Global Oat Drinks Market By Flavor (Natural/Unflavored, Flavored), By Nature (Organic, Conventional, By Format (Shelf-stable, Refrigerated), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Store, Mass Grocery Retailers, Food and Drink Specialty Store, Online Retailing, Others), By End-use (Food Services, Quick-service Restaurants, Full-service Restaurants, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: December 2024

- Report ID: 135222

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Flavor Analysis

- By Nature Analysis

- By Format Analysis

- By Distribution Channel Analysis

- By End-use Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

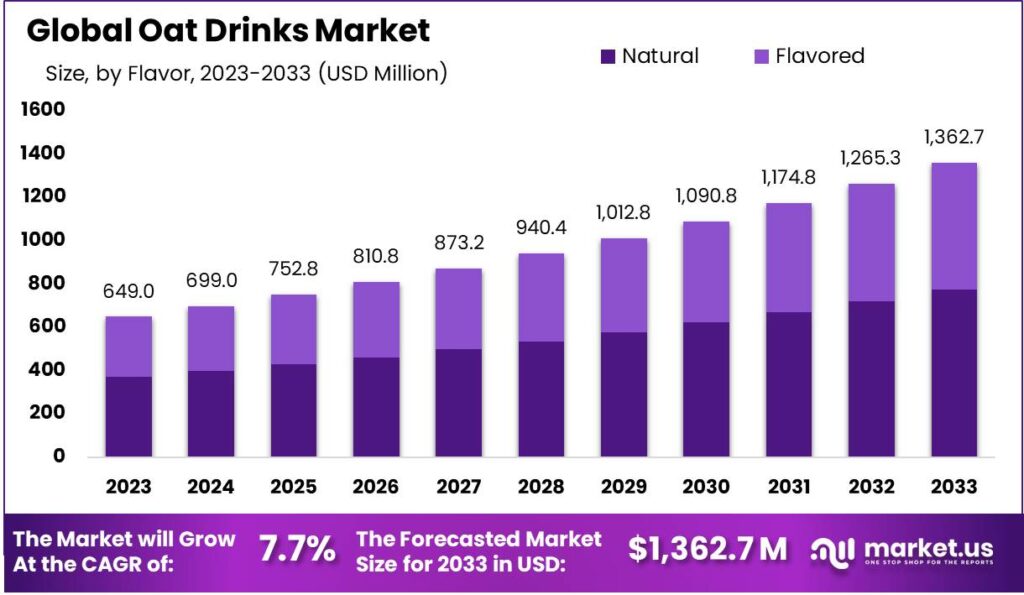

The Global Oat Drinks Market size is expected to be worth around USD 1362.7 Million by 2033, from USD 649.0 Million in 2023, growing at a CAGR of 7.7% during the forecast period from 2024 to 2033.

The Oat Drinks Market has seen a significant rise in consumer interest and industry growth over the past few years. As consumers become more conscious of health, environment, and dietary preferences, oat drinks have emerged as a popular alternative to dairy and other plant-based milks.

This shift is partly due to the creamy texture and mild flavor of oat drinks, which make them a versatile choice for both drinking and culinary uses.

Oat drinks are increasingly favored by consumers seeking lactose-free, vegan, or hypoallergenic options. The demand is further driven by the growing awareness of the nutritional benefits of oats, such as high fiber content and essential vitamins, which align well with current health-conscious trends.

Additionally, oat drinks are seen as a sustainable choice, given that oats require less water and lower agricultural inputs compared to nuts and dairy.

The popularity of oat drinks can also be attributed to their widespread availability and adoption in mainstream cafes and supermarkets. Major coffee chains incorporating oat milk into their menus have significantly boosted their visibility and acceptance. This mainstreaming has led to a surge in consumer trials and repeated purchases, positioning oat drinks not just as a niche product but as a staple in many households.

The market opportunities for oat drinks extend beyond just milk alternatives. Innovations in flavor, packaging, and marketing, along with the expansion into oat-based yogurts, ice creams, and cheeses, present significant growth prospects. There’s also potential to enhance the health benefits of oat drinks by fortifying them with additional nutrients like calcium and protein, catering to a broader range of dietary needs.

