Global Bowling Centers Market Size, Share, Growth Analysis By Facility Type (Traditional Bowling Centers, Boutique Bowling Centers, Bowling Entertainment Centers (BECs)), By Ownership (Independent Centers, Chain or Franchise-Owned Centers), By Lane Material (Wood Lanes, Synthetic Lanes, Hybrid Lanes), By End-User (Commercial Bowling Centers, Residential Bowling Facilities, Amusement and Recreation Centers, Hotels and Resorts, Corporate and Private Venues), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139924

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

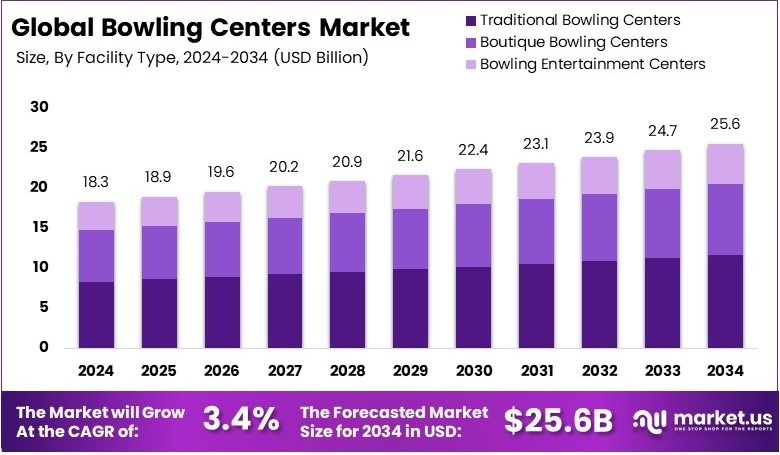

The Global Bowling Centers Market size is expected to be worth around USD 25.6 Billion by 2034, from USD 18.3 Billion in 2024, growing at a CAGR of 3.4% during the forecast period from 2025 to 2034.

Bowling centers are recreational venues designed for bowling activities. They feature multiple lanes, automated scoring, and seating areas. Many offer food, arcade games, and event spaces. These centers cater to casual players, competitive bowlers, and families. Some also host leagues and tournaments, making them popular entertainment destinations.

The bowling centers market includes businesses that operate bowling alleys and related entertainment services. It covers independent venues, chain operators, and multi-entertainment centers. The market is influenced by consumer demand, technological advancements, and social entertainment trends. Revenue comes from lane rentals, food services, arcade games, and private events.

The bowling industry is evolving with changing consumer preferences. Upscale bowling centers are gaining popularity, especially among millennials who seek unique social experiences. According to The Times, the number of ten-pin lanes in the UK reached 5,700, highlighting the growing trend of “competitive socializing.”

As a result, modern bowling centers now integrate food, drinks, and entertainment to enhance customer engagement. Moreover, premium experiences, such as boutique bowling, attract high-spending consumers, making the market more profitable for investors.

In the United States, family entertainment is a key growth driver. According to Hansell Group Research, over 10 million children celebrate birthdays in bowling centers each year, making them a top choice for family-friendly events. Consequently, many centers now offer arcade games, laser tag, and dining services to appeal to a broader audience. Furthermore, partnerships with schools have strengthened the industry’s reach.

More than 10,000 schools have introduced bowling programs, leading to a 17% increase in participation among children under 14. This shift ensures long-term consumer engagement, reinforcing bowling as a popular recreational activity.

The market presents significant opportunities, particularly in emerging regions. In urban areas, saturation is becoming a challenge, with several centers competing for the same audience. However, suburban and less-developed regions still offer room for expansion. Additionally, companies investing in innovative themes and digital scoring systems gain a competitive edge.

On the flip side, traditional bowling alleys face challenges in attracting younger consumers, pushing them to modernize their offerings. Consequently, technological upgrades and strategic marketing are now essential for long-term success.

Key Takeaways

- The Bowling Centers Market was valued at USD 18.3 billion in 2024 and is expected to reach USD 25.6 billion by 2034, with a CAGR of 3.4%.

- In 2024, Traditional Bowling Centers dominated the type segment with 45.5%, driven by their widespread presence and appeal to casual and competitive players.

