Global On-board Charger Market Size, Share, Growth Analysis By Power Output (Less than 11 kW, 11 kW to 22 kW, More than 22 kW), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Electric Two-Wheelers), By Propulsion Type (Battery Electric Vehicles, Plug-In Hybrid Electric Vehicles, Hybrid Electric Vehicles), By Application (Residential Charging, Commercial or Public Charging), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 16745

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

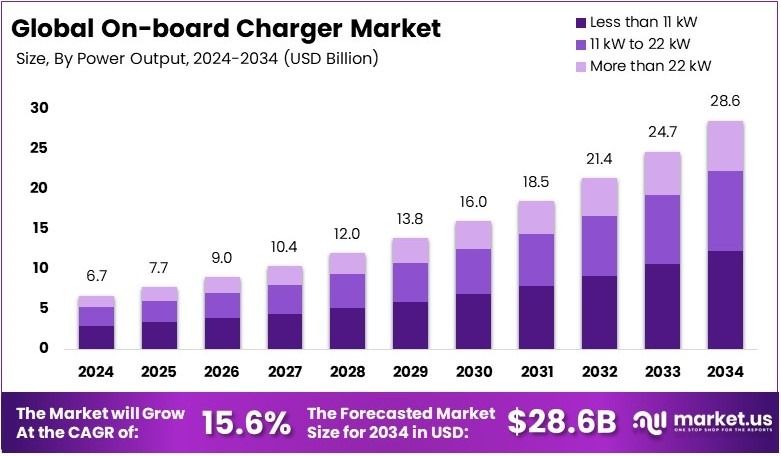

The Global On-board Charger Market size is expected to be worth around USD 28.6 Billion by 2034, from USD 6.7 Billion in 2024, growing at a CAGR of 15.6% during the forecast period from 2025 to 2034.

An on-board charger is a device installed in electric vehicles to convert AC power from the grid to DC power for the battery. It controls and manages the charging process. This equipment ensures the battery charges efficiently and safely, supporting the overall performance of electric vehicles.

The on-board charger market covers the production and sale of charging units for electric vehicles. It serves car manufacturers, service centers, and consumers. The market includes various chargers designed for different vehicle models and charging speeds. It plays a key role in the growth and adoption of electric vehicles.

The on-board charger (OBC) market is pivotal for the adoption and functionality of electric vehicles (EVs). These devices manage the electrical flow from the grid to the vehicle, ensuring that batteries are charged efficiently and safely. As EVs become more prevalent, the demand for advanced on-board chargers that offer faster and more efficient charging is growing rapidly.

In California, the implementation of Senate Bill 59 (SB59) underscores a significant regulatory push towards innovative charging technologies. This legislation facilitates the development of bidirectional charging capabilities, allowing EVs to contribute energy back to the grid.

This is particularly significant as California aims to integrate 8 million EVs by 2030, each potentially supportng grid stability and renewable energy utilization. Meanwhile, in the United Kingdom, the government’s approval of over 120 planning applications for EV charging infrastructure worth more than £500 million highlights a strong commitment to expanding the necessary support network for EVs.

Projects like a £100 million network in Wales and a £68 million initiative in West Sussex exemplify the large-scale efforts underway to enhance the country’s EV infrastructure.

Furthermore, France is pioneering an innovative “electric freeway” project, set to launch in 2025, with a budget of €26 million. This project involves embedding inductive charging technology beneath road surfaces to charge EVs as they drive. This groundbreaking approach could significantly reduce the need for traditional charging stops, paving the way for smaller battery sizes and longer driving ranges.

Key Takeaways

- On-board Charger Market was valued at USD 6.7 Billion in 2024, and is expected to reach USD 28.6 Billion by 2034, with a CAGR of 15.6%.

- In 2024, Less than 11 kW dominates the power output segment with 43%, due to its widespread use in residential and smaller commercial applications.

- In 2024, Passenger Cars lead the vehicle type segment with 51%, owing to the rapid growth of electric car adoption worldwide.

