Global E-commerce Packaging Market Size, Share, Growth Analysis By Product (Corrugated Boxes, Poly Bags, Tapes, Mailer, Protective Packaging, Others), By Application (Apparel and Accessories, Household, Electronics and Electrical, Personal Care, Food and Beverages, Pet Food, Pharmaceutical), By Material (Corrugated Board, Paper and Paperboard, Plastics, Woods), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143429

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

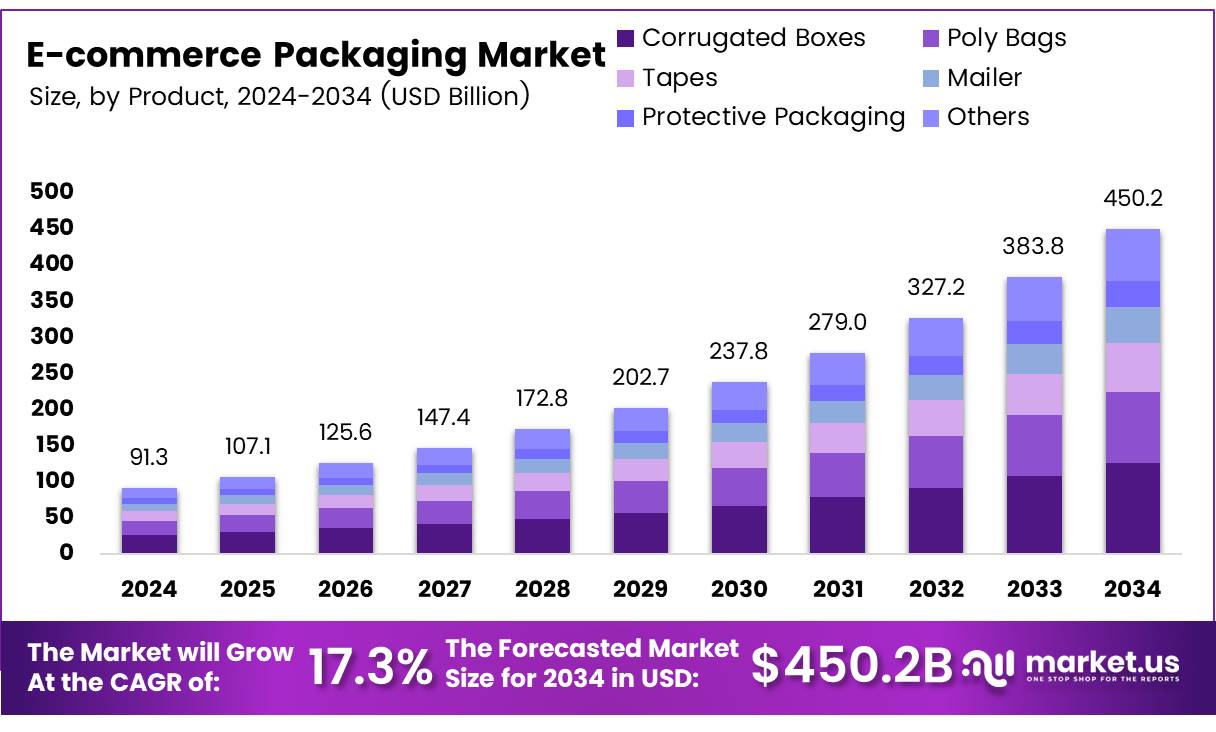

The Global E-commerce Packaging Market size is expected to be worth around USD 450.2 Billion by 2034, from USD 91.3 Billion in 2024, growing at a CAGR of 17.3% during the forecast period from 2025 to 2034.

The e-commerce packaging market encompasses all materials and processes involved in packaging products for online retail. This includes a variety of packaging forms such as boxes, envelopes, and protective fillings designed to ensure product safety during transit. In the digital age, packaging extends beyond mere functionality, serving as a critical component of the customer experience and brand identity.

e-commerce packaging has evolved significantly, adapting to the increasing demands of online consumers for both product safety and sustainability. The trend towards aesthetically pleasing and branded packaging has been underscored by a study from Cart, which revealed that 41% of consumers are more likely to make repeat purchases due to branded packaging. This insight highlights the dual role of e-commerce packaging as both protector and promoter.