Market expansion for oat drinks looks promising. As production techniques improve and scale up, the cost of oat drinks will likely become more competitive with other milk alternatives and even dairy milk. This affordability, coupled with continuous product innovation and expanding distribution channels, suggests that oat drinks will continue to grow in both markets and consumer preferences.

The global oat-based beverages market is witnessing significant growth, driven by increasing consumer awareness of health benefits, a rising vegan population, and a shift towards plant-based diets. In 2022, the market was valued at approximately USD 728.7 million and is projected to expand at a compound annual growth rate (CAGR) of 7.7% from 2023 to 2032, potentially reaching around USD 1.52 billion by the end of the forecast period.

The North American market, particularly the United States, plays a crucial role in the industry, with a market size exceeding USD 156.8 million in 2022. The growth in this region is largely supported by the expansion of the e-commerce sector, which facilitates the distribution and accessibility of oat-based beverages.

Internationally, significant market activities include new product launches and strategic expansions by key players like Oatly and Califia Farms. These companies are innovating in response to consumer demands for health-oriented and environmentally sustainable products. For instance, market players are increasingly focusing on organic oat-based beverages, which represent a major share of the market due to their health benefits and alignment with consumer preferences for natural and non-GMO products.

In Asia, countries like China and South Korea are experiencing robust growth in the oat-based beverages market. In South Korea, for example, the market is expected to grow at a CAGR of 10.2%, influenced by the increasing adoption of veganism and flexitarian diets. Local brands in these regions are gaining prominence by catering to local tastes and offering competitive pricing.

Key Takeaways

- The Global Oat Drinks Market size is expected to be worth around USD 1362.7 Million by 2033, from USD 649.0 Million in 2023, growing at a CAGR of 7.7% during the forecast period from 2024 to 2033.

- Natural/Unflavored dominated the Flavor segment of the Oat Drinks Market with a 57.6% share.

- Conventional dominated the By Nature segment of the Oat Drinks Market with a 65.6% share.

- Shelf-stable dominated the Oat Drinks Market with a 76.4% share in the By Format segment.

- Hypermarkets/Supermarkets dominated the By Distribution Channel segment of the Oat Drinks Market with a 39.7% share.

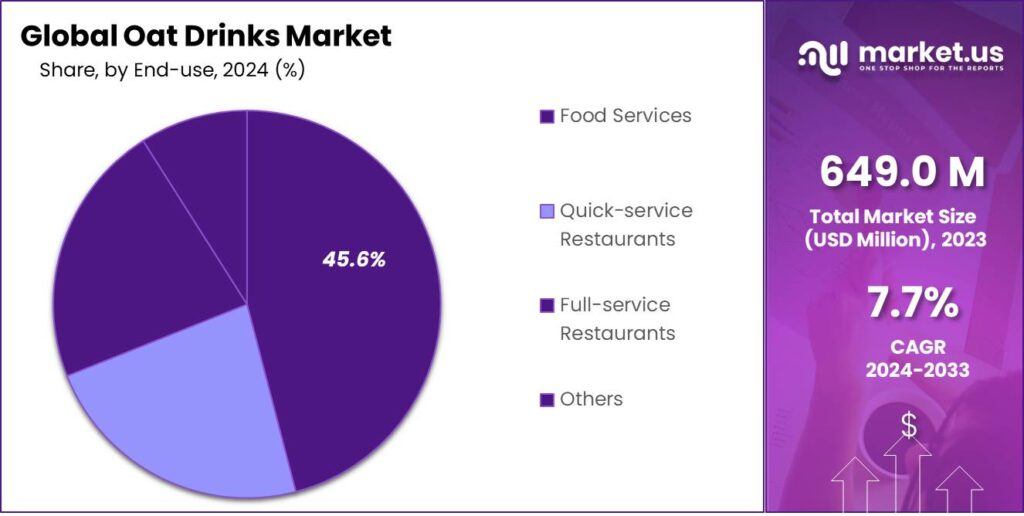

- Food Services dominated the Oat Drinks Market with a 45.6% share By End-Use segment.

