Global Skimmed Milk Powder Market Size, Share, And Enhanced Productivity By Type (Flavoured Non Fat Powder, Whole Milk Powder, Butter Milk Powder), By Food Application (Confectionery, Bakery, Nutritional Food, Infant Formulas, Dry Mixes, Fermented Milk Products, Frozen Desserts, Meat Products, Others), By Distribution Channel (Modern Trade, Convenience Store, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169898

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

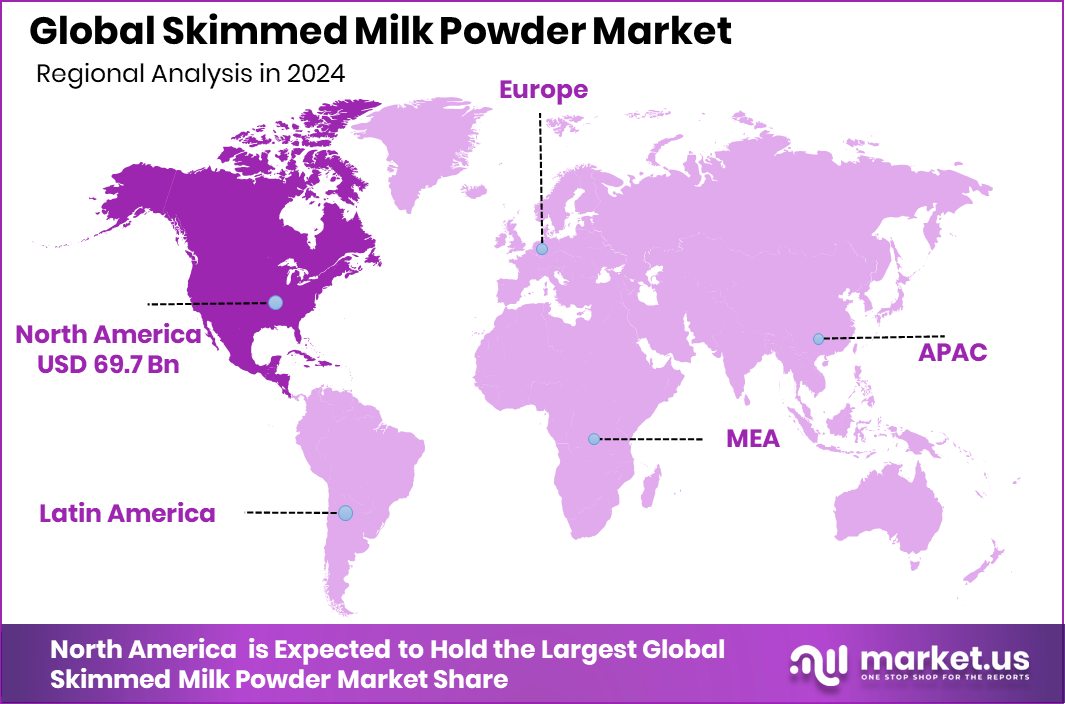

The Global Skimmed Milk Powder Market is expected to be worth around USD 280.7 billion by 2034, up from USD 152.4 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034. North America accounted for 45.80% of the Skimmed Milk Powder Market, USD 69.7 Bn.

Skimmed Milk Powder is made by removing cream and water from fresh milk, leaving a fine powder that is low in fat and high in protein, calcium, and lactose. It has a long shelf life and is easy to store and transport, which makes it useful for households, bakeries, beverage makers, and infant nutrition products. It is commonly reconstituted into liquid milk or used as a functional dairy ingredient.

Growth in skimmed milk powder largely comes from capacity expansion and innovation across dairy and food processing. A dairy cooperative recently secured a state grant to support a $5 million expansion of a High Point milk and ice cream plant, showing public support for modern dairy infrastructure. At the same time, fermentation-based milk proteins are emerging, with a French startup raising €7 million ($8.1 million) to develop casein-based “cheeseable milk” powder planned for 2027, widening the concept of milk powder itself.