The e-commerce packaging market is poised for substantial growth, driven by a surge in online shopping and heightened consumer awareness of environmental impacts. According to iisd, the shift toward reusable packaging is gaining momentum, with predictions that 10% of deliveries will utilize such solutions by 2030, escalating to 50% by 2040.

Furthermore, a mandate for 90% of large household appliances to be delivered in reusable packaging by the same year marks a significant regulatory milestone. This transition is supported by anticipated government investments and regulations aimed at reducing waste and promoting sustainable practices across industries.

The e-commerce packaging market’s growth trajectory is supported by several key factors. Technological advancements in packaging materials and processes, coupled with innovative design solutions, are making it possible to meet the increasing demands for sustainability and efficiency.

E-commerce retailers in Germany are already responding to this trend, with 40% planning to adopt sustainable packaging solutions by 2025, as reported by Ecommerce germany. This reflects a broader shift towards eco-friendly practices, spurred by consumer preferences and regulatory pressures.

Governmental bodies are increasingly investing in sustainable practices, recognizing the role of packaging in environmental sustainability. These investments often come in the form of subsidies for research into biodegradable and reusable materials, as well as stricter regulations to ensure compliance across the sector. Such initiatives not only support environmental objectives but also foster innovation within the packaging industry, creating new opportunities for growth and development.

Key Takeaways

- Global E-commerce Packaging Market projected to grow to USD 450.2 Billion by 2034, from USD 91.3 Billion in 2024, with a CAGR of 17.3%.

- Corrugated boxes led the Product Analysis segment in 2024, holding a 35.2% share due to their durability and recyclability.

- Apparel & Accessories sector dominated the Application Analysis segment in 2024, with a 25.2% market share, driven by consumer preference for online shopping.

- Corrugated Board was the leading material in 2024 within the Material Analysis segment, capturing a 36.2% market share, valued for its robustness and sustainability.

