Global Turbo Expander Market Size, Share, Statistics Analysis Report By Product Type (Axial Flow, Radial Flow), By Loading Device (Compressor, Generator, Hydraulic/Oil-brake), By Power Capacity (Upto 10 MW, 10 MW - 30 MW, 30 MW - 40 MW, Above 40 MW), By Application (Air Separation, Oil and Gas Processing, Cryogenic Application, Others), By End-use (Oil and Gas, Energy and Power, Chemical and Petrochemicals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143839

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

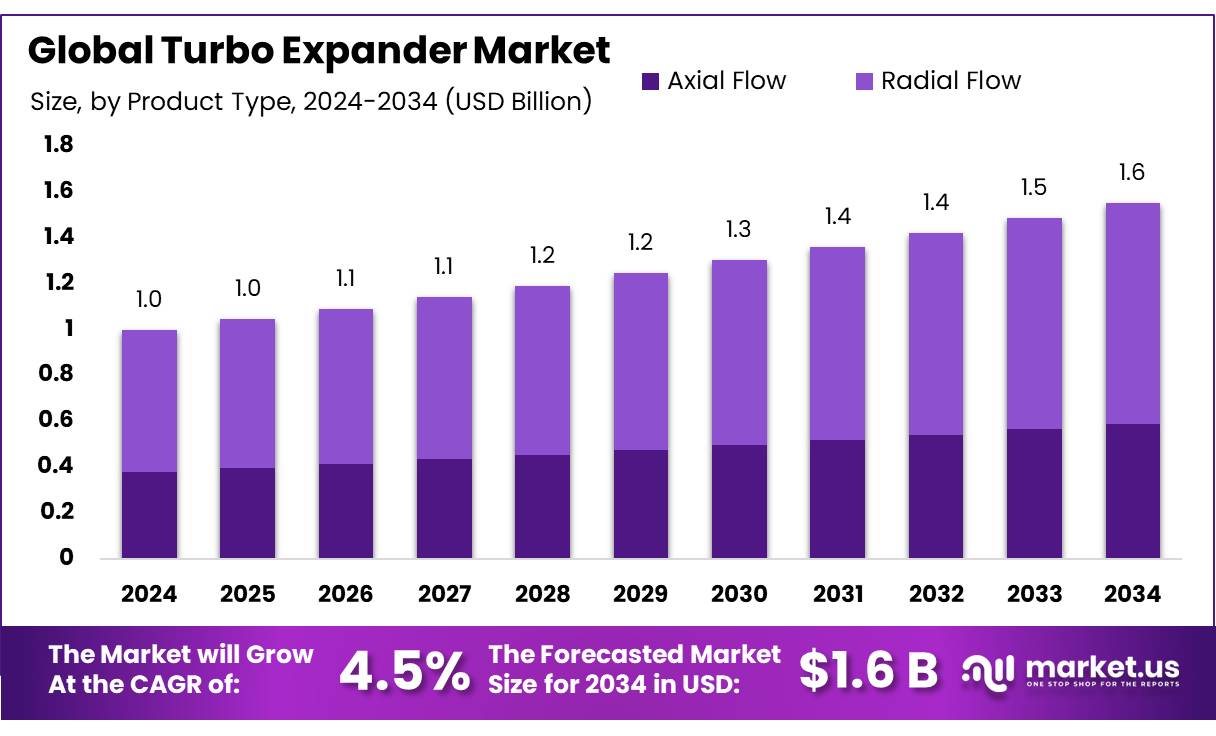

The Global Turbo Expander Market Market size is expected to be worth around USD 1.6 Bn by 2034, from USD 1.0 Bn in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

Turbo expanders, also known as expansion turbines, are critical components in a wide range of industrial processes that require energy-efficient gas expansion and cooling. They convert the energy of high-pressure gas into mechanical work, offering significant operational efficiencies across sectors such as oil and gas, petrochemicals, refrigeration, power generation, and increasingly in liquefied natural gas (LNG) and renewable energy systems. These machines are primarily used in cryogenic applications, pressure let-down systems, and to recover power from high-pressure gas streams, making them highly valuable in energy recovery and process optimization.

