Global Outdoor Kitchen Market By Product (Cooking Fixtures, Islands and Storage Units, Refrigeration Units, Cocktail and Bar Centers, Sinks and Faucets, Others), By Type (Residential, Commercial), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137206

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

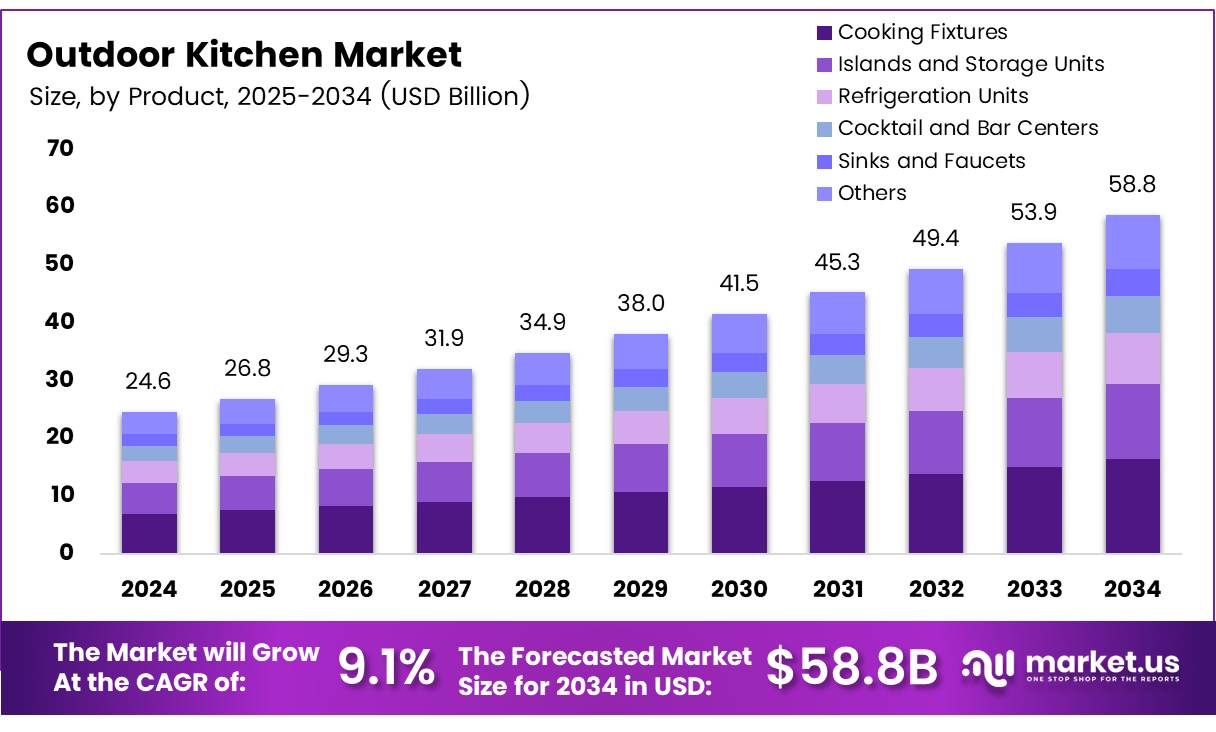

The Global Outdoor Kitchen Market size is expected to be worth around USD 58.8 Billion by 2034, from USD 24.6 Billion in 2024, growing at a CAGR of 9.1% during the forecast period from 2025 to 2034.

An outdoor kitchen refers to a designated cooking and dining area located outside the traditional indoor kitchen, typically built with weather-resistant materials like stainless steel, stone, and concrete. These kitchens often include appliances such as grills, refrigerators, sinks, and sometimes even pizza ovens or outdoor bars, providing an environment for preparing and enjoying meals outdoors.

The outdoor kitchen market is driven by a growing trend in outdoor living, as consumers invest in more luxurious and functional outdoor spaces that support entertainment and cooking activities. This trend has been particularly accelerated by shifts in consumer behavior towards creating more personal and enjoyable environments within their homes.

