Global Fermented Chymosin Market By Form (Liquid, Granules), By Type (Microbial, Animal-Free, Recombinant), By Application (Cheese Production, Yogurt Manufacturing, Milk Coagulation), By Technology (Fermentation Technology, Biotechnology, Genetic Engineering), By End-use (Food Processing, Pharmaceutical Industry, HoReCa(Hotels/Restaurants/Café), Household, Others), By Sales Channel (Direct Sales, Indirect Sales, Hypermarkets/Supermarkets, Wholesalers, Specialty Stores, Online Retailers), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 134088

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Form Analysis

- By Type Analysis

- By Application Analysis

- By Technology Analysis

- By End-use Analysis

- By Sales Channel Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Trending Factors

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

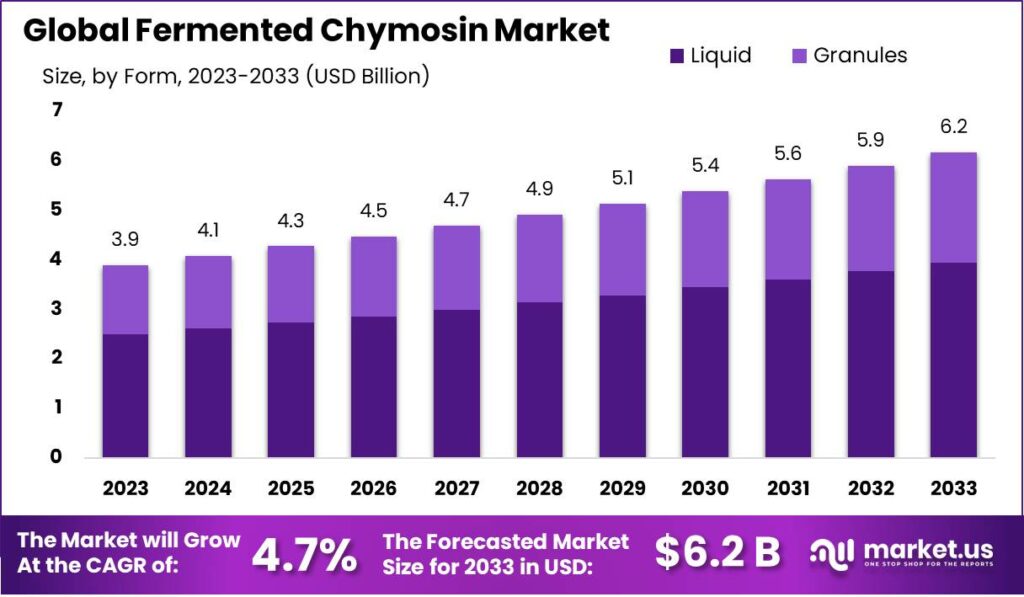

The Global Fermented Chymosin Market size is expected to be worth around USD 6.2 Billion by 2033, from USD 3.9 Billion in 2023, growing at a CAGR of 4.7% during the forecast period from 2024 to 2033.

The global market for fermented chymosin, an enzyme used in cheese production, has been steadily growing, driven by the increasing demand for cheese and dairy products. Fermented chymosin is produced through fermentation by microorganisms, providing a sustainable, cost-effective, and animal-friendly alternative to traditional chymosin, which was originally extracted from the stomachs of calves.

One of the key factors contributing to the growth of the fermented chymosin market is the increasing global consumption of dairy products. As more consumers worldwide embrace cheese, the need for chymosin, which helps curdle milk in the cheese-making process, has surged. Fermented chymosin is becoming increasingly popular due to its sustainability and ethical appeal, as it does not rely on animal sources. This shift aligns with broader consumer trends toward cleaner and more natural food ingredients.

Government regulations have also played a crucial role in supporting the growth of the market. In the United States, the FDA approved the use of recombinant chymosin in 1990, enabling the widespread use of microbial rennet. In Europe, the European Food Safety Authority (EFSA) has established safety guidelines for fermented chymosin, ensuring its safe use in food production. These regulations have helped build consumer trust and allowed for broader adoption in the cheese-making industry.