Demand is rising from infant and child nutrition, driven by parents seeking cleaner labels and reliable protein sources. Organic infant formula brands have drawn strong investor backing, including $72 million raised by a SoHo-based startup and $32 million supporting the launch of a new organic infant formula. These developments increase downstream demand for skimmed milk powder and milk solids.

Opportunities are also expanding in confectionery and frozen desserts. Indian confectionery players raised INR 20 crore (USD 2.26 million), while brands in gelato bites and traditional sweets together attracted $5 million and another $5 million, highlighting the growing use of milk powders in indulgent foods.

- ByHeart raised $190 million to scale next-generation infant formula, supporting innovation in protein quality, gentle processing, and nutrition science that boosts long-term demand for milk-based powders.

- Fonterra Shareholders’ Fund rose from $3.60 to $8 on strong Mainland sales, reflecting improved returns from milk powder exports and reinforcing investment confidence across dairy value chains.

Key Takeaways

- The Global Skimmed Milk Powder Market is expected to be worth around USD 280.7 billion by 2034, up from USD 152.4 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034.

- Buttermilk powder dominates the skimmed powder market by type with a 67.9% share.

- Confectionery leads the skimmed milk powder market applications, capturing 19.3% of consumption share globally.

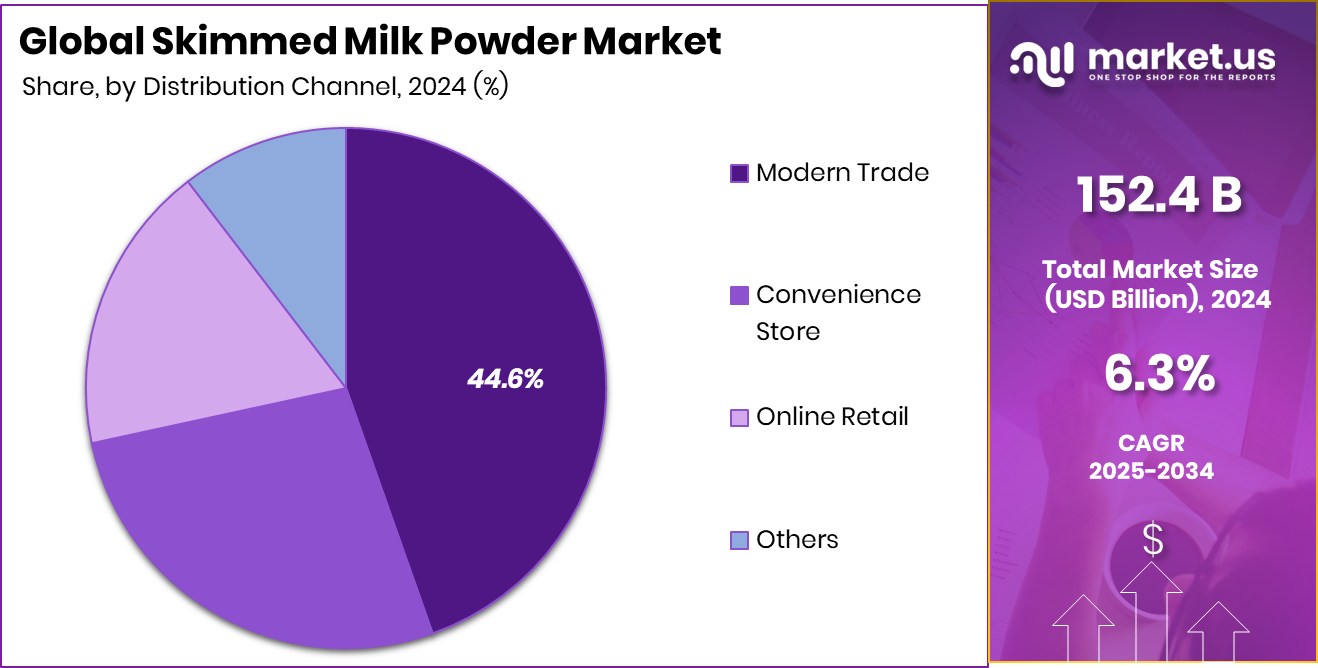

- Modern trade dominates distribution in the skimmed milk powder market, holding a 44.6% share.