The turbo expanders has expanded significantly, driven by the rising demand for energy efficiency and natural gas liquefaction systems. According to the International Energy Agency (IEA), global natural gas demand rose by 1.6% in 2023, reaching approximately 4,070 billion cubic meters. This rise, particularly in Asia-Pacific and the Middle East, has fueled demand for LNG infrastructure where turbo expanders play a pivotal role in cryogenic cooling. Furthermore, the U.S. Energy Information Administration (EIA) reported that the U.S. alone exported 8.6 billion cubic feet per day of LNG in 2023, indicating strong growth prospects for cryogenic turbo expanders in North American facilities.

Government support for industrial decarbonization and energy recovery systems is accelerating turbo expander deployment. The U.S. Department of Energy’s (DOE) Advanced Manufacturing Office has allocated over $250 million in grants since 2022 for enhancing industrial energy efficiency technologies, including energy recovery from pressurized gases. Similarly, the European Commission’s “REPowerEU” plan aims to improve gas infrastructure efficiency and reduce fossil fuel dependency by 2030, promoting the use of turbo expanders in natural gas and hydrogen transport systems. This aligns with the EU’s goal of achieving a 55% reduction in greenhouse gas emissions by 2030, as per the European Climate Law.

Driving factors for turbo expander adoption include the need for reducing operational costs, pressure energy recovery, and enhancing process reliability in energy-intensive sectors. In food and beverage manufacturing, where refrigeration plays a central role, turbo expanders help improve cryogenic systems’ efficiency. Nestlé, for instance, reported that 63% of its factories globally implemented energy-saving projects in 2023, some involving advanced refrigeration processes using expansion turbines to enhance efficiency. Similarly, PepsiCo’s “Positive Agriculture” initiative involves significant investment in sustainable energy systems, indirectly increasing the adoption of efficient gas expansion technologies.

Key Takeaways

- Turbo Expander Market Market size is expected to be worth around USD 1.6 Bn by 2034, from USD 1.0 Bn in 2024, growing at a CAGR of 4.5%.

- Radial Flow turbo expanders solidified their position at the forefront of the market, accounting 62.30% of market share.

- Compressors emerged as the dominant loading device in the turbo expander market, securing a substantial 57.20% market share.

- 30 MW to 40 MW held a leading position in the market, accounting for more than 38.20% of the overall share.

- Air separation processes captured more than a 42.10% share of the market, establishing it as the dominant segment.

