Global Digital Signage in Quick-Service Restaurants (QSRs) Market Size, Share, Statistics Analysis Report By Component (Hardware, Software), By Application (Indoor Signage, Outdoor Signage), By Resolution (8K, 4K, Full High Definition (FHD), High Definition (HD), Lower than HD), By Technology (LCD, LED, OLED, Projection), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140253

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Scope

- Key Takeaways

- Experts Market Review

- Key Statistics

- Regional Analysis

- By Component

- By Application

- By Resolution

- By Technology

- By Signage Size

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Report Scope

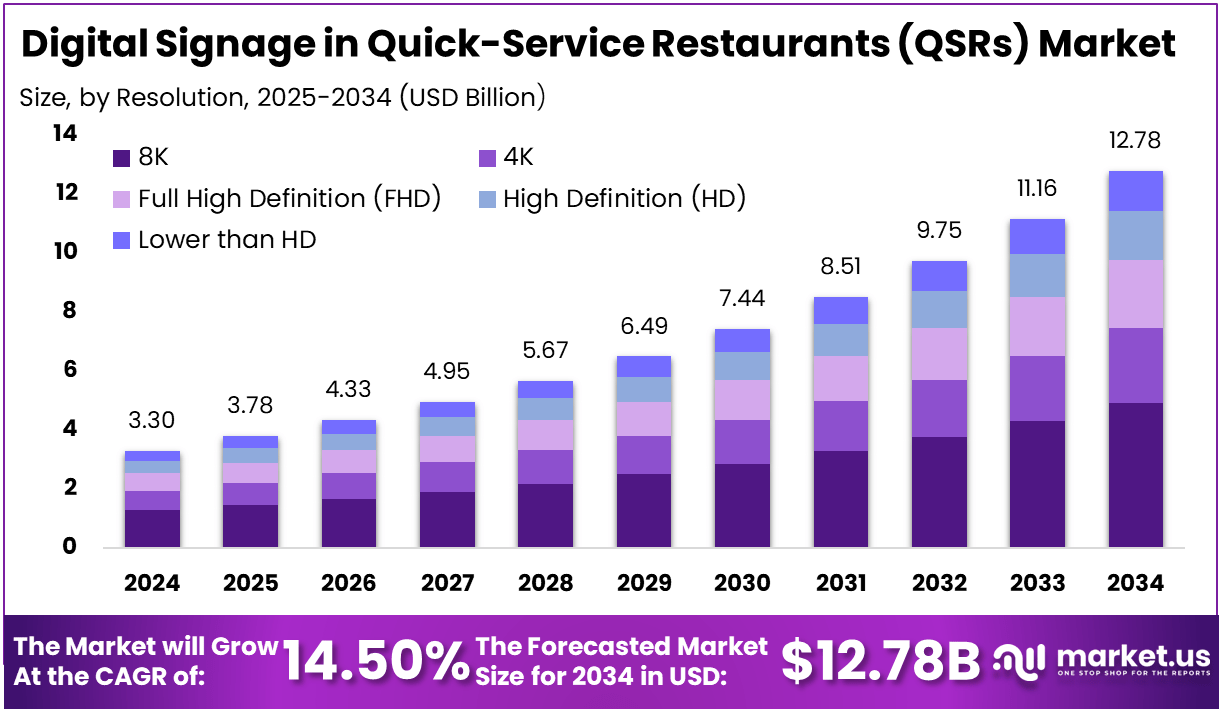

The Global Digital Signage market in Quick-Service Restaurants (QSRs) Market is expected to be worth around USD 12.78 Billion By 2034, up from USD 3.3 billion in 2024. It is expected to grow at a CAGR of 14.50% from 2025 to 2034.

