Global Hand Blender Market By Product (Corded, Cordless), By Application (Commercial, Residential), By Distribution Channel (Online( Company Website, E-Commerce Channel), Offline (Specialty Stores, Mega Retail Store, Others), by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 14854

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

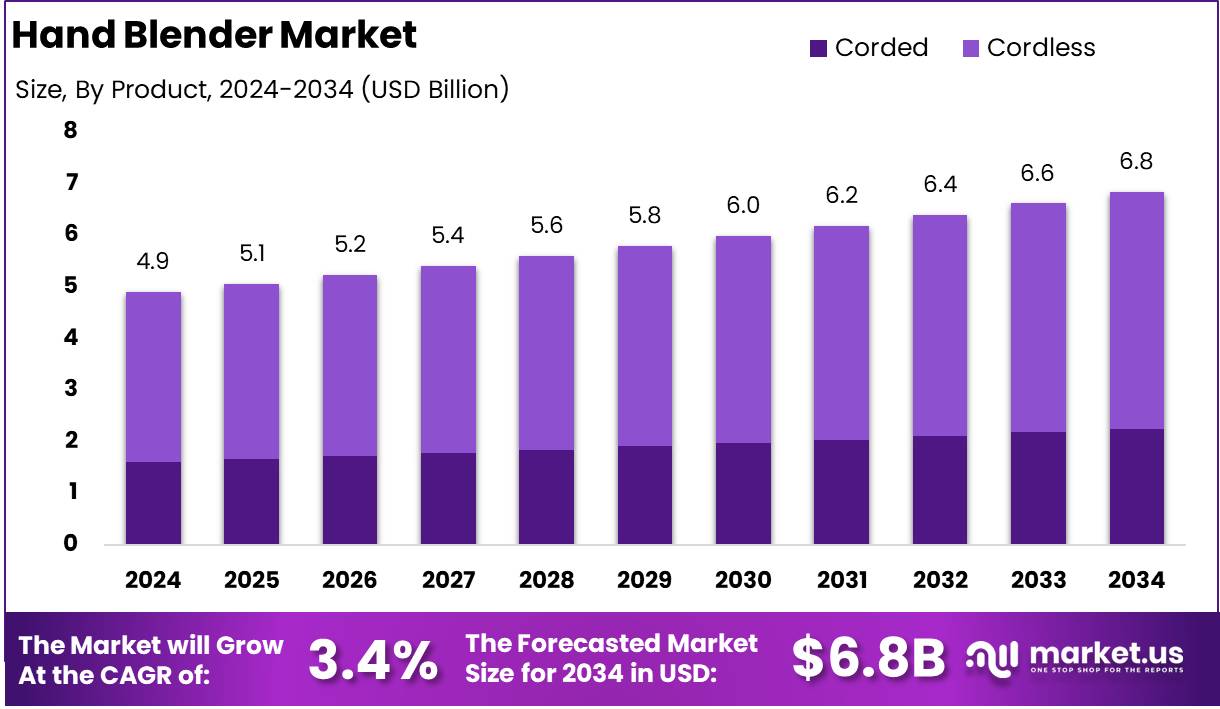

The Global Hand Blender Market size is expected to be worth around USD 6.8 Billion by 2034 from USD 4.9 Billion in 2024, growing at a CAGR of 3.4% during the forecast period from 2025 to 2034.

A hand blender, also known as an immersion blender or stick blender, is a compact and versatile kitchen appliance designed for blending, mixing, and pureeing ingredients directly in a container. Unlike traditional countertop blenders, a hand blender features a slim, handheld design with a rotating blade at the base, allowing for effortless operation in pots, bowls, or cups.

Its convenience, ease of use, and ability to handle a variety of culinary tasks from soups and sauces to smoothies and batters have made it a preferred choice among home cooks and professional chefs alike.

The hand blender market refers to the global industry encompassing the production, distribution, and sales of handheld blending devices. This market includes various product segments, such as corded and cordless hand blenders, as well as models with multiple speed settings, attachments, and advanced technological features.

Manufacturers compete based on product innovation, design, durability, and efficiency, while retailers and e-commerce platforms serve as primary distribution channels. The market is influenced by consumer preferences for convenience-driven kitchen appliances, advancements in motor technology, and increasing health-conscious dietary trends that encourage homemade meal preparation.