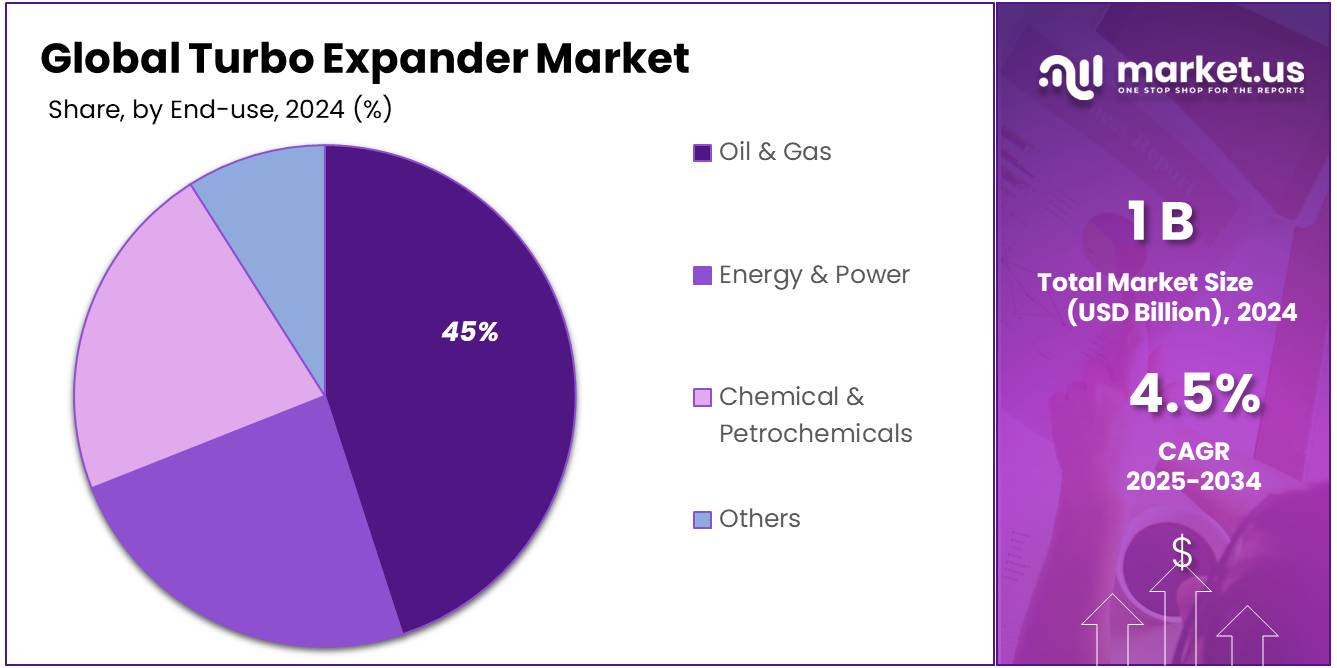

- Oil and gas sector maintained its leading position in the turbo expander market, commanding a 45.30% share.

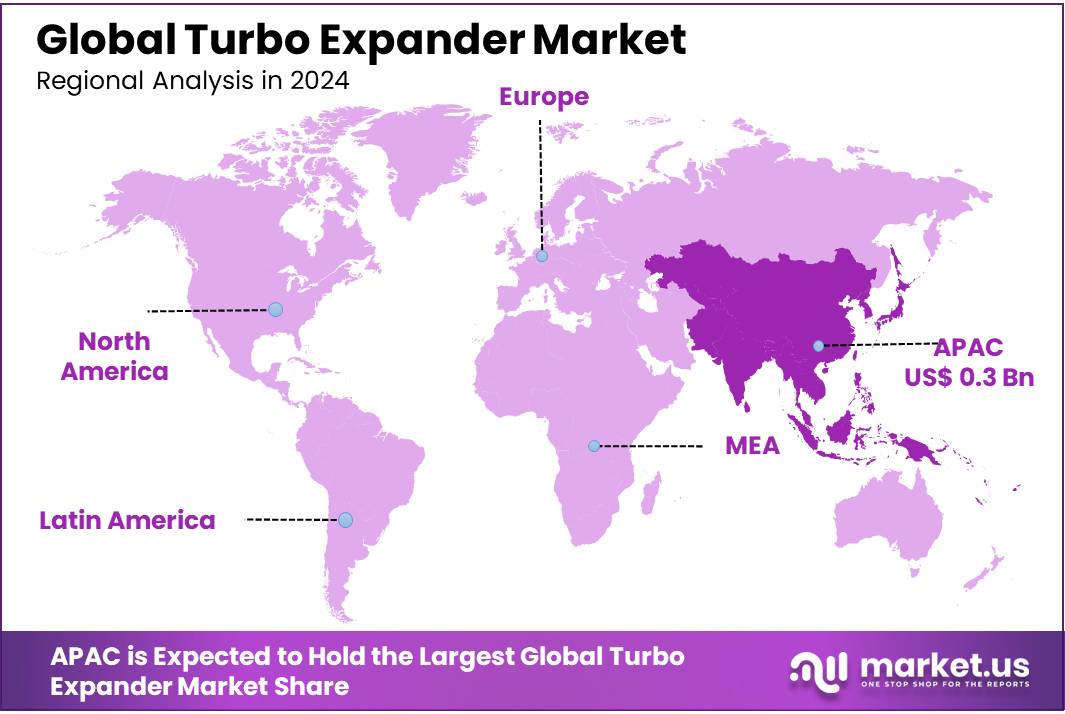

- Asia-Pacific (APAC) region has emerged as a dominant force, commanding a significant 37.20% market share, which translates to approximately $0.372 billion.

