Global Packaging Materials Market Size, Share, Growth Analysis By Materials (Rigid Plastics, Flexible Plastics, Paper & Paperboard, Metal, Glass, Wood, Others), By Materials Product (Boxes & Cartons, Jars & Containers, Bags & Sacks, Bottles & Cans, Closures & Lids, Films & Wraps, Others), By Materials Format (Primary Packaging, Secondary Packaging, Tertiary Packaging), By Application (Food & Beverages, Pharmaceuticals & Healthcare, Personal Care & Cosmetics, Automotive, Electrical & Electronics, Household Products, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143120

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

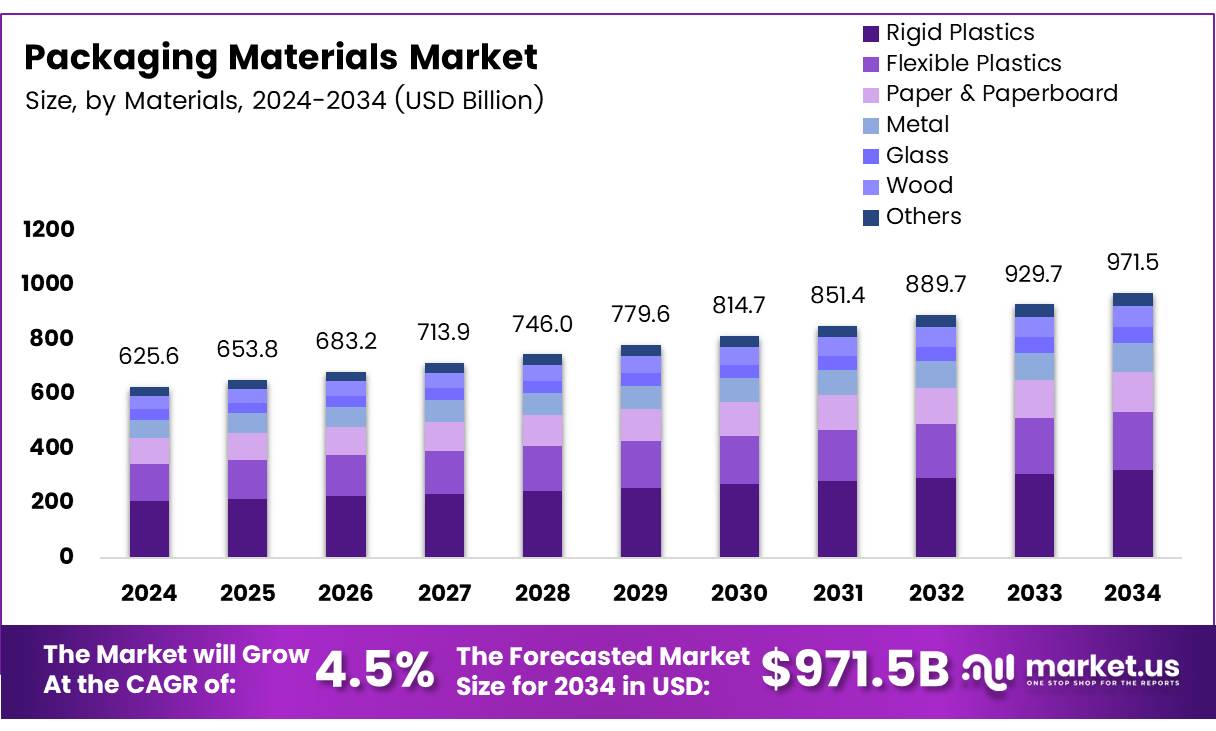

The Global Packaging Materials Market size is expected to be worth around USD 971.5 Billion by 2034, from USD 625.6 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

The Packaging Materials Market encompasses a wide range of materials used to protect, ship, and present goods across industries. From plastics and metals to glass and paper, the market is integral to preserving product integrity and enhancing user experience.

According to Business Dasher, 72% of consumers believe that packaging design significantly influences their purchasing decisions, highlighting the critical role of aesthetics and functionality in packaging materials. This consumer sentiment drives innovation and variety within the market, encouraging manufacturers to explore novel materials and designs that align with evolving preferences and sustainability demands.

The evolution of the Packaging Materials Market is notably driven by increasing consumer demand for sustainability. According to Meyers, 69% of consumers consider compostable and plant-based packaging to be the most sustainable options, pushing the industry towards eco-friendly alternatives. This shift is reshaping market dynamics, where the development of innovative, sustainable materials is becoming a competitive edge.

