Global Media Streaming Market Size, Share, Statistics Analysis Report By Solution (Software, Services), By Channel (Satellite TV, Cable TV, IPTV, OTT Streaming), By Revenue Model (Subscription-based, Transaction-based, Advertising-based), By Vertical (E-Learning, Healthcare, Government, Sports, Gaming, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec. 2024

- Report ID: 136052

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

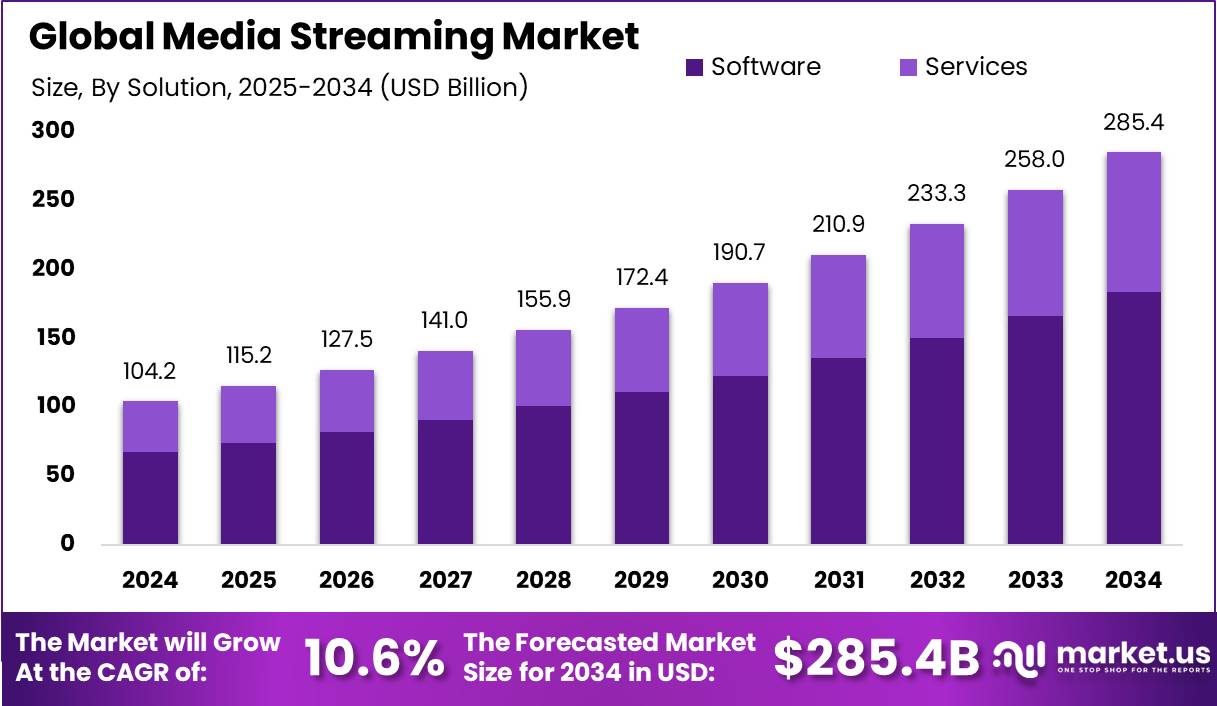

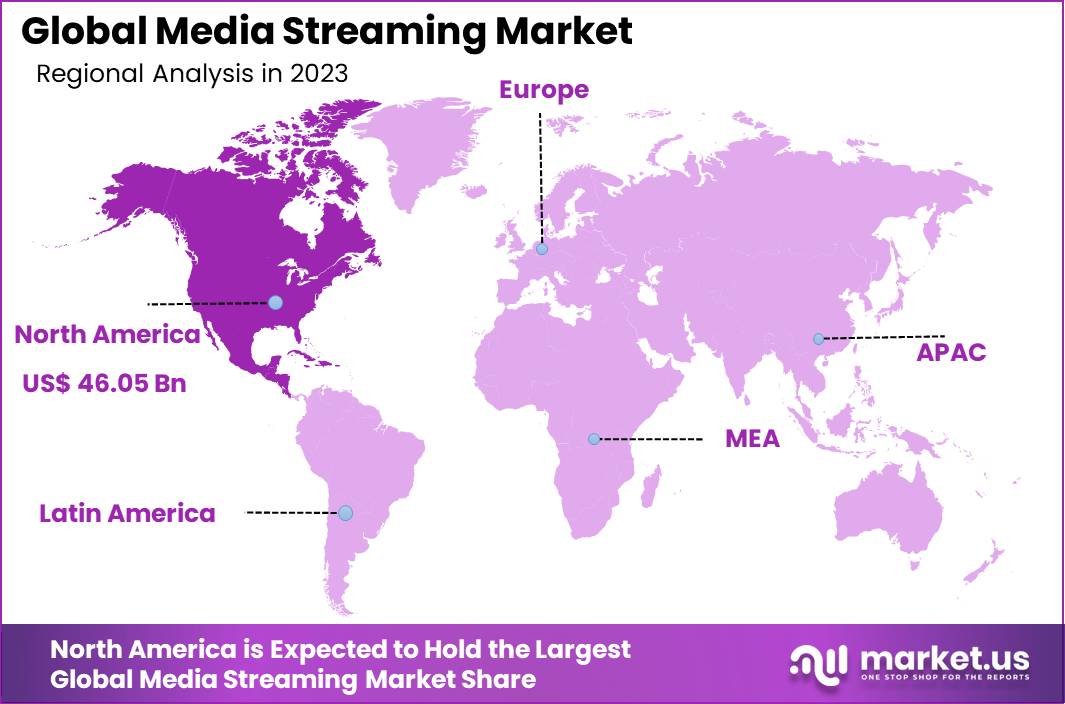

The Global Media Streaming Market size is expected to be worth around USD 285.4 Billion By 2034, from USD 104.2 billion in 2024, growing at a CAGR of 10.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 44.2% share, holding USD 46.05 billion revenue.

Media streaming refers to the process of delivering audio and video content over the internet in real-time, allowing users to consume media without downloading entire files to their devices. This technology has revolutionized how content is distributed and accessed, making media available instantly across various devices. Streaming works by breaking media files into small packets, which are then transmitted over the internet and reassembled by the user’s device.

The media streaming market has seen substantial growth, driven by increasing internet penetration and advancements in mobile technology. Today, it includes a wide array of services offering vast libraries of on-demand content, such as films, TV shows, and music. Key players like Netflix, Amazon Prime Video, and Hulu dominate the sector, continually expanding their user bases and content offerings.

For instance, In the third quarter of 2023, Spotify achieved a significant milestone, reaching 574 million active users globally, marking an all-time high for the platform. This represents a substantial year-on-year growth of 118 million users, as the platform had 456 million active users during the same period in 2022.

