Global Cell Phone Charger Market By Product Type (Wired, Wireless), By Distribution Channel (Offline and Online), By Application (Power Bank, General Charger), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 106661

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

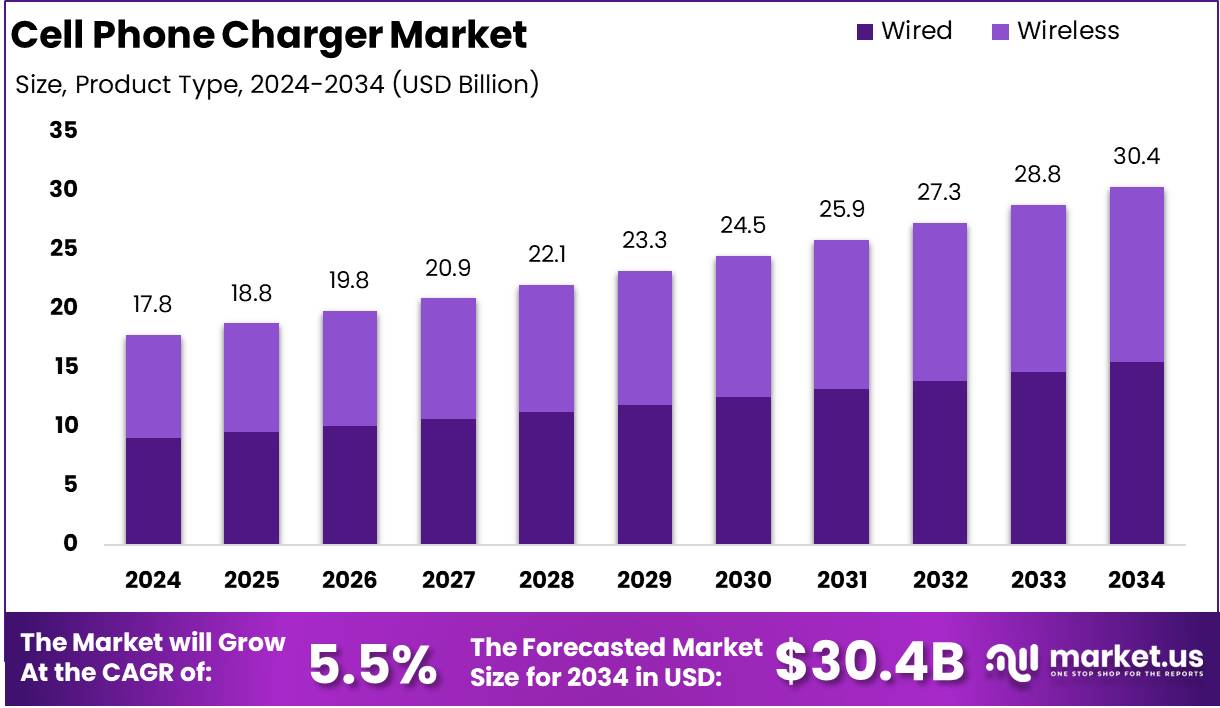

The Global Cell Phone Charger Market size is expected to be worth around USD 30.4 Billion by 2034 from USD 17.8 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

A cell phone charger is an electronic device designed to replenish the battery of a mobile phone. It converts alternating current (AC) from a wall outlet or direct current (DC) from a vehicle or portable battery, into a voltage suitable for recharging the phone. The device usually encompasses a variety of charging standards and connectors to accommodate different phone models and charging protocols.

The cell phone charger market refers to the industry segment focused on the design, manufacturing, and distribution of charging devices for mobile phones. This market includes a range of products such as wired chargers, wireless chargers, car chargers, and portable power banks. It serves both consumer and commercial customers, with products offered through multiple channels including retail, online, and direct sales from manufacturers.

The growth of the cell phone charger market can be attributed to several key factors. The increasing penetration of smartphones globally acts as a primary catalyst. As mobile device usage escalates, so does the need for effective and fast charging solutions. Innovations such as fast charging and wireless charging technologies are further propelling the market forward.

Demand in the cell phone charger market is driven by the continual upgrade and replacement cycle of mobile phones. As consumers adopt newer phone models with different charging requirements, the need for compatible chargers increases. The growing trend of mobility and the increasing use of smartphones for multimedia consumption also necessitate longer battery life and faster charging solutions, thereby boosting the demand for advanced chargers.

