Global Smart Kitchen Appliances Market By Product (Smart Refrigerators, Smart Cookware and Cooktops, Smart Dishwashers, Smart Ovens, Others), By Connectivity Technology (Bluetooth, Wi-Fi, NFC, Others), By End-Use (Quick Service Restaurants, Full-Service Restaurants, Institutional Canteens, Resorts and Hotels, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 18828

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

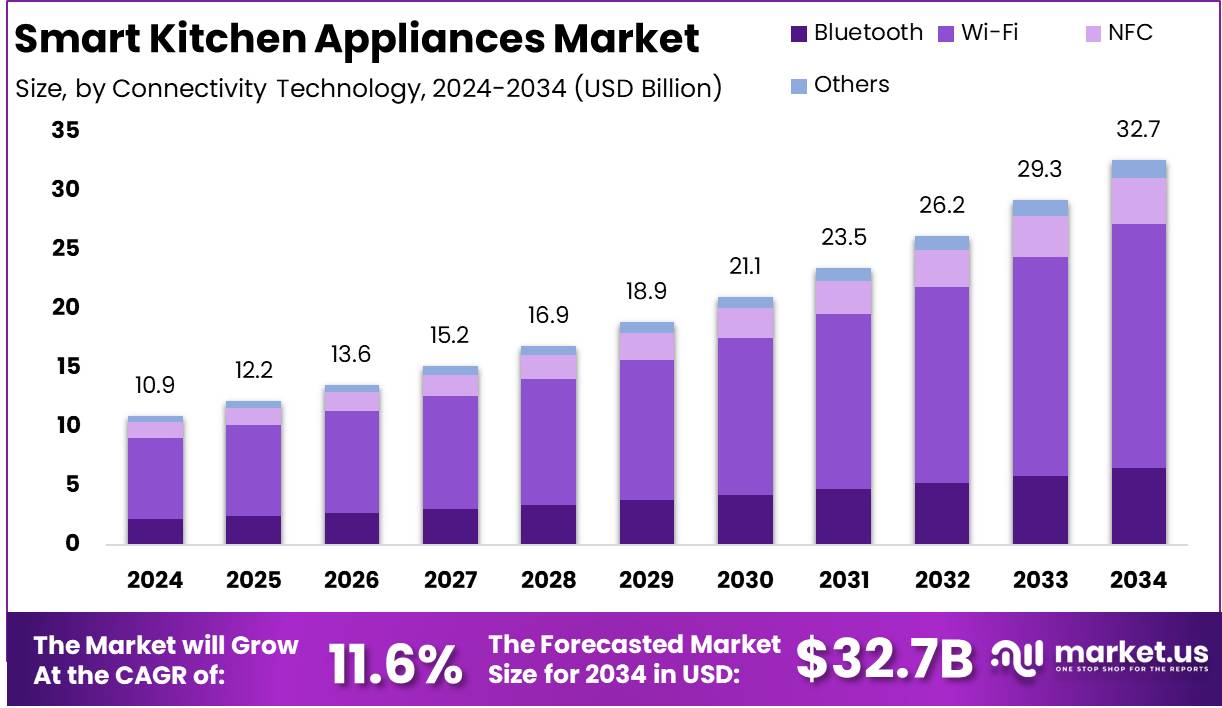

The Global Smart Kitchen Appliances Market size is expected to be worth around USD 32.7 Billion by 2034, from USD 10.9 Billion in 2024, growing at a CAGR of 11.6% during the forecast period from 2025 to 2034.

Smart kitchen appliances refer to technologically advanced devices integrated with Internet of Things (IoT) capabilities, allowing consumers to remotely control, monitor, and automate various kitchen tasks. These appliances include smart refrigerators, ovens, dishwashers, coffee makers, blenders, and more.

They are designed to enhance convenience, energy efficiency, and overall functionality by offering features such as voice control, mobile app connectivity, and AI-driven personalization. Through seamless integration with smart home systems, they provide users with a higher level of control and intelligence, transforming traditional kitchens into interconnected, tech-savvy spaces.

