Global Desalination Pumps Market Size, Share, And Growth Analysis Report By Product Type (Centrifugal Pumps, Positive Displacement Pumps, Vertical Pumps, Others), By Technology (Reverse Osmosis (RO), Multi-Stage Filtration (MSF), Multi-Effect Distillation (MED), Others), By Application (Pre-treatment, Water Intake, In-Process, Water Withdrawal, Others), By End-use (Water and Wastewater Treatment, Oil and Gas, Power, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143424

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

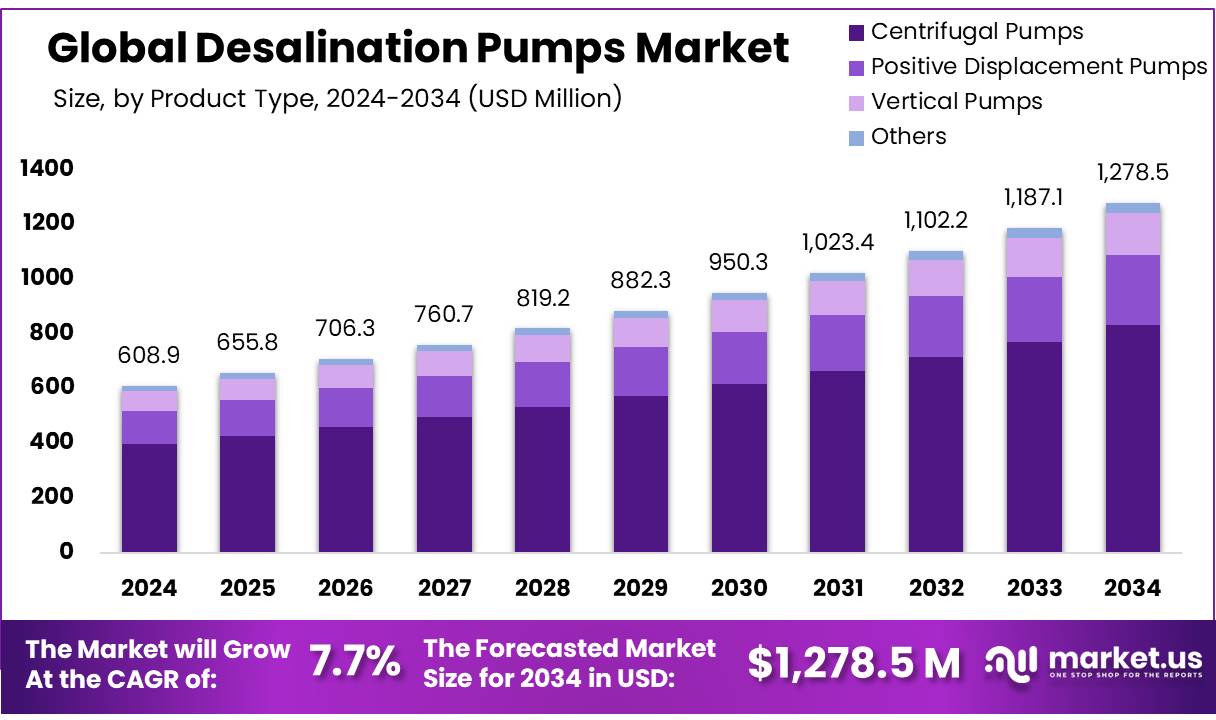

The Global Desalination Pumps Market size is expected to be worth around USD 1278.5 Million by 2034, from USD 608.9 Million in 2024, growing at a CAGR of 7.7% during the forecast period from 2025 to 2034.

The Desalination Pumps Market is experiencing significant growth due to escalating demand for freshwater resources, driven by population growth and industrial development. Desalination pumps, vital components in desalination plants, facilitate the process of converting seawater into potable water. This technology has become increasingly crucial in regions suffering from chronic water scarcity.

