Global Cottonseed Meal Market By Product Type (Primary Meal, Secondary Meal, Others), By Market Type (Conventional, Organic), By Form (Pellets, Powder, Granules), By Application (Animal Feed, Aquaculture Feed, Organic Fertilizers), By End Use (Livestock, Poultry, Aquaculture), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 135218

- Number of Pages: 256

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

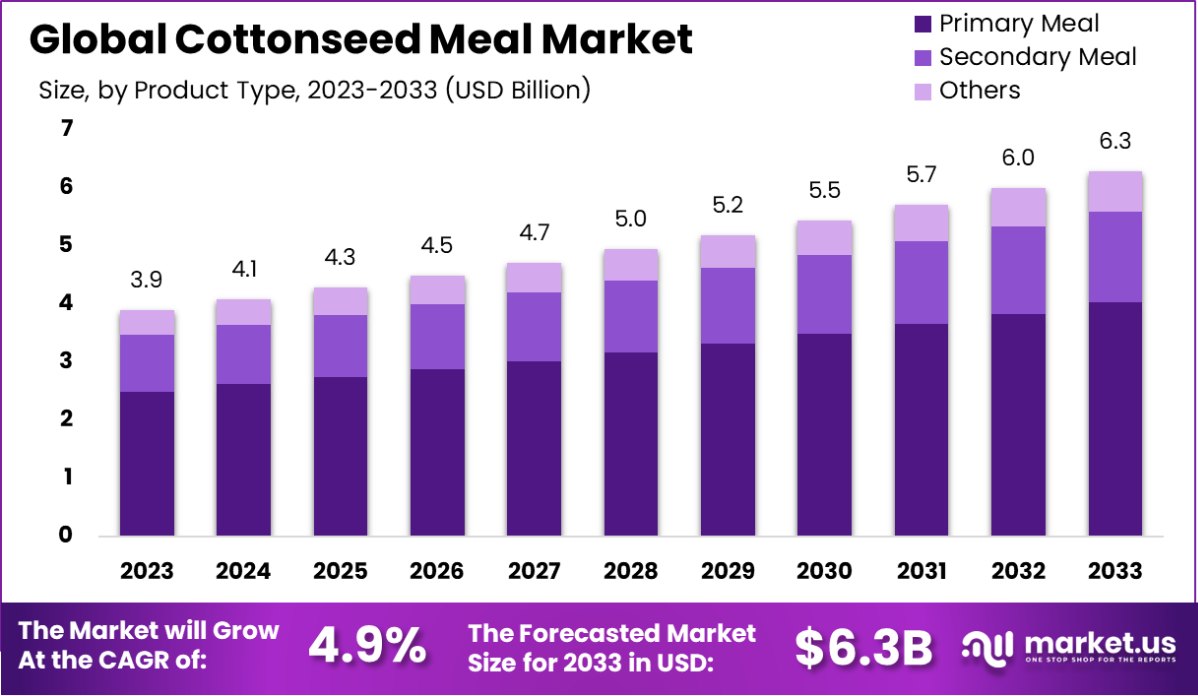

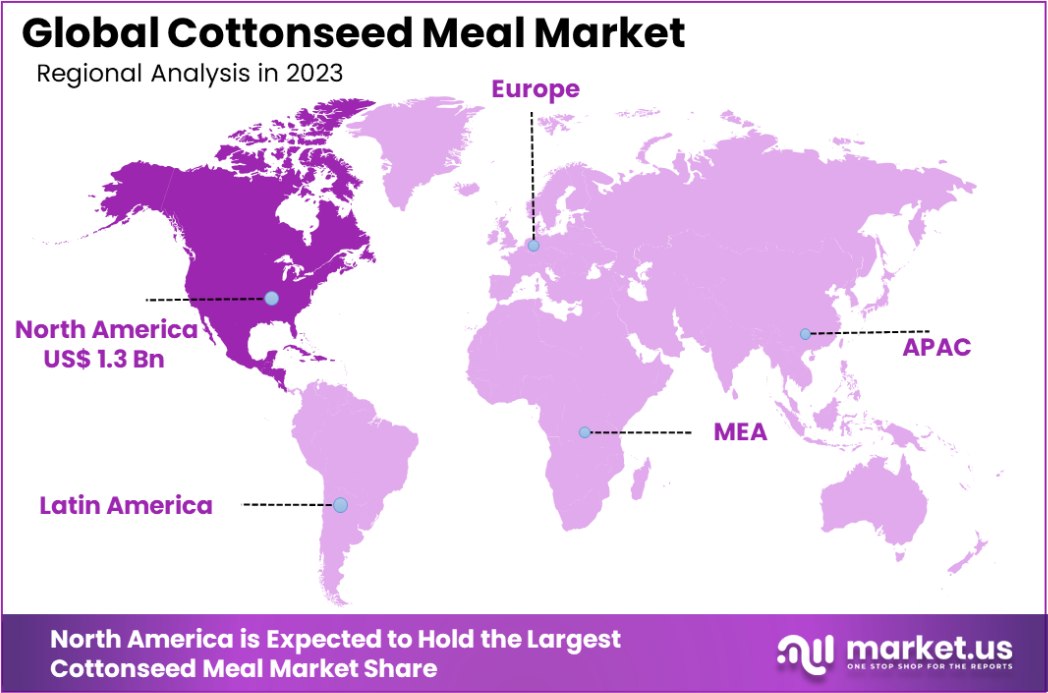

The Global Cottonseed Meal Market is expected to be worth around USD 6.3 Billion by 2033, up from USD 3.9 Billion in 2023, and grow at a CAGR of 4.9% from 2024 to 2033. North America holds 35.4% of the cottonseed meal market, valued at USD 1.3 billion.

Cottonseed meal is a byproduct of the oil extraction process from cotton seeds. It is commonly used as an animal feed due to its high protein content and as a fertilizer in agriculture because of its rich nutrient profile, including nitrogen, phosphorus, and potassium.

The cottonseed meal market encompasses the demand and supply of this byproduct primarily in the animal feed and agriculture sectors. The market’s dynamics are influenced by the production volumes of cotton and the associated industries’ demand for high-protein feed and organic fertilizers.

The market is driven by increasing demand for protein-rich livestock feed and the rising popularity of organic farming practices, which utilize natural fertilizers like cottonseed meal. Demand is robust among cattle and poultry feed manufacturers who value cottonseed meal’s high protein and fiber content, enhancing feed efficiency and animal health.

There’s significant growth potential in regions expanding into organic agriculture, as cottonseed meal serves as an excellent alternative to synthetic fertilizers, aligning with sustainable farming objectives and environmental regulations.

The Cottonseed Meal market is poised for substantial growth, reflecting an increasingly diversified application in animal feed and potential human consumption. As of the 2021/2022 forecast period, global cottonseed production was projected to reach approximately 43.8 million metric tons.

