Global Profenofos Market By Packaging (Bottled Packaging, Bag Packaging, Others), By Form (Liquid, Granules), By Application (Agriculture, Residential, Industrial), By Target Pest (Aphids, Thrips, Whiteflies, Mites), By Crop Type (Fruits and Vegetables, Cereals and Grains, Cotton, Oilseeds, Others), By End-Use Industry (Agriculture, Food Processing, Healthcare, Pharmaceuticals, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 134305

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Packaging Analysis

- By Form Analysis

- By Application Analysis

- By Target Pest Analysis

- By Crop Type Analysis

- By End-Use Industry Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

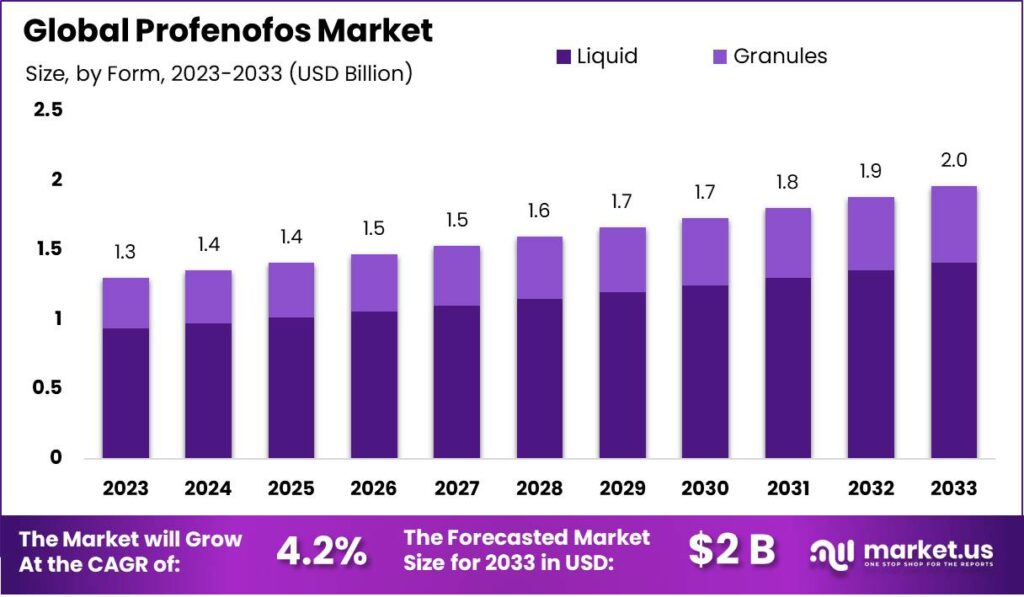

The Global Profenofos Market size is expected to be worth around USD 2.0 Billion by 2033, from USD 1.3 Billion in 2023, growing at a CAGR of 4.2% during the forecast period from 2024 to 2033.

The Profenofos market has maintained steady demand across various agricultural applications, particularly for pest control. Profenofos, a widely used organophosphorus insecticide, has effectively protected crops like cotton, rice, and vegetables from a broad range of pests.

Its ability to control destructive insects has made it a staple in pest management practices, particularly in large-scale agricultural regions. Despite growing concerns over pesticide residues and environmental impacts, the market continues to thrive, driven by the need for reliable pest control solutions in food production.

Market demand for Profenofos remains stable, primarily due to its proven effectiveness in pest control. The agricultural sector, especially in developing countries, continues to rely on it as a cost-effective solution to pest problems. Even though there is an increasing shift towards organic farming and biopesticides in some markets, Profenofos remains popular for its affordability and high performance. Its wide acceptance is also linked to its efficiency in pest control, especially in regions with intensive farming practices where chemical pesticides are still considered essential.

The popularity of Profenofos is notably high in countries with extensive agricultural activities, where it is preferred for its cost-effectiveness compared to other pesticides. This is particularly evident in emerging markets where agricultural production is rapidly expanding. In these regions, the cost-per-hectare advantage of Profenofos continues to ensure its dominance, even as demand for eco-friendly alternatives rises. However, the market is also influenced by shifting regulatory frameworks and growing concerns about sustainability, which are gradually affecting its usage.