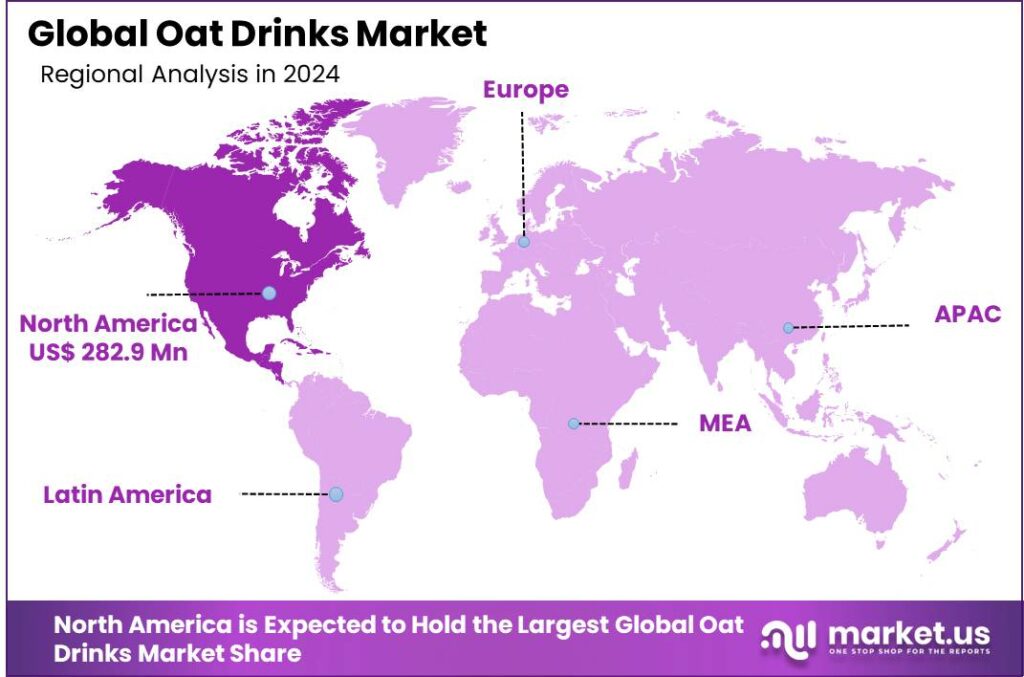

- North America dominated the oat drinks market with a 43.4% share, valued at USD 282.9 million, driven by health trends and dietary shifts.

By Flavor Analysis

In 2023, Natural/Unflavored held a dominant market position in the By Flavor segment of the Oat Drinks Market, capturing more than a 57.6% share. This category’s strong performance is primarily attributed to consumer preferences for products with fewer additives and a more authentic taste, aligning with growing health consciousness and a shift towards plant-based diets.

Natural/Unflavored oat drinks are particularly favored for their versatility in various culinary applications, ranging from direct consumption to use as a dairy alternative in recipes, further bolstering their market presence.

The Flavored segment, which includes varieties such as chocolate, vanilla, and fruit-infused options, also shows substantial traction. These products appeal to younger demographics and those seeking variety in their plant-based beverage choices, contributing to dynamic segment growth.

However, despite the innovation and expanded product offerings in the Flavored category, it trails behind the Natural/Unflavored segment, indicating a strong consumer base that favors the simplicity and purity of unflavored oat drinks.

By Nature Analysis

In 2023, Conventional held a dominant market position in the By Nature segment of the Oat Drinks Market, capturing more than a 65.6% share. The conventional oat drinks sector thrives primarily due to its affordability and widespread availability compared to its organic counterparts.

These factors make it a preferred choice among a broad consumer base, particularly in markets where cost sensitivity and accessibility are significant deciding factors. The production process for conventional oat drinks typically allows for higher yields and lower retail prices, which supports its substantial market share.

The Organic segment, though smaller, is gaining traction as consumers increasingly seek products with claims of being free from pesticides and artificial substances, aligning with the global trend towards health and sustainability. Despite this growth, organic oat drinks face challenges such as higher price points and limited production capacities, which currently restrict their market penetration compared to conventional oat drinks.

By Format Analysis

In 2023, Shelf-stable held a dominant market position in the By Format segment of the Oat Drinks Market, capturing more than a 76.4% share. This format’s widespread popularity is largely due to its convenience and long shelf life, which appeal to consumers looking for durability and ease of storage.

Shelf-stable oat drinks do not require refrigeration until opened, making them ideal for on-the-go consumption and stockpiling, which resonates well in today’s fast-paced lifestyle. Additionally, they are favored in regions where refrigeration is less common or where consumers prefer bulk purchasing.

