Global Pectin Powder Market By Product Type (High-methoxyl Pectin, Low-methoxyl Pectin), By Source (Citrus Fruits, Pears, Apples, Plums, Banana, Others), By Function (Gelling Agents, Thickener, Stabilizer, Fat Replacer, Others), By Application (Food and beverage, Dietary supplements, Pharmaceuticals, Personal care and cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 135255

- Number of Pages: 212

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

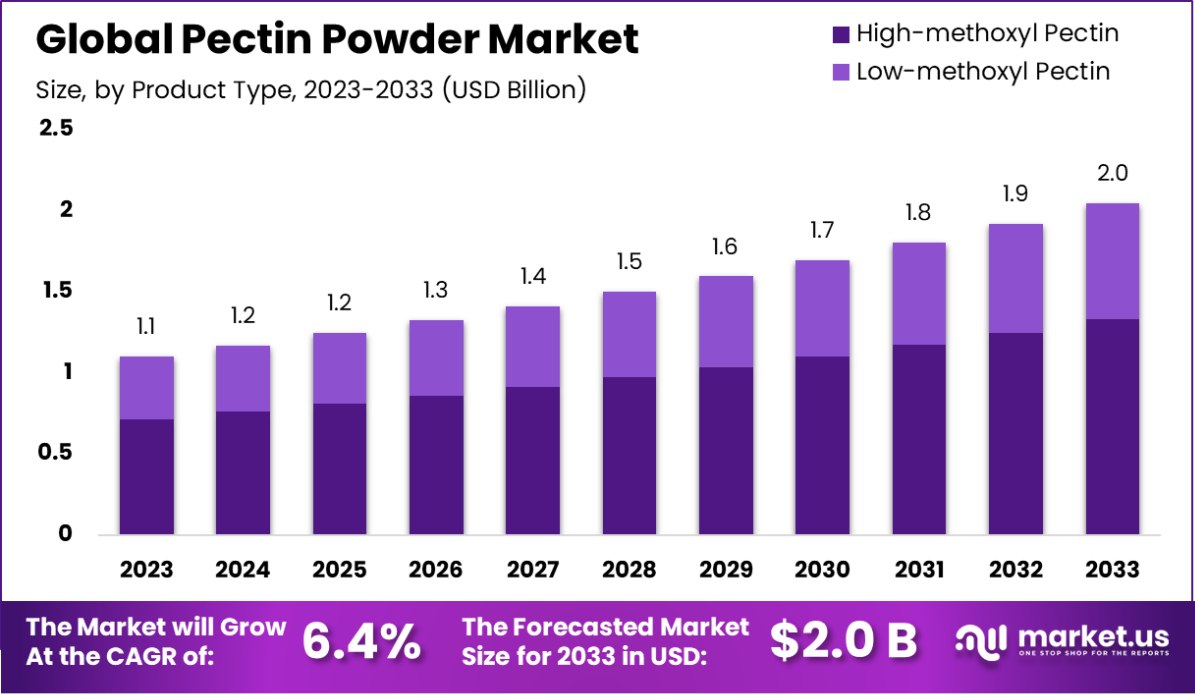

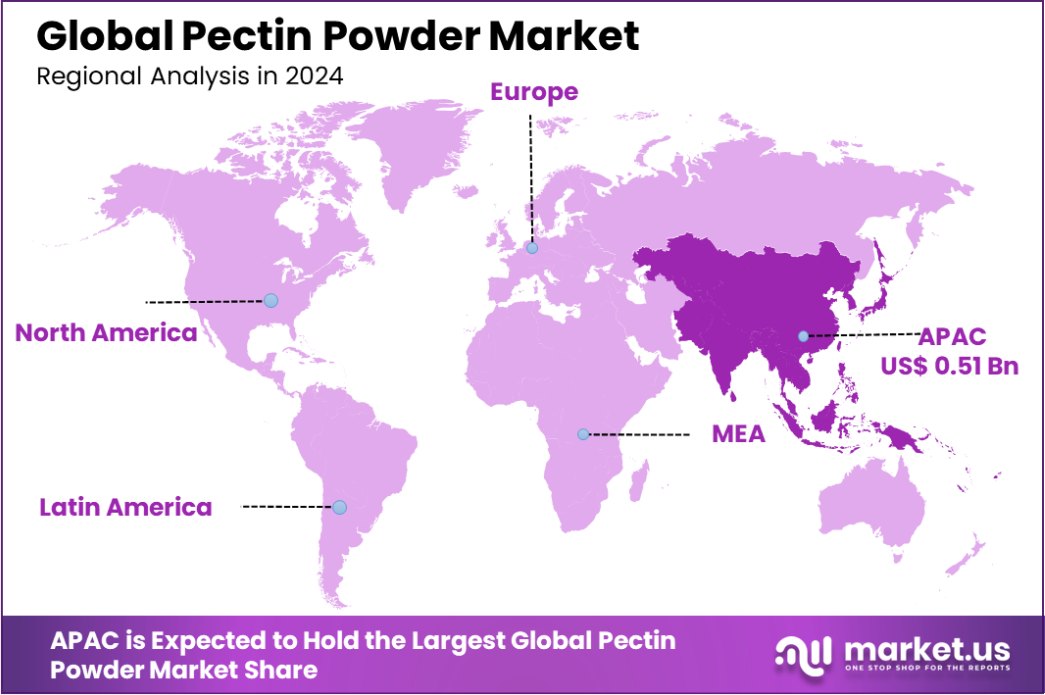

The Global Pectin Powder Market is expected to be worth around USD 2.0 Billion by 2033, up from USD 1.1 Billion in 2023, and grow at a CAGR of 6.4% from 2024 to 2033. The Asia-Pacific pectin powder market holds 45.4%, valued at USD 0.51 billion.

Pectin powder is a natural polysaccharide derived from the cell walls of fruits such as apples and citrus fruits. It is widely used as a gelling agent, thickener, and stabilizer in food products like jams, jellies, and dairy products, as well as in pharmaceuticals for its dietary fiber benefits.

The pectin powder market refers to the global industry involved in the production, distribution, and sale of pectin as a commercial product. This market is driven by the growing consumer preference for natural ingredients in food and personal care products.

Growth factors for the pectin powder market include the increasing demand for clean-label and organic products, innovations in food applications, and rising health consciousness among consumers.

Opportunities lie in expanding its use in nutraceutical products and exploring untapped markets in developing regions, driven by changing dietary patterns and economic growth.

