Global Chickpea Protein Market By Form (Solid, Liquid), By Nature (Organic, Conventional, By Processing Type (Dry Processing, Wet Processing, By Product Type (Protein Isolates, Protein Concentrates, Flour, Others), By End User (Food Processing, Animal Feed, Nutraceuticals, Sports Nutrition, Infant Nutrition, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 134138

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Form Analysis

- By Nature Analysis

- By Processing Type Analysis

- By Product Type Analysis

- By End User Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

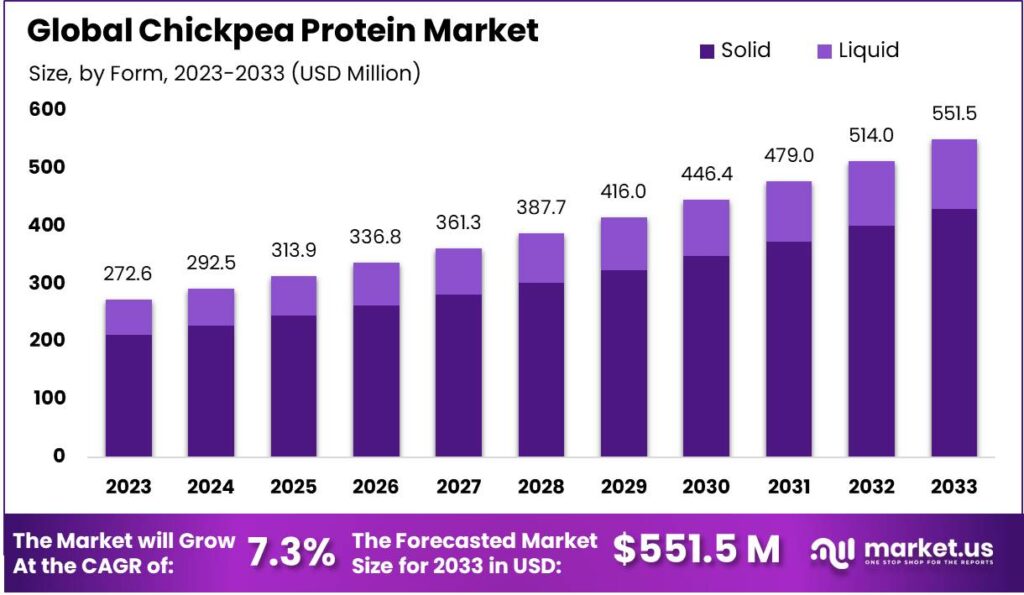

The Global Chickpea Protein Market size is expected to be worth around USD 551.5 Million by 2033, from USD 272.6 Million in 2023, growing at a CAGR of 7.3% during the forecast period from 2024 to 2033.

The chickpea protein market has become a key segment within the broader plant-based food industry, benefiting from growing consumer interest in sustainable and health-conscious eating habits. Chickpeas are well-known for their high protein content, making them an ideal alternative to animal-based proteins.

This demand is largely driven by the increasing popularity of vegan and vegetarian diets, as well as by individuals seeking to reduce meat consumption for health or environmental reasons.

Chickpea protein offers significant nutritional benefits, including being an allergen-free alternative to soy and gluten-based proteins. Its versatility makes it an attractive ingredient for a wide range of food products, such as protein bars, shakes, meat substitutes, and baked goods.

With more consumers focusing on their health and well-being, as well as the environmental impact of their food choices, chickpea protein has become a preferred option for those seeking clean-label, plant-based alternatives.

One of the main drivers behind the rise of chickpea protein is its fit with the clean eating trend. Unlike animal-based proteins, chickpea protein has a minimal environmental footprint, making it especially appealing to eco-conscious consumers. Additionally, its ease of use in cooking and ability to enhance flavor while boosting protein content make it a popular choice for home kitchens and professional food manufacturers.

The chickpea protein market presents many growth opportunities, particularly in product innovation and development. Companies are exploring new product lines tailored to specific dietary needs, such as keto-friendly snacks or high-protein plant-based foods.

There is also room for expansion in markets where plant-based diets are growing, such as parts of Europe, Asia, and Latin America. Strategic partnerships with local distributors and adapting products to regional tastes can help companies expand their reach.