Analysts’ Viewpoint

From an investment perspective, the turbo expander market presents a mix of opportunities and risks, driven by the increasing global demand for natural gas and the shift toward cleaner energy sources. As of recent evaluations, the market is poised for growth with significant investment in natural gas production, particularly in regions like North America and Europe, which are aggressively pursuing energy sustainability goals. However, the high cost of turbo expander installations poses a notable risk, potentially limiting market expansion to only the most financially robust players.

In terms of consumer insights, there’s a clear preference for low power capacity turbo expanders, especially in applications like oil & gas processing and air separation plants. These systems are favored due to their shorter development cycles and lower operational costs, which include installation, commission, and maintenance. This trend is particularly strong in industries where efficiency and cost reduction are priorities.

Technologically, the market is experiencing robust growth due to advancements in energy efficiency. Turboexpanders are increasingly integrated into renewable energy projects, contributing to power generation by converting mechanical energy from high-pressure gas expansions into electrical energy. This process not only enhances energy efficiency but also supports the global shift towards reducing carbon emissions.

By Product Type

Radial Flow Turbo Expanders Lead with 62.3% Market Share Due to Superior Efficiency and Reliability

In 2024, Radial Flow turbo expanders solidified their position at the forefront of the market, accounting for over 62.30% of the total market share. This type of turbo expander is favored for its exceptional efficiency and reliability in converting kinetic energy from a high-pressure gas stream into mechanical energy.

As industries increasingly focus on energy optimization and cost reduction, radial flow models have gained prominence. These turbo expanders are particularly prevalent in applications requiring high power output and are integral in processes such as natural gas liquefaction and petrochemical refining. The robust market dominance of Radial Flow turbo expanders in 2024 underscores their critical role in energy recovery systems across various industrial sectors.

By Loading Device

Compressors Command a 57.2% Share in Turbo Expander Market for Enhanced Energy Efficiency

In 2024, compressors emerged as the dominant loading device in the turbo expander market, securing a substantial 57.20% market share. This prominence is largely due to their critical role in enhancing energy efficiency within various gas processing and refrigeration cycles. Compressors are favored for their ability to recover and recycle energy that would otherwise be lost in industrial operations, making them a key component in energy-intensive sectors like oil and gas, and chemical processing.

Their widespread adoption is driven by their proven effectiveness in reducing operational costs and improving system efficiencies, qualities that are highly valued as industries continually seek ways to optimize performance and sustainability.

By Power Capacity

30 MW – 40 MW Turbo Expanders Dominate with 38.2% Share for Optimal Power and Efficiency

In 2024, turbo expanders with a power capacity ranging from 30 MW to 40 MW held a leading position in the market, accounting for more than 38.20% of the overall share. This segment’s dominance is attributed to the optimal balance these units provide between power output and efficiency, making them ideal for medium-scale industrial applications.

They are particularly valued in sectors such as power generation and oil & gas, where the need for reliable and efficient energy recovery systems is critical. The preference for 30 MW – 40 MW turbo expanders underscores their versatility and ability to meet diverse industrial requirements while maximizing energy efficiency and reducing greenhouse gas emissions.

By Application

Air Separation Leads Turbo Expander Applications with a 42.1% Market Share for Efficient Gas Processing

In 2024, the application of turbo expanders in air separation processes captured more than a 42.10% share of the market, establishing it as the dominant segment. This substantial market share is a testament to the crucial role turbo expanders play in the efficient processing of gases in industries requiring pure oxygen, nitrogen, and argon.

The high adoption rate of turbo expanders in air separation units (ASUs) is driven by their ability to leverage cold energy from expanded gases, significantly improving the energy efficiency of the separation process. As industries such as healthcare, metal fabrication, and chemical manufacturing increasingly demand high-purity gases, the reliance on turbo expanders in air separation applications continues to grow, reflecting their indispensable value in enhancing operational efficiency and reducing energy costs.

