Global Second-Hand Apparel Market By Product Type (Dresses & Tops, Shirts & T-shirts, Sweaters, Coats & Jackets, Other Product Types), By End-User (Men, Women), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2024

- Report ID: 104934

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

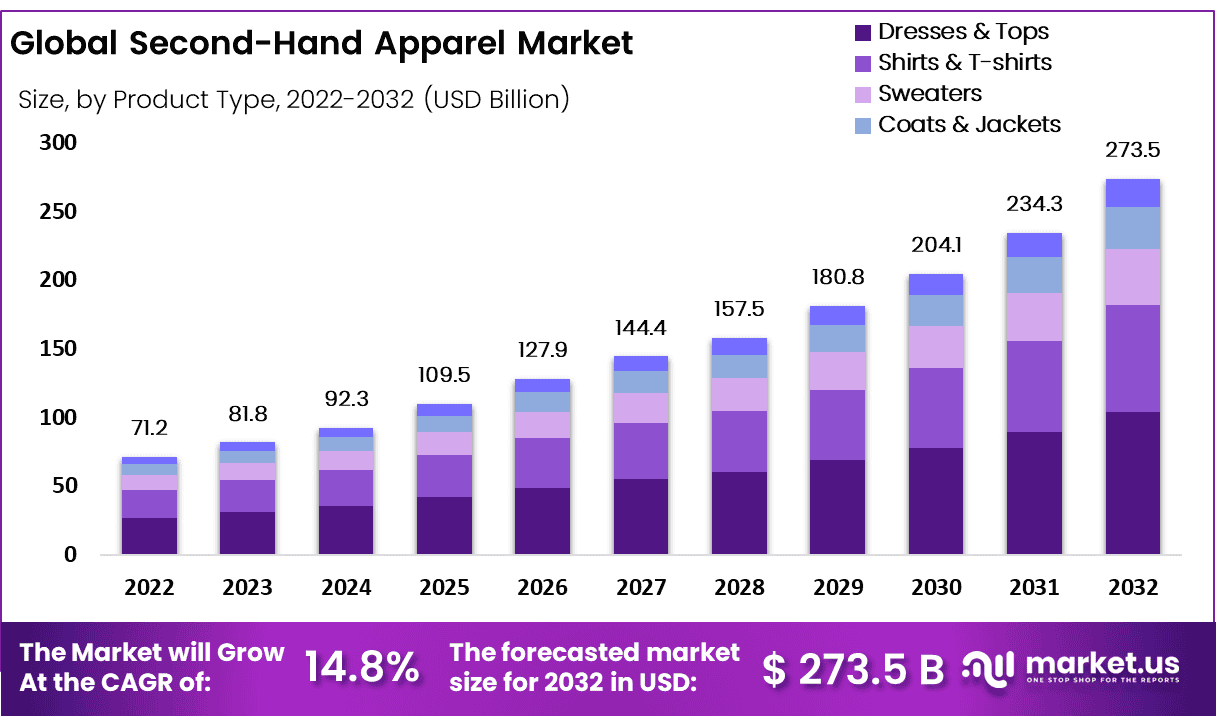

The Global Second-Hand Apparel Market size is expected to be worth around USD 273.5 Billion by 2032 from USD 81.8 Billion in 2023, growing at a CAGR of 14.8% during the forecast period from 2023 to 2032.

The Second-Hand Apparel Market refers to the buying and selling of pre-owned clothing items, including vintage, refurbished, or lightly used garments. This market has gained traction as consumers become increasingly eco-conscious, seeking sustainable fashion options that reduce waste and extend the lifecycle of apparel. It encompasses both online and offline platforms, including resale websites, thrift stores, and peer-to-peer exchanges.

The market is experiencing robust growth due to the rising environmental awareness among consumers and the shift towards circular fashion models. Technological advancements, such as AI-powered resale platforms, are enhancing the efficiency of product listings and personalized recommendations, driving consumer engagement. Additionally, the affordability of second-hand clothing attracts budget-conscious shoppers, expanding the market reach beyond eco-conscious consumers.

