Global OTT Devices and Services Market Share, Trend Analysis Report By Type (OTT Services, OTT Devices), By Platform (Smartphones and Tablets, Smart TVs and Gaming Consoles, Laptops and Desktops, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct. 2024

- Report ID: 128256

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

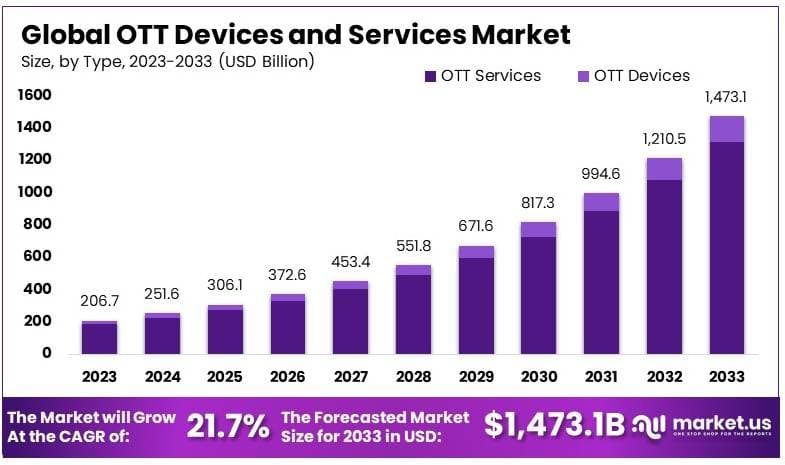

The Global OTT Devices and Services Market size is expected to be worth around USD 1,473.1 Billion by 2033, from USD 206.7 Billion in 2023, growing at a CAGR of 21.7% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 39.7% share, holding USD 82.06 Billion revenue.

OTT (Over-The-Top) devices and services refer to the delivery of film and TV content via the internet, without requiring users to subscribe to a traditional cable or satellite pay-TV service. These devices can include smart TVs, gaming consoles, set-top boxes, and even mobile devices that allow users to stream their favorite shows and movies. Services like Netflix, Hulu, Amazon Prime Video, and Disney+ are popular examples, offering extensive libraries of content directly to consumers.

The market for OTT devices and services has witnessed substantial growth in recent years. This is due in part to the enhanced internet connectivity and the proliferation of mobile devices, which allow users to access content on-the-go. Additionally, the increasing production of high-quality original content by OTT platforms has attracted a larger audience base. Service providers are continuously improving user experiences, integrating advanced technologies like AI for personalized recommendations, which further fuels the market’s expansion.

The growth factors for the OTT devices and services market include the widespread availability of high-speed internet and the growing preference for on-demand entertainment over traditional television. The market’s demand is driven by consumers’ desire for convenience and the ability to choose from a vast library of content across multiple genres and languages.

The market opportunities in the OTT space are vast, with potential for expansion into new regional markets where internet penetration is rapidly increasing. Additionally, there is scope for innovation in content delivery technologies, which can lead to enhanced streaming experiences. Providers who capitalize on these trends by offering competitive pricing and localized content can expect significant growth.

Market expansion for OTT devices and services is expected to continue as more consumers globally move away from traditional media consumption. The ongoing advancements in technology, such as improved data speeds and more capable devices, will further support this shift, making OTT services accessible to a wider audience and fostering market growth in the coming years.

The Over-The-Top (OTT) market is witnessing substantial growth, with the United States projected to generate $137.8 billion USD in revenue in 2023, according to research conducted by TVScientific. This growth is reflected in the increasing amount of time Americans spend on streaming platforms, rising from 44 minutes per day in 2018 to 70 minutes per day in 2022.

Globally, the OTT market is also expanding, with the number of users expected to reach 4.22 billion by 2027. In 2023, user penetration is estimated at 45.7%, and by 2027, it is predicted to rise to 53.0%. Additionally, the average revenue per user (ARPU) in the OTT segment is projected to be $90.14 USD in 2023.

A survey by The Trade Desk highlights consumer price sensitivity, with 59% of Americans unwilling to pay more than $20 per month for streaming services, and 75% unwilling to exceed $30 per month. This indicates that most Americans can afford only one or two subscriptions, emphasizing a competitive landscape among OTT service providers.