The market presents significant opportunities in the development and enhancement of charging technology. There is a continuous shift towards wireless and fast charging solutions, with a growing emphasis on eco-friendly and energy-efficient products. The integration of smart features, such as chargers capable of adapting to different power needs without user intervention, offers another lucrative avenue for innovation.

According to Ugreen, the Cell Phone Charger Market is increasingly influenced by optimal battery health practices, which recommend maintaining lithium-ion batteries between 20% and 80% charge to maximize efficiency.

Chargers are being designed to automatically stop charging at 100%, supporting batteries to avoid deep sleep states triggered below 2-3% charge. Industry standards now promote charging devices when they reach about 30-40% and disconnecting them around 80%, practices that effectively extend battery longevity and improve user experience in temperate conditions, specifically avoiding extremes below 0°C or above 35°C.

Key Takeaways

- The Global Cell Phone Charger Market is expected to grow from USD 17.8 billion in 2024 to approximately USD 30.4 billion by 2034, with a compound annual growth rate (CAGR) of 5.5% during the forecast period from 2025 to 2034.

- In 2024, the Wired segment dominated the market, capturing more than 51.0% of the market share.

- The Offline distribution channel maintained a significant presence, holding over 80.0% of the market share in 2024.

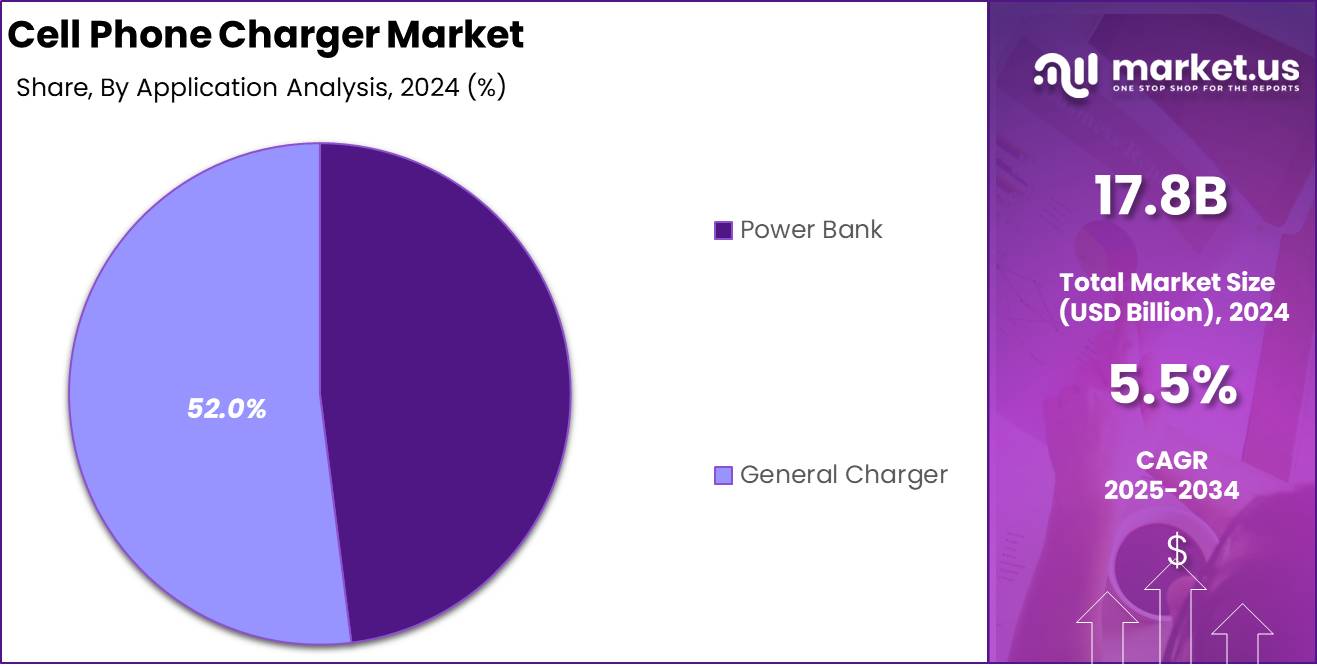

- The General Charger segment was the market leader, securing more than 52.0% of the market share in 2024.