In terms of trade, the fermented chymosin export market is substantial, with countries like Germany, France, and the United States being key exporters. In 2022, global exports of fermented chymosin were valued at approximately USD 320 million.

The Asia-Pacific region, especially countries like China, India, and Japan, has seen a growing demand for cheese, driving the need for fermented chymosin. The demand from these regions is projected to grow at a rate of 9% annually.

Additionally, the import market for fermented chymosin is being driven by countries with expanding dairy industries that require a steady and cost-effective supply of chymosin. For example, India has increased its imports of microbial rennet by 12% over the past five years, reflecting the rise in dairy consumption.

Government initiatives are also helping to stimulate innovation in the sector. In 2021, the European Commission launched a EUR 50 million fund to support the development of plant-based and microbial food ingredients, including microbial chymosin. In the U.S., the National Dairy Council has allocated USD 15 million to research in dairy enzyme production, aligning with global efforts to reduce the environmental impact of food production.

Recent mergers and acquisitions have further strengthened the market. DSM are expanding their product portfolios to meet the growing demand for microbial rennet. Innovations in fermentation technology are also driving down production costs, making fermented chymosin even more attractive to cheese manufacturers.

Key Takeaways

- The Global Fermented Chymosin Market size is expected to be worth around USD 6.2 Billion by 2033, from USD 3.9 Billion in 2023, growing at a CAGR of 4.7% during the forecast period from 2024 to 2033.

- Liquid dominated the Fermented Chymosin market with a 64.3% share, driven by scalability.

- Microbial dominated the Fermented Chymosin market with a 48.1% share, leading growth.

- Cheese Production is dominated By the Application segment of the Fermented Chymosin market with a 64.1% share.

- Fermentation Technology dominated the Fermented Chymosin market with a 53.2% share by Technology segment.

- In 2023, Food Processing dominated the Fermented Chymosin market, accounting for over 67.1% of the total market share.

- The Indirect Sales segment also held a significant position in the market in 2023, capturing more than 69.4% of the total share.

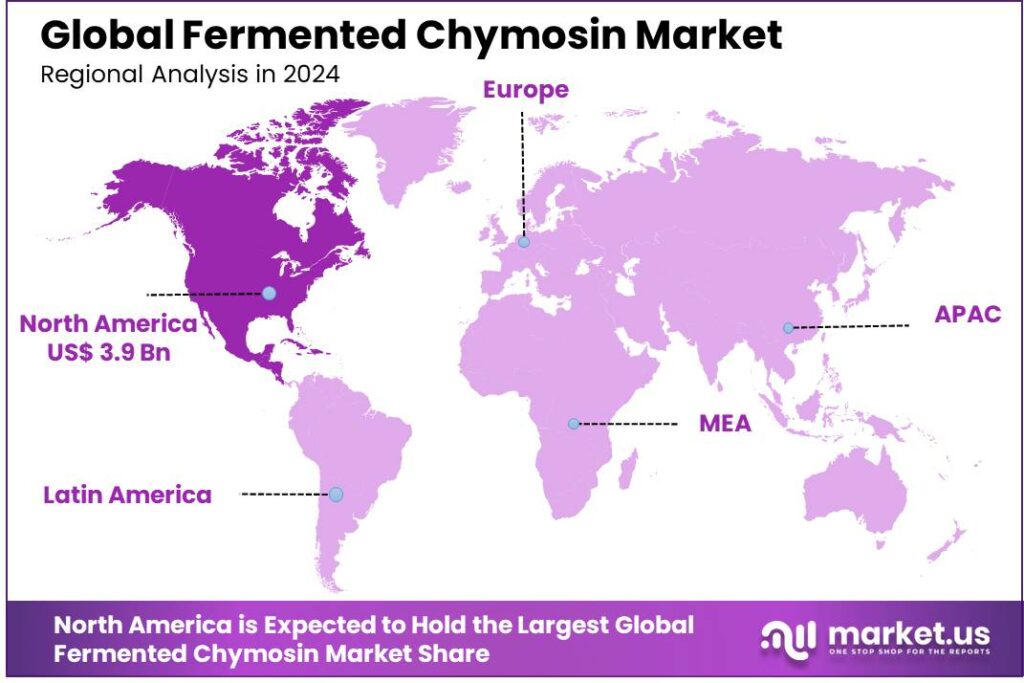

- North America dominates the fermented chymosin market with a 34.2% share, valued at USD 1.5 billion.

