Global Bioliquid Heat and Power Generation Market Size, Share, And Business Benefits By Type (Bioethanol, Biodiesel), By Application (Heat Production, Electricity Generation, Combined heat and power), By End-use (Industrial, Residential, Commercial, Transportation), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143562

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

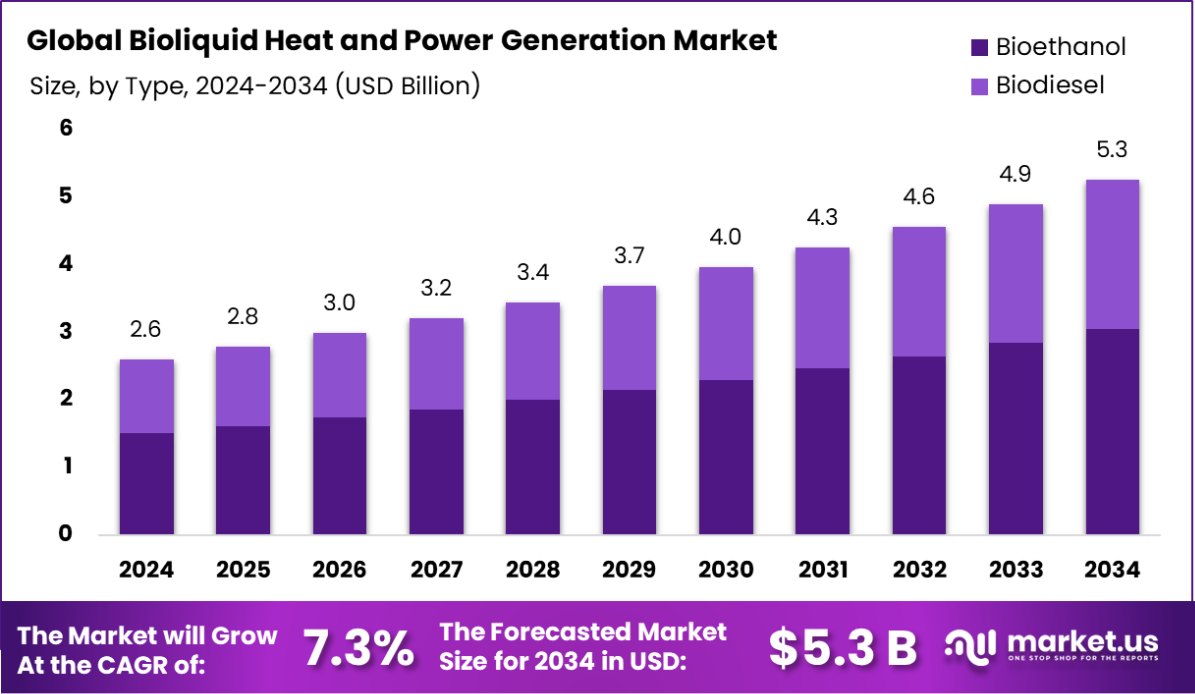

Global Bioliquid Heat and Power Generation Market is expected to be worth around USD 5.3 billion by 2034, up from USD 2.6 billion in 2024, and grow at a CAGR of 7.3% from 2025 to 2034.

Bioliquid heat and power generation refers to the use of liquid biofuels, such as biodiesel and bioethanol, to produce electricity and thermal energy. These bioliquids are derived from organic sources, including vegetable oils, animal fats, and waste cooking oils, offering a renewable alternative to fossil fuels.

The technology is commonly used in combined heat and power (CHP) plants, ensuring efficient energy utilization with reduced carbon emissions. Unlike solid biomass, bioliquids provide greater flexibility, as they can be easily transported and stored, making them suitable for decentralized energy systems.

The growing emphasis on reducing carbon footprints and achieving net-zero emissions is driving the adoption of bioliquid-based energy solutions. Government policies promoting renewable energy and carbon neutrality are supporting infrastructure development and investment in biofuel technologies. Additionally, advancements in refining processes have improved the efficiency and sustainability of bioliquids, making them a viable alternative to traditional fuels.

Rising energy security concerns and volatility in fossil fuel markets are increasing demand for renewable energy sources like bioliquids. Their ability to integrate with existing power plants and heating systems without extensive modifications makes them a cost-effective choice for industrial and residential applications. The need for stable and cleaner energy solutions is further strengthening market adoption.