Companies can focus on increasing awareness of chickpea protein’s health benefits to grow the market further. Targeted marketing campaigns and educational efforts about its nutritional value can attract new customers, particularly those with dietary restrictions or chronic health conditions. Additionally, expanding production capacities and optimizing supply chains will be essential for meeting the rising demand and supporting long-term market growth.

In 2023, global chickpea protein production reached over 150,000 metric tons, with leading producers such as AGT Foods, Ingredion, and InnovoPro accounting for roughly 30% of this capacity. The global consumption of chickpea protein is expected to grow at a CAGR of 9-10% from 2023 to 2030, with North America experiencing a growth rate of 12% annually due to the rising demand for vegan protein alternatives.

Government initiatives have also played a crucial role in supporting this market. In 2023, the U.S. Department of Agriculture allocated USD 50 million for the development of alternative proteins, including chickpea protein, as part of its Innovation in Food and Agriculture initiative.

Similarly, in India, the government launched a program with USD 30 million in subsidies to support the growth of legume-based proteins, including chickpeas.

The global chickpea export market reached a value of USD 3.4 billion in 2023, with India contributing nearly 50% of global exports. The U.S. also played a significant role, exporting chickpeas valued at over USD 400 million in 2023, marking a 10% year-on-year growth. Most of these exports were directed towards Europe and Asia, where plant-based food trends are particularly strong.

Key Takeaways

- The Global Chickpea Protein Market size is expected to be worth around USD 551.5 Million by 2033, from USD 272.6 Million in 2023, growing at a CAGR of 7.3% during the forecast period from 2024 to 2033.

- The Solid segment dominated the Chickpea Protein Market with over 78.5% share, driven by demand.

- The Conventional segment dominated the Chickpea Protein Market with over 69.4% share, driven by affordability.

- The Dry Processing segment dominated the Chickpea Protein Market with over 67.4% share, driven by cost-efficiency.

- The Protein Isolates segment of the Chickpea Protein Market held a dominant position, capturing more than 44.1% of the market share.

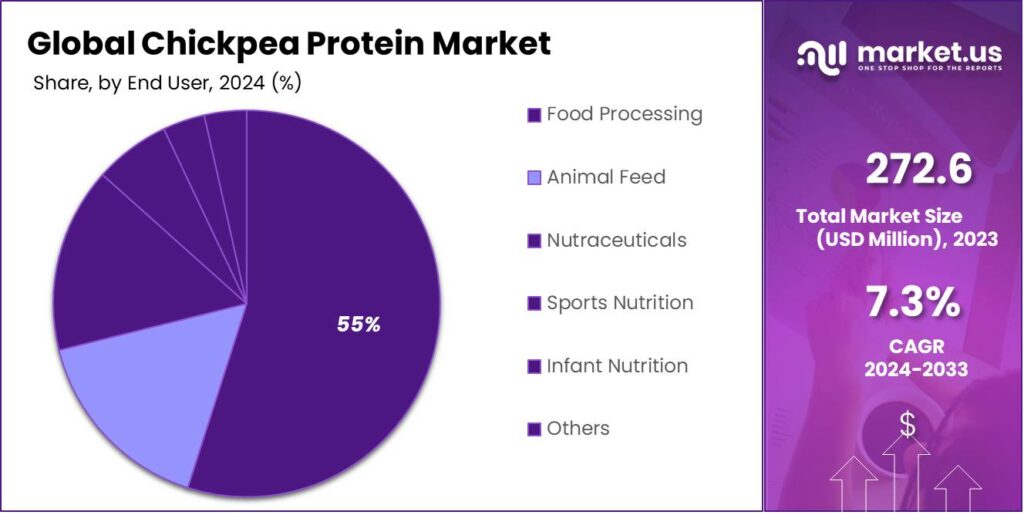

- In 2023, the Food Processing segment dominated the Chickpea Protein Market with over 57.1% share, driven by plant-based demand.