Data from DemandSage further supports the growth of the OTT market, forecasting 3.92 billion users by 2024. The overall market value of the OTT industry exceeds $316.40 billion USD. Globally, users spend an average of 17 hours per week streaming video content on OTT platforms. In the U.S., Americans spend 3 hours and 9 minutes per day (or 21 hours per week) on OTT platforms, with over 70% of users engaging in binge-watching behavior.

Key Takeaways

- The OTT Devices and Services Market was valued at USD 206.7 billion in 2023 and is projected to reach USD 1,473.1 billion by 2033, growing at a robust CAGR of 21.7% over the forecast period.

- In 2023, OTT Services dominated the market by type, capturing a substantial 89% share. This dominance can be attributed to the growing shift toward digital content consumption, as more consumers prefer streaming platforms over traditional media.

- By platform, Smartphones and Tablets led the market with a 36% share in 2023, driven by the widespread accessibility and convenience of mobile streaming, allowing users to watch content on the go.

- Regionally, North America held the leading position in 2023, accounting for 39.7% of the market share. This is due to the region’s advanced digital infrastructure and high adoption rates of OTT services, further boosted by its tech-savvy population.

Type Analysis

In 2023, the OTT Services segment held a dominant market position, capturing more than an 89% share. This substantial market share is primarily driven by the pervasive consumption of streaming content across various demographics worldwide.

Consumers have shown a significant preference for OTT platforms due to their convenience, the variety of content available, and the flexibility to watch from any device at any time. This shift is notably aligned with the broader trend of declining traditional television viewership, as audiences opt for more personalized and on-demand content solutions.

The leadership of the OTT Services segment is further bolstered by continuous technological advancements that enhance user experience. Innovations such as high-definition streaming capabilities, integrated viewing recommendations based on artificial intelligence, and seamless cross-platform functionality allow users to enjoy a rich viewing experience that traditional TV services struggle to match.

Additionally, the expansion of broadband infrastructure globally has made high-speed internet access more widespread, facilitating uninterrupted streaming and attracting a broader audience to OTT platforms. Strategic partnerships and content diversification have also played critical roles in the dominance of this segment.

OTT service providers have been keen on securing exclusive rights to various high-demand content genres, including sports, movies, and original series, which has significantly drawn in viewers. These platforms have not only expanded their libraries with diverse international content but also invested heavily in original productions, thus maintaining a competitive edge by keeping their content fresh and engaging.

Moreover, the adaptability of OTT services to cater to different languages and regional preferences has allowed them to tap into new markets, further solidifying their lead. By offering multilingual support and localized content, these platforms have successfully broadened their user base, making them more accessible to a global audience and driving their predominant share in the OTT market.

Platform Analysis

In 2023, the Smartphones and Tablets segment held a dominant market position in the OTT devices and services market, capturing more than a 36% share. This segment leads primarily due to the ubiquitous nature of these devices.

Smartphones and tablets are a staple in everyday life for billions of people globally, serving not just as communication tools but as primary devices for media consumption. The portability and convenience they offer make them ideal for streaming OTT content anywhere and anytime, aligning perfectly with the modern consumer’s demand for on-the-go accessibility.

Moreover, the integration of high-quality displays and improved sound technology in smartphones and tablets enhances the viewing experience, making these devices even more attractive for consuming media content. As internet connectivity improves worldwide, particularly with the expansion of 4G and the introduction of 5G networks, streaming video content on these devices has become faster and more reliable, further boosting their use for OTT services.

Additionally, the economic aspect plays a crucial role. Smartphones and tablets are increasingly affordable, and with a wide range of price points, they are accessible to a broad audience. This accessibility has expanded the potential market for OTT services, as more people can afford the devices needed to access these platforms. App developers and OTT service providers continue to optimize their applications for mobile devices, ensuring a seamless user experience that promotes longer viewing times and deeper engagement.

The trend towards mobile consumption is supported by the growing habit of multitasking, where users watch shows, movies, or live events on their devices while engaging in other activities. This behavior has made smartphones and tablets the preferred choice for personal entertainment, significantly influencing the growth dynamics of this segment in the OTT market. The continuous innovation in mobile technology and user interface design further solidifies the leading position of smartphones and tablets in the OTT devices and services market.

Key Market Segments

By Type

- OTT Services

- OTT Devices

By Platform

- Smartphones and Tablets

- Smart TVs and Gaming Consoles

- Laptops and Desktops

- Others

Driver

Growing Internet Penetration and Content Diversification Drive Market Growth

The OTT Devices and Services Market is experiencing robust growth driven by increasing internet penetration and content diversification. The widespread availability of high-speed internet, particularly in emerging markets, has significantly expanded the audience for OTT services.