The growth of the hand blender market is driven by several key factors. Rising urbanization and fast-paced lifestyles have increased the demand for compact and efficient kitchen appliances that streamline food preparation. Technological advancements, including the development of powerful yet lightweight motors, rechargeable battery-operated models, and multifunctional attachments, have further enhanced product appeal.

Demand for hand blenders is primarily influenced by changing consumer lifestyles, increased adoption of smart kitchen appliances, and the rising number of health-conscious individuals seeking convenient meal preparation solutions. The surge in home cooking, driven by factors such as remote work trends and rising food costs, has led to higher sales of kitchen appliances, including hand blenders.

The hand blender market presents several growth opportunities for manufacturers and retailers. Product innovation remains a key area, with potential advancements in smart connectivity, ergonomic design, and energy-efficient models enhancing consumer appeal. Expansion into emerging markets, where rising disposable incomes and increasing urbanization are fostering demand for modern kitchen appliances, offers significant revenue potential.

According to Volza, the Hand Blender market in India has demonstrated significant growth, with 678 shipments imported between March 2023 and February 2024, reflecting an 18% increase from the previous year. February 2024 alone saw 131 shipments, marking a 130% year-on-year surge and an unprecedented 992% sequential growth from January 2024.

India leads global imports with 5,403 shipments, surpassing the United States 3,568 and Costa Rica 1,343. This surge underscores rising consumer demand, evolving kitchen appliance preferences, and strengthening supply chain networks. The increasing import momentum signals sustained market expansion, positioning India as a key player in the global Hand Blender industry.

The hand blender market is witnessing significant growth, fueled by consumer demand for efficiency and convenience in food preparation. 25% of blender users make smoothies more than five times a month, indicating a strong adoption in health-focused diets. 90% of users clean their blenders after every use, reflecting high hygiene awareness. According to industry report, 72% of personal and 66% of full-size blender owners use them for five minutes or less per session, emphasizing quick usage patterns.

Additionally, 34% use personal blenders for snacks, 33% for breakfast, and only 16% for dinner, showcasing distinct consumption behaviors that are shaping product innovation and market expansion.

Key Takeaways

- The Global Hand Blender Market is projected to reach USD 6.8 billion by 2034, up from USD 4.9 billion in 2024, reflecting a CAGR of 3.4% during the forecast period (2025–2034).

- Cordless hand blenders led the market in 2024, accounting for 67.1% of the total market share.