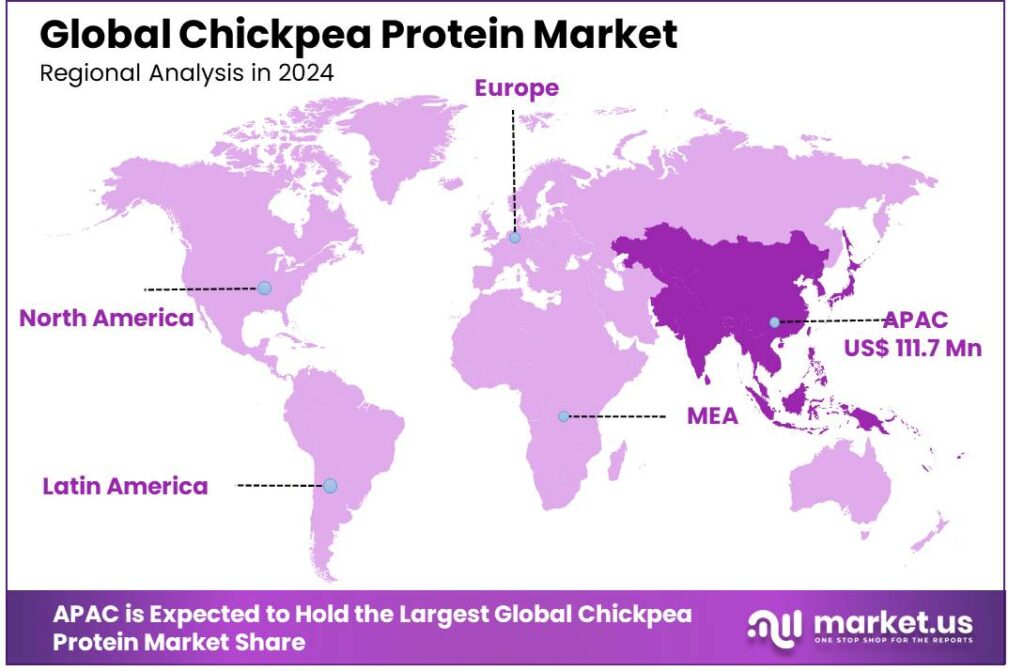

- APAC dominated the Chickpea Protein Market with a 41.9% share, USD 111.7 million.

By Form Analysis

In 2023, The Solid segment of the Chickpea Protein Market held a dominant position, capturing over 78.5% of the market share. This dominance can be attributed to the growing consumer demand for plant-based protein alternatives, especially in the food and beverage industry.

Solid chickpea protein is widely used in a variety of applications, including plant-based meat alternatives, snacks, and bakery products, where it provides a firm texture, better mouthfeel, and improved nutritional content.

The Solid segment is further supported by the increasing popularity of vegan and vegetarian diets, where solid chickpea protein serves as a valuable source of plant-based protein. The demand for protein-enriched products, such as protein bars and ready-to-eat meals, also boosts the consumption of solid forms.

Solid chickpea protein offers higher functionality in terms of emulsification, water retention, and binding properties compared to liquid forms, making it more effective in enhancing product performance.

By Nature Analysis

In 2023, the Conventional segment of the Chickpea Protein Market held a dominant position, capturing more than 69.4% of the market share. This leadership is largely driven by the lower cost of conventional chickpea protein compared to organic alternatives.

Conventional chickpea protein is widely available, benefiting from established production processes and economies of scale. Its affordability makes it a preferred choice for mass-market food products, especially in the food and beverage, nutraceutical, and animal feed industries, where cost efficiency is a key factor in product formulation.

The dominance of the Conventional segment is also supported by the broader supply chain and cultivation practices that make conventional chickpea protein more readily available in the market. While the organic segment has seen growth in consumer demand, particularly among health-conscious and environmentally aware buyers, the larger volume and lower cost of conventional chickpea protein make it more accessible for a wide range of applications.

By Processing Type Analysis

In 2023, the Dry Processing segment of the Chickpea Protein Market held a dominant position, capturing more than 67.4% of the market share. This dominance can be attributed to the efficiency and cost-effectiveness of dry processing methods, which involve minimal use of water and energy compared to wet processing.

The dry processing method is widely used due to its ability to produce high yields with lower operational costs, making it the preferred choice for large-scale production. The resulting chickpea protein is highly versatile and can be easily incorporated into a wide range of products such as protein powders, bars, and snacks.

Dry processing also offers longer shelf life and better preservation of the protein content, which is crucial for maintaining product quality and consistency. Since the process is relatively simple and requires less complex infrastructure, it appeals to manufacturers looking for scalable solutions that are both economical and effective.