The global Pectin Powder Market is witnessing significant growth driven by increasing demand across the food, pharmaceutical, and cosmetic industries. Pectin, a natural polysaccharide found primarily in fruit peels, serves as a gelling agent and stabilizer in various products, including jams, jellies, beverages, and dietary supplements.

The growing trend towards clean-label, natural ingredients in food products is bolstering the market’s expansion. Pectin’s versatility and natural origin make it a preferred choice in food formulation, especially with the rising consumer inclination toward healthier, additive-free alternatives.

One of the key drivers for the market’s growth is the abundant availability of pectin from fruit byproducts, particularly apple pomace and citrus peel, which are rich sources of pectin. Citrus peel, containing 20-30% pectin, and apple pomace, with 10-15%, are being increasingly utilized for pectin extraction, aligning with global sustainability goals of reducing food waste.

This is especially relevant in regions like India, where approximately 18% of the fruit and vegetable production value (Rs. 13,300 crores) is wasted annually, creating an untapped source of pectin. The hydrolysis of lime-treated fruit peel, followed by enzyme treatment, enhances pectin yield and ease of extraction, contributing to more efficient production processes.

Additionally, high methoxy pectin, which forms gels at a pH of below 3.5 and solid content above 55%, is extensively used in jam-making, given its desirable gel strength and setting time. As pectin is a non-toxic, natural ingredient, its increasing use across multiple industries, including pharmaceuticals and cosmetics, will continue to fuel market demand.

