Global Pressure Sensitive Adhesives Market Size, Share, And Growth Analysis Report By Chemistry (Acrylic, Rubber, Silicone, Others), By Technology (Water-based, Solvent-based, Hot Melt, Radiation-Cured), By Substrate (Plastic, Paper, Metal, Glass, Wood), By Application (Labels, Tapes, Graphics, Others), By End-Use (Automotive and Transportation, Electronics, Consumer Goods, Packaging, Building and Construction, Medical and Healthcare), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146444

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

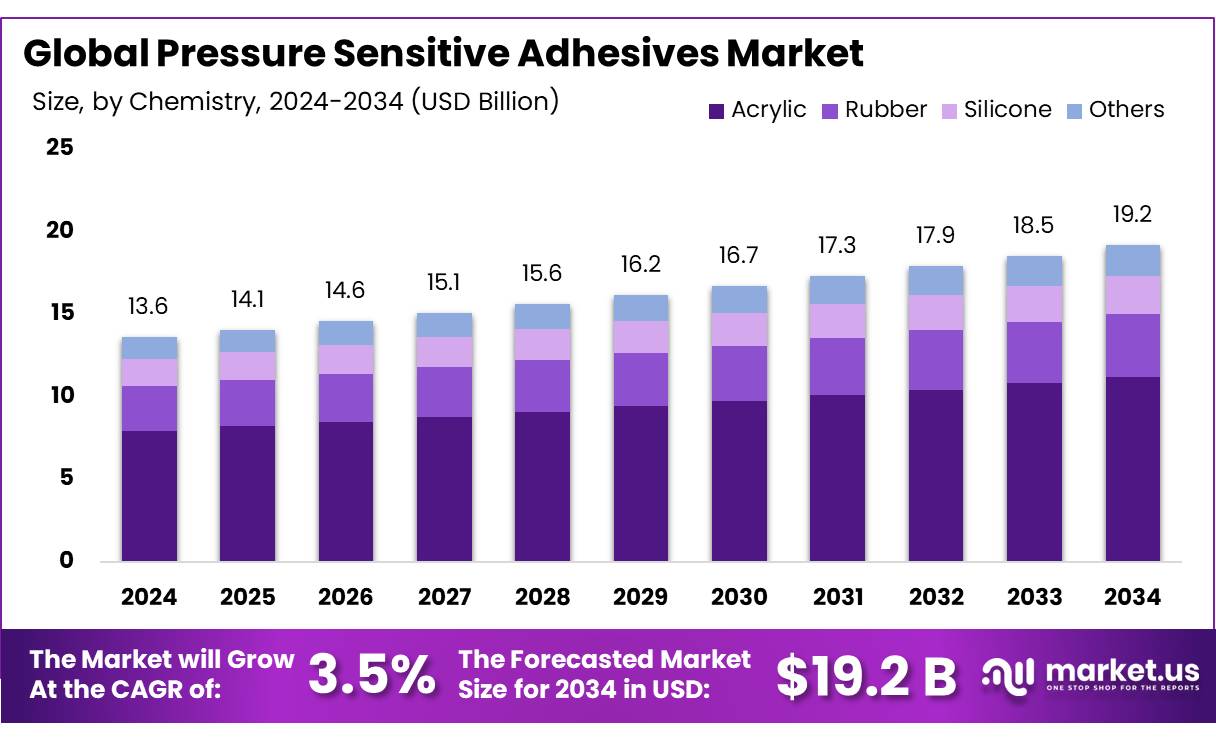

The Global Pressure Sensitive Adhesives Market size is expected to be worth around USD 19.2 billion by 2034, from USD 13.6 billion in 2024, growing at a CAGR of 3.5% during the forecast period from 2025 to 2034.

The Pressure-Sensitive Adhesives (PSA) Market is a dynamic sector within the broader adhesives industry, characterized by its versatility and widespread applications across packaging, automotive, electronics, medical, and construction industries. PSAs are non-reactive adhesives that form bonds when pressure is applied, requiring no heat, solvent, or water for activation. Their ability to remain tacky and adhere to various substrates with minimal pressure makes them integral to modern manufacturing and consumer goods.