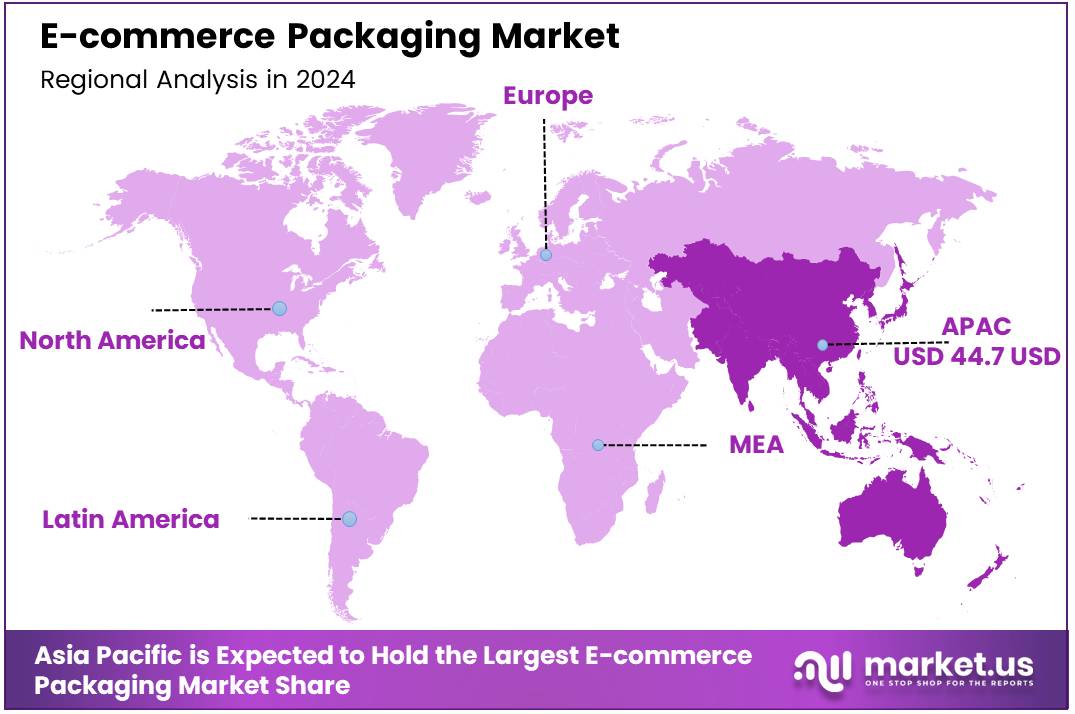

- Asia Pacific region dominated the market, accounting for 49.2% share valued at USD 44.7 billion, propelled by a large digital buyer base and growing internet penetration.

Product Analysis

Corrugated Boxes Lead with 35.2% Share in E-commerce Packaging Markets By Product Analysis Segment

In 2024, the By Product Analysis segment of the E-commerce Packaging Market was prominently led by corrugated boxes, capturing a 35.2% share. This dominance can be attributed to the durability and recyclability of corrugated boxes, which are essential qualities in the fast-paced realm of e-commerce shipping and handling. Following corrugated boxes, poly bags held a significant position due to their lightweight nature and cost efficiency, making them favorable for less fragile items.

Tapes and mailers also contributed notably to the market dynamics. Tapes are critical for securing packages and ensuring their integrity during transit, whereas mailers offer a versatile packaging solution that combines protection with ease of use.

Protective packaging remains a pivotal component, driven by the increasing demand for safeguarding goods against potential shipping damages. This category includes bubble wraps, foam inserts, and air pillows, each essential for protecting various products during shipment.

The segment Others encapsulates a variety of additional packaging materials that cater to niche needs within the e-commerce sector. These alternatives are being continuously developed to enhance product safety, user experience, and environmental sustainability, reflecting the ongoing evolution of e-commerce packaging solutions. Each of these product types plays a vital role in addressing the diverse packaging requirements of the e-commerce industry.

Application Analysis

Apparel & Accessories Leads Application Segment with 25.2% Share

In 2024, the Apparel & Accessories sector maintained a dominant position in the E-commerce Packaging Markets By Application Analysis segment, commanding a substantial 25.2% market share. This sectors prominence is underpinned by the increasing consumer preference for online shopping, driven by the convenience and broad product range available through e-commerce platforms.

Following closely, the Electronics & Electrical category showcased significant engagement, benefitting from the surge in consumer electronics sales and the growing trend of home office setups.

The Household segment also marked a notable presence, reflecting the shift towards online purchases of home essentials. In contrast, the Personal Care sector capitalized on the rising consumer awareness towards health and wellness, which has spurred the demand for personal care products online.

The Food & Beverages segment experienced growth due to the convenience of online grocery shopping, which has been increasingly adopted by consumers seeking diverse culinary options and time-saving solutions. Furthermore, the Pet Food category has seen a steady increase, supported by pet owners growing reliance on e-commerce for consistent access to pet supplies.

Lastly, the Pharmaceutical sector is expanding within the e-commerce space as customers increasingly turn to online platforms for their healthcare needs, indicating a broader shift in consumer behavior towards digital solutions across various sectors.