Key Takeaways

- The Global Pectin Powder Market is expected to be worth around USD 2.0 Billion by 2033, up from USD 1.1 Billion in 2023, and grow at a CAGR of 6.4% from 2024 to 2033.

- High-Methoxyl Pectin dominates the market, holding a 65.2% share by product type.

- Citrus fruits are the primary source of pectin, accounting for 56.1% of production.

- Pectin is most commonly used as a gelling agent, representing 47.1% of its functions.

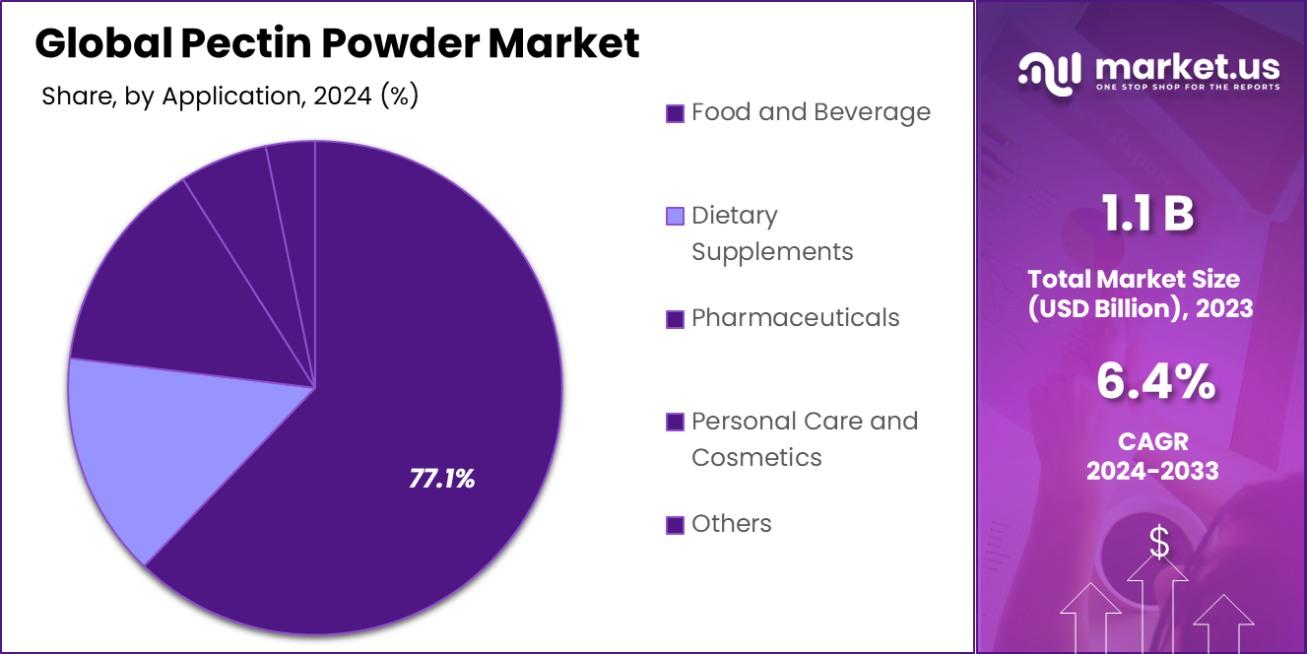

- The food and beverage sector is the largest application area, comprising 77.1% of the market.

- The Asia-Pacific pectin powder market dominates with a 45.4% share, valued at USD 0.51 billion.

By Product Type Analysis

High-methoxyl pectin dominates the market, holding a 65.2% share, favored for its superior gelling properties.

In 2023, High-Methoxyl Pectin held a dominant market position in the By Product Type segment of the Pectin Powder Market, commanding a 65.2% share. This type of pectin, which requires a high sugar concentration and acidic medium to gel, is extensively used in traditional jam and jelly manufacturing, driving its substantial market share.