By Form Analysis

Liquid dominated the Fermented Chymosin market with a 64.3% share, driven by scalability.

In 2023, Liquid held a dominant market position in the By Form segment of the Fermented Chymosin Market, capturing more than 64.3% of the market share. The preference for liquid forms can be attributed to their ease of application, higher solubility, and flexibility in usage, particularly in large-scale cheese production processes. Liquid chymosin is also highly favored due to its ability to provide consistent enzyme activity, which is crucial for achieving desired coagulation properties in dairy production.

The Granules form, while accounting for a smaller portion of the market, remains a notable segment, contributing to the market’s diversification. Granules typically offer extended shelf life and are preferred in certain niche applications where precise control over dosage is required. While the granules segment holds a smaller share in comparison to liquid, it is expected to witness steady growth as manufacturers seek alternatives that offer convenience and longer storage stability.

By Type Analysis

Microbial dominated the Fermented Chymosin market with a 48.1% share, leading growth.

In 2023, Microbial held a dominant market position in the By Type segment of the Fermented Chymosin Market, capturing more than 48.1% of the total market share. Microbial-derived chymosin, produced through fermentation using microorganisms such as Aspergillus and Mucor, is the most widely used form in commercial dairy production. Its cost-effectiveness, high enzyme activity, and ability to meet the scalability demands of large-scale dairy producers contribute significantly to its dominance. Additionally, microbial chymosin is favored for its consistency and reliable performance in coagulating milk, which is crucial for achieving uniform cheese production.

The Animal-Free segment, which accounts for a smaller yet growing share of the market, is driven by increasing consumer demand for plant-based and ethical food products. Animal-free chymosin is derived from non-animal sources, often using yeast or fungi, and appeals to both vegan and clean-label trends. Its market share is expected to grow steadily as more dairy manufacturers shift toward plant-based alternatives and as regulatory pressures around animal-derived ingredients increase.

Recombinant chymosin, created through genetic engineering techniques, represents a niche but innovative segment. Recombinant chymosin combines the advantages of microbial fermentation with precise control over enzyme production. Though it occupies a smaller portion of the market, its growth is spurred by its potential for high purity, scalability, and the ability to avoid animal sources.

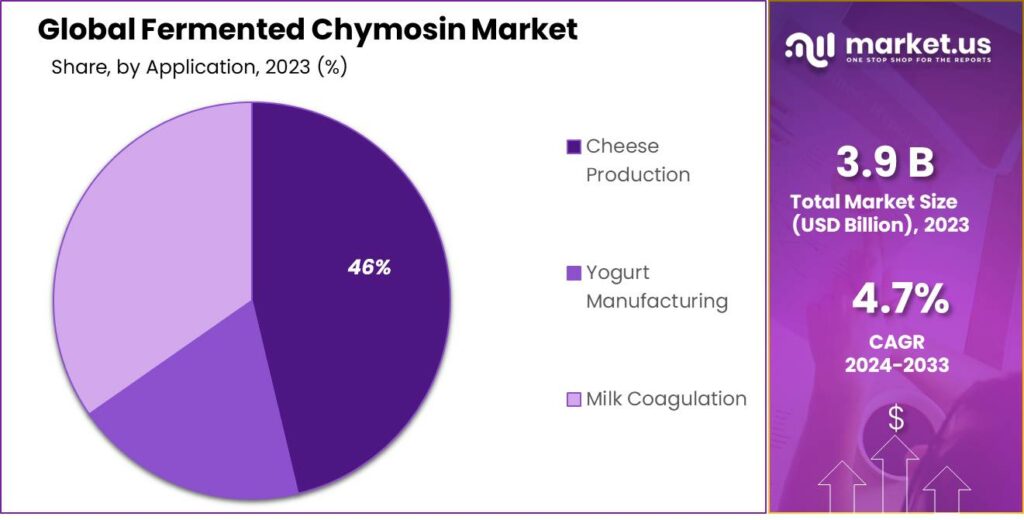

By Application Analysis

Cheese Production is dominated By the Application segment of the Fermented Chymosin market with a 64.1% share.

