Global Hydraulic Pump Market Size, Share, And Growth Analysis Report By Product Type (Gear pump, Vane pump, Piston pump, Others), By Pressure Range (Up to 600 psi, 601 psi–1000 psi, More than 1000 psi), By Displacement Type (Positive displacement, Non-positive displacement), By Type (Manual Control, Selectable Joystick Controls (SJC)), By End User (Construction, Mining, Agriculture, Machinery, Oil and Gas, Chemicals and Petrochemicals, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143596

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

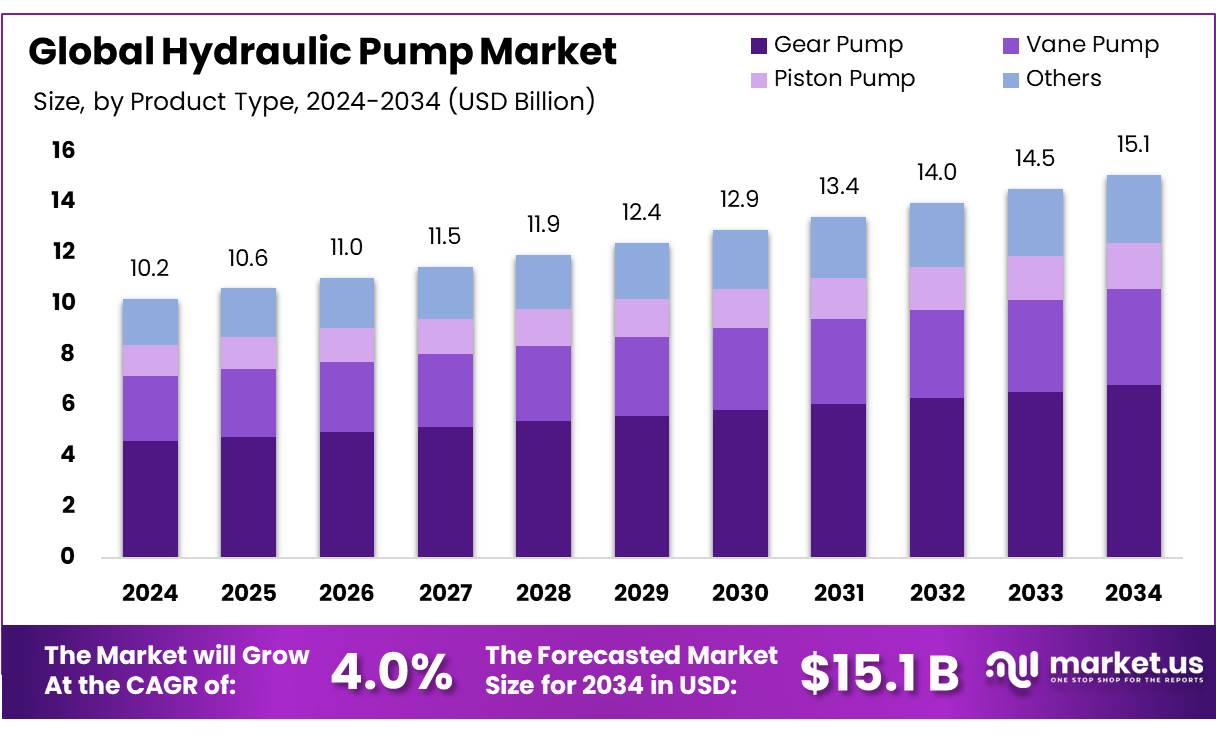

The Global Hydraulic Pump Market size is expected to be worth around USD 15.1 Billion by 2034, from USD 10.2 Billion in 2024, growing at a CAGR of 4.0% during the forecast period from 2025 to 2034.

The Hydraulic Pump Market plays a pivotal role in powering industrial machinery across diverse sectors, converting mechanical energy into hydraulic energy to drive systems in construction, manufacturing, agriculture, and mining. This market is witnessing steady growth, fueled by increasing industrialization, infrastructure development, and technological advancements.

