Global Kitchen Linen Market By Type (Kitchen Towels, Potholder Cloth, Oven Mints & Gloves, Aprons, Others), By Material (Cotton, Linen, Terrycloth, Microfiber, Others), By Application (Household, Commercial), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140770

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

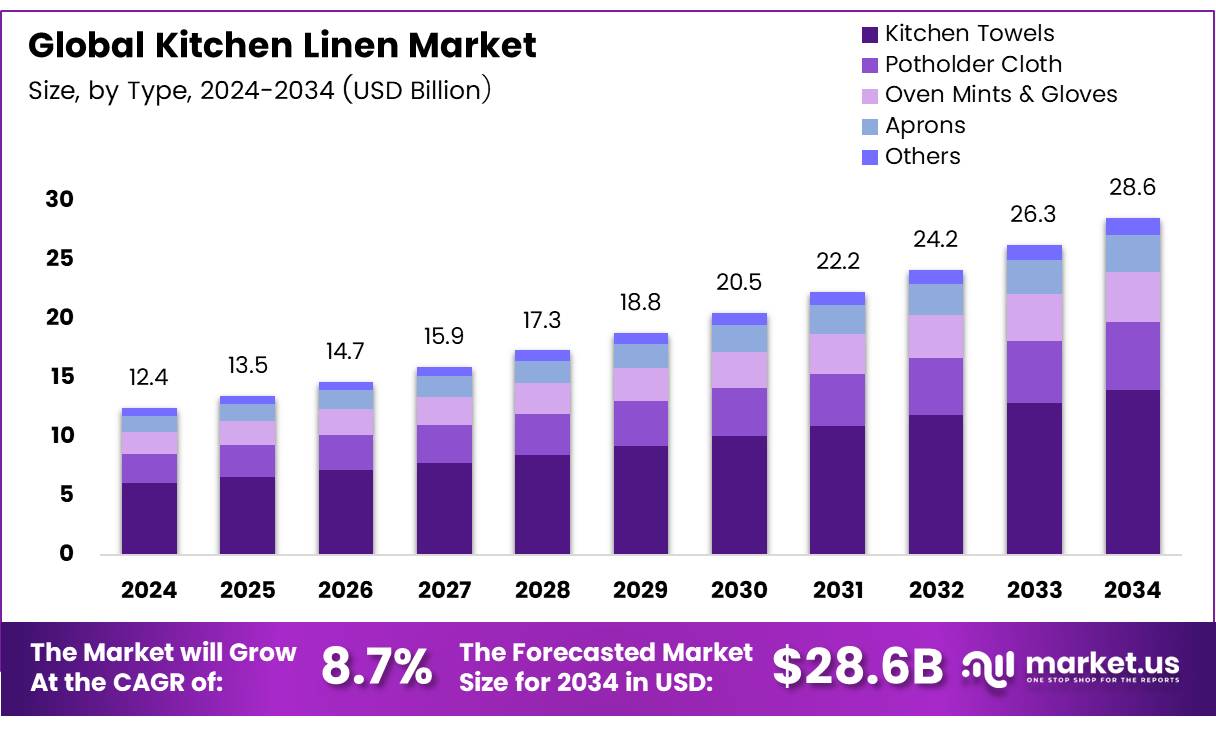

The Global Kitchen Linen Market size is expected to be worth around USD 28.6 Billion by 2034, from USD 12.4 Billion in 2024, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

The Kitchen Linen Market encompasses a variety of textile products designed specifically for use in the kitchen environment. These items include kitchen towels, aprons, napkins, oven mitts, and placemats.

Each product serves functional as well as aesthetic purposes, catering to both domestic and commercial sectors. The market is characterized by its integration of utility and design, with products often crafted to complement contemporary kitchen aesthetics while providing essential utility for everyday cooking and dining activities.

kitchen linen stands out as a significant contributor within the broader home decor industry. Kitchen linen not only enhances the functionality and hygiene of kitchen operations but also plays a crucial role in the aesthetic enhancement of the cooking space. With a focus on sustainability and design innovation, manufacturers are increasingly introducing eco-friendly materials and stylish patterns to appeal to environmentally conscious consumers and design-savvy shoppers.

The Kitchen Linen Market is witnessing substantial growth driven by increasing consumer spending on home décor and a surge in the adoption of modular kitchens globally. According to Greenmatch, the annual sales of kitchen rolls globally amount to approximately £9.2 billion, with the United States accounting for nearly half of this consumption, highlighting the significant market potential in North America.