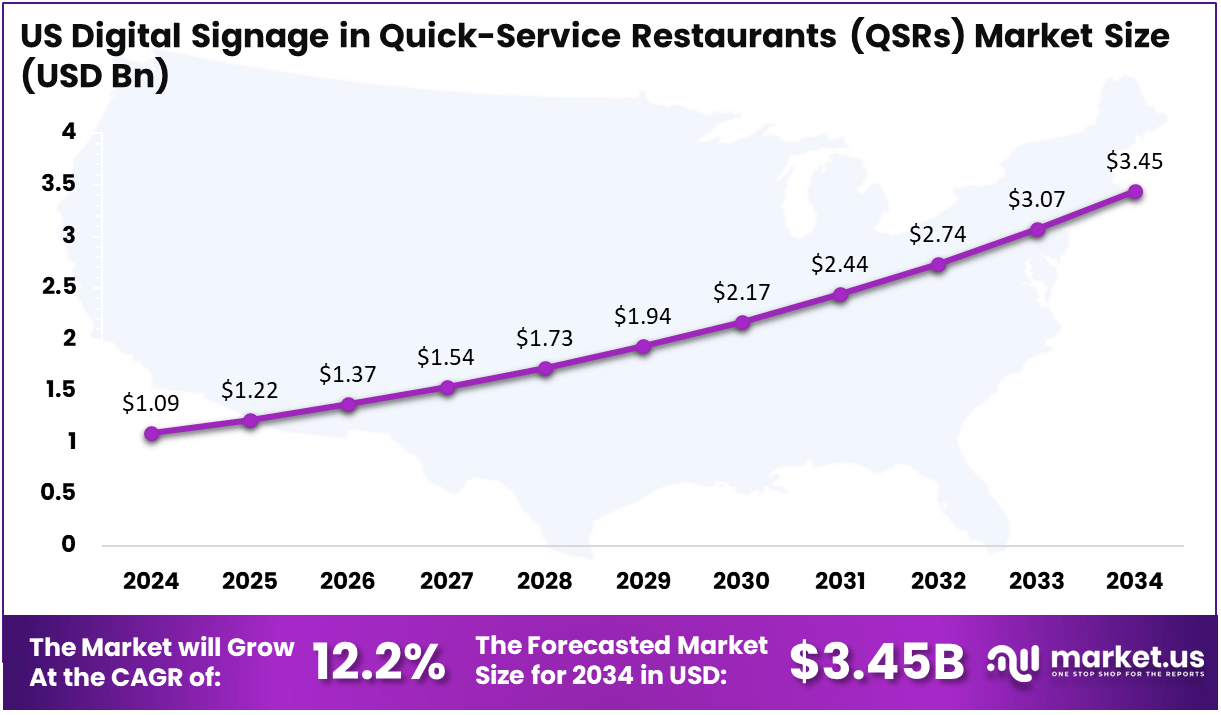

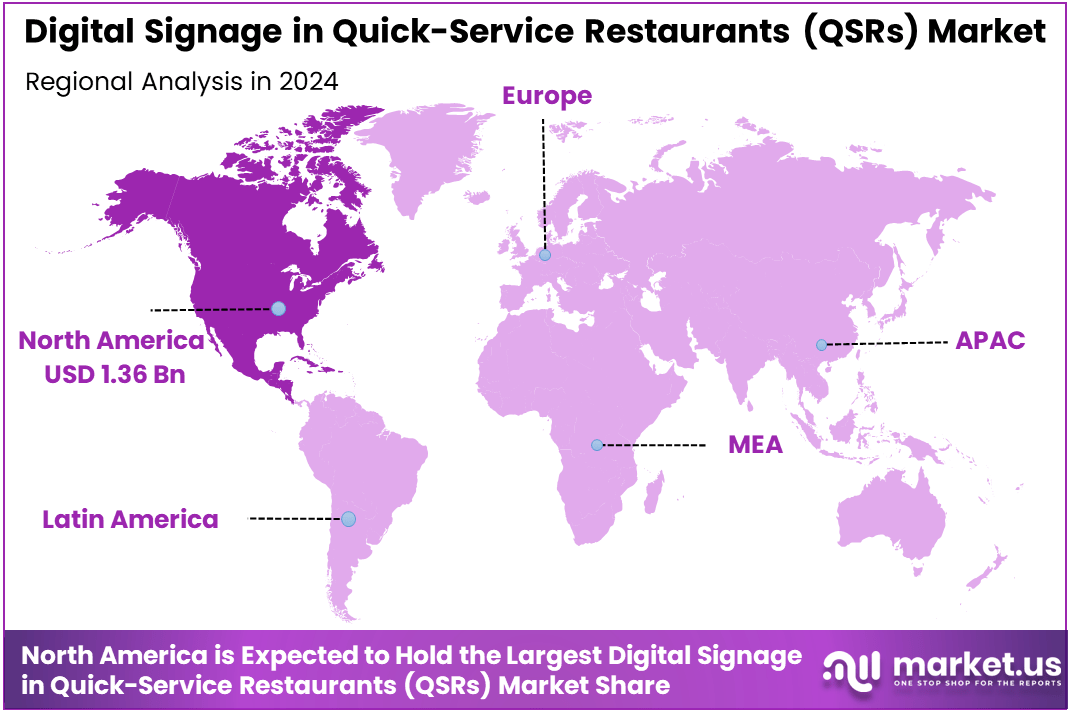

In 2024, North America held a dominant market position, capturing over a 41.5% share and earning USD 1.36 Billion in revenue. Further, the United States dominates the market by USD 1.09 Billion, steadily holding a strong position with a CAGR of 12.2%.

The market for digital signage in QSRs is experiencing significant growth as the restaurant industry increasingly adopts technology to improve customer service and operational efficiency. With the growing demand for modern, tech-driven solutions to enhance customer experiences, digital signage has become a crucial component for restaurants looking to stay competitive.

The market is expanding due to rising consumer expectations for seamless, interactive experiences and the need for QSRs to adapt quickly to changing trends, such as personalized promotions and real-time updates. The use of digital signage also enables restaurants to reduce their reliance on printed menus and traditional signage, lowering long-term costs.

Several key factors are driving the growth of the digital signage market in QSRs. First and foremost, there is an increasing need for efficiency and speed in fast food services, where customer experience is paramount. Digital displays allow for quicker menu updates, real-time promotions, and faster customer interaction, directly impacting customer satisfaction and operational efficiency.

Secondly, the rise of mobile-based ordering and delivery services has led QSRs to invest in technologies that enhance both in-store and online customer engagement. Additionally, the increasing affordability of digital signage solutions, alongside advancements in cloud-based content management systems, has made it easier for QSRs to integrate and manage digital signage. Finally, growing trends toward personalization and the ability to display targeted ads are propelling the adoption of digital signage in the sector.

Key Takeaways

- Market Value Growth: The digital signage market in QSRs is projected to grow from USD 3.3 billion in 2024 to USD 12.78 billion by 2034, reflecting a CAGR of 14.50%.

- Market Segmentation by Component: Hardware accounts for 48.7% of the market share, indicating its significant role in the digital signage ecosystem for QSRs.