Material Analysis

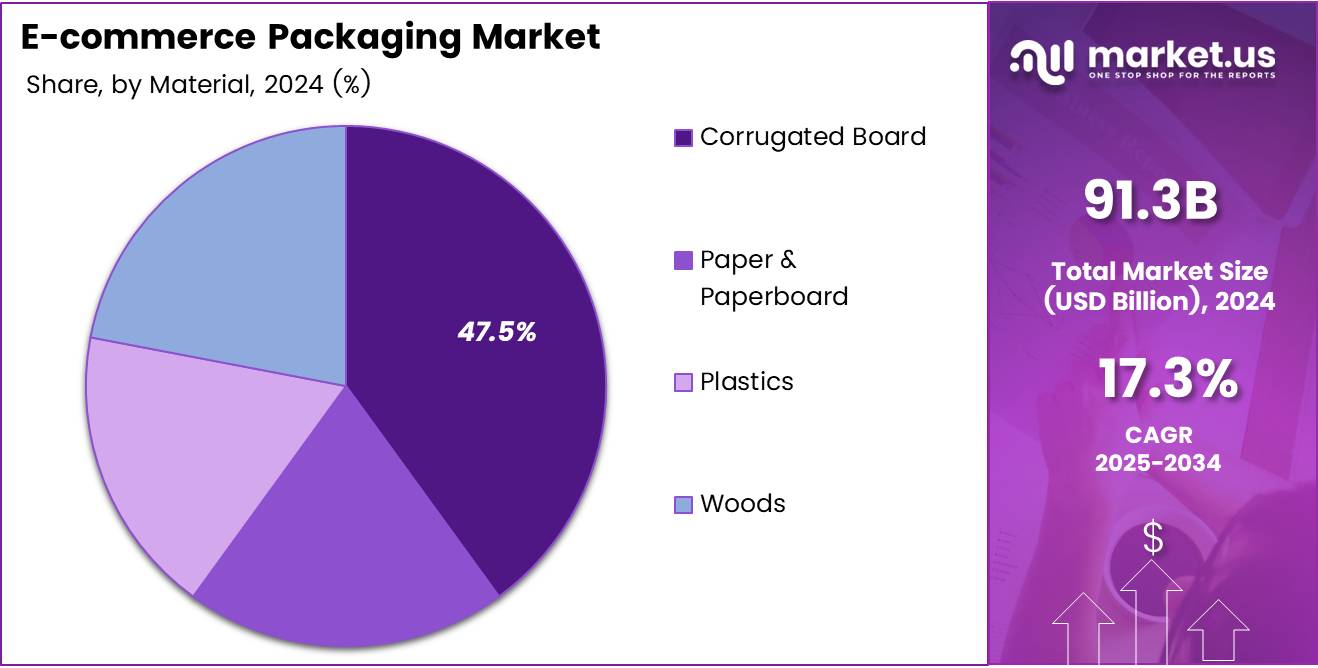

Corrugated Board Leads E-commerce Packaging Materials with a 36.2% Market Share

In 2024, the E-commerce Packaging Market observed that Corrugated Board maintained a commanding lead within the By Material Analysis segment, securing a 36.2% market share. This dominance can be attributed to its robustness and recyclability, which are critical in safeguarding goods during transit while supporting sustainability goals.

The utilization of Corrugated Board is favored due to its cost-effectiveness and structural integrity, offering superior protection and stacking strength which is essential for the transportation of a wide variety of e-commerce products.

Following Corrugated Board, Paper & Paperboard materials also held a significant portion of the market. These materials are chosen for their lightweight nature and biodegradability, making them a preferred choice for less fragile items, thus contributing to an environmentally friendly packaging solution.

Meanwhile, Plastics continue to be utilized in the industry, primarily for their versatility and durability, though their market share is moderated by increasing environmental concerns and regulatory pressures.

Wood packaging remains a niche but vital part of the e-commerce packaging mix, primarily used for heavy or high-value items requiring robust protective frameworks. The distinct properties of each material type and their applications underscore the diverse needs and strategies within the e-commerce packaging industry, reflecting broader trends towards sustainability and cost management.

Key Market Segments

By Product

- Corrugated Boxes

- Poly Bags

- Tapes

- Mailer

- Protective Packaging

- Others

By Application

- Apparel & Accessories

- Household

- Electronics & Electrical

- Personal Care

- Food & Beverages

- Pet Food

- Pharmaceutical

By Material

- Corrugated Board

- Paper & Paperboard

- Plastics

- Woods

Drivers

Rising E-commerce Activity Boosts Packaging Market Needs

The growth of the e-commerce industry is a primary driver in the packaging market, fueled by an increasing number of online shoppers and the expansion of e-commerce platforms globally. This upsurge demands robust packaging solutions that not only ensure product safety during transit but also enhance product presentation, critical in a highly competitive online marketplace.

Concurrently, there is a significant rise in the demand for sustainable packaging, as both consumers and businesses push for eco-friendly and recyclable materials to reduce environmental impact. This shift is transforming packaging practices and materials across the industry. Additionally, the market sees an increase in shipments of small and fragile items, which calls for innovative packaging solutions that are both lightweight and protective, yet cost-efficient.

