Global Live Streaming Pay Per View Market Size, Share, Statistics Analysis Report By Vertical (Media and Entertainment, Education, Sports, Other Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134747

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

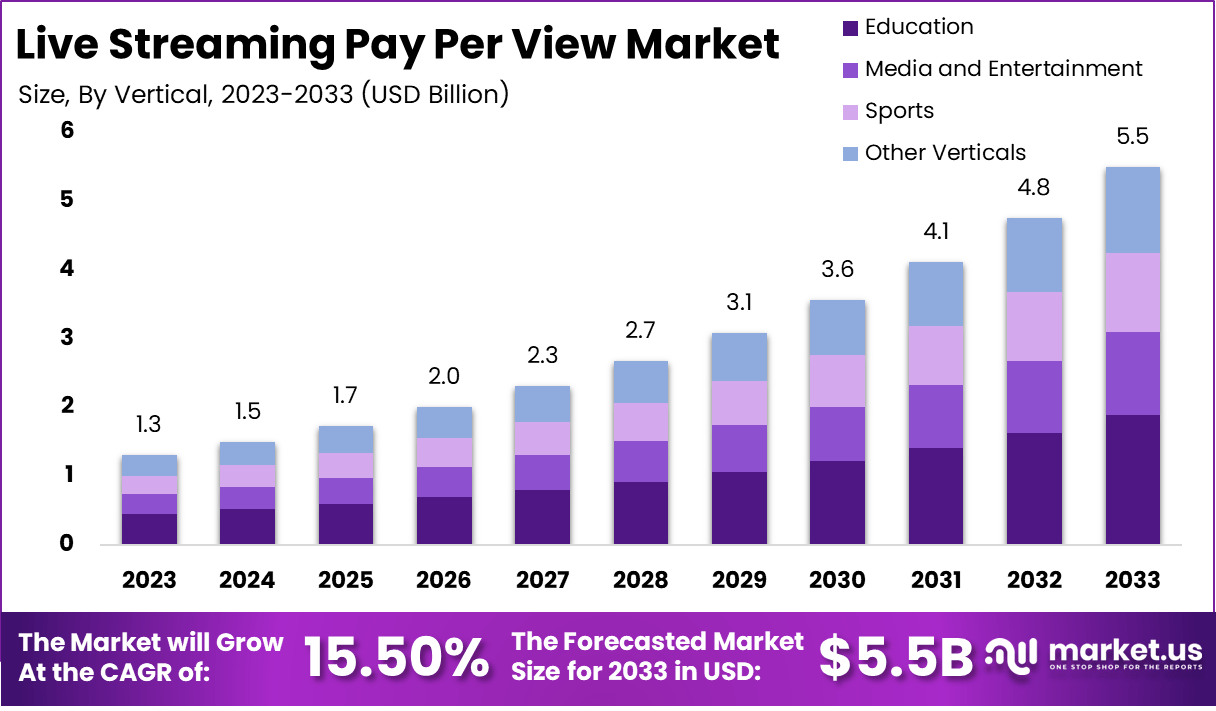

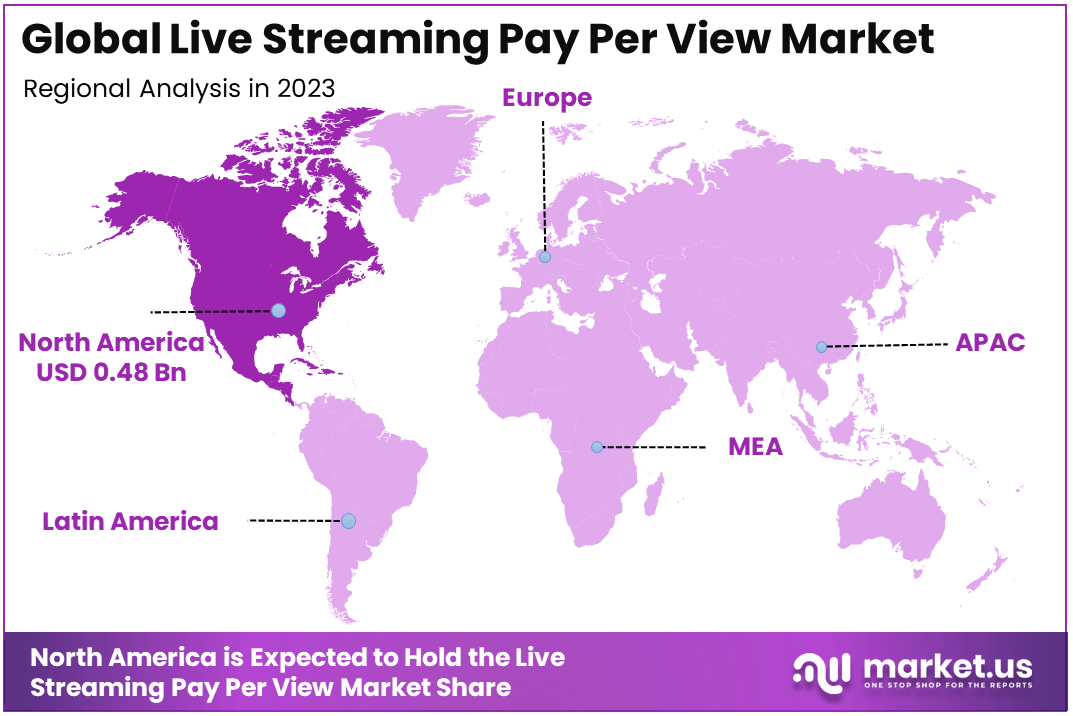

The Global Live Streaming Pay Per View Market size is expected to be worth around USD 5.5 Billion By 2033, from USD 1.3 Billion in 2023, growing at a CAGR of 15.50% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 37.1% share, holding USD 0.48 Billion in revenue.

Live Streaming Pay Per View (PPV) is a monetization model where viewers pay a fee to access live-streamed content in real-time. This model is commonly used in sports, entertainment, and special events like concerts, conferences, and wrestling matches. The content is streamed over the internet, and users can access it for a one-time payment, typically without having to subscribe to a long-term service.

PPV offers a way for event organizers, sports leagues, and content creators to directly generate revenue from audiences who are willing to pay for exclusive, live content. The primary appeal is that it allows creators to monetize niche or one-time events, offering both flexibility and scalability.

The live-streaming pay-per-view (PPV) market has seen significant growth due to increasing demand for online content and the global shift toward digital consumption. With advancements in internet connectivity and streaming technologies, consumers now expect high-quality, on-demand viewing experiences.

PPV offers a more personalized, flexible option compared to traditional cable TV or subscription-based models, and this has contributed to its rising popularity. Moreover, the shift in consumer behavior towards pay-per-view models for live events, particularly in sports and entertainment, further fuels the market expansion.

The key drivers for the Live Streaming pay-per-view market include the growing popularity of digital content consumption, the rising trend of on-demand streaming, and the global growth of internet penetration. As people increasingly prefer watching events online, the demand for high-quality live-streaming services has surged.