In 2023, Cheese Production held a dominant market position in the By Application segment of the Fermented Chymosin Market, capturing more than 64.1% of the total market share. The widespread use of chymosin in cheese production is driven by its essential role in coagulating milk, which forms the basis for curdling and subsequent cheese aging processes. Chymosin ensures consistent and efficient curd formation, leading to improved yield and uniformity in texture, making it indispensable in large-scale cheese manufacturing. The global demand for various cheese types continues to grow, further solidifying chymosin’s dominance in this segment.

The Yogurt Manufacturing segment, while smaller, is steadily growing as chymosin is used to enhance the coagulation process, improving the texture and consistency of yogurt. The increasing consumer preference for diverse and premium yogurt products has spurred demand for high-quality fermentation agents, contributing to the segment’s expansion.

Milk Coagulation, though accounting for a smaller market share compared to cheese production, remains significant in specialized dairy applications. Chymosin’s role in milk coagulation is essential for products like certain types of traditional or artisan cheeses, as well as in research and niche dairy innovations.

By Technology Analysis

Fermentation Technology dominated the Fermented Chymosin market with a 53.2% share by Technology segment.

In 2023, Fermentation Technology held a dominant market position in the By Technology segment of the Fermented Chymosin Market, capturing more than 53.2% of the total market share. Fermentation technology remains the most widely utilized method for producing chymosin due to its scalability, cost-effectiveness, and high yield.

Through microbial fermentation, microorganisms such as Aspergillus or Mucor are cultured to produce chymosin in large quantities, making it the preferred method for industrial-scale cheese and dairy production. The process is well-established, with consistent and reliable enzyme activity, which contributes to its dominant position in the market.

The Biotechnology segment, while smaller, continues to gain traction as advances in enzyme production through biotechnological processes offer enhanced efficiency and precision. Biotechnology focuses on optimizing microbial strains and fermentation conditions to improve chymosin yields and reduce production costs. It also holds promise for developing more sustainable and eco-friendly production methods, aligning with growing consumer demand for sustainable food ingredients.

Genetic Engineering, representing a niche but innovative approach, leverages genetic modification to create microorganisms that produce recombinant chymosin. Although it holds a smaller share, genetic engineering is expected to see gradual growth due to its ability to offer high-purity, customized enzyme products with fewer impurities.

By End-use Analysis

In 2023, Food Processing dominated the Fermented Chymosin market, accounting for over 67.1% of the total market share.

In 2023, Food Processing held a dominant market position in the By End-use segment of the Fermented Chymosin Market, capturing more than 67.1% of the total market share. The food processing industry, particularly in cheese manufacturing, remains the largest end-user of fermented chymosin. Chymosin plays a crucial role in the coagulation of milk, making it an essential ingredient in cheese production.

With the global demand for various cheese types continuing to rise, food processing continues to be the primary driver for chymosin consumption. Its efficiency, cost-effectiveness, and ability to produce high-quality dairy products have cemented its role in large-scale food production, especially in processed cheeses, which are in high demand worldwide.

The Pharmaceutical Industry represents a smaller but growing segment, where chymosin is used in the production of certain medications, including digestive enzymes and supplements. As the demand for functional foods and supplements increases, particularly in digestive health, the pharmaceutical application of chymosin is expected to grow steadily.

The HoReCa (Hotels/Restaurants/Cafés) segment, though niche, is important for specialized dairy applications in premium offerings, particularly in high-end cheeses and other dairy-based dishes served in restaurants and hotels.

Household consumption of chymosin is limited but increasing due to growing interest in home cheese-making. The Others category includes research applications and niche uses, contributing a small share of the market.

By Sales Channel Analysis

The Indirect Sales segment also held a significant position in the market in 2023, capturing more than 69.4% of the total share.