While wet processing has seen increased demand, particularly for specialized applications where a higher protein concentration is required, it generally incurs higher costs and complex processing steps. The dry processing segment’s continued leadership is driven by its ability to meet the mass-market needs for cost-effective, high-quality chickpea protein in various consumer products, making it the go-to choice for most manufacturers in the industry.

By Product Type Analysis

In 2023, the Protein Isolates segment of the Chickpea Protein Market held a dominant position, capturing more than 44.1% of the market share. This leadership is primarily driven by the increasing demand for high-protein ingredients in the food and beverage industry, particularly in the growing plant-based protein segment.

Protein isolates offer a high concentration of protein, typically over 90%, which makes them highly attractive for manufacturers targeting protein-rich products such as protein bars, shakes, and plant-based meat alternatives. The superior protein content of isolates also aligns with consumer preferences for high-protein diets, further supporting the segment’s growth.

Protein Isolates are widely used in products aimed at health-conscious consumers, athletes, and those following specific dietary patterns like vegan and vegetarian diets. Their functional properties, such as excellent solubility, emulsification, and water retention, make them highly versatile and suitable for various applications. As the demand for plant-based alternatives continues to rise, protein isolates are increasingly used as a key ingredient in non-dairy beverages, snacks, and supplements.

The segment’s dominance is also due to the advanced processing technologies available for isolating protein from chickpeas, which result in a clean and high-quality product with minimal processing by-products.

These advances make protein isolates more efficient and cost-effective, ensuring consistent quality and a reliable supply. Moreover, the higher protein content compared to concentrates and flour makes isolates more desirable for formulating high-protein products that meet consumer demand for nutrition and health benefits.

While protein concentrates and flour segments have seen growth, particularly in applications such as bakery products and animal feed, they typically offer lower protein concentrations than isolates. This makes protein isolates more appealing to manufacturers who require a higher protein yield per unit, ensuring their continued leadership in the market. As a result, the Protein Isolates segment is expected to maintain its dominant position as the demand for plant-based protein ingredients continues to surge globally.

By End User Analysis

In 2023, the Food Processing segment of the Chickpea Protein Market held a dominant position, capturing more than 57.1% of the market share. This dominance can be attributed to the growing consumer demand for plant-based food products, which has been fueled by an increasing shift towards health-conscious diets and sustainable eating habits.

Chickpea protein is a key ingredient in the food processing industry, where it is used to produce a variety of products such as plant-based meats, dairy alternatives, snacks, and protein-enriched beverages. Its versatility and ability to enhance the nutritional profile of food products have made it a favored choice among manufacturers in the sector.

The increasing popularity of plant-based and vegan diets plays a significant role in driving the demand for chickpea protein in food processing applications. As consumers seek higher protein content in their meals without relying on animal-based sources, chickpea protein offers a valuable alternative. It is known for its neutral flavor, making it easy to incorporate into a wide range of food products without altering their taste, which further increases its appeal to food manufacturers.

Another factor contributing to the Food Processing segment’s dominance is the growing trend of health and wellness. Chickpea protein is recognized for its high nutritional value, containing essential amino acids, and being rich in fiber, which makes it an ideal ingredient for health-conscious consumers.

It is increasingly found in protein bars, ready-to-eat meals, and functional foods aimed at promoting better health. The rising demand for clean-label products, which are perceived as healthier and more transparent, has further amplified the use of chickpea protein in processed foods.

While other end-use segments such as Animal Feed, Nutraceuticals, and Sports Nutrition are growing, they do not yet match the scale of the Food Processing segment in terms of overall market share. These industries typically require smaller volumes of chickpea protein, and their growth is driven by more specific, niche applications.

On the other hand, the widespread and diverse applications of chickpea protein in food processing ensure that this segment will continue to lead the market as it benefits from economies of scale and a broad consumer base.