Its popularity stems from its ability to form gels under a variety of conditions and its superior flavor release, which is highly valued in the food industry.

Conversely, Low-Methoxyl Pectin, which gels in the presence of calcium ions and does not require a high sugar content, accounted for the remainder of the market share. This type of pectin is gaining traction in low-sugar and sugar-free food products due to rising consumer demand for healthier dietary options.

It is increasingly utilized in dairy alternatives, desserts, and health-oriented food applications, where sugar reduction is a priority. The growing interest in functional and health-promoting foods presents significant opportunities for low-methoxyl pectin, indicating the potential for market expansion in response to evolving consumer preferences and regulatory trends toward healthier food formulations.

By Source Analysis

Citrus fruits are the primary source of pectin, comprising 56.1% of the market, due to their high pectin content.

In 2023, Citrus Fruits held a dominant market position in the By Source segment of the Pectin Powder Market, with a 56.1% share. This leadership stems from the high natural pectin content in citrus peels, which are a byproduct of the juice industry, thus ensuring a cost-effective and abundant source.

The widespread availability and established extraction processes from citrus fruits like oranges and lemons make them the preferred raw material for pectin manufacturers.

Apples, containing significant amounts of pectin, particularly in their skins and cores, captured the next largest market share. They are favored for their balanced gel strength and are extensively used in the production of pectin for food applications requiring less rigidity, such as fillings and spreads.

Other sources such as pears, plums, and bananas hold smaller shares. These sources are often explored for specialty pectin products aimed at diversifying texture and nutritional profiles in niche markets.

The use of such alternative sources is driven by the trend towards utilizing all parts of fruit waste and catering to a market increasingly attentive to sustainable production practices. This approach not only maximizes resource use but also aligns with consumer preferences toward environmental responsibility and waste reduction.

By Function Analysis

Pectin is extensively used as a gelling agent, accounting for 47.1% of its market function, enhancing food texture.

In 2023, Gelling Agents held a dominant market position in the By Function segment of the Pectin Powder Market, with a 47.1% share. Pectin’s ability to form gel-like structures at relatively low concentrations has made it an indispensable ingredient in the food industry, particularly in the production of jams, jellies, and confectioneries.

This functionality has been crucial for manufacturers aiming to meet the consistent demand for these products while adhering to clean-label standards that favor natural ingredients over synthetic alternatives.

Thickeners and stabilizers, other key functions of pectin, also represent significant portions of the market. As a thickener, pectin adds viscosity and body without impacting flavor, making it ideal for sauces, soups, and dairy products. As a stabilizer, it helps maintain the uniform dispersion of ingredients in complex formulations, crucial in beverages and dairy applications to prevent separation and improve mouthfeel.

Fat replacers, while holding a smaller share, are a growing segment, driven by consumer demand for lower-calorie and lower-fat food options. Pectin’s ability to mimic the mouthfeel of fat makes it a valuable component in developing healthier formulations without compromising taste or texture, indicating a potential for further expansion in this area as health-conscious trends continue.

By Application Analysis

The food and beverage sector is the largest application area for pectin, making up 77.1% of the market usage.

In 2023, Food and Beverage held a dominant market position in the By Application segment of the Pectin Powder Market, with a 77.1% share. This sector’s considerable demand for pectin is driven by its extensive use as a natural and versatile ingredient in various food products such as jams, jellies, dairy products, and bakery goods.

Pectin’s appeal in the food and beverage industry stems from its ability to improve texture, enhance mouthfeel, and stabilize ingredients, aligning with the growing consumer preference for natural and clean-label ingredients.

The Dietary Supplements segment also leverages pectin primarily for its dietary fiber properties, contributing to gastrointestinal health and wellness, which appeals to health-conscious consumers. This segment shows potential for growth as consumers increasingly seek out functional foods and supplements that offer additional health benefits.