The ability to charge viewers for access to exclusive or live events, especially niche content, has become a significant revenue-generating opportunity for content creators and event organizers. Additionally, the rapid development of 5G technology, which enables seamless high-definition streaming, is another key factor driving the market’s growth.

The market demand for live-streaming pay-per-view is growing across various sectors, including sports, entertainment, education, and corporate events. Sports events like MMA, boxing, and major leagues are the primary drivers, where PPV allows fans to access events remotely and in real-time.

Furthermore, concerts, music festivals, and live webinars have all increasingly adopted PPV models, as they offer exclusive experiences for audiences. This model is especially popular in areas with high internet penetration and a tech-savvy audience willing to pay for premium, live content.

The live-streaming pay-per-view market holds considerable opportunities for content creators, media companies, and event organizers. As more creators and brands seek to monetize live events, PPV offers an effective way to tap into new revenue streams.

PPV also offers scalability, where small events can generate income by charging users for access to a one-time broadcast. With more global audiences seeking personalized viewing experiences, PPV can cater to regional preferences and target niche audiences. Additionally, the increasing demand for e-sports, online gaming, and virtual events is expected to create new avenues for PPV services.

Technological advancements play a crucial role in the Live Streaming pay-per-view market. Key innovations such as high-definition streaming, 5G network advancements, improved video encoding techniques, and augmented reality (AR) are enhancing the live-streaming experience. These advancements ensure seamless streaming of high-quality video, minimal latency, and an interactive experience for viewers.

Platforms and service providers are also integrating advanced analytics to understand viewer preferences and behavior, optimizing the content for specific target audiences. As technologies continue to evolve, the PPV model will be further refined to offer better streaming experiences, improved payment systems, and more personalized content.

In vertical markets, the sports industry was a significant contributor, generating around $450 million in revenue in 2023, while the entertainment sector accounted for about $650 million. The education sector also saw growth, contributing approximately $100 million to the overall market.