The demand for outdoor kitchens has significantly increased over the past decade, with more homeowners choosing to create versatile outdoor spaces that blend cooking, dining, and entertainment. This trend has been further amplified by lifestyle changes and the growing desire for functional living spaces that extend beyond the indoors.

According to a 2022 survey by Fixr, 41% of industry experts believed that outdoor kitchens would remain a top priority for homeowners in the coming years. Additionally, outdoor dining areas are becoming increasingly sought-after, with 62% of experts, as per Fixr’s 2022 survey, noting that these spaces would be the most desired living feature for homeowners.

From a market perspective, the outdoor kitchen industry continues to witness steady growth, with an increasing number of companies focusing on premium products and services tailored to outdoor cooking enthusiasts. Homeowners are becoming more invested in the functionality of these spaces, preferring customizable solutions that enhance convenience, aesthetics, and comfort.

According to the 2024 Houzz Kitchen Trends Study, 64% of homeowners who opened their kitchens to nearby spaces opted for an open layout, with no wall separation. This shows a clear shift toward seamless integration of indoor and outdoor living.

The growth of the outdoor kitchen market is being propelled by several factors, including increasing disposable income, changing lifestyle preferences, and advancements in outdoor living technologies.

Key Takeaways

- The Global Outdoor Kitchen Market is projected to reach USD 58.8 billion by 2034, growing at a CAGR of 9.1% from 2025 to 2034.

- Cooking Fixtures led the market in 2023 with a 42.3% share, driven by demand for high-quality and functional outdoor cooking equipment.

- Residential outdoor kitchens accounted for 62.3% of the market in 2023, fueled by the trend of outdoor living and luxury home entertainment.

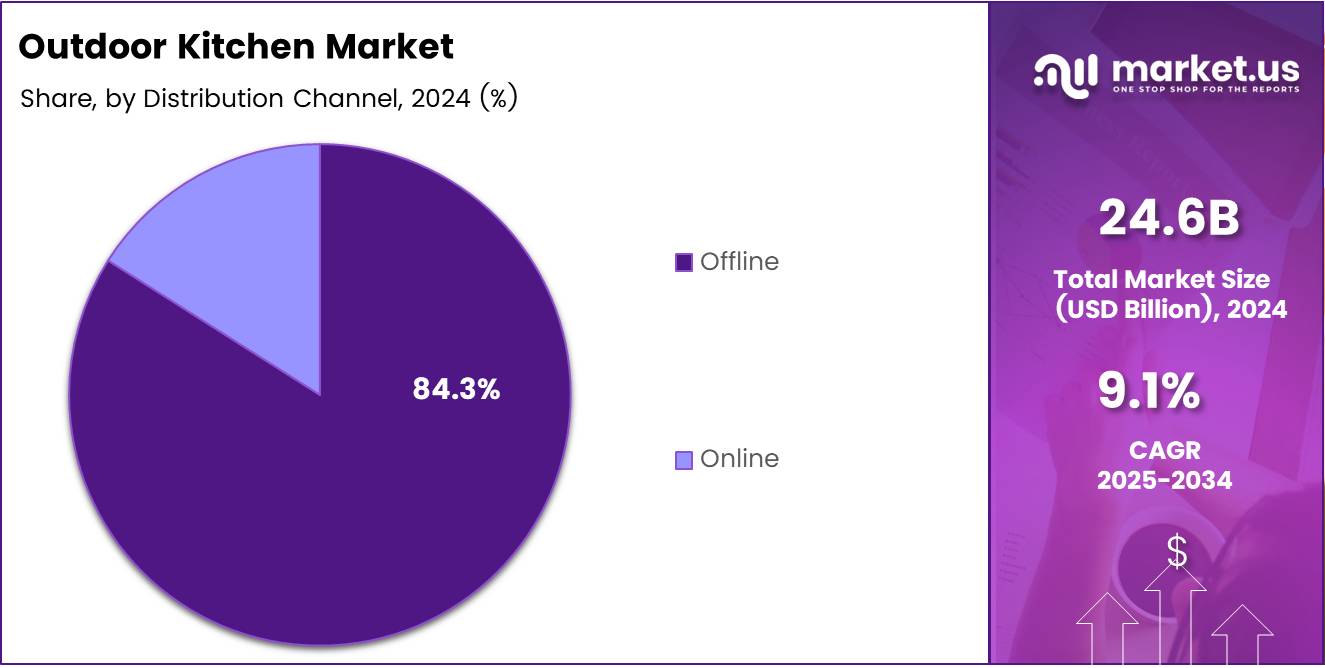

- Offline distribution channels dominated in 2023 with an 84.3% share, due to consumer preference for in-person product evaluation and personalized service.