Pharmaceuticals Personal Care and Cosmetics are smaller but steadily growing segments. In pharmaceuticals, pectin is valued for its use in wound healing dressings and controlled drug delivery systems.

Meanwhile, in personal care and cosmetics, pectin’s role as a bio-based thickener and stabilizer in formulations like lotions and creams is expanding as the industry moves towards more sustainable and gentle ingredients.

Key Market Segments

By Product Type

- High-methoxyl Pectin

- Low-methoxyl Pectin

By Source

- Citrus Fruits

- Pears

- Apples

- Plums

- Banana

- Others

By Function

- Gelling Agents

- Thickener

- Stabilizer

- Fat Replacer

- Others

By Application

- Food and beverage

- Dietary supplements

- Pharmaceuticals

- Personal care and cosmetics

- Others

Driving Factors

Rising Demand for Clean Label Products

The pectin powder market is significantly driven by the rising consumer preference for clean-label products, which are perceived as healthier and safer. Pectin, a natural ingredient, fits well into this category due to its organic origins in fruits.

This trend is amplified by increasing health consciousness among consumers who are actively avoiding artificial additives in their diets. As manufacturers respond to these preferences by reformulating products to include natural ingredients like pectin, its demand across food, pharmaceutical, and cosmetic sectors continues to grow robustly.

Growth in Functional and Healthy Foods

There’s a strong trend towards functional foods that offer specific health benefits beyond basic nutrition, which serves as a key driver for the pectin market. Pectin is recognized for its dietary fiber and prebiotic properties, contributing to digestive health and overall wellness.

This has spurred its integration into a variety of health-oriented products, including dietary supplements and functional beverages. As consumers increasingly seek foods that support health and well-being, the demand for pectin as a functional ingredient is expected to escalate further.

Expansion of the Global Processed Foods Industry

The expansion of the global processed foods industry is another major driver for the pectin market. With urbanization and the busy lifestyles of the modern consumer, there’s a growing reliance on convenient and ready-to-eat food products.

Pectin is a critical ingredient in many of these products due to its ability to enhance texture and stability. This trend is particularly strong in emerging markets, where rapid urbanization and income growth are enabling more consumers to buy processed foods, thereby boosting the demand for ingredients like pectin.

Restraining Factors

Fluctuating Raw Material Prices Impact Production Costs

The pectin powder market faces challenges due to the fluctuating prices of raw materials, primarily citrus peels and apple pomace, which are affected by agricultural conditions and market demand. These fluctuations can significantly impact production costs, making budgeting and pricing strategies more complex for manufacturers.

The dependency on seasonal fruit harvests adds to the uncertainty, potentially leading to supply shortages and increased prices of pectin, thus restraining market growth.

Competition from Synthetic and Alternative Gelling Agents

Pectin competes with several synthetic and alternative natural gelling agents that are often cheaper and more readily available. Products like gelatin, agar, and xanthan gum are used widely across food and pharmaceutical industries for similar applications.

The availability of these alternatives can limit pectin’s market share, especially in cost-sensitive markets where manufacturers may opt for less expensive ingredients to maintain profit margins, posing a significant challenge to pectin’s broader adoption.

Stringent Global Regulatory and Approval Processes

The global pectin market is also constrained by stringent regulatory and approval processes, which vary widely by region and application. The approval of pectin as a food additive or pharmaceutical ingredient involves detailed safety evaluations and compliance with diverse international standards.

This can slow down product launches and limit market entry, especially for new and innovative pectin applications. Navigating these regulatory landscapes requires significant time and investment, which can deter manufacturers from expanding pectin-based product offerings.

Growth Opportunity

Expanding Applications in Nutraceuticals and Functional Foods

There is a significant growth opportunity for pectin in the nutraceuticals and functional foods sector. As consumers increasingly seek products that support health and wellness, the demand for functional ingredients like pectin, which offers benefits such as digestive health and cholesterol management, is on the rise.