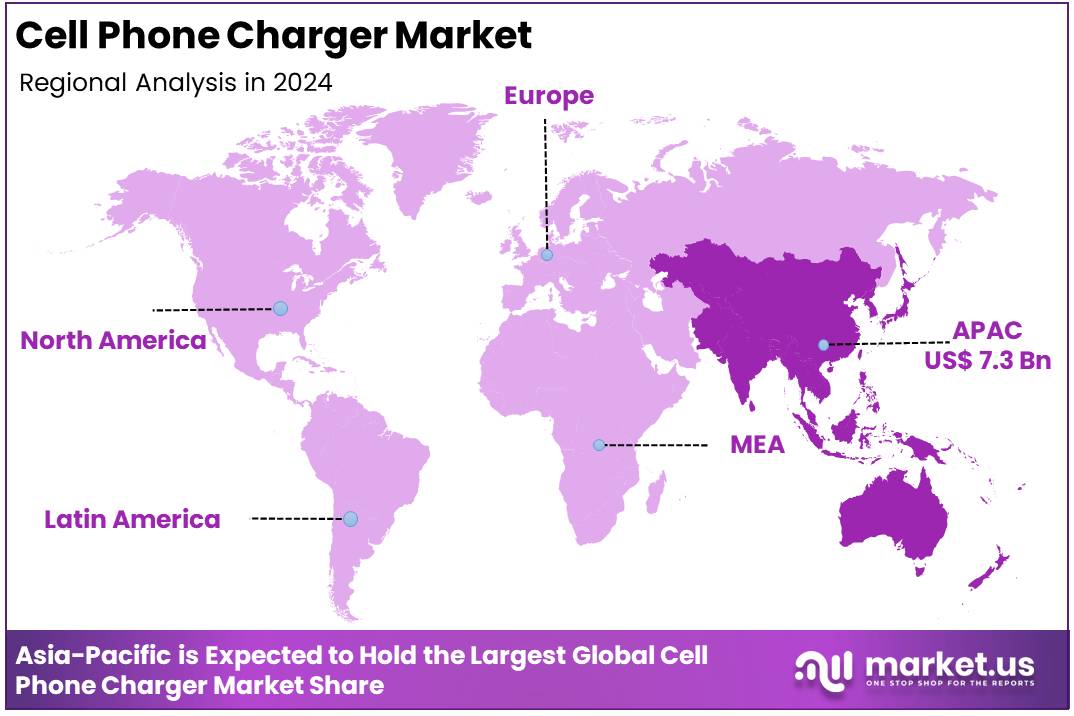

- Asia-Pacific emerged as the dominant region in 2024, accounting for 41.4% of the market share with a market valuation of approximately USD 7.3 billion.

By Product Analysis

Wired Cell Phone Charger Segment Dominates with 51.0% Market Share in 2024

In 2024, the Wired segment held a dominant position in the Cell Phone Charger market, capturing more than 51.0% of the market share. This segment’s predominance can be attributed to several factors that resonate with consumer preferences and technological reliability.

Wired chargers, traditionally comprising USB Type-A, USB Type-C, and Lightning connectors, continue to benefit from widespread compatibility and the perception of faster charging capabilities. The ongoing demand in markets with high sales of smartphones and other portable devices sustains the segment’s substantial share.

Consumers often prefer wired chargers for their dependability and the direct power connection, which typically delivers faster charging compared to wireless alternatives. Additionally, the lower cost associated with wired technology makes it a popular choice among a broad consumer base, particularly in price-sensitive regions.

Despite the growing interest in wireless technology, the wired charger market remains robust due to continuous improvements in charging speeds and the introduction of universal charging solutions by various manufacturers. As the global smartphone market expands, the demand for wired chargers is further supported by the sales of these devices, especially in emerging markets where wireless charging infrastructure is still in its nascent stages.

The standardization of charging ports, primarily through USB-C in newer devices, enhances the user experience by providing a single solution compatible across multiple device types, thus reinforcing the wired segment’s market dominance.

By Distribution Channel Analysis

Offline Cell Phone Charger Segment Dominates with 80.0% Market Share in 2024

In 2024, the Offline distribution channel maintained a dominant market position in the Cell Phone Charger market, capturing more than an 80.0% share. This substantial market share is largely driven by consumer preferences for physical store purchases where they can assess product quality firsthand and receive immediate ownership of the charger without waiting for delivery.