Furthermore, as reported by Fibre2Fashion, kitchen-related linens contribute 5-10% to the total global sales in the home decor industry, reflecting a growing variety and demand in kitchenware. This segment benefits from trends such as the rise in gourmet home cooking and the popularity of custom, thematic kitchen aesthetics.

The growth of the Kitchen Linen Market is robust, buoyed by the increasing consumer interest in personalized kitchen spaces and the rising trend of home renovation. The evolving consumer preferences toward sustainable and high-quality materials are creating ample opportunities for market expansion.

Additionally, government investments in promoting small and medium enterprises are enabling local manufacturers to innovate and expand their reach in global markets. Such initiatives are likely to sustain market growth by encouraging diversification in product offerings and enhancing market competitiveness.

Governmental support plays a pivotal role in shaping the market dynamics of kitchen linens. Regulations focusing on sustainability, such as those mandating the use of organic materials in consumer products, directly influence production strategies. In parallel, fiscal incentives for promoting domestic manufacturing help local businesses scale operations and cater to the growing international demand.

According to Recent Study, in 2023, the average expenditure on kitchen and dining room linens in the US was roughly 7.28 U.S. dollars per consumer unit, indicating a stable consumer investment in this segment, partially supported by favorable economic policies.

Key Takeaways

- Global Kitchen Linen Market projected to grow from USD 12.4 Billion in 2024 to USD 28.6 Billion by 2034, at a CAGR of 8.7%.

- Kitchen towels dominate the market type segment with a 48.1% share in 2024, essential for varied kitchen tasks.

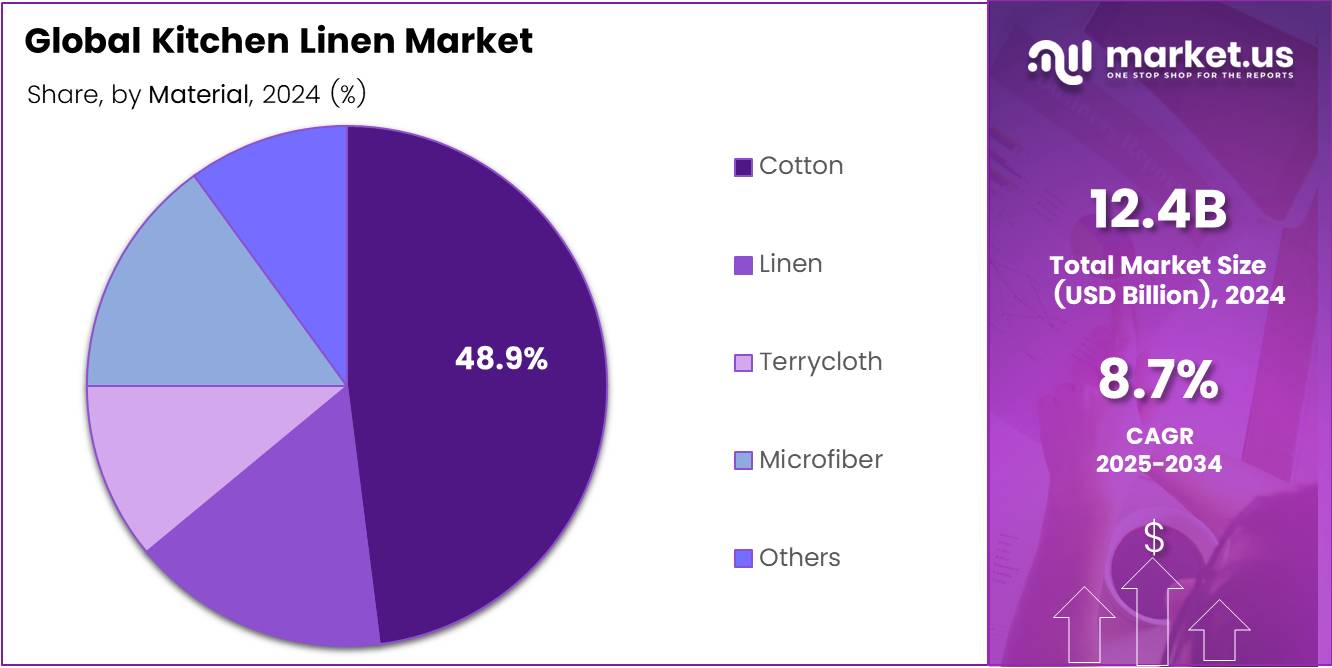

- Cotton leads the material segment, preferred for its absorbency, durability, and comfort, holding a 48.9% share in 2024.