Content diversification is another major driving factor. OTT platforms are increasingly offering a wide range of content, from movies and TV shows to live sports and niche programming. This variety attracts a broader audience, catering to diverse tastes and preferences. As a result, more consumers are shifting from traditional TV to OTT services, boosting market growth.

Additionally, advancements in device technology contribute to this growth. The increasing affordability and availability of smart TVs, smartphones, and other streaming devices have made it easier for consumers to access OTT services. These devices are becoming more user-friendly and feature-rich, enhancing the overall viewing experience and encouraging higher adoption rates.

Moreover, the flexibility of OTT services, which allow users to watch content on-demand and across multiple devices, is driving consumer preference. This convenience is particularly appealing in today’s fast-paced lifestyle, further solidifying the position of OTT platforms as a preferred choice for entertainment.

Restraint

High Competition and Content Licensing Costs Restrain Market Growth

The OTT Devices and Services Market faces several restraining factors, with high competition and content licensing costs being primary concerns. The market is increasingly crowded with numerous players, ranging from global giants to niche local platforms. This intense competition makes it challenging for new entrants to gain market share and for existing players to maintain their positions.

Content licensing costs further restrain market expansion. Acquiring popular and exclusive content is essential for attracting and retaining subscribers, but the cost of these licenses can be prohibitively high. Smaller OTT platforms, in particular, struggle to compete with larger companies that have the resources to secure premium content. .

Moreover, the complexity of negotiating content rights across different regions adds to the challenge. Varying regulations and licensing agreements in different countries can delay the launch of new content and increase operational costs.

Finally, the rise of original content production, while a potential growth avenue, also requires significant investment. This investment can be a burden, especially for smaller platforms, further restraining their ability to compete.

Opportunity

Expanding Global Reach and Partnerships Provide Opportunities

Expanding global reach and strategic partnerships provide significant opportunities for players in the OTT Devices and Services Market. As OTT platforms extend their services into new regions, particularly in developing markets, they tap into a vast pool of potential users. The growing internet infrastructure in these regions, combined with an increasing appetite for digital content creation, presents a lucrative opportunity for market expansion.

Strategic partnerships with telecom providers and content creators also open new avenues for growth. By collaborating with telecom companies, OTT platforms can bundle their services with data plans, making it easier for consumers to access streaming content. These partnerships often include exclusive content deals, which help attract and retain subscribers.

Another opportunity lies in localizing content to cater to regional tastes and preferences. As OTT platforms expand globally, offering content in local languages and reflecting local cultures can significantly boost subscriber numbers. Companies that invest in localized content stand to gain a competitive edge in new markets.

Furthermore, the rise of advertising-based video-on-demand (AVOD) models offers an additional revenue stream. By offering free content supported by ads, OTT platforms can attract users who may not be willing to pay for subscriptions, thereby broadening their audience base.

Challenge

Content Discovery and User Retention Challenge Market Growth

The OTT Devices and Services Market faces significant challenges related to content discovery and user retention, both of which are crucial for sustained growth. With the vast amount of content available on OTT platforms, users often struggle to find new and relevant content. This content discovery challenge is exacerbated by the overwhelming choice, leading to what is commonly referred to as “choice paralysis.”

User retention is another critical challenge. With the ease of switching between different OTT services, maintaining a loyal customer base is increasingly difficult. Subscribers may cancel their subscriptions if they do not find consistent value or if they are attracted to exclusive content on competing platforms.

Additionally, the growing competition from new entrants and established players alike intensifies the challenge of retaining users. Each platform must continuously innovate and offer unique content or features to keep users engaged, which requires significant investment in technology and content.

Furthermore, the increasing adoption of ad-supported models introduces the challenge of balancing ad loads with user experience. Excessive advertising can drive users away, while too few ads may not generate sufficient revenue.

Growth Factors

Rising Demand for Original Content and AI Integration Are Growth Factors

The OTT Devices and Services Market is witnessing significant growth, driven by the rising demand for original content and the integration of artificial intelligence (AI). As consumers increasingly seek unique and high-quality programming, OTT platforms are investing heavily in producing original content. This trend not only attracts new subscribers but also helps retain existing ones, as exclusive shows and movies become key differentiators in a competitive market.