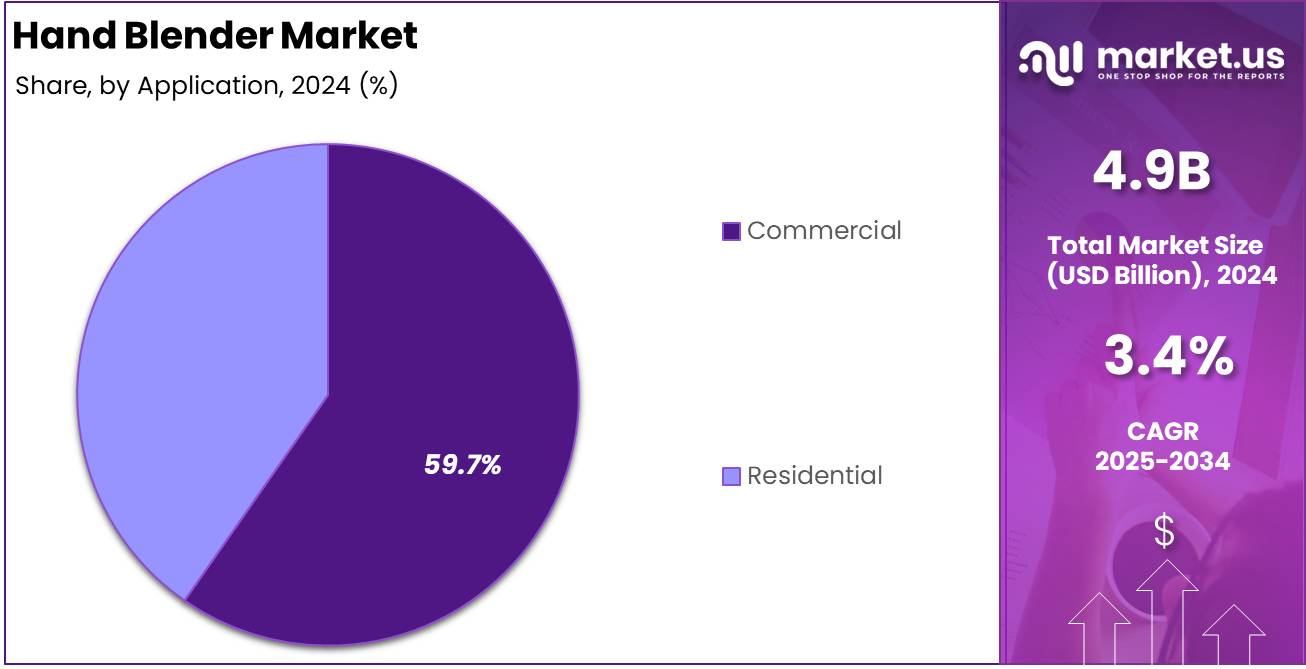

- Commercial hand blenders dominated the market by application, capturing 59.7% of the total market share in 2024.

- Offline distribution channels remained the preferred choice, holding a 66.2% market share in 2024.

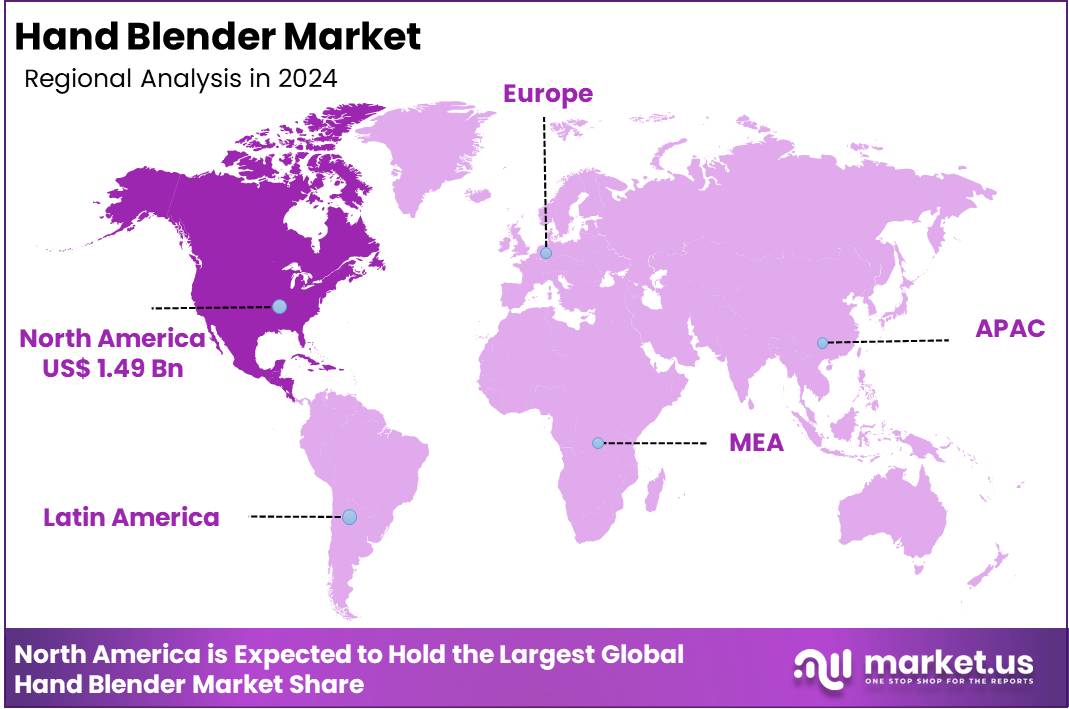

- North America emerged as the largest regional market, representing 30.6% of the total market share in 2024, with a valuation of USD 1.49 billion.

By Product Analysis

Cordless Hand Blender Dominates Hand Blender Market with 67.1% Share in 2024

In 2024, cordless hand blenders emerged as the dominant segment by product in the global hand blender market, capturing more than 67.1% of the total market share. The segment’s growth is driven by increasing consumer preference for convenience, portability, and ease of use.