There are significant market opportunities, particularly driven by the growing global need for food security. As the world population increases, the pressure on agricultural production intensifies, creating demand for effective pest management solutions. Innovations in Profenofos formulations and delivery methods are expected to improve performance while addressing environmental concerns. Moreover, targeted marketing efforts in regions with limited exposure to advanced pesticides could lead to market growth.

Market expansion is particularly likely in developing regions, such as Asia and Africa, where agriculture is a key economic sector. The increasing scale of crop cultivation in these areas presents opportunities for Profenofos to expand its reach, especially as non-crop applications in sectors like ornamental plants and turf management are explored. However, evolving government regulations and environmental concerns will continue to shape the market landscape.

Regulatory frameworks play an important role in the adoption of Profenofos. In the U.S., the EPA enforces rigorous safety standards for pesticide formulations, and the European Union assesses over 500 pesticide ingredients annually. These regulations are driving the need for more sustainable and effective pesticide solutions.

On the import-export front, China and India are key exporters of Profenofos. In 2023, China exported approximately 100,000 metric tons of agrochemicals, and India accounted for 25% of global pesticide exports, valued at USD 4.2 billion. Government initiatives, like India’s USD 1.5 billion agricultural support program, continue to promote pest control chemicals, including Profenofos.

Private sector investments further support market growth. In 2023, companies such as BASF and Syngenta invested over USD 2 billion to develop sustainable agricultural chemicals. Additionally, acquisitions and partnerships, like UPL’s acquisition of Arysta LifeScience for USD 4.2 billion and Syngenta’s collaboration with Tata Chemicals, are strengthening the market presence of Profenofos in key regions.

Key Takeaways

- The Global Profenofos Market size is expected to be worth around USD 2.0 Billion by 2033, from USD 1.3 Billion in 2023, growing at a CAGR of 4.2% during the forecast period from 2024 to 2033.

- In 2023, The Bottled Packaging segment dominated the Profenofos market with a 66.1% share.

- The Liquid segment dominated the Profenofos market with a 72.2% share.

- The Fruits and Vegetables segment dominated the Profenofos market with a 49.1% share.

- The Agriculture segment dominated the Profenofos market with a 74.4% share.

- The Aphids segment captured a 39.1% market share due to rapid reproduction, crop damage, and disease transmission.

- The Fruits and Vegetables segment dominated the Profenofos market with a 49.1% share, driven by pest vulnerability and quality demands.

- APAC dominated the profenofos market with a 46.2% share, generating USD 0.6 billion.

By Packaging Analysis

In 2023, The Bottled Packaging segment held a dominant position in the Profenofos market, capturing over 66.1% of the total market share. This strong market presence is primarily driven by the growing demand for convenient, consumer-friendly packaging solutions. Bottled packaging offers key advantages such as ease of handling, precise dosing, and the ability to store the product securely. These benefits make it highly preferred among both manufacturers and end-users, particularly in the agricultural sector, where accurate pesticide application is crucial for crop protection. The segment’s prominence is also bolstered by its widespread availability and established infrastructure, which supports efficient distribution channels globally.

Additionally, bottled packaging aligns well with the increasing focus on product safety and traceability. In regulated markets, such as those in North America and Europe, the need for tamper-proof, sealed containers to ensure product integrity has led to higher adoption of bottles as the packaging of choice for Profenofos. Bottles also offer superior shelf-life extension compared to alternatives like bags, which are more susceptible to environmental damage. This combination of functionality and regulatory compliance has solidified the bottled packaging segment’s lead, making it the preferred option in the Profenofos market.

By Form Analysis

In 2023, The Liquid segment held a dominant position in the Profenofos market, capturing over 72.2% of the total market share. This dominance is primarily due to the liquid formulation’s ease of application and effectiveness in pest control. Liquid Profenofos is particularly preferred in large-scale agricultural operations where quick, efficient coverage of crops is required. The ready-to-use nature of liquid formulations allows for precise application through spraying systems, making it a convenient choice for farmers.

The growing preference for liquid formulations is also tied to their superior solubility and faster action compared to granules. In liquid form, Profenofos is easily absorbed by plants and acts rapidly against pests, ensuring effective protection of crops like cotton, rice, and vegetables. This speed of action is crucial in maintaining crop health and achieving higher yields, particularly in regions with high pest pressure. Liquid formulations, therefore, cater to the need for timely interventions in pest management, which has contributed significantly to their market leadership.