Highlighting the significant scale of raw material availability for cottonseed meal production capacity is driven by about 20 million cotton farmers worldwide, contributing to a production output that translates into 10 million tons of protein, potentially meeting the protein needs of 500 million people.

Cotto itself is recognized as a high-protein byproduct of oil extraction, containing about 50% protein, which makes it one of the most effective protein concentrates for milch cattle. The meal’s mark only supported by its nutritional profile but also by its cost-effectiveness in comparison to other protein sources.

The inherent presence of gossypol, a natural pest deterrent, although toxic in high doses, is currently addressed through biotechnological advancements. These innovations aim to develop ultra-low-gossypol cottonseed, enhancing its safety for broader consumption and significantly increasing its market potential, particularly for addressing hunger in developing nations.

Commercially, companies are key players within specific regional markets such as India, where it commands a premium of 39.3% over its competitors due to its superior product positioning and quality.

Since beginning operations in January 2010 and following strategic investments by SEAF in 2011, ACPL has seen remarkable growth, with sales estimated at over $70 million in 2014. The future for the Cottonseed Meaooks promising, with regulatory milestones for genetically modified crops presenting the next frontier for unlocking even greater value from this crop.

Key Takeaways

- The Global Cottonseed Meal Market is expected to be worth around USD 6.3 Billion by 2033, up from USD 3.9 Billion in 2023, and grow at a CAGR of 4.9% from 2024 to 2033.

- Primary Meal dominates the Cottonseed Meal Market, representing 64.5% of the product types available.

- Conventional products hold a significant share in the market, accounting for 78.1% of total sales.

- Pellets are the most common form of cottonseed meal, making up 43.2% of the market.