Offline channels, including electronic stores, retail outlets, and supermarkets, offer consumers the advantage of direct interaction with sales staff, who can provide immediate advice and solutions based on the consumer’s specific charging needs. This personal touch helps in building consumer trust and confidence in purchasing decisions.

Conversely, the Online distribution channel, while holding a smaller share, is rapidly growing as consumer shopping behaviors shift towards digital platforms. In 2024, online sales have been increasing due to the convenience of home shopping and the broad range of options available at competitive prices. Consumers benefit from user reviews and ratings, which help in making informed decisions from a diverse range of products that may not be available in physical stores.

The rise of e-commerce platforms and improvements in logistics have made online purchasing more appealing. Specialized tech websites and general e-commerce platforms offer detailed product descriptions, comparison features, and often better pricing, which are particularly attractive to tech-savvy consumers.

As smartphone usage and internet penetration increase globally, the online segment is expected to capture a more significant share of the market, driven by the convenience and enhanced shopping experience it offers.

By Application Analysis

General Charger Cell Phone Charger Segment Dominates with 52.0% Market Share in 2024

In 2024, the General Charger segment held a dominant market position in the Cell Phone Charger market by application, capturing more than a 52.0% share. This prominence is attributed to the universal demand for basic charging solutions that cater to the everyday needs of mobile phone users. General chargers, typically included with the purchase of new mobile devices, are favored for their direct compatibility and optimized charging capabilities designed specifically for the device.

The sustained preference for general chargers stems from their reliability and the convenience they offer. Manufacturers often design these chargers to maximize charging efficiency and safety for the specific battery type and capacity of the devices they accompany.

This targeted approach ensures that the chargers maintain battery health and longevity, which is a critical concern for consumers. Moreover, the regulatory environment in many regions mandates that chargers sold with phones meet specific standards, which reinforces consumer trust in these products.

General chargers also benefit from the widespread network of retail and online stores that stock replacements and upgrades that are guaranteed to work with specific models, further ensuring consumer loyalty to this segment. As technology advances, these chargers continue to evolve, incorporating features like faster charging technologies and energy efficiency, which help sustain their dominance in the market.

On the other hand, the Power Bank segment, while smaller, represents a vital and growing part of the Cell Phone Charger market. Power banks are increasingly popular among users who require mobile charging solutions that can keep their devices operational without being tethered to a power outlet. This need is particularly pronounced in the context of increasing smartphone use, longer commutes, and frequent travel.

Power banks offer the convenience of portable, on-the-go charging and are capable of charging multiple devices simultaneously, making them ideal for users with multiple gadgets. They come in various capacities, allowing consumers to choose based on their typical usage and charging needs.

As the dependency on smartphones and other portable electronic devices grows, so does the demand for power banks, with consumers seeking out more robust solutions that offer fast charging capabilities and higher energy retention. This trend is expected to drive gradual growth in the power bank market share as advancements in battery technology and compact designs make them more appealing to a broader audience.

Key Market Segments

By Product Type

- Wired

- Wireless

By Distribution Channel

- Offline

- Hypermarkets & Supermarkets

- Specialty Stores

- Retail Stores

- Other Offline Distribution Channel

- Online

By Application

- Power Bank

- General Charger

Driver

Increasing Smartphone Penetration

The global cell phone charger market is significantly driven by the escalating penetration of smartphones across various demographics and geographies. As of 2024, the widespread adoption of mobile devices in emerging markets, coupled with the replacement cycle of smartphones in developed regions, is catalyzing the demand for cell phone chargers.

This surge is further amplified by the growing consumer inclination towards advanced smartphones featuring high-end functionalities that require more frequent charging, thus propelling the market for robust and fast-charging solutions. Moreover, the evolution of smartphone technology, including the integration of larger batteries and more powerful processors, necessitates the development of innovative charging technologies that can efficiently cater to these advanced devices.

The demographic shift towards a more tech-savvy population, with a higher spending capability on mobile accessories, also contributes significantly to the market’s growth. As consumers, especially in urban areas, become more dependent on their smartphones for both personal and professional purposes, the demand for additional chargers, including portable and wireless variants, is expected to rise.

This trend underscores the need for manufacturers to continuously innovate and expand their product offerings to meet the evolving consumer preferences and technology standards, thereby driving the growth of the global cell phone charger market.

Restraint

Environmental Regulations and Standardization Issues

Environmental regulations and the push for standardization pose considerable restraints on the global cell phone charger market. In 2024, stringent environmental laws aimed at reducing electronic waste influence the design and manufacturing processes of cell phone chargers.

