Global Specialty Aluminas Market Size, Share, And Business Benefits By Type (Calcined Alumina, Activated Alumina, Aluminium Trihydroxide (ATH), Fused Alumina (White, Brown), Boehmite, Reactive Alumina, Others), By Particle Size (Coarse, Fine, Ultra-fine, Medium), By Application (Refractory Materials, Ceramics, Abrasives, Polishing, Catalyst, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146567

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

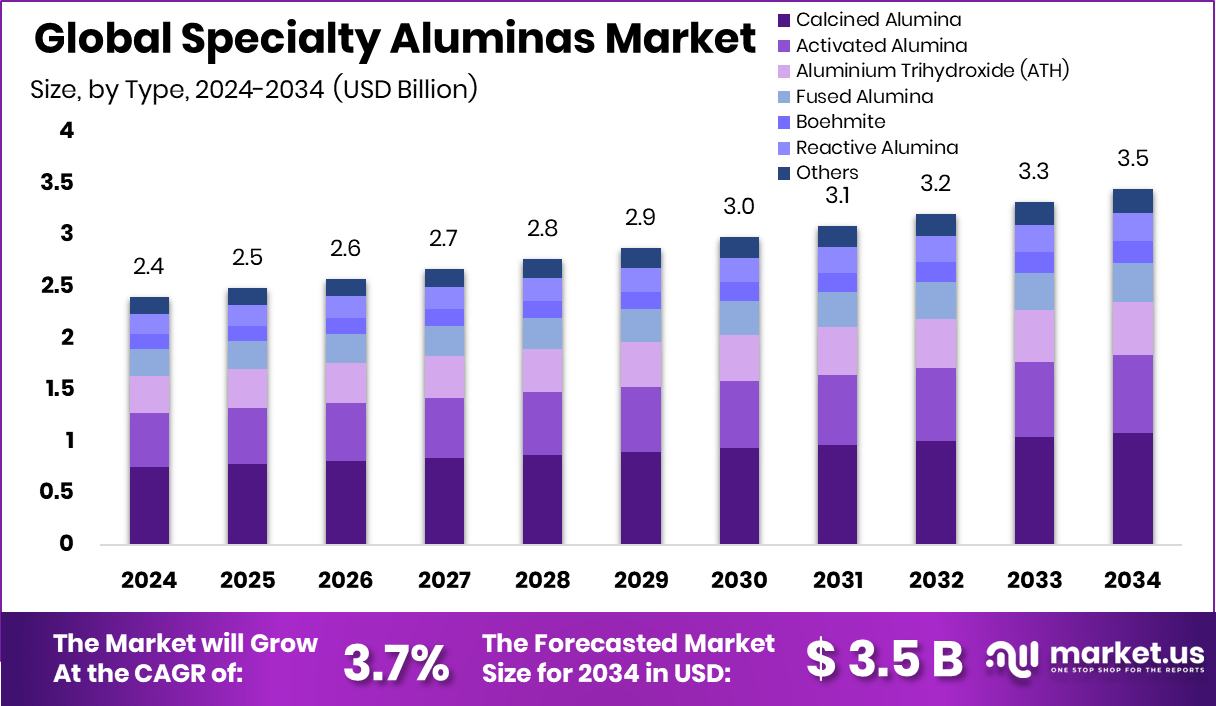

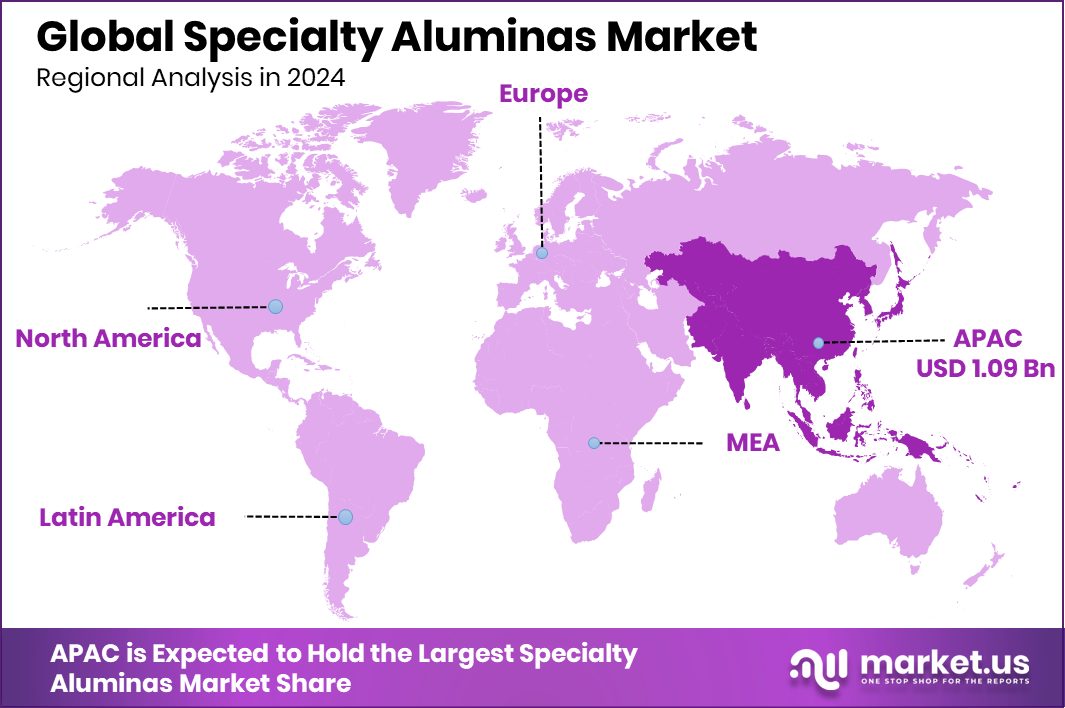

Global Specialty Aluminas Market is expected to be worth around USD 3.5 billion by 2034, up from USD 2.4 billion in 2024, and grow at a CAGR of 3.7% from 2025 to 2034. Strong manufacturing base in Asia-Pacific drives USD 1.09 Bn market, 45.8% share.

Specialty aluminas, encompassing high-purity and engineered alumina products, are integral to various advanced applications such as ceramics, refractories, abrasives, catalysts, and electronic components. These materials are distinguished by their tailored physical and chemical properties, including controlled particle size, phase composition, and purity levels, which are achieved through precise processing techniques.

India’s alumina production has demonstrated consistent growth, reflecting the country’s expanding industrial base and technological advancements. According to the Indian Minerals Yearbook 2022, the production of alumina (including calcined alumina) reached 7.23 million tonnes in 2021-22, up from 6.52 million tonnes in the previous year.

