Global Wind Turbine Pitch System Market Size, Share Analysis Report By Type of Pitch Systems (Electric Pitch System, Hydraulic Pitch System), By Turbine Power (Upto 10 MW, 10 MW to 15 MW, Above 15 MW), By Location (Off-Shore, On-Shore) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143912

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

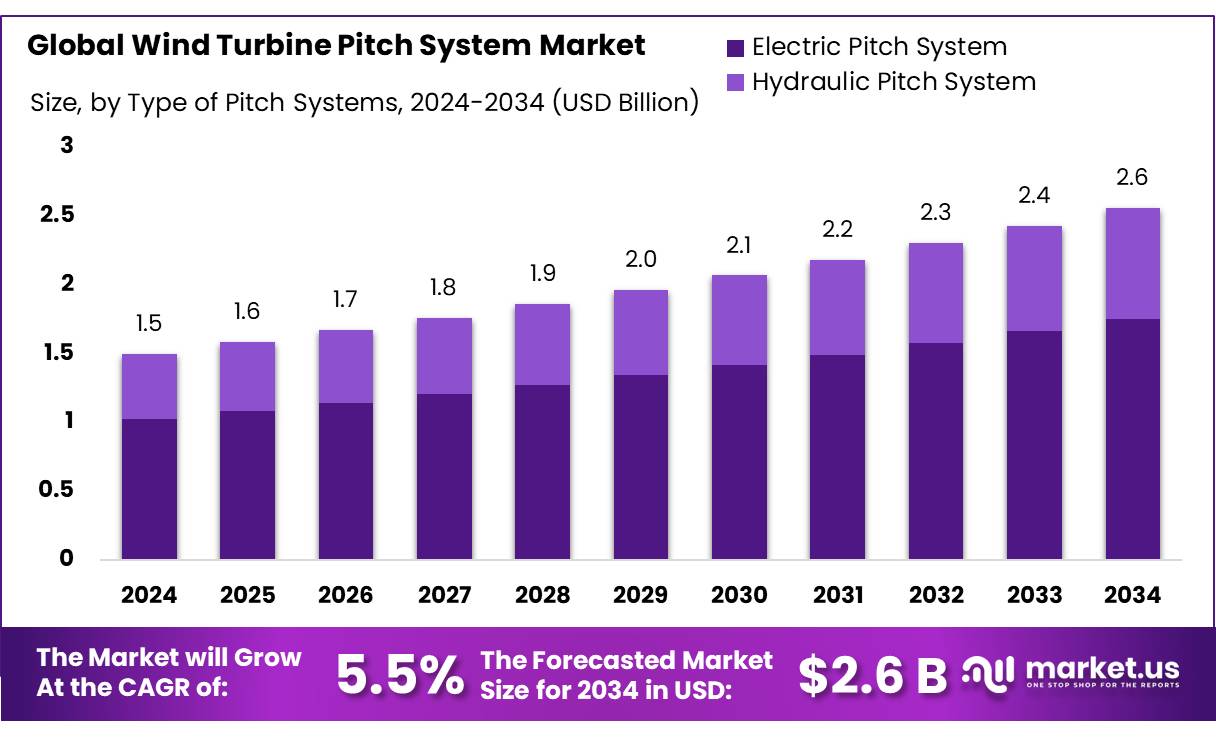

The Global Wind Turbine Pitch System Market size is expected to be worth around USD 2.6 Bn by 2034, from USD 1.5 Bn in 2024, growing at a CAGR of 5.5% from 2025 to 2034.

The wind turbine pitch system is a critical component of modern wind energy technology, responsible for adjusting the angle of the blades to optimize aerodynamic efficiency, regulate rotor speed, and protect the turbine during extreme conditions. The pitch control mechanism, whether hydraulic or electric, significantly influences the power output, reliability, and lifespan of wind turbines. As global energy demand accelerates toward renewable sources, wind power stands out, accounting for 9.1% of global electricity generation in 2023, as per the International Energy Agency (IEA).

The wind turbine pitch systems is characterized by rapid technological advancements and growing installations of onshore and offshore wind projects. According to the Global Wind Energy Council (GWEC), global wind power capacity reached 1,000 GW by the end of 2023, with an estimated addition of 110 GW during the year. This expansion directly correlates with an increasing demand for pitch systems, which are integral to both new turbines and retrofitting projects.