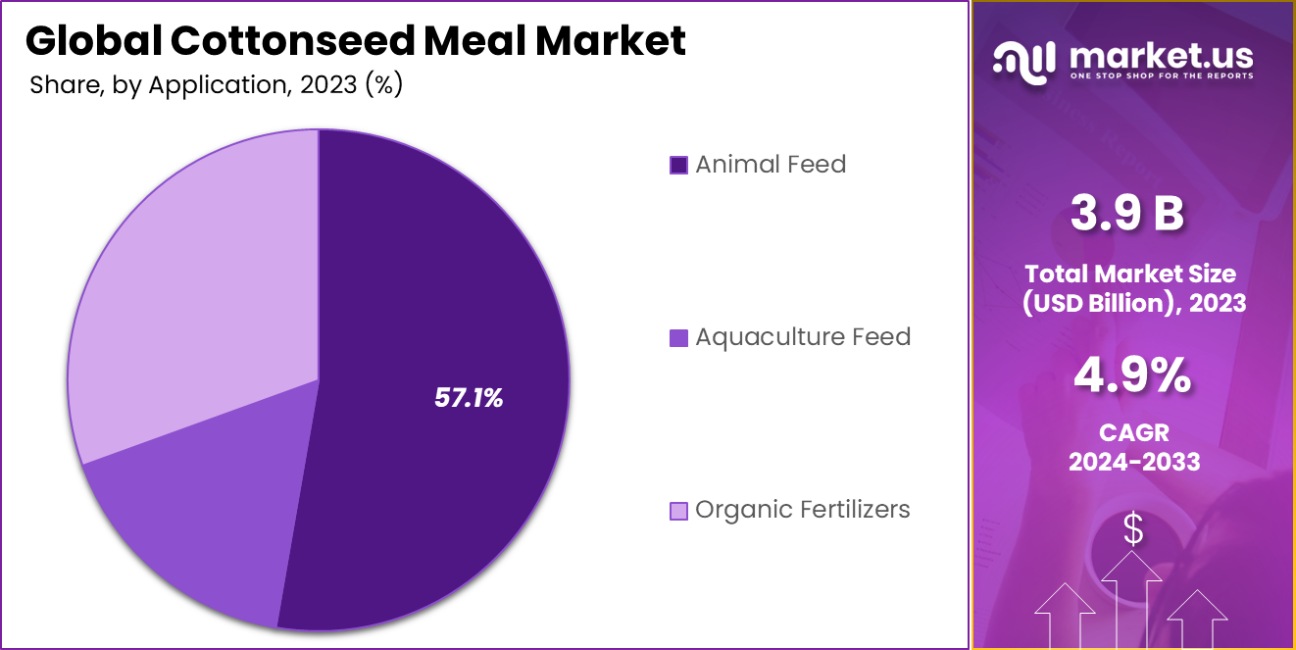

- Animal feed is the primary application for cottonseed meal, comprising 57.1% of its use.

- Within end uses, livestock feed utilizes 49.1% of the market, emphasizing its importance.

- North America holds 35.4% of the cottonseed meal market, valued at USD 1.3 billion.

By Product Type Analysis

Primary meal dominates the cottonseed meal market, comprising 64.5% of the product types available.

In 2023, Primary Meal held a dominant market position in the By Product Type segment of the Cottonseed Meal Market, with a 49.2% share. This segment’s strength is primarily due to its widespread use in high-protein livestock feeds, which are essential for the dairy and meat industries.

The high nutrient content of Primary meat, particularly in terms of protein and fiber, makes it a preferred choice for feed manufacturers aiming to optimize animal health and productivity.

On the other hand, Secondary Meal, which is typically lower in protein content but still retains significant nutritional value, accounted for the remainder of the market share. While it is less favored than Primary Meal for premium livestock feeds, it finds substantial application in budget feeds and as a soil amendment in agricultural settings.

The market dynamics for both segments are influenced by factors such as fluctuations in cotton production, technological advancements in oil extraction, and evolving regulations in animal feed standards. The ongoing research and development aimed at improving the efficiency of nutrient extraction from cottonseed are likely to further refine the market’s composition.

Additionally, sustainability trends and the push towards organic farming practices present growth opportunities, particularly in the use of Secondary Meal as an organic fertilizer, which can leverage its lower nutrient density to offer a slower, more sustainable nutrient release.