Technological advancements in packaging, such as smart packaging, custom designs, and automation in packaging processes, are further streamlining operations and improving the functionality and efficiency of packaging systems, catering to the dynamic needs of e-commerce businesses.

Restraints

Stringent Environmental Regulations Challenge E-commerce Packaging Sector

The e-commerce packaging market faces significant restraints primarily due to stringent environmental regulations aimed at reducing packaging waste, particularly single-use plastics. These regulations compel companies to seek alternative materials, which can often be more costly and less readily available. This shift necessitates extensive research and development efforts to find sustainable yet durable packaging solutions that meet both consumer expectations and legal standards.

Additionally, the market is further constrained by the complexities of supply chain management. E-commerce companies must navigate the intricate processes of sourcing, managing, and delivering packaging materials, which can introduce delays and increase operational costs.

These challenges are exacerbated by the global nature of supply chains, where coordination across multiple jurisdictions and compliance with diverse regulatory environments intensify the logistical hurdles. Such factors not only strain resources but also demand a high level of adaptability and strategic planning from companies aiming to maintain efficiency while embracing environmentally responsible practices.

Growth Factors

Expansion in Emerging Markets Drives E-commerce Packaging Opportunities

In the burgeoning e-commerce packaging market, significant growth opportunities are emerging, particularly in developing countries where the expansion of e-commerce activities is accelerating.

As these markets continue to grow, packaging companies are presented with substantial prospects to establish their presence and cater to the increasing demands. Another pivotal opportunity lies in the adoption of biodegradable materials, addressing the consumer’s escalating demand for sustainable and environmentally friendly packaging solutions.

Furthermore, the rise of subscription-based services and personalized product deliveries is driving the need for innovative and customized packaging solutions. Additionally, the integration of smart packaging technologies, such as RFID and QR codes, is enhancing logistics efficiency and improving consumer interactions, thereby opening new avenues for market growth in the e-commerce sector.

These developments are creating diverse opportunities for packaging companies to innovate, expand, and solidify their market position in a rapidly evolving industry landscape.

Emerging Trends

Sustainability Drives Innovations in E-commerce Packaging

The e-commerce packaging market is undergoing significant transformations, driven by consumer demand for sustainability and eco-conscious choices. Increasingly, consumers prefer packaging solutions that are recyclable, reusable, or biodegradable, prompting e-commerce companies to innovate and integrate these options into their product offerings. This shift towards environmentally-friendly materials is not just a trend but a substantial move towards responsible business practices, shaping the overall development of the market.

Additionally, the rise in personalization and customization in packaging reflects the growing desire among businesses to offer a unique and tailored shopping experience, featuring custom designs, colors, and logos.

Moreover, there is a noticeable trend towards minimalist packaging, which focuses on reducing waste and enhancing packaging efficiency. The adoption of post-consumer recycled (PCR) materials is also escalating as brands strive to meet their sustainability goals while maintaining the integrity and appeal of their packaging solutions. This holistic approach to e-commerce packaging underlines the industry’s response to consumer preferences and regulatory pressures, fostering a competitive and innovative market landscape.

Regional Analysis

Asia Pacific Leads E-commerce Packaging Market with 49.2% Share, Valued at $44.7 Billion

Asia Pacific is the dominant region in the e-commerce packaging market, holding a 49.2% share with a valuation of USD 44.7 billion. This dominance is attributed to the expansive digital buyer base, particularly in countries like China and India, and the increasing penetration of internet services. The region’s market is further propelled by innovations in packaging technologies and materials that cater to a wide range of products from electronics to perishables.

Regional Mentions:

North America, the market is driven by a surge in online shopping and advances in sustainable packaging solutions. This region has witnessed significant investment in automated packaging facilities to enhance speed and efficiency in order fulfillment processes.

Europe’s e-commerce packaging market benefits from stringent regulations promoting eco-friendly packaging materials, coupled with high consumer awareness regarding sustainable practices. The presence of major e-commerce retailers and a robust logistic network also contribute to the growth of this market segment.

