Global Squash Equipment Market Size, Share, Growth Analysis By Product Type (Rackets, Balls, Bags, Shoes, Apparel, Accessories), By Distribution Channel (Specialty and Sports Shops, Department Stores, Online Retailers, Others), By End-User (Individual, Clubs and Sports Organizers, Educational Institutions), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138683

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

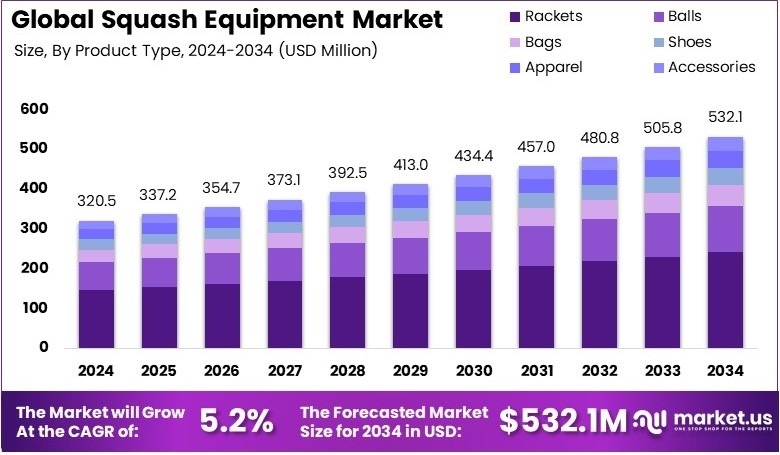

The Global Squash Equipment Market size is expected to be worth around USD 532.1 Million by 2034, from USD 320.5 Million in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

Squash Equipment includes all the gear needed to play squash, such as racquets, balls, footwear, and protective gear. The racquet is typically made from lightweight materials like graphite, while the ball is rubber. Other items include goggles, gloves, and bags used for storage and transportation of the equipment.

Squash Equipment Market refers to the industry involved in manufacturing and selling gear for the sport of squash. This market includes various types of equipment like squash racquets, balls, shoes, and protective gear. It involves both consumer and professional demand and covers retail, online sales, and tournament supplies.

The squash equipment market is growing steadily, with key drivers like increased participation and demand for quality sports equipment. Over 50,000 people in England engage in organized squash activities annually, reflecting the sport’s sustained popularity. Moreover, more than 1,500 clubs and facilities boost market access, encouraging wider adoption. According to sources, the growth is also supported by improvements in sports technology and material innovation for squash rackets and accessories.

The demand for squash equipment is expected to rise, especially in markets with strong grassroots programs like the 10,000 young players involved in junior squash. Opportunities exist in improving product offerings and expanding distribution networks. As more individuals join organized events, equipment makers can leverage growing interest to tap into larger markets. Increased investments in sports development and tournaments will further drive this growth.

The market shows moderate saturation, mainly in well-established areas like England, where squash is already popular. Competition remains high, with brands constantly innovating to offer better performance equipment. On a broader scale, global interest in squash continues to grow, but local markets may face stronger competition as brands aim for market leadership and differentiation.

Governments and local authorities have a role in supporting squash growth through investments in public facilities and youth programs. The rise of participation, including at the junior level, reflects successful public investments. These initiatives not only increase grassroots participation but also enhance the market potential for squash equipment, fueling demand further.

Key Takeaways

- The Squash Equipment Market was valued at USD 320.5 million in 2024 and is expected to reach USD 532.1 million by 2034, with a CAGR of 5.2%.

- In 2024, Rackets dominate the type segment with 45.3% due to their essential role in the sport and widespread use among players.

- In 2024, Specialty and Sports Shops lead the distribution channel segment with 60.0% as they provide specialized services and expert guidance.