Manufacturers can capitalize on this trend by developing new pectin-based formulations for health-oriented products, potentially expanding their market reach and customer base in the rapidly growing health and wellness sector.

Increasing Demand in Emerging Markets

Emerging markets present a major growth opportunity for the pectin powder market. With rising incomes and urbanization, these regions are experiencing increased demand for processed and convenience foods, where pectin is a key ingredient due to its gelling and stabilizing properties.

By targeting these markets with localized production and distribution strategies, companies can tap into new consumer segments, driving growth and expanding their global footprint in the pectin industry.

Innovation in Eco-Friendly and Sustainable Products

Sustainability is becoming a crucial factor in consumer purchasing decisions, and there is a growing opportunity for innovation in eco-friendly and sustainable pectin products. Developing pectin extraction processes that utilize less energy or waste, or creating products that can replace synthetic ingredients in food and cosmetics, can meet consumer demands for sustainability.

This not only helps in building a greener brand image but also aligns with global regulatory trends towards environmentally friendly manufacturing practices, offering a competitive edge in the market.

Latest Trends

Rising Preference for Vegan and Plant-Based Products

A significant trend shaping the pectin powder market is the increasing consumer preference for vegan and plant-based products. As more people adopt vegetarian and vegan diets due to health, ethical, or environmental reasons, the demand for plant-based gelling agents like pectin intensifies.

Pectin is derived from fruits, making it an ideal component in vegan-friendly food products, thereby positioning it as a key ingredient in this rapidly expanding market segment.

Technological Advances in Pectin Extraction and Processing

Technological advancements in the extraction and processing of pectin are revolutionizing the market. Improved techniques are enabling manufacturers to extract pectin more efficiently and from a broader range of raw materials, such as previously underutilized fruit byproducts.

These innovations not only enhance yield and quality but also reduce production costs and environmental impact. As these technologies continue to evolve, they provide a substantial opportunity for companies to enhance their operational efficiencies and product offerings.

Increased Focus on Functional Dietary Fibers in Diets

Another emerging trend is the heightened focus on functional dietary fibers in consumer diets, with pectin at the forefront due to its health benefits. Pectin is well-known for its ability to aid digestion and regulate blood sugar levels, making it increasingly popular in dietary supplements and functional foods.

This trend is supported by a growing body of research that emphasizes the role of dietary fibers in maintaining overall health and propelling pectin’s inclusion in health and wellness products.

Regional Analysis

The Asia-Pacific pectin powder market holds a 45.4% share, valued at USD 0.51 billion, demonstrating significant growth.

The global pectin powder market exhibits distinct regional dynamics, influenced by local consumer preferences, regulatory environments, and economic conditions. Dominating the market with a 45.4% share and valued at USD 0.51 billion, Asia-Pacific leads due to robust demand from expanding food and pharmaceutical sectors, particularly in countries like China and India.

This region benefits from increasing urbanization and rising incomes, which enhance consumer spending on processed and convenience foods that often incorporate pectin for texturization and stabilization.

Europe follows closely, leveraging its advanced food processing industry and high consumer preference for natural and organic products. The stringent EU regulations supporting clean labels act as a catalyst for pectin demand, positioning Europe as a critical market for high-quality and sustainably sourced pectin.

North America, driven by the U.S., shows strong growth attributed to rising health awareness and the growing trend of clean-label food products. The region’s sophisticated supply chains and significant investments in R&D activities contribute to innovative pectin applications in health-oriented food products.

Latin America and the Middle East & Africa, although smaller in market size, are emerging as potential growth areas. Latin America benefits from its local citrus production, facilitating raw material access for pectin extraction. Meanwhile, the Middle East & Africa are gradually adopting more Western food habits, increasing the demand for processed foods containing pectin.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global pectin powder market will see significant contributions from several key players, each bringing distinct strengths and strategic positions. Companies like Cargill, Incorporated, and DuPont Inc. continue to dominate due to their extensive research and development capabilities, coupled with vast distribution networks.