The Middle East & Africa region, although smaller in comparison, is experiencing rapid growth due to the rising e-commerce adoption amongst its populous, particularly in the Gulf Cooperation Council (GCC) countries. Improvements in logistics and warehousing in the region are key factors driving the demand for effective e-commerce packaging solutions.

Latin America shows potential for significant growth in the e-commerce packaging market, spurred by increasing internet penetration and smartphone usage. The region is seeing a shift in consumer behavior with a preference for online shopping, which in turn stimulates demand for innovative and secure packaging solutions that ensure product integrity during transit.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global e-commerce packaging market, key players are anticipated to drive significant developments and innovations in 2024.

Among these, Sonoco Products Company and Amcor plc are positioned as leaders due to their robust offerings in sustainable packaging solutions, which are increasingly critical in a market demanding environmentally-friendly options. Sonoco’s commitment to creating recyclable and reusable packaging aligns with global sustainability trends, likely enhancing its market share and customer base.

CCL Industries and Berry Global Group, Inc. are also critical to watch, with their expansive range of label and packaging solutions tailored for e-commerce applications. Their focus on technological enhancements, such as smart labels and enhanced barrier properties, positions them well to meet the dynamic requirements of the e-commerce sector.

Further, companies like Sealed Air and Greif are pivotal in innovating packaging for durability and protection. Sealed Air’s expertise in void-fill packaging and protective packaging solutions is essential for shipping a wide array of products safely, which is a cornerstone for e-commerce vendors.

Emerging players like Transcontinental Inc. and Constantia Flexibles are enhancing their capabilities in flexible packaging, a segment that offers cost-effective yet high-quality solutions for e-commerce, particularly in the food and apparel sectors. Their agility in adapting to market demands helps them maintain a competitive edge.

Lastly, Gerresheimer AG and ALPLA are focusing on the specialized segment of rigid plastic packaging for pharmaceuticals and cosmetics, which are burgeoning sectors within e-commerce. Their high-quality standards and innovation in materials and design are crucial for companies looking to differentiate themselves in these niche markets.

Overall, these key players are expected to leverage advanced technologies, sustainability, and customization to address the evolving needs of the e-commerce packaging market in 2024.

Top Key Players in the Market

- Sonoco Products Company

- CCL Industries

- Greif

- Berry Global Group, Inc.

- Sealed Air

- WINPAK Ltd.

- Silver Spur Corp.

- Alpha Packaging

- Mondi

- Amcor plc

- Coveris

- Constantia Flexibles

- Transcontinental Inc.

- Gerresheimer AG

- ALPLA

Recent Developments

- In December 2024, Movopack announced the successful securing of $2.5 million in funding to enhance their sustainable ecommerce packaging solutions. This financial boost aims to expand their market reach and innovate in environmentally friendly packaging technologies.

- In March 2024, Bambrew, an emerging packaging startup, secured Rs 60 Crore in a Series A funding round led by Blume Ventures. The investment is intended to propel the development of sustainable packaging materials and broaden their industry impact.

- In October 2024, Paccurate raised $8.1 million in a Series A funding to spearhead advancements in packing intelligence tailored for retailers and shippers. This funding is expected to support new technology deployments that optimize packaging efficiency and cost-effectiveness.

Report Scope

Report Features Description Market Value (2024) USD 91.3 Billion Forecast Revenue (2034) USD 450.2 Billion CAGR (2025-2034) 17.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Corrugated Boxes, Poly Bags, Tapes, Mailer, Protective Packaging, Others), By Application (Apparel and Accessories, Household, Electronics and Electrical, Personal Care, Food and Beverages, Pet Food, Pharmaceutical), By Material (Corrugated Board, Paper and Paperboard, Plastics, Woods) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sonoco Products Company, CCL Industries, Greif, Berry Global Group, Inc., Sealed Air, WINPAK Ltd., Silver Spur Corp., Alpha Packaging, Mondi, Amcor plc, Coveris, Constantia Flexibles, Transcontinental Inc., Gerresheimer AG, ALPLA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  E-commerce Packaging MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

E-commerce Packaging MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-