Global Sports headphones Market By Product Type (In-ear headphones, On-ear headphones, Over-ear headphones), By Features (Smart headphones, Non-smart headphones), By Technology (True wireless headphones, Wired headphones, Wireless headphones), By Distribution Channel (Online retail, Offline retail), By End-user Application (Running & Jogging, Gym & Fitness Workouts, Cycling & Outdoor Sports, Swimming), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140318

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

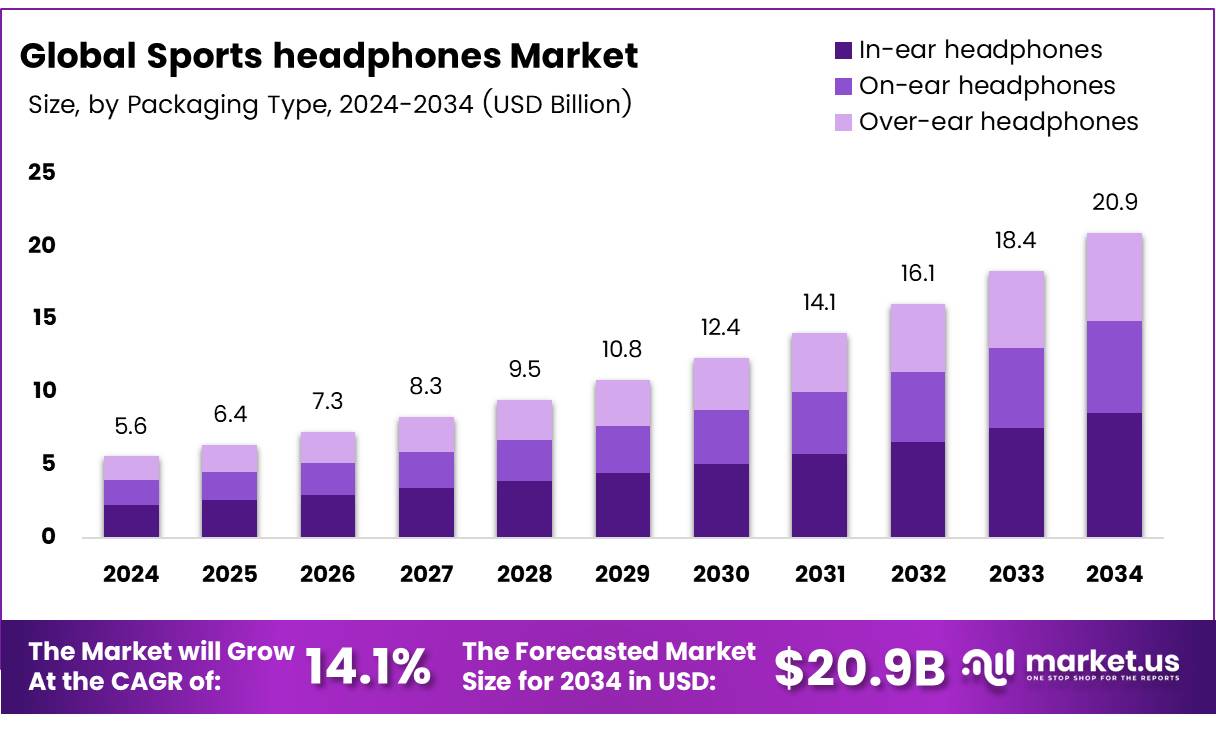

The Global Sports headphones Market size is expected to be worth around USD 20.9 Billion by 2034, from USD 5.6 Billion in 2024, growing at a CAGR of 14.1% during the forecast period from 2025 to 2034.

The sports headphones market has experienced a notable surge in demand due to growing consumer interest in fitness and health. With an increasing emphasis on active lifestyles, consumers are seeking high-performance, durable, and comfortable audio products tailored for physical activities.

The market encompasses a range of products designed to withstand intense physical exertion, offer sweat resistance, and provide high-quality sound even in noisy environments. These headphones are often integrated with advanced features such as fitness tracking, heart rate monitoring, and long battery life, all contributing to a stronger market presence.

