Global Projector Image Processing Chip Market Size, Share, Statistics Analysis Report By Component Type (Graphics Processing Units (GPUs), Scaler Chips, Signal Processing Chips, Embedded AI Chips, Others), By Chip Model (1-chip DLP, 3-chip DLP), By Technology Type (Digital Light Processing (DLP) Chips, Liquid Crystal Display (LCD) Chips, Liquid Crystal on Silicon (LCoS) Chips), By End-User (Residential Consumers, Businesses & Enterprises, Educational Institutions, Entertainment & Media Industry, Automotive Manufacturers, Healthcare, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Mar 25

- Report ID: 141626

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Scope

- Key Takeaways

- Analysts’ Viewpoint

- Key Statistics

- Regional Analysis

- By Component Type

- By Chip Model

- By Technology Type

- By End-User

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Report Scope

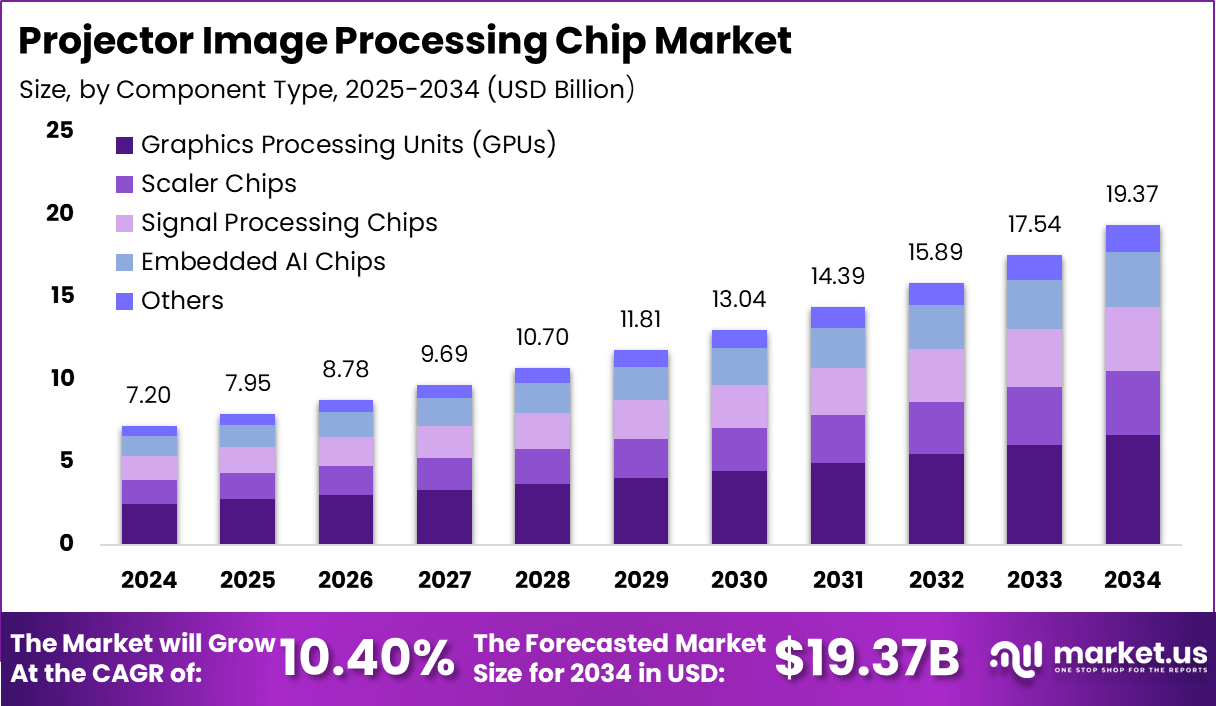

The Global Projector Image Processing Chip Market is expected to be worth around USD 19.37 Billion by 2034, up from USD 7.2 Billion in 2024. It is expected to grow at a CAGR of 10.40% from 2025 to 2034.