The major driving factors for the growth of the media streaming market include the widespread adoption of mobile devices, improved internet connectivity, and the increasing preference for on-demand entertainment. Consumers’ shift away from traditional television towards digital platforms has compelled media companies to innovate and expand their streaming offerings.

Additionally, the integration of advanced technologies such as artificial intelligence and machine learning has improved content discovery, personalized user experiences, and streamlined operations, further fueling market growth. Market demand for streaming media is primarily driven by the convenience of accessing a broad range of content anytime and anywhere.

The COVID-19 pandemic significantly boosted this demand as people sought entertainment options while adhering to social distancing measures. Furthermore, the affordability of streaming services compared to traditional cable TV packages has made them an attractive option for a broad audience, sustaining high demand in the market.

According to Vdocipher, the major streaming platforms continue to dominate with massive subscriber bases. Netflix leads the pack with 269.6 million subscribers, followed by Amazon Prime Video at 220 million, Disney+ at 150.2 million, and HBO Max rounding out the list with 95.6 million subscribers. These numbers highlight the growing demand for high-quality streaming services globally.

When it comes to how people watch, Smart TVs are the most popular streaming devices, used by 74.5% of households. Streaming sticks come in second at 64%, while gaming consoles are gaining ground, now used by 43.5% of viewers for streaming content. This shift shows how viewers are prioritizing convenience and seamless streaming experiences on larger screens.