The Pressure Sensitive Adhesive features a variety of products tailored for medical applications, each with distinct compositions and performance characteristics. 3M’s Medical Tape 1538, designed for wearable device fixation and wound dressing cover tape, uses an acrylic adhesive with a peel adhesion of 7.4 N/25 mm to stainless steel, offering reliable bonding for medical uses.

Similarly, 3M’s Tegaderm, a polyurethane-based adhesive for wound dressings, prioritizes flexibility and skin comfort, though its peel adhesion data is not specified. Avery Dennison’s MED 5078A, another acrylic-based adhesive, serves short-term surgical applications, wound dressings, and ostomy flanges, boasting a strong peel adhesion of 14.1 N/25 mm, making it ideal for secure, temporary fixation.

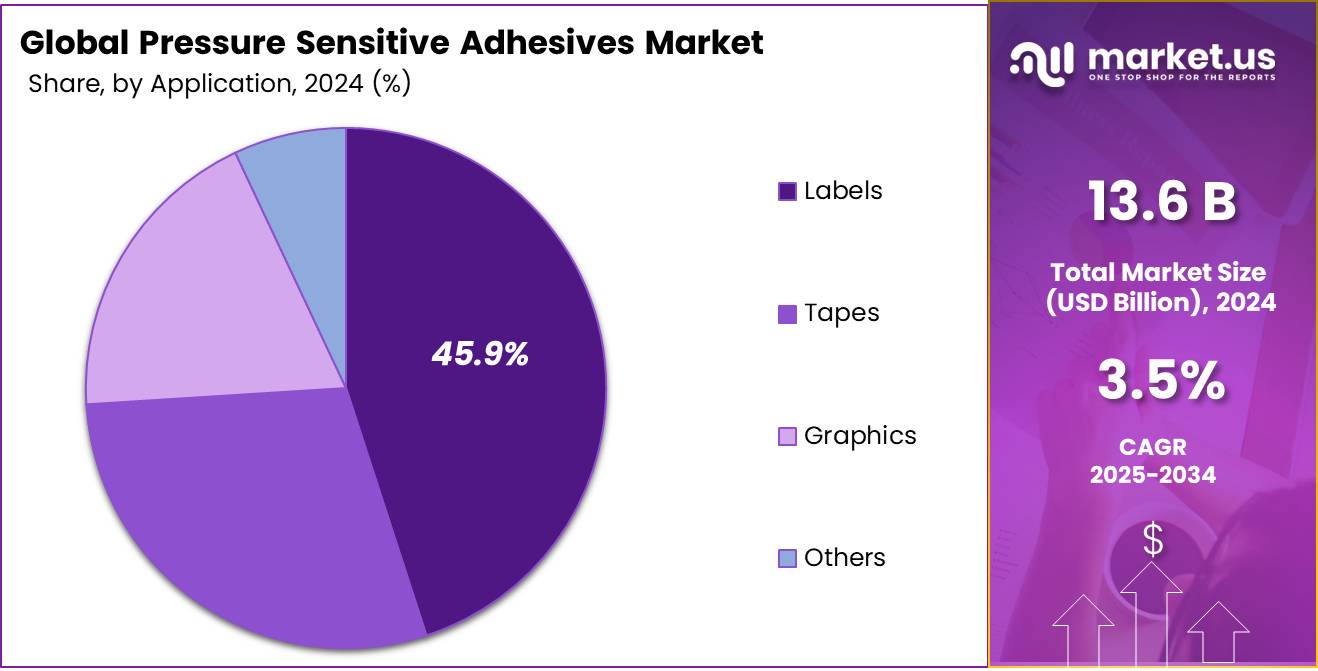

The PSA market is segmented by technology, application, and end-use industry. Water-based PSAs dominate the market, holding over 46% share in 2024, driven by environmental regulations favoring low-VOC (volatile organic compound) formulations. The tapes segment accounts for the largest application share, 45%, owing to rising demand in logistics and e-commerce. Geographically, Asia-Pacific leads the market with a 46% share, fueled by rapid industrialization in China, India, and Japan.

Key Takeaways

- The global Pressure Sensitive Adhesives Market is projected to reach USD 19.2 billion by 2034, growing at a CAGR of 3.5% from 2025 to 2034.

- Acrylic-based PSAs dominated with 58.3% market share in 2024 due to their durability, UV resistance, and versatility across industries.