The Refrigerated segment, while smaller, caters to a niche market that values freshness and often perceives refrigerated options as more natural or healthier. This segment is growing, particularly in well-developed markets with greater consumer awareness and higher demand for premium products.

However, the need for cold storage throughout the supply chain makes refrigerated oat drinks less accessible and more expensive than their shelf-stable counterparts.

By Distribution Channel Analysis

In 2023, Hypermarkets/Supermarkets held a dominant market position in the By Distribution Channel segment of the Oat Drinks Market, capturing more than a 39.7% share. This channel’s success is attributed to its ability to offer a wide variety of oat drink brands and formulations under one roof, providing convenience and choice to consumers.

The extensive reach and strategic location of hypermarkets and supermarkets, often in densely populated areas, make them accessible to a large customer base, significantly driving sales.

The Convenience Store channel, although smaller, is notable for providing easy access to quick purchases, catering especially to busy consumers looking for on-the-go options. Meanwhile, Mass Grocery Retailers also play a crucial role, similar to hypermarkets but often with a focus on bulk purchases and competitive pricing, appealing particularly to price-sensitive consumers.

Food & Drink Specialty Stores offer a curated selection, often featuring premium or niche products that cater to health-conscious or gourmet shoppers, though their market share is limited by higher prices and more selective locations.

Online Retailing is rapidly growing, driven by the rise of e-commerce platforms and changing consumer shopping habits, offering convenience and sometimes broader selections than physical stores.

By End-use Analysis

In 2023, Food Services held a dominant market position in the By End-Use segment of the Oat Drinks Market, capturing more than a 45.6% share. This segment includes a broad range of establishments like cafeterias, hospitals, and schools, where oat drinks are increasingly offered as a healthy beverage option.

The popularity of oat drinks in food services is driven by the growing consumer demand for plant-based and lactose-free alternatives, aligning with the broader health and wellness trend that prioritizes sustainability and dietary needs.

Quick-service Restaurants (QSRs) also contribute significantly to the market, incorporating oat drinks into their menus as part of a strategy to attract health-conscious customers. Meanwhile, Full-service Restaurants are gradually adding oat drinks to their offerings, often in premium forms such as artisanal coffee blends and specialty beverages, appealing to customers seeking quality and variety.

Key Market Segments

By Flavor

- Natural/Unflavored

- Flavored

By Nature

- Organic

- Conventional

By Format

- Shelf-stable

- Refrigerated

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Store

- Mass Grocery Retailers

- Food & Drink Specialty Store

- Online Retailing

- Others

By End-use

- Food Services

- Quick-service Restaurants

- Full-service Restaurants

- Others

Driving factors

Rising Popularity of Plant-Based Diets

The global oat drinks market is significantly driven by the increasing adoption of plant-based diets among health-conscious consumers. As more people seek alternatives to animal products due to health, environmental, and ethical concerns, oat milk has emerged as a popular choice.

Its creamy texture and mild flavor make it an appealing substitute for dairy milk, and it’s often enriched with vitamins and minerals, enhancing its nutritional profile. This trend is supported by the growing awareness of lactose intolerance and dairy allergies, further propelling the demand for oat drinks.

Environmental Sustainability Concerns

Oat drinks are gaining traction as a more environmentally sustainable option compared to dairy and some other plant-based milks. The production of oat milk generally requires less water and results in lower greenhouse gas emissions than dairy milk production.

As global awareness of environmental impacts increases, consumers are turning to more sustainable options that align with their values. This shift is further supported by initiatives from manufacturers who promote the sustainability benefits of oat drinks, appealing to environmentally conscious consumers and driving market growth.

Expansion of Vegan Product Ranges by Manufacturers

Manufacturers are increasingly expanding their product ranges to include vegan options, recognizing the growing consumer demand for plant-based products. Oat drinks benefit from this trend as they naturally align with vegan diets.

Companies are not only increasing the availability of oat drinks but are also innovating in flavor and fortification to cater to diverse tastes and nutritional needs. This strategic expansion into new markets and demographic segments is creating more opportunities for the oat drinks industry, enhancing its growth and visibility.