Hydraulic pumps, essential for operating heavy equipment like excavators, cranes, and tractors, are integral to modern industrial processes, offering reliability and efficiency in high-pressure environments. The Industrial Scenario reflects robust demand, particularly in emerging economies where rapid urbanization and infrastructure projects are underway.

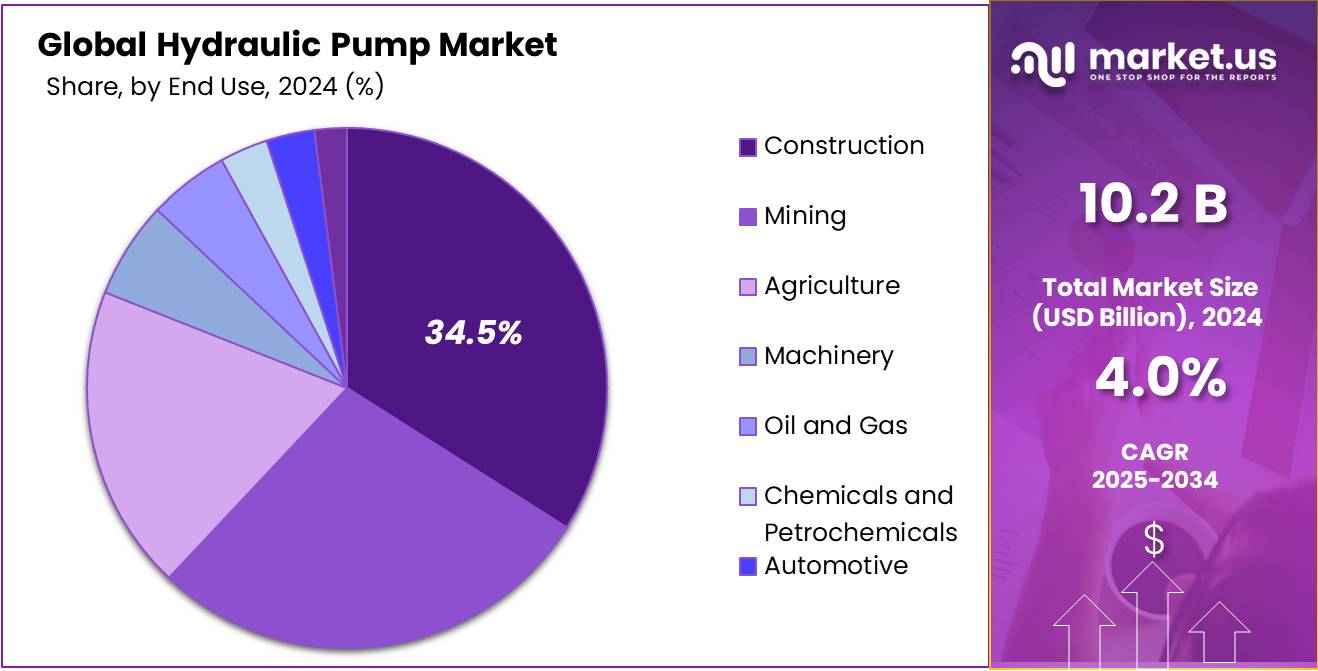

The construction industry, which accounts for 34.5% of the market share, is a major driver due to the rising number of infrastructure projects globally. The Agriculture Sector, which contributes 20% to the market, is witnessing growth due to the mechanization of farming processes.

The manufacturing oil and gas sectors collectively hold 25% of the market, driven by the need for advanced hydraulic systems in automation and exploration activities. The automotive industry contributes significantly, utilizing hydraulic pumps in power steering and braking systems, with global vehicle production reaching 95 million units in 2024.

Key Takeaways

-

The Hydraulic Pump Market is projected to grow from USD 10.2 billion in 2024 to USD 15.1 billion by 2034, at a CAGR of 4.0%.

-

Gear pumps held a 45.2% market share, favored for their cost-effectiveness, simple design, and versatility.