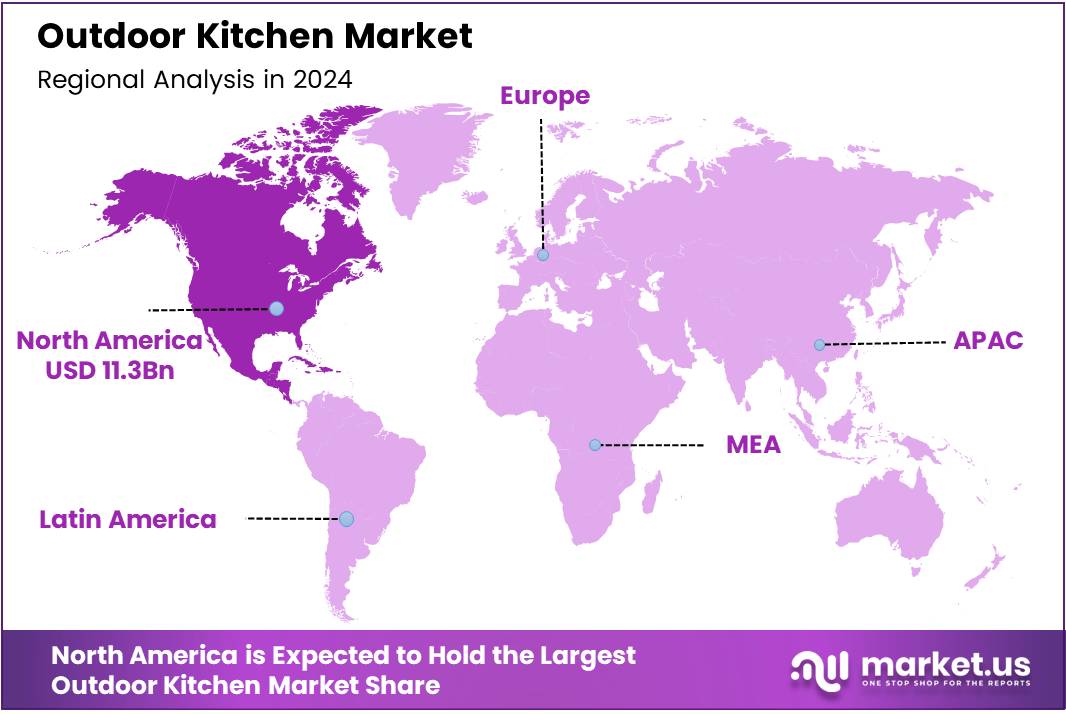

- North America held a 46% market share in 2023, valued at USD 11.3 billion, driven by high disposable incomes and interest in outdoor living spaces.

Product Analysis

Cooking Fixtures Lead with 42.3% Share in 2023

In 2023, Cooking Fixtures held a dominant market position in the By Product Analysis segment of the Outdoor Kitchen Market, with a 42.3% share. This segment’s growth can be attributed to the increasing demand for outdoor cooking experiences, where consumers seek high-quality, durable, and functional fixtures.

Following cooking fixtures, Islands & Storage Units emerged as the second-largest segment, capturing a significant share due to the rising trend of modular outdoor kitchens that integrate multiple functions.

Refrigeration Units, Cocktail & Bar Centers, and Sinks & Faucets also contributed to market growth, reflecting the expanding interest in fully equipped outdoor living spaces.

Refrigeration Units, in particular, saw an uptick as consumers sought convenience in storing ingredients and beverages outdoors. Cocktail & Bar Centers further fueled this trend by enhancing outdoor entertainment spaces. Sinks & Faucets rounded out the list, as they are essential for maintaining the functionality and hygiene of outdoor cooking areas.