The smart kitchen appliances market encompasses the production, sales, and development of these innovative devices. The market is characterized by a wide array of products that cater to consumer demands for convenience, energy efficiency, and connectivity.

This includes major players in the technology, home appliance, and IoT sectors, which contribute to the growth of the market through continuous product innovation, consumer-centric features, and a focus on sustainability. The market also covers the growing adoption of smart appliances in both residential and commercial sectors.

The growth of the smart kitchen appliances market is driven by several key factors. First, the increasing adoption of smart home technology is playing a crucial role in the widespread acceptance of smart kitchen devices. As consumers continue to embrace connected ecosystems in their homes, the demand for appliances that seamlessly integrate with other smart home devices rises. Secondly, the growing consumer focus on convenience, time-saving, and energy efficiency has spurred the demand for appliances that simplify meal preparation, cooking, and cleaning tasks.

Demand for smart kitchen appliances is witnessing a significant surge, primarily driven by evolving consumer preferences for more advanced, efficient, and user-friendly kitchen solutions. As more people prioritize convenience and efficiency in their daily routines, particularly in the post-pandemic era, the need for connected kitchen devices continues to expand.

The smart kitchen appliances market presents significant opportunities for innovation and market expansion. There is a clear opportunity for companies to introduce new products that leverage cutting-edge technologies such as voice assistants, machine learning, and artificial intelligence to enhance the user experience.

According to industry report, the smart kitchen appliances market has experienced substantial growth, with notable benefits driving consumer adoption. In 2023, the use of these appliances has led to a 30% increase in fruit and vegetable consumption, reflecting their positive impact on healthier eating habits.

Smart refrigerators have also reduced food waste by 25%, while the appliances have contributed to energy savings of up to 50% and reduced cooking time by 20%. Additionally, 67% of global users prefer smart kitchen appliances for their advanced features, such as voice commands, remote control, and automated cooking settings, highlighting the increasing demand for more efficient and convenient kitchen solutions.

According to Ignitec, reducing food waste in households can prevent 7.41 million tonnes of greenhouse gas emissions annually. With 70% of food waste originating from UK households, smart kitchen appliances are increasingly crucial in mitigating this issue.

Key Takeaways

- The global Smart Kitchen Appliances market is projected to grow from USD 10.9 billion in 2024 to USD 32.7 billion by 2034, reflecting a strong CAGR of 11.6% over the forecast period.

- Smart Refrigerators dominate the Smart Kitchen Appliances market with a market share of 38.7% in 2024, driven by advanced features like energy efficiency and smart connectivity.