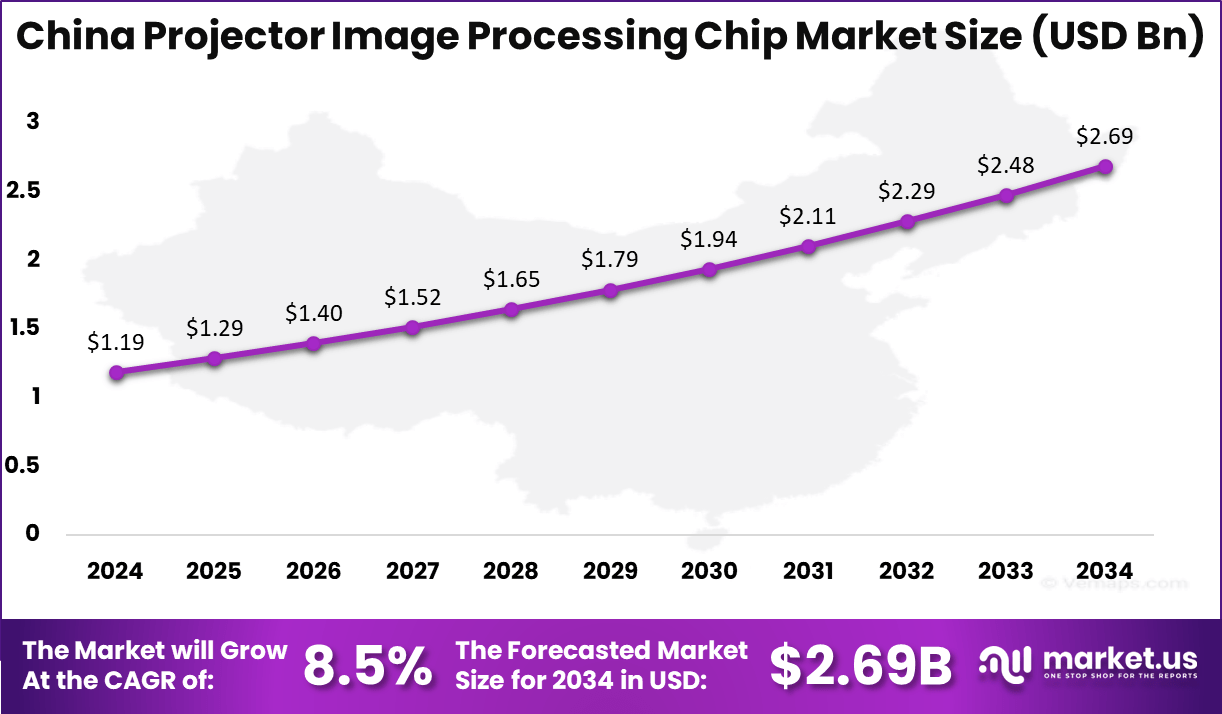

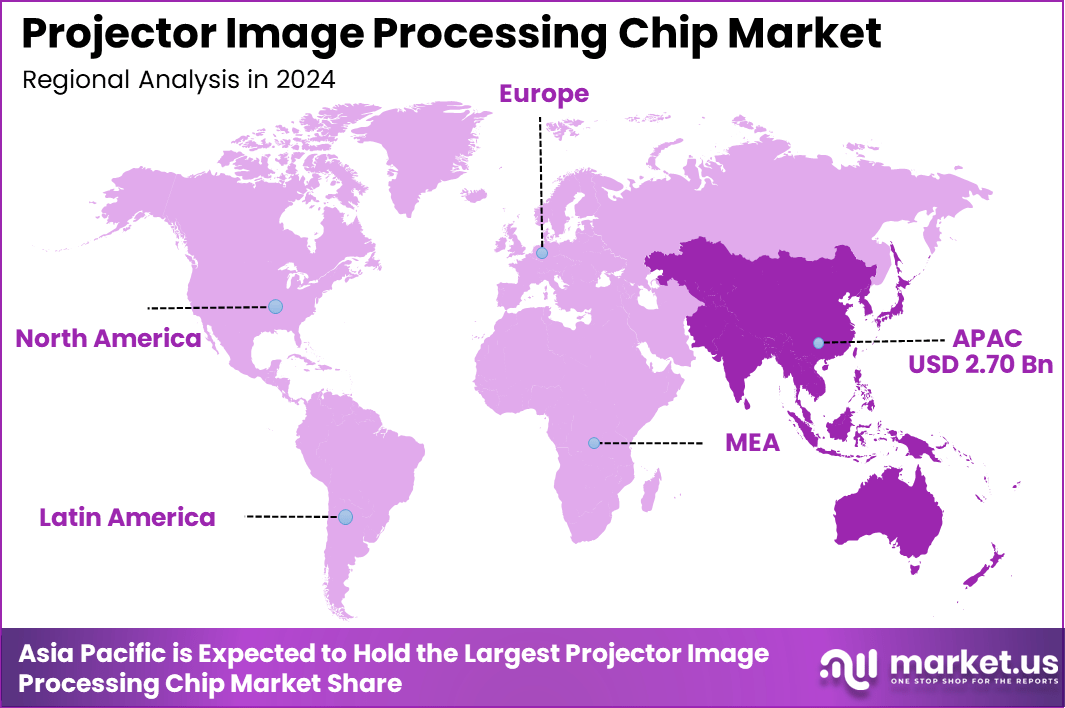

In 2024, Asia-Pacific held a dominant market position, capturing over a 37.6% share and earning USD 2.70 Billion in revenue. Further, China dominates the market by USD 1.19 Billion, steadily holding a strong position with a CAGR of 8.5%.

The projector image processing chip market is an essential segment within the broader projector industry, focusing on the development and integration of specialized chips that enhance image quality, processing speed, and overall performance of projection devices. These chips play a pivotal role in various applications, including business presentations, educational tools, home entertainment systems, and large-scale cinematic displays.

Several key factors are propelling the growth of the projector image processing chip market. The increasing demand for high-definition and 4K content necessitates advanced processing capabilities to deliver sharp and vibrant images.

Additionally, the rise in educational and corporate sectors adopting projectors for interactive learning and presentations fuels the need for efficient image processing solutions. The growing popularity of home theaters and the entertainment industry’s continuous expansion further contribute to the market’s upward trajectory.

Key Takeaways

- Market Growth: The projector image processing chip market is projected to grow from USD 7.2 billion in 2024 to USD 19.37 billion by 2034, reflecting significant expansion.

- CAGR: The market is expected to grow at a CAGR of 10.40% over the forecast period, showcasing steady and strong demand.

- Component Type: Graphics Processing Units (GPUs) account for 34.5% of the market, highlighting their crucial role in image processing.