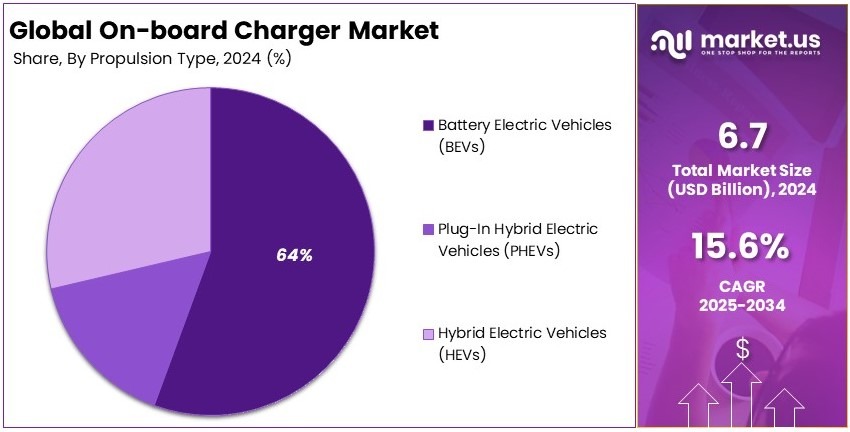

- In 2024, Battery Electric Vehicles (BEVs) dominate the propulsion type segment with 64%, as BEVs drive the majority of on-board charger demand.

- In 2024, Residential Charging dominates the application segment, reflecting the growing trend of home-based EV charging solutions.

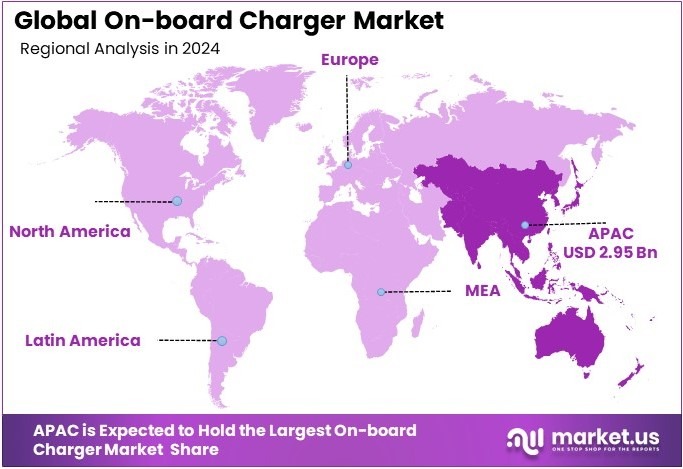

- In 2024, Asia-Pacific leads the market with 44%, contributing USD 2.95 Billion, driven by significant electric vehicle production and adoption.

Power Output Analysis

Less than 11 kW dominates with 43% due to its suitability for standard home charging requirements.

In the On-board Charger Market, the segment for chargers with a power output of less than 11 kW holds the largest share, at 43%.

This dominance is primarily due to the compatibility of these chargers with the standard electrical systems found in most residential homes, making them a practical choice for daily charging needs of electric vehicles (EVs). They offer an efficient solution for overnight charging without the need for specialized infrastructure.

Other power outputs also play a crucial role in the market. Chargers with 11 kW to 22 kW are favored for faster charging times, which are essential for users needing quicker turnarounds. Chargers with more than 22 kW are typically used in commercial and public charging stations where high-speed charging is necessary to accommodate multiple vehicles in short periods.

Vehicle Type Analysis

Passenger Cars lead with 51% due to the high adoption rate of EVs among individual consumers.

Passenger Cars dominate the Vehicle Type segment of the On-board Charger Market, with a 51% share. This leading position reflects the growing adoption of electric passenger vehicles by consumers worldwide, driven by increasing environmental awareness and supportive government policies promoting EV usage.

Light Commercial Vehicles (LCVs) and Heavy Commercial Vehicles (HCVs) also benefit from the integration of on-board chargers, particularly in urban fleets looking to reduce emissions. Electric Two-Wheelers are becoming increasingly popular in urban areas due to their low cost and efficiency, driving demand for compatible on-board chargers.

Propulsion Type Analysis

Battery Electric Vehicles (BEVs) dominate with 64% due to their reliance on pure electric propulsion.

BEVs hold the largest market share within the Propulsion Type category at 64%. This segment’s dominance is bolstered by the increasing shift towards vehicles that rely entirely on electric power, excluding the use of any fossil fuels, which aligns with global efforts to reduce carbon emissions.

Plug-In Hybrid Electric Vehicles (PHEVs) and Hybrid Electric Vehicles (HEVs) also utilize on-board chargers but to a lesser extent. PHEVs benefit from the ability to charge their batteries externally to extend their electric-only range, while HEVs primarily charge their batteries through regenerative braking, making their need for on-board charging less critical.

Application Analysis

Residential Charging leads due to the convenience of home-based vehicle charging.