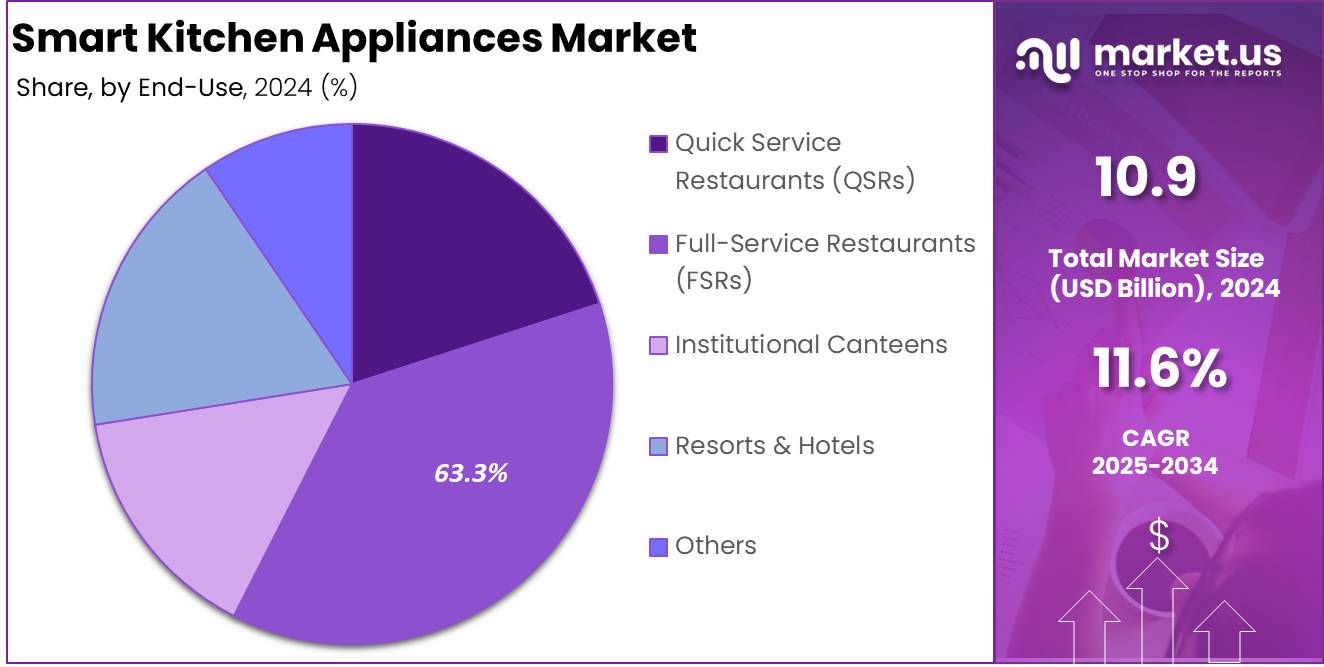

- Wi-Fi leads the connectivity technology segment with a dominant market share of 63.3% in 2024, enabling seamless integration with other smart home devices and remote control.

- Full-Service Restaurants (FSRs) hold a dominant position in the market with a 37.5% share in 2024, driven by their demand for innovative kitchen solutions that enhance efficiency and food quality.

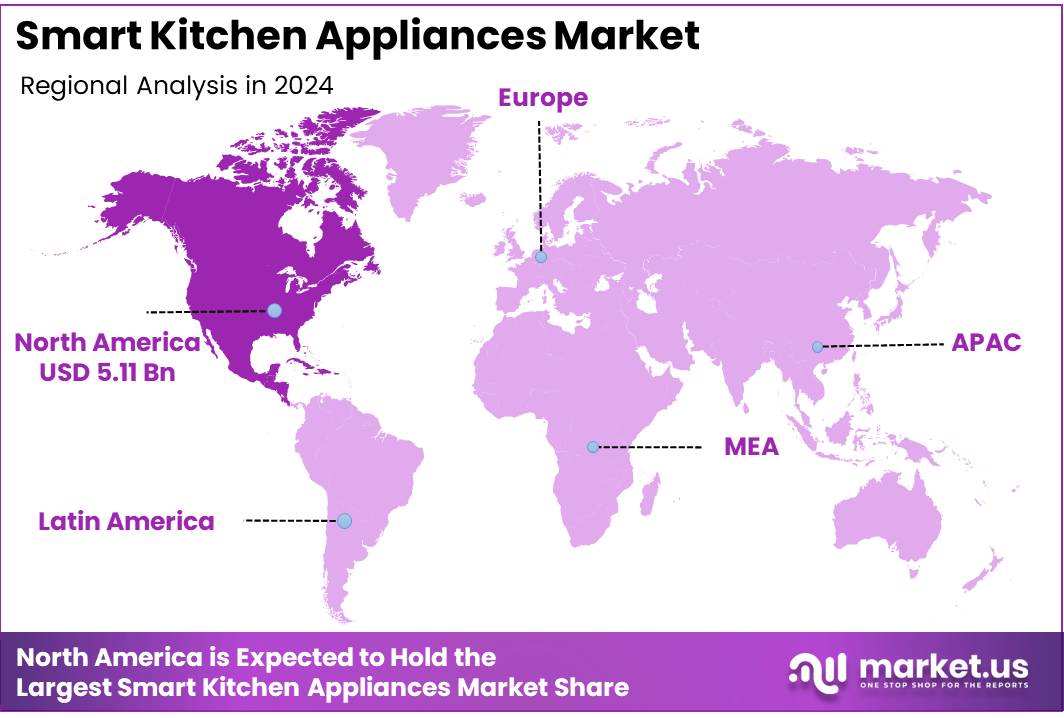

- North America leads the global Smart Kitchen Appliances market with a market share of 46.9% in 2024, fueled by strong consumer spending and the growing trend of smart home adoption.