Restraining Factors

High Competition from Other Plant-Based Milk

The oat drinks market faces significant competition from a variety of other plant-based milks like almond, soy, and coconut milk. Each alternative offers distinct health benefits and flavor profiles that appeal to different consumer preferences.

Almond milk, for instance, is known for its low-calorie content, while soy milk is rich in protein. This variety enables consumers to choose based on taste, dietary needs, and nutritional content, potentially limiting the market share of oat drinks among consumers exploring plant-based alternatives.

Volatility in Oat Supply and Price Fluctuations

The production and pricing of oat drinks can be significantly affected by fluctuations in oat supply, which are influenced by various factors such as weather conditions, farming practices, and global trade policies.

When oat prices increase due to poor harvests or trade disruptions, the cost of producing oat drinks also rises. This can lead to higher retail prices for oat drinks, making them less competitive against other dairy and non-dairy alternatives, potentially restraining market growth.

Limited Consumer Awareness Outside Urban Areas

While oat drinks are gaining popularity in urban centers, there is still limited awareness and availability in rural or less urbanized regions. This gap in market penetration can act as a restraint on the overall growth of the oat drinks market.

Consumers in these areas may not be as exposed to plant-based trends or may have limited access to diverse retail channels that offer such products. Increasing awareness and distribution in these regions remains a challenge for producers aiming to expand their market reach.

Growth Opportunity

Expanding Global Markets with Rising Health Consciousness

The global expansion of the oat drinks market presents a significant growth opportunity, driven by increasing health consciousness among consumers worldwide. As more people become aware of the health benefits associated with oat drinks, such as lower cholesterol levels and improved heart health, the demand for oat milk is rising.

This trend is particularly strong in regions where dairy consumption is traditionally low or where there is a high prevalence of lactose intolerance. Entering these new markets with targeted marketing strategies and localized products can significantly boost the global presence and sales of oat drink brands.

Innovation in Flavors and Functional Ingredients

There is a growing opportunity for oat drink manufacturers to innovate by diversifying their product offerings with new flavors and functional ingredients. By incorporating popular flavors such as vanilla, chocolate, or strawberry, and adding health-boosting additives like probiotics, omega-3s, and additional fibers, companies can cater to a broader range of consumer tastes and dietary needs.

This not only attracts a wider audience but also enhances the product’s appeal as a nutritious and tasty alternative to traditional dairy and other plant-based milks.

Strategic Partnerships with Coffee Shops and Restaurants

Forming strategic partnerships with coffee shops and restaurants offers a lucrative growth opportunity for the oat drinks market. Oat milk’s ability to froth similarly to dairy milk makes it an ideal choice for coffee and other beverages, which is increasingly recognized by baristas and consumers alike.

By collaborating with these establishments to offer oat milk as a default or featured option, manufacturers can increase product visibility and consumption. Such partnerships also provide a platform to showcase the versatility of oat drinks in various culinary applications, further stimulating market growth.

Challenge

Competition from Traditional Dairy and Other Plant-based Beverages

The oat drinks market faces significant competition from both traditional dairy products and other plant-based alternatives like almond, soy, and rice milk. As consumers explore various plant-based options, the demand for oat drinks must overcome the entrenched loyalty to dairy and the growing popularity of other non-dairy beverages.

This competition is driving innovation and price sensitivity, forcing oat drink brands to differentiate themselves on taste, health benefits, and sustainability. Companies need to highlight the unique attributes of oat-based drinks to capture a larger market share.

Supply Chain and Sourcing of High-Quality Oats

Securing a steady and reliable supply of high-quality oats remains a major challenge for the oat drinks industry. Oats are a key ingredient, and fluctuations in agricultural production due to weather conditions, crop diseases, or rising costs can directly affect the availability and cost of oats.

The volatility in raw material prices can lead to increased production costs, impacting profitability. Oat drink manufacturers need to build resilient supply chains and consider partnerships with farmers or invest in sustainable agricultural practices to ensure a stable supply of oats for their products.

Consumer Awareness and Education on Health Benefits

While oat drinks are considered a healthy alternative to dairy, many consumers are still unaware of the specific health benefits, such as their potential to support heart health, digestion, and sustainability. Educating consumers about the nutritional value of oats and their environmental benefits is crucial for market growth.