- Household sector leads application segment with a 75.3% share in 2024, driven by frequent need for linen replacement and aesthetic upgrades.

- Offline sales channels dominate distribution, with a 54.1% share in 2024, due to consumer preference for tactile purchasing experiences.

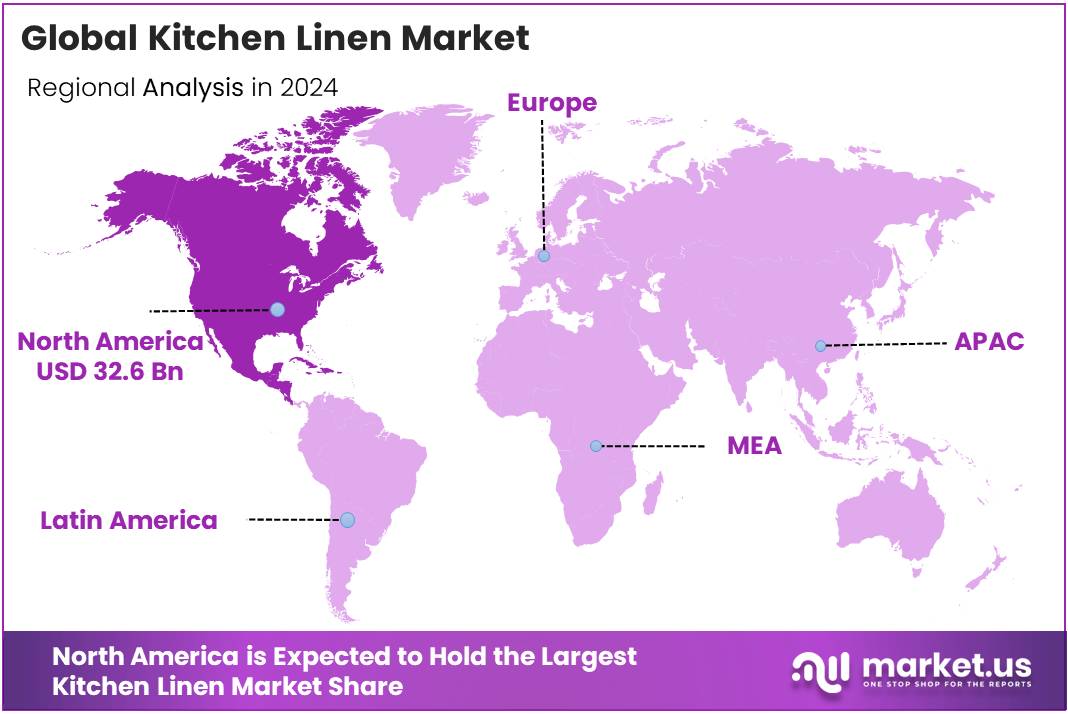

- North America is the leading region with a 32.6% market share, driven by high standards of living and trends in home renovation and culinary activities.

Type Analysis

Kitchen Towels Lead with 48.1% Market Share in Kitchen Linen Sector

In 2024, kitchen towels emerged as the frontrunner in the By Type Analysis segment of the kitchen linen market, capturing a significant 48.1% share. This segment’s dominance is primarily attributed to the essential role kitchen towels play in everyday kitchen activities, from drying hands and dishes to handling hot utensils, demonstrating their indispensable nature in both residential and commercial kitchens.

Following kitchen towels, potholder cloths accounted for a substantial portion of the market. These items are crucial for protecting hands from burns while handling hot cookware, underscoring their importance in safety-conscious kitchen environments.

Oven mitts and gloves also held a notable market share, favored for their functionality and variety in design, which cater to a wide range of consumer preferences and ergonomic needs. Their market position is bolstered by innovations in heat-resistant materials and aesthetic diversity, appealing to both amateur and professional chefs.

Aprons, serving both practical and aesthetic functions, maintained a steady market presence. They are not only pivotal in protecting attire from spills and splatters but have also become a style statement in modern kitchen attire, often customized to reflect personal tastes or branding needs.