The Bioliquid Heat and Power Generation Market is gaining momentum with policy-driven investments. The USDA’s $180 million REAP and HBIIP funding boosts biofuels, while India’s Rs 2500 crore investment targets 5% biodiesel blending by 2030, strengthening global adoption.

Key Takeaways

- Global Bioliquid Heat and Power Generation Market is expected to be worth around USD 5.3 billion by 2034, up from USD 2.6 billion in 2024, and grow at a CAGR of 7.3% from 2025 to 2034.

- Bioethanol dominates with 58.20%, offering a cleaner alternative for bioliquid heat and power generation worldwide.

- Electricity generation holds 48.40%, reflecting increased demand for bioliquid-powered grids supporting the energy transition.

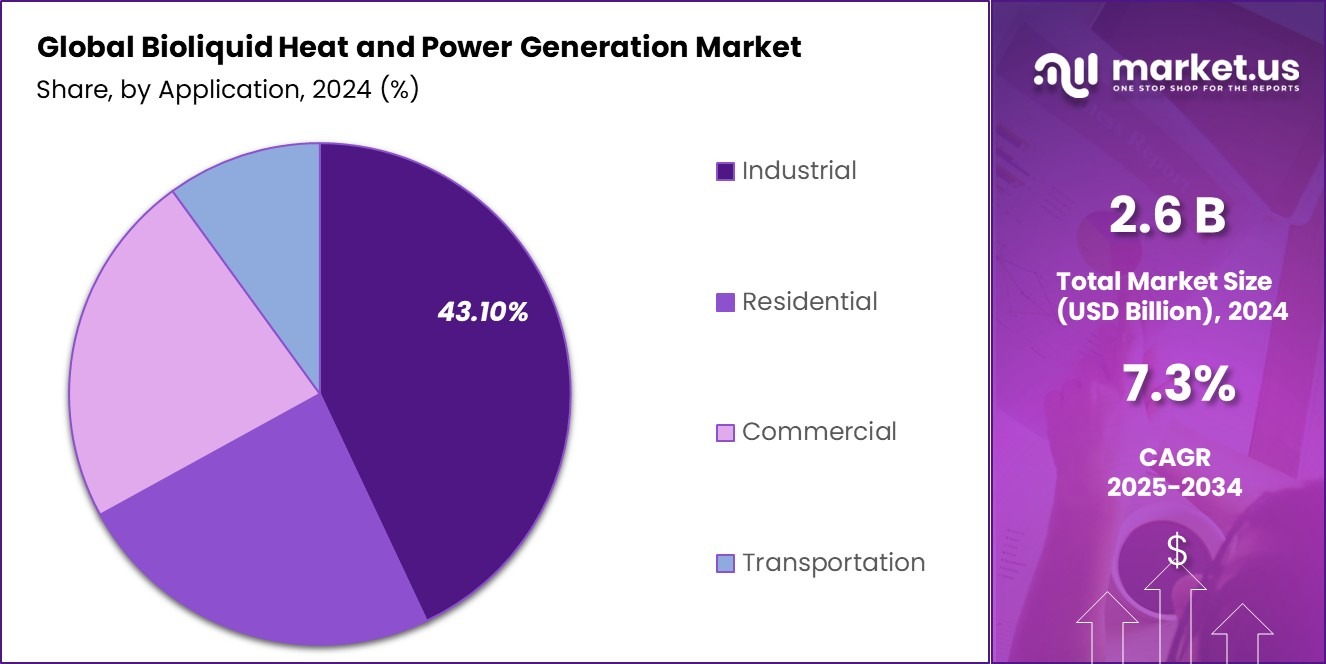

- The industrial sector leads with 43.10%, leveraging bioliquid energy for sustainable manufacturing processes and operations.

By Type Analysis

Bioethanol dominates the bioliquid heat and power generation market with a 58.20% share.

In 2024, Bioethanol held a dominant market position in the By Type segment of the Bioliquid Heat and Power Generation Market, with a 58.20% share. Its widespread adoption is driven by its high energy efficiency, lower emissions, and compatibility with existing power infrastructure.

Bioethanol’s ability to blend seamlessly with conventional fuels has made it a preferred choice for electricity and heat generation, particularly in regions with stringent carbon reduction targets. Additionally, advancements in second-generation bioethanol production, derived from non-food feedstocks, have further strengthened its market position.