According to industry report, in 2022, 42.41% of people reported they always wear headphones, while 25% used them frequently, indicating a high consumer base that could be inclined to purchase sports-specific audio products.

The sports headphones market is poised for significant growth, driven by both technological advancements and increased consumer spending on health and fitness. The average battery life of sports headphones, for instance, has increased from 8 hours in 2022 to 12 hours in 2024, reflecting a 50% improvement in battery longevity over two years, according to Phiaton. This improvement caters directly to consumer demands for convenience, especially in long workout sessions.

Additionally, the integration of smart features, such as voice assistants and connectivity with fitness apps, opens new opportunities for innovation and product diversification. The growing trend of smart sports devices, supported by government initiatives for promoting fitness and well-being, is expected to further boost market growth.

Governments are increasingly investing in health-related programs that encourage physical activity, indirectly benefiting the sports headphone sector. Regulations, particularly those surrounding product safety, durability, and wireless communication standards, will play a crucial role in shaping market dynamics. Governments worldwide are expected to enforce stricter guidelines on wireless technology, battery safety, and environmental sustainability.

As sustainability becomes a more prominent focus for both consumers and manufacturers, regulatory bodies are likely to introduce more stringent standards related to material sourcing and disposal of electronic products, further influencing market trends. The market’s resilience and its ability to adapt to these regulations will be essential for maintaining growth and consumer trust.

Key Takeaways

- The global sports headphones market is projected to reach USD 20.9 billion by 2034, growing at a 14.1% CAGR from 2025 to 2034.

- In-ear headphones dominate the market in 2024 due to their compact design, portability, and comfort for active users.

- Smart headphones lead the market in 2024, driven by advanced features like fitness tracking, heart rate monitoring, and mobile app integration.

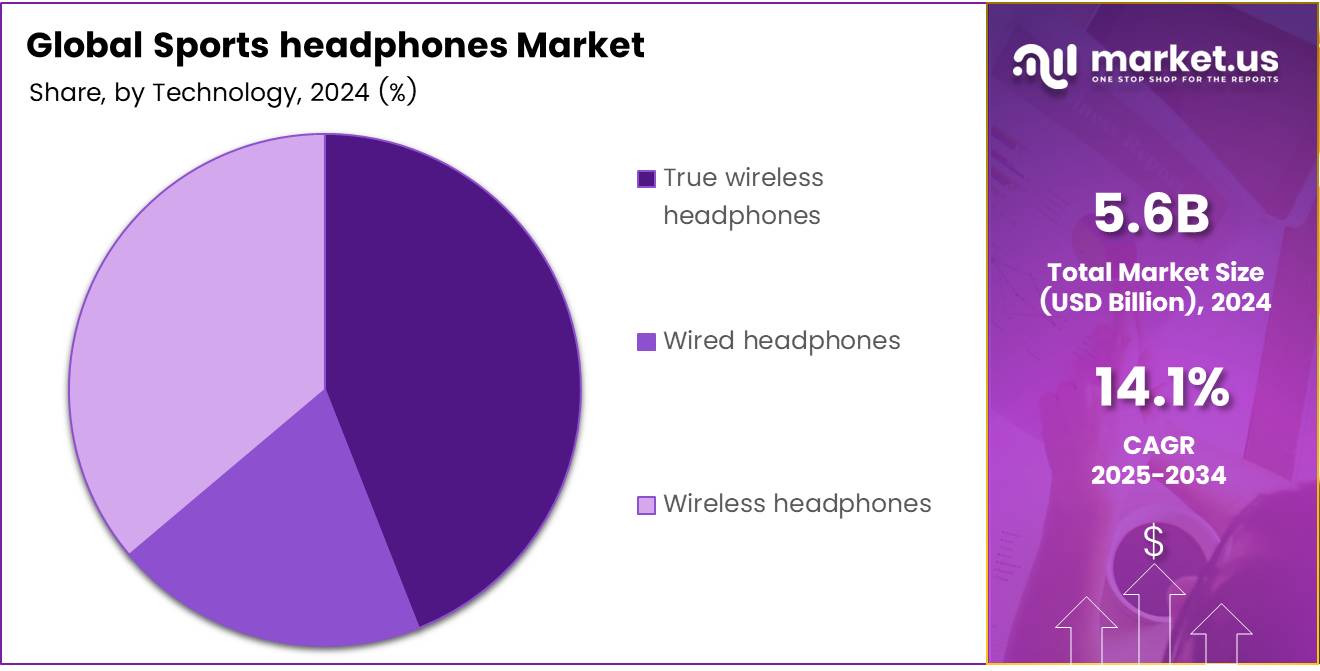

- True wireless headphones are the top choice in 2024, offering convenience, portability, and features like noise cancellation and sweat resistance.