On the revenue side, data from Uscreen reveals that the OTT video market is set to generate $316.4 billion by 2024. Interestingly, viewers are increasingly streaming on the go, with 65% of streaming time spent on mobile and TV apps, rather than web browsers. This trend underscores the importance of user-friendly apps designed for mobile and TV platforms.

Another striking insight is the stark contrast in how Americans consume video. Over 90% of U.S. adults use streaming platforms, while only 40% still have cable or satellite TV. This massive shift highlights the ongoing transformation of the entertainment industry as more viewers cut the cord in favor of on-demand content.

There are significant opportunities in the media streaming market, particularly in expanding into emerging markets where internet penetration is rapidly increasing. Additionally, the ongoing development of new content delivery technologies, such as 5G, offers potential for further market expansion. Services are also exploring diverse revenue streams through ad-supported models and premium tiers, catering to different consumer segments.

Technological advancements play a crucial role in shaping the media streaming industry. The adoption of cloud-based platforms allows for scalable and flexible content delivery, while technologies like 4K, HDR, and Dolby Atmos improve the quality of video and audio streams. Innovations in compression and delivery protocols, such as HEVC for video and advanced codecs for audio, optimize bandwidth usage and enhance the streaming experience, even in regions with lower internet speeds.

Key Takeaways

- The global media streaming market is projected to grow significantly, with its size expected to reach USD 285.4 billion by 2034, up from USD 104.2 billion in 2024, reflecting a strong CAGR of 10.6% during the forecast period of 2025 to 2034. This robust growth highlights the increasing demand for on-demand content and technological advancements in streaming platforms.

- In 2024, North America led the market, holding a dominant share of over 44.2%, with revenue of approximately USD 46.05 billion. This region’s growth is driven by high internet penetration, advanced infrastructure, and a strong presence of leading streaming service providers.

- Among segments, the Software category dominated the market in 2024, capturing more than 64.5% of the market share. This dominance stems from the widespread adoption of streaming solutions for both entertainment and professional applications.