By End-use

Oil & Gas Sector Leads Turbo Expander Usage with 45.3% Share for Enhanced Energy Recovery

In 2024, the oil and gas sector maintained its leading position in the turbo expander market, commanding a 45.30% share. This dominance is primarily due to the critical role that turbo expanders play in energy recovery processes within the industry. Utilized extensively in natural gas liquefaction and gas processing applications, turbo expanders are instrumental for their high efficiency in converting thermal energy into mechanical energy, which is then often converted to electrical power.

The significant reliance on these devices in the oil and gas industry is driven by their ability to enhance the overall efficiency of operations and reduce environmental impact by maximizing the use of available energy resources. As global energy demands and efficiency standards continue to rise, the oil and gas industry’s commitment to turbo expanders underscores their essential role in meeting these evolving requirements.

Key Market Segments

By Product Type

- Axial Flow

- Radial Flow

By Loading Device

- Compressor

- Generator

- Hydraulic/Oil-brake

By Power Capacity

- Upto 10 MW

- 10 MW – 30 MW

- 30 MW – 40 MW

- Above 40 MW

By Application

- Air Separation

- Oil & Gas Processing

- Cryogenic Application

- Others

By End-use

- Oil & Gas

- Energy & Power

- Chemical & Petrochemicals

- Others

Drivers

Increasing Demand for Energy Efficiency Drives Turbo Expander Market Growth

One of the primary driving factors for the growth of the turbo expander market is the increasing demand for energy efficiency across various industries, especially in sectors like oil and gas, and power generation. Governments worldwide are implementing stricter regulations and initiatives to promote energy conservation, which in turn is boosting the adoption of energy-efficient technologies such as turbo expanders.

For instance, the U.S. Department of Energy (DOE) has been actively promoting the use of advanced technology to enhance energy efficiency in industrial processes. According to the DOE, utilizing energy-efficient technologies in industries can lead to significant reductions in energy consumption. In particular, the industrial sector, which accounts for approximately 32% of total U.S. energy usage, is a major area of focus for these initiatives. The DOE’s Advanced Manufacturing Office (AMO) supports research and development of energy-efficient technologies, including those involving the expansion and compression of gases.

Turbo expanders play a crucial role in this context by allowing for the recovery of energy that would otherwise be wasted in processes such as natural gas processing and cryogenic applications. They convert excess pressure and thermal energy into mechanical energy, which can then be used to generate electricity or drive other machinery, thereby significantly reducing the energy footprint of industrial operations.

In addition to government initiatives, industry leaders in the food sector are also adopting these technologies to improve sustainability and reduce operational costs. For example, large food processing companies are integrating turbo expanders in their refrigeration systems to reclaim energy from the cooling process, enhancing overall plant efficiency and contributing to their sustainability goals.

This growing emphasis on energy efficiency, backed by supportive government policies and industrial adoption, underscores the expanding role of turbo expanders in global efforts to enhance energy utilization and minimize environmental impacts.

Restraints

High Initial Investment and Maintenance Costs Hinder Turbo Expander Adoption

A significant restraining factor for the turbo expander market is the high initial investment and maintenance costs associated with these systems. Turbo expanders, while beneficial for energy recovery and efficiency, require a substantial upfront investment, which can be a barrier for many industries, including small to medium-sized enterprises in the food sector.

According to a report by the Food and Agriculture Organization (FAO), the food processing industry is under constant pressure to reduce costs and increase profitability while maintaining product quality and complying with environmental regulations. The high cost of installing advanced energy recovery systems like turbo expanders can deter these companies from adopting such technologies. The report highlights that for small and medium enterprises (SMEs), which form a significant portion of the global food industry, the return on investment (ROI) period for expensive energy-efficient technologies can be prohibitively long, affecting their financial stability.

Furthermore, the maintenance of turbo expanders involves specialized knowledge and parts, which can add to the operational costs over time. Regular maintenance is crucial to ensure optimal performance and prevent breakdowns, but the associated costs and the need for skilled personnel can further complicate their widespread adoption.