The largest application segment for on-board chargers is Residential Charging, driven by the convenience and cost-effectiveness of home-based vehicle charging solutions. This method allows EV owners to charge their vehicles overnight, readying them for use each day without additional time commitments.

Commercial/Public Charging is also essential as it provides critical infrastructure for EV users who need to charge their vehicles away from home, particularly during long journeys or in urban areas where private parking may not be available.

Key Market Segments

By Power Output

- Less than 11 kW

- 11 kW to 22 kW

- More than 22 kW

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric Two-Wheelers

By Propulsion Type

- Battery Electric Vehicles (BEVs)

- Plug-In Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

By Application

- Residential Charging

- Commercial/Public Charging

Driving Factors

EV Adoption and Sustainability Efforts Drive Market Growth

The rapid adoption of electric vehicles (EVs) globally is a significant factor propelling the growth of the on-board charger market. Consumers and manufacturers are increasingly prioritizing sustainable transportation options to reduce carbon emissions in the automotive sector.

Government policies and incentives promoting EV adoption further boost market dynamics. For instance, subsidies for EV buyers and tax exemptions for manufacturers create a favorable environment. Simultaneously, investments in EV charging infrastructure are rising, enhancing convenience for end-users and encouraging EV sales.

Additionally, countries are setting ambitious goals for emission reduction, pushing automakers to develop more efficient on-board chargers. These systems ensure faster charging, making EVs more practical for everyday use. Technological advancements also contribute by improving charger efficiency and integration with other EV components.

Restraining Factors

Infrastructure and Cost Limitations Restraints Market Growth

The on-board charger market faces significant challenges due to limited charging infrastructure in developing regions. This lack of infrastructure makes EV adoption less practical in areas where public charging stations are scarce.

Challenges in standardizing charging protocols further constrain growth. Different automakers use varied systems, complicating compatibility and limiting market uniformity. Additionally, the high cost of advanced on-board charger systems presents a barrier, especially for budget-conscious buyers.

Battery thermal management issues during fast charging also pose a challenge. Excessive heat during high-speed charging can impact battery life, deterring some consumers from embracing fast-charging technologies. These concerns raise doubts about long-term performance and reliability.

Growth Opportunities

Bi-Directional Charging and Emerging Markets Provide Opportunities

The development of bi-directional chargers for vehicle-to-grid (V2G) applications presents significant growth opportunities in the on-board charger market. These systems allow EVs to return power to the grid, offering utility and efficiency benefits.

Emerging EV markets in Asia-Pacific and Latin America also provide untapped potential for growth. Governments in these regions are increasingly supportive of EV adoption, opening doors for on-board charger manufacturers to expand.

The integration of renewable energy solutions with on-board chargers is another promising trend. For example, solar-powered charging stations complement on-board chargers, creating a sustainable energy loop. The development of high-efficiency silicon carbide (SiC) and GaN-based chargers enhances system performance while reducing energy losses.

These opportunities demonstrate how technological innovation and market expansion can create new revenue streams for manufacturers. By focusing on bi-directional capabilities, renewable integration, and tapping into emerging regions, the industry can align with global sustainability trends while expanding its reach.

Emerging Trends

AI, IoT, and Thermal Management Are Latest Trending Factors

The shift toward ultra-fast on-board charging solutions is a notable trend shaping the market. These systems reduce charging times significantly, making EVs more appealing to time-conscious consumers.

Additionally, the increasing adoption of smart chargers with AI and IoT integration is transforming the industry. These chargers offer predictive maintenance, energy optimization, and remote control features, enhancing user experience. For instance, an IoT-enabled charger can adjust charging patterns based on grid demand, reducing electricity costs.

Modular charger designs for scalability are also gaining popularity. These systems allow manufacturers to customize chargers for different vehicle types, offering flexibility and cost efficiency. Advancements in thermal management systems for chargers ensure reliability during fast charging by mitigating overheating risks.

These trends reflect the industry’s focus on innovation and customer-centric solutions. By addressing speed, smart functionality, and reliability, manufacturers are setting new benchmarks, ensuring on-board chargers remain at the forefront of EV technology.

Regional Analysis

Asia Pacific Dominates with 44% Market Share

Asia Pacific leads the On-board Charger Market with a 44% share, totaling USD 2.95 billion. This strong market presence is driven by the rapid adoption of electric vehicles (EVs) across the region, especially in countries like China, Japan, and South Korea.