Demand for second-hand apparel is surging as consumers prioritize sustainability and affordability. Younger generations, particularly Gen Z and millennials, are major contributors, valuing unique fashion choices and environmental responsibility. This shift is further amplified by the increasing integration of resale sections in mainstream retail stores, boosting accessibility and consumer confidence in second-hand purchases.

The market presents significant growth opportunities, especially in online platforms that leverage technology for personalized shopping experiences. Collaborations between major fashion retailers and second-hand platforms are expected to expand, offering brands an avenue to reach sustainability-oriented consumers. Moreover, government initiatives promoting sustainable consumption and waste reduction create a supportive regulatory environment for the market’s expansion.

The market presents significant growth opportunities, especially in online platforms that leverage technology for personalized shopping experiences. Collaborations between major fashion retailers and second-hand platforms are expected to expand, offering brands an avenue to reach sustainability-oriented consumers. Moreover, government initiatives promoting sustainable consumption and waste reduction create a supportive regulatory environment for the market’s expansion.The second-hand apparel market is experiencing a transformative shift, driven by consumer demand for sustainable and affordable fashion alternatives. According to ThredUp, the U.S. secondhand apparel sector expanded at a rate seven times faster than the broader retail clothing market in 2023, highlighting its resilience and growing appeal.

The market is projected to reach $73 billion by 2028, with online resale expected to more than double over the next five years, reaching $40 billion at a CAGR of 17%. This trajectory indicates a fundamental change in consumer behavior, particularly among younger demographics who increasingly prioritize sustainability and affordability. Notably, 38% of consumers reported shopping secondhand to access higher-end brands, up 11% points from 2022.

The growth of the market is further supported by the increasing adoption of circular business models among retailers. ThredUp’s Recommerce 100 report reveals that 163 brands now offer resale programs, marking a 31% increase from 2022, with notable entrants such as J.Crew, American Eagle, and Kate Spade. Nearly two-thirds of retail executives involved in resale expect these initiatives to generate at least 10% of their company’s total revenue within five years, demonstrating the financial viability of the model.

Additionally, 87% of executives affirm that resale has advanced their sustainability goals. Legislative momentum is also gaining traction, with 42% of consumers advocating for government action to promote sustainable fashion and 52% of retail executives indicating a willingness to adopt circular models if incentivized. As online platforms gain prominence 45% of younger consumers prefer online secondhand purchases the sector’s digital expansion is poised to reshape retail dynamics significantly.

The second-hand apparel market is witnessing robust growth, driven by shifting consumer preferences toward sustainable and cost-effective fashion choices. In 2023, 52% of consumers engaged in second-hand shopping, allocating nearly half of their apparel budget to pre-owned items.

This trend aligns with the broader industry trajectory, where the average revenue per user (ARPU) in the fashion sector is projected at $288.30. The market’s expansion highlights the increasing importance of circular economy models and the rising demand for affordable, sustainable fashion alternatives.

Key Takeaways

- The global second-hand apparel market is projected to grow from USD 81.8 billion in 2023 to USD 273.5 billion by 2032, with a CAGR of 14.8%, driven by rising sustainability awareness and consumer demand for affordable fashion alternatives.

- Analyst Viewpoint Summary:The second-hand apparel market’s robust growth is attributed to the increasing shift towards circular fashion models, technological advancements in online resale platforms, and strong consumer engagement, particularly among Gen Z and millennials.

- Dresses & Tops dominate the product type segment, capturing over 38.0% of the market share due to their versatility and demand among eco-conscious consumers.