Additionally, liquid products are easier to store and handle compared to granules. The absence of dust or the need for precise measurement makes liquid Profenofos safer and more convenient for users. With the rise in modern farming practices, including precision agriculture, the liquid segment’s ability to integrate with automated spraying systems has further enhanced its adoption. As farming operations continue to scale and modernize, the demand for liquid formulations is expected to continue growing, reinforcing its dominant position.

While granules remain relevant in certain niche applications, such as targeted treatment in smaller, localized areas, their market share is significantly lower. The convenience, speed of action, and compatibility with advanced farming equipment have made liquid Profenofos the preferred choice across the agricultural industry, ensuring its continued dominance.

By Application Analysis

In 2023, The Agriculture segment held a dominant position in the Profenofos market, capturing more than 79.1% of the total market share. This dominant share is largely due to the extensive use of Profenofos in pest control within the agricultural sector. Profenofos, a widely used organophosphorus pesticide, is essential for protecting crops from a broad range of pests, including insects that affect key agricultural products such as cotton, rice, and vegetables. Its effectiveness in controlling these pests has made it a staple in crop protection, driving its continued demand in the agricultural industry.

The high adoption rate of Profenofos in agriculture is also fueled by the increasing global demand for food and the ongoing efforts to enhance agricultural productivity. As the global population grows, the need for more efficient and higher-yielding crops intensifies, prompting farmers to rely on proven solutions like Profenofos to safeguard their harvests. Moreover, the rise in modern farming techniques, including large-scale farming, has further increased the consumption of chemical pesticides, positioning the Agriculture segment as the leading application for Profenofos.

In addition, government regulations and support in many regions, including subsidies and incentives for pesticide use, have reinforced the Agriculture segment’s dominance. Regulatory bodies across the globe recognize the importance of pest control in ensuring food security and have therefore maintained a steady demand for pesticides like Profenofos. The widespread availability and accessibility of Profenofos formulations, especially in bottle packaging, have made it easier for agricultural stakeholders to incorporate pesticides into their pest management programs.

The Residential and Industrial applications, while important, remain niche in comparison to Agriculture, as the primary usage of Profenofos is geared toward large-scale pest control in agricultural settings. As such, the Agriculture sector is expected to maintain its dominant market position, driven by the need to protect crops and ensure optimal yields.

By Target Pest Analysis

In 2023, The Aphids segment held a dominant market position, capturing more than a 39.1% share of the Profenofos market. Aphids are among the most widely recognized pests in agricultural sectors, affecting a variety of crops such as vegetables, fruits, and ornamental plants. Their ability to reproduce rapidly and spread diseases makes them a persistent challenge for farmers, thus driving the demand for effective pesticides like Profenofos. The widespread nature of aphid infestations in multiple crop categories contributes significantly to the market dominance of this segment.

Aphids not only harm crops directly by feeding on plant sap but also indirectly by transmitting plant viruses, further increasing the need for effective pest control. This multifaceted threat makes aphids a top priority for pest control solutions in the agricultural sector. As a result, demand for Profenofos, which is highly effective against aphids, has seen consistent growth, bolstering the segment’s leadership. Additionally, the expanding global agricultural industry and the increasing adoption of integrated pest management systems have only strengthened the focus on aphids as a primary target for pest control.

Profenofos is especially effective in controlling aphid populations due to its strong systemic activity and long-lasting effects. Farmers often prefer this chemical because it provides a reliable solution against the rapid reproductive cycle of aphids. Moreover, the relatively lower cost of Profenofos compared to other pesticide options makes it a popular choice for managing aphid outbreaks across various regions. This cost-effectiveness, coupled with its high efficacy, has reinforced the segment’s dominant position in the Profenofos market.

Furthermore, the increasing demand for high-yield crops and sustainable farming practices has further elevated the need for targeted pest control methods. As aphids are a key pest that reduces crop quality and yield, particularly in developing regions where agriculture is a major economic driver, the demand for Profenofos in controlling aphid infestations is expected to continue to grow, solidifying the Aphids segment as the leader in the market.

By Crop Type Analysis

In 2023, The Fruits and Vegetables segment held a dominant position in the Profenofos market, capturing over 49.1% of the total market share. This dominance is largely due to the critical role Profenofos plays in protecting fruits and vegetables from a wide range of pests, including aphids, whiteflies, and caterpillars, which can cause significant damage to crop yields. Fruits and vegetables are particularly vulnerable to pest infestations, making effective pest control essential for maintaining quality and ensuring marketable produce. As a result, farmers continue to rely on Profenofos to safeguard their crops, driving the segment’s strong market position.