Regionally, North America held the largest share at about 40%, translating to roughly $600 million in revenue for 2023. The Asia-Pacific region followed closely with an estimated revenue of $400 million, while Europe accounted for approximately $300 million. Additionally, Latin America contributed around $100 million to the total market.

Overall, the live streaming pay-per-view market demonstrates robust growth across various sectors and regions, driven by increasing demand for digital content and advancements in streaming technology.

Key Takeaways

- Market Growth: The global Live Streaming Pay Per View market is projected to grow from USD 1.3 billion in 2023 to USD 5.5 billion by 2033, reflecting a robust CAGR of 15.50%.

- Dominant Vertical: The Media and Entertainment sector holds the largest share of the market, accounting for 34.3% in 2023, driven by the increasing demand for live events, concerts, and sports streaming.

- Regional Leadership: North America leads the market, capturing 37.1% of the total revenue in 2023, supported by its strong media and entertainment infrastructure, high consumer spending on digital content, and widespread internet adoption.

- High Growth Potential: The market’s rapid growth is fueled by rising demand for personalized and on-demand live content, with consumers willing to pay for exclusive access to sports events, entertainment shows, and other live broadcasts.

- Technological Advancements: Advancements in streaming technology, including improved video quality (e.g., 4K, 8K) and faster internet speeds, continue to enhance the user experience, contributing to market growth.

- Increasing Consumer Engagement: The popularity of live streaming events and the ease of accessing content directly through PPV platforms is helping drive both demand and revenue generation for content providers.

By Vertical

In 2023, the Media and Entertainment segment held a dominant market position, capturing more than a 34.3% share. This leadership can be attributed to the growing demand for exclusive live content, such as concerts, movie premieres, award shows, and live TV events.

As consumers increasingly seek personalized and high-quality streaming experiences, media and entertainment companies have expanded their live streaming offerings, particularly through pay-per-view models. The ability to offer on-demand access to popular content, like music festivals, live sports, and exclusive entertainment events, is driving significant revenue growth in this sector.

One key factor contributing to the dominance of this segment is the increasing shift from traditional television to digital streaming platforms. Consumers, particularly younger demographics, prefer the flexibility of live streaming on multiple devices, leading to the rapid rise of subscription-based and pay-per-view services.

Platforms like Netflix, Hulu, Amazon Prime Video, and specialized streaming services for music and events, such as Twitch and YouTube Live, have capitalized on this trend, creating new revenue streams through pay-per-view access to live events.

Moreover, the global entertainment industry has been quick to adopt emerging technologies like 4K streaming and virtual reality, which enhance the viewing experience for live events, further bolstering the segment’s growth. These innovations provide high-definition, immersive experiences for users, driving up demand for premium content that can be accessed through pay-per-view models.

As a result, the Media and Entertainment vertical is expected to remain the largest segment in the live-streaming pay-per-view market, benefiting from the ongoing expansion of digital platforms, changing consumer behavior, and the increasing monetization of live events. With rising interest in exclusive, real-time content, this sector will continue to lead the market in the coming years.

Key Market Segments

By Vertical

- Media and Entertainment

- Education

- Sports

- Other Verticals

Driving Factors

Increasing Consumer Demand for On-Demand and Exclusive Content

The rising demand for on-demand content and exclusive live events is one of the primary drivers of the Live Streaming Pay-Per-View market. Consumers are increasingly drawn to live-streaming platforms that offer convenient access to exclusive content such as live sports events, concerts, and other entertainment shows. With the growing adoption of digital media consumption, the pay-per-view model has become increasingly popular, especially for events that attract large audiences.

In the past few years, the trend toward personalized and flexible viewing experiences has accelerated, especially among millennials and Gen Z audiences who seek convenience and immediate access to their favorite events and content.

As more consumers move away from traditional TV viewing, they are turning to digital streaming services to meet their entertainment needs. This has significantly boosted the demand for live-streaming platforms offering pay-per-view services.

Additionally, technological advancements in streaming technologies such as 4K resolution, ultra-low latency streaming, and enhanced video quality have raised consumer expectations, further propelling the demand for high-quality live streaming experiences.

Companies are capitalizing on this trend by investing in high-quality production and streaming infrastructure to offer a seamless user experience. This is particularly relevant for industries like sports, where viewers are willing to pay a premium for live access to games and events.