Governments and regulatory bodies are increasingly advocating for universal chargers that can work across multiple devices and models to minimize electronic waste and enhance user convenience. These regulations require manufacturers to adhere to specific standards, which may limit design innovations and increase production costs.

Furthermore, the market faces challenges from the growing consumer awareness regarding environmental impacts. This awareness drives demand for eco-friendly products, compelling manufacturers to invest in sustainable technologies that are often more expensive to develop and implement.

The need for compliance with multiple international standards can also complicate the production processes and extend time-to-market for new products, thereby restraining market growth. These factors collectively create a competitive environment where only companies that can balance innovation with environmental and regulatory demands are likely to thrive.

Opportunity

Wireless Charging Technology

The advent and enhancement of wireless charging technology present significant opportunities for the cell phone charger market in 2024. With the technology becoming more mainstream, the demand for wireless chargers is expected to witness substantial growth, driven by the convenience and improved usability they offer.

This shift is supported by the increasing integration of wireless charging capabilities in newer smartphone models, promoting a wire-free, minimalistic charging environment. Innovations such as faster charging speeds and extended range wireless charging are making these solutions more attractive to consumers.

Additionally, the proliferation of public spaces such as cafes, airports, and hotels adopting wireless charging facilities creates a conducive environment for market expansion. These developments not only enhance consumer convenience but also encourage the adoption of wireless charging technology, further broadening the market scope.

As technology companies continue to invest in and promote wireless charging standards, the potential for market growth is immense, positioning wireless charging as a key driver in the evolution of the cell phone charger market landscape.

Trends

Eco-Friendly and Smart Charging Solutions

A prominent trend in the global cell phone charger market in 2024 is the shift towards eco-friendly and smart charging solutions. This trend is driven by increasing consumer consciousness about sustainability and the environmental impact of their purchasing decisions. Market players are responding by developing chargers made from recycled materials, featuring energy-efficient designs that minimize power consumption and reduce carbon footprints.

Additionally, the integration of smart technology into chargers, enabling them to adjust the power output based on the device’s requirements, enhances charging efficiency and extends battery life.

This trend is not only a response to consumer demand but also aligns with global sustainability goals. Smart chargers also cater to the growing market for IoT and connected devices, where chargers play a crucial role in ensuring energy efficiency and managing power dynamically across different devices.

As these technologies develop, they pave the way for innovative products that support a sustainable future while meeting the high-performance expectations of modern consumers, thereby influencing the growth trajectory of the cell phone charger market significantly.

Regional Analysis

Asia-Pacific Leads Cell Phone Charger Market with Largest Market Share of 41.4% in 2024

The Cell Phone Charger Market exhibits significant regional disparities, with Asia-Pacific, North America, Europe, the Middle East & Africa, and Latin America contributing uniquely to the global landscape. In 2024, Asia-Pacific emerges as the dominant region, holding a commanding 41.4% of the market share. This region’s market valuation reached approximately USD 7.3 billion, underscoring its pivotal role in the industry. The substantial market share can be attributed to the high population density, rapidly expanding consumer electronics sector, and increasing adoption of mobile devices in countries such as China, India, and Japan.

North America, guided by advancements in technology and high consumer purchasing power, also plays a crucial role in the dynamics of the Cell Phone Charger Market. The region focuses on innovative charger solutions, including wireless and fast-charging technologies, which cater to a tech-savvy consumer base seeking convenience and efficiency.

Europe’s market is characterized by a strong emphasis on sustainable and energy-efficient products, aligning with the region’s stringent regulations on electronic waste and energy consumption. The presence of several key market players in the region drives the development of advanced, eco-friendly charging solutions.

The Middle East & Africa region shows promising growth, driven by increasing urbanization and mobile penetration. The market is benefiting from the gradual shift towards digitalization and improved telecommunications infrastructure, which are essential for the broader adoption of mobile technologies.

Latin America’s market is evolving with the rising affordability of smartphones and improving internet infrastructure. This region is experiencing a gradual increase in demand for mobile accessories, including chargers, as consumers in countries like Brazil and Mexico increasingly rely on mobile devices for daily activities.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The Global Cell Phone Charger Market, a notable participant is Momax. As of 2024, Momax has positioned itself strategically by leveraging advanced technology to enhance the efficiency and durability of its products. The company’s focus on wireless and fast charging solutions reflects its commitment to addressing the growing consumer demand for quick and convenient charging options. Momax’s innovative product line, characterized by sleek designs and compatibility with a wide range of devices, supports its competitive edge in various international markets.