Government initiatives aimed at supporting energy efficiency are available, yet the assistance provided often falls short of covering the significant initial outlay required for turbo expander systems. For instance, energy grants and subsidies might offset some of the costs, but many businesses find the application process cumbersome or the funding insufficient.

Opportunity

Renewable Energy Integration Offers Major Growth Opportunities for Turbo Expanders

The integration of turbo expanders with renewable energy projects presents a significant growth opportunity for the industry. As the global shift towards sustainable energy sources accelerates, the ability of turbo expanders to enhance energy efficiency in renewable energy systems, particularly in geothermal and biomethane production, is increasingly recognized.

In geothermal energy production, for instance, turbo expanders can be utilized to convert thermal energy from steam into mechanical energy more efficiently. According to the International Renewable Energy Agency (IRENA), geothermal energy capacity is expected to grow substantially by 2030. Turbo expanders are pivotal in optimizing the energy efficiency of these operations by harnessing the high-pressure steam produced during geothermal activities.

Similarly, in the biomethane sector, which is an emerging field within the renewable energy landscape, turbo expanders play a crucial role in the upgrading process where biogas is converted into biomethane. This biomethane can then be injected into natural gas grids or used as vehicle fuel. The European Biogas Association reports a steady increase in biomethane production facilities across Europe, indicating a growing market for technologies that can enhance the efficiency and profitability of these operations.

Government policies and incentives are also bolstering this growth. Many countries offer financial incentives for renewable energy projects that incorporate technologies reducing carbon footprints and improving energy efficiency. Turbo expanders, with their ability to recover waste heat and convert it into usable energy, align well with these policies, making them an attractive option for project developers.

Trends

Digitalization and IoT Integration in Turbo Expanders Shape Future Trends

One of the latest trends in the turbo expander market is the integration of digital technologies and the Internet of Things (IoT). This technological advancement is revolutionizing how turbo expanders are monitored, maintained, and optimized, significantly enhancing their efficiency and reliability. Digital tools and IoT-enabled devices allow for real-time data collection and analysis, leading to predictive maintenance and operational efficiencies that were not possible before.

In the food industry, where maintaining product quality and operational efficiency is crucial, the application of IoT in turbo expanders can lead to substantial energy savings and reduced downtime. For example, a leading food processing company reported a 20% reduction in energy costs by implementing IoT solutions to optimize their refrigeration systems, which included turbo expanders. These systems now smartly adjust operations based on real-time data, improving overall energy management and reducing wastage.

Government initiatives further support this trend. Several countries have introduced policies encouraging the adoption of smart manufacturing technologies. For instance, the U.S. Department of Energy has launched programs aimed at fostering innovation in energy-efficient manufacturing technologies, including the use of IoT for industrial equipment like turbo expanders.

Moreover, the trend is gaining momentum due to the increasing focus on sustainability and carbon footprint reduction. Industries are under pressure to adopt greener technologies and improve their energy efficiency, and digitalization of turbo expanders offers a viable solution. By integrating advanced sensors and analytics, companies can not only enhance their energy usage but also contribute to global environmental goals.

This convergence of digitalization and industrial equipment heralds a new era for turbo expanders, promising significant improvements in performance and a reduction in environmental impact, aligning perfectly with global trends towards smarter, more sustainable industrial operations.

Regional Analysis

In the turbo expander market, the Asia-Pacific (APAC) region has emerged as a dominant force, commanding a significant 37.20% market share, which translates to approximately $0.372 billion in value. This substantial market presence is driven by the region’s rapid industrialization and increasing focus on energy efficiency. Countries like China, Japan, India, and South Korea are leading the charge, with expansive investments in infrastructure development that necessitate advanced energy solutions, including turbo expanders.

The demand in APAC is particularly strong in sectors such as oil & gas, petrochemicals, and power generation, where turbo expanders are utilized for their ability to recover waste heat and improve overall energy conservation. These applications are crucial in supporting the region’s growing energy needs while addressing environmental concerns associated with industrial expansion.