Biodiesel accounted for the remaining market share, benefiting from its ease of use in modified diesel generators and heating systems. With its higher energy density compared to bioethanol, biodiesel continues to be a strong alternative, particularly in industrial and district heating applications. However, challenges related to feedstock availability and refining costs have limited its overall growth rate.

Looking ahead, bioethanol’s market dominance is expected to continue as regulatory frameworks favor low-carbon fuels and investments in biofuel infrastructure increase. Additionally, technological advancements aimed at improving bioethanol’s efficiency and cost-effectiveness are likely to reinforce its competitive edge in the bioliquid heat and power generation sector.

By Application Analysis

Electricity generation leads to bioliquid heat and power applications, holding a 48.40% share.

In 2024, Electricity Generation held a dominant market position in the By Application segment of the Bioliquid Heat and Power Generation Market, with a 48.40% share. The increasing need for reliable and sustainable power sources has driven the adoption of bioliquids in power generation, particularly in regions focusing on reducing fossil fuel dependency.

Bioliquids offer a flexible and cleaner alternative, integrating efficiently with existing power plants and combined heat and power (CHP) systems. Government incentives and policies supporting renewable electricity generation further strengthen the segment’s growth.

Heat Generation followed closely, benefiting from rising demand in industrial and residential heating applications. Bioliquids are increasingly replacing conventional heating fuels due to their lower carbon emissions and compatibility with existing heating infrastructure. The expansion of district heating networks and the push for greener energy solutions in commercial and municipal sectors are key factors supporting this segment’s growth.

As the transition toward renewable energy sources accelerates, electricity generation using bioliquids is expected to maintain its leading position. Continued advancements in bioliquid fuel processing, along with regulatory support, will likely enhance its efficiency and adoption rate, reinforcing its role in sustainable power production over the coming years.

By End-use Analysis

Industrial applications hold a 43.10% share in bioliquid heat and power generation.

In 2024, Industrial held a dominant market position in the By End-use segment of the Bioliquid Heat and Power Generation Market, with a 43.10% share. The industrial sector’s high energy consumption, coupled with increasing regulatory pressure to reduce carbon emissions, has driven the adoption of bioliquid-based power and heating solutions.

Industries such as manufacturing, chemicals, and food processing are leveraging bioliquids to meet sustainability targets while ensuring a stable energy supply. Additionally, the ability of bioliquids to integrate with existing industrial boilers and cogeneration systems without significant infrastructure modifications has further supported their widespread use.

Commercial and Residential sectors also contributed to the market, with bioliquids being increasingly used in district heating systems, commercial buildings, and households looking for sustainable energy alternatives. Rising energy costs and government incentives promoting renewable heating solutions have boosted bioliquid adoption in these sectors.

With stricter emission regulations and increasing investments in low-carbon energy solutions, the industrial sector is expected to maintain its dominance. Continued advancements in feedstock processing and improved efficiency in bioliquid energy conversion will further reinforce its position in the market.

Key Market Segments

By Type

- Bioethanol

- Biodiesel

By Application

- Heat Production

- Electricity Generation

- Combined heat and power

By End-use

- Industrial

- Residential

- Commercial

- Transportation

Driving Factors

Government Policies Accelerating Renewable Energy Adoption

Government policies play a crucial role in driving the Bioliquid Heat and Power Generation Market. Many countries have set ambitious renewable energy targets to reduce carbon emissions and achieve sustainability goals. Financial incentives, including tax credits, subsidies, and feed-in tariffs, encourage industries and power producers to adopt bioliquid-based energy solutions.

Regulations limiting fossil fuel usage and promoting cleaner alternatives further support market expansion. Additionally, blending mandates for biofuels in energy production create a stable demand for bioliquids. Policies favoring circular economy practices, such as waste oil recycling for bioliquid production, also contribute to growth.

As governments continue to tighten environmental laws, the bioliquid heat and power sector is expected to see increased investment, technological advancements, and broader adoption across various industries.

Restraining Factors

High Production Costs Limiting Market Expansion

One of the biggest challenges in the Bioliquid Heat and Power Generation Market is the high production cost of bioliquids. The process of converting raw materials, such as vegetable oils and animal fats, into usable bioliquids requires advanced refining technologies, which can be expensive.

Additionally, securing a steady supply of sustainable feedstock at competitive prices remains a concern. Compared to traditional fossil fuels, bioliquids often face cost disadvantages, making adoption slower, especially in price-sensitive industries.