The adoption of advanced technologies, such as reverse osmosis (RO) and multi-stage flash distillation (MSF), which require robust and efficient pumping systems. The market is characterized by a diverse range of pump types, including centrifugal and positive displacement pumps, tailored to specific desalination needs. As of 2025, the market is densely populated with both well-established manufacturers and emerging players, contributing to a competitive and dynamic environment.

Driving factors for the market include severe water scarcity affecting over 2 billion people globally, compelling governments and private entities to invest in alternative water-sourcing technologies. Technological advancements that enhance energy efficiency and reduce operational costs also contribute to market growth. Furthermore, environmental regulations pushing for more sustainable water-sourcing solutions are pivotal in driving the adoption of desalination technologies.

The global water crisis, with approximately 25% of the world’s population facing high water stress, and the depletion of freshwater reserves. In 2023, the global desalination capacity reached 110 million cubic meters per day, with pumps accounting for a significant portion of plant infrastructure costs. Rising investments in water infrastructure, especially in Asia-Pacific, where water demand is projected to increase by 55%. Technological advancements, such as energy recovery systems reducing energy consumption by up to 60%, also drive adoption.

Key Takeaways

- The Desalination Pumps Market is projected USD 608.9 million in 2024 to USD 1278.5 million by 2034, at a CAGR of 7.7% from 2025 to 2034.

- Centrifugal pumps dominate with a 65.3% share due to efficiency, reliability, and high-volume water handling capabilities.

- Reverse Osmosis (RO) leads with a 72.2% share, favored for effective salt and impurity removal in desalination.

- Pre-treatment segment holds a 43.2% share, crucial for system efficiency by removing contaminants before desalination.

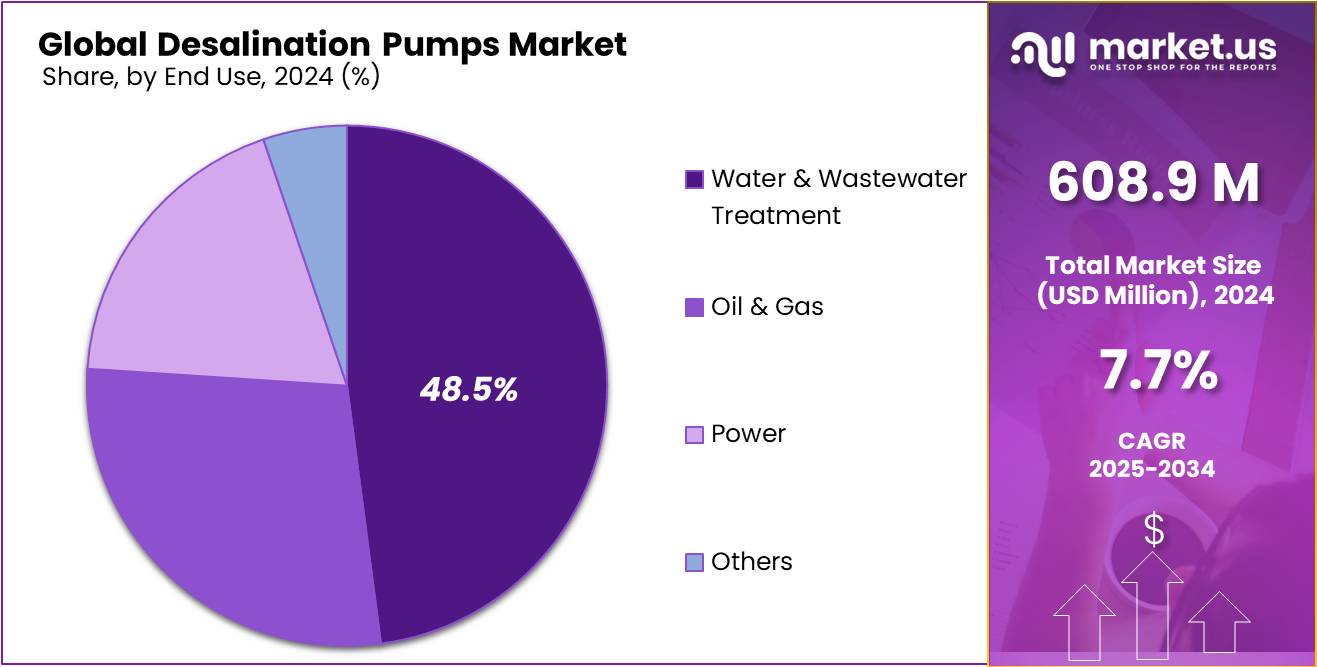

- The water & wastewater treatment segment captures a 48.5% share, driven by rising demand for clean water solutions.