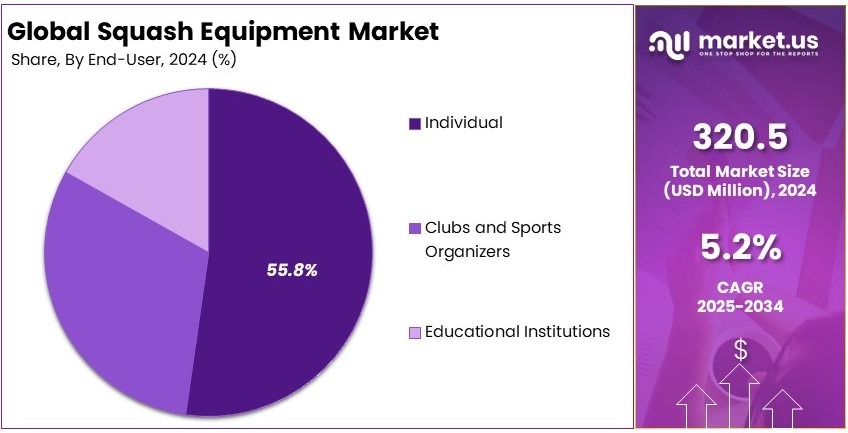

- In 2024, Individual Players lead the end-use industry segment with 55.8% as most squash enthusiasts purchase equipment for personal use.

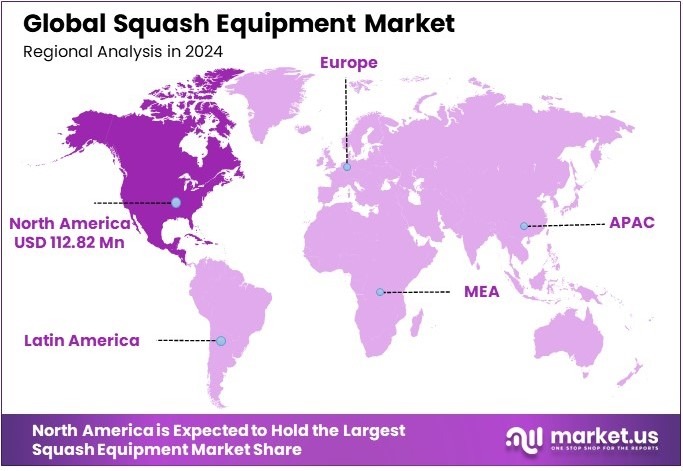

- In 2024, North America dominates the regional market with 35.2%, driven by high participation in squash and a robust retail environment, valued at USD 112.82 million.

Type Analysis

Rackets dominate with 45.3% due to their essential role in gameplay and high demand among players.

The Squash Equipment market is divided into several sub-segments, with squash rackets being the dominant one. Rackets account for the largest market share, capturing 45.3% of the total segment. This dominance can be attributed to the essential role a racket plays in every game of squash. Every player, regardless of skill level, requires a racket to participate in the sport.

As the game continues to grow in popularity worldwide, especially in countries like Egypt, England, and the United States, the demand for high-quality rackets has surged. Additionally, manufacturers are constantly innovating with lighter and more durable materials, making the rackets more appealing to players at all levels.

On the contrary, other sub-segments, like balls, bags, shoes, apparel, and accessories, also contribute to the growth of the market. Balls, though necessary for play, only account for a smaller portion, as they are considered a consumable item. Players may need several balls throughout a season, but the purchase frequency is lower compared to rackets.

Bags and shoes, while essential for players’ convenience and comfort, also make up a smaller share of the market, as players tend to invest in them less frequently. Apparel, such as jerseys and shorts, although important for sporting events and competitions, typically has a smaller market size compared to more functional equipment. Accessories like grips, strings, and bags add value to the experience but are less significant in terms of overall sales.

Product Type Analysis

Rackets dominate with 45.3% due to their fundamental role in gameplay and high demand for variety and performance.

The dominant sub-segment in the product type category is rackets. With an estimated market share of 45.3%, rackets are the most important purchase for any squash player. This significant share is driven by factors such as the growing participation in squash worldwide and the constant innovation in racket technology.

Manufacturers offer various types of rackets that cater to different player needs, from lightweight rackets for beginners to high-performance ones for professionals. The demand for rackets is high because they are not only a key piece of equipment but also an expression of a player’s style and performance aspirations.

In comparison, balls are the next largest sub-segment, but their share is much smaller than rackets. Balls are essential for playing, but they are less of an investment compared to rackets, and their purchase frequency is higher. Bags, shoes, and apparel are secondary products that cater to players’ comfort and convenience but are typically not bought as frequently as rackets.