The Others category, which includes various lesser-known kitchen linen types, collectively accounted for the remainder of the market share, highlighting the diverse needs and preferences within kitchen environments.

Material Analysis

Cotton Dominates Kitchen Linen Market with 48.9% Share Due to Versatility and Comfort

In 2024, cotton solidified its status as the leading material in the By Material Analysis segment of the kitchen linen market, holding a dominant 48.9% share. Cotton’s preeminence is largely due to its natural properties such as high absorbency, durability, and comfort, making it the preferred choice for consumers seeking quality and sustainability in kitchen textiles.

Linen followed as a strong contender, appreciated for its natural luster and strength, which contribute to its longevity and luxury appeal. Despite its higher price point, linen remains popular for its excellent performance in both durability and aesthetic charm.

Terrycloth was another significant material in the segment, prized for its super absorbent qualities, making it ideal for kitchen towels and other spill-management linens. Its looped texture not only enhances absorbency but also increases its utility in busy kitchen environments.

Microfiber also captured a noteworthy market share, favored for its micro-level fiber properties that offer superior cleaning capabilities, often used in cloths for polishing and deep cleaning without the need for chemical cleaners.

The Others category, which includes various synthetic and blended materials, accounted for the remaining portion of the market. These materials are often engineered to combine the best properties of natural and synthetic fibers, meeting specific consumer needs for functionality and cost-effectiveness.

Application Analysis

Household Use Dominates Kitchen Linen Market with 75.3% Share, Highlighting Everyday Essentiality

In 2024, the household sector maintained a commanding lead in the By Application Analysis segment of the kitchen linen market, securing a substantial 75.3% share. This dominance underscores the essential role of kitchen linens in daily home life, where they facilitate a range of tasks from cooking and cleaning to serving and decor. The high penetration rate in households is driven by the frequent need for product replacements and upgrades due to wear and tear, as well as aesthetic changes in home decor trends.

The commercial sector, while smaller in comparison, still plays a crucial role in the kitchen linen market. This segment includes restaurants, hotels, and other hospitality industries where kitchen linens such as chef’s aprons, towels, and protective gloves are indispensable for both hygiene and operational efficiency. The demand in the commercial sector is driven by stringent health regulations and the high volume of usage, which necessitates durable and high-quality linens.

Despite the smaller market share, the commercial sector is expected to witness steady growth, driven by the expanding hospitality industry and heightened standards for kitchen hygiene and aesthetics in commercial settings.

Distribution Channel Analysis

Offline Channels Lead with 54.1% in Kitchen Linen Distribution, Reflecting Consumer Preference for In-Store Purchases

In 2024, offline sales channels maintained a dominant position in the By Distribution Channel Analysis segment of the kitchen linen market, commanding a 54.1% share. This prominence is largely attributed to consumer preference for physically inspecting the quality and feel of kitchen linens before purchasing, an important consideration given the tactile nature of these products.

Among offline channels, home improvement stores and hypermarkets are primary contributors to sales, offering wide visibility and accessibility to a broad range of kitchen linen products. These outlets cater to consumers seeking immediate purchases and the convenience of one-stop shopping for household goods.

Specialty stores also play a significant role in the offline market share, attracting customers looking for premium products and specific brands that may not be available in larger retail outlets. The expertise and customer service provided by specialty stores also enhance consumer trust and satisfaction.

The online segment, while smaller, is rapidly growing due to the increasing convenience of e-commerce. Online platforms offer the advantage of easy comparison shopping, customer reviews, and the availability of a wider range of products, including niche and bespoke items not typically found in brick-and-mortar stores. This sector is expected to gain more traction as digital marketing and e-commerce technologies continue to evolve.

Key Market Segments

By Type

- Kitchen Towels

- Potholder Cloth

- Oven Mints and Gloves

- Aprons

- Others

By Material

- Cotton

- Linen

- Terrycloth

- Microfiber

- Others

By Application

- Household

- Commercial

By Distribution Channel

- Offline

- Home Improvement Stores

- Hypermarkets Supermarkets

- Specialty Stores

- Others

- Online

Drivers

Rising Disposable Income Fuels Demand for Stylish Kitchen Linen

As disposable incomes rise, individuals are increasingly investing in enhancing their home aesthetics, notably in kitchen spaces. This surge in financial flexibility allows consumers to purchase premium, decorative kitchen linen, thus propelling market growth.