Moreover, the global production of plastic packaging stands at a staggering 141 million tonnes annually, as per Ipoly, indicating the vast scale and potential environmental impact of this sector. This underscores the urgent need for sustainable practices and materials that can reduce the ecological footprint of packaging.

The Packaging Materials Market is poised for growth, driven by several factors including technological advancements, rising consumer awareness, and stringent governmental regulations. The introduction of smart packaging technologies that enhance the functionality and traceability of products is creating new opportunities for market expansion.

Additionally, the push for sustainable packaging solutions by governments and regulatory bodies worldwide is catalyzing the adoption of environmentally friendly materials, opening up a significant growth avenue for new and existing players in the market.

Governmental investment and regulations play a pivotal role in shaping the Packaging Materials Market. Initiatives aimed at reducing waste and promoting recycling are compelling companies to innovate and rethink their packaging strategies.

Regulations such as the EU’s directives on single-use plastics are prompting industry-wide shifts towards sustainable materials. This regulatory environment, coupled with financial incentives for adopting green practices, is crucial for fostering a sustainable ecosystem within the packaging industry.

Overall, the Packaging Materials Market is at a critical juncture, where consumer preferences, environmental imperatives, and regulatory frameworks are collectively steering the industry towards innovation and sustainability. As the market continues to evolve, stakeholders must adapt to these changes by embracing new technologies and sustainable practices to stay competitive and relevant.

Key Takeaways

- The global packaging materials market is projected to grow from USD 625.6 billion in 2024 to USD 971.5 billion by 2034, at a CAGR of 4.5%.

- Rigid Plastics dominate the materials segment with a 30.1% market share in 2024, valued for their versatility and durability.

- Boxes & Cartons lead the product analysis segment, favored for their cost-effectiveness and sustainability.

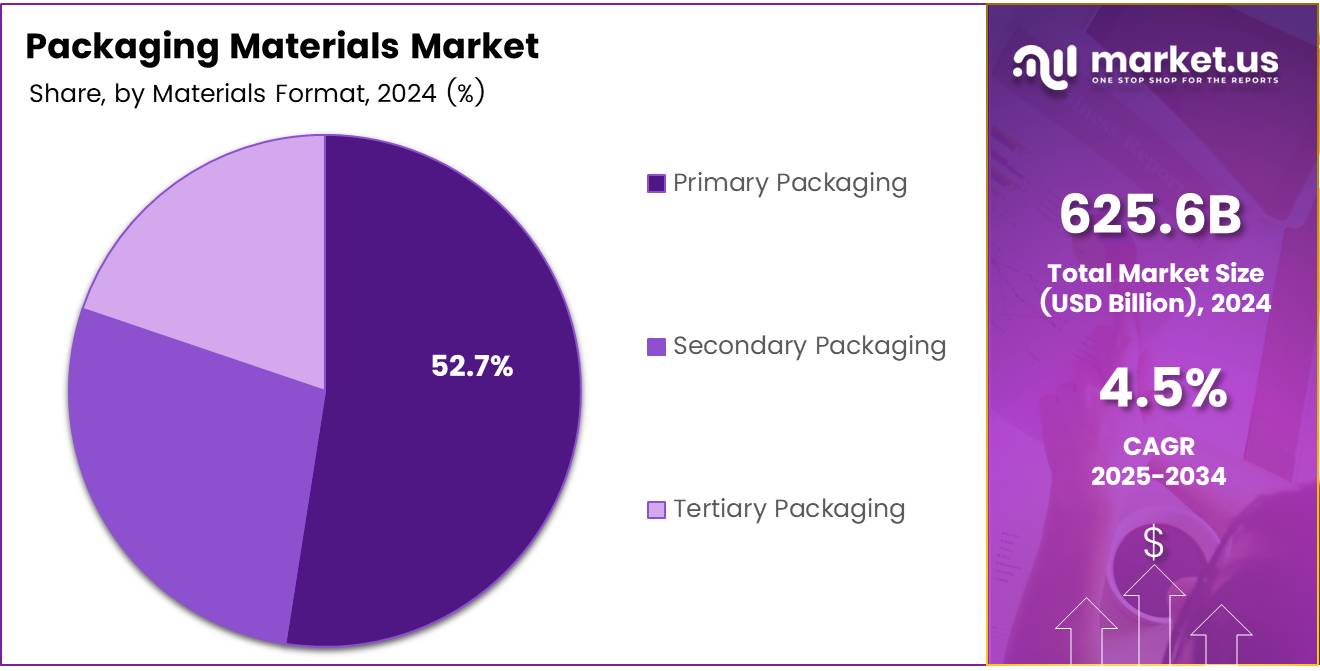

- Primary Packaging commands the format analysis segment with a 52.7% share, essential for product protection and consumer appeal.