The integration of AI into OTT services is another major growth factor. AI is being used to enhance content recommendation systems, providing users with personalized viewing experiences. By analyzing user behavior and preferences, AI-powered algorithms can suggest content that is more likely to keep viewers engaged, thereby increasing user satisfaction and reducing churn rates.

Additionally, AI is being leveraged to optimize streaming quality by adjusting video resolution in real-time based on network conditions. This ensures a smooth viewing experience, even in areas with fluctuating internet speeds, further enhancing user satisfaction and encouraging continued use of OTT services.

Emerging Trends

AI-Driven Personalization and 5G Adoption Are Latest Trending Factors

AI-driven personalization and the adoption of 5G technology are among the latest trending factors influencing the growth of the OTT Devices and Services Market. AI-driven personalization is transforming how users interact with OTT platforms by offering tailored content recommendations based on individual viewing habits.

The rollout of 5G services is another significant trend shaping the market. With its high-speed data transmission and low latency, 5G is revolutionizing the streaming experience. It enables smoother streaming of high-definition and 4K technology, even in areas with previously unreliable internet connections.

The improved connectivity offered by 5G also supports the growing demand for live streaming events, such as sports and concerts, which require robust and stable networks to deliver a seamless experience.

Additionally, 5G is facilitating the expansion of OTT services into new markets, particularly in regions where internet infrastructure has historically been a barrier to high-quality streaming. The increased accessibility and performance enabled by 5G are expected to drive further adoption of OTT devices and services globally.

Regional Analysis

In 2023, North America held a dominant market position in the OTT devices and services market, capturing more than a 39.7% share, amounting to USD 82.06 billion in revenue. This leadership can be primarily attributed to the region’s advanced digital infrastructure, which supports high-speed internet connectivity essential for streaming high-quality OTT content.

North America’s technological prowess allows consumers to access a wide array of streaming services on various devices with ease and reliability, promoting higher adoption rates. Additionally, North America boasts a strong presence of major OTT service providers and tech companies, such as Netflix, Amazon, and Apple, who are continually innovating and expanding their content libraries.

This not only enhances consumer choice but also drives competitive pricing and service quality, making OTT services more attractive to users. The region’s robust entertainment industry, coupled with high consumer spending capability, further supports the growth and dominance of OTT services.

The widespread use of mobile devices and smart TVs in households across North America also contributes significantly to the region’s leading position. With a culture that values convenience and on-demand services, North American consumers are quick to adopt new technologies that enhance their viewing experiences. This tendency is reflected in the high penetration rates of smartphones and smart TVs, which are primary platforms for OTT content consumption.

Furthermore, regulatory support for digital services and copyright protections in North America encourages content creators and distributors to invest in OTT platforms, ensuring a steady supply of high-quality, diverse content. This legal and regulatory framework helps maintain the region’s attractiveness as a market leader in the OTT industry, ensuring ongoing investment and innovation in this sector.

Regional Mentions:

- Europe: Europe holds a significant share in the OTT market, driven by strong local content production and high-speed broadband availability. Privacy regulations and consumer demand for non-English content shape the market dynamics.

- Asia Pacific: Asia Pacific is rapidly expanding in the OTT sector, spurred by increasing internet connectivity and a young, tech-savvy population. Local content and affordable pricing models are key growth drivers.

- Middle East & Africa: The OTT market in the Middle East & Africa is growing, with improvements in internet infrastructure and a rising middle class driving demand for digital entertainment.

- Latin America: Latin America shows promising growth in OTT adoption, thanks to improving internet penetration and regional investments in telecommunications infrastructure. The market benefits from a diverse array of both global and local content providers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the OTT Devices and Services Market, three companies stand out as key players: Netflix, Inc., Amazon.com, Inc., and Google LLC. These companies have established themselves as market leaders through strategic positioning, content offerings, and technological innovation.

Netflix, Inc. is a dominant force in the OTT market, recognized for its vast library of original content and global reach. Netflix’s strategy of investing heavily in original programming has not only set it apart from competitors but also helped it to maintain a strong subscriber base. Its ability to cater to diverse audiences across various regions gives Netflix significant market influence.

Amazon.com, Inc. leverages its massive ecosystem to drive its OTT services, primarily through Amazon Prime Video. Amazon’s strategic advantage lies in bundling Prime Video with its broader Prime membership, offering consumers added value. Additionally, Amazon’s global infrastructure and investment in original content enhance its competitive edge, making it a key player in the market.