Moreover, the region’s commitment to adopting renewable energy sources has further propelled the turbo expander market. Governments across APAC have set ambitious targets for reducing carbon emissions and are actively promoting the use of energy-efficient technologies. Initiatives and incentives to enhance industrial energy efficiency are also in place, providing a conducive environment for the growth of the turbo expander market.

China, as the largest energy consumer in the region, plays a pivotal role in the market dynamics. Its focus on reducing reliance on coal and increasing investment in cleaner energy sources has made it a hotspot for turbo expander technology. Additionally, Japan and South Korea’s advanced manufacturing sectors offer sophisticated applications for turbo expanders, especially in air separation and cryogenic processes, further underlining the region’s technological prowess and market potential.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Atlas Copco AB stands as a leading figure in the turbo expander market, renowned for its engineering excellence and innovation. The company offers a range of energy-efficient turbo expanders that are integral in various industrial applications, including oil and gas and air separation processes. With a strong focus on sustainability and energy recovery, Atlas Copco continues to expand its market reach and technological capabilities, aiming to meet the growing global demand for efficient energy solutions.

Air Products Inc., through its ROTOFLOW line, specializes in providing high-quality turbo expanders that cater to the needs of the air separation and hydrocarbon processing industries. Their products are celebrated for their reliability and cutting-edge design, which optimize operational efficiency and minimize downtime. Air Products’ commitment to innovation and customer-centric solutions makes it a pivotal player in the turbo expander market.

Air Liquide is a global leader in gases, technologies, and services for the industry and health sectors, and their turbo expanders are critical in applications requiring high purity gases. Known for their robust performance and durability, Air Liquide’s turbo expanders help in enhancing productivity and reducing energy costs in various sectors, supporting the company’s commitment to offering sustainable and innovative solutions.

Top Key Players

- Atlas Copco AB

- Air Products Inc. (ROTOFLOW)

- Air Liquide

- Baker Hughes Company

- Chart Industries

- Linde Plc

- R&D Dynamics Corporation

- Elliott Group

- Siemens Energy

- Man Energy

- PBS Group, a. s.

- Turbogaz

- Sapphire Technologies Inc

- Suzhou Xida

- Hangzhou Hangyang

Recent Developments

In 2024, Atlas Copco supported over 300 installed turbo expander units globally, helping industrial clients improve energy efficiency and reduce operational costs.

In 2024, Air Products Inc., through its ROTOFLOW division, remained a major player in the turbo expander market, focusing on precision-engineered solutions for energy-intensive industries. The company supported over 1,100 turboexpander units installed globally, serving applications in LNG, industrial gases, and hydrocarbon processing.

Report Scope

Report Features Description Market Value (2024) USD 1.0 Bn Forecast Revenue (2034) USD 1.6 Bn CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Axial Flow, Radial Flow), By Loading Device (Compressor, Generator, Hydraulic/Oil-brake), By Power Capacity (Upto 10 MW, 10 MW – 30 MW, 30 MW – 40 MW, Above 40 MW), By Application (Air Separation, Oil and Gas Processing, Cryogenic Application, Others), By End-use (Oil and Gas, Energy and Power, Chemical and Petrochemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Atlas Copco AB, Air Products Inc. (ROTOFLOW), Air Liquide, Baker Hughes Company, Chart Industries, Linde Plc, R&D Dynamics Corporation, Elliott Group, Siemens Energy, Man Energy, PBS Group, a. s., Turbogaz, Sapphire Technologies Inc, Suzhou Xida, Hangzhou Hangyang Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Atlas Copco AB

- Air Products Inc. (ROTOFLOW)

- Air Liquide

- Baker Hughes Company

- Chart Industries

- Linde Plc

- R&D Dynamics Corporation

- Elliott Group

- Siemens Energy

- Man Energy

- PBS Group, a. s.

- Turbogaz

- Sapphire Technologies Inc

- Suzhou Xida

- Hangzhou Hangyang