Type Analysis

Residential Dominates Outdoor Kitchen Market in 2023 with a 62.3% Share

In 2023, Residential held a dominant market position in the By Type Analysis segment of the Outdoor Kitchen Market, with a 62.3% share. The growing trend of outdoor living and the desire for luxurious home entertainment areas have significantly fueled the adoption of residential outdoor kitchens.

Consumers increasingly seek high-quality, customizable outdoor spaces for cooking, dining, and socializing, driving this segment’s strong performance. Key factors such as technological advancements in outdoor cooking appliances, alongside innovations in durable, weather-resistant materials, have further contributed to the rise of residential outdoor kitchens.

Commercial outdoor kitchens, while showing growth, held a smaller share of the market in 2023. With a focus on high-end outdoor dining experiences, restaurants, hotels, and resorts are investing in robust and efficient outdoor kitchens to cater to the increasing demand for outdoor dining.

The commercial segment is driven by the growing popularity of alfresco dining, especially in warmer climates. However, it is still catching up to residential demand, with businesses looking for cost-effective, space-efficient solutions without compromising on quality or functionality.

Both segments are expected to continue expanding, but the residential market remains the leading force in shaping overall industry trends.

Distribution Channel Analysis

Offline Dominates Outdoor Kitchen Market Distribution with 84.3% Share in 2023

In 2023, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Outdoor Kitchen Market, with a 84.3% share. This continued preference for offline channels is driven by the tangible experience they offer, allowing consumers to touch and feel the products, observe their quality firsthand, and receive personalized recommendations from sales staff.

Additionally, many buyers in this market, especially those making large, high-investment purchases like outdoor kitchens, often prefer the reassurance of seeing the product in person and seeking expert guidance before finalizing their purchase.

Offline retail stores, showrooms, and home improvement centers play a critical role in this trend, as they not only provide a hands-on experience but also offer installation services, warranties, and maintenance options that add value for consumers.

On the other hand, the online segment continues to grow, driven by the convenience and competitive pricing offered through e-commerce platforms. While online sales represent a smaller portion of the market compared to offline, the gap is narrowing as digital platforms improve their customer service and virtual tools for product visualization.

Overall, offline remains the preferred channel for outdoor kitchen purchases, but online platforms are slowly gaining ground in this competitive segment.

Key Market Segments

By Product

- Cooking Fixtures

- Gas Grills

- Pizza Ovens, Smokers & Specialty Grills

- Side Burners & Other Secondary Cooking Fixtures

- Islands & Storage Units

- Prefabricated Islands

- Cabinets and Storage Units

- Countertops

- Refrigeration Units

- Cocktail & Bar Centers

- Sinks & Faucets

- Others

By Type

- Residential

- Commercial

By Distribution Channel

- Offline

- Online

Drivers

Outdoor Kitchen Market Growth Driven by Lifestyle Changes and Increased Spending Power

The outdoor kitchen market is being driven by several key factors. One of the most significant drivers is the increasing trend of outdoor living. As people spend more time at home, they seek to extend their living spaces into their backyards, turning them into comfortable and functional areas. This shift in lifestyle preferences is pushing the demand for outdoor kitchens, as they offer a way to entertain, cook, and relax in open spaces.

Rising disposable income is another major factor, as more people are willing to invest in high-quality outdoor kitchen setups. With more money to spend, consumers are opting for premium grills, countertops, and other kitchen appliances to enhance their outdoor cooking experience.

Moreover, technological advancements are shaping the market. The integration of smart appliances—such as smart grills, refrigerators, and lighting into outdoor kitchens is appealing to tech-savvy consumers who enjoy convenience and innovation.

These advancements not only make outdoor cooking more efficient but also add a modern touch to the backyard. As a result, outdoor kitchens are becoming increasingly popular as a valuable home upgrade, making them more accessible and desirable across different income groups.

Restraints

High Initial Cost & Space Constraints

The outdoor kitchen market faces significant restraints, with the high initial cost being one of the biggest barriers for many consumers.

Building an outdoor kitchen involves expenses for durable materials, high-quality appliances, and professional installation, all of which can quickly add up. For many, this upfront cost is simply too high, especially when compared to traditional indoor kitchens.