- Online retail dominates the sports headphones market in 2024, driven by the convenience, competitive pricing, and wide selection available.

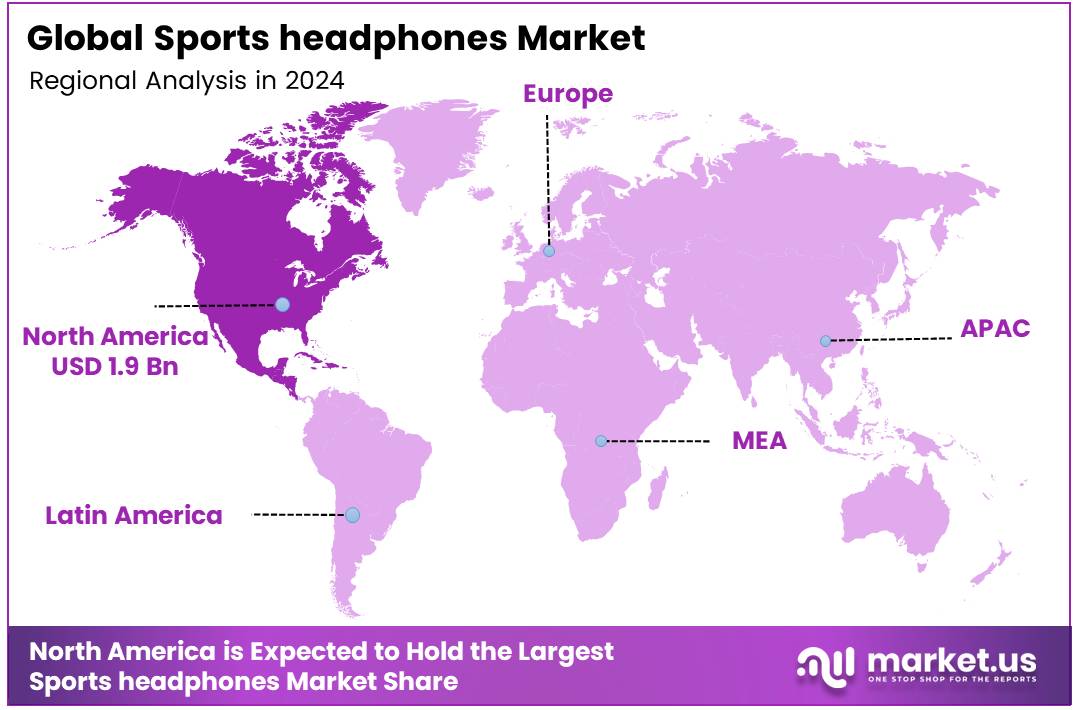

- North America leads the global sports headphones market with a 35.2% share, valued at USD 1.9 billion in 2024, fueled by fitness demand and tech advancements.

Product Type Analysis

In-ear Headphones Lead Sports Headphones Market in 2024

In 2024, in-ear headphones held a dominant position in the By Product Type Analysis segment of the sports headphones market. The preference for in-ear headphones is driven by their compact design, ease of use, and suitability for active users who prioritize portability and comfort during physical activities.

The lightweight and secure fit of in-ear models ensures they remain popular among consumers engaged in sports, as they provide effective noise isolation and minimal distraction during workouts.

On-ear headphones follow as the second most favored product type. Although they deliver high-quality sound, their adoption for sports applications remains lower due to factors such as a less secure fit and potential discomfort during extended use.

Over-ear headphones, while offering superior sound quality and noise cancellation, account for a smaller market share in the sports headphones sector. Their bulkier design and reduced portability make them less suitable for active individuals seeking lightweight and compact options for physical activities. This limits their appeal in the sports-specific category.