The challenge lies in overcoming misinformation and promoting oats as a nutritious, eco-friendly choice over other plant-based beverages. Effective marketing campaigns and in-store education can help increase consumer awareness and drive the adoption of oat-based products.

Emerging Trends

The oat drinks market is experiencing notable trends that are shaping its future. One key trend is the rise in demand for clean-label and organic products. Consumers are increasingly seeking transparency in their food products, preferring items that are free from artificial additives and made with non-GMO ingredients.

This shift is driving oat drink manufacturers to focus on sourcing premium, organic raw materials and highlighting the naturalness of their products in their marketing efforts.

Another significant trend is the fortification of oat drinks with additional nutrients like vitamins and minerals. This not only enhances the health benefits of these beverages but also caters to the nutritional needs of consumers looking for more than just hydration from their drinks.

The inclusion of natural sweeteners like honey and agave instead of artificial ones is also gaining traction, appealing to health-conscious consumers who are mindful of their sugar intake.

Finally, there’s a growing interest in oat-based ready-to-drink (RTD) teas and coffees among startups and younger consumers. This trend is fueled by the demand for convenience combined with the health benefits of oat drinks, making these products increasingly popular in fast-paced environments.

Business Benefits

The trends emerging in the oat drinks market present numerous business benefits. For one, the push towards clean and organic labels opens up opportunities for companies to differentiate their products in a crowded market. By focusing on transparency and quality, brands can build stronger trust and loyalty among consumers, potentially commanding a premium price for their offerings.

Moreover, the innovation in product fortification and the use of natural sweeteners can help companies tap into the growing segment of health-conscious consumers. These enhanced products not only meet the dietary preferences of a wider audience but also align with the global shift towards healthier, more sustainable diets.

This could lead to increased market share and customer retention as consumers increasingly look for products that contribute positively to their health.

Additionally, the increasing popularity of oat-based RTD beverages represents a significant growth opportunity, particularly in urban markets where consumers value convenience. By expanding into this segment, companies can leverage the trend of on-the-go consumption and cater to the needs of young professionals and millennials, who are often looking for quick, nutritious options that fit their busy lifestyles.

Regional Analysis

In 2023, North America dominated the oat drinks market with a 43.4% share, valued at USD 282.9 million, driven by health trends and dietary shifts.

In 2023, North America held a dominant position in the oat drinks market, capturing more than a 43.4% share with revenues reaching USD 282.9 million. This robust market performance can be attributed to several key factors. Firstly, the growing consumer awareness regarding the health benefits of oat drinks, such as their high fiber content and cholesterol-lowering properties, has significantly driven demand.

Europe follows closely, driven by heightened consumer preferences for sustainable and plant-based products. European markets have seen a considerable increase in the consumption of oat drinks, supported by strong government initiatives promoting healthier lifestyles. Moreover, the presence of leading oat drink brands that focus on product innovation and extensive marketing campaigns has helped increase visibility and consumer uptake in this region.

The Asia Pacific region is witnessing the fastest growth in the oat drinks market, thanks to changing dietary habits and increasing health consciousness among consumers. Countries like China and India are leading this surge, with local manufacturers expanding their product lines to include oat drinks, tapping into the large lactose-intolerant population seeking dairy alternatives.

Latin America the Middle East and Africa are emerging markets in the oat drinks industry. These regions show promising growth potential due to the gradual shift towards healthier dietary preferences and the increasing availability of oat drinks through expanding retail channels.

While these markets currently hold smaller shares, their growth is supported by rising urbanization and the young demographic inclined towards adopting Western dietary trends, which include plant-based diets.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

Analyzing the dynamic global oat drinks market in 2024, several key players stand out for their strategic positions and innovative approaches. Among them, Danone S.A., Oatly AB, Quaker Oats Company (a PepsiCo subsidiary), and Califia Farms are particularly noteworthy.

Danone S.A. has leveraged its extensive experience in the dairy alternatives sector to carve out a significant niche in the oat drinks market. By focusing on sustainability and health, Danone appeals to environmentally conscious consumers who are also looking for nutritional benefits in their beverages. Danone’s global reach and established distribution networks provide a formidable platform for scaling up its oat drink offerings.