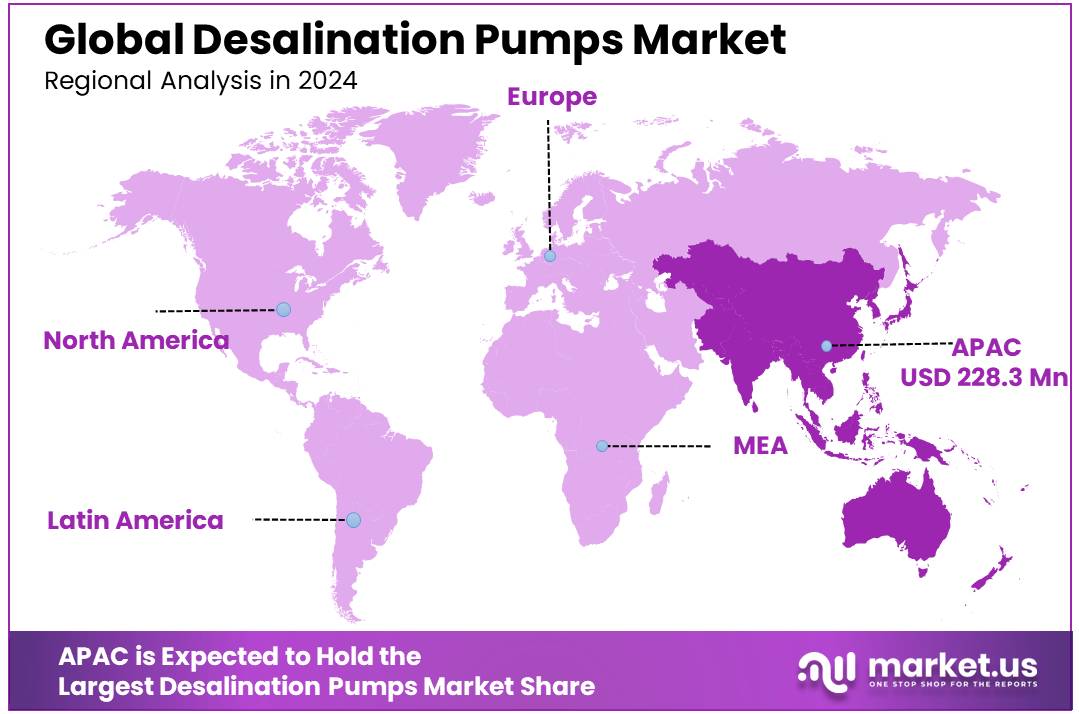

- The Asia-Pacific (APAC) region dominates the global desalination pumps market, holding a 37.5% share, valued at approximately USD 228.3 million.

By Product Type

Centrifugal Pumps held a dominant market position in the desalination pumps segment, capturing more than a 65.3% share. This stronghold is attributed to their widespread adoption in desalination plants due to their efficiency, reliability, and ability to handle large volumes of water.

Centrifugal pumps are particularly favored in reverse osmosis (RO) desalination systems, where they play a critical role in maintaining the high-pressure requirements necessary for the process. Their versatility in handling both seawater and brackish water further solidifies their position as the preferred choice in the industry.

The demand for centrifugal pumps is expected to remain robust, driven by the increasing global need for freshwater and the expansion of desalination projects worldwide. The growing focus on water scarcity solutions, especially in arid regions, is likely to sustain the momentum for centrifugal pumps.