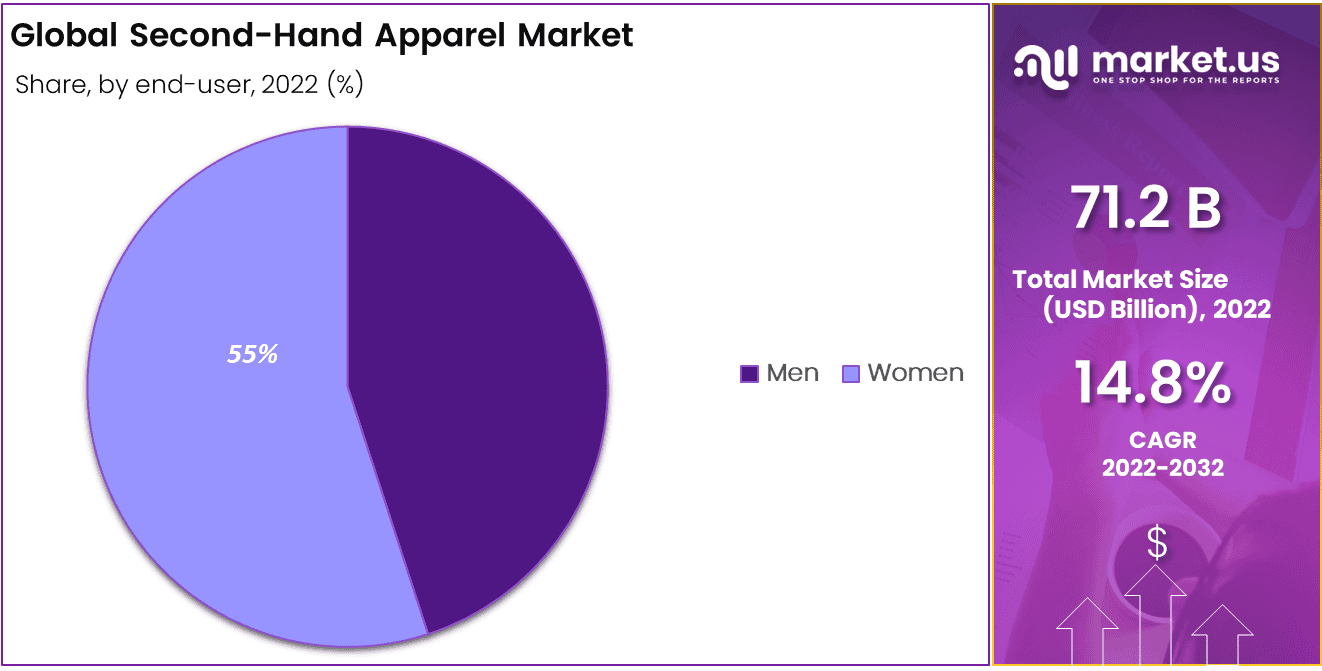

- Women’s Apparel leads the end-user segment, holding more than 55.0% of the market share, driven by female consumers’ preferences for diverse, sustainable, and affordable styles.

- Online Distribution dominates, holding a significant share of the market in 2022, propelled by convenience, variety, and tech-savvy consumer preferences for digital shopping.

- Resale Platforms outpace traditional thrift stores, showing significant market growth as brands collaborate with these platforms, integrating sustainable practices to reach eco-conscious shoppers.