Key Market Segments

By Form

- Solid

- Liquid

By Nature

- Organic

- Conventional

By Processing Type

- Dry Processing

- Wet Processing

By Product Type

- Protein Isolates

- Protein Concentrates

- Flour

- Others

By End User

- Food Processing

- Animal Feed

- Nutraceuticals

- Sports Nutrition

- Infant Nutrition

- Others

Driving factors

Growing Demand for Plant-Based Proteins

The increasing shift toward plant-based diets is one of the key drivers behind the growth of the chickpea protein market. With concerns over the environmental impact of animal-based products and rising health consciousness, consumers are actively seeking alternatives to traditional protein sources. Chickpea protein, known for its rich amino acid profile and low allergenic potential, has become a popular choice in the plant-based protein segment.

According to data from various sources, the plant-based protein market is expected to witness steady growth over the next several years, with chickpea protein positioned as a preferred option for a variety of applications, including meat alternatives, snacks, and beverages. This growing consumer preference is further bolstered by the increasing availability of chickpea-based protein products in supermarkets, health food stores, and online platforms.

As a result, manufacturers are expanding their product portfolios to cater to a broad range of consumers, including vegans, vegetarians, and those seeking sustainable food choices. This demand, coupled with the increasing awareness of the health benefits associated with plant proteins, is likely to support the market’s growth in the coming years.

Restraining Factors

Limited Awareness of Chickpea Protein Benefits

Despite its numerous health benefits, the chickpea protein market faces a challenge in terms of consumer awareness. While chickpeas have long been consumed in various forms, chickpea protein as an ingredient is still relatively unknown to many consumers. This lack of understanding can limit the growth of the market, particularly among consumers who are unaware of its potential benefits as a high-quality protein source.

Compared to other plant-based proteins like soy and pea, chickpea protein still struggles with recognition in mainstream markets. Limited marketing and educational campaigns by producers could be contributing to this issue. Furthermore, consumers who have traditionally relied on animal-based proteins may not immediately consider chickpea protein as a viable alternative.

Overcoming this barrier requires strategic efforts in consumer education, clear labeling, and product positioning to highlight the nutritional value of chickpea protein. As the market matures and awareness campaigns become more widespread, this restraint may ease, allowing the chickpea protein segment to gain more traction in the global plant-based protein market.

Growth Opportunity

Expansion in the Sports Nutrition Segment

The chickpea protein market holds a promising opportunity within the growing sports nutrition sector. As more athletes, fitness enthusiasts, and health-conscious individuals seek protein-rich supplements, plant-based protein sources are gaining in popularity. Chickpea protein, in particular, offers an attractive alternative to animal-based protein powders, with its high digestibility, low allergenic profile, and robust nutritional content.

As consumers increasingly prioritize plant-based diets for health and environmental reasons, chickpea protein is well-positioned to cater to the rising demand for plant-based supplements. The sports nutrition segment is expected to expand as more individuals adopt fitness routines, and the demand for plant-based protein powders continues to increase. Brands that introduce innovative, chickpea-based protein powders, shakes, and snack bars stand to benefit from tapping into this growing market.

Additionally, partnerships with fitness influencers and professional athletes could help boost consumer confidence and awareness. As the trend toward plant-based diets in sports nutrition continues to grow, chickpea protein may find itself as a key ingredient in performance-oriented nutritional products.

Challenge

Price Competitiveness with Other Protein Sources

One of the primary challenges faced by the chickpea protein market is its price competitiveness with other plant-based protein sources. Although chickpea protein offers significant nutritional benefits, it is often more expensive than other alternatives, such as pea protein or soy protein. This price difference can deter some consumers, especially when chickpea protein products are marketed at a premium price point.

Producers may face difficulties in lowering production costs without compromising the quality of the product, as chickpeas are typically more expensive to source and process than some other plant-based protein sources. Additionally, economies of scale are not yet fully realized in the chickpea protein industry, which makes it harder for companies to compete on cost with larger protein suppliers.

This challenge is compounded by the fact that consumers have multiple affordable protein options to choose from, including soy, hemp, and rice protein, which may offer lower costs and a more established market presence. To overcome this challenge, companies may need to focus on optimizing production processes, exploring cost-reduction techniques, and building consumer trust in the unique benefits of chickpea protein.

Emerging Trends

One of the most significant emerging trends in the chickpea protein market is the increasing demand for protein-rich plant-based food products. As consumers become more health-conscious and environmentally aware, there is a shift towards plant-based diets. Chickpea protein, with its high-quality amino acid profile and numerous health benefits, is gaining traction among vegans, vegetarians, and flexitarians.