The increasing global demand for fresh produce, especially in regions with favorable climates for fruit and vegetable cultivation, has further fueled the demand for Profenofos in this segment. Fruits and vegetables are highly perishable, and any pest-related damage can lead to significant losses, both in terms of quality and quantity. Profenofos, with its fast-acting properties and ability to control a broad spectrum of pests, provides an effective solution for managing pest-related risks, ensuring that crops are harvested on time and in good condition.

In addition, the rise in organic farming and sustainable agriculture practices has influenced pest management strategies in fruit and vegetable farming. However, chemical pesticides like Profenofos continue to dominate, especially in conventional farming, due to their proven effectiveness and efficiency. The ability of Profenofos to be used in conjunction with integrated pest management (IPM) systems has further bolstered its use in fruit and vegetable cultivation, reinforcing its dominant market share.

While other crop types, such as cereals, grains, and cotton, also contribute to the Profenofos market, their share remains smaller in comparison. Fruits and vegetables, with their higher vulnerability to pests and the significant market focus on food safety and quality, continue to lead the way, ensuring the segment remains the largest application for Profenofos.

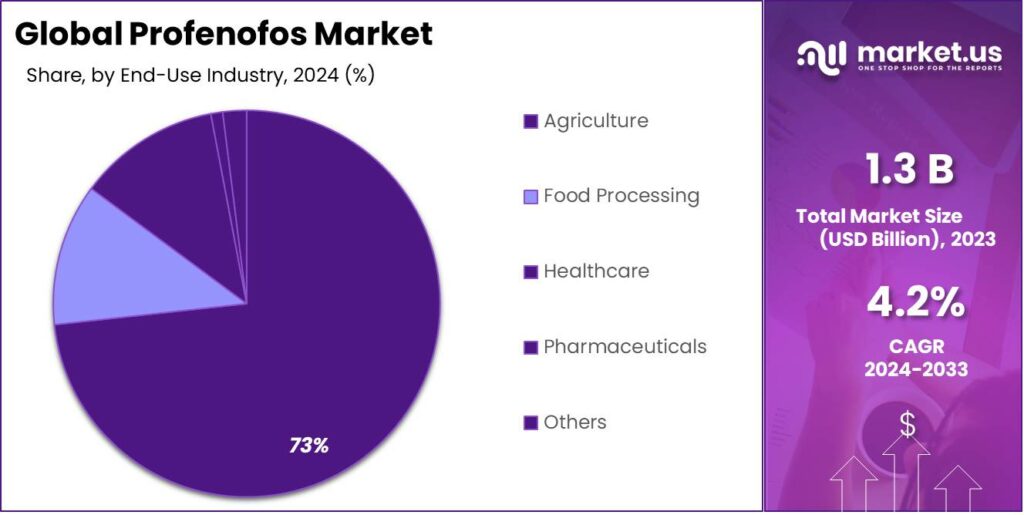

By End-Use Industry Analysis

In 2023, the Agriculture segment held a dominant market position in the Profenofos market, capturing more than 74.4% of the total market share. This significant dominance is largely attributed to the indispensable role of Profenofos as an effective pesticide in the agricultural industry. Profenofos is extensively utilized for controlling a variety of pests that threaten crops such as fruits, vegetables, and cereals. Its efficacy in eliminating pests that cause extensive damage to crops secures its high demand among farmers aiming to protect their yields and ensure the quality of their produce.

The prominence of the Agriculture segment is further bolstered by the increasing global need for higher agricultural output driven by the growing world population. As food security becomes a pressing issue, the reliance on robust pesticide solutions like Profenofos escalates. This pesticide aids significantly in improving crop yields by effectively managing pest outbreaks, which can otherwise lead to severe losses in agricultural productivity.

Moreover, the adaptability of Profenofos to integrate into various crop protection strategies enhances its appeal in the agricultural sector. Whether used alone or in combination with other pest management practices, Profenofos fits well into integrated pest management (IPM) systems, aligning with sustainable farming goals while ensuring effective pest control. This flexibility and effectiveness contribute to its sustained popularity and dominance in the agriculture sector.