- Water-based PSAs led with a 46.8% share in 2024, favored for being eco-friendly, low-VOC, and compliant with strict environmental regulations.

- Plastic substrates held the largest share, 35.6% in 2024, due to their widespread use in packaging, automotive, and electronics.

- Labels were the top PSA application, capturing 45.9% market share in 2024, driven by demand in food & beverage, pharmaceuticals, and logistics.

- The automotive sector was the leading end-user, holding 42.7% share in 2024, due to demand for lightweight and durable bonding solutions.

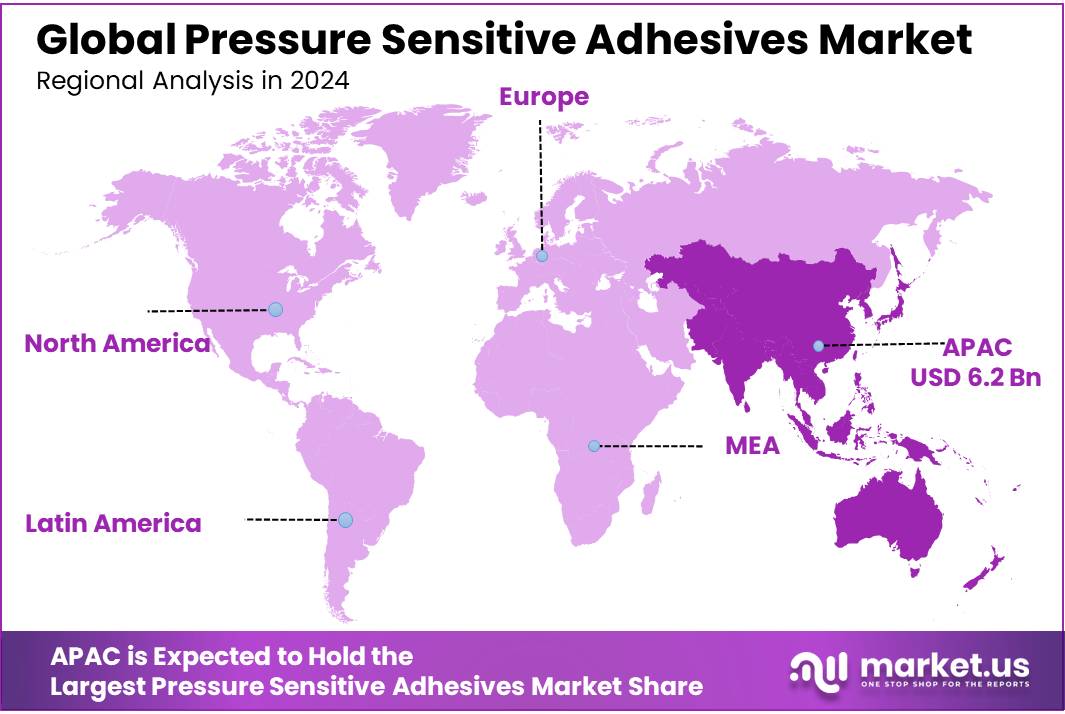

- APAC is the dominant region, accounting for 46.3% of the global PSA market USD 6.2 billion, led by China, Japan, India, and South Korea.

Analyst Viewpoint

The pressure-sensitive adhesives (PSA) market is buzzing with potential for investors, driven by their versatility across industries like packaging, automotive, electronics, and healthcare. From an investment perspective, the global demand for PSAs is soaring due to their ease of use, no heat or solvents needed, just a bit of pressure to stick.

The growing trend toward lightweight vehicles and compact electronics also fuels demand, as PSAs offer reliable bonding without adding bulk. Plus, the shift toward sustainability is opening doors for eco-friendly PSAs, like bio-based or recyclable options, which align with what consumers want today. Investors could find opportunities in companies innovating in these green adhesives or expanding into high-growth regions like Asia-Pacific, where rapid industrialization is driving adhesive use.

Technological advancements, like UV-curable or smart adhesives, are exciting but require hefty R&D investment. The regulatory environment, especially in Europe and North America, is tightening, with strict VOC limits and recycling mandates. While these push innovation, they also raise compliance costs. Investors should focus on firms with strong R&D and a knack for sustainable solutions to stay ahead in this sticky but promising market.