In 2023, Indirect Sales held a dominant market position in the By Sales Channel segment of the Fermented Chymosin Market, capturing more than 69.4% of the total market share. Indirect sales typically involve the distribution of chymosin through intermediaries such as wholesalers, distributors, and retail networks.

This channel is preferred for its wide-reaching distribution capabilities, enabling manufacturers to access a broader customer base across different regions. The ability to leverage established distribution networks allows for greater market penetration and cost efficiency, making indirect sales the dominant channel in the fermented chymosin market.

Direct Sales, though accounting for a smaller share, continue to be important for large-scale dairy producers who prefer to purchase directly from chymosin manufacturers. This sales channel offers benefits such as customized pricing, tailored delivery schedules, and more direct relationships between producers and suppliers. While the direct sales channel is favored for high-volume transactions, it remains less prevalent than indirect sales due to its narrower scope.

The Hypermarkets/Supermarkets segment plays a role in the distribution of chymosin, particularly for consumer-facing applications such as home cheese-making kits. While this channel holds a smaller share compared to indirect sales, it has seen some growth due to the rising consumer interest in DIY dairy products.

Wholesalers and Specialty Stores are key players in the distribution of niche chymosin products, particularly for smaller-scale manufacturers or specialty dairy products. Online Retailers have gained traction in recent years, with a steady rise in e-commerce for food ingredients and specialty products. However, this segment remains relatively small but is expected to grow with increasing consumer interest in home-based dairy production.

Key Market Segments

By Form

- Liquid

- Granules

By Type

- Microbial

- Animal-Free

- Recombinant

By Application

- Cheese Production

- Yogurt Manufacturing

- Milk Coagulation

By Technology

- Fermentation Technology

- Biotechnology

- Genetic Engineering

By End-use

- Food Processing

- Pharmaceutical Industry

- HoReCa(Hotels/Restaurants/Café)

- Household

- Others

By Sales Channel

- Direct Sales

- Indirect Sales

- Hypermarkets/Supermarkets

- Wholesalers

- Specialty Stores

- Online Retailers

Driving factors

Growing Demand for Plant-Based and Vegetarian Products

The increasing consumer shift toward plant-based and vegetarian diets has been a significant driver of growth in the Fermented Chymosin market. As more individuals adopt plant-based lifestyles, there is a corresponding rise in the demand for plant-based cheeses and other dairy alternatives. Traditional rennet, which is derived from animal sources, is not suitable for these products.

Consequently, plant-based chymosin, derived from microbial fermentation, offers a sustainable and ethical alternative. This growing trend aligns with the broader movement toward ethical consumption and sustainability, contributing to the expansion of the market for fermented chymosin in the production of plant-based dairy substitutes.

Rising Demand for Dairy Alternatives

The increasing preference for dairy alternatives, driven by factors such as lactose intolerance, veganism, and environmental concerns, is further accelerating the need for fermented chymosin. Plant-based dairy products, such as plant-based milk, cheese, and yogurt, require an enzyme that mimics the coagulation properties of traditional rennet.

Fermented chymosin, due to its ability to produce desired textures and flavors in dairy alternatives, has become a key ingredient in the manufacturing of these products. With the dairy alternative market expected to reach USD 44.93 billion by 2027, the demand for fermented chymosin is poised for continued growth.

Increasing Consumer Preference for Natural and Non-GMO Ingredients

Consumers are increasingly seeking natural, clean-label, and non-GMO products, driving the demand for fermented chymosin derived through microbial fermentation. Unlike animal-based rennet, which is subject to ethical concerns and genetic modification, microbial fermentation offers a natural and non-GMO alternative that meets the preferences of health-conscious and environmentally aware consumers.

As the global clean-label movement intensifies, companies are opting for fermented chymosin to cater to these evolving consumer expectations, contributing to the market’s growth. This shift is particularly notable in regions with stringent labeling regulations and a strong emphasis on organic and natural food products.

Restraining Factors

High Initial Investment in Biotechnology

One of the primary constraints on the growth of the Fermented Chymosin market is the high initial investment required in biotechnology and fermentation technologies. Developing and scaling microbial fermentation processes for chymosin production requires significant capital investment in research and development (R&D), infrastructure, and specialized equipment.