By Market Type Analysis

Conventional cottonseed meal holds a significant market share of 78.1%, preferred for its cost-effectiveness and availability.

In 2023, Conventional cottonseed meal held a dominant market position in the By Market Type segment of the Cottonseed Meal Market, with a 49.2% share. This segment’s prominence is attributed to its established use in traditional agriculture and livestock feed sectors, where cost-effectiveness and high-volume availability are critical.

Conventional cottonseed meal benefits from streamlined production processes and a robust distribution network that caters to large-scale farming operations and feed manufacturers seeking economical feed solutions.

Meanwhile, the Organic segment, though smaller, is rapidly gaining traction, driven by the global shift towards sustainable and environmentally friendly farming practices. Organic cottonseed meal is increasingly preferred in organic farming setups for its natural nutrient content, which supports soil health without the use of synthetic chemicals. This segment appeals to a niche yet growing market of consumers and producers dedicated to organic products, which are often sold at a premium.

The market dynamics for both Conventional and Organic segments are shaped by consumer trends, regulatory changes, and technological advancements in agricultural practices. The rising consumer awareness about the benefits of organic products is likely to boost the growth of the Organic segment, while the Conventional segment continues to benefit from its established presence and scalability.

By Form Analysis

Pellets are the most common form of cottonseed meal, making up 43.2% of the market, due to easy handling.

In 2023, Pellets held a dominant market position in the By Form segment of the Cottonseed Meal Market, with a 49.2% share. The pellet form of cottonseed meal is highly favored in animal feed applications due to its convenience in handling, storage, and transportation.

Pellets help reduce feed wastage and ensure uniformity in feed intake by livestock, which is crucial for maintaining consistent growth rates and health. The compact nature and reduced dust of pellets also contribute to their popularity in both small-scale and industrial livestock operations.

Powder and Granules form the rest of the market, with each catering to specific needs within the agricultural and feed sectors. Powder is particularly valued in the pet food industry and small-holder farms where precise mixing of feed ingredients is required.

Granules, on the other hand, are often preferred for their ease of use in soil amendment applications, releasing nutrients slowly and enhancing soil structure.

Market dynamics for these forms are influenced by technological advances in feed processing and the growing emphasis on sustainable agricultural practices. As producers continue to seek efficient and environmentally friendly feed options, the demand for innovative forms like advanced granules and specialized pellets is expected to rise, potentially reshaping market shares in the coming years.

By Application Analysis

The primary application of cottonseed meal is in animal feed, accounting for 57.1% of its usage.

In 2023, Animal Feed held a dominant market position in the By Application segment of the Cottonseed Meal Market, with a 49.2% share. This segment’s leadership is underpinned by the high demand for cottonseed meal as a protein-rich supplement in the diets of ruminants, poultry, and swine.

Its nutritional profile, which includes essential amino acids and a high fiber content, makes it an excellent choice for enhancing animal growth and overall health. The economic viability of cottonseed meal, compared to other protein sources, also contributes to its prevalence in animal feed formulations.

Aquaculture Feed and Organic Fertilizers constitute the other parts of the market. Aquaculture Feed is expanding as fish farming practices grow globally, with cottonseed meal serving as a sustainable feed ingredient that helps improve feed conversion ratios and sustain aquaculture systems.

Organic Fertilizers, meanwhile, are gaining momentum in the market due to the rising trend towards organic and sustainable farming practices. Cottonseed meal, as an organic fertilizer, offers a slow-release of nutrients, which is beneficial for maintaining soil health and fertility over longer periods.

The market dynamics across these segments reflect shifting dietary preferences, sustainability concerns, and innovations in feed and fertilizer technology, with ongoing research and development likely to introduce further shifts in market composition and growth opportunities.

By End Use Analysis

Livestock end use represents 49.1% of the market, highlighting its importance in the diet of farm animals.

In 2023, Livestock held a dominant market position in the By End Use segment of the Cottonseed Meal Market, with a 49.2% share. This segment benefits significantly from the high protein and fiber content of cottonseed meal, making it a staple in the diets of cattle, sheep, and goats.

Its ability to improve feed efficiency and animal health, particularly in ruminants, has cemented its position as a favored feed ingredient within the livestock industry. The cost-effectiveness of cottonseed meal compared to other protein sources also adds to its appeal, supporting its widespread use in economically sensitive agricultural markets.