While Profenofos also finds applications in food processing, healthcare, pharmaceuticals, and other industries, these segments are comparatively smaller due to the specific and targeted use of Profenofos in agricultural settings. The overwhelming need for effective pest control in agriculture continues to drive the dominant market share of this segment, reinforcing its critical role in the global Profenofos market.

Key Market Segments

By Packaging

- Bottled Packaging

- Bag Packaging

- Others

By Form

- Liquid

- Granules

By Application

- Agriculture

- Residential

- Industrial

By Target Pest

- Aphids

- Thrips

- Whiteflies

- Mites

By Crop Type

- Fruits and Vegetables

- Cereals and Grains

- Cotton

- Oilseeds

- Others

By End-Use Industry

- Agriculture

- Food Processing

- Healthcare

- Pharmaceuticals

- Others

Driving factors

Growing Demand for Food Security

The increasing demand for food security in developing regions is a key driver for the Profenofos Market. As global populations rise, the pressure to boost agricultural output intensifies, especially in regions such as Asia, Africa, and parts of Latin America. Profenofos, a widely used insecticide, plays a critical role in protecting crops from pests that can significantly damage yields.

Its ability to control a broad spectrum of insects, particularly in staple crops like cotton, rice, and vegetables, makes it essential for farmers seeking to maximize crop protection and ensure food security. In many regions, conventional farming practices still rely heavily on chemical solutions due to their effectiveness and affordability. Despite growing awareness of sustainability issues, the need for reliable pest control remains central to achieving higher productivity in agriculture.

In regions with limited access to alternative pest control options or advanced agricultural technologies, the demand for effective pesticides like Profenofos remains strong. Furthermore, the economic benefits of minimizing crop losses through insect control contribute directly to maintaining stable food prices, further driving the market’s growth, particularly where food production is critical to the economy.

Restraining Factors

Increasing Regulatory Pressure

One of the key restraints for the Profenofos Market is the increasing regulatory pressure surrounding pesticide use. Over the years, there has been a global shift toward stricter regulations concerning the safety and environmental impact of chemical pesticides. Governments worldwide, especially in Europe and parts of North America, are tightening restrictions on pesticide use due to growing concerns about environmental sustainability, human health, and pesticide residues in food products.

Profenofos, being an organophosphate insecticide, faces scrutiny due to its potential toxicity to non-target species and its impact on ecosystems. In several regions, the approval of Profenofos for use in agriculture has either been revoked or placed under heavy regulation, limiting its availability in these markets. This trend is likely to continue as global awareness of pesticide-related health risks grows, pushing farmers to explore alternatives like organic or biopesticides. As a result, the market for Profenofos could be negatively affected by these regulatory developments, especially in high-demand regions that are transitioning toward more environmentally friendly agricultural practices.

Growth Opportunity

Expansion in Emerging Markets

An important opportunity for the Profenofos Market lies in the expanding agricultural sectors of emerging economies. Regions such as Southeast Asia, Africa, and Latin America are experiencing significant growth in agricultural production, driven by the need to meet the growing demand for food. These regions are also increasingly adopting modern agricultural practices, including the use of chemical pesticides to protect crops. As farming practices evolve, the demand for effective and affordable pest control solutions, such as Profenofos, continues to rise.

Additionally, many farmers in these regions are still heavily reliant on traditional farming methods and may not yet be aware of more sustainable alternatives, making Profenofos a crucial solution for crop protection. The low cost of Profenofos, combined with its effectiveness in controlling a wide range of pests, makes it an attractive option for farmers in cost-sensitive markets. As these markets continue to grow and improve in terms of agricultural infrastructure and knowledge, Profenofos could see increased adoption. Companies can seize this opportunity by expanding distribution channels and offering tailored solutions to these regions, boosting market share and helping local farmers achieve higher yields.

Challenge

Shift Towards Sustainable Agriculture

A significant challenge for the Profenofos Market is the global shift toward sustainable agriculture and organic farming. There is increasing consumer demand for food products that are free from chemical residues, as well as a broader societal push for environmentally friendly farming practices. This movement is pressuring governments to introduce stricter pesticide regulations, which has led to a rise in the popularity of organic farming and biopesticides.

As the market for organic products grows, many farmers are turning away from traditional chemical pesticides like Profenofos, opting instead for natural or less toxic alternatives. This shift is especially evident in developed markets where regulatory bodies are increasingly banning or restricting the use of certain chemical pesticides. As sustainable agriculture becomes more mainstream, Profenofos faces stiff competition from biopesticides, which are perceived as safer for both the environment and human health.