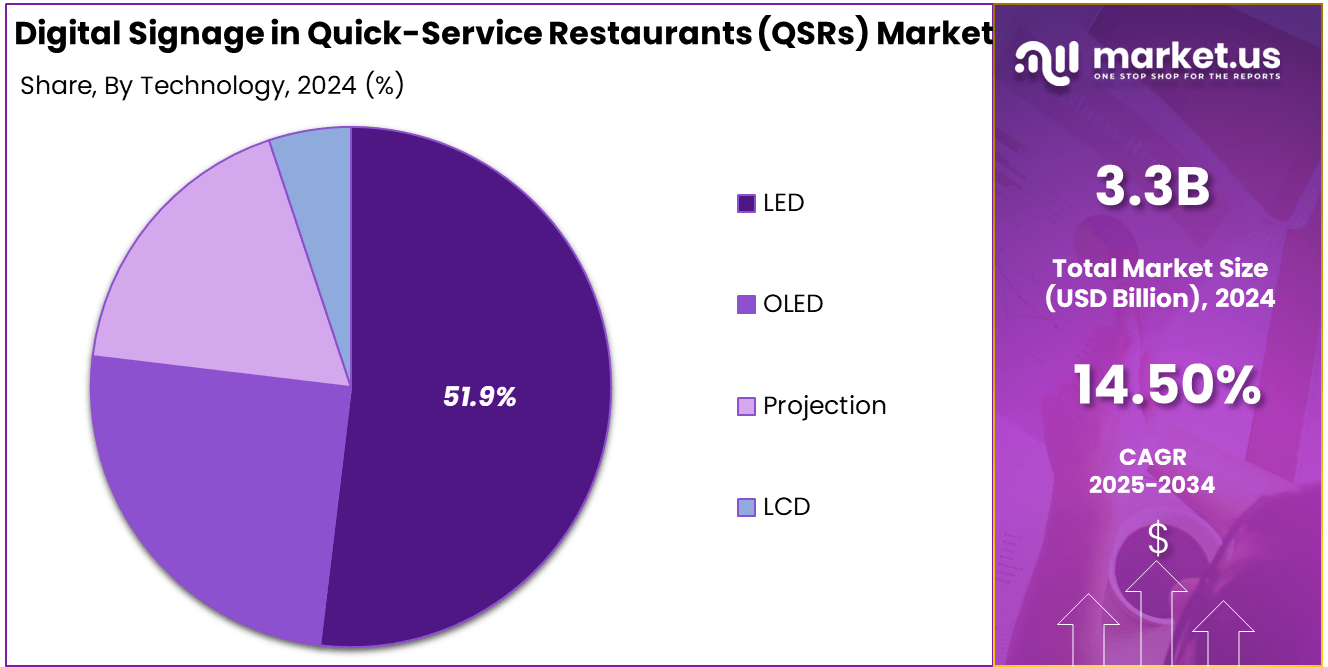

- Technology Preference: LED technology leads the market, comprising 51.9% of the market share, showcasing its dominance in the digital signage landscape due to its energy efficiency and brightness.

- Resolution Trends: 8K resolution is a growing trend, holding 38.4% of the market, reflecting the increasing demand for high-quality, ultra-clear displays in QSRs.

- Application Focus: Indoor signage is the most common application, accounting for 68.7% of the market share, highlighting the importance of in-store digital signage for customer engagement and experience.

- Signage Size: The Below 32 Inches category holds 60.2% of the market, suggesting that smaller, compact displays are more commonly used in QSR environments.

- Geographic Dominance: North America is the largest market region, with a market share of 41.5%, driven by high adoption rates in QSRs across the region.

- The US Market: The US market alone is valued at USD 1.09 billion, making it a key driver of growth in North America.

- CAGR in North America: The North American market is expected to grow at a CAGR of 12.2%, reflecting continued expansion in digital signage adoption within QSRs.

Experts Market Review

The demand for digital signage in QSRs is being fueled by changing consumer behaviors and expectations. Today’s customers are more tech-savvy and prefer interactive, visually engaging experiences. Digital signage caters to this shift by allowing QSRs to provide digital menu boards that are easy to read, update, and even customize based on customer preferences or time of day.

As consumers increasingly seek convenience, digital signage solutions enable QSRs to offer real-time information, promote daily specials, or showcase upselling opportunities with minimal manual effort. Moreover, the growth of the takeaway and delivery segments has heightened the need for digital solutions that enhance the overall ordering experience for customers, both in-store and online.

The market for digital signage in QSRs offers several growth opportunities. One key opportunity is the integration of artificial intelligence (AI) and machine learning with digital signage systems. By leveraging AI, QSRs can analyze customer preferences and behaviors to offer more personalized and targeted content, increasing sales and customer loyalty.

Another opportunity lies in the expansion of digital signage into emerging markets, where the adoption of new technologies is rapidly growing. Furthermore, as more QSRs implement digital signage, the demand for complementary solutions such as self-ordering kiosks, mobile integration, and even digital payment systems will continue to rise, providing new avenues for innovation and growth within the market.

Technological advancements are a major driving force in the digital signage market for QSRs. The integration of cloud-based software has simplified the management of digital signage, allowing QSRs to remotely control content across multiple locations, ensuring consistency and efficiency. Advancements in display technology, such as ultra-high-definition screens and interactive touchscreens, have also enhanced the effectiveness of digital signage, making it more engaging for customers.

Additionally, the growing use of data analytics is allowing QSRs to optimize content based on real-time customer interactions and sales trends. As technologies like artificial intelligence, 5G connectivity, and machine learning continue to evolve, the potential for digital signage to become even more personalized and interactive will only grow, offering greater opportunities for QSRs to enhance both customer experiences and operational efficiencies.

Key Statistics

Market Presence

- Quick-service restaurants account for approximately 20% of the digital signage industry.

- Digital signage deployments in QSRs include dynamic menu boards and promotional displays, enhancing customer engagement and operational efficiency.

User Engagement

- 74% of restaurant customers prioritize clear and engaging menu displays when choosing where to eat.

- About 73% of diners believe that technology, such as digital menus, improves their overall dining experience.