By Product Analysis

Smart Refrigerators Held a Dominant Position in Smart Kitchen Appliances Market with 38.7% Market Share

In 2024, Smart Refrigerators held a dominant market position in the By Product segment of Smart Kitchen Appliances, capturing more than 38.7% market share. This segment’s growth can be attributed to the increasing consumer demand for energy-efficient, feature-rich refrigerators that offer smart capabilities such as inventory management, temperature control, and remote access.

Smart Refrigerators lead the market primarily due to their advanced features, such as touchscreen interfaces, internet connectivity, and integration with other smart home devices. These appliances not only improve energy efficiency but also enhance convenience by allowing users to track food inventory and receive alerts for maintenance needs.

Smart Cookware & Cooktops are gaining momentum in the market. These products, which include smart induction cooktops and connected cookware, accounted for a notable share of the Smart Kitchen Appliances market in 2024. They are especially popular due to their precision cooking capabilities, energy efficiency, and ease of use.

The Smart Dishwashers segment continues to grow, driven by the increasing consumer preference for appliances that save time and water. These devices offer features such as remote monitoring, cycle customization, and energy-efficient operation, appealing to environmentally-conscious buyers.

Smart Ovens are revolutionizing cooking with features such as pre-set cooking modes, remote operation, and integration with recipe apps. They represent a growing trend in the market as consumers demand smarter, more versatile cooking solutions.

Other smart kitchen appliances, such as smart coffee makers, air fryers, and blenders, are also expanding within the market. While these segments represent a smaller share, their innovative features are gradually increasing their market presence.

By Connectivity Technology Analysis

Wi-Fi Held a Dominant Position in Smart Kitchen Appliances Market with 63.3% Market Share

In 2024, Wi-Fi held a dominant market position in the By Connectivity Technology segment of Smart Kitchen Appliances, capturing more than 63.3% market share. Wi-Fi connectivity has become the standard for smart appliances due to its ability to offer fast, reliable, and widespread connectivity, allowing users to control and monitor their devices remotely through mobile apps and smart home systems.

Wi-Fi technology leads the market as it enables seamless integration with other smart home devices and platforms like Amazon Alexa, Google Assistant, and Apple HomeKit. This technology supports features like remote monitoring, real-time updates, and system automation, making it the preferred choice for consumers looking for convenience and connectivity.

Bluetooth is also present in the Smart Kitchen Appliances market, although it holds a smaller share compared to Wi-Fi. Bluetooth technology is commonly used in appliances that require shorter-range connectivity, such as smart cooktops or smart coffee makers. It offers benefits like low energy consumption, but its range limitations restrict its widespread use in larger appliances.

Near Field Communication (NFC) is emerging as a connectivity option in the Smart Kitchen Appliances market, although its adoption remains relatively niche. NFC is used in specific appliances, such as smart refrigerators and dishwashers, for tasks like pairing devices or providing touch-based access. However, its adoption is limited by the availability of alternative, more widespread technologies like Wi-Fi.

Other connectivity technologies are also being used in Smart Kitchen Appliances, including Zigbee, Z-Wave, and Thread. These technologies offer various benefits such as low power consumption and greater reliability in certain use cases, but they are still emerging compared to Wi-Fi. As the market grows, these technologies may see more adoption in specific product categories.