By Chemistry

In 2024, Acrylic-Based pressure-sensitive adhesives (PSAs) dominated the market, holding more than 58.3% of the total share. This strong position was driven by their versatility, strong bonding performance, and resistance to environmental factors like UV light and temperature changes.

Acrylic PSAs are widely used in industries such as packaging, automotive, electronics, and healthcare due to their durability and ease of application. The demand for acrylic PSAs is expected to grow steadily, supported by increasing applications in labels, tapes, and medical adhesives.

Their non-toxic nature and ability to adhere to various surfaces make them a preferred choice over other chemistries. While other adhesive types compete in niche segments, acrylic remains the leader. The growth is further fueled by advancements in formulation technologies, enhancing performance for specialized industrial needs.

By Technology

In 2024, Water-Based pressure-sensitive adhesives (PSAs) led the market with a dominant share of over 46.8%. Their popularity comes from being eco-friendly, low in volatile organic compounds (VOCs), and easy to apply across industries like packaging, labels, and consumer goods.

Manufacturers prefer water-based PSAs because they offer strong adhesion while meeting strict environmental regulations, especially in North America and Europe. The demand for water-based PSAs is expected to stay strong, driven by sustainability trends and stricter environmental policies.

Solvent-based and hot-melt adhesives compete in certain high-performance applications, while water-based technology remains the top choice for everyday uses like stickers, tapes, and medical patches. Supported by ongoing innovations in adhesive formulations that improve drying times and bond strength without compromising environmental benefits.

By Substrate

In 2024, Plastic was the leading substrate in the pressure-sensitive adhesives (PSAs) market, accounting for more than 35.6% of the total share. Its dominance comes from widespread use in industries like packaging, automotive, electronics, and consumer goods, where flexibility, durability, and lightweight properties are key.

PSAs stick well to different types of plastic, including polyethylene, polypropylene, and PVC, making them essential for labels, tapes, and protective films. Plastic is expected to maintain its top position, with demand driven by growing packaging needs and the rise of flexible electronics.

Paper and metal substrates also hold significant shares, plastic remains the preferred choice due to its cost-effectiveness and adaptability. Innovations in adhesive formulations are further improving bond strength on challenging plastic surfaces. Sustainability trends may push for more recyclable plastic options, but for now, traditional plastics continue to dominate PSA applications.

By Application

In 2024, Labels dominated the pressure-sensitive adhesives (PSAs) market with a commanding 45.9% share. This huge demand comes from nearly every industry: food & beverage, pharmaceuticals, retail, and logistics, all relying heavily on labels for branding, information, and tracking.

Pressure-sensitive labels are preferred because they stick instantly without water, heat, or solvents, making them fast and cost-effective for high-speed production lines. The label segment is expected to keep its stronghold, with growth driven by e-commerce expansion, stricter labeling regulations, and smart label technologies like RFID.

Tapes and specialty films also use PSAs, labels remain the biggest application due to their everyday necessity. The segment’s share is likely to stay around 45-46%, supported by innovations like eco-friendly adhesives and linerless labels that reduce waste. Even with digital alternatives emerging, traditional adhesive labels aren’t going anywhere soon.

By End-Use

In 2024, the Automotive and Transportation sector dominated the pressure-sensitive adhesives (PSAs) market, holding a substantial 42.7% share. This strong position comes from the industry’s growing demand for lightweight, durable bonding solutions in vehicle assembly, interior trim, and noise reduction applications.

PSAs are preferred over mechanical fasteners because they reduce weight, improve fuel efficiency, and provide better vibration resistance, key factors as automakers push for more efficient and electric vehicles. The automotive and transportation segment is expected to maintain its lead, with steady growth driven by rising electric vehicle (EV) production and stricter emissions regulations.

Packaging and healthcare also rely on PSAs, automotive applications, such as adhesive tapes for wire harnessing, interior panels, and exterior decals, will keep this sector at the forefront. Innovations like high-temperature-resistant and recyclable PSAs are further boosting adoption.