Features Analysis

Smart Headphones Lead Sports Headphones Market in 2024

In 2024, smart headphones held a dominant position in the By Features Analysis segment of the sports headphones market. The growing consumer preference for smart headphones is largely due to their advanced functionalities, including fitness tracking, heart rate monitoring, and integration with mobile apps, making them ideal for active users who seek to optimize their workout experience. Additionally, the appeal of wireless connectivity and compatibility with voice assistants further supports the rise of smart headphones among sports enthusiasts.

Non-smart headphones, while still prevalent in the market, have a relatively smaller share. These headphones are appreciated for their straightforward, reliable audio performance and cost-effectiveness. However, their lack of advanced features compared to smart headphones has limited their appeal among consumers who prioritize innovation and enhanced functionality in their sports gear.

Technology Analysis

True Wireless Headphones Capture Majority Share in Sports Headphones Market by Technology

In 2024, true wireless headphones held a dominant position in the By Technology segment of the sports headphones market. This leadership can be attributed to their convenience, portability, and advanced features such as touch controls, noise cancellation, and sweat resistance, making them highly preferred by active consumers.

The increasing adoption of wireless technology in everyday life has further fueled the demand for true wireless products, particularly among fitness enthusiasts and athletes seeking a seamless experience during physical activity.

Wireless headphones, while lagging behind, continue to see solid demand, driven by consumers seeking flexible alternatives to wired models. This segment benefits from Bluetooth connectivity, offering convenience for users, though their performance capabilities fall short when compared to the superior features of true wireless options.

Wired headphones, though still present in the market, have seen reduced demand as more consumers opt for wireless solutions. Their market share remains limited, primarily due to the growing preference for the freedom and flexibility provided by wireless technologies in sports and fitness activities.

Distribution Channel Analysis

Online Retail Dominates Sports Headphones Market in 2024 Due to Convenience and Consumer Preference

In 2024, online retail held a dominant market position in the By Distribution Channel Analysis segment of the sports headphones market. The shift towards e-commerce continues to drive growth in the sector, with consumers increasingly preferring the convenience, competitive pricing, and broad product range available through online platforms.

Online retail offers consumers an easier, more personalized shopping experience, with the ability to compare multiple brands and models at their fingertips. The growing influence of online marketing and the availability of customer reviews further contribute to its dominance.

On the other hand, offline retail, while still relevant, plays a secondary role in the distribution of sports headphones. Traditional brick-and-mortar stores cater to a specific segment of consumers who prioritize in-person experiences or wish to make immediate purchases. However, the trend of online shopping, driven by convenience, continues to outpace the growth of offline retail in the sports headphones market.

Key Market Segments

By Product Type

- In-ear headphones

- On-ear headphones

- Over-ear headphones

By Features

- Smart headphones

- Non-smart headphones

By Technology

- True wireless headphones

- Wired headphones

- Wireless headphones

By Distribution Channel

- Online retail

- Offline retail

By End-user Application

- Running & Jogging

- Gym & Fitness Workouts

- Cycling & Outdoor Sports

- Swimming (Waterproof Headphones)

Drivers

Rising Demand for Sports Headphones Driven by Evolving Consumer Preferences and Technological Advancements

The sports headphones market is experiencing significant growth, primarily driven by the increasing demand for wireless audio devices and the growing trend of fitness and wellness. As more consumers prioritize health and fitness, sports headphones have become a popular choice due to their ability to provide comfort, durability, and high-quality sound during physical activities such as running, cycling, and gym workouts.

In addition, technological advancements, such as improvements in battery life, water resistance, and noise-cancelling features, have made these headphones more functional and appealing. Another key driver is the rising popularity of smart devices and wearables, with sports headphones being integrated into connected ecosystems, allowing users to track their fitness metrics seamlessly. Moreover, the growing preference for wireless audio solutions, driven by the expansion of Bluetooth technology and the decline of wired alternatives, has further boosted the market.

Enhanced ergonomics, such as ear hooks and customizable fits, also contribute to the appeal of sports headphones, ensuring they stay secure during intense physical activity. As disposable income increases globally, consumers are more inclined to invest in premium sports audio equipment, further propelling the growth of this market segment.