Sales Impact

- Restaurants using digital signage have reported an average sales increase of 3% per transaction due to effective menu displays.

- Digital menu boards can increase sales by up to 30% on average.

- Customers influenced by digital signage promotions account for 29.5% of purchasing decisions in restaurants.

Consumer Behavior

- 80% of customers have made unplanned purchases after seeing items advertised on digital displays.

- Approximately 30% of consumers consider digital signage significant when making purchasing decisions.

Operational Efficiency

- Digital signage has been shown to improve order accuracy, contributing to overall customer satisfaction.

- The implementation of digital menu boards has led to a reported increase in employee productivity by 20%.

Regional Analysis

US Region Market Size

In North America, the United States dominates the digital signage market for quick-service restaurants (QSRs), holding a significant market size of USD 1.09 billion. The US has consistently maintained a strong position within the market, driven by a high adoption rate of advanced technologies across the QSR sector.

The continued growth in digital signage solutions in the region reflects the increasing need for innovative customer engagement strategies, particularly in fast-paced, high-volume restaurant environments. The adoption of digital signage in the US is being propelled by its ability to streamline operations, reduce costs, and enhance the overall customer experience.

The US market also benefits from technological advancements, such as the integration of LED displays, cloud-based content management systems, and interactive screens, which have made digital signage more accessible and effective for QSRs. This trend is further supported by the need for personalized promotions, real-time updates, and improved operational efficiencies.

As a result, the US is expected to maintain a strong CAGR of 12.2%, reflecting a continued shift toward technology-driven solutions within the QSR industry. This growth highlights the increasing reliance on digital signage to improve service delivery, customer interaction, and ultimately, business profitability within the US market.

North America Market Size

In 2024, North America held a dominant market position, capturing more than 41.5% of the global digital signage market in quick-service restaurants (QSRs), generating a substantial USD 1.36 billion in revenue. The region’s stronghold is largely driven by the widespread adoption of technology in the restaurant industry, especially in the United States, which remains a leader in digital transformation within the QSR sector.

North American QSRs are increasingly turning to digital signage to streamline operations, enhance customer engagement, and boost operational efficiency. The region’s high-tech infrastructure, robust consumer demand for interactive experiences, and the preference for personalized promotions are key drivers behind this market dominance.

One of the primary reasons North America is leading the market is the region’s early adoption of digital signage solutions, coupled with the increasing affordability of technology. With more QSRs relying on LED screens, interactive kiosks, and cloud-based content management systems, the region has seen a surge in digital signage installations.

Furthermore, the market benefits from strong consumer expectations for modern, seamless experiences, with digital displays providing an effective means to meet these demands. As a result, North America continues to maintain its dominant position, with the US alone contributing significantly to the revenue generation, underpinned by a CAGR of 12.2%.

By Component

In 2024, the Hardware segment held a dominant market position in the digital signage market for quick-service restaurants (QSRs), capturing more than 48.7% of the market share. This leadership can be attributed to the essential role that hardware components such as displays, media players, projectors, and other related devices play in the functionality of digital signage systems.

The demand for high-quality, durable, and energy-efficient hardware has surged as QSRs look to enhance customer experiences and operational efficiency. Displays, especially LED screens, are a critical part of digital signage solutions, providing bright, clear, and visually engaging content that can be updated in real time to reflect promotions, menu changes, or advertisements.

Additionally, hardware investments have become more cost-effective, with technological advancements lowering the overall cost of displays and media players. The increased adoption of cloud-based solutions also means that QSRs can manage and update content remotely, further driving demand for reliable and scalable hardware solutions.

Given these factors, the Hardware segment is expected to maintain its leading position, as it forms the backbone of digital signage systems in QSRs, offering essential functionalities that support seamless operations and customer engagement.

By Application

In 2024, the Indoor Signage segment held a dominant market position, capturing more than 68.7% of the market share in the digital signage industry for quick-service restaurants (QSRs). This dominance is primarily due to the critical role that indoor signage plays in enhancing customer experiences within the restaurant environment. Menu boards, promotional displays, ordering kiosks, and queue management systems are essential tools that drive customer engagement, streamline operations, and increase sales.