- In 2024, Chain/Franchise-Owned Centers led the ownership segment with 55.7%, benefiting from brand recognition and operational efficiencies.

- In 2024, Synthetic Lanes accounted for 63.4% of the lane material segment, preferred for their durability and low maintenance costs.

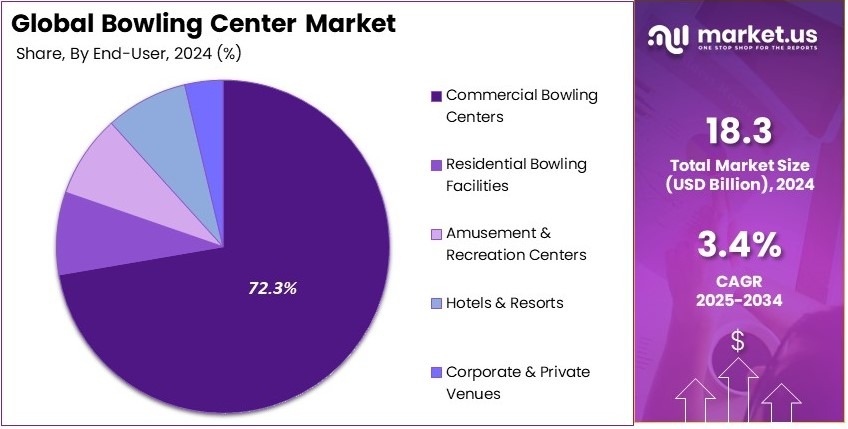

- In 2024, Commercial Bowling Centers dominated the end-user segment with 72.3%, fueled by strong demand from entertainment and leisure venues.

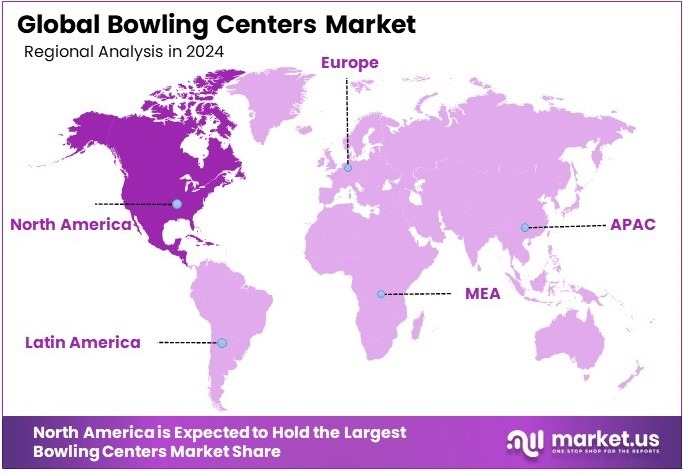

- In 2024, North America led the market, supported by a strong presence of bowling entertainment centers and major industry players.

Type Analysis

Traditional Bowling Centers dominate with 45.5% due to their widespread appeal and nostalgic value.

Traditional Bowling Centers are the cornerstone of the bowling industry, encapsulating the classic bowling experience and bowling equipment with a focus on the sport itself. These centers are characterized by their retro aesthetics and emphasis on league play, which remains a significant draw for enthusiasts.

This sub-segment thrives due to its established customer base and the consistent demand for traditional bowling activities. Their market position is reinforced by periodic modernizations that retain customer interest and integrate modern leisure trends.

Boutique Bowling Centers and Bowling Entertainment Centers (BECs) represent other crucial segments. Boutique centers, blending luxury and intimacy, cater to upscale markets and focus on providing a premium experience.

On the other hand, BECs, which mix bowling with other entertainment options like arcades and dining, are pivotal in attracting a diverse demographic, from families to young adults, thereby supporting the market’s expansion in different directions.

Ownership Analysis

Chain/Franchise-Owned Centers dominate with 55.7% due to their ability to leverage branding and standardized services.

Chain or Franchise-Owned Centers have proven to be highly successful in the bowling center market by utilizing a standardized model that ensures consistent quality and service across locations. This approach not only builds a reliable brand image but also facilitates marketing and operational efficiencies.