Infrastructure upgrades needed to integrate bioliquids into existing energy systems further add to expenses. Unless technological advancements or government incentives help bring costs down, the market may struggle to compete with cheaper renewable energy sources, slowing its overall growth in the coming years.

Growth Opportunity

Advancements in Feedstock Diversification Enhancing Growth

A key growth opportunity in the Bioliquid Heat and Power Generation Market lies in feedstock diversification. Traditionally, bioliquids rely on vegetable oils and animal fats, but expanding to non-food sources, such as algae-based oils, agricultural residues, and waste cooking oils, can boost production while lowering costs.

Research into second-generation biofuels is making it possible to use a wider range of raw materials, reducing dependency on conventional feedstocks. This not only improves sustainability but also ensures a more stable supply chain for energy producers.

Investments in advanced refining technologies are further making bioliquids more efficient and cost-effective. As innovations continue, new feedstock sources will open doors for scalability and broader adoption, strengthening the market’s long-term growth potential.

Latest Trends

Integration of Bioliquids in Hybrid Energy Systems

A key trend shaping the Bioliquid Heat and Power Generation Market is the integration of bioliquids in hybrid energy systems. Many power plants and industries are now combining bioliquids with other renewable sources, such as solar, wind, and hydrogen, to create more efficient and reliable energy solutions.

This hybrid approach helps balance energy supply fluctuations, making the overall system more stable and cost-effective. Additionally, combined heat and power (CHP) systems using bioliquids are gaining popularity due to their high efficiency and lower emissions.

As industries focus on energy diversification and sustainability, hybrid energy models will continue to evolve, offering greater flexibility and resilience, while driving wider adoption of bioliquid-based power and heating solutions in the global market.

Regional Analysis

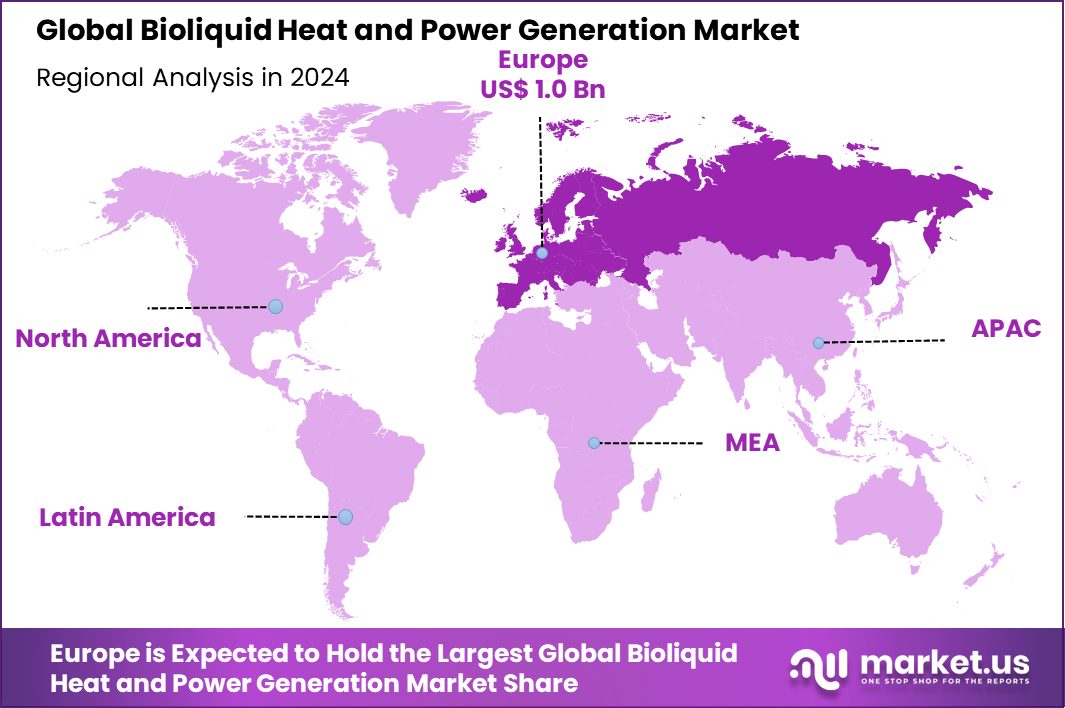

In 2024, Europe dominated the Bioliquid Heat and Power Generation Market, holding a 38.90% share, valued at USD 1.0 billion. The region’s strong position is driven by stringent environmental policies, carbon reduction goals, and government incentives promoting renewable energy. Countries like Germany, the UK, and Sweden are leading in bioliquid adoption, supported by favorable regulations and established infrastructure for biofuel-based power generation.