-

Hydraulic pumps operating above 1000 psi held a significant market share of 42.2%, driven by demand in heavy-duty industries.

-

Positive Displacement Pumps Lead to a 67.2% market share, positive displacement pumps were the most preferred.

-

The construction industry was the largest consumer of hydraulic pumps, holding a 34.5% share, driven by the widespread.

-

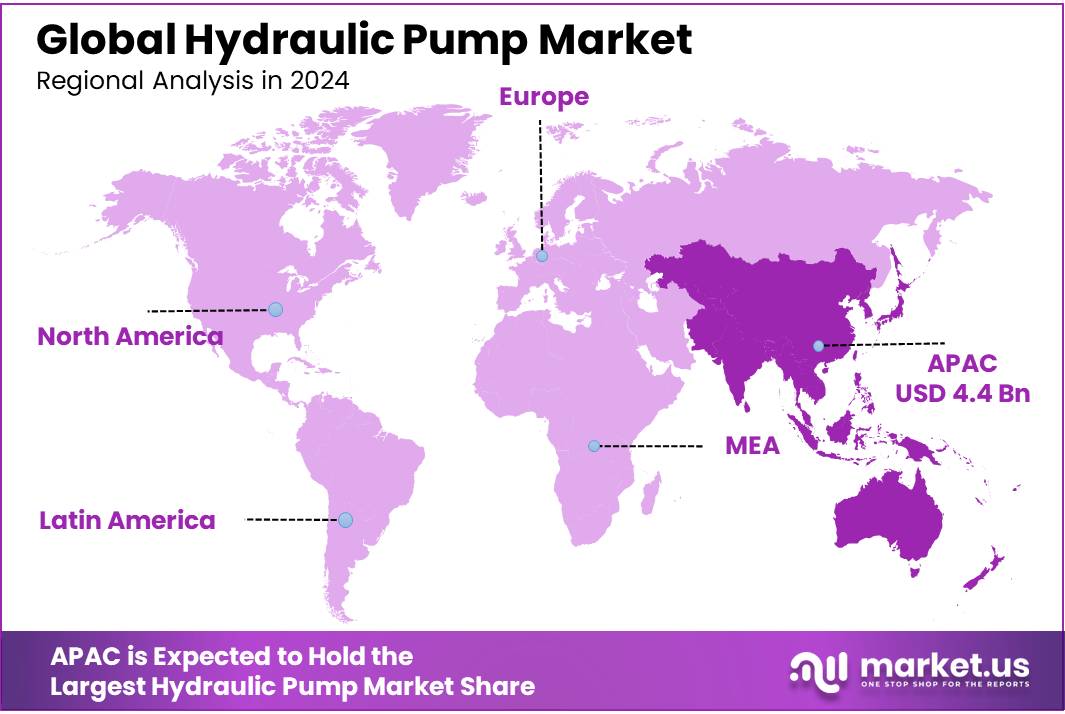

APAC lead the hydraulic pump market with a 43.8% share, valued at USD 4.4 billion, propelled by significant industrial and infrastructural developments.

By Product Type

In 2024, Gear Pumps held a dominant market position, capturing more than a 45.2% share of the global hydraulic pump market. This segment’s strong performance is attributed to its cost-effectiveness, simplicity in design, and widespread use in medium-pressure applications across industries such as construction, agriculture, and manufacturing.

Gear pumps are particularly favored for their reliability and ability to handle a wide range of fluid viscosities, making them a versatile choice for various operational needs. The growth of the gear pump segment is further driven by the increasing demand for compact and efficient hydraulic systems in emerging economies.

The gear pump market is expected to grow at a steady rate, supported by advancements in materials and manufacturing processes that enhance durability and performance. The segment’s dominance is also reinforced by its extensive adoption in mobile hydraulics, such as forklifts and small construction equipment, where space and weight constraints are critical factors.

By Pressure Range

In 2024, the More than 1000 psi pressure range segment held a dominant market position, capturing more than a 42.2% share of the global hydraulic pump market. This segment’s leadership is driven by the increasing demand for high-pressure hydraulic systems in industries such as construction, oil & gas, and heavy manufacturing, where robust performance and reliability are critical.