Indoor signage allows QSRs to deliver real-time updates, showcase personalized promotions, and improve the ordering process, all of which contribute to a smoother and more efficient dining experience. Ordering kiosks, for example, reduce wait times and allow customers to customize their orders, while menu boards provide dynamic, visually appealing content that can be quickly adapted to reflect menu changes or promotions.

As the demand for enhanced in-store customer engagement grows, the indoor signage segment is expected to maintain its leadership. The ability to seamlessly integrate digital displays into the restaurant’s daily operations makes indoor signage an indispensable tool, propelling its continued dominance in the market.

By Resolution

In 2024, the 8K Resolution segment held a dominant market position, capturing more than 38.4% of the market share in the digital signage industry for quick-service restaurants (QSRs). The growing preference for 8K resolution can be attributed to its superior image clarity, detail, and ability to deliver stunning visual experiences that captivate customers. With the increasing adoption of high-definition displays, QSRs are moving toward 8K resolution to offer the highest level of quality in their digital signage solutions.

8K displays provide crisp, vibrant content that enhances promotional materials, menu boards, and advertisements, offering an immersive experience that grabs customer attention. As the demand for high-quality visuals increases, QSRs are leveraging 8K technology not only for its aesthetic appeal but also to improve branding and communication.

While 4K and FHD (Full High Definition) resolutions also hold significant market shares, 8K is leading due to its ability to display more detailed images at larger screen sizes, making it ideal for creating an impactful visual presence in busy restaurant environments. With its unmatched picture quality, 8K resolution continues to define the future of digital signage in QSRs.

By Technology

In 2024, the LED segment held a dominant market position, capturing more than 51.9% of the digital signage market share for quick-service restaurants (QSRs). LED technology continues to lead due to its unmatched combination of energy efficiency, durability, and superior brightness, making it the preferred choice for both indoor and outdoor signage applications. LED displays are particularly well-suited for QSR environments, where high visibility is essential to attract customer attention in busy, high-traffic areas.

Compared to LCD, OLED, and projection technologies, LED offers better performance in terms of clarity, contrast, and energy consumption. LED screens are also more versatile, with the ability to function effectively in a wide range of lighting conditions, from dimly lit indoor spaces to bright outdoor settings.

Furthermore, the affordability and scalability of LED technology make it an attractive option for QSRs of all sizes, allowing them to deploy digital signage solutions across multiple locations without significant cost barriers. As demand for vibrant, high-quality digital displays grows, the LED segment is expected to maintain its leadership, shaping the future of digital signage in the QSR industry.

By Signage Size

In 2024, the Below 32 Inches segment held a dominant market position, capturing more than 60.2% of the digital signage market share in quick-service restaurants (QSRs). This leadership can be attributed to the practical advantages offered by smaller display sizes, which are ideal for the dynamic and space-efficient environments of QSRs.

Below 32-inch displays are particularly well-suited for applications like menu boards, ordering kiosks, and promotional displays, where clear, concise information needs to be presented without overwhelming customers.

The compact size of these displays makes them highly adaptable, allowing QSRs to integrate them in various in-store locations, from countertops and kitchen areas to waiting zones. Moreover, these smaller screens are cost-effective, making them an attractive choice for restaurants looking to implement digital signage on a budget while still offering high-quality visual content.

Additionally, the smaller form factor ensures that these displays are easy to install, maintain, and upgrade as needed. As the demand for cost-efficient, space-saving solutions grows, the Below 32 Inches segment remains a key driver in the widespread adoption of digital signage within the QSR market.

Key Market Segments

By Component

- Hardware

- Displays

- Media Players

- Projectors

- Others

- Software

- Service

- Installation Services

- Maintenance & Support Services

- Consulting Services

By Application

- Indoor Signage

- Menu boards

- Promotional displays

- Ordering kiosks

- Queue management systems

- Outdoor Signage

- Drive-thru menu boards

- Exterior promotional displays

- Directional signage

By Resolution

- 8K

- 4K

- Full High Definition (FHD)

- High Definition (HD)

- Lower than HD

By Technology

- LCD

- LED

- OLED

- Projection

By Signage Size

- Below 32 Inches

Driving Factors

Increasing Demand for Enhanced Customer Experience

One of the primary driving factors behind the growth of digital signage in quick-service restaurants (QSRs) is the increasing demand for enhanced customer experience. As competition in the QSR industry intensifies, restaurants are increasingly adopting digital signage as a tool to attract and engage customers more effectively. Digital displays, such as menu boards, ordering kiosks, and promotional screens, provide an interactive and dynamic way to engage with customers.