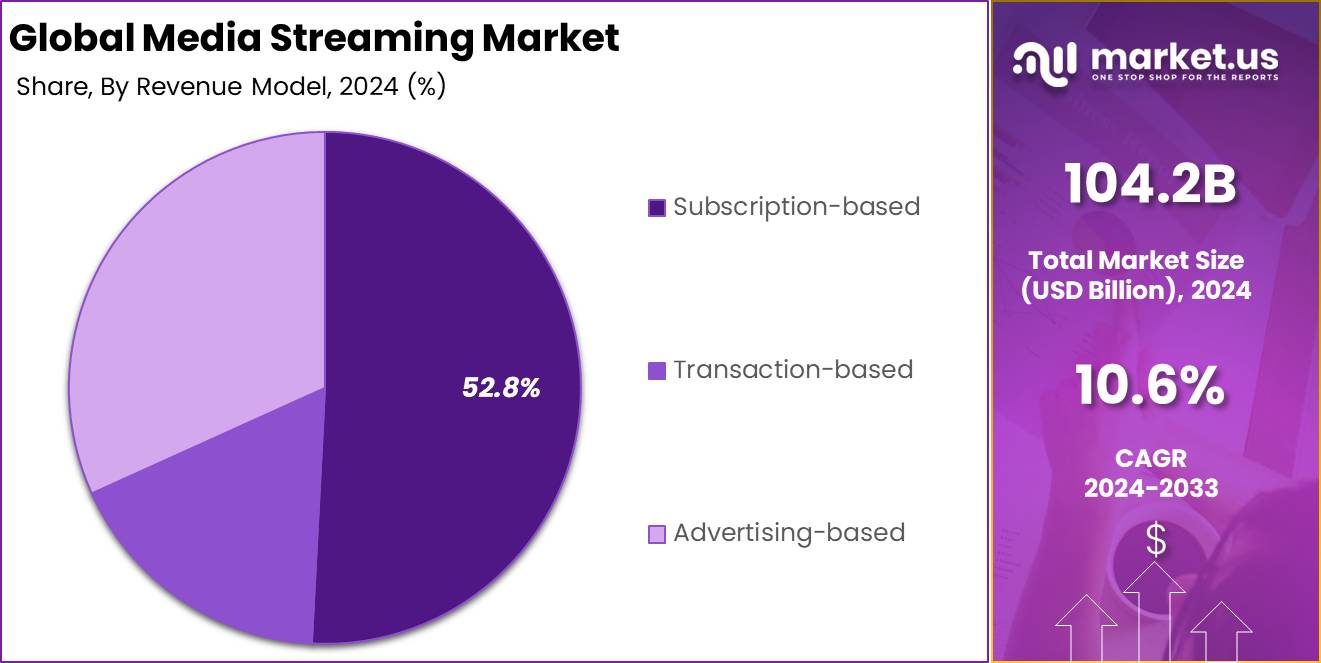

- In terms of delivery methods, the Satellite TV segment accounted for over 44.8% of the market in 2024, underscoring its continued relevance alongside emerging streaming platforms. Meanwhile, the Subscription-based model remained a consumer favorite, holding a commanding share of over 52.8%, thanks to its convenience and value-for-money offerings.

- Interestingly, the E-Learning segment also played a significant role in the media streaming landscape, contributing over 38.5% of the market share in 2024. The rising popularity of online education platforms and corporate training solutions has propelled this segment’s growth.

North America Media Streaming Market Size

In 2024, North America maintained a commanding presence in the media streaming market, capturing a significant 44.2% share, equating to a revenue of USD 46.05 billion. The U.S. alone showcased a market size of USD 39.8 billion, underscoring its pivotal role in this sector.

This dominance can be attributed to several key factors including high internet penetration rates, advanced technological infrastructure, and robust consumer demand for streaming services. The presence of major platforms like Netflix, Amazon Prime Video, and Disney+ has further entrenched North America’s leadership in the media streaming domain.

The region’s advanced digital infrastructure is a critical enabler of its market leadership, providing seamless access and quality streaming experiences to consumers. North America also benefits from a mature market environment where consumers are quick to adopt new technologies and media consumption habits. This has spurred continuous innovation and competition among streaming platforms, each vying for greater market share with unique content offerings and enhanced user experiences.

Moreover, strategic movements such as partnerships with content creators and investments in original programming have fortified the region’s market position. These efforts are complemented by the integration of advanced technologies such as artificial intelligence and machine learning, which improve content recommendation engines and user interface designs, making streaming services more appealing and accessible to a broad audience.

Looking forward, the region is expected to maintain its dominance by leveraging these technological advancements and continuing to expand its content libraries to meet the diverse preferences of its consumer base. This strategy not only helps in retaining existing subscribers but also attracts new users, further boosting market growth in North America.

Solution Analysis

In 2024, the Software segment held a dominant market position in the media streaming market, capturing more than a 64.5% share. This significant market share can be attributed to the widespread adoption of streaming platforms that rely heavily on advanced software solutions for content management, distribution, and user interface design.

Software solutions are integral to providing a seamless streaming experience, facilitating efficient content delivery and personalized viewing options, which are crucial for customer retention and satisfaction. The dominance of the Software segment is further bolstered by ongoing innovations in streaming technology, including the integration of artificial intelligence and machine learning.

These technologies enhance content recommendations and streamline video compression processes, making streaming services more accessible and enjoyable for a broad user base. Additionally, the software enables robust data analytics capabilities, allowing streaming providers to gain insightful consumer behavior patterns and preferences which in turn help in tailoring their offerings and marketing strategies effectively.

Moreover, the expansion of cloud-based solutions has revolutionized the media streaming landscape. Cloud platforms offer scalable and flexible hosting environments that reduce the need for substantial upfront capital expenditures on infrastructure for streaming service providers. This has enabled even smaller players to enter the market and compete effectively, thus broadening the reach and impact of the software segment.

Overall, the software segment’s dominance in the media streaming market is driven by its critical role in enabling high-quality, user-friendly, and adaptable streaming services that meet the evolving demands of a diverse global audience. As technologies advance and consumer expectations grow, the importance of software in delivering innovative and competitive streaming services is expected to increase, potentially leading to further growth and market consolidation.