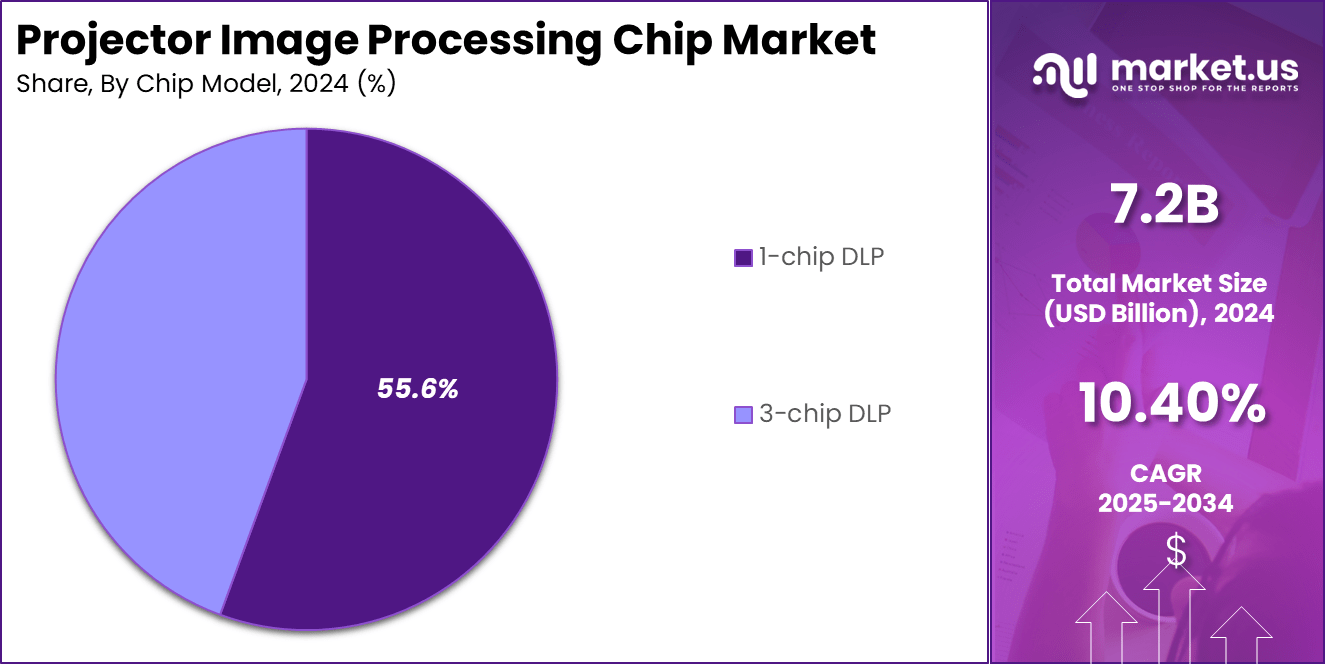

- Chip Model: 1-chip DLP technology dominates with a 55.6% market share, indicating strong preference due to efficiency and cost-effectiveness.

- Technology Type: Digital Light Processing (DLP) chips hold 42.8% of the market, making them a key technology driving industry growth.

- End-User Segment: Automotive manufacturers represent 30.8% of the demand, emphasizing the rising use of projector chips in vehicle displays and head-up displays (HUDs).

- Regional Insights: Asia Pacific leads with a 37.6% market share, indicating strong growth potential in the region. China contributes USD 1.19 billion to the market, with a CAGR of 8.5%, underscoring its role as a key market player.

Analysts’ Viewpoint

Opportunities within the projector image processing chip market are abundant, particularly with the advent of emerging technologies. The integration of artificial intelligence (AI) and machine learning algorithms into image processing chips can lead to smarter projectors capable of real-time image enhancements and adaptive functionalities.

Moreover, the development of energy-efficient chips aligns with the global push towards sustainability, presenting manufacturers with prospects to cater to environmentally conscious consumers. Technological advancements are at the forefront of this market’s evolution. The shift towards Digital Light Processing (DLP) technology, which utilizes digital micromirror devices (DMD), has revolutionized image projection by offering higher contrast ratios and improved color accuracy.

Furthermore, innovations such as the development of ultra-high frame rate digital light projectors using chip-scale LED-on-CMOS technology have paved the way for more compact and efficient projection systems. These advancements not only enhance the viewing experience but also expand the applicability of projectors in fields like medical imaging and interactive displays.

Key Statistics

Users and Usage

- User Base: Approximately 10 million projectors are used globally in various sectors such as education, entertainment, and business.

- Usage Patterns: Commonly used in 80% of educational institutions for presentations and in 60% of home theaters for enhanced viewing experiences.

Quantity

- Production Volume: In 2023, the production volume of projector image processing chips was approximately 12 million units.