These companies leverage their size and market reach to adapt quickly to changing consumer preferences, such as the increasing demand for clean-label and organic products.

B&V Srl and CEAMSA (Compañía Española de Algas Marinas S.A) excel in specialized segments, particularly in offering customized solutions to food and beverage manufacturers. Their focus on innovation in texture and stabilization plays a crucial role in catering to niche markets that require unique formulations, thereby securing their market positions through specialized offerings.

CP Kelco USA, Inc. and Herbstreith & Fox Corporate Group are noteworthy for their commitment to sustainable and ethical sourcing practices, which resonate well with the modern consumer’s inclination towards environmentally friendly products. This approach not only enhances their brand reputation but also aligns with global regulatory trends pushing for sustainable industry practices.

Emerging players like Yantai Andre Pectin Co. Ltd. are making significant inroads into the market by focusing on cost-effective production methods without compromising quality, appealing particularly to price-sensitive markets.

Companies like Tate & Lyle PLC and Ingredion Incorporated, with their global presence and broad product portfolios, continue to influence market dynamics through technological advancements and strategic partnerships, facilitating their expansion into new geographic and product segments.

Overall, the landscape in 2023 reflects a blend of traditional expertise and innovative approaches, with each key player leveraging its core competencies to adapt to the evolving demands of the pectin powder market.

Top Key Players in the Market

- B&V Srl

- Cargill, Incorporated

- CEAMSA

- Compañía Española de Algas Marinas S.A (CEAMSA)

- CP Kelco USA, Inc.

- DuPont Inc.

- Herbstreith & Fox Corporate Group

- Ingredion Incorporated

- Koninklijke DSM N.V.

- Lucid Colloids Ltd

- Lucid Colloids Ltd

- Naturex Group

- Quadra Chemicals

- Silvateam Food Ingredients

- Tate & Lyle PLC

- Yantai Andre Pectin Co. Ltd.

Recent Developments

- In 2023, Cargill expanded pectin production to meet the rising demand for natural ingredients, focusing on sustainable sourcing of citrus peels and investing in technology to enhance quality and efficiency in its pectin offerings for food and beverage industries.

- In 2023, Herbstreith & Fox Corporate Group specialize in high-quality pectin for the food, beverage, and pharmaceutical industries. It expanded its product range, focusing on sustainable sourcing, innovation, and clean-label solutions to meet the growing demand for natural, plant-based ingredients.

Report Scope

Report Features Description Market Value (2023) USD 1.1 Billion Forecast Revenue (2033) USD 2.0 Billion CAGR (2024-2033) 6.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (High-methoxyl Pectin, Low-methoxyl Pectin), By Source (Citrus Fruits, Pears, Apples, Plums, Banana, Others), By Function (Gelling Agents, Thickener, Stabilizer, Fat Replacer, Others), By Application (Food and beverage, Dietary supplements, Pharmaceuticals, Personal care and cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape B&V Srl, Cargill, Incorporated, CEAMSA, Compañía Española de Algas Marinas S.A (CEAMSA), CP Kelco USA, Inc., DuPont Inc., Herbstreith & Fox Corporate Group, Ingredion Incorporated, Koninklijke DSM N.V., Lucid Colloids Ltd, Lucid Colloids Ltd, Naturex Group, Quadra Chemicals, Silvateam Food Ingredients, Tate & Lyle PLC , Yantai Andre Pectin Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- B&V Srl

- Cargill, Incorporated

- CEAMSA

- Compañía Española de Algas Marinas S.A (CEAMSA)

- CP Kelco USA, Inc.

- DuPont Inc.

- Herbstreith & Fox Corporate Group

- Ingredion Incorporated

- Koninklijke DSM N.V.

- Lucid Colloids Ltd

- Lucid Colloids Ltd

- Naturex Group

- Quadra Chemicals

- Silvateam Food Ingredients

- Tate & Lyle PLC

- Yantai Andre Pectin Co. Ltd.