Driving factors behind this market include aggressive decarbonization targets, escalating demand for clean power, and robust government initiatives. The European Union, under its Green Deal, aims for 510 GW of wind energy capacity by 2030, up from 204 GW in 2022.

Similarly, the U.S. Department of Energy has launched initiatives like the Wind Energy Technologies Office (WETO), investing over $50 million in 2023 to advance turbine technologies, including pitch systems. India’s MNRE (Ministry of New and Renewable Energy) also targets 140 GW of wind energy by 2030, further supporting the pitch system industry.

Future growth opportunities lie in the offshore wind segment, projected to contribute 25% of new wind installations by 2030. Nations like the UK, Japan, and South Korea are ramping up offshore developments, with the UK aiming for 50 GW of offshore wind by 2030. Moreover, repowering aging wind farms across Europe and North America offers lucrative retrofit opportunities for pitch system manufacturers.

The wind turbine pitch system market is poised for robust expansion, driven by global renewable targets, supportive government policies, and advancements in smart technologies. As wind power scales from 1,000 GW in 2023 to a projected 2,000 GW by 2030, the demand for high-performance pitch systems will remain central to industry evolution.

Key Takeaways

- Wind Turbine Pitch System Market size is expected to be worth around USD 2.6 Bn by 2034, from USD 1.5 Bn in 2024, growing at a CAGR of 5.5%.

- Electric Pitch System segment held a dominant position in the wind turbine pitch system market, capturing more than a 68.40% share.

- Up to 10 MW held a commanding position in the wind turbine pitch system market, capturing more than a 58.20% share.

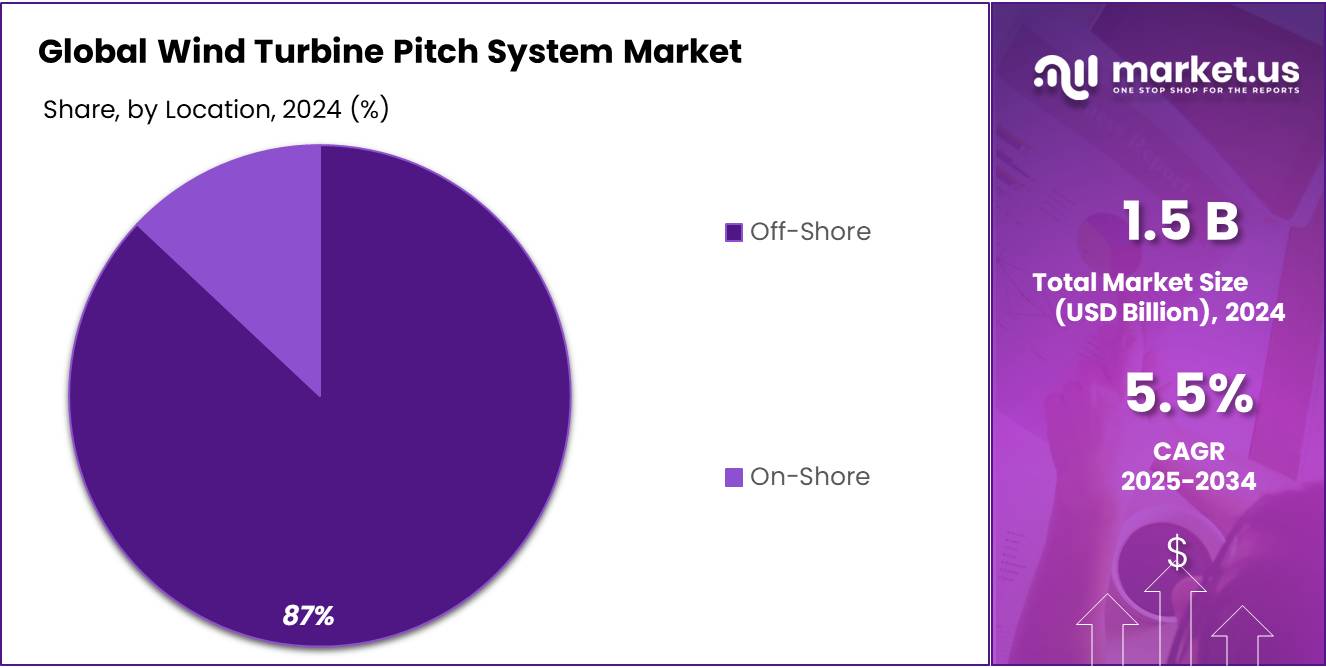

- Onshore segment of the wind turbine pitch system market held a dominant market position, capturing more than 87.40% share.