Additionally, space limitations in urban areas or smaller homes can make it difficult for homeowners to consider an outdoor kitchen. In densely populated regions or apartments, where outdoor spaces may be limited to small balconies or patios, it can be challenging to set up a fully functional outdoor kitchen.

The lack of adequate space often restricts the installation of larger appliances or dining areas, forcing homeowners to scale down their plans. These factors high costs and space constraints—are important considerations that can slow down market growth in certain demographics and geographic regions. While the concept of an outdoor kitchen is appealing, these limitations mean it’s not a feasible option for all potential buyers.

Growth Factors

Growth Opportunities in the Outdoor Kitchen Market Driven by Rising Incomes and Technological Advancements

The outdoor kitchen market is set to grow significantly due to several key trends. First, the rising disposable incomes and urbanization in regions like Asia-Pacific and Latin America present a major opportunity. As more people move to cities and experience higher living standards, they are increasingly looking to upgrade their outdoor living spaces, including kitchens.

Second, the integration of smart technologies like the Internet of Things (IoT), artificial intelligence (AI), and smart home devices into outdoor kitchens is another important growth driver.

Consumers are looking for ways to make cooking and entertaining easier and more efficient, and smart outdoor kitchens are meeting this demand. These kitchens can include features like automated cooking, smart temperature controls, and integrated voice assistants.

Finally, eco-friendly outdoor kitchens are gaining popularity, as consumers become more environmentally conscious. This includes the demand for sustainable materials, energy-efficient appliances, and designs that reduce environmental impact.

As sustainability continues to be a key focus, brands that incorporate these elements into their outdoor kitchen offerings stand to benefit from growing consumer interest in green products. Together, these trends represent significant growth opportunities for businesses in the outdoor kitchen market.

Emerging Trends

The Outdoor Kitchen Market is Thriving Due to a Growing Desire for Stylish, Functional, and Seamless Living Spaces

The outdoor kitchen market is rapidly evolving, shaped by several key trends that reflect consumer desire for style, functionality, and seamless integration with nature. One of the most notable trends is the shift toward minimalist design aesthetics. People are increasingly drawn to sleek, modern outdoor kitchens that feature clean lines and clutter-free spaces, focusing on simplicity and elegance.

Another trend is the integration with outdoor living spaces. Homeowners are looking for kitchens that blend effortlessly with other areas like patios, gardens, and lounges, creating a cohesive environment for entertainment and relaxation.

This movement toward all-inclusive outdoor living concepts is also gaining traction, with many opting to design comprehensive outdoor spaces that combine kitchens, dining areas, firepits, and even lounge zones.

This trend emphasizes the idea of transforming backyards into multifunctional spaces where family and friends can gather, dine, and enjoy each other’s company.

The rise of sustainable and durable materials also plays into these trends, as consumers prioritize longevity and environmental impact when designing their outdoor kitchens. Overall, these trends point to a growing demand for outdoor kitchens that not only offer functionality but also enhance the beauty and flow of outdoor living spaces.

Regional Analysis

North America Leads Outdoor Kitchen Market with 46% Share at USD 11.3 Billion Driven by Rising Demand for Luxury Outdoor Living Spaces

North America dominates the global outdoor kitchen market, accounting for approximately 46% of the market share, valued at USD 11.3 billion.

The growth in this region is driven by increasing consumer interest in outdoor living spaces and high disposable incomes. The U.S. is the leading contributor, with a significant demand for premium outdoor kitchen solutions, particularly in affluent suburban areas.

The growing trend of home renovation and backyard entertainment is boosting market growth. Moreover, advancements in outdoor kitchen appliances, including high-end grills, refrigerators, and smart technologies, have further spurred the demand in the region.

Regional Mentions:

Europe follows as a key market, driven by an increasing focus on sustainable and energy-efficient outdoor living spaces. In countries like Germany, the UK, and France, there is a growing demand for outdoor kitchens that are both functional and aesthetically pleasing. The region also shows a strong preference for compact and modular designs, suitable for smaller outdoor areas.