By End-Use Analysis

Full-Service Restaurants (FSRs) Held a Dominant Position in Smart Kitchen Appliances Market with 37.5% Market Share

In 2023, Full-Service Restaurants (FSRs) held a dominant market position in the End-Use segment of Smart Kitchen Appliances, capturing more than 37.5% of the market share. This segment’s strong market presence is driven by the increasing demand for high-efficiency kitchen technologies that streamline food preparation and enhance operational productivity. Full-service restaurants are increasingly adopting smart appliances to meet the needs of large-scale food production while maintaining consistency and quality.

Quick Service Restaurants (QSRs), while not directly provided, typically account for a significant portion of the market, but their share is comparatively smaller than FSRs in terms of overall revenue generated from smart kitchen appliances.

Institutional Canteens, Resorts & Hotels, and Other establishments also contribute to the market, with adoption rates varying according to the size, scale, and technological maturity of their kitchen facilities. The segment overall is evolving, with rapid growth expected as operators in all these sectors recognize the long-term value of investing in smarter, more efficient kitchen equipment.

Key Market Segments

By Product

- Smart Refrigerators

- Smart Cookware & Cooktops

- Smart Dishwashers

- Smart Ovens

- Others

By Connectivity Technology

- Bluetooth

- Wi-Fi

- NFC

- Others

By End-Use

- Quick Service Restaurants (QSRs)

- Full-Service Restaurants (FSRs)

- Institutional Canteens

- Resorts & Hotels

- Others

Driver

Increasing Demand for Convenience and Time-saving Solutions

The global Smart Kitchen Appliances market is experiencing significant growth due to an increasing consumer demand for convenience and time-saving solutions in their daily routines. Consumers are increasingly adopting smart devices in their homes, with a particular focus on kitchen appliances that help optimize cooking processes, enhance meal preparation, and streamline kitchen tasks.

The growing pace of life, coupled with rising consumer expectations for smart technology, drives this shift toward automation in the kitchen. As people become more tech-savvy and reliant on technology for efficiency, smart kitchen appliances offer a compelling value proposition by allowing consumers to cook more efficiently, monitor their cooking remotely, and reduce the time spent on mundane kitchen chores.

This growing demand for convenience is supported by advancements in connectivity, particularly in the form of IoT (Internet of Things), which makes it easier for kitchen appliances to communicate and work together in a synchronized way. Consumers can now control their kitchen appliances using smartphones or voice assistants, making cooking an effortless experience.

As a result, appliances such as smart ovens, refrigerators, and dishwashers are increasingly designed to be more intuitive and responsive, further encouraging their adoption. This shift toward a more connected and convenient kitchen environment is likely to continue driving the global market for smart kitchen appliances well into 2024 and beyond, particularly as younger, more tech-oriented generations become a dominant consumer segment in this space.

Restraint

High Initial Cost of Smart Kitchen Appliances

A primary restraint to the widespread adoption of smart kitchen appliances is their high initial cost. While traditional kitchen appliances are typically more affordable, the premium pricing of smart devices acts as a barrier for many consumers. Smart kitchen appliances incorporate advanced features such as AI-driven cooking algorithms, touchscreens, and integration with other smart home systems, all of which contribute to a higher price tag. For many consumers, the cost of upgrading to these appliances outweighs the perceived benefits, especially if they already own functioning traditional devices.

The high upfront costs, combined with additional maintenance and potential software updates, create concerns about the overall long-term value of smart kitchen appliances. Although prices for some devices may decrease over time as technology matures and mass production increases, the perception of high initial investment remains a critical challenge. For consumers on a budget or in emerging markets where disposable income is lower, the cost of adopting smart appliances may limit growth.

Additionally, in regions where the adoption of smart home technology is still in its early stages, high prices may hinder the broader acceptance of smart kitchen appliances, preventing them from becoming mainstream in some parts of the world.

Opportunity

Expansion in Emerging Markets

Emerging markets present a significant growth opportunity for the global smart kitchen appliance market. As economies in regions such as Asia-Pacific, Latin America, and the Middle East continue to develop, there is an increasing demand for technology-driven solutions in the home.

Rising urbanization, growing disposable incomes, and improved standards of living are driving demand for innovative products, including smart kitchen appliances. In these markets, consumers are gradually adopting smart home technologies, including smart kitchen devices, as they seek to improve their lifestyles and increase the efficiency of household tasks.