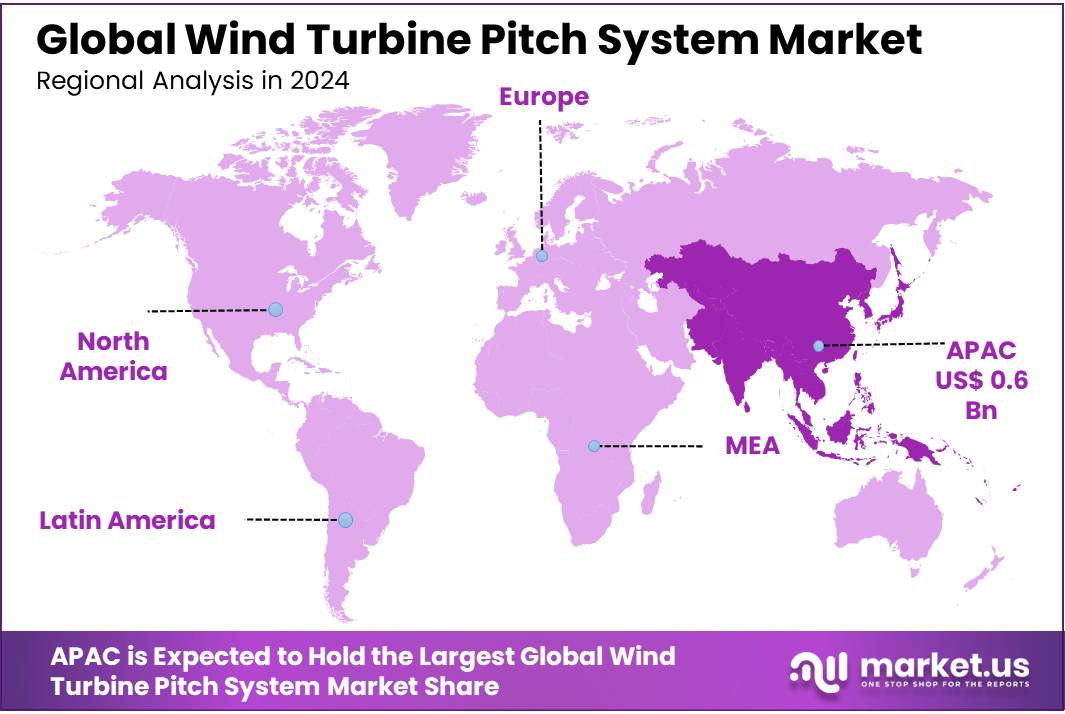

- Asia-Pacific (APAC) region emerged as a powerhouse in the wind turbine pitch system market, commanding a substantial 40.20% market share, translating to a market value of approximately USD 0.6 billion.

Analysts’ Viewpoint

From an investment perspective, the wind turbine pitch system market presents significant opportunities alongside distinct challenges. The sector is poised for robust growth, especially in offshore installations where the demand for sophisticated, reliable pitch systems is escalating due to the challenges posed by harsh marine environments.

The market for pitch systems is expected to see substantial growth, driven by global efforts to increase renewable energy production, particularly in regions like Europe and Asia-Pacific. These areas are leading in offshore wind farm developments, supported by favorable government incentives and substantial investment in technology

Consumers and regulatory bodies are increasingly favoring green technologies, which drives the demand for advanced wind turbine technologies. Modern pitch systems integrate sophisticated controls and remote diagnostic capabilities to enhance efficiency and reduce maintenance costs. Technological innovations in materials and design are also critical, ensuring systems can withstand extreme operational stresses

The regulatory environment is generally supportive, with initiatives like the European Union’s Green Deal and the U.S.’s extended tax credits for wind energy projects fostering a conducive investment climate. Emerging markets such as India and Brazil are also enhancing their regulatory frameworks to attract wind energy investments, setting ambitious renewable installation targets

By Type of Pitch Systems

Electric Pitch Systems Lead with 68.40% Due to Advanced Control and Efficiency

In 2024, the Electric Pitch System segment held a dominant position in the wind turbine pitch system market, capturing more than a 68.40% share. This prominence is attributed to the system’s advanced control mechanisms and efficiency in adjusting blade angles according to wind conditions.