- Food & Beverages is the leading application sector, driven by growing consumer demand for convenience and packaged foods.

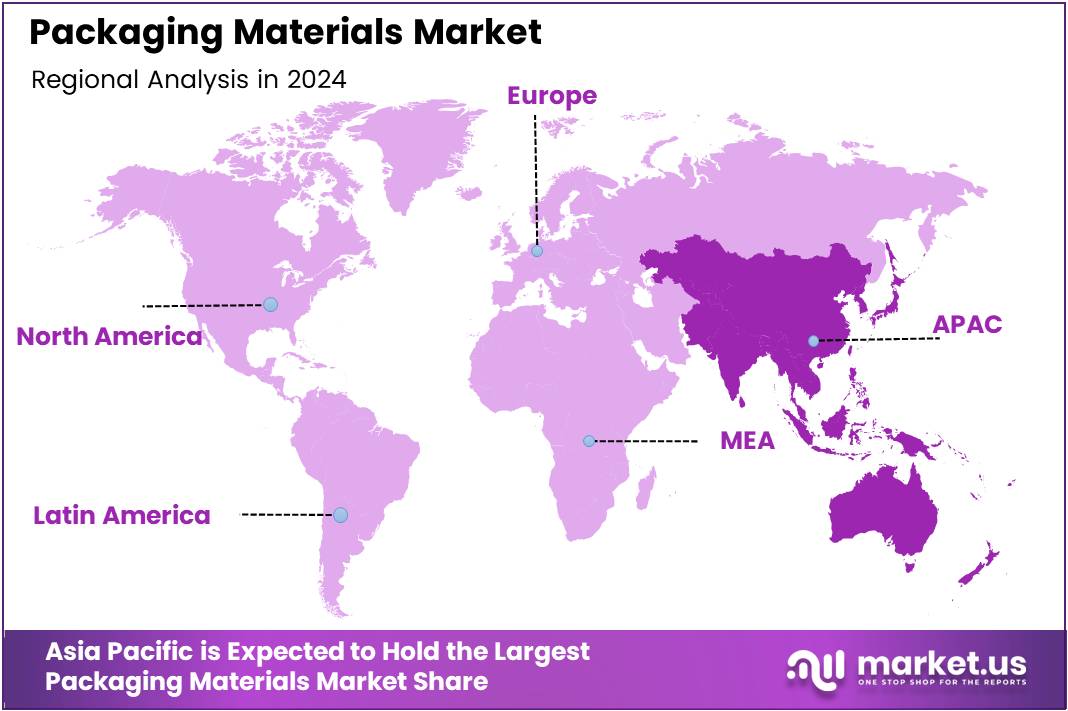

- Asia Pacific is the leading region in market share, propelled by rapid industrialization and expanding consumer markets in China and India.

Materials Analysis

Rigid Plastics Lead Packaging Materials with Over 30% Market Share

In 2024, Rigid Plastics maintained a dominant position in the By Materials Analysis segment of the Packaging Materials Market, commanding a 30.1% share. This prominence can be attributed to the material’s versatility and durability, which make it highly sought after for a wide range of packaging applications, from consumer goods to industrial products. The affordability and recyclability of rigid plastics also contribute to their widespread use, aligning with global sustainability trends.

Flexible Plastics followed closely, offering enhanced convenience and innovation in packaging design, thus appealing to industries looking for customizable and lightweight packaging solutions. Paper & Paperboard also held a significant portion of the market, favored for its eco-friendly attributes and robustness, which are essential for shipping and retail packaging.

Metals, glass, and wood materials presented smaller shares but are indispensable in specific sectors such as beverages and luxury goods due to their protective qualities and premium appearance. The ‘Others’ category, which includes novel biodegradable and composite materials, is witnessing growth driven by increasing environmental concerns and technological advancements in material science.

The distribution of market share among these materials indicates a diverse landscape in packaging solutions, shaped by industry demands, consumer preferences, and regulatory frameworks focused on sustainability.