Simultaneously, the growing enthusiasm for home cooking, influenced by both a surge in culinary hobbyists and a cultural shift towards home-prepared meals, has elevated the demand for various kitchen linen products like towels, aprons, and oven mitts.

Additionally, heightened awareness around health and hygiene has led consumers to seek out high-quality kitchen linens, including those with antimicrobial properties, to ensure a sanitary cooking environment.

The market is also witnessing a shift in consumer preferences, with a noticeable trend towards unique, sustainable, and luxurious kitchen textiles. This evolving demand encourages manufacturers to innovate in both product design and material use, further stimulating the kitchen linen market.

Restraints

Price Sensitivity Challenges Premium Kitchen Linen Sales

The kitchen linen market faces significant headwinds due to consumer price sensitivity, which can deter spending on premium or eco-friendly options. Many shoppers prioritize affordability over quality or sustainability, making it challenging for brands to upsell higher-priced, eco-conscious kitchen textiles. This restraint is exacerbated by the widespread availability of low-cost alternatives.

The market is inundated with inexpensive kitchen linens from unbranded or lesser-known sources, which are highly attractive to budget-conscious consumers. This abundance of cheaper options not only intensifies competition but also puts pressure on established brands to lower prices or increase the perceived value of their offerings.

As a result, the presence of these cost-effective alternatives limits the growth potential of more expensive kitchen linen products, complicating efforts by companies to expand their market share among price-sensitive segments of the consumer base.

Growth Factors

Growing Demand for Sustainable Products Opens New Avenues in Kitchen Linen Market

The kitchen linen market is poised for growth with expanding consumer interest in sustainability, presenting a lucrative opportunity for brands to innovate with environmentally friendly and ethically produced items.

As awareness and commitment towards environmental impact intensify, consumers are increasingly gravitating towards products that not only serve their needs but also align with their values on sustainability. This shift encourages manufacturers to explore eco-friendly materials and ethical production techniques.

Additionally, the trend towards personalized and unique items, like monogrammed towels and custom aprons, taps into the desire for individual expression in home decor. There’s also a burgeoning niche for smart kitchen linens that incorporate technology for added functionality, such as temperature sensitivity or self-cleaning properties, which could differentiate products in a competitive market.

Furthermore, the rising middle-class population in emerging markets offers a fresh, expansive customer base. Tapping into these regions could significantly broaden the market reach for kitchen linen products, aligning with global economic shifts and consumer trends towards quality and sustainability. These factors combined suggest robust growth prospects for innovative kitchen linen manufacturers looking to make a mark in both established and burgeoning markets.

Emerging Trends

Minimalist Designs Lead Trends in the Kitchen Linen Market

The kitchen linen market is currently shaped by several compelling trends that cater to modern consumer preferences. Minimalist designs are at the forefront, with consumers increasingly opting for kitchen linens that feature simple aesthetics, neutral colors, and clean lines. This trend aligns with the modular kitchen décor that emphasizes uncluttered spaces and understated elegance.

Additionally, there’s a growing demand for multi-functional kitchen linen products, such as dish towels and aprons that offer not just high absorbency and protection but also add style to the kitchen environment.

In response to a heightened environmental consciousness among consumers, eco-friendly materials like organic cotton, hemp, and recycled fabrics are becoming increasingly popular. These materials appeal to those seeking to reduce their environmental footprint while maintaining quality and functionality in their kitchen textiles.

Furthermore, there’s a noticeable shift towards bold aesthetics within minimalist frameworks, with color blocking and geometric patterns emerging as popular choices for those looking to introduce vibrant, eye-catching elements into their kitchen spaces. These trends reflect a dynamic market where functionality, style, and sustainability intersect, offering numerous opportunities for brands to innovate and cater to evolving consumer tastes.

Regional Analysis

North America leads the kitchen linen market with 32.6% share at USD 3.9 billion

The global kitchen linen market is experiencing significant variances across different regions, shaped by diverse consumer preferences, economic conditions, and market maturity.

As of recent assessments, North America emerges as the dominating region, holding a 32.6% market share valued at USD 3.9 billion. This prominence is largely due to the high standard of living and the prevalent trend of home renovation and culinary leisure activities that prioritize high-quality kitchen amenities.