For instance, digital menu boards can display high-quality images, videos, and even real-time pricing, which not only helps QSRs improve their service speed but also makes the menu visually appealing. Similarly, interactive ordering kiosks allow customers to customize their orders, reducing human error and providing a seamless ordering experience. The ability to instantly update promotions or menu items in real time also helps keep customers informed, creating a more personalized and engaging dining experience.

Restraining Factors

High Initial Installation and Maintenance Costs

While digital signage offers numerous benefits, one of the major restraining factors for its widespread adoption in quick-service restaurants (QSRs) is the high initial installation and maintenance costs. The upfront expenses for purchasing hardware such as displays, media players, and other accessories can be significant, especially for small to medium-sized QSRs. For example, LED displays, while energy-efficient and long-lasting, can be costly to install, particularly when high-quality, large-format screens are required.

Additionally, ongoing maintenance costs can also add up over time. Regular servicing, software updates, and repairs are necessary to ensure the displays function optimally. For QSRs that operate in high-traffic environments, the wear and tear on digital signage equipment can result in increased maintenance frequency. This can be a financial burden, particularly for restaurants operating on tight margins.

Growth Opportunities

Expansion in Emerging Markets

A significant growth opportunity for the digital signage market in quick-service restaurants (QSRs) lies in the expansion into emerging markets. As economies in regions like Asia-Pacific (APAC), Latin America, and parts of the Middle East continue to develop, the demand for modern retail and dining experiences is growing.

These regions are seeing a rapid urbanization trend, along with an increase in disposable income and changing consumer preferences. Consequently, digital signage is becoming a valuable tool for QSRs looking to differentiate themselves and meet the evolving expectations of customers.

For instance, in China and India, the adoption of technology in the food service industry is accelerating. QSRs are increasingly investing in digital menu boards and interactive ordering kiosks to cater to the growing demand for convenience and personalization.

The lower cost of digital signage solutions in these emerging markets also makes them more accessible, allowing QSRs to implement these systems without breaking the bank. Furthermore, the widespread use of smartphones and mobile-based ordering in these regions creates opportunities for integrating digital signage with mobile apps for an even more seamless customer experience.

Challenging Factors

Technological Integration and Compatibility Issues

One of the key challenges facing the digital signage market in quick-service restaurants (QSRs) is the technological integration and compatibility issues that arise when incorporating digital signage solutions into existing restaurant infrastructures. Many QSRs, especially smaller chains, are already operating with legacy systems such as point-of-sale (POS) systems, inventory management tools, and ordering software. Integrating digital signage with these systems can be technically challenging and costly.

For example, ensuring that digital displays synchronize with the POS systems to reflect real-time menu changes, promotions, and pricing can be a complex process. Additionally, maintaining seamless communication between multiple locations, especially in large chains, requires a robust cloud-based infrastructure, which may not be feasible for all QSRs. The compatibility of digital signage with existing back-end software and hardware can cause delays, resulting in a fragmented system that may not provide the intended efficiency improvements.

Growth Factors

Increased Demand for Customer Engagement and Efficiency

A significant growth factor driving the digital signage market in quick-service restaurants (QSRs) is the increasing demand for enhanced customer engagement and operational efficiency. As QSRs face fierce competition, they are investing in digital signage solutions to differentiate themselves and improve customer experiences. Digital signage offers a variety of benefits, including dynamic content updates, promotional displays, and real-time messaging, which allow QSRs to engage customers in meaningful ways.

Additionally, digital signage enhances operational efficiency by reducing wait times and streamlining ordering processes. Interactive ordering kiosks, for example, reduce the burden on staff and minimize human error. Moreover, the integration of cloud-based management systems makes it easier for QSRs to update content remotely across multiple locations, leading to significant time and cost savings. The growing need for speed, convenience, and personalization in QSRs is driving the expansion of digital signage solutions, making this a key factor contributing to market growth.