- Sales Volume: Sales figures were around 10 million units, indicating a strong demand in the market.

Other Numerical Data

- Resolution and Performance: Projector image processing chips support various resolutions, including:

- HD (720p): Used in 30% of projectors.

- Full HD (1080p): Used in 40% of projectors.

- 4K (2160p): Used in 30% of projectors, enhancing image quality and user experience.

- Power Consumption: Chips are designed to optimize power efficiency, contributing to reduced energy consumption in projectors, with an average power consumption of 150-250 watts.

Regional Analysis

China Region Market Size

In Asia-Pacific, China dominates the market size by USD 1.19 Billion, holding a strong position steadily with a CAGR of 8.5%. The country’s rapid advancements in digital display technologies, coupled with increasing demand from automotive and consumer electronics sectors, are key factors fueling its market expansion. As China continues to invest in smart infrastructure, education technology, and immersive entertainment solutions, the adoption of projector image processing chips is rising significantly.

The Asia-Pacific region as a whole is emerging as the fastest-growing market, driven by rising demand for high-resolution projection technology across various industries. Countries like China, Japan, and South Korea are leading the adoption of Digital Light Processing (DLP) chips and Graphics Processing Units (GPUs), which enhance the image quality and efficiency of modern projectors.

The growing demand for automotive displays, home entertainment projectors, and corporate presentation systems further strengthens the market outlook. Moreover, increasing government initiatives in digital classrooms and smart city projects contribute to the surge in projector adoption, boosting the need for advanced image processing chips. With continued technological advancements and strong manufacturing capabilities, China and the broader Asia-Pacific region are expected to maintain their leadership in this market.

Asia Pacific Market Size

In 2024, Asia-Pacific held a dominant market position, capturing more than a 37.6% share, equating to USD 2.70 billion in revenue. This leadership is primarily driven by the region’s rapid technological advancements and the increasing adoption of projection technologies across various sectors.

One of the key factors contributing to this dominance is the significant investment in the education sector. Governments in countries like China, India, and Japan are heavily investing in digital classrooms and e-learning platforms, necessitating the use of advanced projectors equipped with sophisticated image processing chips. For instance, initiatives like India’s Digital India campaign aim to integrate technology into education, boosting the demand for such projectors.

Moreover, the burgeoning consumer electronics market in Asia-Pacific plays a crucial role. The rising middle-class population with increasing disposable income has led to a surge in home entertainment systems, including projectors with high-quality image processing capabilities. Additionally, the region’s strong manufacturing base, particularly in China, allows for cost-effective production and rapid innovation in projector technologies.

Furthermore, the corporate sector’s expansion in Asia-Pacific has led to increased demand for projectors in business settings, such as conferences and presentations. The emphasis on interactive and collaborative work environments has further propelled the need for advanced projection solutions. Collectively, these factors solidify Asia-Pacific’s leading position in the projector image processing chip market.

By Component Type

In 2024, the Graphics Processing Units (GPUs) segment held a dominant market position, capturing more than a 34.5% share in the projector image processing chip market. The primary reason for this leadership is the increasing demand for high-resolution visuals, faster processing, and real-time image enhancements in projectors.

GPUs play a crucial role in ensuring smooth rendering of complex visuals, reducing lag, and enhancing color accuracy, making them essential for applications such as home theaters, gaming projectors, and professional presentations. The surge in 4K and 8K projection technology has further fueled the demand for powerful GPUs, as they provide the necessary processing capabilities to handle high-resolution content efficiently.

Additionally, the adoption of GPUs in automotive heads-up displays (HUDs) and interactive education projectors is expanding, contributing to the segment’s growth. With continuous advancements in AI-driven graphics processing and power efficiency, the GPU segment is expected to maintain its dominance as industries increasingly prioritize superior image quality and seamless performance in projection technologies.