Oatly AB, originally from Sweden, has been a trailblazer in popularizing oat drinks outside of Europe, particularly in North America and Asia. Oatly’s strong focus on branding and its outspoken stance on environmental and health issues resonate well with a younger, more informed consumer base. The company’s commitment to transparency in sourcing and production processes further strengthens its market position.

Quaker Oats Company, under PepsiCo, capitalizes on its longstanding reputation and extensive expertise in oat-based products. Their entry into the oat drinks market is supported by robust marketing strategies and the advantage of an existing loyal customer base. Quaker’s focus on convenience and health, exemplified by fortified products, positions it well to cater to busy, health-focused consumers.

Califia Farms stands out for its innovative product formulations and eye-catching packaging. Known for its plant-based beverages, Califia has successfully extended their product line to include oat drinks, which are praised for their taste and creamy texture. Their commitment to using non-GMO ingredients and focus on clean, sustainable production practices appeal to health-conscious consumers.

These companies, through strategic marketing, innovation in product development, and an emphasis on sustainability, are poised to drive forward the growth of the oat drinks market in 2024. Each brings a unique strength to the table, from global reach and established brand reputation to innovative marketing and commitment to sustainability.

Market Key Players

- Abafoods s.r.l.

- Alpro

- Cereal Base

- Ceba AB

- Danone S.A.

- Drink Simple Pacifica Beverage

- Earth’s Own Food Company

- Elmhurst Milked Direct LLC

- Hälsa Foods

- Happy Planet Foods

- Kaslink Foods Oy

- Lima Food SRL

- Minor Figures

- Nancy’s Oatmilk

- Nature’s Path Foods

- Oatly AB Califia Farms

- Oatworks

- Pacific Foods of Oregon LLC

- Pureharvest

- Quaker Oats Company (PepsiCo)

- Rude Health

- The Hain Celestial Inc.

- Valsoia S.p.A.

Recent Development

- In May 2024, Nestlé Singapore introduced OAT and ALMOND & OAT drinks, which are fortified with essential nutrients like vitamins B2, B3, and D, along with calcium. This launch is part of Nestlé’s strategy to cater to the rising demand for nutritious, plant-based alternatives.

- In January 2024, Oatly unveiled two new variants of oat milk: Unsweetened Oatmilk and Super Basic Oatmilk. These products are designed to offer enhanced nutritional benefits and cater to health-conscious consumers looking for tasty dairy alternatives.

- In October 2023, Califia Farms announced a partnership with Starbucks to introduce a new line of oat milk beverages exclusively available at Starbucks locations. This initiative aims to boost Califia Farms’ brand presence and meet the growing consumer interest in plant-based options.

Report Scope

Report Features Description Market Value (2023) USD 649.0 Million Forecast Revenue (2033) USD 1362.7 Million CAGR (2024-2032) 7.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Flavor (Natural/Unflavored, Flavored), By Nature (Organic, Conventional, By Format (Shelf-stable, Refrigerated), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Store, Mass Grocery Retailers, Food & Drink Specialty Store, Online Retailing, Others), By End-use (Food Services, Quick-service Restaurants, Full-service Restaurants, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Abafoods s.r.l., Alpro, Cereal Base, Ceba AB, Danone S.A., Drink Simple Pacifica Beverage, Earth’s Own Food Company, Elmhurst Milked Direct LLC, Hälsa Foods, Happy Planet Foods, Kaslink Foods Oy, Lima Food SRL, Minor Figures, Nancy’s Oatmilk, Nature’s Path Foods, Oatly AB Califia Farms, Oatworks, Pacific Foods of Oregon LLC, Pureharvest, Quaker Oats Company (PepsiCo), Rude Health, The Hain Celestial Inc., Valsoia S.p.A. Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Abafoods s.r.l.

- Alpro

- Cereal Base

- Ceba AB

- Danone S.A.

- Drink Simple Pacifica Beverage

- Earth's Own Food Company

- Elmhurst Milked Direct LLC

- Hälsa Foods

- Happy Planet Foods

- Kaslink Foods Oy

- Lima Food SRL

- Minor Figures

- Nancy's Oatmilk

- Nature's Path Foods

- Oatly AB Califia Farms

- Oatworks

- Pacific Foods of Oregon LLC

- Pureharvest

- Quaker Oats Company (PepsiCo)

- Rude Health

- The Hain Celestial Inc.

- Valsoia S.p.A.