Asia Pacific is emerging as a high-growth market, primarily driven by the rising middle class, urbanization, and an increased interest in outdoor cooking experiences, particularly in countries like China, Japan, and Australia. The region’s market is expected to experience substantial growth due to the growing number of new residential developments and the increasing popularity of lifestyle-oriented outdoor living.

Middle East & Africa and Latin America are relatively smaller markets but exhibit promising growth potential due to the increasing adoption of outdoor living spaces, particularly in affluent regions like the UAE and Brazil. These markets are characterized by a growing interest in luxury outdoor furniture and appliances, particularly for hospitality and residential developments.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global outdoor kitchen market in 2023 is marked by significant competition among industry leaders offering innovative products that enhance the outdoor cooking and entertaining experience.

Among these key players, AB Electrolux, Summerset Grills, Wolf Steel Ltd, and DCS Appliances stand out with strong brand equity, high-quality manufacturing, and diverse product portfolios that appeal to both luxury and mainstream consumers.

AB Electrolux, known for its premium home appliances, has extended its expertise into the outdoor cooking space with advanced products that combine functionality and sleek designs.

Summerset Grills and Wolf Steel Ltd are recognized for their robust grill systems and integrated outdoor kitchens, which appeal to the high-end segment by offering customization and durability.

Danver Stainless Outdoor Kitchens and Brown Jordan Outdoor Kitchens represent strong players in luxury and high-end outdoor kitchen solutions, known for custom stainless steel cabinetry and modern designs, focusing on the aesthetics of outdoor living.

Similarly, Kalamazoo Outdoor Gourmet is a leader in offering top-tier outdoor cooking equipment, blending performance with cutting-edge innovation.

The market also includes companies like Bull Outdoor Products, Inc., Alfresco Grills, and Coyote Outdoor Living, Inc., which have established themselves with a reputation for offering high-quality products at a relatively lower price point, expanding the appeal of outdoor kitchens to a broader consumer base.

Blaze has been quick to capture the attention of budget-conscious buyers, while maintaining product integrity and durability.

Top Key Players in the Market

- AB Electrolux

- Summerset Grills

- Wolf Steel Ltd

- DCS Appliances

- Danver Stainless Outdoor Kitchens

- Brown Jordan Outdoor Kitchens

- Kalamazoo Outdoor Gourmet, LLC

- Bull Outdoor Products, Inc.

- Alfresco Grills

- RH Peterson Co.

- Coyote Outdoor Living, Inc.

- Blaze

Recent Developments

- In Dec 2024, Ghost Kitchen raised $5 million in Series A funding to expand its virtual kitchen operations and strengthen its position in the growing food delivery sector.

- In Dec 2023, Cloud kitchen startup Kitchens@ secured $65 million in Series C funding from Finnest, aiming to scale its innovative kitchen infrastructure and enhance delivery capabilities.

- In Apr 2023, Valentine Companies acquired Danver Stainless Outdoor Kitchens, marking a strategic move to expand its outdoor kitchen offerings and bolster its presence in the premium outdoor living market.

Report Scope

Report Features Description Market Value (2023) USD 24.6 Billion Forecast Revenue (2033) USD 58.8 Billion CAGR (2024-2033) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered AB Electrolux, Summerset Grills, Wolf Steel Ltd, DCS Appliances, Danver Stainless Outdoor Kitchens, Brown Jordan Outdoor Kitchens, Kalamazoo Outdoor Gourmet, LLC, Bull Outdoor Products, Inc., Alfresco Grills, RH Peterson Co., Coyote Outdoor Living, Inc., Blaze Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape By Product (Cooking Fixtures, Islands & Storage Units, Refrigeration Units, Cocktail & Bar Centers, Sinks & Faucets, Others), By Type (Residential, Commercial), By Distribution Channel (Offline, Online) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AB Electrolux

- Summerset Grills

- Wolf Steel Ltd

- DCS Appliances

- Danver Stainless Outdoor Kitchens

- Brown Jordan Outdoor Kitchens

- Kalamazoo Outdoor Gourmet, LLC

- Bull Outdoor Products, Inc.

- Alfresco Grills

- RH Peterson Co.

- Coyote Outdoor Living, Inc.

- Blaze