Major contributors to this output include Hindalco Industries Ltd., Vedanta Aluminium Ltd., and National Aluminium Company Ltd. (NALCO), with Hindalco’s Utkal Alumina International Ltd. producing 3.15 million tonnes, Vedanta’s Lanjigarh refinery yielding 1.97 million tonnes, and NALCO’s Damanjodi facility contributing 2.11 million tonnes during the same period.

Government initiatives have further bolstered the specialty alumina industry. The Ministry of Mines has undertaken projects aimed at developing process technologies for the low-cost production of 3N (99.9%) pure alumina, targeting applications in LEDs and semiconductors.

Moreover, policies such as the National Non-Ferrous Metal Scrap Recycling Policy and the Resource Efficiency Policy aim to enhance recycling rates and promote the efficient use of resources, thereby supporting the sustainable growth of the alumina sector.

Looking ahead, the specialty alumina market in India is poised for significant expansion. The anticipated growth in sectors like electric vehicles, renewable energy, and advanced electronics will drive the demand for high-purity and engineered alumina products.

Key Takeaways

- Global Specialty Aluminas Market is expected to be worth around USD 3.5 billion by 2034, up from USD 2.4 billion in 2024, and grow at a CAGR of 3.7% from 2025 to 2034.

- Calcined alumina held a 31.3% share in the Specialty Aluminas Market due to its versatile applications.

- Fine particle specialty aluminas captured 31.6% market share owing to superior dispersion and surface properties.