- In North America, the Skimmed Milk Powder Market reached 45.80%, totaling USD 69.7 Bn.

By Type Analysis

Buttermilk powder leads the skimmed milk powder market with askimmed milk powder market 67.9% share, driven by processing versatility.

In 2024, buttermilk powder held a dominant market position in the By Type segment of the skimmed milk powder market, with a 67.9% share, reflecting its strong acceptance across industrial and institutional dairy applications. This leadership position highlights consistent demand for buttermilk powder as a stable skimmed dairy ingredient, valued for its functional reliability and processing efficiency.

The 67.9% share indicates wide adoption in large-volume usage environments where uniform quality, longer shelf life, and ease of storage are critical purchasing factors. Producers and bulk users continue to rely on buttermilk powder for standardized formulations, supporting its sustained market presence.

Overall, the dominant 67.9% market share underscores the segment’s established supply chains and dependable consumption patterns, reinforcing buttermilk powder’s importance within the skimmed milk powder market structure in 2024.

By Food Application Analysis

Confectionery accounts for 19.3% of demand in the skimmed milk powder market, supporting texture and sweetness applications.

In 2024, Confectionery held a dominant market position in the By Food Application segment of the Skimmed Milk Powder Market, with a 19.3% share, showing its strong role in value-added dairy ingredient usage. This dominance reflects the steady incorporation of skimmed milk powder in confectionery formulations where consistency, texture control, and flavor balance are essential.

The 19.3% share highlights sustained demand from confectionery manufacturers that depend on skimmed milk powder for reliable performance in large-scale production. Its stable composition supports uniform product outcomes, which is critical in standardized confectionery processing.

Overall, the 19.3% market share confirms confectionery as a key consumption area for skimmed milk powder in 2024, supported by continuous production cycles and predictable ingredient requirements within the segment

By Distribution Channel Analysis

Modern Trade controls 44.6% of sales across the skimmed milk powder market through organized retail expansion channels.

In 2024, Modern Trade held a dominant market position in the By Distribution Channel segment of the Skimmed Milk Powder Market, with a 44.6% share, reflecting its strong reach and structured retail presence for packaged dairy products. This dominance indicates that a significant portion of skimmed milk powder sales flows through organized retail formats that offer higher visibility and consistent availability.

The 44.6% share highlights the importance of large-scale retail networks in driving volume movement and maintaining consumer trust in standardized dairy offerings. Modern trade channels support efficient distribution, better inventory management, and wider geographic coverage.

Overall, the 44.6% market share underlines modern trade’s leading role in the skimmed milk powder market in 2024, supported by organized supply chains and established purchasing habits within this distribution channel.

Key Market Segments

By Type

- Flavored Nonfat Powder

- Whole Milk Powder

- Buttermilk Powder

By Food Application

- Confectionery

- Bakery

- Nutritional Food

- Infant Formulas

- Dry Mixes

- Fermented Milk Products

- Frozen Desserts

- Meat Products

- Others

By Distribution Channel

- Modern Trade

- Convenience Store

- Online Retail

- Others

Driving Factors

Rising Bakery And Confectionery Usage Drives Demand

A key driving factor for the skimmed milk powder market is its growing use in bakery, sweets, and confectionery products. Skimmed milk powder improves texture, taste, and shelf life while keeping fat levels low, making it suitable for modern recipes. Expansion across sweets and bakery businesses shows this clearly. MO Alts acquired a minority stake worth Rs 330 Cr in a Bengaluru-based ready-to-eat sweets company to strengthen the production of dairy-rich products such as traditional sweets and bakery items.

Luxury sweets brand Khoya Mithai raised over Rs 6 Cr in a pre-seed round to scale premium milk-based offerings. In the UK, a wholesale bakery received a £20,000 grant to upgrade systems and expand output, indirectly lifting demand for stable milk ingredients. Candy and snack innovation is also accelerating, highlighted by a sour candy brand raising $30M to expand product lines that rely heavily on milk solids.

- Candytoy Corporate raised INR 110 Cr (Series A) to expand manufacturing capacity and hire skilled talent, supporting higher usage of functional ingredients like skimmed milk powder in large-scale confectionery production.