Electric pitch systems are favored for their reliability and precision in maintaining optimal turbine speeds and maximizing energy output. This segment benefits significantly from ongoing technological advancements that enhance system performance and durability, making it a preferred choice for new wind energy installations.

By Turbine Power

Turbines Up to 10 MW Command 58.20% Market Share Due to Versatility and Broad Application

In 2024, the segment for wind turbines up to 10 MW held a commanding position in the wind turbine pitch system market, capturing more than a 58.20% share. This significant market share is primarily due to the versatility and broad application of these turbines in both onshore and offshore settings.

Turbines of this size are especially popular in medium-scale wind projects and in geographic areas where larger turbines might not be feasible due to logistical or regulatory constraints. Their dominance in the market is supported by a well-established infrastructure for installation and maintenance, alongside a strong track record of reliability and cost-effectiveness in energy production.

By Location

Onshore Turbines Lead with 87.40% Share, Favored for Easier Accessibility and Lower Costs

In 2024, the onshore segment of the wind turbine pitch system market held a dominant market position, capturing more than 87.40% share. This overwhelming preference for onshore installations stems from their easier accessibility and significantly lower installation and maintenance costs compared to offshore setups.

Onshore wind farms benefit from more straightforward logistics and the availability of existing infrastructure, which not only reduces initial investments but also simplifies ongoing operations. Their continued dominance in the market reflects broader industry trends favoring sustainable, cost-effective solutions in renewable energy generation.

Key Market Segments

By Type of Pitch Systems

- Electric Pitch System

- Hydraulic Pitch System

By Turbine Power

- Upto 10 MW

- 10 MW to 15 MW

- Above 15 MW

By Location

- Off-Shore

- On-Shore

Drivers

Government Incentives Propel Growth in Wind Turbine Installations

One of the major driving factors for the growth of the wind turbine pitch system market is the substantial support from government initiatives around the world. These initiatives often come in the form of financial incentives such as tax rebates, grants, and subsidies aimed at encouraging the adoption of renewable energy sources.

For example, in the United States, the government offers a Production Tax Credit (PTC) for wind energy, which provides operators with a tax credit for each kilowatt-hour of electricity generated for the first ten years of a wind turbine’s operation. This incentive significantly reduces the operational costs of wind farms and enhances their economic viability.

According to the U.S. Energy Information Administration, the PTC and its counterpart for investment, the Investment Tax Credit, have been pivotal in increasing the country’s installed wind power capacity, which stood at over 118 gigawatts by the end of 2021.

Similarly, in Europe, the European Union’s strategic agenda for the Green Deal aims to achieve carbon neutrality by 2050. This policy framework includes significant funding opportunities and regulatory support for wind energy projects. The European Commission reported that these incentives have helped double the rate of wind power installation compared to previous years, aiming to reach a wind power capacity of 300 GW by 2050.

These government policies not only support the financial aspects of wind energy projects but also reassure investors and stakeholders of the market’s stability and growth potential. By reducing financial risks and providing a clear long-term policy framework, governments are effectively lowering barriers to entry and accelerating the adoption of wind energy technologies, including advanced pitch systems essential for optimizing turbine performance.

Restraints

High Maintenance Costs Challenge Wind Turbine Pitch System Adoption

A significant restraining factor for the adoption of wind turbine pitch systems is the high maintenance costs associated with these technologies. Wind turbines, particularly those located in harsh or remote environments such as offshore or high-altitude sites, require regular maintenance to ensure optimal performance and longevity. The pitch systems, which adjust the angle of the blades to control the rotor speed and maximize efficiency, are particularly critical components that can be costly to maintain.

For instance, according to data from the U.S. Department of Energy, maintenance of wind turbine pitch systems can account for up to 20% of the total operational costs in wind farms. These expenses are driven by the need for regular inspections, replacement of mechanical parts, and specialized labor, all of which are more intensive for pitch systems than for more passive components of the turbine.