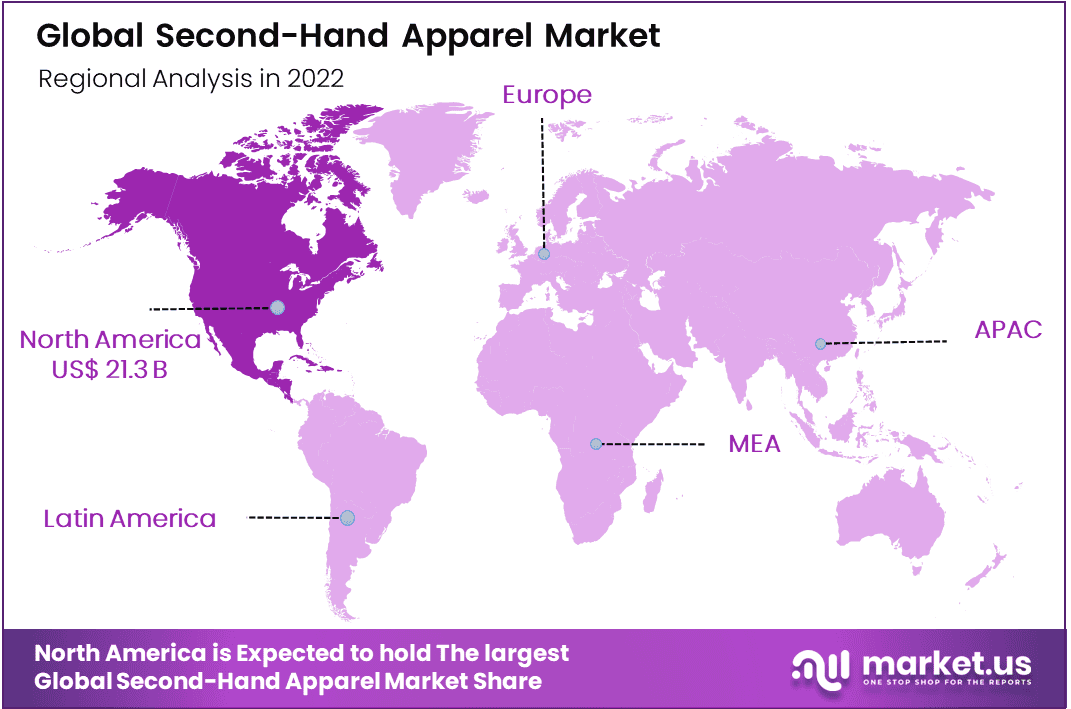

- North America holds the highest revenue share, accounting for 30.0% of the global market, valued at USD 21.3 billion, with growth propelled by online platforms and the region’s strong sustainability culture.

- Sustainability Awareness: With 62% of Gen Z preferring sustainable brands, the shift towards eco-friendly fashion is a key growth driver, reshaping consumer behaviors and market strategies.

- Quality Concerns: Approximately 37% of consumers are hesitant to buy second-hand clothing due to fears about product defects and hygiene issues, impacting market growth and consumer trust.

By Product Type Analysis

Dresses & Tops dominant market position in the Second-Hand Apparel Market, capturing more than a 38.0% share.

Dresses & Tops secured over 38.0% of the market share in 2022, establishing itself as the leading product segment in the second-hand apparel market. The preference for dresses and tops is driven by their adaptability for various occasions, from casual to formal wear, making them a staple in the wardrobe of consumers seeking affordable yet stylish options. The growing inclination toward sustainable fashion practices has also amplified the demand for second-hand dresses and tops, particularly among eco-conscious and budget-savvy consumers.

The Shirts & T-shirts segment accounted for a significant share of the market, reflecting a strong demand for casual, everyday wear. This category benefits from the trend of minimalistic and comfort-oriented fashion, especially among younger consumers.

Sweaters represented a smaller yet essential share of the market. Demand for this category tends to fluctuate seasonally, with an uptick during colder months. Vintage and designer sweaters, especially those made from high-quality materials like wool and cashmere, have seen increased interest among second-hand shoppers looking for both style and comfort.

The Coats & Jackets segment also held a noteworthy portion of the market, appealing to consumers interested in seasonal and functional fashion pieces. With an emphasis on outerwear’s longevity and quality, second-hand coats and jackets particularly those from high-end and designer brands have maintained a strong market presence.

This segment includes diverse apparel items such as pants, skirts, and activewear, which collectively form an important but less dominant portion of the market. While these items do not hold as substantial a share as Dresses & Tops or Shirts & T-shirts, they represent critical components of a comprehensive second-hand wardrobe.

By End-User Analysis

Women’s dominant market position in the Second-Hand Apparel Market, capturing more than a 55.0% share.

In 2022, the women’s segment held a dominant market position in the Second-Hand Apparel Market, capturing more than 55.0% of the overall market share. This significant share is attributed to several factors, including the increasing demand for variety, style, and sustainable fashion among female consumers. Women, as a demographic, display a higher frequency of purchasing second-hand clothing, driven by the appeal of diverse styles, premium brand access at affordable prices, and environmental consciousness.