- Joyride secured $30M in funding to grow its sour candy portfolio, increasing demand for milk-derived ingredients used for creaminess balance, flavor stability, and controlled sweetness in modern candy formulations.

Restraining Factors

Rising Costs And Shifting Preferences Limit Adoption

A major restraining factor for the skimmed milk powder market is increasing cost pressure, along with fast-changing consumer preferences. Many bakeries, snack brands, and protein food makers are experimenting with alternatives, which reduces steady reliance on traditional milk powders. When brands focus on high-protein bars or low-dairy recipes, skimmed milk powder volumes can fluctuate. This trend is visible as food companies redirect capital to new formulations and product categories.

A nutrition bar brand recently closed a $75M funding round following the September 2024 launch of its flagship bar containing 28 g of protein, showing how investment is moving toward concentrated protein formats that may reduce milk powder usage per unit. At the same time, bakeries are facing financial stress, as highlighted by debates around a proposed $132M bailout linked to employment and cost pressures, indicating a lower ability to absorb raw-material price swings such as milk solids.

Access to capital is also uneven across the bakery and dessert segment, limiting consistent demand growth. While multiple food startups across Australia and New Zealand collectively raised $59.61, the funds are split across many small players, slowing large-scale ingredient purchases. In India, bakery and dessert brands continue expanding but remain cost-sensitive, which restrains premium ingredient adoption despite funding inflows.

- The Baker’s Dozen raised Rs 33 crore, led by a consumer-focused venture arm to strengthen café expansion and bakery operations, but rising dairy input costs may still limit higher use of skimmed milk powder across outlets.

- Creme Castle secured Rs 7 crore in seed funding from a venture investor, supporting product expansion yet highlighting how early-stage dessert brands closely manage costs, often restricting bulk use of milk powder ingredients.

Growth Opportunity

Nutrition Programs And Smart Food Innovation Expansion

A major growth opportunity for the skimmed milk powder market lies in the expansion of nutrition-focused food programs and smarter food design. Milk powder is easy to store, simple to blend, and rich in protein, which makes it suitable for school meals, community feeding, and fortified foods. Public and institutional spending strengthens this opportunity.

Ontario increased student nutrition investment to $37.5 million, improving access to balanced meals that often use shelf-stable dairy ingredients. In parallel, health systems are stepping in where public aid falls short, with a major U.S. hospital group allocating $1 million to food assistance organizations to help families affected by gaps in nutrition support.

Private innovation is further accelerating demand. A Mumbai-based healthy food brand raised $18 million to scale clean-label and protein-rich foods, creating new uses for skimmed milk powder in everyday diets.

- Bezos Earth Fund granted $2 million to UC Davis and the American Heart Association to develop AI-designed sustainable foods, opening long-term opportunities for milk powder in nutritionally optimized, eco-friendly products.

Latest Trends

Premium Desserts And Animal-Free Dairy Innovation

A clear latest trend in the skimmed milk powder market is the shift toward premium desserts and next-generation dairy alternatives. Ice cream and frozen dessert brands are upgrading recipes to deliver better texture, balanced sweetness, and consistent quality, where skimmed milk powder remains a reliable base. This premium push is visible as an Indian ice cream brand secured $10M to expand high-end offerings nationwide. At the same time, food technology is reshaping dairy itself.

A fermentation-focused food company raised $47M to scale solid-state fermentation, while another alternative dairy startup closed $15M in seed extension funding to prepare for broader alt-milk launches. These innovations are redefining how milk proteins are produced and used, influencing future skimmed milk powder formats, blends, and functional roles.

- NIC plans to raise $20M to accelerate premium ice cream growth, signaling stronger demand for consistent dairy solids in upscale frozen desserts.

- Vivici raised $34M to expand animal-free dairy and move into lactoferrin, highlighting a trend toward precision-produced milk proteins alongside traditional powders.

Regional Analysis

North America leads the skimmed milk powder market with 45.80%, valued at USD 69.7 Bn.