Bags play a crucial role in carrying equipment, but they account for a much smaller share of the overall market, as many players may only purchase a new bag when the old one wears out. Shoes, which are designed for quick movements and grip, are also important but generally receive less investment compared to the primary equipment used during gameplay.

Distribution Channel Analysis

Specialty and Sports Shops dominate with 60.0% due to their specialized nature and customer-focused services.

The distribution channels for squash equipment are diverse, with specialty and sports shops holding the dominant share. These stores account for 60.0% of the total market share, as they provide customers with the ability to physically test products and receive expert advice tailored to their needs.

Specialty shops often carry a curated selection of squash equipment, from top-tier rackets to specialized shoes and balls, providing players with high-quality options that general retailers may not offer. The experience of in-store shopping, where customers can interact with knowledgeable staff, test products, and often receive personalized fittings, strengthens this segment’s appeal.

Online retailers have also seen a surge in demand for squash equipment, particularly as e-commerce continues to grow globally. However, online platforms capture a smaller portion of the market. While the convenience of online shopping and competitive pricing play a significant role in this growth, it lacks the tactile experience of trying out products, which is a key advantage for specialty shops.

Department stores and others account for the remaining 15.0% of the market. These segments typically sell squash equipment alongside a wide range of other sporting goods, with less emphasis on specialized knowledge or high-end products. Customers who visit these stores may not have the same experience or expertise as those who shop at specialty retailers, which limits their overall market share in the squash equipment sector.

End-User Analysis

Individual players dominate with 55.8% due to the widespread popularity of recreational squash.

The individual player segment is the dominant sub-segment in the squash equipment market, with an estimated market share of 55.8%. This is because squash is a popular recreational sport that many people play casually for fitness or enjoyment.

Individuals often invest in their own equipment, including rackets, balls, shoes, and apparel, making them a major contributor to the market. As the sport continues to grow, especially in urban areas, more people are taking up squash as a fitness activity, leading to increased sales of equipment. Additionally, individual players tend to update their equipment more regularly than clubs or institutions, further driving demand.

On the other hand, clubs and sports organizers, while important, make up a smaller portion of the market. These organizations may purchase equipment in bulk but do not contribute as much in terms of individual purchases.

Educational institutions, such as schools and universities, also account for a smaller share of the market. While squash is sometimes included in physical education programs or offered at the collegiate level, the overall volume of equipment purchases by educational institutions is lower than that of individual players. However, as more schools introduce squash programs, there is potential for growth in this segment.

Key Market Segments

Product Type

- Rackets

- Balls

- Bags

- Shoes

- Apparel

- Accessories

Distribution Channel

- Specialty and Sports Shops

- Department Stores

- Online Retailers

- Others

End-User

- Individual

- Clubs and Sports Organizers

- Educational Institutions

Driving Factors

Rising Popularity of Squash as a Competitive and Fitness Sport Drives Market Growth

The increasing popularity of squash as both a competitive sport and a high-intensity workout is a major driver for the Squash Equipment Market. As more individuals embrace squash for its fitness benefits, demand for quality equipment has surged. Squash offers a full-body workout, enhancing cardiovascular health and improving agility, which has caught the attention of fitness enthusiasts.

This trend is particularly evident in urban areas, where fitness-conscious individuals seek activities that provide both fun and a rigorous workout. Squash is often seen as an ideal sport for busy professionals and city dwellers who want a challenging, fast-paced activity that fits into their schedules.

As squash tournaments and leagues gain traction globally, both casual and professional players are seeking specialized equipment, thus increasing sales of rackets, balls, and other gear. The rise in popularity of professional squash leagues also boosts the visibility of the sport, driving further interest and participation.

Additionally, squash is being promoted as a sport for all age groups, which further accelerates the demand for varied equipment types. Youth programs and school-level participation have expanded, making the sport more accessible. The growing recognition of squash as an enjoyable and challenging workout contributes significantly to the expansion of the market.

Restraining Factors

Space and Cost Constraints Restrain Market Growth

Space constraints and high real estate costs are significant barriers to the development of new squash courts, especially in urban environments. Building new courts in areas with expensive land or limited space can be financially challenging. As a result, many regions face a shortage of squash facilities, limiting opportunities for new players to engage with the sport.