Poultry and Aquaculture are the other key segments. The Poultry segment utilizes cottonseed meal to enhance the protein content in feed, supporting optimal growth and egg production. As the global demand for poultry continues to rise, so does the reliance on cost-effective feed options like cottonseed meal.

In the Aquaculture segment, it is increasingly used as a protein substitute in fish feed formulations, driven by the expansion of sustainable aquaculture practices that favor environmentally friendly feed ingredients.

The market dynamics of these segments are influenced by global trends in meat and fish consumption, dietary shifts, and the ongoing development of feed technology, promising continued growth and evolution in cottonseed meal applications.

Key Market Segments

By Product Type

- Primary Meal

- Secondary Meal

- Others

By Market Type

- Conventional

- Organic

By Form

- Pellets

- Powder

- Granules

By Application

- Animal Feed

- Aquaculture Feed

- Organic Fertilizers

By End Use

- Livestock

- Poultry

- Aquaculture

Driving Factors

Rising Demand for High-Protein Animal Feed

Cottonseed meal is rich in protein, making it a valuable ingredient for animal feed, especially for livestock and poultry. The increasing global demand for animal-based protein products drives the demand for high-quality animal feed, and cottonseed meal is seen as a cost-effective source.

This trend is fueled by the growing meat and dairy industries in both developed and emerging economies. As the demand for affordable, nutritious feed continues to rise, cottonseed meal’s role in the market expands significantly.

Growth in Organic Farming and Sustainable Agriculture

The shift towards organic farming and sustainable agricultural practices has boosted the use of cottonseed meal as a natural fertilizer. Rich in essential nutrients like nitrogen and phosphorus, it enhances soil health while being an eco-friendly alternative to synthetic fertilizers.

As more farmers adopt organic practices, the demand for cottonseed meal as a natural input increases. This growth is driven by consumer preference for organic food products and the global push for sustainability in agriculture.

Cost-Effectiveness Compared to Other Protein Sources

Cottonseed meal remains a cost-effective alternative to other protein-rich animal feed ingredients, such as soybean meal or fishmeal. Its lower price point provides farmers and feed manufacturers with an affordable option without compromising nutritional value.

With rising global feed costs, the price advantage of cottonseed meal is increasingly attractive to producers. This factor has accelerated its demand, particularly in emerging economies where cost-efficiency is crucial for the growth of the agriculture and livestock sectors.

Restraining Factors

Limited Availability Due to Cotton Production Volatility

The availability of cottonseed meal is directly linked to cotton production levels. Any disruptions in cotton farming—due to unfavorable weather conditions, pests, or market fluctuations—can limit the supply of cottonseed meal.

These disruptions lead to price volatility and shortages, hindering the stability of the cottonseed meal market. As a result, its use as an animal feed and fertilizer becomes less predictable, making it a less reliable option for large-scale producers and farmers who require consistent supplies.

Presence of Anti-Nutritional Factors in Cottonseed Meal

Cottonseed meal contains compounds like gossypol, which can be toxic to animals when consumed in high amounts. This natural toxin limits its use in animal feed, especially for poultry and certain livestock. The process of detoxifying cottonseed meal to remove gossypol adds extra costs and complexity for producers.

As a result, many livestock and poultry farmers opt for other protein-rich feed ingredients that don’t require additional treatment, thereby restricting the growth potential of the cottonseed meal market.

Competition from Alternative Feed Ingredients

Cottonseed meal faces strong competition from other widely used feed ingredients like soybean meal, corn gluten, and fishmeal. These alternatives are often more readily available and are perceived to have higher nutritional value for animals.

As demand for animal protein continues to rise globally, livestock producers seek the most efficient and cost-effective feed solutions. While cottonseed meal is a good alternative, its lower nutrient profile and limited availability can make it less attractive when compared to these other feed sources.

Growth Opportunity

Expanding Use in Organic Farming and Eco-Friendly Practices

With the increasing global trend toward organic farming and sustainable agriculture, cottonseed meal presents a growing opportunity. It is seen as a natural fertilizer that enriches soil without harmful chemicals, making it an attractive option for organic growers.

As more farmers switch to eco-friendly and sustainable practices, the demand for cottonseed meal as a soil enhancer is expected to rise. This trend provides a significant growth opportunity in both organic crop production chemical and sustainable farming practices across various regions.