This high upfront cost can be a barrier for smaller players and start-ups, limiting market entry and competition. Furthermore, the complexity of optimizing fermentation processes to ensure product consistency and efficiency can further increase production costs. As a result, the high financial barriers associated with biotechnological advancements may slow down the widespread adoption of fermented chymosin, especially in markets where cost sensitivity is high.

Regulatory Hurdles and Compliance Issues

Regulatory challenges also play a significant role in restraining the growth of the fermented chymosin market. Given that chymosin is an enzyme used in food production, it is subject to stringent food safety regulations and approval processes by authorities such as the FDA, EFSA, and other global regulatory bodies.

The approval of genetically engineered or microbial fermentation-derived ingredients requires comprehensive testing and documentation to ensure consumer safety. In some regions, regulatory hurdles surrounding the use of microbial fermentation-derived chymosin—especially concerning its safety, labeling, and approval for use in specific food products can delay market entry and increase costs for manufacturers. These compliance requirements are more complex and time-consuming compared to traditional methods, thus hindering the pace at which fermented chymosin can become widely adopted.

Ethical and Religious Concerns

Ethical and religious considerations regarding the use of microbial fermentation-based chymosin can also pose challenges to its acceptance. While microbial chymosin is non-animal-derived, some consumers may still harbor concerns over the use of genetically modified organisms (GMOs) or biotechnological processes in food production. Religious groups that restrict the consumption of genetically modified or fermented food products may limit the market reach of fermented chymosin.

Additionally, concerns over transparency in labeling and consumer awareness regarding the fermentation process further contribute to hesitance in adopting these products. As consumer trust in biotechnology and genetic engineering varies by region and cultural context, these ethical and religious concerns can restrict market growth, particularly in conservative or GMO-skeptical regions.

Growth Opportunity

Development of New Applications Beyond Cheese

The global Fermented Chymosin market is witnessing exciting growth opportunities, particularly in the expansion of its applications beyond traditional cheese-making. Historically, chymosin has been most closely associated with cheese production, but ongoing research and market trends are uncovering new uses for the enzyme.

For instance, fermented chymosin is increasingly being explored in the production of plant-based dairy substitutes, as well as in other food applications such as ice cream, yogurts, and fermented beverages. These innovations are driven by the rising demand for dairy-free and plant-based products. As consumers increasingly seek diverse dairy alternatives, the application of fermented chymosin in non-cheese products presents a significant opportunity for market expansion.

R&D Investment for Improved Fermentation Strains

Continued investment in research and development (R&D) to enhance microbial fermentation strains presents another key opportunity for the fermented chymosin market. The current landscape is seeing a focus on improving the yield, efficiency, and consistency of chymosin produced through microbial fermentation.

Advances in synthetic biology and genetic engineering are expected to yield more robust strains that can lower production costs while increasing enzyme activity and stability. This would not only enhance the cost-effectiveness of producing fermented chymosin but also improve its overall market competitiveness, enabling wider adoption across industries beyond traditional dairy products.

Innovations in Dairy-Free and Vegan Products

The rapidly expanding market for dairy-free and vegan products is perhaps the most significant growth driver for fermented chymosin in 2024 and beyond. With the global plant-based dairy market projected to reach USD 44.93 billion by 2027, demand for microbial-derived chymosin to create authentic-tasting, plant-based cheeses and other dairy alternatives is surging.

As consumer preferences continue to shift toward vegan and clean-label products, innovations that improve the taste, texture, and nutritional profile of dairy-free foods will be critical. Fermented chymosin is positioned as a key ingredient in enabling these innovations, driving demand, and fueling market growth in the coming years.

Trending Factors

Growing Popularity of Clean Label Products

A significant trend in the Fermented Chymosin market for 2024 is the rising demand for clean-label products, which has become a key driver of growth. Consumers are increasingly concerned with food transparency, seeking products with fewer artificial ingredients, preservatives, and additives. As fermented chymosin is produced through microbial fermentation rather than using animal-derived enzymes, it aligns well with the clean label movement.