These challenges hinder the growth of the market by restricting access to squash. Without sufficient courts, potential players may turn to other sports that are less dependent on specialized facilities, such as tennis or badminton. This limits the number of people who can actively participate in squash, reducing the demand for equipment.

Additionally, competition from other racquet sports such as tennis, badminton, and pickleball, which require less space and investment, poses a challenge for squash. The rise of pickleball, in particular, has been noteworthy, as it is gaining popularity in many countries with fewer space requirements and a lower cost of entry.

While squash maintains a dedicated following, the lack of standardized equipment regulations across competitions further complicates the market, creating confusion for players and manufacturers alike. Without consistency in equipment standards, players may feel uncertain about what gear to use, limiting their willingness to invest in higher-quality products.

Growth Opportunities

Growth of Eco-Friendly Products and Smart Equipment Provides Opportunities

The introduction of eco-friendly and recyclable squash equipment is creating opportunities for growth in the market. As sustainability becomes a priority for consumers, demand for products made from environmentally friendly materials is rising. Brands that innovate with eco-friendly rackets, balls, and accessories are gaining attention from environmentally conscious players.

Eco-friendly products are not only appealing to sustainability-focused consumers but also enhance the image of the sport, promoting it as a modern, progressive activity. This trend aligns with growing environmental awareness, encouraging manufacturers to prioritize green initiatives in their product development.

Furthermore, the development of smart squash rackets equipped with performance analytics and tracking features is offering new possibilities for skill improvement. These high-tech products allow players to monitor their gameplay in real time, providing insights into their strengths and areas for improvement.

The integration of virtual coaching platforms and AI-based training also opens new avenues for players, making training more accessible and personalized. Players can use these technologies to access professional advice, even without attending physical training sessions. These advancements create significant growth prospects for manufacturers to tap into untapped markets and provide high-tech products that appeal to modern players.

Emerging Trends

Lightweight Equipment and Virtual Coaching are Latest Trending Factors

Lightweight and ergonomic squash rackets with customizable grip options are among the latest trends in the market. As players increasingly look for equipment that enhances their performance while offering comfort, the demand for such products is rising. Lightweight rackets reduce the strain on players, allowing for faster movements and increased agility during gameplay.

Additionally, the growth of online squash communities and digital coaching platforms is gaining momentum. These platforms provide players with access to professional guidance, techniques, and tutorials, fostering community interaction. Players can now improve their skills from the comfort of their homes, engaging with a global network of squash enthusiasts.

The rising popularity of squash-themed fitness workouts and high-intensity training (HIT) also contributes to this trend. These workouts, which incorporate squash movements for fitness, are attracting people who may not be competitive players but are still interested in using squash equipment for their exercise routines.

Integrating augmented reality (AR) in training simulations is another trend, offering players a unique and immersive way to practice. This innovative technology allows players to simulate matches, track their performance, and receive real-time feedback. These trends are reshaping the market and driving further interest in squash as both a fitness activity and a competitive sport.

Regional Analysis

North America Dominates with 35.2% Market Share

North America leads the Squash Equipment Market with a significant 35.2% share, valued at USD 112.82 million. This dominance can be attributed to the region’s established sporting culture, high participation rates, and strong infrastructure supporting squash clubs and tournaments. The growing interest in fitness and health, along with a solid base of top-level professional players and international competitions, further strengthens the region’s position.

The region also benefits from a well-developed retail network, including specialized sports stores and an expanding e-commerce presence. Additionally, the growing popularity of indoor sports like squash, especially in colder climates, supports consistent demand. Major countries like the United States and Canada invest heavily in squash facilities and community programs, fostering both grassroots and elite-level development.

Looking ahead, North America is expected to maintain its stronghold in the squash equipment market, supported by continuous growth in recreational sports participation and the expansion of professional squash leagues. The region’s technological advancements in sports equipment, alongside rising interest in active lifestyles, will likely drive continued market growth.

Regional Mentions:

- Europe: Europe holds a considerable portion of the market due to the long-standing tradition of squash in countries like the UK and France. Popular professional leagues and tournaments, such as the PSA World Tour, continue to drive the demand for high-quality squash equipment in the region.