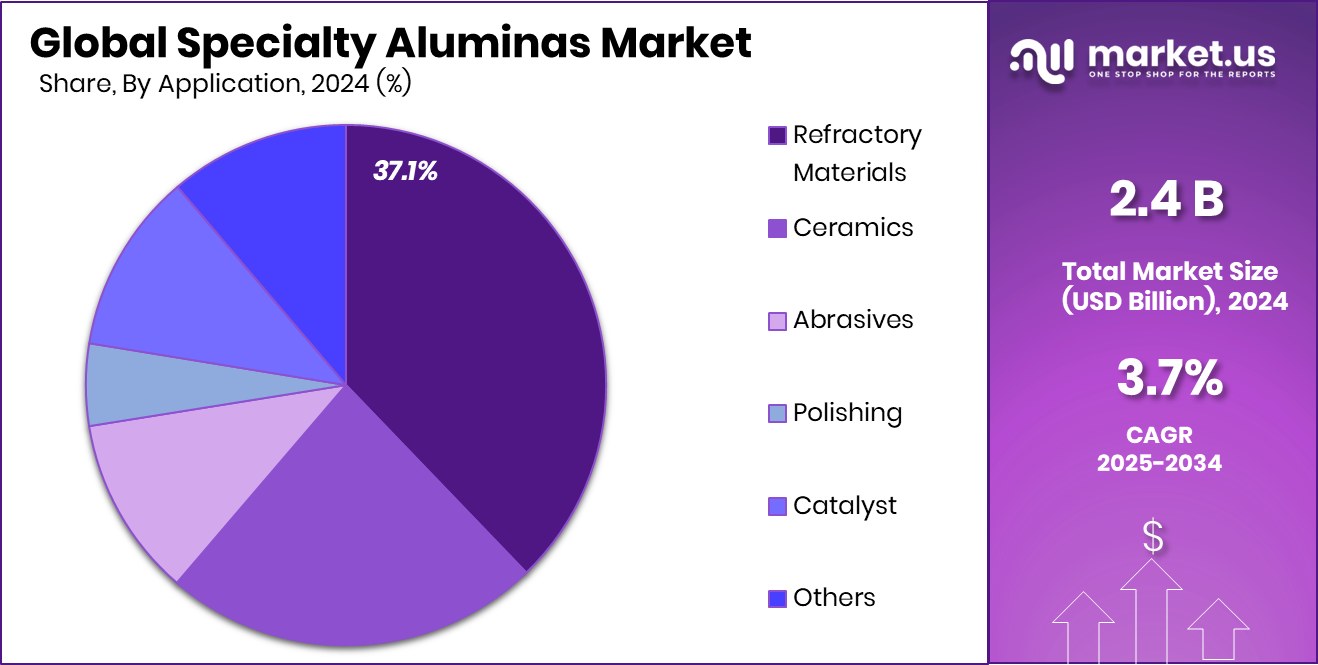

- The refractory materials segment led the market with 37.1% share due to high-temperature performance needs.

- Specialty Aluminas demand in Asia-Pacific reached USD 1.09 Bn, capturing 45.8% share.

By Type Analysis

Calcined alumina held 31.3% market share in Specialty Aluminas by type.

In 2024, Calcined Alumina held a dominant market position in the By Type segment of the Specialty Aluminas Market, with a 31.3% share. This segment’s leading position reflects its strong demand across multiple industrial applications where high purity and thermal resistance are essential.

Calcined alumina is widely used in ceramics, refractories, and polishing applications due to its hardness, excellent wear resistance, and ability to withstand high temperatures without degrading.

Its performance in thermal stability and chemical inertness has made it a preferred material in manufacturing technical ceramics and electronic substrates. The 31.3% share underscores its significance in industries requiring consistent material performance under extreme conditions. This demand is further supported by ongoing growth in sectors like electronics and metallurgy, which require advanced materials capable of delivering durability and efficiency.

The share dominance also reflects continued advancements in alumina refining techniques and increasing investments in high-performance materials across end-use sectors. Industries value calcined alumina for its consistent grain size and surface characteristics, contributing to improved process reliability and product lifespan.

By Particle Size Analysis

Fine particle alumina accounted for 31.6% of the specialty aluminas market.

In 2024, Fine held a dominant market position in the By Particle Size segment of the Specialty Aluminas Market, with a 31.6% share. This leadership is largely attributed to the increasing preference for fine particle aluminas in precision-driven applications such as advanced ceramics, polishing compounds, and catalyst supports. Fine alumina particles offer superior surface area, enhanced reactivity, and improved sintering behavior, making them ideal for high-performance industrial uses.