North America follows closely, with increasing investments in bioenergy projects, particularly in the United States and Canada. The growing emphasis on reducing fossil fuel reliance and expanding renewable power capacities is fueling market demand. Asia Pacific is witnessing rapid growth due to rising energy needs and supportive policies in countries like China, India, and Japan, promoting biofuel-based power solutions.

The Middle East & Africa market remains in its early stages, with potential expansion driven by industrialization and efforts to diversify energy sources. Latin America is showing steady progress, particularly in Brazil, where bioethanol production is well-established, supporting bioliquid-based power generation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players in the Bioliquid Heat and Power Generation Market continue to focus on expanding bioliquid production, enhancing feedstock efficiency, and investing in sustainable fuel technologies. Companies are leveraging government incentives and carbon reduction targets to drive their market presence and align with global renewable energy goals.

Archer Daniels Midland Company (ADM) remains a significant player due to its strong expertise in biofuel production and supply chain capabilities. The company’s focus on second-generation biofuels and advanced bioliquid processing technologies positions it well in the expanding market. ADM’s strategic partnerships and sustainable sourcing initiatives are helping strengthen its global footprint.

Argent Energy continues to play a key role by utilizing waste-based feedstocks such as used cooking oils and animal fats. The company’s emphasis on circular economy practices and sustainable biodiesel production aligns with increasing regulatory demands for low-carbon energy solutions. Its presence in Europe, a dominant region, provides a competitive edge.

Betarenewables focuses on next-generation biofuels, particularly advanced bioliquids derived from non-food biomass sources. The company is actively involved in innovative bioliquid production techniques, enabling it to cater to both power generation and industrial heating applications.

Biox, with its strong presence in North America, remains a key supplier of biodiesel and renewable fuels. The company’s expansion in biofuel refining capacity supports growing demand for clean energy alternatives, particularly in the U.S. and Canada.

Top Key Players in the Market

- Archer Daniels Midland Company

- Argent Energy

- Betarenewables

- Biox

- BP

- BTG Bioliquids B.V.

- Bunge

- Encontech

- Ensyn Fuels

- Kraton

- MBP Group

- Munzer Bioindustrie

- Neste

- Olleco

- REG

- XBM LTD

Recent Developments

- In 2024, Münzer Bioindustrie expanded 2024 by acquiring AGRA Entsorgungs GmbH, strengthening its waste-to-energy operations. CEO Ewald-Marco Münzer was recognized globally. The company operates in 10 countries, focusing on biodiesel production. Lobbying expenses ranged between €100,000–€199,999, reflecting industry influence.

- In May 2022, Bunge and Chevron established a joint venture named Bunge Chevron Ag Renewables LLC, aiming to develop renewable fuel feedstocks. This collaboration combines Bunge’s expertise in oilseed processing and strong relationships with farmers with Chevron’s capabilities in fuel manufacturing and marketing. The joint venture contributed approximately $600 million in cash, with Bunge providing its soybean processing facilities in Destrehan, Louisiana, and Cairo.

Report Scope

Report Features Description Market Value (2024) USD 2.6 Billion Forecast Revenue (2034) USD 5.3 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Bioethanol, Biodiesel), By Application (Heat Production, Electricity Generation, Combined heat and power), By End-use (Industrial, Residential, Commercial, Transportation) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland Company, Argent Energy, Betarenewables, Biox, BP, BTG Bioliquids B.V., Bunge, Encontech, Ensyn Fuels, Kraton, MBP Group, Munzer Bioindustrie, Neste, Olleco, REG, XBM LTD Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Bioliquid Heat and Power Generation MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Global Bioliquid Heat and Power Generation MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Archer Daniels Midland Company

- Argent Energy

- Betarenewables

- Biox

- BP

- BTG Bioliquids B.V.

- Bunge

- Encontech

- Ensyn Fuels

- Kraton

- MBP Group

- Munzer Bioindustrie

- Neste

- Olleco

- REG

- XBM LTD