: Akamai Technologies acquired assets from Edgio to enhance its content delivery network, strengthening its position in the online video platforms market.

- In 2024: Brightcove Inc. was acquired by Bending Spoons for $233 million, expanding its reach in video streaming and digital media services.

Report Scope

Report Features Description Market Value (2024) USD 12.4 Billion Forecast Revenue (2034) USD 117.35 Billion CAGR (2025-2034) 25.20% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Type (Video processing, Video management, Video distribution, Video analytics, Others), By Streaming Type (Live streaming, Video on demand), By End-user (Media & entertainment, BFSI, Retail, Education, IT and Telecom, Others) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Akamai Technologies, Brightcove Inc., Comcast Cable Communications Management, LLC, Endavo Media., Frame.io, Inc., Kaltura, Inc., Limelight Networks, Longtail Ad Solutions, Inc. (JW PLAYER), MediaMelon Inc, Ooyala Inc. (Telstra), Panopto, SpotX, Inc., Wistia Inc., Others Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Online Video Platforms MarketPublished date: Mar 25add_shopping_cartBuy Now get_appDownload Sample

Online Video Platforms MarketPublished date: Mar 25add_shopping_cartBuy Now get_appDownload Sample -

-

- Akamai Technologies

- Brightcove Inc.

- Comcast Cable Communications Management, LLC

- Endavo Media.

- Frame.io, Inc.

- Kaltura, Inc.

- Limelight Networks

- Longtail Ad Solutions, Inc. (JW PLAYER)

- MediaMelon Inc

- Ooyala Inc. (Telstra)

- Panopto

- SpotX, Inc.

- Wistia Inc. Inc.

- Others