The demand for cordless hand blenders has surged due to advancements in battery technology, extended runtime, and enhanced power efficiency, making them a preferred choice among home and professional users.

Despite the rising preference for cordless models, corded hand blenders continue to hold a substantial share in the market. Their appeal is driven by a consistent power supply, eliminating the need for recharging, and offering affordability compared to cordless alternatives.

These blenders remain a preferred choice for consumers who require uninterrupted performance for extended blending sessions, particularly in commercial settings and among budget-conscious buyers.

By Application Analysis

Commercial Hand Blender Dominates Hand Blender Market with 59.7% Share in 2024

In 2024, commercial hand blenders emerged as the dominant segment by application in the global hand blender market, capturing more than 59.7% of the total market share.

The segment’s growth is fueled by increasing demand from restaurants, cafes, and food service establishments requiring high-performance blending solutions. These blenders are preferred for their durability, powerful motors, and ability to handle large volumes, making them essential in professional kitchens.

While commercial models lead the market, residential hand blenders continue to hold a significant share, driven by growing adoption in home kitchens.

The rising trend of home cooking, increasing health consciousness, and demand for convenient kitchen appliances have contributed to steady demand in this segment. These blenders are favored for their compact size, ease of use, and affordability, catering to everyday culinary needs.

By Distribution Channel Analysis

Offline Channel Dominates Hand Blender Market with 66.2% Share in 2024

In 2024, offline distribution channels emerged as the dominant segment by distribution channel in the global hand blender market, capturing more than 66.2% of the total market share.

The segment’s dominance is driven by strong consumer preference for in-store purchases, allowing hands-on product testing and immediate availability. Specialty stores and mega retail outlets continue to be key sales points, offering a wide range of hand blenders with expert assistance, promotional discounts, and after-sales services.

Although offline channels lead the market, online distribution channels, including company websites and e-commerce platforms, are witnessing steady growth.

Increasing digital adoption, convenience, and competitive pricing are driving consumer preference for online purchases. E-commerce platforms offer a wide selection, customer reviews, and doorstep delivery, making them an increasingly popular choice among tech-savvy and urban consumers.

Key Market Segments

By Product

- Corded

- Cordless

By Application

- Commercial

- Residential

By Distribution Channel

- Online

- Company Website

- E-Commerce Channel

- Offline

- Specialty Stores

- Mega Retail Store

- Others

Driver

Rising Demand for Convenient and Time-Saving Kitchen Appliances

The global hand blender market has experienced significant growth, driven by the increasing demand for convenient and time-saving kitchen appliances. Urban households, characterized by fast-paced lifestyles due to long work hours, commuting, and various social commitments, are seeking appliances that simplify cooking and food preparation.

Hand blenders, with their multifunctional capabilities such as blending, mixing, pureeing, and emulsifying, cater to this need by offering efficiency and versatility in meal preparation. This trend is particularly strong in urban areas where busy lifestyles demand quick and easy meal preparation solutions.

Moreover, the rising disposable incomes have significantly driven the market as consumers increasingly invest in high-quality kitchen appliances that offer convenience and efficiency. As people have more disposable income, they are more inclined to purchase appliances that offer convenience and enhance their cooking experience.

This shift towards healthier food consumption is even more buoyed by fitness enthusiasts, nutritionists, and social media advocating for homemade, healthy meals. Hand blenders are convenient, enabling consumers to prepare tasty and healthy meals using fresh products without spending much time.

Restraint

Potential for Overheating and Safety Risks

Despite the growing popularity of hand blenders, concerns regarding their safety and maintenance present significant restraints to market growth. Hand blenders, being electrical appliances, carry inherent electrical safety risks. Issues such as faulty wiring, poor insulation, or improper usage can lead to electric shocks or short circuits.

The potential for electrical malfunctions creates anxiety among consumers, as they want to ensure their safety and that of their families while using kitchen appliances. Additionally, the potential for overheating during extended use raises concerns about the durability and reliability of these appliances. Such safety issues can deter consumers from purchasing hand blenders, thereby hindering market expansion.

Maintenance challenges also impact user adoption of hand blenders. The complexity involved in disassembling and cleaning certain models can be a deterrent for consumers seeking hassle-free kitchen appliances.