Hydraulic pumps operating at pressures above 1000 psi are essential for powering heavy machinery, hydraulic presses, and industrial equipment that require significant force and precision. The growth of this segment is further fueled by the expansion of infrastructure projects and the rising adoption of advanced hydraulic systems in emerging economies.

The segment is expected to maintain its strong market position, supported by ongoing technological advancements that enhance efficiency and durability in high-pressure applications. The oil & gas industry, in particular, is a major contributor to this segment’s growth, as hydraulic pumps with pressures exceeding 1000 psi are widely used in drilling and exploration activities.

By Displacement Type

In 2024, the Positive Displacement segment held a dominant market position, capturing more than a 67.2% share of the global hydraulic pump market. This segment’s leadership is primarily due to its ability to deliver consistent and precise fluid flow, making it ideal for applications requiring high accuracy and control, such as in the construction, manufacturing, and automotive industries.

Positive displacement pumps are widely preferred because they can handle varying pressures and flow rates efficiently, ensuring reliable performance in demanding environments. The growth of this segment is driven by the increasing demand for automation and advanced hydraulic systems across industries.

The positive displacement segment is expected to maintain its strong market position, supported by ongoing innovations in pump design and materials that enhance efficiency and durability. The construction sector, in particular, is a major contributor to this segment’s growth, as these pumps are extensively used in heavy machinery like excavators, cranes, and loaders.

By Type

In 2024, Selectable Joystick Controls (SJC) held a dominant market position, capturing more than a 68.4% share of the global hydraulic pump market. This segment’s leadership is driven by the increasing demand for advanced control systems that enhance operator efficiency, precision, and safety in heavy machinery and equipment.

SJC systems are widely adopted in industries such as construction, agriculture, and material handling, where seamless control over hydraulic functions is critical for productivity. The growth of the SJC segment is fueled by the rising trend of automation and the need for user-friendly interfaces in complex machinery.

The segment is expected to maintain its strong market position, supported by continuous advancements in joystick technology, such as ergonomic designs and integration with IoT-enabled systems. The construction industry, in particular, is a major contributor to this segment’s growth, as SJC systems are extensively used in excavators, loaders, and cranes to improve operational accuracy and reduce fatigue for operators.

By End User

In 2024, the Construction segment held a dominant market position, capturing more than a 34.5% share of the global hydraulic pump market. This segment’s leadership is driven by the extensive use of hydraulic pumps in heavy machinery such as excavators, bulldozers, cranes, and loaders, which are essential for infrastructure development and construction activities.

The growing number of large-scale infrastructure projects, particularly in emerging economies, has significantly boosted the demand for hydraulic pumps in this sector. The construction industry’s reliance on hydraulic pumps is due to their ability to provide high power density, precise control, and reliability in demanding environments.

The segment is expected to maintain its strong market position, supported by ongoing urbanization and government investments in infrastructure development. Additionally, the adoption of advanced hydraulic systems with improved efficiency and automation features is further driving growth in this segment.

Key Market Segments

By Product Type

- Gear pump

- Vane pump

- Piston pump

- Others

By Pressure Range

- Up to 600 psi

- 601 psi–1000 psi

- More than 1000 psi

By Displacement Type

- Positive displacement

- Non-positive displacement

By Type

- Manual Control

- Selectable Joystick Controls (SJC)

By End User

- Construction

- Mining

- Agriculture

- Machinery

- Oil and Gas

- Chemicals and Petrochemicals

- Automotive

- Others

Drivers

Government Initiatives Driving Hydraulic Pump Demand

One of the major driving factors for the hydraulic pump market is the increasing focus on renewable energy projects, supported by government initiatives worldwide. Governments are investing heavily in renewable energy infrastructure, such as wind and solar power, to reduce carbon emissions and achieve sustainability goals.