Regional Mentions:

In Europe, the market is driven by a blend of traditional designs and modern, eco-friendly materials reflecting the region’s strong focus on sustainability. Countries like Germany, the UK, and France show a keen interest in premium, durable kitchen textiles, contributing to steady market growth.

The Asia Pacific region is noted for its rapid market expansion, fueled by increasing disposable incomes and urbanization, particularly in China and India. The growing influence of Western lifestyles, coupled with a rising number of households, is propelling demand for functional and aesthetically pleasing kitchen linen.

Middle East & Africa region presents a smaller, yet evolving market segment. The luxury sector in the GCC countries, with their affluent consumer base, is particularly receptive to high-end, imported kitchen linens, aligning with the luxurious interiors that characterize the regional aesthetic.

Latin America shows a dynamic market potential, with countries like Brazil and Mexico leading the way. The increasing influence of global culinary trends and a growing middle-class population are key drivers that stimulate the demand for modern kitchen linen products in this region.

Overall, while North America currently leads the market in both share and revenue, the rapid growth rates in Asia Pacific signal a potential shift in dynamics over the coming years, possibly challenging North America’s dominance as market conditions evolve and new consumer segments emerge.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global kitchen linen market is poised for dynamic transformation as evolving consumer preferences drive demand for premium, sustainable, and aesthetically refined products.

Leading industry players such as Maison d’Hermine, Yves Delorme, Inc., McGee & Co., Coyuchi, Stoffer Home, Kitchen Linen Company, All-Clad, Williams-Sonoma Inc., Rough Linen, and All Cotton and Linen are at the forefront of this shift. These brands differentiate themselves through heritage, innovation, and targeted market positioning.

Maison d’Hermine and Yves Delorme, Inc. capitalize on their storied histories and commitment to artisanal quality, catering to luxury segments with sophisticated designs and meticulous craftsmanship.

In contrast, McGee & Co. and Stoffer Home leverage modern design trends and agile production methodologies to appeal to contemporary consumers seeking versatility and durability. Coyuchi and Rough Linen emphasize eco-friendly practices and sustainable sourcing, reflecting an industry-wide shift towards environmental responsibility.

Meanwhile, Kitchen Linen Company and All Cotton and Linen have carved niche positions by offering specialized product lines that balance tradition with modern functionality. Retail powerhouses such as All-Clad and Williams-Sonoma Inc. extend their influence through expansive distribution networks and strong brand recognition, ensuring a consistent presence in both upscale department stores and online channels.

Collectively, these companies drive market innovation and set industry standards through continuous product improvements and customer-centric strategies. Their diverse approaches not only meet varying consumer tastes but also foster healthy competition that is essential for market growth and evolution in a rapidly changing global landscape. Robust competition is driving remarkable expansion throughout the global sector.

Top Key Players in the Market

- Maison d’Hermine

- Yves Delorme, Inc.

- McGee & Co.

- Coyuchi

- Stoffer Home

- Kitchen Linen Company

- All-Clad

- Williams-Sonoma Inc.

- Rough Linen

- All Cotton and Linen

Recent Developments

- In November 2024, Argos Wityu successfully acquired Lavatio GmbH, a premier German B2B textile rental and laundry service provider, aiming to enhance its service offerings and expand its market reach.

- In February 2025, CREO Group announced the strategic acquisition of HMS Mfg. Co., an initiative aimed at expanding its portfolio and driving innovation within the industry.

- In August 2024, Beco secured $10 million in a pre-Series B funding round led by Tanglin, with the investment poised to accelerate product development and expand market presence.

Report Scope

Report Features Description Market Value (2024) USD 12.4 Billion Forecast Revenue (2034) USD 28.6 Billion CAGR (2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Kitchen Towels, Potholder Cloth, Oven Mints & Gloves, Aprons, Others), By Material (Cotton, Linen, Terrycloth, Microfiber, Others), By Application (Household, Commercial), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Maison d’Hermine, Yves Delorme, Inc., McGee & Co., Coyuchi, Stoffer Home, Kitchen Linen Company, All-Clad, Williams-Sonoma Inc., Rough Linen, All Cotton and Linen Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Maison d’Hermine

- Yves Delorme, Inc.

- McGee & Co.

- Coyuchi

- Stoffer Home

- Kitchen Linen Company

- All-Clad

- Williams-Sonoma Inc.

- Rough Linen

- All Cotton and Linen