Residue buildup in hard-to-reach areas not only affects the appliance’s performance but also raises hygiene concerns. Consequently, consumers may opt for alternative kitchen tools that are easier to maintain, limiting the widespread adoption of hand blenders.

Opportunity

Growing Influence of Social Media and Cooking Shows on Consumer Choices

The proliferation of social media platforms and the popularity of cooking shows have opened new avenues for the hand blender market. These platforms have become instrumental in shaping consumer preferences and driving the adoption of kitchen appliances.

Influencers and celebrity chefs often showcase recipes that utilize hand blenders, highlighting their versatility and convenience. This exposure not only educates consumers about the appliance’s capabilities but also inspires them to replicate culinary creations at home, thereby increasing the demand for hand blenders.

Moreover, user-generated content, such as reviews and tutorials, provides potential buyers with insights into product performance and usability. Positive testimonials and demonstrations can significantly influence purchasing decisions, encouraging consumers to invest in hand blenders.

Manufacturers can capitalize on this opportunity by collaborating with influencers, creating engaging content, and leveraging social media marketing strategies to enhance brand visibility and reach a broader audience.

Trends

Increasing Adoption of Hand Blenders in Commercial Establishments

Beyond residential kitchens, hand blenders are witnessing increased adoption in commercial establishments such as restaurants, cafes, and catering services. The demand for hand blenders in commercial settings has been driven by their utility in efficiently preparing large quantities of food.

These appliances facilitate the quick preparation of soups, sauces, and purees, enhancing operational efficiency and consistency in food quality. The commercial segment attained a significant revenue share in the market, reflecting the growing reliance on hand blenders in the foodservice industry.

The robustness and durability of commercial-grade hand blenders make them suitable for the rigorous demands of professional kitchens.

Their ergonomic designs and powerful motors enable chefs to perform tasks swiftly, reducing preparation time and labor costs. As the foodservice industry continues to expand, the integration of versatile tools like hand blenders becomes essential, thereby contributing to the market’s growth.

Regional Analysis

North America Leads the Hand Blender Market with a 30.6% Market Share in 2024

The North American hand blender market holds the largest market share, accounting for 30.6% in 2024, with a total market valuation of USD 1.49 billion. The region’s strong dominance is driven by a high adoption rate of kitchen appliances, increasing consumer preference for convenience-oriented products, and a rising trend toward home cooking and healthy eating habits.

The United States and Canada contribute significantly to this growth, with a strong retail network and a well-established e-commerce presence. The demand for high-power and multifunctional hand blenders is increasing, particularly due to consumers’ preference for compact, easy-to-use appliances that offer versatility in food preparation.

Europe follows as a key market for hand blenders, supported by a strong inclination toward home-cooked meals and an increasing focus on sustainable and energy-efficient appliances. The Western European countries, including Germany, France, and the United Kingdom, exhibit a steady demand for high-end hand blenders featuring advanced functionalities.

The region’s market is further strengthened by stringent energy efficiency regulations and the rising preference for premium kitchen appliances. The Eastern European market is also experiencing growth, driven by rising disposable income and increasing awareness of smart kitchen solutions.

The Asia Pacific hand blender market is expanding at a notable pace, fueled by rapid urbanization, a growing middle-class population, and increasing spending on modern kitchen appliances. China, India, and Japan are among the key contributors to regional market growth.

The rising penetration of e-commerce platforms, along with the increasing influence of international cooking trends, has boosted the demand for hand blenders. Consumers in the region seek affordable, durable, and multifunctional appliances, leading to increased sales of entry-level and mid-range hand blenders.

The Middle East & Africa (MEA) market is witnessing gradual growth, primarily driven by a rising urban population, increasing disposable income, and changing consumer lifestyles. The demand for compact kitchen appliances is growing in countries such as the UAE, Saudi Arabia, and South Africa, where consumers are becoming more inclined toward modern cooking equipment. However, the market faces challenges due to the presence of low-cost alternatives and a relatively lower penetration of high-end kitchen appliances.

Latin America is also experiencing steady growth, with countries like Brazil, Mexico, and Argentina driving market expansion. The increasing awareness of kitchen convenience products, coupled with growing disposable income levels, is contributing to the demand for hand blenders. The market benefits from a rising trend of home cooking and a growing influence of social media-driven food trends.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global hand blender market in 2024 remains competitive, with key players focusing on innovation, product differentiation, and expanding their geographical footprint. AB Electrolux, a leader in home appliances, continues to leverage its strong brand reputation and sustainability initiatives to attract eco-conscious consumers.