The expansion of e-commerce and the rising number of retail outlets dedicated to technology-based products are helping to make smart kitchen appliances more accessible to consumers in these regions. With increased awareness of the benefits of connected devices, consumers in emerging markets are more willing to invest in smart appliances that offer improved convenience and energy savings.

Furthermore, as manufacturers tailor products to meet the unique needs and price sensitivities of emerging markets, there is a growing opportunity to capture new consumer segments. As smart kitchen appliances become more affordable and accessible, the market is expected to see considerable growth in these regions in the coming years, contributing significantly to the global market expansion.

Trends

Integration with Voice Assistants and AI

One of the most prominent trends shaping the future of smart kitchen appliances is the integration with voice assistants and artificial intelligence (AI). As voice-controlled devices such as Amazon Alexa, Google Assistant, and Apple’s Siri gain popularity, consumers are increasingly seeking ways to control their kitchen appliances using voice commands.

This integration provides an unparalleled level of convenience, allowing users to preheat the oven, set timers, or even ask for recipes hands-free. Smart kitchen appliances that are compatible with these voice assistants can become a central part of the connected home ecosystem, making them more appealing to tech-savvy consumers.

AI is also playing a significant role in revolutionizing smart kitchen appliances. With AI algorithms, appliances can learn users’ habits and preferences, optimizing settings for cooking temperatures, times, and methods based on historical data. For example, smart refrigerators with AI capabilities can suggest recipes based on available ingredients or alert users when food is about to expire.

As AI and machine learning technologies continue to evolve, the functionality of smart kitchen appliances will become even more personalized, making the kitchen experience more efficient, intuitive, and enjoyable. This trend toward greater AI integration will not only enhance user experience but also drive the adoption of smart kitchen appliances among a broader consumer base in 2024 and beyond.

Regional Analysis

North America: Smart Kitchen Appliances Market with Largest Market Share of 46.9%

North America dominates the Smart Kitchen Appliances Market, accounting for 46.9% of the market share in 2024, with a market size of USD 5.11 billion. This leadership is driven by high consumer spending, strong infrastructure, and the growing trend of smart homes. The region’s focus on energy-efficient, sustainable appliances, coupled with the demand for convenience-driven technologies, solidifies its position as the largest market.

Europe is experiencing steady growth in the Smart Kitchen Appliances Market, with a strong emphasis on energy efficiency and sustainability. While not as dominant as North America, Europe has a growing demand for premium, eco-friendly smart appliances. Stringent regulations and heightened environmental awareness continue to fuel the market, particularly in Western Europe.

Asia Pacific is the fastest-growing region, driven by urbanization, rising disposable incomes, and technological advancements. While market share remains smaller compared to North America, the region’s rapid growth in countries like China, India, and Japan indicates high future potential. The increasing demand for energy-efficient and space-saving appliances is contributing to this expansion.

The Middle East & Africa market is emerging, with rising disposable incomes and urbanization driving demand for smart kitchen appliances. Although the market share is small, countries in the GCC are seeing increased adoption of premium, high-tech appliances. This region shows promising growth, particularly among affluent consumers.

Latin America’s market is growing at a gradual pace, with countries like Brazil and Mexico leading the way. However, affordability remains a key factor, with demand mainly for cost-effective, entry-level smart kitchen appliances. As economic conditions improve, higher adoption of more advanced technologies is expected.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The Global Smart Kitchen Appliances Market is seeing significant competition from a variety of established players, each bringing their unique strengths to capitalize on the growing demand for smart home solutions. Whirlpool Corporation remains a dominant force with its long history in appliance innovation and its integration of smart technologies to enhance consumer convenience and energy efficiency.

LG Electronics and Samsung Electronics are highly competitive due to their advanced technological capabilities, including AI-powered appliances and seamless connectivity with other smart home systems, positioning them at the forefront of the market. Similarly, Electrolux AB and Haier Group are investing heavily in smart kitchen products that prioritize sustainability, automation, and smart features like voice control and remote monitoring.