Materials Product Analysis

Boxes & Cartons Lead with Major Share in Packaging Materials Market

In 2024, Boxes & Cartons held a dominant market position in the By Materials Product Analysis segment of the Packaging Materials Market. This category emerged as the leading choice, underpinning vital market functions across diverse industries due to its cost-effectiveness and sustainability features. The versatility and recyclability of boxes and cartons enhance their appeal among manufacturers seeking eco-friendly packaging solutions.

Following Boxes & Cartons, Jars & Containers are recognized for their robust application in the food and cosmetic sectors, attributed to their ability to preserve product integrity and extend shelf life. Bags & Sacks also carved a significant niche, favored for their lightweight and durability, making them indispensable in the retail and logistics sectors.

The demand for Bottles & Cans is driven by the beverages and pharmaceutical industries, where stringent product safety requirements elevate their necessity. Closures & Lids play a critical role in securing the contents of containers and extending usability, while Films & Wraps are pivotal in ensuring product safety and freshness, gaining traction particularly in food packaging.

The segment labeled ‘Others’ encapsulates a variety of emerging packaging formats that cater to niche market requirements, reflecting ongoing innovation and adaptation in packaging technologies. Collectively, these segments underscore a dynamic and evolving landscape in the Packaging Materials Market, with Boxes & Cartons leading the way through 2024.

Materials Format Analysis

Dominance of Primary Packaging in Material Format Analysis with a 52.7% Market Share

In 2024, the Packaging Materials Market witnessed a significant trend in the By Materials Format Analysis segment, where Primary Packaging emerged as the predominant category, securing a 52.7% share.

This segment’s leadership can be attributed to its direct role in product protection and consumer appeal, factors essential for market penetration and retention. Primary Packaging is designed to come into immediate contact with the product, offering essential protection while also serving as a critical tool for branding and customer engagement.

Secondary Packaging, which serves as additional protection and bundles primary packages, also plays a crucial role, though it does not interface directly with consumers to the same extent. This layer is vital for logistical purposes, including storage and transportation, enhancing the overall integrity and distribution efficiency of consumer goods.

Tertiary Packaging, primarily focused on bulk handling and shipping, is utilized less in direct consumer interactions but is indispensable for the safe and efficient transport of goods in large volumes. This packaging level is crucial for optimizing the supply chain and minimizing damage during transit, thereby supporting the broader logistics network.

Collectively, these packaging levels underscore a layered approach to market strategies in the packaging sector, reflecting varied consumer and logistical requirements.

Application Analysis

Packaging Materials Market Sees Strong Lead from Food & Beverages with Major Share in Application

In 2024, Food & Beverages held a dominant market position in the By Application Analysis segment of the Packaging Materials Market. The sector’s significant share can be attributed to increasing consumer demand for packaged food products driven by changing lifestyle patterns and the rising need for convenience. Moreover, stringent regulatory standards for food safety and quality have compelled manufacturers to invest in reliable and durable packaging solutions, further bolstering the growth of this segment.

The Pharmaceuticals & Healthcare segment also showed notable growth, fueled by the global rise in health awareness and pharmaceutical consumption. The demand for high-barrier protection against contaminants and the integration of anti-tampering features have enhanced the development of advanced packaging materials in this sector.

Personal Care & Cosmetics, another key segment, has seen expansion due to an increased focus on sustainability and aesthetics in packaging, which significantly influences consumer purchase decisions. Meanwhile, the Automotive segment is experiencing a shift towards lightweight and durable packaging materials to reduce the environmental impact and enhance fuel efficiency.

Electrical & Electronics, along with Household Products segments, are adopting innovative packaging solutions to ensure product safety during transit and handling. The ‘Others’ category, encompassing a variety of industries, continues to explore customized packaging options to meet diverse market needs, maintaining a steady growth trajectory across the board.

Key Market Segments

By Materials

- Rigid Plastics

- Flexible Plastics

- Paper & Paperboard

- Metal

- Glass

- Wood

- Others

By Materials Product

- Boxes & Cartons

- Jars & Containers

- Bags & Sacks

- Bottles & Cans

- Closures & Lids

- Films & Wraps

- Others

By Materials Format

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

By Application

- Food & Beverages

- Pharmaceuticals & Healthcare

- Personal Care & Cosmetics

- Automotive

- Electrical & Electronics

- Household Products

- Others

Drivers

Rising Demand for Sustainable Packaging Boosts Market Prospects

The packaging materials market is experiencing significant growth, primarily driven by the escalating demand for eco-friendly and sustainable packaging solutions. This surge is fueled by heightened consumer awareness of environmental issues and the implementation of strict governmental regulations aimed at reducing ecological impact.