By Technology

Reverse Osmosis (RO) held a dominant market position in the desalination pumps segment, capturing more than a 72.2% share. This significant market share is driven by the widespread adoption of RO technology in desalination plants globally, as it is highly effective in removing salts and impurities from seawater and brackish water.

The efficiency, scalability, and relatively lower energy consumption of RO systems compared to other desalination technologies have made it the preferred choice for both large-scale and small-scale projects. The RO segment is expected to maintain its strong market position, supported by ongoing technological advancements and increasing investments in desalination infrastructure.

Innovations in membrane technology and energy recovery systems are likely to enhance the efficiency and cost-effectiveness of RO processes, making them even more attractive for new projects. With the global focus on addressing water scarcity and ensuring sustainable water supplies, the demand for RO-based desalination pumps is projected to remain high, solidifying its leadership in the market.

By Application

The Pre-Treatment segment held a dominant market position in the desalination pumps market, capturing more than a 43.2% share. This strong performance is largely due to the critical role pre-treatment plays in ensuring the efficiency and longevity of desalination systems. Pre-treatment processes, such as filtration and sedimentation, are essential for removing large particles, debris, and other contaminants from seawater or brackish water before they enter the main desalination process.

By doing so, pre-treatment helps protect downstream equipment, such as reverse osmosis membranes, from damage and clogging, thereby reducing maintenance costs and improving overall system performance. The increasing complexity of water sources and the need for higher-quality feed water has further driven the demand for advanced pre-treatment solutions.

The Pre-Treatment segment is expected to maintain its leading position, supported by the growing emphasis on optimizing desalination plant operations and reducing operational costs. As desalination projects expand globally, particularly in regions with challenging water quality conditions, the importance of effective pre-treatment will only increase. Innovations in pre-treatment technologies, such as improved filtration systems and chemical treatment methods, are likely to enhance the efficiency and reliability of these processes.

By End-use

The Water & Wastewater Treatment segment held a dominant market position in the desalination pumps market, capturing more than a 48.5% share. This significant share is driven by the increasing global demand for clean water and the growing need to treat and recycle wastewater to address water scarcity issues.

Desalination pumps play a crucial role in water and wastewater treatment plants, where they are used to move and process large volumes of water efficiently. The rising focus on sustainable water management practices, coupled with stringent environmental regulations, has further boosted the adoption of desalination pumps in this segment.

Municipalities and industries alike are investing heavily in advanced treatment systems to ensure a reliable supply of potable water and to meet wastewater discharge standards. The Water & Wastewater Treatment segment is expected to maintain its strong market position, supported by continued investments in water infrastructure and the expansion of treatment facilities worldwide.

Key Market Segments

By Product Type

- Centrifugal Pumps

- Positive Displacement Pumps

- Vertical Pumps

- Others

By Technology

- Reverse Osmosis (RO)

- Multi-Stage Filtration (MSF)

- Multi-Effect Distillation (MED)

- Others

By Application

- Pre-treatment

- Water Intake

- In-Process

- Water Withdrawal

- Others

By End-use

- Water & Wastewater Treatment

- Oil & Gas

- Power

- Others

Drivers

Government Initiatives Driving the Desalination Pumps Market

One of the major driving factors for the growth of the desalination pumps market is the increasing government initiatives and investments in water infrastructure to address global water scarcity. Governments worldwide are recognizing the urgent need to secure sustainable water supplies, especially in arid and water-stressed regions.

For instance, according to the International Energy Agency (IEA), global water demand is projected to increase by 20-30% by 2050, with desalination playing a critical role in meeting this demand. To support this, governments are launching large-scale desalination projects and providing funding for advanced water treatment technologies.

The United Arab Emirates (UAE) has allocated significant resources to expand its desalination capacity, with projects like the Taweelah Reverse Osmosis Plant, which is expected to produce 909,200 cubic meters of water daily upon completion.