By Chip Model

In 2024, the 1-chip DLP segment held a dominant market position, capturing more than a 55.6% share in the projector image processing chip market. The primary reason for this leadership is the cost-effectiveness, compact design, and efficient performance of 1-chip DLP technology, making it the preferred choice for a wide range of applications. These projectors deliver sharp and vibrant images while maintaining affordability, which has driven their adoption in home entertainment, business presentations, and educational institutions.

Additionally, 1-chip DLP projectors offer high brightness, reliable performance, and minimal maintenance, making them ideal for classrooms, conference rooms, and portable projector solutions. Unlike 3-chip DLP projectors, which are more expensive and designed for high-end applications like cinema and large-scale events, 1-chip DLP models provide a balanced combination of performance and cost, catering to mainstream users.

With the continuous advancements in digital light processing (DLP) technology, the 1-chip DLP segment is expected to maintain its dominance, as businesses and consumers increasingly seek high-quality yet budget-friendly projection solutions.

By Technology Type

In 2024, the Digital Light Processing (DLP) Chips segment held a dominant market position, capturing more than a 42.8% share in the projector image processing chip market. This leadership is driven by DLP technology’s superior image quality, high contrast ratios, and long-lasting performance, making it the preferred choice across multiple industries.

Unlike Liquid Crystal Display (LCD) and Liquid Crystal on Silicon (LCoS) chips, DLP chips use millions of microscopic mirrors to create sharp, high-resolution images with minimal motion blur and excellent brightness levels.

DLP chips are widely adopted in business presentations, education, home theaters, and automotive heads-up displays (HUDs) due to their reliability and efficiency. Additionally, DLP projectors require less maintenance compared to LCD-based systems, as they do not use organic materials that degrade over time. Their compact size and energy efficiency also make them ideal for portable and ultra-short-throw projectors.

With increasing demand for 4K and high-frame-rate projection technology, DLP chips are expected to maintain dominance, as they continue to evolve with better light efficiency, improved color accuracy, and enhanced durability, ensuring a strong market position in the coming years.

By End-User

In 2024, the Automotive Manufacturers segment held a dominant market position, capturing more than a 30.8% share in the projector image processing chip market. The rapid adoption of advanced display technologies in vehicles, such as heads-up displays (HUDs), digital dashboards, and augmented reality (AR) navigation systems, has significantly driven demand for high-performance image processing chips in the automotive sector.

Modern vehicles, particularly electric and luxury cars, are increasingly integrating high-resolution projection-based displays to enhance driver safety, convenience, and in-car entertainment. HUD technology, which projects critical driving information directly onto the windshield, is becoming a standard feature in premium vehicles, reducing driver distractions and improving road awareness. Additionally, rear-seat entertainment projectors are gaining popularity, further boosting the demand for image processing chips in automobiles.

With automotive companies heavily investing in AI-powered and interactive display technologies, the need for efficient image processing chips will continue to rise. As autonomous driving and smart cockpit innovations evolve, the Automotive Manufacturers segment is expected to maintain its leadership, ensuring a steady demand for advanced projection technologies in the coming years.

Key Market Segments

By Component Type

- Graphics Processing Units (GPUs)

- Scaler Chips

- Signal Processing Chips

- Embedded AI Chips

- Others

By Chip Model

- 1-chip DLP

- 3-chip DLP

By Technology Type

- Digital Light Processing (DLP) Chips

- Liquid Crystal Display (LCD) Chips

- Liquid Crystal on Silicon (LCoS) Chips

By End-User

- Residential Consumers

- Businesses & Enterprises

- Educational Institutions

- Entertainment & Media Industry

- Automotive Manufacturers

- Healthcare

- Others

Driving Factors

Advancements in Display Technologies

The projector image processing chip market is experiencing significant growth, primarily driven by continuous advancements in display technologies. Innovations such as 4K and 8K resolutions, High Dynamic Range (HDR), and 3D projection have heightened consumer expectations for superior visual experiences. To meet these demands, manufacturers are integrating advanced image processing chips into projectors, enabling enhanced color accuracy, contrast ratios, and overall image clarity.