Key Market Segments

By Chemistry

- Acrylic

- Pure Acrylic

- Modified Acrylic

- Rubber

- Natural

- Synthetic

- Silicone

- Others

By Technology

- Water-based

- Solvent-based

- Hot Melt

- Radiation-Cured

By Substrate

- Plastic

- Paper

- Metal

- Glass

- Wood

- Others

By Application

- Labels

- Tapes

- Single-Faced

- Double-Faced

- Others

- Graphics

- Others

By End-Use

- Automotive and Transportation

- Electronics

- Consumer Goods

- Packaging

- Building and Construction

- Medical and Healthcare

- Others

Drivers

Surge in E-commerce and Packaging Needs

The pressure-sensitive adhesives (PSA) market is riding a wave of growth, largely fueled by the explosive rise in e-commerce and the packaging demands that come with it. Every online order, from a new phone to a bag of groceries, needs secure packaging—think tapes and labels that stick fast and hold tight.

PSAs are perfect for this because they bond instantly with just a press, no heat or solvents required. The boom in online shopping, especially since the pandemic, has sent the need for reliable packaging solutions through the roof. This trend isn’t just about numbers, it’s about how we live now. People want fast deliveries, and companies need packaging that’s efficient and cost-effective.

PSAs fit the bill, offering durability without complicating production lines. Plus, government initiatives, like infrastructure investments in logistics and trade in places like Asia-Pacific, are making it easier for e-commerce to flourish, indirectly boosting PSA demand. For instance, China’s massive export market, driven by its manufacturing might, leans heavily on PSA-based tapes and labels for global shipping.

Restraints

Volatility in Raw Material Prices

The pressure-sensitive adhesives (PSA) market faces a significant hurdle with the unpredictable swings in raw material prices, which can throw a wrench into production costs and profit margins. Most PSAs rely on petrochemical-based ingredients like acrylics, rubber, and tackifying resins, and their prices are tied to the volatile oil market. When oil prices spike, so do the costs of these key components, making it tough for manufacturers to keep prices steady for customers.

Government initiatives, like the U.S. push for energy independence, aim to stabilize oil markets, but they haven’t fully tamed these fluctuations. Add to that the global demand for chemicals outpacing supply, think shortages of monomers like piperylene, and you’ve got a recipe for higher costs. This restraint isn’t just numbers on a spreadsheet; it’s about real businesses scrambling to plan while keeping their products affordable.

Opportunity

Rising Demand from the Packaging Industry

The pressure-sensitive adhesives (PSA) market is booming, and a big reason is the skyrocketing demand from the packaging industry. With online shopping becoming a way of life, every package—whether it’s a box of clothes or a grocery delivery, needs tapes and labels that stick reliably.

PSAs are a go-to choice because they bond instantly with just a press, making them perfect for sealing cartons or labeling products. Fast, reliable packaging is a must, and PSAs deliver without slowing down production lines. Government initiatives, like trade policies boosting exports in countries like China and India, are also helping. These policies make it easier for goods to move globally, increasing the need for PSA-based packaging solutions.

The American Chemistry Council notes that the chemical industry, including adhesives, underlines its economic importance. Still, challenges like raw material price swings can make things tricky for manufacturers. But with e-commerce showing no signs of slowing down, the packaging industry’s reliance on PSAs is a solid bet for growth, keeping things sticky in the best way.

Trends

Push for Sustainable and Bio-Based Adhesives

The pressure-sensitive adhesives (PSA) market is seeing a game-changing shift with the rise of sustainable and bio-based adhesives, driven by growing environmental awareness. People today care about the planet, and they’re pushing companies to ditch traditional petroleum-based PSAs for greener options made from renewable sources like plant-based resins or biodegradable polymers.

Bio-based PSAs are gaining traction in the packaging, medical, and automotive sectors because they reduce carbon footprints while still sticking strong. This shift feels personal because it’s about the world we’re leaving behind. Governments are stepping in too, with initiatives like the European Union’s Green Deal, which aims to cut emissions and promote circular economies, encouraging companies to develop eco-friendly adhesives.

Regional Analysis

Asia-Pacific (APAC) Dominates the Pressure Sensitive Adhesives Market with 46.3% Share

The Asia-Pacific (APAC) region is the largest and fastest-growing market for pressure-sensitive adhesives (PSAs), accounting for 46.3% of the global market share, valued at USD 6.2 billion in 2024. This dominance is driven by rapid industrialization, expanding packaging industries, and increasing demand from the automotive and electronics sectors. Countries like China, Japan, India, and South Korea are key contributors.