The 31.6% market share indicates the strong demand for fine aluminas in sectors requiring controlled particle morphology and consistency. These particles enable better dispersion, uniform material distribution, and improved end-product quality in applications ranging from electronic components to high-efficiency catalysts. Their role in achieving tighter tolerances and smoother finishes has especially driven adoption in automotive and semiconductor manufacturing.

Additionally, the ongoing trend toward miniaturization in electronics and the need for high-precision polishing in optics and hard disk manufacturing continue to push demand for fine-sized alumina. Its adaptability across multiple high-end industrial processes reinforces its dominant standing in 2024.

By Application Analysis

Refractory materials consumed a 37.1% share in the Specialty Aluminas application segment.

In 2024, Refractory Materials held a dominant market position in the By Application segment of the Specialty Aluminas Market, with a 37.1% share. This dominance reflects the material’s critical role in high-temperature industrial processes, particularly within the steel, cement, glass, and non-ferrous metal industries. Specialty aluminas are favored in refractory applications due to their exceptional thermal stability, mechanical strength, and resistance to chemical corrosion under extreme conditions.

The 37.1% share indicates strong demand from industries relying on furnaces, kilns, incinerators, and reactors, where maintaining structural integrity under intense heat is essential. Specialty aluminas are commonly used in the production of shaped and unshaped refractories, including bricks, castables, and monolithics, which form the backbone of heat-intensive operations.

Growth in infrastructure, energy, and heavy manufacturing sectors is also supporting the consumption of refractory-grade aluminas. Their ability to enhance life and reduce energy consumption aligns with industries seeking operational efficiency and longer service cycles. As a result, refractory applications remained the leading segment in 2024, driven by consistent investments in metallurgical capacity, particularly in emerging economies.

Key Market Segments

By Type

- Calcined Alumina

- Activated Alumina

- Aluminium Trihydroxide (ATH)

- Fused Alumina

- White

- Brown

- Boehmite

- Reactive Alumina

- Others

By Particle Size

- Coarse

- Fine

- Ultra-fine

- Medium

By Application

- Refractory Materials

- Ceramics

- Abrasives

- Polishing

- Catalyst

- Others

Driving Factors

Rising Demand from Refractory and Ceramic Industries

One of the biggest reasons behind the growth of the Specialty Aluminas Market is the rising demand from the refractory and ceramic industries. Specialty aluminas are widely used in manufacturing high-temperature-resistant materials like kiln linings, furnace parts, and thermal insulation products.

These materials are essential in industries such as steel, glass, cement, and ceramics. With infrastructure and industrial activities growing across Asia-Pacific and the Middle East, the need for durable and heat-resistant materials is also increasing. As a result, manufacturers are using more calcined and tabular aluminas to enhance product performance and lifespan.

Restraining Factors

High Production Costs Limit Market Growth Potential

One major factor that holds back the growth of the Specialty Aluminas Market is the high production cost. Manufacturing specialty aluminas involves energy-intensive processes like calcination at extremely high temperatures. This leads to higher electricity and fuel usage, increasing overall operating expenses.

Additionally, raw material prices, especially bauxite and aluminum hydroxide, can be volatile, making it harder for producers to manage costs. For small and mid-size companies, these expenses can affect profitability and limit large-scale expansion. The need for advanced technologies and strict quality control further adds to production costs.

Growth Opportunity

Expanding Electric Vehicle Market Fuels Alumina Demand

The rapid growth of the electric vehicle (EV) industry is creating significant opportunities for the specialty alumina market. Specialty aluminas are essential in producing advanced ceramics and components used in EV batteries, power electronics, and thermal management systems. As the global shift towards cleaner transportation accelerates, the demand for high-performance materials like specialty alumina is increasing.

These materials offer excellent thermal stability, electrical insulation, and mechanical strength, making them ideal for EV applications. With governments worldwide promoting EV adoption through incentives and regulations, the market for specialty alumina is poised for substantial growth.

Latest Trends

Rising Demand for High-Purity Alumina Grades

One of the latest trends in the specialty alumina market is the growing use of high-purity alumina (HPA) in advanced applications. Industries like electronics, semiconductors, LED lighting, and lithium-ion batteries increasingly require HPA due to its superior thermal stability, corrosion resistance, and electrical insulation properties.

As electric vehicle (EV) production and energy storage needs rise, companies are shifting toward HPA to ensure better performance and longevity of battery components. Moreover, governments in Asia-Pacific and Europe are encouraging battery technology innovation, which further boosts the trend.