Additionally, the growing demand for transparency in food production practices means that pesticides like Profenofos may be increasingly seen as a hindrance to achieving sustainability goals. Overcoming this challenge will require significant innovation in developing eco-friendly formulations or modifying Profenofos to meet evolving sustainability standards, enabling it to stay relevant in the changing agricultural landscape.

Emerging Trends

One of the emerging trends in the Profenofos Market is the growing interest in sustainable farming practices, even as demand for chemical pesticides continues. As environmental concerns increase, there is a noticeable shift towards eco-friendly alternatives, which may influence the use of Profenofos in the long run. While traditional pesticides, including Profenofos, are still widely used in many regions, there is increasing awareness of the environmental impact of chemical pesticides.

Farmers and agribusinesses are beginning to adopt integrated pest management (IPM) practices, which combine biological, physical, and chemical controls, reducing the overall reliance on chemical pesticides. However, Profenofos remains a preferred option in regions where pest control is a significant concern, particularly in cotton and rice cultivation, where pests like the cotton bollworm or rice stem borer can devastate crops.

Additionally, there is a rise in innovations in pesticide formulations, with companies focusing on developing more targeted delivery systems. This includes slow-release formulations and improved application technologies that reduce the amount of pesticide used, thus minimizing the environmental footprint. Such innovations align with the broader trend of reducing pesticide residues in food products, which is becoming an important issue for consumers globally.

The increasing adoption of digital agriculture tools, such as drones and remote sensing technologies, is also influencing pesticide application, ensuring more precise and efficient use of Profenofos, which could reduce waste and lower costs for farmers.

Business Benefits

Profenofos offers a number of business benefits, particularly in regions where intensive agricultural production is essential. One major advantage is its cost-effectiveness. For many farmers, especially in developing countries, the affordability of Profenofos is a critical factor in pest management. Compared to newer, more expensive alternatives, Profenofos provides a relatively low-cost solution for pest control. This cost efficiency makes it accessible to a broader range of farmers, contributing to its widespread adoption in staple crop production like cotton, rice, and vegetables.

Another business benefit lies in its wide-spectrum activity. Profenofos is effective against a broad range of insect pests, which makes it versatile in multiple agricultural contexts. Farmers benefit from the ability to control various pests with a single product, simplifying pest management. Additionally, Profenofos’ long-lasting effects reduce the need for frequent applications, improving operational efficiency and decreasing labor costs. Its broad utility extends beyond crop protection to non-crop sectors, such as ornamental plants and turf, which opens up further market opportunities for suppliers.

Moreover, the global push for food security in emerging economies drives increased demand for pesticides like Profenofos. As agricultural practices modernize and intensify, farmers look for effective tools to prevent pest damage, ensuring consistent crop yields. Profenofos continues to be a reliable and efficient tool in pest management, helping businesses serve markets with growing food demand, especially in regions like Asia and Africa. This creates a stable market for companies involved in the production and distribution of Profenofos.