The growth in the women’s segment is further fueled by the active participation of women in resale platforms and the growing number of collaborations between high-profile fashion brands and resale marketplaces. Influencer marketing and social media campaigns targeting female audiences have also proven effective, reinforcing the perception of second-hand apparel as trendy and economically viable. This has led to the rise of peer-to-peer and curated collections that cater specifically to women’s tastes, ensuring sustained growth and prominence in this segment.

Although the men’s segment accounts for a smaller share compared to women’s, it is gaining traction and growing steadily. In recent years, male consumers have increasingly embraced second-hand fashion, with an emphasis on premium and vintage brands that offer a blend of quality and style. The shift in male consumer behavior towards sustainable fashion choices and the appeal of luxury items at reduced prices are critical factors driving this growth.

Men’s second-hand apparel typically includes a focus on streetwear, sportswear, and classic business attire. The rising popularity of sustainable menswear brands and specialized platforms catering to this demographic suggests that the segment is evolving.

By Distribution Channel Analysis

Online dominant market position in the Second-Hand Apparel Market

In 2022, the online segment held a dominant market position in the Second-Hand Apparel Market. This growth is primarily driven by the convenience, variety, and accessibility offered by digital platforms, which appeal to a broad and increasingly tech-savvy consumer base.

Online marketplaces and apps specializing in second-hand fashion, such as ThredUp, Poshmark, and Depop, have optimized user experience by leveraging AI-powered recommendations, secure payment options, and user-friendly interfaces. These features enhance consumer trust and engagement, leading to higher conversion rates.

The expansion of the online segment is also supported by strategic collaborations with high-end brands, which have increasingly recognized the value of resale channels as a way to reach new audiences and promote sustainable consumption practices.

While the offline segment remains a significant component of the Second-Hand Apparel Market, its growth trajectory is more moderate compared to its online counterpart. Brick-and-mortar stores, thrift shops, and pop-up events provide a tactile and immersive shopping experience that appeals to consumers who prefer to physically inspect items before purchasing.

Despite the rapid expansion of digital platforms, the offline segment benefits from its ability to cultivate local loyalty and build brand identity through personalized customer service. Hybrid models, such as stores that integrate both physical and digital experiences, are also emerging as effective strategies to capture the interest of consumers who value both convenience and the traditional shopping experience.

Key Market Segments

Based on Product Type

- Dresses & Tops

- Shirts & T-shirts

- Sweaters

- Coats & Jackets

- Other Product Types

Based on the End User

- Men

- Women

Based on the Distribution Channel

- Online

- Offline

Driver

Sustainability Awareness

As global environmental concerns intensify, sustainability awareness has emerged as a pivotal driver in the growth of the second-hand apparel market. Consumers, particularly millennials and Gen Z, increasingly prioritize eco-friendly options, leading to a shift away from fast fashion.

Reports indicate that 62% of Gen Z buyers prefer sustainable brands, illustrating a clear market trend toward environmentally responsible purchasing decisions. The fashion industry is one of the largest polluters, contributing approximately 10% of global carbon emissions, and the second-hand market presents a viable solution to reduce waste and carbon footprint.

This heightened awareness not only reshapes consumer preferences but also influences how brands position themselves. Companies are integrating circular economy models, such as take-back and resale programs, to align with consumer values and expand their offerings.

This interplay between consumer demand and brand adaptation amplifies market growth, fostering an ecosystem where sustainability and profitability coalesce, further accelerating the adoption of second-hand apparel as a mainstream choice.

Restraint

Quality Concerns

Quality concerns present a significant restraint on the growth of the second-hand apparel market by directly impacting consumer trust and purchase intent. Consumers often perceive second-hand items as inferior in quality compared to new products, fearing defects, wear and tear, or hygiene issues. This perception is compounded by inconsistent quality standards across different second-hand platforms and vendors, leading to a fragmented market experience.

According to industry reports, around 37% of consumers hesitate to purchase second-hand clothing due to doubts about the durability and cleanliness of these items. This skepticism slows market expansion, as potential buyers prioritize product longevity and condition. Additionally, quality concerns reduce repeat purchases, a key driver of growth for resale platforms.