This natural and non-GMO aspect of microbial chymosin appeals to health-conscious consumers, particularly those in regions where organic and clean-label foods are in high demand. With more food manufacturers opting for clean-label solutions, fermented chymosin is poised to benefit from this consumer preference shift, supporting its wider adoption in cheese, dairy alternatives, and other food products.

Rising Demand for Lactose-Free Products

The growing prevalence of lactose intolerance is another crucial trend influencing the Fermented Chymosin market. Lactose-free dairy products have seen substantial growth in recent years, as an increasing number of consumers seek alternatives to traditional dairy products. Fermented chymosin, which is commonly used in the production of lactose-free cheese and other dairy products, plays a pivotal role in this market segment.

The ability of fermented chymosin to create high-quality dairy products without compromising taste or texture supports its growing demand in the lactose-free product category. As the global lactose-free market is projected to expand significantly in 2024, the role of microbial chymosin in these innovations will become more pronounced.

Shift Toward Microbial Fermentation Over Animal Rennet

There is a clear shift away from animal-based rennet toward microbial fermentation-derived chymosin, driven by both ethical and practical considerations. Consumer concerns regarding animal welfare and the environmental impact of animal agriculture are prompting food manufacturers to adopt microbial fermentation methods.

Moreover, microbial chymosin offers a more consistent, scalable, and cost-effective production process compared to animal-derived rennet. As more producers embrace microbial fermentation to meet these ethical and operational demands, the market for fermented chymosin is expected to experience sustained growth.

Business Benefits

Fermented chymosin provides a range of business benefits that resonate with both producers and consumers in the evolving food industry. One of the most significant advantages for businesses is cost efficiency. The production of fermented chymosin via microbial fermentation is less resource-intensive compared to traditional animal-based methods. By using microorganisms like fungi or bacteria, businesses can reduce costs related to livestock farming, including feed, space, and veterinary care.

From a production standpoint, fermented chymosin offers greater scalability. With the fermentation process being more controllable and reproducible than animal harvesting, manufacturers can increase production volumes without being constrained by animal farming cycles. This scalability leads to more consistent product availability, which is crucial for meeting the demands of large-scale food manufacturers and retailers.

Moreover, the growing consumer demand for plant-based and cruelty-free products is another reason why businesses are increasingly switching to fermented chymosin. Companies that adopt this enzyme can improve their market positioning by aligning with consumer values related to sustainability, animal welfare, and health. As a result, these companies can tap into a broader and more engaged customer base, enhancing brand loyalty and potentially commanding premium prices for their products.

Regulatory benefits also cannot be overlooked. As governments and international bodies continue to implement stricter regulations on animal-derived products, businesses that use fermented chymosin are better positioned to navigate these changes. This is particularly true in regions like the European Union, where animal welfare standards are increasingly stringent, making it more difficult for traditional rennet producers to comply.

Regional Analysis

North America dominates the fermented chymosin market with a 34.2% share, valued at USD 1.5 billion.

In 2023, North America held a dominant market position in the fermented chymosin industry, capturing more than 34.2% of the global market share, with a revenue of approximately USD 1.5 billion. This leadership can be attributed to the region’s strong demand for plant-based and dairy-free products, especially in the United States, where consumers are increasingly seeking alternatives to traditional dairy-based enzymes.

The established food and beverage sector, coupled with advanced technological infrastructure, allows North American manufacturers to innovate rapidly and scale the production of fermented chymosin, which further boosts regional market growth. Moreover, regulatory support and an increasing preference for clean-label ingredients in food products are key drivers behind the rise of this market segment.

The region also benefits from a highly organized distribution network and a well-developed research and development (R&D) ecosystem, facilitating continuous product improvements and the introduction of novel applications for fermented chymosin. Additionally, leading companies in the enzyme production space, such as DuPont is based in North America, which strengthens its position in the global market. Their investments in biotechnology and sustainable production methods further enhance the region’s dominance, allowing it to meet the growing demand for fermented chymosin in diverse food products like plant-based cheeses, dairy substitutes, and other functional foods.