Restraints

High Energy Consumption: A Major Restraint for the Desalination Pumps Market

One of the most significant challenges facing the desalination pump market is the high energy consumption associated with desalination processes. Desalination, particularly reverse osmosis (RO) and thermal desalination, requires substantial amounts of energy to operate pumps and other equipment.

According to the International Renewable Energy Agency (IRENA), desalination plants consume approximately 10-13 kilowatt-hours (kWh) of energy to produce one cubic meter of freshwater. This high energy demand not only increases operational costs but also raises environmental concerns, especially when the energy is sourced from non-renewable resources like fossil fuels.

In Saudi Arabia, where desalination accounts for about 15% of the country’s total energy consumption, the reliance on oil and gas for powering desalination plants has led to significant carbon emissions. Similarly, in the United States, the Carlsbad Desalination Plant in California consumes around 38 megawatts (MW) of energy daily, equivalent to powering 28,000 homes.

Opportunity

Rising Water Scarcity: A Major Growth Factor for the Desalination Pumps Market

One of the most significant growth factors for the desalination pump market is the increasing global water scarcity, driven by population growth, urbanization, and climate change. According to the United Nations (UN), over 2 billion people currently live in countries experiencing high water stress, and this number is expected to rise as global water demand increases by 55%.

Desalination has emerged as a critical solution to address this challenge, particularly in regions where freshwater resources are limited or overexploited. In the Middle East and North Africa (MENA) region, which is one of the most water-scarce areas in the world, desalination accounts for nearly 50% of the total freshwater supply.

Saudi Arabia, the largest producer of desalinated water globally, operates over 30 desalination plants and produces more than 5 million cubic meters of water daily. Israel relies on desalination for about 80% of its domestic water needs, with facilities like the Sorek Desalination Plant producing 624,000 cubic meters of water daily.

Trends

Integration of Renewable Energy: An Emerging Factor for the Desalination Pumps Market

One of the most promising emerging factors for the desalination pumps market is the integration of renewable energy sources to power desalination plants. Traditional desalination processes are energy-intensive, often relying on fossil fuels, which contribute to high operational costs and environmental concerns.

The growing adoption of renewable energy technologies, such as solar and wind power, is transforming the desalination industry by making it more sustainable and cost-effective. According to the International Renewable Energy Agency (IRENA), renewable energy-powered desalination could reduce carbon emissions by up to 270 million tons annually by 2030.

Countries like Saudi Arabia are leading the way in this transition, with projects like the Al Khafji Solar-Powered Desalination Plant, which produces 60,000 cubic meters of water daily using solar energy. Australia’s Sundrop Farms uses concentrated solar power to desalinate seawater, producing 15,000 cubic meters of freshwater annually for agricultural use.

Regional Analysis

Dominating Region: APAC with a Market Share of 37.5% (228.3 Million)

The Asia-Pacific (APAC) region holds a commanding position in the global desalination pumps market, accounting for 37.5% of the market with an estimated value of USD 228.3 million. This region’s dominance is driven by several factors, including rapid industrialization, escalating water scarcity, and significant investments in water infrastructure by emerging economies such as China, India, and Southeast Asia.

The urgent need for potable water in these densely populated areas has propelled the adoption of desalination technologies, subsequently boosting the demand for desalination pumps. China leads the APAC market, spurred by governmental initiatives aimed at improving water security and supporting industrial growth. The country’s focus on constructing new desalination plants, particularly in water-stressed coastal cities, is a primary growth driver.

India’s increasing investment in desalination infrastructure, backed by government schemes like the ‘Jal Jeevan Mission is expected to significantly contribute to market expansion. Australia’s extensive use of desalination to combat persistent drought conditions further amplifies regional demand.

The market in APAC is characterized by a preference for high-efficiency, low-energy consumption pumps, which has led to technological advancements and innovations in pump manufacturing. Leading players in the region are focusing on sustainable solutions, such as energy recovery devices and high-pressure pumps, which are essential for cost-effective desalination operations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- Baker Hughes Company is a major player in the desalination pumps market, known for its engineering prowess and innovative pump solutions tailored for desalination applications. Their offerings emphasize energy efficiency and long-term reliability, which are crucial in high-demand settings.