Channel Analysis

In 2024, the Satellite TV segment held a dominant market position in the media streaming market, capturing more than a 44.8% share. This leadership can be primarily attributed to its extensive global reach and reliability, which remain compelling for a vast audience base, especially in regions with less developed internet infrastructure.

Satellite TV continues to be favored for its ability to deliver a wide array of channels and high-quality content across geographically dispersed areas without the dependency on broadband connectivity. The resilience of the Satellite TV segment is also supported by its evolution in integrating advanced technologies such as high-definition (HD) and ultra-high-definition (UHD) broadcasts, which enhance viewer experience.

Additionally, Satellite TV providers have been proactive in bundling value-added services such as video-on-demand, multi-screen viewing, and interactive TV services, which have helped maintain their attractiveness among consumers who seek more than just linear TV programming. Furthermore, the segment benefits from longstanding customer relationships and established infrastructure, which can be costly and complex for competitors to replicate.

These factors contribute to the high entry barriers for new entrants and sustain the strong position of Satellite TV in the market. Despite the growing popularity of over-the-top (OTT) services, Satellite TV’s unique ability to offer reliable service even in adverse weather conditions and remote locations reinforces its significance in the global media landscape.

Overall, while the media streaming market continues to evolve with new platforms and technologies, Satellite TV retains a significant share due to its proven reliability, continuous enhancement in service quality, and strategic adaptations to changing consumer preferences. As the market progresses, Satellite TV providers are expected to further innovate and possibly integrate more internet-based features to remain competitive and relevant in the dynamic media streaming ecosystem.

Revenue Model Analysis

In 2024, the Subscription-based segment held a dominant market position in the media streaming market, capturing more than a 52.8% share. This leading position can be attributed to the consistent revenue streams and customer loyalty that subscription models foster.

Consumers appreciate the convenience and cost-effectiveness of paying a recurring fee for unlimited access to a wide array of content, ranging from movies and TV shows to music and podcasts. This model has proven especially popular among major streaming platforms, which have successfully scaled their operations and expanded their subscriber bases globally.

The robust growth of the Subscription-based segment is also driven by the increasing value consumers place on high-quality and on-demand content. As the appetite for binge-watching and access to exclusive releases grows, platforms that offer extensive libraries and original programming continue to see an uptick in subscriber numbers. Furthermore, the flexibility to cancel subscriptions without long-term commitments makes this revenue model highly attractive, providing consumers with control over their entertainment spending.

Moreover, subscription services benefit from advanced data analytics that allow them to understand viewer preferences and tailor content and recommendations accordingly. This personalized approach not only enhances user experience but also improves retention rates by making platforms indispensable to their daily entertainment needs.

Overall, the Subscription-based model’s dominance in the media streaming market is supported by its ability to provide value, convenience, and personalized experiences to consumers. As technology evolves and consumer behaviors shift, this model is likely to remain a cornerstone of the media streaming industry, continuing to drive growth and innovation in the sector.

Vertical Analysis

In 2024, the E-Learning segment held a dominant market position in the media streaming market, capturing more than a 38.5% share. This prominence is largely driven by the global shift towards digital education platforms, accelerated by the need for remote learning solutions during and following the COVID-19 pandemic.

The E-Learning segment benefits from the widespread adoption of video streaming, which is integral for delivering interactive and engaging content to learners across various educational levels and professional training programs.

The growth of the E-Learning segment is further supported by technological advancements that enhance the learning experience through high-quality video content, real-time interaction, and accessibility on multiple devices. These features cater to a diverse range of learning preferences and schedules, making education more flexible and accessible to people worldwide.

Additionally, the integration of artificial intelligence and machine learning technologies has enabled personalized learning paths, automated assessments, and adaptive learning strategies, which significantly improve learning outcomes.

Moreover, the increasing collaboration between educational institutions and streaming platform providers has led to the development of tailored E-Learning solutions that are optimized for scalability and user engagement. This partnership approach not only expands the reach of digital education but also opens up new revenue streams for both content providers and platform developers.