Restraints

High Initial Investment and Space Constraints Pose Challenges for Market Growth

The sports headphones market faces certain restraints that could limit its growth potential. A primary concern is the high initial investment required for high-quality sports headphones. Premium models with advanced features such as noise cancellation, sweat resistance, and superior sound quality tend to be more expensive, which could deter budget-conscious consumers from making a purchase. In addition, the availability of cheaper alternatives could further challenge the adoption of high-end models.

Another limiting factor is the space constraints experienced by consumers, particularly in urban settings. As sports headphones are often used for active sports or workouts, customers may find it difficult to invest in high-performance models if they perceive them as bulky or not easily portable.

Moreover, while larger and more feature-rich headphones may offer enhanced performance, consumers may prefer compact, lightweight alternatives that can fit more easily into a busy lifestyle. These factors combined may slow the widespread adoption of premium sports headphones, affecting market penetration.

Growth Factors

Innovative Features and Customization Open New Growth Opportunities for Sports Headphones Market

The sports headphones market is poised for growth through several emerging opportunities that align with consumer demand for advanced features and personalization. One key opportunity lies in the integration of smart features, such as fitness tracking capabilities, heart rate monitoring, and app connectivity.

These innovations can elevate the user experience by offering real-time performance data, making the headphones more valuable for fitness enthusiasts who want to optimize their workouts.

Another promising opportunity is the rise of customization options, where consumers can personalize their headphones with unique designs, colors, or even team logos. This could appeal to sports fans who seek a closer connection to their preferred teams and athletes.

Additionally, there is growing potential for incorporating eco-friendly and sustainable materials into sports headphones, appealing to environmentally conscious consumers. With an increasing focus on sustainability, manufacturers who embrace green production practices can differentiate themselves in the competitive market.

Lastly, leveraging technologies such as augmented reality (AR) to enhance the workout experience offers another avenue for growth. AR could enable features like virtual coaching or immersive workout scenarios, which could particularly appeal to tech-savvy users.

Collectively, these opportunities represent a strong foundation for expanding the sports headphones market, as they cater to evolving consumer preferences for high-tech, customizable, and environmentally responsible products.

Emerging Trends

Minimalist Design and Smart Features Lead the Way in Sports Headphones Market Trends

The sports headphones market is witnessing several key trends that are reshaping consumer preferences and influencing product development. One of the most notable trends is the demand for minimalist and sleek designs, with urban consumers particularly seeking compact, stylish, and visually appealing products. These designs often prioritize functionality while maintaining a modern aesthetic, which aligns well with the preferences of modern households and individuals living in smaller spaces.

Another major trend is the growing integration of sports headphones with mobile applications. Consumers are increasingly looking for headphones that can seamlessly connect to apps for tracking workouts, managing settings, or even offering personalized training plans.

This integration elevates the overall user experience by providing added convenience and performance insights. In addition, there is a rising interest in high-tech features that enhance the competitive edge, particularly for athletes or fitness enthusiasts who engage in performance-driven activities. Features like advanced noise cancellation, virtual coaching, and real-time biometric feedback are becoming increasingly sought after.

Lastly, consumers are also leaning toward more comfortable and ergonomically designed headphones, with improved airflow systems and sweat-resistant materials, ensuring durability and comfort during intense workouts. These trends highlight how the sports headphones market is evolving to meet the demands of a more connected, stylish, and performance-focused consumer base.

Regional Analysis

North America leads with 35.2% market share valued at USD 1.9 billion

The global sports headphones market exhibits notable regional distinctions, with North America, Europe, Asia Pacific, Middle East & Africa, and Latin America each demonstrating unique growth patterns and market dynamics.

North America dominates the sports headphones market, capturing 35.2% of the global market share, valued at USD 1.9 billion in 2024. The region’s leadership is primarily attributed to the high consumer demand for fitness-oriented products, an established sports culture, and rapid technological advancements in wireless audio solutions. The increasing participation in fitness activities, including running and gym workouts, along with a strong presence of leading audio technology brands, further bolsters market growth.