According to a report on the growing plant-based food sector, many consumers are seeking alternatives to traditional animal-based proteins due to concerns about sustainability and health. Chickpea protein fits perfectly into this trend, as it is both nutritious and eco-friendly, requiring less water and land than animal farming.

Moreover, innovation in food processing is enabling companies to create more versatile chickpea protein products. For example, chickpea protein isolates are now being used in a variety of applications, from meat alternatives and dairy-free snacks to beverages and protein bars. This flexibility is expanding its footprint in the mainstream food industry. Additionally, the rise of “clean label” products, which emphasize transparency and natural ingredients, aligns well with chickpea protein, as it is often perceived as a simple and wholesome ingredient.

Another growing trend is the use of chickpea protein in the sports nutrition market. As more athletes and fitness enthusiasts move toward plant-based diets, there is a rising demand for plant-based protein powders and supplements. Chickpea protein is increasingly being used in these products due to its high protein content and digestibility.

Business Benefits

The business benefits of incorporating chickpea protein into product lines are significant, especially for companies looking to tap into the growing plant-based food and supplement markets. One of the key advantages is that chickpea protein is a highly nutritious ingredient.

Rich in protein, fiber, and essential micronutrients, it provides a strong value proposition for health-conscious consumers. This nutritional profile allows businesses to market chickpea protein as a superior, plant-based alternative to traditional animal proteins, which appeals to a broad range of consumers, from vegans to those with lactose intolerance or dietary restrictions.

Another business benefit is the growing consumer preference for sustainable and ethical food products. Chickpea protein has a relatively low environmental footprint compared to animal proteins, making it an attractive option for consumers who prioritize sustainability.

By offering chickpea-based products, businesses can align with the growing trend of sustainability in the food industry, potentially attracting environmentally-conscious consumers. This can also serve as a differentiator in a crowded marketplace, where consumers are increasingly looking for products that not only support their health but also promote environmental responsibility.

Furthermore, chickpea protein’s versatility as an ingredient offers businesses the opportunity to diversify their product portfolios. From plant-based meat substitutes to protein bars and smoothies, the application possibilities are vast.

Companies can experiment with new product formulations to appeal to both mainstream consumers and niche markets. The rise of the clean label movement also provides a competitive advantage for businesses using chickpea protein, as it is often seen as a more natural, minimally processed ingredient compared to others.

Regional Analysis

APAC dominated the Chickpea Protein Market with a 41.9% share, USD 111.7 million.

In 2023, APAC held a dominant market position in the Chickpea Protein Market, capturing more than a 41.9% share, amounting to USD 111.7 million in revenue. The region’s leadership can be attributed to several key factors, including the growing demand for plant-based proteins driven by a large population, increasing health consciousness, and rising vegetarian and vegan trends. Countries like India and China are emerging as major hubs for plant-based food products, with their expanding middle-class population and shifting dietary preferences toward protein-rich alternatives, which has fueled the demand for chickpea protein.

The availability of abundant chickpea production in APAC countries also plays a significant role in driving market growth. India, being the largest producer of chickpeas globally, benefits from easy access to raw materials, reducing the cost of chickpea protein production. Furthermore, the region’s expanding food and beverage industry, which increasingly incorporates plant-based ingredients in product formulations, has created a strong market for chickpea protein. The rise of food innovation and new product launches featuring chickpea protein has further strengthened its market presence in the region.

In contrast, North America and Europe have experienced steady growth but lag behind APAC in terms of market share. North America’s market is growing due to rising consumer demand for sustainable and healthy protein alternatives. Europe, with a market growth driven by the popularity of vegan and vegetarian diets, as well as the shift towards plant-based protein sources in the food industry. Latin America, along with the Middle East and Africa, holds smaller shares but shows potential for growth as awareness of plant-based diets and alternative proteins increases across these regions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the rapidly growing Chickpea Protein Market, several key players are driving innovation and market expansion. These companies play a crucial role in shaping the market through strategic partnerships, product development, and geographical expansion. The top players are leveraging their expertise in ingredient sourcing, processing technologies, and consumer trends to gain a competitive edge in this evolving sector.