While Europe and APAC are also significant players in the market, North America’s head start in terms of technological capabilities and consumer awareness provides it with a substantial advantage. The market’s growth in North America is expected to continue as more food manufacturers adopt plant-based and clean-label solutions, aligning with the broader trend toward sustainable and health-conscious food production.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

Koninklijke DSM N.V., a global leader in nutrition and biosciences, has maintained a strong presence in the fermented chymosin market through its subsidiary DSM Food Specialties. The company’s expertise in fermentation technology and sustainable production processes has helped it to secure a dominant position in the industry. DSM’s emphasis on producing non-animal-derived enzymes aligns with the growing demand for vegetarian rennet alternatives, particularly in Europe and North America.

DuPont Nutrition and Biosciences leverages its vast expertise in fermentation and enzymatic technologies to offer high-performance chymosin products. DuPont’s innovative solutions address the evolving needs of the global dairy industry, focusing on enhancing cheese quality and reducing production costs. Its presence in both developed and emerging markets, particularly in Asia Pacific, positions it well for continued market expansion.

These companies, through strategic acquisitions, R&D investments, and product innovation, will continue to influence the direction of the fermented chymosin market in 2024, helping to meet the growing consumer demand for sustainable and natural dairy ingredients.

Market Key Players

- Koninklijke DSM N.V.

- Maysa Gida

- Mayasan AS

- Nelson to Jameson

- DuPont Nutrition and Biosciences

- DSM Food Specialties

- Kerry Group

- Meiji Holdings

- Novozymes

- Biocatalysts

- Sacco System

- Enzyme Development Corporation

- Renco New Zealand

- Fonterra Cooperative Group

- Caglificio Clerici

- Mayasan Biotech

- Enzybel Group

- Amicogen

- AB Enzymes

- Advanced Enzyme Technologies

- Royal Bioproducts

- Renco Food Ingredients

- Biocon

Recent Development

- In March 2024, DSM Food Specialties, a division of Koninklijke DSM N.V., introduced a next-generation rennet enzyme for the global dairy industry, focusing on enhancing the sustainability of cheese production. The new enzyme reduces water and energy consumption by 10%, aligning with DSM’s commitment to cutting the carbon footprint of its dairy sector customers by 20% over the next five years. This aligns with the growing demand for sustainable food production methods, particularly in Europe and North America.

Report Scope

Report Features Description Market Value (2023) USD 3.9 Billion Forecast Revenue (2033) USD 6.2 Billion CAGR (2024-2032) 4.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Granules), By Type (Microbial, Animal-Free, Recombinant), By Application (Cheese Production, Yogurt Manufacturing, Milk Coagulation), By Technology (Fermentation Technology, Biotechnology, Genetic Engineering), By End-use (Food Processing, Pharmaceutical Industry, HoReCa(Hotels/Restaurants/Café), Household, Others), By Sales Channel (Direct Sales, Indirect Sales, Hypermarkets/Supermarkets, Wholesalers, Specialty Stores, Online Retailers) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Koninklijke DSM N.V., Maysa Gida, Mayasan AS, Nelson to Jameson, DuPont Nutrition and Biosciences, DSM Food Specialties, Kerry Group, Meiji Holdings, Novozymes, Biocatalysts, Sacco System, Enzyme Development Corporation, Renco New Zealand, Fonterra Cooperative Group, Caglificio Clerici, Mayasan Biotech, Enzybel Group, Amicogen, AB Enzymes, Advanced Enzyme Technologies, Royal Bioproducts, Renco Food Ingredients, Biocon Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fermented Chymosin MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Fermented Chymosin MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Koninklijke DSM N.V.

- Maysa Gida

- Mayasan AS

- Nelson to Jameson

- DuPont Nutrition and Biosciences

- DSM Food Specialties

- Kerry Group

- Meiji Holdings

- Novozymes

- Biocatalysts

- Sacco System

- Enzyme Development Corporation

- Renco New Zealand

- Fonterra Cooperative Group

- Caglificio Clerici

- Mayasan Biotech

- Enzybel Group

- Amicogen

- AB Enzymes

- Advanced Enzyme Technologies

- Royal Bioproducts

- Renco Food Ingredients

- Biocon