Overall, the E-Learning segment’s significant share in the media streaming market is expected to grow as the demand for accessible, customizable, and engaging educational content continues to rise. This trend is likely to persist as educational institutions and corporate training programs increasingly rely on digital solutions to meet their educational objectives and skill development needs.

Key Market Segments

By Solution

- Software

- Services

By Channel

- Satellite TV

- Cable TV

- IPTV

- OTT Streaming

By Revenue Model

- Subscription-based

- Transaction-based

- Advertising-based

By Vertical

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Adoption of Streaming on Mobile Devices

The media streaming market is experiencing significant growth, driven largely by the increasing penetration of mobile devices and the expansion of high-speed internet access, particularly in the Asia-Pacific region. Mobile devices are becoming the primary means for media consumption due to their convenience and the growing availability of optimized streaming applications.

Companies like Disney and Apple are capitalizing on this trend by enhancing their mobile streaming services to accommodate the rising demand for on-the-go content consumption. This trend is supported by data showing that a substantial portion of the global population uses smartphones for listening to music and watching videos, which promotes continuous growth in the media streaming sector.

Restraint

Fragmentation and Subscription Fatigue

One significant challenge facing the media streaming market is the issue of market fragmentation and subscription fatigue. Consumers are increasingly experiencing frustration with managing multiple subscriptions across different platforms, which not only complicates the user experience but also adds financial burdens.

This has led to what industry experts term “fragmentation fatigue,” where the hassle of maintaining numerous subscriptions can lead to decision fatigue and dissatisfaction. This issue is exacerbated by the proliferation of services, each requiring separate subscriptions, which can deter new subscriptions and increase churn rates among existing users.

Opportunity

Expansion into Emerging Markets

The media streaming industry holds substantial opportunities for growth in emerging markets, where there is a notable surge in internet users and a shift towards digital media consumption. Regions such as Asia-Pacific, Latin America, and parts of Africa are witnessing rapid increases in internet penetration and mobile usage, creating fertile ground for media streaming services.

Companies are increasingly focusing on these regions to capitalize on the untapped customer base, adapting their offerings to local content preferences and investing in regional marketing strategies to enhance their reach and penetration.

Challenge

Content Moderation and Regulatory Compliance

A significant challenge in the media streaming market is content moderation, particularly with the need to manage and filter out inappropriate content, which has grown more complex with the scale of content being uploaded. Streaming platforms are under increasing pressure to effectively monitor content to comply with various regional regulations and maintain brand integrity.

The challenge is intensified by the diverse nature of global audiences and the varying standards for what constitutes acceptable content across different cultures and jurisdictions. This regulatory landscape requires robust systems and significant resources to manage, posing a persistent challenge for media companies.

Growth Factors

The media streaming market is experiencing robust growth, driven by several key factors. Firstly, the widespread availability of high-speed internet has significantly impacted market expansion. As internet speeds increase, streaming services become more accessible and appealing to a broader audience, particularly in urban areas where high-speed connectivity is more common.

Additionally, the surge in smartphone and tablet usage provides an easy and convenient platform for media consumption, which further fuels the demand for streaming services. These mobile devices have become the preferred method for accessing various streaming platforms due to their portability and the increasing quality of mobile networks.

Moreover, technological advancements such as cloud computing are pivotal in transforming the streaming landscape. Cloud technology not only facilitates the scale of streaming services but also enhances the quality and reliability of the service provided. This development has allowed streaming platforms to offer a vast array of content with improved viewing experiences, encouraging more users to subscribe to these services.

The introduction of smart TVs and the integration of streaming apps with these devices have also contributed to the growth of the media streaming market by making it easier for consumers to access streaming content directly on their television sets.

Emerging Trends

Emerging trends in the media streaming market are shaping the future trajectory of the industry. The transition towards cloud-based gaming platforms is a notable trend, driven by advancements in 5G technology and increased internet speeds, which allow gamers to stream games without the need for expensive hardware.

Additionally, the rise of independent content creators who use streaming platforms to reach audiences directly is reshaping the creator economy. This trend is moving away from traditional, algorithm-driven platforms to more direct and personal engagement with audiences. Another significant trend is the increasing focus on personalized streaming experiences through the use of AI and machine learning.