Additionally, the logistical challenges associated with servicing turbines, especially those offshore, add a significant premium to maintenance costs. Offshore wind farms are often located far from the coast and require specialized vessels and equipment for maintenance work. The increased complexity and cost of these operations can deter new investments and slow down the adoption of new technologies in the pitch system market.

These high maintenance demands can be particularly daunting for smaller operators or those in developing countries where the costs might outweigh the economic benefits of installing new wind energy capacity. While government initiatives and technological advancements aim to reduce these costs, the economic burden remains a significant hurdle, affecting the pace at which new wind energy projects are deployed and the technological upgrades that are essential for improving turbine efficiency and reducing overall lifecycle costs.

Opportunity

Emerging Markets Offer New Growth Avenues for Wind Turbine Pitch Systems

One of the most significant growth opportunities for the wind turbine pitch system market lies in the expansion into emerging markets. Countries in regions such as Southeast Asia, Africa, and Latin America are increasingly focusing on renewable energy projects to meet their growing energy needs while also addressing climate change concerns. This shift presents a substantial opportunity for the deployment of advanced wind turbine technologies, including sophisticated pitch systems that enhance turbine efficiency and reliability.

For example, according to the Global Wind Energy Council, Vietnam aims to increase its wind power capacity from 140 megawatts in 2020 to over 11 gigawatts by 2030. The Vietnamese government has introduced several incentives, such as feed-in tariffs and tax benefits, to attract investments in renewable energy. Similarly, the government of South Africa, under its Integrated Resource Plan, plans to significantly expand its wind energy production by adding approximately 14.4 gigawatts of wind power by 2030.

The market potential in these regions is enhanced by the fact that many emerging markets are located in areas with high wind speeds, making them ideal for wind power projects. Moreover, the local governments are increasingly supportive, providing various incentives to encourage the adoption of renewable energy technologies.

This expansion into new geographic areas not only helps companies in the wind energy sector to diversify their market presence but also contributes to global sustainability efforts. By tapping into new markets, manufacturers of wind turbine pitch systems can not only boost their sales and revenue but also play a pivotal role in the global transition towards more sustainable energy solutions. The combination of high wind resource potential, favorable government policies, and untapped market opportunities makes emerging markets an attractive prospect for stakeholders in the wind energy industry.

Trends

Digitalization and IoT Integration Propel Wind Turbine Pitch System Innovations

A significant trend reshaping the wind turbine pitch system market is the increasing integration of digital technologies and the Internet of Things (IoT). These advancements are revolutionizing how wind turbines operate and are maintained, leading to greater efficiencies and reduced downtime.

The modern wind turbine pitch systems are increasingly equipped with sensors and connected technologies that provide real-time data on their operational status. This data is crucial for predictive maintenance, which can foresee potential failures before they occur, thereby minimizing repair costs and extending the turbine’s lifespan. For example, sensors can detect unusual vibrations or temperatures that indicate wear and tear on pitch bearings or motors before they lead to system failures.

Moreover, IoT technology facilitates remote monitoring and control of pitch systems, allowing operators to adjust settings for optimal performance across various wind conditions without being physically present at the turbine site. This capability is particularly beneficial for turbines in remote or offshore locations, where access can be challenging and costly.

According to industry reports, the implementation of IoT in wind turbines can lead to a 10% reduction in operational costs. This saving is primarily due to improved operational efficiency and the avoidance of unplanned downtime. Additionally, digital platforms can analyze vast amounts of data collected from turbines across different locations to optimize the performance of entire wind farms.

Government initiatives also support this trend by funding research and development in renewable energy technologies. For instance, the European Union’s Horizon 2020 program has funded multiple projects focusing on enhancing wind turbine efficiency through advanced digital technologies.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region emerged as a powerhouse in the wind turbine pitch system market, commanding a substantial 40.20% market share, translating to a market value of approximately USD 0.6 billion. This dominance is attributed to several factors, including rapid industrialization, increasing investments in renewable energy, and supportive government policies across key nations such as China, India, and Japan.

China leads the region, not just as a consumer, but also as a major manufacturer of wind turbine components, including sophisticated pitch systems. The Chinese government’s commitment to reducing carbon emissions has resulted in aggressive expansion and incentives for wind power projects. For instance, China aims to achieve over 50% of its energy from renewable sources by 2030, with wind energy playing a significant role in this transition.