The interplay between quality concerns and inventory management further amplifies this issue. For instance, second-hand apparel platforms must invest heavily in quality control and authentication processes to build consumer confidence. However, this investment increases operational costs, which can be passed on to consumers as higher prices, further limiting market appeal.

Ultimately, addressing quality concerns through rigorous quality assurance measures and transparency is critical for enhancing consumer trust, thereby unlocking further growth potential in the second-hand apparel market.

Opportunity

Cultural Acceptance of Vintage Fashion

One of the pivotal drivers of growth in this market is the cultural shift toward the acceptance and appreciation of vintage fashion. The consumer perception of second-hand clothing has evolved from being associated with affordability alone to embodying uniqueness, nostalgia, and exclusivity. This trend is especially prevalent among younger demographics, particularly Millennials and Gen Z, who view vintage apparel as a way to express individuality while supporting sustainable fashion practices.

According to recent surveys, nearly 40% of Gen Z shoppers have purchased second-hand clothing in the past year, emphasizing a preference for circular fashion. This demographic shift not only enhances market growth but also encourages established brands to enter the resale space, either through partnerships or dedicated resale platforms, further legitimizing and expanding the market.

Trends

Growth of Online Resale Platforms

In 2024, the global second-hand apparel market is experiencing significant expansion, primarily driven by the growth of online resale platforms. Digital marketplaces, such as ThredUp, Depop, and Poshmark, are capitalizing on the increasing consumer demand for sustainable and affordable fashion. These platforms are not only convenient but also cater to a tech-savvy demographic seeking variety and customization elements that traditional retail models often struggle to offer.

A key differentiator of online resale platforms is their integration of advanced technologies, including AI-powered recommendations and virtual fitting rooms. These technologies enhance the user experience by providing personalized shopping options and minimizing the challenges associated with buying second-hand items, such as sizing inconsistencies and product quality concerns. Such innovations make second-hand shopping more appealing, accessible, and efficient, contributing to market growth.

Additionally, the collaboration between luxury brands and online resale platforms is reshaping perceptions of second-hand fashion. High-end labels are increasingly partnering with these digital platforms to control the resale of their products, ensuring authenticity while tapping into new revenue streams. This trend indicates a shift from viewing resale as a threat to brand equity to recognizing it as a strategic opportunity for customer retention and engagement.

Regional Analysis

North America Accounted for the Highest Revenue Share 30.0%

North America holds a dominant position, accounting for 30.0% of the global second-hand apparel market. With an estimated market value of USD 21.3 billion, the region is driven by a strong preference for thrift shopping and sustainability among younger consumers, particularly in the United States and Canada.

The rise of online platforms like ThredUp and Poshmark has further catalyzed growth, making it easier for consumers to access and purchase pre-owned clothing. Moreover, increasing efforts to promote circular fashion have accelerated market penetration, particularly in urban areas.

Europe is a key player in the second-hand apparel market, influenced by the region’s longstanding focus on sustainability and eco-conscious living. Countries like the UK, Germany, and France are leading markets where second-hand fashion is well integrated into mainstream retail.

The European market benefits from a well-developed network of charity shops and online resale platforms, supported by favorable government policies encouraging the circular economy. As consumers prioritize reducing textile waste, Europe continues to grow steadily in this sector.

The Asia Pacific region is emerging as a fast-growing market for second-hand apparel, fueled by an expanding middle class and increasing fashion consciousness. Countries such as China, Japan, and India are witnessing a shift towards affordable fashion alternatives, with resale platforms gaining traction.

The market’s growth is supported by a combination of rising internet penetration, increasing smartphone usage, and a youthful population eager to adopt new shopping habits. As regional players innovate with localized business models, the market is projected to grow rapidly in the coming years.

The Middle East & Africa region is seeing a gradual increase in the acceptance of second-hand apparel, driven primarily by young, urban populations and expatriate communities.