Regional Mentions:

Europe represents a significant portion of the global market, driven by growing health and wellness trends, the rising adoption of fitness wearables, and the demand for high-quality audio experiences. Key markets such as the UK, Germany, and France are witnessing substantial growth, particularly as consumers seek specialized sports headphones that cater to various sports and fitness needs.

In the Asia Pacific region, the market is expanding rapidly, fueled by an increase in disposable income, a growing middle class, and the rising popularity of fitness and sports activities. Countries such as China and India are experiencing rapid adoption of sports headphones, supported by advancements in Bluetooth technology and an increasing focus on health-conscious lifestyles.

The Middle East & Africa and Latin America regions represent smaller but emerging markets, with gradual growth driven by the expanding fitness culture and a rising number of health-focused consumers. While economic challenges in certain areas may slow rapid growth, the increasing availability of global sports brands and fitness products continues to support market expansion in these regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Samsung and Apple stand as major contenders, leveraging their vast ecosystems and technological innovation. Samsung’s integration with its Galaxy line and Apple’s seamless connectivity with the iOS ecosystem enhance their appeal to athletes seeking high-quality audio and ease of use. Apple’s AirPods Pro, with fitness-oriented features, including sweat resistance and noise cancellation, positions it strongly in the market.

Sony and Sennheiser, renowned for premium audio quality, will likely continue to appeal to audiophiles and athletes who prioritize sound clarity alongside comfort and durability. Sony’s WH-1000XM series and Sennheiser’s Sport True Wireless offer cutting-edge technology like adaptive sound control and personalized audio, which appeal to both fitness enthusiasts and casual users.

Bang & Olufsen, known for their luxury audio products, may carve a niche for high-end consumers desiring a blend of superior design and performance, albeit at a higher price point.

Emerging brands like JLab, Boat, and Cowin will drive affordability and accessibility, offering competitive pricing while delivering essential features such as waterproofing, long battery life, and ergonomic designs. Their growing market presence is aligned with the increasing demand for budget-friendly yet functional sports headphones.

Motorola Mobility (Lenovo) and Philips will likely focus on innovation in fitness-specific features, such as heart rate monitoring and advanced connectivity.

As competition intensifies, differentiation will revolve around sound quality, user experience, fitness features, and price, which will ultimately shape the market in 2024.

Top Key Players in the Market

- Samsung

- Bang & Olufsen

- Sony

- Sennheiser

- Apple

- Audio-Technica

- Bragi

- Jays

- JLab

- Motorola Mobility (Lenovo)

- Philips

- Pioneer

- Boat

- Cowin

Recent Developments

- In February 2025, StatusPro secured $20 million in a Series A funding round, with the aim to accelerate its virtual reality (VR) technology and expand its market presence in the gaming and simulation sectors.

- In May 2024, Neurable raised $13 million to further develop its brain-computer interface technology, focusing on integrating these advancements into everyday consumer products, enhancing human-computer interaction.

- In August 2023, Sony acquired the high-end audio headphone maker Audeze, reinforcing its position in the premium audio market and expanding its portfolio with advanced headphone technologies.

- In November 2024, Bose completed the acquisition of McIntosh, a renowned premium audio brand, strategically enhancing its high-end audio offerings and broadening its consumer base in the luxury audio segment.

Report Scope

Report Features Description Market Value (2024) USD 5.6 Billion Forecast Revenue (2034) USD 20.9 Billion CAGR (2025-2034) 14.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(In-ear headphones, On-ear headphones, Over-ear headphones), By Features(Smart headphones, Non-smart headphones), By Technology(True wireless headphones, Wired headphones, Wireless headphones), By Distribution Channel(Online retail, Offline retail), By End-user Application(Running & Jogging, Gym & Fitness Workouts, Cycling & Outdoor Sports, Swimming) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Samsung, Bang & Olufsen, Sony, Sennheiser, Apple, Audio-Technica, Bragi, Jays, JLab, Motorola Mobility (Lenovo), Philips, Pioneer, Boat, Cowin Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Samsung

- Bang & Olufsen

- Sony

- Sennheiser

- Apple

- Audio-Technica

- Bragi

- Jays

- JLab

- Motorola Mobility (Lenovo)

- Philips

- Pioneer

- Boat

- Cowin