- Asia Pacific: The Asia Pacific region is showing rapid growth in the squash equipment market, with emerging squash hubs in countries like India, Malaysia, and Singapore. Increasing youth engagement in squash, along with government-backed sports programs, is fueling the growth of squash participation.

- Middle East & Africa: The Middle East & Africa is gradually increasing its market share with countries like Egypt, where squash has a strong following. The region’s investment in sports infrastructure and rising participation among younger generations contribute to steady growth in squash equipment demand.

- Latin America: Latin America is experiencing gradual growth in the squash market. The popularity of sports is on the rise, particularly in countries like Brazil and Argentina, where squash is being introduced into sports clubs and recreational facilities, leading to increased equipment sales.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Squash Equipment Market is led by several key companies, with Dunlop Sports, Tecnifibre, Head N.V., and Wilson Sporting Goods standing out as the dominant players. These companies have built strong reputations by offering high-quality products that cater to both professional and recreational players.

Dunlop Sports is one of the most recognized brands in the squash industry. Known for its high-performance rackets, balls, and accessories, Dunlop has a long history of supporting top athletes and tournaments. The company’s commitment to innovation and quality has made it a leading choice among players worldwide, contributing significantly to its market share.

Tecnifibre is another top player, known for its cutting-edge squash rackets and strings. The company’s products are designed to enhance player performance, offering lightweight designs and durable materials. Tecnifibre has a strong presence in the professional squash scene and focuses on providing equipment that caters to the needs of both competitive and recreational players.

Head N.V. brings innovation and technology to the squash equipment market with its wide range of rackets, balls, and accessories. Head is well-known for its advanced racket technologies and collaborations with top athletes. The brand’s products are designed for players seeking power, control, and precision, which has helped it secure a large market share.

Wilson Sporting Goods is a major competitor, offering a diverse range of squash rackets, balls, and gear. Wilson’s reputation in other sports, particularly tennis, has helped it expand its influence in the squash market. The company emphasizes quality and performance, making its products highly popular among both professional players and enthusiasts.

Together, these companies shape the competitive landscape of the squash equipment market, driving innovation and maintaining strong customer loyalty. Their focus on performance, durability, and athlete satisfaction continues to fuel their dominance in the industry.

Major Companies in the Market

- Dunlop Sports

- Tecnifibre

- Head N.V.

- Wilson Sporting Goods

- Prince Sports, Inc.

- Karakal

- Black Knight

- Eye Rackets

- Oliver Sports

- Harrow Sports

- Ashaway Racket Strings

- Victor Rackets

- Salming Sports

- Pro Kennex

- Unsquashable

Recent Developments

- World Squash Federation: On January 2025, the World Squash Federation (WSF) unveiled the first phase of its rebranding initiative, introducing a new logo in preparation for the sport’s debut at the 2028 Summer Olympics. This rebrand is part of squash’s effort to evolve its identity and boost its global appeal.

- England Squash: On January 2025, England Squash entered a partnership with OLIVER, naming the company the official racket supplier. This collaboration is set to provide significant support for the sport in England, benefiting both professional and amateur players.

Report Scope

Report Features Description Market Value (2024) USD 320.5 Million Forecast Revenue (2034) USD 532.1 Million CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Rackets, Balls, Bags, Shoes, Apparel, Accessories), By Distribution Channel (Specialty and Sports Shops, Department Stores, Online Retailers, Others), By End-User (Individual, Clubs and Sports Organizers, Educational Institutions) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Dunlop Sports, Tecnifibre, Head N.V., Wilson Sporting Goods, Prince Sports, Inc., Karakal, Black Knight, Eye Rackets, Oliver Sports, Harrow Sports, Ashaway Racket Strings, Victor Rackets, Salming Sports, Pro Kennex, Unsquashable Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Dunlop Sports

- Tecnifibre

- Head N.V.

- Wilson Sporting Goods

- Prince Sports, Inc.

- Karakal

- Black Knight

- Eye Rackets

- Oliver Sports

- Harrow Sports

- Ashaway Racket Strings

- Victor Rackets

- Salming Sports

- Pro Kennex

- Unsquashable