Google LLC plays a crucial role in the OTT market through its YouTube platform and the Google Play Store. YouTube’s massive user base and dominance in user-generated content provide Google with a strong market position. Furthermore, Google’s integration of its OTT services with Android devices and its robust advertising model contribute to its significant influence in the industry.

These companies shape the OTT landscape through content innovation, technological advancements, and strategic integrations, making them the most influential players in the OTT Devices and Services Market.

Top Key Players in the Market

- Akamai Technologies

- Amazon.com, Inc.

- Apple, Inc.

- Brightcove Inc.

- Disney + Hotstar

- Google LLC

- Limelight Networks Inc.

- Netflix, Inc.

- Microsoft Corporation

- Roku, Inc.

- WarnerMedia Direct, LLC (HBO Max)

- Hulu, LLC

- Tencent Holdings Ltd.

- PCCW Enterprises Limited

- Other Key Players

Recent Developments

- Reliance Jio: In May 2024, Reliance Jio launched the ‘Ultimate Streaming Plan’ for its JioFiber and Jio AirFiber users, priced at Rs 888 per month. This postpaid plan includes over 15 premium OTT subscriptions, such as Netflix, Prime Video, Disney+ Hotstar, and more, bundled with high-speed internet access capped at 30 Mbps.

- Florida Panthers: In August 2024, the Florida Panthers, the reigning NHL Stanley Cup Champions, announced a strategic multi-year partnership with ViewLift to launch a new direct-to-consumer (DTC) streaming service.

- Ooredoo Group: In March 2024, Ooredoo Group launched its new OTT streaming service, ‘Go Play Market,’ across six markets in the Middle East, including Oman, Kuwait, and Iraq. Powered by MediaKind’s technology platform on Microsoft Azure, this service combines live TV with on-demand content.

Report Scope

Report Features Description Market Value (2023) USD 206.7 Billion Forecast Revenue (2033) USD 1,473.1 Billion CAGR (2024-2033) 21.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (OTT Services, OTT Devices), By Platform (Smartphones and Tablets, Smart TVs and Gaming Consoles, Laptops and Desktops, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Akamai Technologies, Amazon.com, Inc., Apple, Inc., Brightcove Inc., Disney + Hotstar, Google LLC, Limelight Networks Inc., Netflix, Inc., Microsoft Corporation, Roku, Inc., WarnerMedia Direct, LLC (HBO Max), Hulu, LLC, Tencent Holdings Ltd., PCCW Enterprises Limited, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the OTT Devices and Services Market?The OTT Devices and Services Market involves over-the-top (OTT) streaming devices and services that deliver media content directly to consumers via the internet, bypassing traditional cable or satellite television providers.

How big is the OTT Devices and Services Market?The OTT Devices and Services Market was valued at USD 206.7 billion and is projected to reach USD 1,473.1 billion, growing at a CAGR of 21.7%.

What are the key factors driving the growth of the OTT Devices and Services Market?Key factors driving the growth of the OTT Devices and Services Market include the increasing consumption of online content, rising internet penetration, and the growing popularity of streaming services.

What are the current trends and advancements in the OTT Devices and Services Market?Current trends in the OTT Devices and Services Market include the rise of original content production by OTT platforms, the adoption of subscription-based models, and the increasing integration of OTT services with smart TVs and mobile devices.

What are the major challenges and opportunities in the OTT Devices and Services Market?Challenges in the OTT Devices and Services Market include content licensing issues and competition from traditional media, while opportunities lie in the expansion of OTT services in emerging markets and the development of innovative content distribution models.

Who are the leading players in the OTT Devices and Services Market?Leading players in the OTT Devices and Services Market include Akamai Technologies, Amazon.com, Inc., Apple, Inc., Brightcove Inc., Disney+ Hotstar, Google LLC, Netflix, Inc., Microsoft Corporation, Roku, Inc., and others.

OTT Devices and Services MarketPublished date: Oct. 2024add_shopping_cartBuy Now get_appDownload Sample

OTT Devices and Services MarketPublished date: Oct. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Akamai Technologies

- Amazon.com, Inc.

- Apple, Inc.

- Brightcove Inc.

- Disney + Hotstar

- Google LLC

- Limelight Networks Inc.

- Netflix, Inc.

- Microsoft Corporation

- Roku, Inc.

- WarnerMedia Direct, LLC (HBO Max)

- Hulu, LLC

- Tencent Holdings Ltd.

- PCCW Enterprises Limited

- Other Key Players