Another key player, Yoobao, has distinguished itself through its expansive distribution network and robust after-sales services. Yoobao’s chargers are renowned for their reliability and safety features, which have cultivated trust among consumers. In 2024, Yoobao continues to expand its product offerings to include environmentally friendly options, thus appealing to a market increasingly inclined towards sustainable products.

HONGYI and SIYOTEAM are also significant contenders, with each bringing unique strengths to the market. HONGYI focuses on cost-effective solutions without compromising quality, making it a popular choice in emerging markets. Conversely, SIYOTEAM capitalizes on innovative designs and user-friendly interfaces, which have proven successful in attracting tech-savvy consumers.

Companies like LG Electronics and Samsung maintain a strong presence in the market by integrating their chargers with their extensive line of consumer electronics, ensuring compatibility and enhancing consumer convenience. Their continuous investment in research and development drives technological advancements, setting industry standards in charger efficiency and safety.

Top Key Players in the Market

- Momax

- Yoobao

- HONGYI

- SIYOTEAM

- AOHAI

- LG Electronics

- Hosiden

- Rayovac

- Aigo

- MC power

- ARUN

- Mipow

- Salcomp

- Samsung

- Sinoele

- Scud

- PNY

- Other Key Players

Recent Developments

- In June 20, 2023, Nichicon Corporation teamed up with Ossia, Inc. to leverage the potential of wireless power technology. This collaboration aims to integrate Ossia’s innovative Cota Real Wireless Power™ into Nichicon’s SLB Series of Lithium Titanate Oxide (LTO) Batteries. The result is a revolutionary Nichicon branded battery that charges continuously in the presence of a Cota Power Transmitter. This enhancement not only simplifies the charging process but also extends the battery’s lifespan, opening up new possibilities for device manufacturers and improving user satisfaction.

- On July 12, 2023, WiTricity introduced its FastTrack Integration Program, designed to expedite the adoption of wireless EV charging by automotive OEMs. The program promises to enable a seamless integration of WiTricity’s technology, including the Halo™ receiver and the 11kW charger, into OEMs’ electric vehicles within just three months. This initiative significantly reduces the time for testing and deploying wireless charging solutions on both current and forthcoming EV models.

- September 5, 2023 marked a significant milestone for TORRAS as it unveiled its latest product line at IFA 2023. The brand showcased innovative kickstand phone cases that promise to transform the user experience by enabling hands-free usage, particularly beneficial in today’s era of short-form video content. These products exemplify TORRAS’ commitment to technological innovation aimed at enhancing the functionality and convenience of smartphone accessories.

- In 2025, Anker announced the launch of a groundbreaking 140W wall charger at CES. This new charger features a unique design with USB ports positioned at the bottom, enhancing stability and connectivity. It represents Anker’s first foray into chargers with integrated display screens, showing real-time power output for each port, which enhances user convenience and efficiency.

- On January 5, 2023, Blink Charging Co. introduced five innovative EV charging solutions at the Consumer Electronics Show (CES) 2023. These new offerings, including models like the Vision and Series 3, cater to the burgeoning demand for efficient EV charging infrastructure in various global markets. Blink Charging’s initiative highlights their ongoing commitment to enhancing EV accessibility and user experience worldwide, emphasizing their role in the sustainable transportation revolution.

Report Scope

Report Features Description Market Value (2024) USD 17.8 Billion Forecast Revenue (2034) USD 30.4 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Wired, Wireless), By Distribution Channel (Offline & Online), By Application (Power Bank, General Charger Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Momax, Yoobao, HONGYI, SIYOTEAM, AOHAI, LG Electronics, Hosiden, Rayovac, Aigo, MC power, ARUN, Mipow, Salcomp, Samsung, Sinoele, Scud, PNY, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cell Phone Charger MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Cell Phone Charger MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Momax

- Yoobao

- HONGYI

- SIYOTEAM

- AOHAI

- LG Electronics

- Hosiden

- Rayovac

- Aigo

- MC power

- ARUN

- Mipow

- Salcomp

- Samsung

- Sinoele

- Scud

- PNY

- Other Key Players