The economies of scale achieved allow these centers to offer competitive pricing and innovate with new entertainment options, enhancing their market share.

Independent Centers, though they offer unique and personalized experiences, face challenges in scaling and competing with the marketing capabilities of larger chains. However, these centers are essential for providing local flavor and diversity within the market, often pioneering innovative concepts that later become mainstream within the industry.

Lane Material Analysis

Synthetic Lanes dominate with 63.4% due to their durability and lower maintenance costs.

Synthetic lanes have become the preferred choice for modern bowling centers, primarily because of their longevity and ease of maintenance compared to traditional wood lanes.

These lanes can withstand heavy usage without the frequent resurfacing required by wood, making them cost-effective for high-traffic centers. Additionally, synthetic lanes offer consistent playing conditions, which is crucial for both casual play and competitive leagues.

Wood Lanes, offering authentic play, are favored in traditional and boutique centers for their classic feel and performance characteristics. Hybrid Lanes combine the benefits of wood and synthetic, providing a middle ground for centers that cater to both serious bowlers and casual enthusiasts.

End-User Analysis

Commercial Bowling Centers dominate with 72.3% due to their comprehensive facilities and broad consumer base.

Commercial Bowling Centers are the backbone of the bowling industry, providing extensive facilities that cater to a wide range of customers, from casual visitors to professional bowlers.

These centers are designed to maximize foot traffic and revenue, often featuring multiple lanes, dining areas, and other entertainment options such as game arcades. Their ability to host events and leagues makes them pivotal in sustaining the industry’s growth.

Other segments like Residential Bowling Facilities and Amusement & Recreation Centers also contribute to the market. Residential facilities offer private, luxury bowling experiences and are popular in high-end homes and estates.

Amusement and Recreation Centers, including hotels and corporate venues, incorporate bowling as part of a larger recreational offering, which helps in diversifying the customer base and enhancing the appeal of these facilities.

Key Market Segments

By Facility Type

- Traditional Bowling Centers

- Boutique Bowling Centers

- Bowling Entertainment Centers (BECs)

By Ownership

- Independent Centers

- Chain/Franchise-Owned Centers

By Lane Material

- Wood Lanes

- Synthetic Lanes

- Hybrid Lanes

By End-User

- Commercial Bowling Centers

- Residential Bowling Facilities

- Amusement & Recreation Centers

- Hotels & Resorts

- Corporate & Private Venues

Driving Factors

Boutique and Digital Integration Drives Market Growth

Bowling centers are evolving to meet modern customer demands and create engaging experiences. Stylish boutique centers attract millennials by offering creative themes and lively ambiances that resonate with younger tastes. Many centers are also expanding into family entertainment venues that welcome parents and children alike.

Strategic partnerships with schools and corporate groups help establish leagues and community events that foster regular participation. In addition, the integration of virtual reality and augmented reality into games provides an innovative twist that makes bowling more interactive and fun. These combined factors enhance customer satisfaction and drive repeat business, as visitors enjoy a mix of nostalgia and modern technology.

Owners invest in upgrading facilities and creating unique experiences to stand out in a competitive market. This blend of traditional bowling with advanced digital elements not only diversifies the entertainment options but also builds strong community connections.

Such strategic adaptations open new revenue streams and secure long-term growth prospects in an industry that is continuously evolving to meet the changing expectations of its diverse clientele. This strategic shift revitalizes traditional leisure and attracts investors with innovative, sustainable business models that promise profitability and community enrichment.

Restraining Factors

Operational and Regulatory Barriers Restrain Market Growth

Bowling centers face many challenges that hinder steady progress. High maintenance expenses and costly equipment investments put financial strain on operations. Facilities must regularly update lanes, machinery, and decor to meet safety and quality standards.

Moreover, strong competition from home entertainment systems and online streaming services offers consumers alternative leisure options that reduce center visits. Seasonal fluctuations further impact revenue, as colder months or holiday periods may see fewer customers. In addition, regulatory hurdles, especially those involving alcohol licensing, create extra burdens for management. These issues demand additional resources and time to navigate legal requirements.