AGT Food and Ingredients Inc. is one of the key players in the Chickpea Protein Market, known for its extensive portfolio of plant-based ingredients. The company specializes in producing and supplying chickpea protein isolate and concentrate to various industries, particularly the food and beverage sector. AGT’s strong global presence, coupled with its advanced processing capabilities, enables it to cater to the growing demand for high-quality, sustainable protein alternatives.

Archer Daniels Midland Company (ADM) is a global leader in agricultural products and ingredients, including chickpea protein. ADM has expanded its portfolio by integrating chickpea protein into its plant-based offerings, particularly for the food processing industry. The company’s robust distribution network, research and development capabilities, and strong customer relationships help it maintain a dominant position in the market. ADM’s focus on sustainable sourcing practices and the development of clean-label products aligns well with the growing consumer preference for healthy, environmentally friendly options.

Batory Foods is another major player in the Chickpea Protein Market, offering a wide range of plant-based protein ingredients. Known for its high-quality chickpea protein isolates and concentrates, the company supplies various industries, including food, beverage, and nutraceuticals. Batory Foods is committed to providing sustainable solutions, ensuring that its chickpea protein products meet the rising demand for clean-label and plant-based ingredients.

Cambridge Commodities Limited is an established player in the plant-based protein sector, providing chickpea protein among its wide range of nutritional ingredients. The company is well-known for its focus on product quality and customer-specific solutions. By offering chickpea protein isolates and concentrates, Cambridge Commodities supports the growing demand for plant-based protein in food processing and nutraceuticals. Its reputation for quality control and supply chain transparency makes it a trusted supplier in the industry.

Each of these key players is not only focused on growing their market share but also on creating products that meet the changing demands of consumers seeking healthier, more sustainable protein alternatives. Their investments in research, production, and distribution enable them to lead the charge in the plant-based protein revolution, ensuring their continued dominance in the Chickpea Protein Market.

Market Key Players

- AGT Food and Ingredients Inc.

- Archer Daniels Midland Company

- Batory Foods

- Cambridge Commodities Limited

- ChickP Protein Ltd.

- Chickplease

- Ingredion Incorporated

- InnovoPro Ltd.

- Nutraonly

- Nutriati, Inc.

- Nutritions Inc.

- Parabel USA Inc.

- PLT Health Solutions

- Puris Proteins, LLC

- Socius Ingredients

- The Scoular Company

- Vestkorn Milling AS

Recent Development

- In April 2024, Ingredion launched a new chickpea protein product aimed at plant-based meat manufacturers. The product is expected to capture 5% of the global chickpea protein market share within the first year of its launch.

- In 2023, ChickP Protein Ltd. secured USD 10 million in funding to expand its chickpea protein production facility in the Middle East. This expansion will increase their production capacity by 20,000 metric tons annually, catering to the rising demand from the European and North American markets.

Report Scope

Report Features Description Market Value (2023) USD 272.6 Million Forecast Revenue (2033) USD 551.5 Million CAGR (2024-2032) 7.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Form (Solid, Liquid), By Nature (Organic, Conventional, By Processing Type (Dry Processing, Wet Processing, Product Type (Protein Isolates, Protein Concentrates, Flour, Others), By End User (Food Processing, Animal Feed, Nutraceuticals, Sports Nutrition, Infant Nutrition, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape AGT Food and Ingredients Inc., Archer Daniels Midland Company, Batory Foods, Cambridge Commodities Limited, ChickP Protein Ltd, Chickplease, Ingredion Incorporated, InnovoPro Ltd, Nutraonly, Nutriati, Inc, Nutritions Inc., Parabel USA Inc, PLT Health Solution, Puris Proteins, LL, Socius Ingredient, The Scoular Compan, Vestkorn Milling AS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Chickpea Protein MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Chickpea Protein MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- GT Food and Ingredients Inc.

- Archer Daniels Midland Company

- Batory Foods

- Cambridge Commodities Limited

- ChickP Protein Ltd.

- Chickplease

- Ingredion Incorporated

- InnovoPro Ltd.

- Nutraonly

- Nutriati, Inc.

- Nutritions Inc.

- Parabel USA Inc.

- PLT Health Solutions

- Puris Proteins, LLC

- Socius Ingredients

- The Scoular Company

- Vestkorn Milling AS