These technological improvements not only cater to the entertainment industry but also find applications in education, corporate presentations, and home theaters, thereby broadening the market’s scope. As display technologies continue to evolve, the reliance on sophisticated image processing chips is expected to intensify, further propelling market growth.

Restraining Factors

High Production Costs

Despite the promising advancements, the high production costs associated with sophisticated image processing chips pose a significant restraint on the projector market. Developing and manufacturing these advanced chips require substantial investment in research and development, specialized equipment, and skilled labor.

These costs are often transferred to consumers, resulting in higher-priced projectors that may not be affordable for all segments of the market. Additionally, the complexity of integrating these chips into projector systems can lead to increased manufacturing time and potential supply chain challenges. These factors collectively hinder the widespread adoption of high-end projectors, limiting market expansion.

Growth Opportunities

Integration with Emerging Technologies

The convergence of projector image processing chips with emerging technologies presents substantial growth opportunities. The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms enables projectors to adapt in real-time, optimizing image quality based on content and ambient conditions.

Additionally, the rise of Augmented Reality (AR) and Virtual Reality (VR) applications opens new avenues for projectors equipped with advanced image processing capabilities. These developments can lead to immersive experiences in gaming, education, and professional training sectors. Manufacturers that capitalize on these integrations are poised to tap into new markets and diversify their product offerings, driving future growth.

Challenging Factors

Competition from Alternative Display Technologies

The projector market faces challenges from alternative display technologies, such as large-screen LED and OLED displays, which offer high-resolution images without the need for external projection devices. These alternatives are becoming increasingly affordable and accessible, appealing to both consumers and businesses seeking compact and straightforward display solutions.

The convenience of direct-view displays, coupled with their declining costs, poses a significant challenge to the projector market. To remain competitive, projector manufacturers must innovate by enhancing the portability, affordability, and functionality of their products, ensuring they offer unique advantages over alternative technologies.

Growth Factors

Rising Demand for Portable Projection Solutions

The projector image processing chip market is experiencing significant growth, primarily driven by the escalating demand for portable projection solutions. This surge is largely attributed to the increasing need for flexible, on-the-go display options in both personal and professional settings.

As remote work and hybrid working models become more prevalent, professionals require portable devices that facilitate seamless presentations and collaborations outside traditional office environments. Additionally, consumers are seeking compact entertainment systems that can be easily transported, enhancing their viewing experiences at home or during travel.

Emerging Trends

Integration of Smart Features in Projectors

An emerging trend in the projector image processing chip market is the integration of smart features into projection devices. This trend is driven by consumer desire for devices that offer more than basic projection capabilities. Modern projectors now come equipped with built-in operating systems, internet connectivity, and compatibility with various streaming services, transforming them into versatile entertainment and presentation tools.

The incorporation of advanced image processing chips is crucial in supporting these smart functionalities, ensuring smooth operation and high-quality visual output. As consumers increasingly seek multifunctional devices, the demand for projectors with integrated smart features is expected to rise, influencing manufacturers to innovate and integrate sophisticated chip technologies to meet these evolving preferences.

Business Benefits

Enhanced User Engagement and Learning Outcomes

The adoption of advanced projector image processing chips offers significant business benefits, particularly in educational and corporate sectors. Interactive projectors, which rely on sophisticated image processing, are projected to see substantial growth. In educational settings, these projectors facilitate interactive learning experiences, allowing educators to engage students more effectively through dynamic presentations and collaborative activities.