The region’s growth is further supported by rising e-commerce activities, which fuel demand for labels, tapes, and specialty films. The electronics sector, particularly in South Korea and Taiwan, is a major consumer of PSAs for display bonding and smartphone assembly.

The automotive industry in Japan and India is boosting demand for PSAs in lightweight vehicle manufacturing. APAC’s cost-competitive production capabilities and strong export markets further reinforce its leadership. APAC remains the undisputed leader, driven by its dynamic industrial growth and technological advancements in adhesive formulations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- Henkel AG & Co. KGaA is a global leader in adhesives, with a strong presence in the pressure-sensitive adhesives (PSA) market through its Loctite and Technomelt brands. The company focuses on innovation in automotive, electronics, and packaging applications. With a robust R&D network, Henkel holds a significant market share, particularly in Europe and North America.

- Arkema, through its Bostik subsidiary, is a key PSA supplier, known for high-performance solutions in hybrid and acrylic adhesives. The company focuses on sectors like electronics, medical, and construction. With a strong presence in Europe and Asia, Arkema invests in eco-friendly adhesives to meet regulatory demands.

- 3M is a dominant force in PSAs, renowned for its Scotch and VHB tape brands. The company leads in industrial, automotive, and consumer applications, with advanced adhesive technologies. 3M’s strong global distribution network ensures market penetration across North America, Europe, and APAC.

Top Key Players in the Market

- Henkel AG and Co. KGaA

- H.B. Fuller Company

- Arkema

- 3M

- Sika AG

- Ashland, Inc.

- Pidilite Industries Ltd.

- Momentive Performance Materials, Inc.

- Franklin International, Inc.

- DuPont de Nemours, Inc.

- Helmitin Adhesives

- DIC Corporation

- Avery Dennison Corporation

- Wacker Chemie AG

- Tesa SE

- Illinois Tool Works Inc

- Scapa

- Jowat SE

- Exxon Mobil Corporation

Recent Developments

- In 2024, Henkel announced the establishment of a new application lab in Chennai, India, set to open by early 2025. This facility aims to support local customers in the adhesives and electronics packaging sectors, enhancing Henkel’s ability to deliver tailored PSA solutions for the Asia-Pacific market.

- In 2024, Arkema has been innovating in the PSA space with its Bostik division, launching a new range of UV-curable PSAs for electronics and medical applications. These adhesives offer high peel strength and low VOC emissions. The company also benefits from French government incentives for sustainable chemical production.

Report Scope

Report Features Description Market Value (2024) USD 13.6 Billion Forecast Revenue (2034) USD 19.2 Billion CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Chemistry (Acrylic, Rubber, Silicone, Others), By Technology (Water-based, Solvent-based, Hot Melt, Radiation-Cured), By Substrate (Plastic, Paper, Metal, Glass, Wood, Others), By Application (Labels, Tapes, Graphics, Others), By End-Use (Automotive and Transportation, Electronics, Consumer Goods, Packaging, Building and Construction, Medical and Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Henkel AG and Co. KGaA, H.B. Fuller Company, Arkema, 3M, Sika AG, Ashland, Inc., Pidilite Industries Ltd., Momentive Performance Materials, Inc., Franklin International, Inc., DuPont de Nemours, Inc., Helmitin Adhesives, DIC Corporation, Avery Dennison Corporation, Wacker Chemie AG, Tesa SE, Illinois Tool Works Inc., Scapa, Jowat SE, Exxon Mobil Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Pressure Sensitive Adhesives MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Pressure Sensitive Adhesives MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Henkel AG and Co. KGaA

- H.B. Fuller Company

- Arkema

- 3M

- Sika AG

- Ashland, Inc.

- Pidilite Industries Ltd.

- Momentive Performance Materials, Inc.

- Franklin International, Inc.

- DuPont de Nemours, Inc.

- Helmitin Adhesives

- DIC Corporation

- Avery Dennison Corporation

- Wacker Chemie AG

- Tesa SE

- Illinois Tool Works Inc

- Scapa

- Jowat SE

- Exxon Mobil Corporation