Rising Animal Feed Demand in Emerging Economies

The rising demand for meat and dairy products in emerging markets, particularly in Asia, Africa, and Latin America, presents a substantial growth opportunity for cottonseed meal. As the population and income levels in these regions continue to grow, there is an increased need for affordable, high-protein animal feed.

Cottonseed meal is an effective, cost-efficient alternative to other protein-rich feed ingredients. This makes it a preferred choice for livestock and poultry farmers in these regions, creating a strong growth potential in the animal feed industry.

Increasing Adoption of Cottonseed Meal in Aquaculture

Aquaculture, or fish farming, is one of the fastest-growing sectors in the global food industry. As demand for fish and seafood increases, the need for high-quality, affordable feed ingredients grows as well. Cottonseed meal, with its protein-rich content, has significant potential in aquaculture feed formulations.

As the aquaculture industry expands in both developed and emerging economies, the adoption of cottonseed meal as an ingredient in fish feed is expected to grow. This provides a promising opportunity for market players in the cottonseed meal sector.

Latest Trends

Increased Focus on Cottonseed Meal as Animal Feed

Cottonseed meal is gaining popularity as a cost-effective and protein-rich animal feed, particularly in the livestock and poultry sectors. The increasing global demand for affordable animal feed is driving this trend. Cottonseed meal provides an alternative to more expensive feed ingredients, such as soybean meal.

As feed producers look for budget-friendly options without compromising on quality, cottonseed meal’s use continues to grow. This trend is especially noticeable in emerging markets where farmers are seeking more affordable feed solutions.

Growing Interest in Cottonseed Meal for Aquaculture

The aquaculture industry is experiencing rapid growth, and cottonseed meal is emerging as an important feed ingredient in fish farming. Due to its high protein content, cottonseed meal is being incorporated into aquafeed formulations as an alternative to fishmeal.

This trend is driven by both the rising global demand for seafood and the need for sustainable aquaculture practices. As wild fish populations decline, aquaculture is seen as a key solution to meet global protein needs, further increasing the demand for cottonseed meal.

Innovation in Cottonseed Meal Processing for Nutritional Value

Advancements in processing techniques are allowing for better utilization of cottonseed meal by removing harmful compounds like gossypol. This trend is enabling cottonseed meal to be used more widely in animal feed without compromising animal health.

New technologies are making it possible to detoxify cottonseed meal more efficiently and cost-effectively. As a result, cottonseed meal is becoming more accessible to a broader range of livestock and poultry farmers, contributing to its growing role in the global animal feed market.

Regional Analysis

The North American cottonseed meal market holds a 35.4% share, valued at USD 1.3 billion.

The Cottonseed Meal Market is segmented by region, with North America leading the market, holding 35.4% of the global share, valued at USD 1.3 billion. The dominance of North America is largely attributed to the United States, which is a major cotton producer.

The demand for cottonseed meal as an essential component of animal feed, particularly for poultry and livestock, continues to grow in this region. Furthermore, the adoption of cottonseed meal for sustainable agriculture and organic farming practices contributes to its widespread use.

In Europe, the cottonseed meal market is driven by increasing interest in organic farming and sustainable agricultural practices. European countries like France, Spain, and Italy are gradually incorporating cottonseed meal into animal feed and soil conditioning, although the market share remains smaller than North America. This region is expected to witness moderate growth as organic and eco-friendly farming practices gain popularity.

Asia Pacific is emerging as a key growth region due to rising cotton production and expanding livestock industries in countries like India and China. The demand for cottonseed meal as a protein-rich, cost-effective animal feed ingredient is increasing rapidly. As Asia Pacific’s livestock and aquaculture sectors expand, the market for cottonseed meal is expected to grow significantly.

In the Middle East & Africa and Latin America, cottonseed meal adoption is growing as well, driven by increasing agricultural and livestock production. These regions, while smaller in market share, are projected to experience robust growth due to rising demand for affordable animal feed and natural fertilizers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Cottonseed Meal Market is highly competitive, with numerous key players driving growth through innovation, strategic partnerships, and geographical expansion. Companies such as ADM, Cargill, and Bunge Limited dominate the market, benefiting from their extensive distribution networks and strong presence in both animal feed and agricultural products.

These multinational corporations are leveraging their capabilities in processing and supply chain management to maintain leadership positions in North America, Europe, and emerging markets in Asia-Pacific.