Similarly, businesses benefit from enhanced meeting environments where interactive projectors enable real-time collaboration, brainstorming, and decision-making processes. The improved image quality and responsiveness provided by advanced processing chips ensure that visuals are clear and engaging, thereby enhancing overall communication and productivity.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Optoma has established itself as a key player in the projector industry by consistently introducing innovative products that cater to diverse consumer needs. The company focuses on delivering high-quality projectors suitable for home entertainment, business, and educational purposes. Optoma’s commitment to integrating advanced technologies, such as 4K resolution and laser light sources, has strengthened its market position.

BenQ has made significant strides in the projector market by launching products that blend cutting-edge technology with user-friendly features. In September 2020, BenQ introduced the TH585, a Full HD home entertainment projector designed to deliver immersive viewing experiences. This product launch underscores BenQ’s dedication to meeting the evolving demands of consumers seeking high-quality visual solutions.

Barco NV has positioned itself as a leader in the projector industry by offering advanced projection solutions tailored for professional applications, including cinema, events, and large venues. The company has been proactive in expanding its market presence through strategic product launches and collaborations. Barco’s commitment to innovation is evident in its development of high-end projectors that cater to the specific needs of various industries.

Top Key Players in the Market

- Optoma

- BenQ

- Barco NV

- Acer Inc.

- ViewSonic Corporation

- XGIMI Technology Co.

- Delta Electronics, Inc.

- Panasonic Holdings Corporation

- JVC Kenwood Holdings Inc.

- Appotronics Corp

- Mitsubishi Electric Corporation

- LG Corporation

- Canon Inc.

- Christie Digital Systems USA, Inc.

- Digital Projection

- Dell Technologies

- ACTO Technologies Inc.

- ASUSTeK Computer Inc.

- Others

Recent Developments

- In 2024, the global 3D projector market saw significant growth, driven by increasing adoption in cinemas, education, and gaming, as demand for immersive viewing experiences continues to rise.

- In 2024, the DLP projector market expanded rapidly, fueled by the growing preference for high-resolution, compact, and energy-efficient projection technologies across business and entertainment sectors.

Report Scope

Report Features Description Market Value (2024) USD 7.2 Billion Forecast Revenue (2034) USD 19.37 Billion CAGR (2025-2034) 10.40% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component Type (Graphics Processing Units (GPUs), Scaler Chips, Signal Processing Chips, Embedded AI Chips, Others), By Chip Model (1-chip DLP, 3-chip DLP), By Technology Type (Digital Light Processing (DLP) Chips, Liquid Crystal Display (LCD) Chips, Liquid Crystal on Silicon (LCoS) Chips), By End-User (Residential Consumers, Businesses & Enterprises, Educational Institutions, Entertainment & Media Industry, Automotive Manufacturers, Healthcare, Others), By Revenue Model (Subscription-Based, Ad-Supported, Pay-Per-View, Others) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Optoma, BenQ, Barco NV, Acer Inc., ViewSonic Corporation, XGIMI Technology Co., Delta Electronics, Inc., Panasonic Holdings Corporation, JVC Kenwood Holdings Inc., Appotronics Corp, Mitsubishi Electric Corporation, LG Corporation, Canon Inc., Christie Digital Systems USA, Inc., Digital Projection, Dell Technologies, ACTO Technologies Inc., ASUSTeK Computer Inc., Others Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Projector Image Processing Chip MarketPublished date: Mar 25add_shopping_cartBuy Now get_appDownload Sample

Projector Image Processing Chip MarketPublished date: Mar 25add_shopping_cartBuy Now get_appDownload Sample -

-

- Optoma

- BenQ

- Barco NV

- Acer Inc.

- ViewSonic Corporation

- XGIMI Technology Co.

- Delta Electronics, Inc.

- Panasonic Holdings Corporation

- JVC Kenwood Holdings Inc.

- Appotronics Corp

- Mitsubishi Electric Corporation

- LG Corporation

- Canon Inc.

- Christie Digital Systems USA, Inc.

- Digital Projection

- Dell Technologies

- ACTO Technologies Inc.

- ASUSTeK Computer Inc.

- Others