Similarly, India has seen substantial growth in its wind energy sector, supported by government initiatives like the National Wind-Solar Hybrid Policy, which aims to facilitate the integration of wind and solar power generation. Japan, too, contributes to regional growth with its focus on increasing renewable energy sources following the 2011 Fukushima nuclear disaster.

The strategic push towards renewable energy in these countries, coupled with technological advancements in turbine efficiency and government subsidies, has fueled the demand for advanced wind turbine pitch systems. These systems are crucial for optimizing wind energy production, particularly in variable wind conditions typical of the APAC region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Acciona Energía is a prominent player in the renewable energy sector, specializing in the development and management of wind and other renewable projects. In the wind turbine pitch system market, Acciona is recognized for integrating innovative technologies that enhance the efficiency and reliability of wind turbines. The company’s commitment to sustainable energy solutions drives its continuous improvement of pitch system designs, ensuring optimal performance in diverse operating environments.

Atech Antriebstechnik is known for its engineering excellence in the development of drive systems, including those used in wind turbines. The company focuses on delivering high-performance pitch systems that are tailored to meet specific operational requirements. Atech’s pitch systems are designed to withstand the rigors of various climatic conditions, enhancing the durability and efficiency of wind turbines, thus supporting higher energy output and longer lifecycle benefits.

General Electric (GE) is a global giant in energy infrastructure and technology. In the wind turbine pitch system market, GE leverages its extensive technological and industrial expertise to provide advanced pitch control systems that optimize wind turbine performance. GE’s systems are designed to enhance energy capture and reduce load on the turbine, thereby improving the longevity and efficiency of wind energy projects.

Goldwind is one of the world’s leading wind turbine manufacturers, originating from China. The company specializes in the production of highly efficient and reliable wind turbines, with a strong emphasis on its pitch control systems. Goldwind’s pitch systems utilize cutting-edge technology to maximize wind energy conversion and minimize operational costs, aligning with the company’s mission to promote sustainable and cost-effective wind energy solutions globally.

Top Key Players

- Acciona Energía

- Atech Antriebstechnik

- Enercon

- General Electric

- Goldwind

- Hydratech Industries

- KEBA

- Mingyang Smart Energy

- Emerson Electric Co.

- Moog Inc.

- Nidec Industrial Solutions

- Nordex SE

- OAT GmbH

- Parker Hannifin Corporation

- Senvion

- Siemens Gamesa Renewable Energy

- Suzlon Energy

- Vestas

- Windurance

Recent Developments

In 2024, Acciona Energía added approximately 2 gigawatts (GW) of new capacity, bringing its total installed capacity to 15.4 GW.

In 2024 General Electric (GE), the global wind turbine pitch systems market was valued at approximately $1.53 billion and is projected to reach $1.60 billion by 2025. Despite challenges in the offshore wind sector, GE’s commitment to innovation and efficiency positions it well to meet the growing demand for renewable energy solutions.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Bn Forecast Revenue (2034) USD 2.6 Bn CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Pitch Systems (Electric Pitch System, Hydraulic Pitch System), By Turbine Power (Upto 10 MW, 10 MW to 15 MW, Above 15 MW), By Location (Off-Shore, On-Shore) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Acciona Energía, Atech Antriebstechnik, Enercon, General Electric, Goldwind, Hydratech Industries, KEBA, Mingyang Smart Energy, Emerson Electric Co., Moog Inc., Nidec Industrial Solutions, Nordex SE, OAT GmbH, Parker Hannifin Corporation, Senvion, Siemens Gamesa Renewable Energy, Suzlon Energy, Vestas, Windurance Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wind Turbine Pitch System MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Wind Turbine Pitch System MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Acciona Energía

- Atech Antriebstechnik

- Enercon

- General Electric

- Goldwind

- Hydratech Industries

- KEBA

- Mingyang Smart Energy

- Emerson Electric Co.

- Moog Inc.

- Nidec Industrial Solutions

- Nordex SE

- OAT GmbH

- Parker Hannifin Corporation

- Senvion

- Siemens Gamesa Renewable Energy

- Suzlon Energy

- Vestas

- Windurance