The combined effect of rising costs, digital competition, seasonal trends, and regulatory complexities pressures owners to operate efficiently. As a result, many centers struggle to balance expenditures with income while maintaining service quality. This situation forces operators to seek cost-cutting measures or innovative strategies that may not fully address all challenges.

Leaders must consider new technologies and strategic partnerships to mitigate these restraints. Their goal is to improve efficiency and attract more visitors. This complex mix of challenges restrains market growth significantly and demands a proactive, adaptive approach from management. Operators must continuously innovate while reducing costs, ensuring safety standards, and meeting evolving consumer expectations.

Growth Opportunities

Innovative Expansion Provides Opportunities

Bowling centers can seize many opportunities to grow and improve their market position. Advanced scoring systems can enhance the game experience by making play more interactive and accurate. Expanding into untapped markets opens new customer bases where competition is limited.

Centers that diversify into multiple entertainment activities, such as arcades, dining, and live events, attract a broader audience. Social media marketing helps reach potential customers with targeted promotions and engaging content. Each of these strategies builds a unique brand identity that stands out in the leisure market.

Owners who invest in modern technology and expand service offerings often see increased customer satisfaction and loyalty. These initiatives encourage repeat visits and positive word-of-mouth. Moreover, integrating digital solutions with traditional bowling experiences offers a blend that appeals to diverse age groups.

Strategic investments in both technology and service innovation set the stage for long-term revenue growth. Business leaders find that combining advanced systems, market expansion, diversified offerings, and smart marketing creates significant competitive advantages. This comprehensive approach allows centers to adapt to evolving consumer trends and overcome market challenges.

Emerging Trends

Retro Revival and Mobile Trends Are Latest Trending Factor

Bowling centers are embracing innovative trends that refresh the traditional experience. Retro bowling alleys are being revived with modern twists that combine classic charm with contemporary design. These revamped centers use nostalgic elements alongside state-of-the-art lighting and sound systems.

In addition, mobile app-based reservations and promotions provide customers with quick and easy access to booking services. Such digital solutions enhance convenience and encourage frequent visits. Cosmic bowling nights have also become popular by offering themed events with vibrant lighting and upbeat music. This creates an energetic atmosphere that attracts younger crowds and social media attention.

Furthermore, many centers are locating within mixed-use developments, where they benefit from shared spaces and increased foot traffic. These strategic locations allow for better visibility and access to a diverse audience. The mix of retro design, digital innovation, themed events, and prime locations boosts overall appeal.

Owners find that embracing these trends not only modernizes the experience but also drives higher engagement and revenue. As consumer preferences shift, these innovations help centers remain competitive and relevant. Adapting to both nostalgic appeal and digital trends ensures that bowling centers can meet the evolving demands of today’s market.

Regional Analysis

North America Dominates with Major Market Share

North America leads the Bowling Centers Market with a major share, driven by a robust culture of recreational sports and significant consumer spending on leisure activities. The region boasts a high number of established bowling centers, benefiting from advanced technology in gaming and entertainment, which enhances customer experiences.

The presence of major industry players and ongoing investments in upgrading facilities play a crucial role in the market’s growth. Additionally, popular bowling leagues and events attract participants of all ages, fostering a strong community around bowling.

The future influence of North America on the global market is expected to grow as trends in entertainment and family-oriented activities continue to evolve. The region’s emphasis on creating comprehensive entertainment experiences is likely to draw more customers, potentially increasing its market share.

Regional Mentions:

- Europe: Europe maintains a competitive edge in the market with innovations in eco-friendly and technologically advanced bowling centers. The region’s focus on sustainable practices attracts a growing environmentally conscious consumer base.

- Asia Pacific: Rapid urbanization and increasing disposable income in Asia Pacific boost the expansion of bowling centers. Countries like Japan and South Korea are seeing more state-of-the-art facilities, drawing a younger demographic.

- Middle East & Africa: Emerging markets in the Middle East and Africa are gradually adopting bowling as a popular leisure activity, with investments in luxury and entertainment complexes that include bowling facilities.

- Latin America: Latin America is witnessing gradual growth in the bowling centers market, driven by increasing urbanization and the rising popularity of bowling among youth, which helps to invigorate local economies.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Bowling Centers Market is characterized by a dynamic group of leading companies that significantly shape industry trends and market dynamics. Among these, Bowlero Corporation, Hollywood Bowl Group, Ten Entertainment Group, and Brunswick Bowling Products LLC are particularly influential.