Braun and Braun GmbH, known for their high-quality German engineering, maintain a strong presence through premium product offerings and technological advancements in motor efficiency and design. Breville, an established player in the small kitchen appliance sector, differentiates itself through sleek designs and multifunctional hand blenders that cater to high-end consumers.

BSH Hausgeräte GmbH, a subsidiary of Bosch, emphasizes smart kitchen integration, with a growing focus on IoT-enabled appliances. Conair Corporation, through its Cuisinart brand, continues to expand its market share by offering a diverse range of hand blenders at various price points.

Groupe SEB, the parent company of brands like Moulinex and Tefal, benefits from its strong distribution network and strategic acquisitions. Hamilton Beach Brands Holding Company focuses on affordability and durability, appealing to cost-conscious consumers in North America.

KitchenAid, a brand under Whirlpool Corporation, maintains its dominance through premium aesthetics and robust performance, particularly in Western markets. Koninklijke Philips N.V. and Philips emphasize advanced blending technology, ergonomic designs, and powerful motors.

Panasonic Corporation strengthens its foothold by integrating Japanese precision with user-friendly designs. Sunbeam Products, Inc., a key player in the North American market, competes on affordability and versatility. Lastly, Whirlpool Corporation, leveraging its extensive distribution channels, continues to drive sales through product innovation and brand loyalty.

Top Key Players in the Market

- AB Electrolux

- Braun

- Braun GmbH

- Breville

- BSH Hausgeräte GmbH

- Conair Corporation

- Cuisinart

- Groupe SEB

- Hamilton Beach Brands Holding Company

- KitchenAid

- Koninklijke Philips N.V.

- Panasonic Corporation

- Philips

- Sunbeam Products, Inc.

- Whirlpool Corporation

Recent Developments

- In 2025, Breville Group reported a strong surge in half-year revenues, driven by increasing global demand for home coffee machines. The Sydney-based appliance company experienced double-digit sales growth across the Americas, Asia-Pacific, and EMEA. Beanz, its specialty coffee e-commerce marketplace, also recorded significant volume growth, prompting plans for further expansion.

- In Feb. 26, 2025, Hamilton Beach Brands Holding Company (NYSE: HBB) announced fourth-quarter and full-year 2024 results. CEO R. Scott Tidey highlighted strong execution, market share gains, and growth in premium and commercial small appliances. The company generated robust cash flow, enabling share repurchases and dividends while maintaining a net cash position.

- In Feb. 18, 2025, Whirlpool Corporation confirmed its return to the Kitchen & Bath Industry Show (KBIS) in Las Vegas from February 25-27. The global appliance leader plans to showcase innovative products across its trusted brands, offering immersive experiences that reflect modern consumer needs in luxury, performance, and everyday care.

- In 2025, KitchenAid introduced its Color of the Year, Butter, a warm, sunny yellow designed to brighten kitchens. The new hue is available for its iconic stand mixer, bringing a fresh, vibrant look to home baking spaces.

Report Scope

Report Features Description Market Value (2024) USD 4.9 Billion Forecast Revenue (2034) USD 6.8 Billion CAGR (2025-2034) 3.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Corded, Cordless), By Application (Commercial, Residential), By Distribution Channel (Online( Company Website, E-Commerce Channel), Offline (Specialty Stores, Mega Retail Store, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AB Electrolux, Braun, Braun GmbH, Breville, BSH Hausgeräte GmbH, Conair Corporation, Cuisinart, Groupe SEB, Hamilton Beach Brands Holding Company, KitchenAid, Koninklijke Philips N.V., Panasonic Corporation, Philips, Sunbeam Products, Inc., Whirlpool Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AB Electrolux

- Braun

- Braun GmbH

- Breville

- BSH Hausgeräte GmbH

- Conair Corporation

- Cuisinart

- Groupe SEB

- Hamilton Beach Brands Holding Company

- KitchenAid

- Koninklijke Philips N.V.

- Panasonic Corporation

- Philips

- Sunbeam Products, Inc.

- Whirlpool Corporation