Additionally, the robust expansion of e-commerce globally necessitates durable and efficient packaging materials that ensure product integrity throughout transportation and delivery processes. Technological advancements in the sector, including the development of active and smart packaging solutions, are also pivotal drivers.

These innovations not only extend the shelf life of products but also enhance their visual appeal, thereby influencing consumer purchasing decisions. Collectively, these factors are shaping the dynamics of the packaging materials market, steering it towards more sustainable and technologically enhanced solutions.

Restraints

Stringent Environmental Regulations Challenge Packaging Materials Market

Stringent environmental regulations represent a significant restraint in the packaging materials market. These regulations necessitate compliance with various sustainability standards, compelling manufacturers to innovate and adopt eco-friendly solutions. While this shift can spur the development of advanced, sustainable packaging technologies, it also introduces complexities and financial burdens.

Manufacturers must invest in new materials and processes that meet these rigorous environmental standards, which can increase production costs. Additionally, issues related to the recycling and effective waste management of packaging materials further complicate the landscape. These challenges can impede market growth as companies struggle to balance regulatory compliance with cost-efficiency and operational feasibility.

Growth Factors

Biodegradable Packaging Options Drive Market Expansion

The packaging materials market is poised for substantial growth, driven primarily by the escalating investment in biodegradable and compostable packaging solutions. This trend is fueled by heightened consumer awareness and demand for environmentally friendly products, coupled with increasing regulatory pressures aimed at reducing plastic waste.

Additionally, significant expansion opportunities are emerging in developing regions, where rising consumer spending and an expanding retail sector are evident. These markets are ripe for the introduction of innovative packaging solutions that meet the needs of a growing customer base. Moreover, the adoption of technologies that facilitate personalization and customization of packaging is becoming a crucial differentiator in a highly competitive landscape.

Such advancements not only cater to specific consumer preferences but also enhance brand recognition and customer loyalty. Collectively, these factors are shaping a dynamic environment where strategic investments in sustainable and consumer-focused packaging technologies are likely to yield considerable returns.

Emerging Trends

Lightweight Packaging Drives Market Trends

In the packaging materials market, several key factors are shaping current trends. The move towards lightweight packaging materials is prominent, primarily because it helps reduce shipping costs and the overall carbon footprint, supporting global sustainability initiatives. Additionally, consumer preferences are leaning heavily towards convenience, with a growing demand for features like easy-open, resealable, and portable packaging options.

These preferences are not only enhancing user experience but also boosting market growth. Furthermore, there is a noticeable surge in aesthetic and functional innovations within the packaging industry.

These enhancements are aimed at not only improving the visual appeal of packaging but also its functionality, particularly catering to the premium market segment. Such innovations are critical as they significantly influence consumer purchasing decisions, driving further expansion in the packaging materials market.

Regional Analysis

Asia-Pacific Leads Global Packaging Materials Market with Robust Growth in Manufacturing and Consumer Demand

The global market for packaging materials is segmented into five key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Each region exhibits distinct market dynamics and growth potentials based on industrial development, consumer behavior, and regulatory landscapes.

Asia Pacific emerges as the dominating region in the packaging materials market, driven by rapid industrialization, expanding manufacturing sectors, and increasing consumer demand across populous countries like China and India. This region benefits from a robust supply chain infrastructure and favorable government policies promoting export-oriented production, which significantly boosts the consumption of packaging materials.

Regional Mentions:

In North America, the market is characterized by high demand for sustainable and innovative packaging solutions, fueled by stringent regulations regarding environmental sustainability and consumer preferences for eco-friendly products. The United States and Canada lead in the adoption of advanced packaging technologies, which supports the market growth in this region.

Europe’s packaging materials market is driven by advanced manufacturing practices, with a strong emphasis on recycling and reusability. The region’s focus on circular economy principles enhances the demand for packaging materials that are designed to minimize waste. European Union regulations play a crucial role in shaping the market, pushing for packaging solutions that comply with environmental conservation norms.

The Middle East & Africa region shows growth in the packaging materials market, attributed to economic diversification efforts and expansion in retail sectors. The increasing urbanization and improvement in living standards also contribute to the market growth, with Gulf Cooperation Council (GCC) countries leading in innovative packaging adoption.

Latin America’s market is influenced by the expansion of the food and beverage industry, coupled with the rise in consumer spending power. Brazil and Mexico, in particular, show significant growth prospects due to their large consumer bases and increasing investment in domestic manufacturing capabilities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In analyzing the global packaging materials market for 2024, it is crucial to consider the strategic positioning and potential of key players, including Sealed Air Corporation, DS Smith, Amcor plc, Mondi Plc, and International Paper, among others. These companies are pivotal in driving innovation and sustainability within the industry.