Hydraulic pumps play a critical role in these projects, particularly in wind turbines, where they are used for pitch and yaw control systems to optimize turbine performance. The growing adoption of wind energy is directly boosting the demand for hydraulic pumps, as they are essential for the efficient operation of wind turbines.

Government policies are further accelerating this trend. The U.S. Department of Energy announced a target to deploy 30 GW of offshore wind energy, which is expected to create a substantial demand for hydraulic pumps.

Restraints

High Maintenance Costs Restraining Market Growth

One of the major restraints for the hydraulic pump market is the high maintenance and operational costs associated with these systems. Hydraulic pumps, especially those used in heavy industries like construction, mining, and energy, require regular maintenance to ensure optimal performance and prevent breakdowns.

According to the U.S. Department of Energy, maintenance costs for hydraulic systems can account for up to 30-40% of the total operational expenses in industries relying heavily on hydraulic machinery. The Global Wind Energy Council (GWEC) reported that the global wind energy capacity reached 1,017 GW in 2023, highlighting the scale of maintenance requirements and associated costs.

Opportunity

Expansion of Construction and Infrastructure Projects

One of the major growth factors for the hydraulic pump market is the rapid expansion of construction and infrastructure projects worldwide. Governments and private sectors are investing heavily in building roads, bridges, airports, and urban infrastructure to support economic growth and urbanization.

Hydraulic pumps are a critical component in construction machinery such as excavators, cranes, bulldozers, and loaders, which are essential for these large-scale projects. Hydraulic pumps are indispensable in construction machinery due to their ability to provide high power density, precise control, and reliability in demanding conditions.

The surge in construction and infrastructure projects globally is a significant growth driver for the hydraulic pump market. With governments and private sectors prioritizing infrastructure development, the demand for hydraulic pumps in construction machinery is set to rise steadily in the coming years.

Trends

Adoption of Smart Hydraulic Systems with IoT Integration

One of the major emerging factors for the hydraulic pump market is the adoption of smart hydraulic systems integrated with Internet of Things (IoT) technology. Industries are increasingly focusing on automation, predictive maintenance, and real-time monitoring to enhance efficiency and reduce downtime.

Smart hydraulic pumps equipped with IoT sensors and connectivity features are transforming traditional hydraulic systems by providing data-driven insights, improving performance, and enabling remote diagnostics.

The integration of IoT in hydraulic systems is also gaining traction in the renewable energy sector. For instance, wind turbines equipped with smart hydraulic pumps can adjust blade angles in real-time based on wind conditions, improving energy output by up to 15-20%, according to the Global Wind Energy Council (GWEC).

Regional Analysis

The Asia-Pacific (APAC) region stands as the dominant force in the global hydraulic pump market, commanding a substantial share of 43.8% and valuing approximately USD 4.4 billion. This dominance is driven by robust industrial growth, particularly in emerging economies such as China, India, and Southeast Asia. These countries are witnessing significant investments in infrastructure development and manufacturing expansion, fueling the demand for hydraulic pumps.

APAC’s strategic embrace of automation and modernization in manufacturing processes has led to increased adoption of hydraulic systems that are integral to machinery operation in sectors like construction, agriculture, and automotive. China’s push towards high-speed rail projects and urban infrastructure has necessitated advanced hydraulic solutions for efficient machinery operation.

India’s growing focus on mechanizing its agriculture has spurred the demand for hydraulic pumps in farm equipment, further cementing the region’s market position. The region benefits from the presence of key industry players who are expanding their operational bases and distribution networks across APAC to leverage lower manufacturing costs and tap into local market potential.

The APAC market is gradually shifting towards energy-efficient and environmentally friendly hydraulic pumps, reflecting global trends towards sustainability. This shift is anticipated to open new avenues for growth and attract substantial investments, reinforcing the region’s leading status in the global arena.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- Actuant Corporation, a prominent player in the hydraulic pump market, is recognized for its innovative hydraulic solutions catering to diverse industries such as construction, industrial, and automotive. The company focuses on delivering high-performance hydraulic pumps that enhance operational efficiency and reliability. Actuant’s commitment to quality and continuous improvement has solidified its position as a leader in hydraulic technology, making it a preferred supplier for heavy-duty hydraulic applications globally.