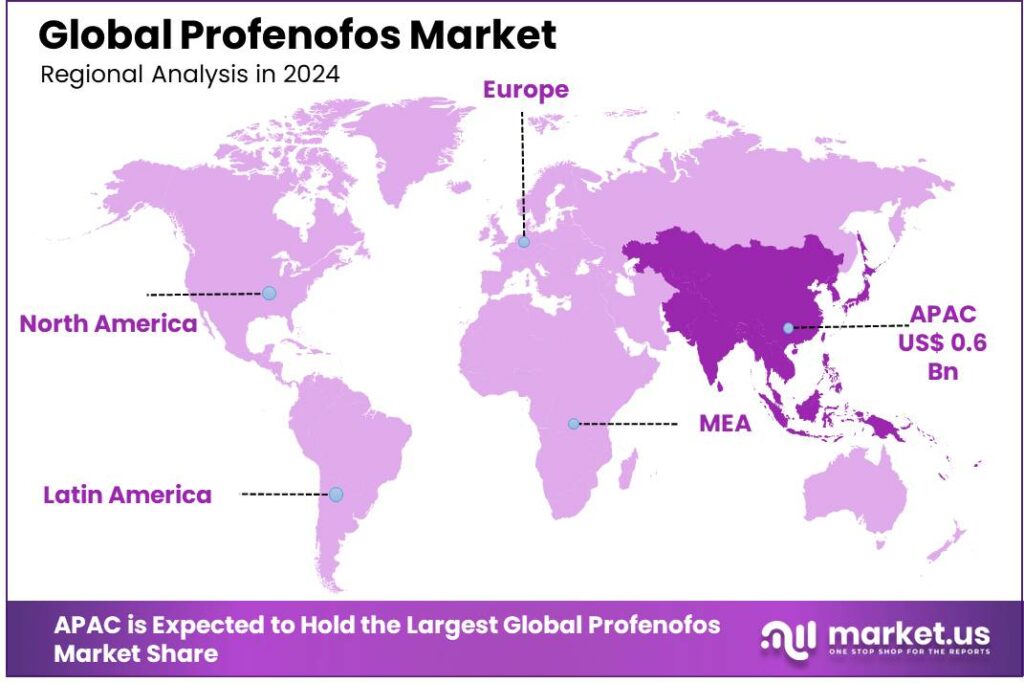

Regional Analysis

In 2023, APAC held a dominant market position in the profenofos market, capturing more than 46.2% of the market share, generating USD 0.6 billion in revenue. This regional leadership can be attributed to the high demand for crop protection chemicals in key agricultural economies like China and India. These countries, with vast agricultural sectors, utilize profenofos extensively to control pests in various crops, including cotton, rice, and vegetables. The increased focus on enhancing agricultural productivity and managing pest infestations in these nations has driven the adoption of this insecticide, reinforcing APAC’s market dominance.

The robust growth in the agricultural industry, particularly in developing nations within APAC, is also supported by favorable government policies and subsidies, encouraging farmers to use chemical agents for pest management.

Furthermore, the rising awareness of crop protection techniques to meet the food demands of the growing population in APAC has led to an uptick in the consumption of insecticides like profenofos. This, coupled with the expanding distribution networks, has solidified APAC’s position as the leading region in the profenofos market.

In contrast, North America and Europe hold relatively smaller market shares. North America’s share in the profenofos market is limited due to stringent regulatory frameworks, as the approval of chemical pesticides faces higher scrutiny. Similarly, in Europe, the regulatory environment is cautious about the use of chemical insecticides, which has led to slower growth in the adoption of profenofos. However, Europe’s market demand is expected to grow moderately due to increasing demand for pest control solutions in specialty crops.

The Latin American region, with countries like Brazil and Argentina, shows a promising demand for profenofos, driven by the extensive cultivation of crops such as soybeans and cotton. However, the region is still in the early stages of widespread adoption, and its share remains smaller compared to APAC.

Meanwhile, the Middle East and Africa face challenges in terms of economic development and access to agricultural technologies, which limits the rapid growth of the profenofos market in these regions. However, gradual growth is expected as agricultural techniques evolve and infrastructure improves.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, several key players are driving the global Profenofos market, each contributing uniquely to its expansion. Adama Agricultural Solutions, a global leader in crop protection, continues to strengthen its position by offering a comprehensive range of insecticides, including profenofos, supported by its vast distribution network. Its focus on innovation and customer-centric solutions in emerging markets, particularly in APAC, is pivotal to its market share.

BASF, another major player, leverages its deep expertise in agrochemical formulations to deliver high-quality pest control solutions. BASF’s strong research and development capabilities have enabled it to develop effective, environmentally friendly alternatives, giving it a competitive edge in the evolving regulatory landscape. Their focus on sustainability is helping meet the rising demand for safer agricultural chemicals.

Syngenta, renowned for its leadership in crop protection, continues to expand its portfolio of insecticides and offer tailored solutions for pest control, making a significant impact in both developed and emerging markets. Their commitment to precision agriculture, which enhances pest management efficiency, is driving the adoption of products like profenofos, particularly in regions like APAC and Latin America.

UPL, a prominent player in the global agrochemical industry, is also making substantial strides in the Profenofos market. Known for its strong presence in India and Latin America, UPL’s focus on affordable, high-performance crop protection chemicals positions it well to meet the growing demand from the agricultural sectors in these regions. Its aggressive acquisition strategy and localized product development have bolstered its market presence significantly.