BSH Hausgerate GmbH, with its brands like Bosch and Siemens, offers a strong presence in Europe and beyond, combining superior quality with smart connectivity. Breville’s focus on premium kitchen appliances, such as smart coffee makers and ovens, aligns well with consumer preferences for high-quality, feature-rich products. Miele & Cie. KG has carved a niche in the premium segment by offering technologically advanced kitchen appliances that emphasize both design and functionality.

Xiaomi, known for its disruptive pricing, has made a significant push in affordable smart kitchen solutions, leveraging its massive consumer base and online platforms. Finally, Koninklijke Philips stands out for its robust product portfolio, emphasizing innovation in home cooking appliances like air fryers, while continuously enhancing their integration with smart technology for improved user experiences.

Top Key Players in the Market

- Whirlpool Corporation

- LG Electronics

- Electrolux AB

- Samsung Electronics Co., Ltd.

- Haier Group

- Panasonic Corporation

- BSH Hausgerate GmbH

- Breville.

- Miele & Cie. KG

- Dongbu Daewoo Electronics

- Xiaomi

- Miele & Cie.

- Koninklijke Philips

Recent Developments

- In 2023, Fresco introduced KitchenOS, an innovative all-in-one operating system designed to enhance the use of connected kitchen appliances. The platform allows users to control IoT-enabled appliances, receive smart recipe recommendations, and access interactive features. By promoting cross-brand compatibility, KitchenOS aims to streamline the smart kitchen experience, providing both manufacturers and consumers with greater convenience. “Our platform connects appliances across brands, making the kitchen smarter and more efficient for home cooks,” said Ben Harris, CEO of Fresco.

- In February 3, 2023, Samsung Electronics UK unveiled its new Series 7 Bespoke AI™ Oven, designed to elevate the cooking experience. Featuring advanced AI Pro Cooking technology, the oven helps users prepare healthy meals tailored to their dietary needs. With its versatility and smart features, the Series 7 Oven aims to make kitchen tasks easier and more interactive.

- In January 29, 2025, Whirlpool Corporation reported its fourth-quarter and full-year financial results for 2024. The company highlighted its progress in operational efficiency, having met a $300 million cost reduction target and completed the closure of its European transaction. Looking ahead to 2025, Whirlpool expects to continue its cost-saving efforts, aiming for an additional $200 million in savings, while preparing for a recovery in the U.S. housing market.

- On September 7, 2024, Midea Group showcased a range of smart home appliances at IFA 2024, emphasizing its commitment to “Friendly Innovations for Homes.” Kurt Jovais, Global Director of Product Management, noted that Midea’s mission is to create intelligent and convenient home solutions, striving to improve everyday living through smarter, more accessible technology.

Report Scope

Report Features Description Market Value (2024) USD 10.9 Billion Forecast Revenue (2034) USD 32.7 Billion CAGR (2025-2034) 11.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Whirlpool Corporation, LG Electronics, Electrolux AB, Samsung Electronics Co., Ltd., Haier Group, Panasonic Corporation, BSH Hausgerate GmbH, Breville., Miele & Cie. KG, Dongbu Daewoo Electronics, Xiaomi, Miele & Cie., Koninklijke Philips Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Uber Technologies Inc., Lyft Inc., Lime, Bird, Spin, Hellobike, DiDi Bike, Yonganxing Technology Co. Ltd., Bolt, TIER Mobility, Voi Technology, Nextbike GmbH, SG Bike, Call a Bike, Bluegogo Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Kitchen Appliances MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Smart Kitchen Appliances MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Whirlpool Corporation

- LG Electronics

- Electrolux AB

- Samsung Electronics Co., Ltd.

- Haier Group

- Panasonic Corporation

- BSH Hausgerate GmbH

- Breville.

- Miele & Cie. KG

- Dongbu Daewoo Electronics

- Xiaomi

- Miele & Cie.

- Koninklijke Philips