Restraining Factors

High Cost of Infrastructure and Technology

One of the key restraints hindering the growth of the Live Streaming Pay-Per-View market is the high cost associated with setting up and maintaining the required infrastructure. While the demand for live streaming is growing, the expenses involved in acquiring and maintaining high-performance servers, advanced video production equipment, and content delivery networks (CDNs) can be prohibitive for smaller businesses or content creators.

For instance, to deliver high-quality streaming experiences such as 4K or 8K resolution with minimal buffering, companies need to invest in specialized hardware and software infrastructure. Furthermore, for live events, there is a need for real-time encoding, distribution to multiple devices, and seamless playback. These technical requirements can be costly and require significant ongoing investments in maintenance and upgrades.

Additionally, content licensing and rights acquisition also contribute to operational costs. For many industries, especially in sports, the cost of securing broadcasting rights for live events can be prohibitively high, making it difficult for smaller companies to compete in the pay-per-view model.

As a result, many content providers must focus on partnerships with larger media companies or streaming platforms to mitigate these financial constraints, which may limit their ability to operate independently in the market.

Growth Opportunities

Expansion of Sports and Esports Events

One significant opportunity within the live-streaming pay-per-view market lies in the expansion of live sports and esports events. As global sports and gaming industries continue to thrive, there is a growing market for live pay-per-view events.

The global sports industry alone generates billions in revenue, and with the increased interest in esports tournaments, both traditional sports leagues and gaming organizations are looking to monetize their live events via pay-per-view services.

The popularity of sports, combined with the growing interest in esports, has created an exciting opportunity for streaming platforms to tap into previously underserved markets. Events like the Super Bowl, and World Cup, and popular esports competitions, such as the League of Legends World Championship or International Dota 2, are attracting millions of live viewers. These events, particularly esports, offer a younger demographic that is more inclined to engage with pay-per-view options rather than traditional cable TV subscriptions.

Furthermore, new technologies such as augmented reality (AR) and virtual reality (VR) could enhance the live streaming experience, providing unique opportunities to offer interactive and immersive pay-per-view content. These technologies are gaining traction in both the sports and entertainment industries, opening the door to new monetization avenues, especially for niche events that were once difficult to broadcast on a global scale.

Challenging Factors

Intense Competition and Market Saturation

One of the primary challenges facing the Live Streaming Pay-Per-View market is the intense competition and market saturation, particularly in the media and entertainment sector. As more companies enter the market, offering live-streaming solutions and exclusive content, the level of competition increases, making it difficult for new entrants or smaller businesses to gain a foothold.

The market is already dominated by large streaming giants such as Amazon Prime, YouTube, and Netflix, which offer a variety of subscription-based models and have significant budgets for content acquisition, infrastructure, and marketing.

These companies also have established user bases, making it difficult for smaller pay-per-view platforms to differentiate themselves. Additionally, many of the major players in the market are expanding into live sports broadcasting, further intensifying competition.

Another challenge is the ability to sustain user engagement. Pay-per-view platforms rely heavily on consumer willingness to pay for individual events or content, which means they must consistently deliver high-quality, exclusive content to retain subscribers and viewers. In a saturated market, consumers can easily switch between platforms, making user loyalty a significant hurdle.

Growth Factors

The Live Streaming Pay-Per-View market is experiencing significant growth driven by several key factors. One of the main drivers is the increasing demand for exclusive and on-demand content. Consumers are increasingly turning to live streaming platforms for real-time access to sports events, concerts, conferences, and other exclusive content.

The convenience of watching events on-demand, without the constraints of traditional broadcast schedules, is fueling the popularity of pay-per-view (PPV) models. Moreover, the growth of mobile devices and faster internet connectivity is allowing users to enjoy seamless streaming experiences on various platforms, which further accelerates market growth.

Emerging Trends

An emerging trend in the Live Streaming Pay-Per-View market is the integration of interactive features such as live chats, social media sharing, and multiple viewing angles. These features provide a more engaging and immersive experience for viewers.

Additionally, the rise of virtual reality (VR) and augmented reality (AR) is opening up new possibilities for live streaming, allowing users to experience events more interactively. Platforms are also leveraging artificial intelligence (AI) for content recommendations and personalized experiences, which is expected to continue driving market expansion.

Business Benefits

Live streaming pay-per-view models offer businesses several advantages. For content creators and distributors, the PPV model allows for higher revenue generation from exclusive or high-demand events. By targeting niche audiences willing to pay for exclusive content, businesses can maximize monetization opportunities.