These technologies enable streaming services to provide personalized content recommendations, improve user engagement, and optimize streaming quality for various devices. Furthermore, there is a growing emphasis on integrating streaming services with other forms of digital entertainment, creating ‘super bundles’ that offer comprehensive entertainment solutions beyond traditional video content.

Business Benefits

The media streaming market offers numerous business benefits. For one, it opens up vast opportunities for content monetization through subscription models and targeted advertising. Streaming platforms can leverage detailed viewer data to offer highly targeted advertising, increasing revenue potential.

Additionally, the global reach provided by streaming platforms allows content creators and distributors to access a broader audience, which can significantly increase their market penetration and brand recognition. Furthermore, the flexibility and scalability offered by cloud deployments enable streaming services to manage large volumes of traffic and adapt to fluctuating demand without substantial upfront investments.

This aspect is particularly beneficial for rapidly growing services that need to expand their infrastructure quickly to accommodate increasing viewer numbers. Lastly, the ongoing innovation in streaming technologies ensures that businesses can continuously improve their offerings and stay competitive in a fast-evolving market.

Key Player Analysis

The media streaming market has seen significant movements in mergers, acquisitions, and new product launches by leading companies, aiming to expand their offerings and market reach.

Amazon’s acquisition of MGM is a pivotal move to bolster its entertainment platform. This acquisition has expanded Amazon’s intellectual property library, enhancing its content production capabilities and reinforcing its position as a major player in the entertainment industry. The merger aims to transform Amazon into a comprehensive entertainment hub, merging traditional film production with new media streaming services.

In a landmark deal, Microsoft acquired Activision Blizzard for $68.7 billion, significantly enhancing its gaming portfolio. This acquisition is particularly strategic as it expands Microsoft’s footprint in mobile gaming, leveraging Activision’s popular titles like Candy Crush Saga to tap into the vast mobile gaming market. This move is set to accelerate Microsoft’s growth across various gaming platforms, including mobile, PC, console, and cloud services, underscoring its commitment to becoming a leader in the digital entertainment space.

DAZN has strengthened its position in sports streaming by acquiring ELEVEN Sports, which includes rights to stream significant European football leagues. This deal not only enhances DAZN’s content offerings but also its operational capabilities in digital sports broadcasting. The acquisition aligns with DAZN’s strategy to become a central platform for sports fans, incorporating services like ticket purchasing, sports betting, and on-demand media.

Top Key Players in the Market

- International Business Machines Corporation (IBM)

- Amazon.com Inc.

- Brightcove Inc.

- Roku, Inc.

- Tencent Holdings Ltd.

- The Walt Disney Company

- Alphabet Inc.

- Hulu, LLC

- Apple Inc.

- Netflix, Inc.

- Others

Recent Developments

- IBM completed its acquisition of StreamSets and webMethods from Software AG in July 2024, enhancing its data ingestion and integration capabilities for AI and automation solutions.

- Amazon merged its miniTV streaming service with MX Player in India in October 2024, creating a combined platform called Amazon MX Player with over 250 million users.

- Brightcove agreed to be acquired by Bending Spoons for $233 million in November 2024, with plans to go private after the deal closes in 2025.

Report Scope

Report Features Description Market Value (2024) USD 104.2 Bn Forecast Revenue (2034) USD 285.4 Bn CAGR (2025-2034) 10.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution (Software, Services), By Channel (Satellite TV, Cable TV, IPTV, OTT Streaming), By Revenue Model (Subscription-based, Transaction-based, Advertising-based), By Vertical (E-Learning, Healthcare, Government, Sports, Gaming, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape International Business Machines Corporation (IBM), Amazon.com Inc., Brightcove Inc., Roku Inc., Tencent Holdings Ltd., The Walt Disney Company, Alphabet Inc., Hulu LLC , Apple Inc., Netflix, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- International Business Machines Corporation (IBM)

- Amazon.com Inc.

- Brightcove Inc.

- Roku, Inc.

- Tencent Holdings Ltd.

- The Walt Disney Company

- Alphabet Inc.

- Hulu, LLC

- Apple Inc.

- Netflix, Inc.

- Others