- Bailey International LLC excels in the design and manufacture of robust hydraulic pumps and fluid power components. Their products are integral to mobile and industrial applications, ensuring high efficiency and durability. With a strong emphasis on customer-centric solutions, Bailey International maintains a competitive edge by offering custom-built hydraulic systems that meet specific industry needs, thus reinforcing its market presence in North America and beyond.

- Bondioli and Pavesi stand out in the hydraulic pump market with their specialized offerings in power transmission systems. Known for their reliability and innovation, their hydraulic pumps are extensively used in agricultural and construction machinery. The company’s dedication to research and development drives its ability to offer advanced hydraulic solutions that improve machinery performance and adaptability in challenging environments.

- Bosch Rexroth India Limited, a subsidiary of the global Bosch Rexroth AG, is a key supplier of cutting-edge hydraulic pumps. The company leverages advanced German engineering to produce highly efficient and reliable hydraulic systems. Its focus on integrating digital technologies into hydraulic solutions positions Bosch Rexroth as a frontrunner in the smart automation and connected machinery space, prominently serving the expanding Asian markets.

Top Key Players in the Market

- Actuant Corporation (Enerpac)

- Bailey International LLC

- Bondioli&Pavesi

- Bosch Rexroth India Limited

- Bucher Hydraulics

- Casappa S.p.A.

- Danfoss AS

- Dynamatic Technologies Limited

- Eaton

- Enerpac Tool Group Corp.

- HAWE Hydarulik

- Hydac International GmbH.

- Linde Hydraulics GmbH & Co. KG

- OILGEAR

- Parker Hannifin

- PARKER HANNIFIN CORP

- Toshiba Machine Pvt.Ltd

Recent Developments

- In 2024, Actuant Corporation rebranded to Enerpac Tool Group in 2019, reflecting its focus on industrial tools and hydraulic solutions. A recent notable update is the continued expansion of its hydraulic offerings under the Enerpac brand. Enerpac introduced new high-pressure hydraulic tools and pumps designed for heavy lifting and industrial applications, emphasizing safety and efficiency.

- In 2025, Bailey International LLC, a key player in hydraulic components, has recently focused on expanding its product catalog for mobile hydraulic applications. They announced a new line of hydraulic pumps tailored for agricultural and construction equipment, emphasizing durability in extreme conditions.

Report Scope

Report Features Description Market Value (2024) USD 10.2 Billion Forecast Revenue (2034) USD 15.1 Billion CAGR (2025-2034) 4.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Gear pump, Vane pump, Piston pump, Others), By Pressure Range (Up to 600 psi, 601 psi–1000 psi, More than 1000 psi), By Displacement Type (Positive displacement, Non-positive displacement), By Type (Manual Control, Selectable Joystick Controls (SJC)), By End User (Construction, Mining, Agriculture, Machinery, Oil and Gas, Chemicals and Petrochemicals, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Actuant Corporation, Bailey International LLC, Bondioli&Pavesi, Bosch Rexroth India Limited, Bucher Hydraulics, Casappa S.p.A., Danfoss AS, Dynamatic Technologies Limited, Eaton, Enerpac Tool Group Corp., HAWE Hydarulik, Hydac International GmbH., Linde Hydraulics GmbH & Co. KG, OILGEAR, Parker Hannifin, PARKER HANNIFIN CORP, Toshiba Machine Pvt.Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

-

- Actuant Corporation

- Bailey International LLC

- Bondioli&Pavesi

- Bosch Rexroth India Limited

- Bucher Hydraulics

- Casappa S.p.A.

- Danfoss AS

- Dynamatic Technologies Limited

- Eaton

- Enerpac Tool Group Corp.

- HAWE Hydarulik

- Hydac International GmbH.

- Linde Hydraulics GmbH & Co. KG

- OILGEAR

- Parker Hannifin

- PARKER HANNIFIN CORP

- Toshiba Machine Pvt.Ltd