This rising preference for ultra-pure grades of alumina is shaping production strategies, leading to increased investment in advanced refining and processing technologies to meet the stringent quality demands.

Regional Analysis

Asia-Pacific led the Specialty Aluminas Market with 45.8% share, reaching USD 1.09 Bn.

In 2024, Asia-Pacific emerged as the dominant region in the global Specialty Aluminas Market, holding a significant 45.8% market share, valued at USD 1.09 billion. The region’s leadership is driven by strong demand from end-use industries such as refractories, ceramics, and electronics, supported by large-scale manufacturing hubs in China, Japan, South Korea, and India.

The rapid industrialization and infrastructure development across Asia-Pacific countries have further boosted the consumption of specialty aluminas for use in high-performance applications.

Meanwhile, North America and Europe also maintained stable positions in the market, backed by advancements in automotive and aerospace components where specialty aluminas play a critical role. Latin America and the Middle East & Africa are experiencing moderate growth, primarily due to the expansion of industrial operations and emerging construction activities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Huber Engineered Materials maintained its strategic focus on advanced alumina solutions tailored for high-performance applications. The company continued strengthening its portfolio of specialty aluminas used in flame retardants, ceramics, and abrasives. Huber’s vertical integration and process optimization played a key role in ensuring consistency in quality and supply reliability, which are vital in sectors demanding thermal and chemical resistance.

Imerys Fused Minerals Villach GmbH remained a significant player, leveraging its strong technical expertise in fused aluminas and premium calcined products. Operating from Austria, the company serves as a core supplier to the European ceramics and abrasives industries. In 2024, the company continued prioritizing energy-efficient processes and material innovation, aligning with sustainability trends across the region.

Nabaltec AG, headquartered in Germany, reinforced its position through its strong specialization in functional fillers and ceramic raw materials. The company’s specialty aluminas segment showed consistent growth due to increasing use in electrical insulation, refractories, and flame-retardant systems. In 2024, Nabaltec emphasized expanding its product applications and scaling up capacity to cater to customer-specific requirements.

Top Key Players in the Market

- Almatis

- Alteo Alumina

- Traxys S.à.r.l.

- Huber Engineered Materials

- Imerys Fused Minerals Villach GmbH

- Nabaltec AG

- Silkem d.o.o.

- MOTIM Electrocorundum Ltd.

- Sasol Germany GmbH

- Hindalco

- Resonac

- NICHE Fused Alumina

- Carborundum Universal Limited

- Axens Group

- Other Key Players

Recent Developments

- In October 2023, Alteo introduced HYCal®, a new brand of high-performance alumina solutions tailored for advanced ceramics. This product line underscores Alteo’s commitment to innovation and supporting the growth of its customers in the advanced ceramics sector.

- In February 2023, Traxys’ management, along with investors like Optiver, acquired full ownership of the company. This change aims to enhance Traxys’ role in supplying materials essential for energy transitions, potentially impacting their specialty aluminas business.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Billion Forecast Revenue (2034) USD 3.5 Billion CAGR (2025-2034) 3.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Calcined Alumina, Activated Alumina, Aluminium Trihydroxide (ATH), Fused Alumina (White, Brown), Boehmite, Reactive Alumina, Others), By Particle Size (Coarse, Fine, Ultra-fine, Medium), By Application (Refractory Materials, Ceramics, Abrasives, Polishing, Catalyst, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Almatis, Alteo Alumina, Traxys S.à.r.l., Huber Engineered Materials, Imerys Fused Minerals Villach GmbH, Nabaltec AG, Silkem d.o.o., MOTIM Electrocorundum Ltd., Sasol Germany GmbH, Hindalco, Resonac, NICHE Fused Alumina, Carborundum Universal Limited, Axens Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Specialty Aluminas MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Specialty Aluminas MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Almatis

- Alteo Alumina

- Traxys S.à.r.l.

- Huber Engineered Materials

- Imerys Fused Minerals Villach GmbH

- Nabaltec AG

- Silkem d.o.o.

- MOTIM Electrocorundum Ltd.

- Sasol Germany GmbH

- Hindalco

- Resonac

- NICHE Fused Alumina

- Carborundum Universal Limited

- Axens Group

- Other Key Players