North America dominates the skimmed milk powder market with 45.80%, valued at USD 69.7 Bn, reflecting its strong position within the global regional landscape. This dominance is supported by well-established dairy processing infrastructure, high consumption of standardized dairy ingredients, and consistent demand from food and beverage applications.

Europe represents a significant regional presence in the skimmed milk powder market, supported by long-standing dairy traditions and advanced processing capabilities. The region maintains steady demand driven by industrial food usage and regulated quality standards that favor skimmed dairy products. Europe’s market structure emphasizes consistency and large-scale production volumes.

Asia Pacific shows growing relevance in the market due to expanding food processing activities and increasing adoption of milk-based ingredients. The region’s role is shaped by rising usage of dairy powders in packaged foods and industrial formulations.

The Middle East & Africa segment reflects gradual development, supported by increasing reliance on processed dairy ingredients. Latin America demonstrates stable participation, backed by established dairy production bases and regional consumption patterns within the skimmed milk powder market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Fonterra Co-operative Group Limited remained a pivotal player in the global Skimmed Milk Powder Market in 2024, supported by its strong cooperative structure and large-scale milk collection network. The company’s integrated dairy operations allow consistent production of skimmed milk powder aligned with international quality requirements. Fonterra’s focus on efficiency, standardized processing, and export-oriented dairy solutions reinforces its relevance for bulk customers and food manufacturers seeking stable supply and uniform specifications.

Nestlé S.A. continued to strengthen its position through its broad dairy expertise and global manufacturing footprint. In 2024, the company leveraged its long-standing know-how in milk processing to ensure reliable skimmed milk powder output for diverse food applications. Nestlé’s emphasis on quality assurance, traceability, and product consistency supports its role as a trusted supplier within regulated and high-volume markets, particularly where premium dairy standards are expected.

Danone S.A. maintained a strategic presence in the skimmed milk powder space by aligning its dairy production with evolving nutritional and formulation needs. In 2024, the company’s focus on controlled sourcing and specialized dairy processing helped sustain demand across industrial and consumer-driven segments. Danone’s balanced approach to scale and quality positions it well within the global skimmed milk powder value chain.

Top Key Players in the Market

- Fonterra Co-operative Group Limited

- Nestlé S.A.

- Danone S.A.

- Arla Foods amba

- FrieslandCampina

- Lactalis Group

- Dairy Farmers of America (DFA)

- Saputo Inc.

- Glanbia plc

- Amul

Recent Developments

- In August 2025, Fonterra agreed to sell its global consumer and associated businesses to Lactalis for NZ$3.845 billion—a move that will enable Fonterra to concentrate on supplying milk and ingredients, including skimmed-milk powders, to business customers rather than retail consumers.

- In April 2024, Glanbia acquired Flavor Producers LLC—a US-based natural & organic flavors and extracts company—for an initial US$300 million plus deferred consideration. This expands Glanbia’s flavors and ingredient capabilities for food and beverage customers under its Nutritionals arm.

- In February 2025, Saputo announced that during its share-buyback program, it had repurchased 1,782,863 common shares at an average price of US$25.28—reflecting efforts to return value to shareholders.

Report Scope

Report Features Description Market Value (2024) USD 152.4 Billion Forecast Revenue (2034) USD 280.7 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Flavoured Non Fat Powder, Whole Milk Powder, Butter Milk Powder), By Food Application (Confectionery, Bakery, Nutritional Food, Infant Formulas, Dry Mixes, Fermented Milk Products, Frozen Desserts, Meat Products, Others), By Distribution Channel (Modern Trade, Convenience Store, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Fonterra Co-operative Group Limited, Nestlé S.A., Danone S.A., Arla Foods amba, FrieslandCampina, Lactalis Group, Dairy Farmers of America (DFA), Saputo Inc., Glanbia plc, Amul Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Skimmed Milk Powder MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Skimmed Milk Powder MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Fonterra Co-operative Group Limited

- Nestlé S.A.

- Danone S.A.

- Arla Foods amba

- FrieslandCampina

- Lactalis Group

- Dairy Farmers of America (DFA)

- Saputo Inc.

- Glanbia plc

- Amul