Furthermore, live streaming offers the ability to reach global audiences without the limitations of traditional distribution channels. This opens up new revenue streams and boosts overall profitability. The market also allows brands to engage directly with audiences through interactive features, helping build customer loyalty and long-term relationships.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 37.1% share, holding USD 0.48 Billion in revenue. The region’s leading position can be attributed to the high demand for live-streaming content, particularly in the media, entertainment, and sports industries.

North America has long been at the forefront of digital innovation, with significant investments in streaming technologies, which provide seamless, high-quality viewing experiences. Moreover, the region’s large number of tech-savvy consumers, along with the popularity of sports events like the NFL, and NBA, and major music concerts, has made North America a primary hub for live streaming pay-per-view services.

Additionally, North America benefits from a well-developed infrastructure, with high-speed internet access and widespread mobile device usage, which are essential for high-quality live streaming. The region’s content creators and broadcasters also play a crucial role in the dominance of PPV models, as many major players like ESPN, UFC, and WWE utilize pay-per-view to monetize exclusive content and attract large-scale audiences.

This has led to consistent market growth, with high demand for on-demand and live content among consumers who prefer flexible viewing options. Furthermore, North America’s early adoption of new technologies, such as 5G networks and artificial intelligence (AI) for personalizing viewing experiences, has contributed to its market leadership.

With an established base of digital infrastructure and a culture of innovation, North America is expected to continue its dominance in the live-streaming pay-per-view market. The region’s focus on enhancing user experience with interactive features and the rapid adoption of digital payment systems also reinforce its strong market position.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Vimeo, a leading player in the live-streaming pay-per-view market, has been focusing on expanding its offerings through strategic acquisitions and product innovations. In recent years, Vimeo has acquired several companies to bolster its platform’s capabilities, including the acquisition of Livestream, a prominent live-streaming service provider. This acquisition enabled Vimeo to enhance its live-streaming offerings, providing a seamless pay-per-view experience for customers.

Additionally, Vimeo introduced a range of advanced tools aimed at simplifying live event production and monetization for creators, making it easier for content creators to engage audiences and generate revenue through pay-per-view models. Vimeo continues to target growth in the media and entertainment vertical, a key driver of pay-per-view demand, by offering flexible streaming solutions and robust monetization tools.

Dacast has emerged as a strong player in the live-streaming pay-per-view market, gaining recognition for its comprehensive, customizable streaming platform. The company has been at the forefront of integrating pay-per-view services with features like ad-free viewing, password protection, and multi-camera support for live events.

Recently, Dacast introduced a new suite of analytics and monetization tools, allowing broadcasters to track real-time viewer engagement and revenue, helping them optimize their pay-per-view offerings. Dacast’s focus on offering white-label solutions, which allow businesses to build and brand their streaming platforms, has positioned it as a key player in both the media and sports verticals.

Muvi, a platform specializing in video streaming solutions, has made significant strides in the pay-per-view market with its all-in-one streaming platform. Muvi’s platform offers an array of features that support live streaming and video-on-demand (VOD) pay-per-view services. One of Muvi’s major recent developments was the launch of its cloud-based solution for live-streaming events with integrated monetization options.

This platform supports both subscription-based models and one-time pay-per-view events, making it versatile for a range of industries including sports, entertainment, and education. Muvi’s commitment to delivering a customizable and secure platform has made it popular among companies looking for comprehensive solutions to manage and monetize live-streaming events.

Top Key Players in the Market

- Vimeo

- Dacast

- Muvi

- Uscreen

- JW Player

- Brightcove Inc.

- StreamingVideoProvider

- Callaba

- Castr

- Other Key Players

Recent Developments

- In September 2023: Vimeo announced the launch of its enhanced live streaming pay-per-view platform, featuring new monetization tools and support for higher-quality video streams.

- In August 2023: Dacast unveiled a major update to its streaming platform by integrating AI-driven personalization features aimed at improving viewer engagement and optimizing pay-per-view models.

Report Scope

Report Features Description Market Value (2023) USD 1.3 Bn Forecast Revenue (2033) USD 5.5 Bn CAGR (2024-2033) 15.50% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vertical (Media and Entertainment, Education, Sports, Other Verticals) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Vimeo, Dacast, Muvi, Uscreen, JW Player, Brightcove Inc., StreamingVideoProvider, Callaba, Castr, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Live Streaming Pay Per View MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Live Streaming Pay Per View MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Vimeo

- Dacast

- Muvi

- Uscreen

- JW Player

- Brightcove Inc.

- StreamingVideoProvider

- Callaba

- Castr

- Other Key Players