China National Chemical Corporation and COFCO Group, major players in Asia, have capitalized on the region’s growing cotton production and the increasing demand for protein-rich feed ingredients. These companies are also expanding their footprint in the aquaculture and livestock sectors, further driving market growth.

Additionally, Olam International Limited and Wilmar International Limited are making significant strides in diversifying cottonseed meal applications across various industries, from animal feed to organic fertilizers.

Smaller regional players like Cottonseed Solutions and Shree Ram Proteins are increasingly competing on price and quality, particularly in emerging markets where demand for cost-effective feed ingredients is rising.

Similarly, companies such as Oilseeds Australia and Richardson International Limited focus on organic and sustainable agricultural practices, positioning themselves in a growing niche of environmentally-conscious consumers and farmers.

The market is witnessing continuous consolidation through mergers and acquisitions, with companies such as Louis Dreyfus Company and Dreyfus Corporation strengthening their market share by expanding into new regions and diversifying their product offerings. As sustainability trends continue to evolve, these key players are likely to focus on innovation and environmentally friendly practices to stay competitive in the evolving cottonseed meal market.

Top Key Players in the Market

- ADM

- American Cotton Shippers Association

- Bunge Limited

- Cargill, Incorporated

- China National Chemical Corporation

- COFCO Group

- Cottonseed Solutions

- Dreyfus Corporation

- Groupe Sofiprotéol

- Hodgson Mill

- Louis Dreyfus Company

- N.K.Proteins

- Oilseeds Australia

- Olam International Limited

- Planters Cotton Oil Mill

- Richardson International Limited

- Shandong Huaao

- Shree Ram Proteins

- Sime Darby Plantation Berhad

- Stillwater Milling Company

- Sunopta Inc.

- The Scoular Company

- TT Limited

- Wilmar International Limited

- Yihai Kerry

- Arawana Holdings

- Zhongmin Group

- Zouping Fuhai

Recent Developments

- In 2023, Louis Dreyfus Company enhanced cottonseed meal production with advanced processing technology, improving protein content and efficiency while focusing on sustainability and reducing environmental impact.

- In 2023, Olam International’s Cottonseed Meal operations saw growth driven by rising animal feed demand, particularly in emerging markets. The company leveraged its global supply chain and sustainability innovations, contributing significantly to its agricultural and food processing revenue.

Report Scope

Report Features Description Market Value (2023) USD 3.9 Billion Forecast Revenue (2033) USD 6.3 Billion CAGR (2024-2033) 4.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Primary Meal, Secondary Meal, Others), By Market Type (Conventional, Organic), By Form (Pellets, Powder, Granules), By Application (Animal Feed, Aquaculture Feed, Organic Fertilizers), By End Use (Livestock, Poultry, Aquaculture) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ADM, American Cotton Shippers Association, Bunge Limited, Cargill, Incorporated, China National Chemical Corporation, COFCO Group, Cottonseed Solutions, Dreyfus Corporation, Groupe Sofiprotéol, Hodgson Mill, Louis Dreyfus Company, N.K.Proteins, Oilseeds Australia, Olam International Limited, Planters Cotton Oil Mill, Richardson International Limited, Shandong Huaao, Shree Ram Proteins, Sime Darby Plantation Berhad, Stillwater Milling Company, Sunopta Inc., The Scoular Company, TT Limited, Wilmar International Limited, Yihai Kerry , Arawana Holdings, Zhongmin Group, Zouping Fuhai Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cottonseed Meal MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Cottonseed Meal MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ADM

- American Cotton Shippers Association

- Bunge Limited

- Cargill, Incorporated

- China National Chemical Corporation

- COFCO Group

- Cottonseed Solutions

- Dreyfus Corporation

- Groupe Sofiprotéol

- Hodgson Mill

- Louis Dreyfus Company

- N.K.Proteins

- Oilseeds Australia

- Olam International Limited

- Planters Cotton Oil Mill

- Richardson International Limited

- Shandong Huaao

- Shree Ram Proteins

- Sime Darby Plantation Berhad

- Stillwater Milling Company

- Sunopta Inc.

- The Scoular Company

- TT Limited

- Wilmar International Limited

- Yihai Kerry

- Arawana Holdings

- Zhongmin Group

- Zouping Fuhai