Bowlero Corporation stands out as a major player, operating the largest number of bowling centers across the United States. Their success is attributed to a strong focus on providing a comprehensive entertainment experience, which includes upscale amenities and a variety of dining and gaming options. Bowlero’s aggressive expansion strategy through acquisitions has further solidified its market dominance.

In the UK, Hollywood Bowl Group is a leading name, known for its modern, family-friendly bowling centers. The company has consistently invested in enhancing customer experience by renovating older centers and incorporating advanced technology like digital scorekeeping and immersive lane projection. This focus on customer engagement and retention has made them a pivotal player in the European market.

Ten Entertainment Group, another UK-based company, closely follows in terms of market impact, with a strong portfolio of bowling centers that also offer a mix of additional attractions such as arcades and soft play areas. Their centers cater to a wide demographic, which has been key to their sustained growth in a competitive market.

Lastly, Brunswick Bowling Products LLC, while primarily known for manufacturing bowling equipment, also operates a number of bowling centers. Their expertise in the technical aspects of bowling provides them with a unique advantage in creating high-quality bowling experiences. Brunswick’s dedication to innovation is evident in their development of new bowling technology and equipment, enhancing the overall appeal of bowling as a sport and recreational activity.

These top companies drive the global Bowling Centers Market through strategic innovations, customer-centric services, and expansive operational networks, ensuring their continued influence and leadership in the industry.

Major Companies in the Market

- Bowlero Corporation

- Hollywood Bowl Group

- Ten Entertainment Group

- Brunswick Bowling Products LLC

- QubicaAMF Worldwide

- Main Event Entertainment

- Round One Corporation

- Lucky Strike Entertainment Corporation

- Pinstripes

- Lane7

- REVS Bowling & Entertainment

- O’Learys

- Strike & Spare

Recent Developments

- Bowlero Corporation and Lucky Strike Entertainment: On December 2024, Bowlero Corporation announced its rebranding to Lucky Strike Entertainment, effective December 2024. This move reflects the company’s strategy to broaden its entertainment offerings beyond traditional bowling, including a new NYSE ticker symbol “LUCK” and plans to transition over 75 Bowlero centers to Lucky Strike locations within two years.

- Hollywood Bowl Group: On October 2024, Hollywood Bowl Group reported a record annual revenue of £230.4 million, marking a 7.2% increase from the previous year. This growth was significantly driven by a 42% surge in sales across its 13 Canadian sites, totaling £30.7 million. However, the company faces intensified competition in the UK from emerging activity-focused venues offering experiences like mini-golf and axe-throwing, which have impacted its UK like-for-like sales.

Report Scope

Report Features Description Market Value (2024) USD 18.3 Billion Forecast Revenue (2034) USD 25.6 Billion CAGR (2025-2034) 3.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Facility Type (Traditional Bowling Centers, Boutique Bowling Centers, Bowling Entertainment Centers (BECs)), By Ownership (Independent Centers, Chain or Franchise-Owned Centers), By Lane Material (Wood Lanes, Synthetic Lanes, Hybrid Lanes), By End-User (Commercial Bowling Centers, Residential Bowling Facilities, Amusement and Recreation Centers, Hotels and Resorts, Corporate and Private Venues) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bowlero Corporation, Hollywood Bowl Group, Ten Entertainment Group, Brunswick Bowling Products LLC, QubicaAMF Worldwide, Main Event Entertainment, Round One Corporation, Lucky Strike Entertainment Corporation, Pinstripes, Lane7, REVS Bowling & Entertainment, O’Learys, Strike & Spare Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Bowling Centers MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Global Bowling Centers MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bowlero Corporation

- Hollywood Bowl Group

- Ten Entertainment Group

- Brunswick Bowling Products LLC

- QubicaAMF Worldwide

- Main Event Entertainment

- Round One Corporation

- Lucky Strike Entertainment Corporation

- Pinstripes

- Lane7

- REVS Bowling & Entertainment

- O'Learys

- Strike & Spare