Emerging Trends

Integration of AI and Mobile Technology

Emerging trends in the digital signage market for QSRs point to the growing integration of artificial intelligence (AI) and mobile technology. The global market for AI in digital signage is projected to reach USD 4.5 billion by 2026, driven by the increasing adoption of AI-powered solutions for content personalization and customer analytics. AI allows QSRs to tailor their digital signage content to the preferences of individual customers, delivering personalized promotions, recommendations, and even dynamic pricing based on real-time data.

Mobile integration is another significant trend, as more QSRs are using digital signage to complement mobile ordering and loyalty programs. By integrating digital signage with mobile apps, restaurants can create a more seamless and interactive customer experience, where consumers can place orders, receive promotions, or redeem loyalty points directly from their smartphones.

For example, QR codes displayed on digital signage encourage customers to interact with their mobile devices, driving higher engagement and increasing the likelihood of repeat business. These emerging trends are not only enhancing customer interaction but also helping QSRs gather valuable data to optimize operations and marketing efforts.

Business Benefits

Cost Savings, Increased Revenue, and Brand Visibility

The adoption of digital signage in quick-service restaurants (QSRs) brings numerous business benefits, including significant cost savings, increased revenue, and improved brand visibility. In 2024, QSRs using digital signage solutions are projected to save up to 30% on labor costs due to the automation of tasks such as menu updates, promotions, and customer engagement. This reduction in operational costs makes digital signage a cost-effective solution for QSRs looking to optimize their resources and improve efficiency.

Moreover, digital signage can directly contribute to increased revenue by driving customer purchases. Promotional displays and up-selling strategies, such as suggesting additional items at the point of order, can increase average transaction values by up to 20%. Real-time updates allow QSRs to push time-sensitive offers or promotions to customers, driving foot traffic and sales during peak hours.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Samsung Electronics is a key player in the digital signage market, particularly in the quick-service restaurant (QSR) sector. Known for its cutting-edge display technology, Samsung has continued to lead the market with innovative products that provide enhanced visual quality and reliability. In recent years, Samsung has expanded its presence in the digital signage space through strategic acquisitions and partnerships.

LG Electronics is another major player in the digital signage market, especially in the QSR space, where the company has made notable strides in recent years. LG’s success can be attributed to its high-quality OLED displays and LED signage solutions, which are widely adopted in restaurants due to their superior picture quality, energy efficiency, and sleek design.

NEC Corporation is a global leader in the digital signage market, and its focus on the QSR sector has helped solidify its position as one of the top players in the industry. NEC has consistently advanced its digital signage offerings with large-format displays, interactive screens, and customized solutions for QSRs.

Top Key Players in the Market

- Samsung Electronics

- LG Electronics

- NEC Corporation

- Sony Corporation

- Sharp Corporation

- CrownTV

- Moving Tactics

- Remote Media Group Limited

- Smartzone Enterprises

- Spectrio LLC.

- Others

Recent Developments

- In 2024, Samsung Electronics launched a new line of AI-powered digital signage solutions tailored specifically for the quick-service restaurant (QSR) industry.

- In 2024, LG Electronics expanded its digital signage offerings by integrating 5G technology into its display solutions, specifically designed for the QSR sector.

Report Scope

Report Features Description Market Value (2024) USD 3.3 Billion Forecast Revenue (2034) USD 12.78 Billion CAGR (2025-2034) 14.50% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware[Displays, Media Players, Projectors, Others], Software [Service, Installation Services, Maintenance & Support Services, Consulting Services]), By Application (Indoor Signage [Menu boards, Promotional displays, Ordering kiosks, Queue management systems], Outdoor Signage [Drive-thru menu boards, Exterior promotional displays, Directional signage]), By Resolution (8K, 4K, Full High Definition (FHD), High Definition (HD), Lower than HD), By Technology (LCD, LED, OLED, Projection) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Samsung Electronics, LG Electronics, NEC Corporation, Sony Corporation, Sharp Corporation, CrownTV, Moving Tactics, Remote Media Group Limited, SmartZone Enterprises, Spectrio LLC., Others Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Signage in Quick-Service Restaurants (QSRs) MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Signage in Quick-Service Restaurants (QSRs) MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung Electronics

- LG Electronics

- NEC Corporation

- Sony Corporation

- Sharp Corporation

- CrownTV

- Moving Tactics

- Remote Media Group Limited

- Smartzone Enterprises

- Spectrio LLC.

- Others