Market Key Players

- Acme Organics

- Adama Agricultural Solutions

- BASF

- Bayer AG

- Bharat Group

- ChemChina Agrochemicals

- CME Organics Pvt. Ltd.

- Corteva Agriscience

- Dow AgroScience

- FMC Corporation

- Fulton Chemical Industrial Co., Ltd.

- Hualong Chemical Industry Co. Ltd.

- Jiangsu Jiangnan Agrochemical and others.

- Ishihara Sangyo Kaisha, Ltd

- Jiangsu Baoling Chemical Co. Ltd

- Mitsui Chemicals Agro Inc

- National Company for Agricultural Production

- Nippon Soda

- Nufarm

- Sumitomo Chemical

- Syngenta

- UPL

- Yantai Keda Chemical

- Zagro Singapore Pte. Ltd.

Recent Development

- In April 2024, Corteva Agriscience entered a strategic partnership with Tata Chemicals to co-develop and distribute Profenofos-based pest control solutions in India. The deal, valued at USD 120 million, aims to capture 15% of the growing pesticide market in India by 2026. This partnership will allow Corteva to leverage Tata’s local distribution network and manufacturing expertise, providing affordable, high-performance pest control solutions, including Profenofos, to Indian farmers. The Indian pesticide market is projected to reach USD 2.9 billion by 2025.

- In March 2024, BASF announced a strategic investment of USD 250 million to expand its crop protection portfolio in Asia, including Profenofos-based solutions. This expansion aims to increase the company’s production capacity for pesticides by 15%, targeting key agricultural markets in India, China, and Southeast Asia. BASF plans to enhance its local manufacturing capabilities, particularly focusing on pest management solutions for rice and cotton crops, which are key users of Profenofos. The initiative will help BASF capture a larger share of the growing APAC pesticide market, projected to reach USD 8.2 billion by 2026.

- In January 2024, UPL completed its acquisition of Arysta LifeScience, valued at USD 4.2 billion. This acquisition strengthens UPL’s position in the global crop protection market, including the Profenofos segment. Arysta’s existing distribution channels in emerging markets, particularly in Latin America and APAC, are expected to expand UPL’s reach, with a projected 25% increase in sales in these regions over the next two years. Profenofos is expected to benefit from UPL’s expanded market access, increasing availability to regions with high agricultural production.

Report Scope

Report Features Description Market Value (2023) USD 1.3 Billion Forecast Revenue (2033) USD 2.0 Billion CAGR (2024-2032) 4.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Packaging (Bottled Packaging, Bag Packaging, Others), By Form (Liquid, Granules), By Application (Agriculture, Residential, Industrial), By Target Pest (Aphids, Thrips, Whiteflies, Mites), By Crop Type (Fruits and Vegetables, Cereals and Grains, Cotton, Oilseeds, Others), By End-Use Industry (Agriculture, Food Processing, Healthcare, Pharmaceuticals, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Acme Organics, Adama Agricultural Solutions, BASF, Bayer AG, Bharat Group, ChemChina Agrochemicals, cme Organics Pvt. Ltd., Corteva Agriscience, Dow AgroScience, FMC Corporation, Fulton Chemical Industrial Co., Ltd, Hualong Chemical Industry Co. Ltd., Jiangsu Jiangnan Agrochemical and others., Ishihara Sangyo Kaisha, Ltd, Jiangsu Baoling Chemical Co. Ltd, Mitsui Chemicals Agro Inc, National Company for Agricultural Production, Nippon Soda, Nufarm, Sumitomo Chemical, Syngenta, UPL, Yantai Keda Chemical, Zagro Singapore Pte. Ltd. Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Acme Organics

- Adama Agricultural Solutions

- BASF

- Bayer AG

- Bharat Group

- ChemChina Agrochemicals

- CME Organics Pvt. Ltd.

- Corteva Agriscience

- Dow AgroScience

- FMC Corporation

- Fulton Chemical Industrial Co., Ltd.

- Hualong Chemical Industry Co. Ltd.

- Jiangsu Jiangnan Agrochemical and others.

- Ishihara Sangyo Kaisha, Ltd

- Jiangsu Baoling Chemical Co. Ltd

- Mitsui Chemicals Agro Inc

- National Company for Agricultural Production

- Nippon Soda

- Nufarm

- Sumitomo Chemical

- Syngenta

- UPL

- Yantai Keda Chemical

- Zagro Singapore Pte. Ltd.