Key factors contributing to this dominance include extensive government incentives for EVs, a growing environmental awareness, and substantial investments in EV infrastructure such as charging stations. The region’s large automotive manufacturing base also supports the development and integration of advanced on-board charging technologies.

Looking forward, Asia Pacific’s influence on the global On-board Charger Market is expected to grow. With increasing urbanization, rising disposable incomes, and ongoing investments in technological advancements for cleaner transportation solutions, the demand for efficient and fast charging options is likely to surge, further solidifying the region’s market leadership.

Regional Mentions:

- North America: North America is a significant player in the On-board Charger Market, driven by advancements in automotive technology and strong regulatory support for green vehicles. The region’s focus on reducing carbon emissions and promoting electric mobility continues to fuel market growth.

- Europe: Europe maintains a robust position in the On-board Charger Market, bolstered by strict environmental regulations and government policies favoring electric vehicle adoption. The region’s commitment to sustainability and innovation in automotive technologies supports its steady market presence.

- Middle East & Africa: The Middle East and Africa are gradually advancing in the On-board Charger Market, with investments in sustainable transportation and growing environmental consciousness. The region’s developing automotive sector and urbanization efforts contribute to its emerging market status.

- Latin America: Latin America’s On-board Charger Market is evolving, with increasing awareness of environmental issues and improvements in electric vehicle infrastructure. The region is witnessing a slow yet steady increase in EV adoption, driven by government initiatives and foreign investments in green technologies.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the On-board Charger Market, leading companies include Delphi Technologies, BorgWarner Inc., Continental AG, and Robert Bosch GmbH. These firms are at the forefront due to their innovative technologies and global reach in the automotive industry.

Delphi Technologies is recognized for its efficient charging solutions that integrate seamlessly with advanced vehicle architectures, supporting faster charging capabilities.

BorgWarner Inc. offers innovative on-board chargers that are known for their compact design and high efficiency, catering to both hybrid and fully electric vehicles.

Continental AG focuses on the development of high-power chargers that reduce charging time significantly, enhancing the usability of electric vehicles.

Robert Bosch GmbH is pivotal in shaping the market with its reliable and technologically advanced chargers that support a wide range of vehicle types, from passenger cars to commercial vehicles.

These companies are driving the expansion of the On-board Charger Market by focusing on technology advancements that enhance the charging experience and meet the evolving needs of electric vehicle manufacturers and consumers. Their continued R&D investments and collaborations with automotive manufacturers are critical for maintaining their leadership and adapting to the dynamic market conditions.

Major Companies in the Market

- Delphi Technologies

- BorgWarner Inc.

- Continental AG

- Robert Bosch GmbH

- STMicroelectronics

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Delta Electronics, Inc.

- Infineon Technologies AG

- LG Electronics Inc.

Recent Developments

- Coulomb Solutions Inc. (CSI): On August 2024, Coulomb Solutions Inc. (CSI) announced the production of its 40 kW On-Board Charger and EVSE Combo for commercial electric vehicles, enabling overnight charging on standard infrastructure. This solution addresses long installation waits for DC fast chargers, offering a quicker and more affordable alternative for fleets with vehicles that operate within a 300-mile range.

- Nissan: On October 2024, Nissan revealed plans to launch on-board bi-directional Vehicle to Grid (V2G) charging technology in 2026, initially available in the UK. This technology will enable electric vehicle (EV) owners to power their homes or sell electricity back to the grid, helping to reduce energy costs and CO2 emissions while supporting the integration of renewable energy sources.

Report Scope

Report Features Description Market Value (2024) USD 26.9 Billion Forecast Revenue (2034) USD 41.4 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Skid Steer Loaders, Compact Track Loaders, Backhoe Loaders, Wheel Loaders), By Operating Capacity (Less than 1,200 lbs, 1,200–2,000 lbs, 2,000–3,000 lbs, Above 3,000 lbs), By Engine Power (Less than 50 HP, 50–75 HP, Above 75 HP), By Application (Construction, Agriculture, Landscaping, Mining, Forestry, Material Handling) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Caterpillar Inc., Deere & Company, Bobcat Company, Komatsu Ltd., CNH Industrial N.V. (CASE Construction Equipment), JCB Ltd., Hitachi Construction Machinery Co., Ltd., Volvo Construction Equipment, Kubota Corporation, Takeuchi Manufacturing Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Delphi Technologies

- BorgWarner Inc.

- Continental AG

- Robert Bosch GmbH

- STMicroelectronics

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Delta Electronics, Inc.

- Infineon Technologies AG

- LG Electronics Inc.