Sealed Air Corporation is expected to continue its leadership in providing protective packaging solutions, capitalizing on the rising demand for e-commerce packaging. The company’s focus on sustainability and efficiency in packaging is likely to enhance its market position.

DS Smith, known for its production of recycled corrugated packaging, is positioned to benefit from the growing emphasis on sustainable packaging solutions. Its commitment to environmental sustainability and circular economy principles can be expected to attract partnerships and client engagements, bolstering its market share.

Amcor plc, with its global presence and broad range of packaging options for various industries including food, beverage, pharmaceutical, and personal care, is well-equipped to leverage its innovation in barrier technologies and recyclable materials to meet the stringent regulations and consumer demands for environmentally friendly packaging.

Mondi Plc’s integrated approach, from managing forests to producing packaging and paper, allows it to maintain control over its sustainability practices and supply chain, which is increasingly important to clients seeking responsible packaging solutions.

International Paper, with its significant capacity in paper-based packaging, is likely to focus on innovations in lightweight and renewable packaging solutions. The company’s extensive manufacturing footprint and commitment to sustainability can be expected to sustain its competitiveness in a market that values eco-friendly and innovative packaging solutions.

Collectively, these key players are anticipated to drive forward the global packaging materials market through strategic focus on sustainability, innovation, and adaptation to the evolving regulatory and consumer landscapes.

Top Key Players in the Market

- Oliver Packaging & Equipment Company

- 3M

- Sealed Air Corporation

- Tetra Pak Group

- DS Smith

- Amcor plc

- Amerplast

- Mondi Plc

- International Paper

- Honeywell International Inc.

- Sonoco Products Company

- A-ROO Company LLC

- Graham Packaging Company

- Westrock Company

- Ajover S.A.S.

- Berry Global

- Avery Dennison Corporation

- Flexpak Services

Recent Developments

- In January 2025, the U.S. Department of Commerce announced the allocation of $1.4 billion in final awards aimed at bolstering the U.S. semiconductor industry through advanced packaging technologies.

- In October 2024, Notpla successfully secured £20 million to expand its production of sustainable packaging materials, which are innovatively made from seaweed and plants. This investment highlights the growing market demand for eco-friendly packaging solutions that contribute to environmental sustainability.

- In October 2024, Sorich, a pharmaceutical packaging startup, raised $1 million to advance its development of innovative packaging solutions tailored for the healthcare industry. This funding is intended to support the startup’s expansion and enhance its packaging technologies to meet the stringent requirements of pharmaceutical products.

- In March 2024, Bambrew, an emerging player in the eco-friendly packaging market, secured Rs 60 Crore in a Series A funding round led by Blume Ventures. This investment will enable Bambrew to scale its operations and continue its mission of replacing plastic packaging with sustainable alternatives.

Report Scope

Report Features Description Market Value (2024) USD 625.6 Billion Forecast Revenue (2034) USD 971.5 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Materials (Rigid Plastics, Flexible Plastics, Paper & Paperboard, Metal, Glass, Wood, Others), By Materials Product (Boxes & Cartons, Jars & Containers, Bags & Sacks, Bottles & Cans, Closures & Lids, Films & Wraps, Others), By Materials Format (Primary Packaging, Secondary Packaging, Tertiary Packaging), By Application (Food & Beverages, Pharmaceuticals & Healthcare, Personal Care & Cosmetics, Automotive, Electrical & Electronics, Household Products, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Oliver Packaging & Equipment Company, 3M, Sealed Air Corporation, Tetra Pak Group, DS Smith, Amcor plc, Amerplast, Mondi Plc, International Paper, Honeywell International Inc., Sonoco Products Company, A-ROO Company LLC, Graham Packaging Company, Westrock Company, Ajover S.A.S., Berry Global, Avery Dennison Corporation, Flexpak Services Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Packaging Materials MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Packaging Materials MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Oliver Packaging & Equipment Company

- 3M

- Sealed Air Corporation

- Tetra Pak Group

- DS Smith

- Amcor plc

- Amerplast

- Mondi Plc

- International Paper

- Honeywell International Inc.

- Sonoco Products Company

- A-ROO Company LLC

- Graham Packaging Company

- Westrock Company

- Ajover S.A.S.

- Berry Global

- Avery Dennison Corporation

- Flexpak Services