Latin America, though currently smaller in scale compared to other regions, is gradually embracing the second-hand apparel trend, particularly in Brazil, Mexico, and Argentina. Economic factors such as fluctuating incomes and high retail prices for new apparel drive consumers to seek affordable alternatives, making second-hand clothing an attractive option. Growth in the region is also supported by the rise of online marketplaces and social media channels that facilitate peer-to-peer sales.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global second-hand apparel market in 2024 is experiencing rapid growth, fueled by shifting consumer preferences toward sustainable fashion and the circular economy. Key players in this market, such as ThredUP, Poshmark, Depop, and Vestiaire Collective, are capitalizing on these trends by leveraging digital platforms and innovative business models to cater to both sellers and buyers.

ThredUP and Poshmark, as major players in North America, continue to dominate the resale space through user-friendly mobile apps and broad product offerings. ThredUP’s partnerships with major retailers further enhance its reach, positioning it as a key player in the omnichannel retail strategy.

Depop, with its strong appeal to Gen Z and focus on vintage and unique items, benefits from its social-commerce model, integrating community engagement with peer-to-peer selling. Vestiaire Collective, a leader in the luxury segment, differentiates itself with a robust authentication process, ensuring the resale of high-value items remains a premium experience, driving customer trust and loyalty.

Mercari and The RealReal are also critical to the market landscape. Mercari’s emphasis on accessibility and low barriers to entry attracts a wide range of users, while The RealReal’s specialization in authenticated luxury items captures high-margin opportunities.

Traditional players like eBay, Goodwill Industries, and Buffalo Exchange maintain relevance by adapting their models to digital formats, integrating sustainability narratives into their brand strategies. Meanwhile, platforms such as ASOS Marketplace blend retail with resale, offering unique positioning that appeals to fashion-conscious consumers seeking value.

Overall, these players are crucial to the global second-hand apparel ecosystem, each employing unique strategies to capture market share in an increasingly competitive and expanding sector.

Top Key Players in the Market

- ThredUP

- Poshmark

- Depop

- Vestiaire Collective

- Mercari

- The RealReal

- eBay

- ASOS Marketplace

- Goodwill Industries International

- Buffalo Exchange

- Other Key Players

Recent Developments

- In 2024, ThredUp, a major online resale platform for clothes, shoes, and accessories, has launched new AI-powered shopping tools. These features make it quicker and easier for shoppers to find unique fashion items from their vast marketplace of over four million products, creating a more personalized shopping experience.

- In 2024 The RealReal, the largest online marketplace for authentic luxury resale items, released its 2024 Luxury Resale Report. The report uses over a decade of data to look at current trends in luxury resale, the shopping habits of its 37 million+ members, and the brands and products that are most in demand and hold their value best.

- In 2024 Target, is hosting its first Denim Take Back Event across all stores from August 4-10. Customers can bring in any brand of used denim to recycle and receive 20% off their next denim purchase using Target Circle, encouraging sustainable fashion choices.

- In 2023 Zara, launched a service in France to help customers sell, repair, or donate their used clothes. This effort is part of Zara’s larger sustainability plan, aiming for 40% of its clothes to be made from recycled fibers by 2030. The initiative supports their goal of extending the life of garments and reducing fashion waste.

Report Scope

Report Features Description Market Value (2023) US$ 81.8 Bn Forecast Revenue (2032) US$ 273.5 Bn CAGR (2023-2032) 14.8 % Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Dresses & Tops, Shirts & T-shirts, Sweaters, Coats & Jackets, Other Product Types), By End-User (Men, Women), By Distribution Channel (Online, Offline) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, Japan, South Korea, India, ASEAN, and the Rest of APAC, Latin America: Brazil, Mexico, and Rest of Latin America, Middle East & Africa: GCC, South Africa, United Arab Emirates, and Rest of Middle East & Africa. Competitive Landscape ThredUP, Poshmark, Depop, Vestiaire Collective, Mercari, The RealReal, eBay, ASOS Marketplace, Goodwill Industries International, Buffalo Exchange, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ThredUP

- Poshmark

- Depop

- Vestiaire Collective

- Mercari

- The RealReal

- eBay

- ASOS Marketplace

- Goodwill Industries International

- Buffalo Exchange

- Other Key Players