- Ebara Corporation, headquartered in Japan, specializes in the development and manufacture of industrial machinery, including pumps for desalination processes. With a strong emphasis on sustainability and innovation, Ebara offers robust and energy-efficient pump solutions that cater to a range of desalination needs, from small-scale installations to major infrastructural projects.

- Flowserve Corporation is a recognized leader in supplying engineered pumps, pump systems, and services to the desalination industry. Their products are designed to withstand the challenging conditions of desalination processes, including corrosion and high pressure. Flowserve’s pumps are integral to many desalination plants worldwide, helping to transform seawater into potable water efficiently.

- Grundfos Holding A/S is renowned for its high-quality, energy-efficient pumping solutions used in water technology, including desalination. The company emphasizes innovation and sustainability, aiming to revolutionize desalination techniques with their scalable and adaptable pumps.

- Henan Province Xixia Automobile Water Pump Co. Ltd. may not be as globally prominent as its counterparts, but it plays a critical role in the Chinese and broader Asian markets. Specializing in the manufacture of automotive and industrial pumps, their entry into the desalination pump market is marked by competitive pricing and adaptability.

Top Key Players in the Market

- BAKER HUGHES COMPANY

- Ebara Corporation

- Flowserve Corporation

- Grundfos Holding A/S

- Henan Province Xixia Automobile Water Pump

- Idex

- IWAKI

- Kirloskar Brothers Limited

- KSB SE

- Pentair

- PROCON Products

- PSG Dover

- Shanghai Kai Quan Pump

- SPX

- Sulzer Ltd.

- Torishima Pump

- Watson-Marlow

- Wilo SE

- Xylem, Inc.

- Zoeller Pump Company

Recent Developments

- In 2024, Ebara Corporation, a major player in pump manufacturing, continues to innovate in water management. Ebara has been enhancing its pump lineup for large-scale water infrastructure projects, including desalination. They showcased energy-efficient pumps designed for high-pressure applications, which are critical in reverse osmosis desalination systems.

- In 2025, Flowserve made notable strides in pump technology relevant to desalination. Flowserve announced the launch of the INNOMAG TB-MAG Dual Drive Pump via its official social media channels. This sealless pump is designed for safety and environmental protection, making it suitable for desalination applications where chemical resistance and reliability are paramount.

Report Scope

Report Features Description Market Value (2024) USD 608.9 Million Forecast Revenue (2034) USD 1278.5 Million CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Centrifugal Pumps, Positive Displacement Pumps, Vertical Pumps, Others), By Technology (Reverse Osmosis (RO), Multi-Stage Filtration (MSF), Multi-Effect Distillation (MED), Others), By Application (Pre-treatment, Water Intake, In-Process, Water Withdrawal, Others), By End-use (Water & Wastewater Treatment, Oil & Gas, Power, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BAKER HUGHES COMPANY, Ebara Corporation, Flowserve Corporation, Grundfos Holding A/S, Henan Province Xixia Automobile Water Pump, Idex, IWAKI, Kirloskar Brothers Limited, KSB SE, Pentair, PROCON Products, PSG Dover, Shanghai Kai Quan Pump, SPX, Sulzer Ltd., Torishima Pump, Watson-Marlow, Wilo SE, Xylem, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited Users and Printable PDF)  Desalination Pumps MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Desalination Pumps MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BAKER HUGHES COMPANY

- Ebara Corporation

- Flowserve Corporation

- Grundfos Holding A/S

- Henan Province Xixia Automobile Water Pump

- Idex

- IWAKI

- Kirloskar Brothers Limited

- KSB SE

- Pentair

- PROCON Products

- PSG Dover

- Shanghai Kai Quan Pump

- SPX

- Sulzer Ltd.

- Torishima Pump

- Watson-Marlow

- Wilo SE

- Xylem, Inc.

- Zoeller Pump Company