Global Power Generation Market Size, Share, And Business Benefits By Type (Fossil Fuel Electricity, Hydroelectricity, Nuclear Electricity, Solar Electricity, Wind Electricity, Geothermal Electricity, Others), By Grid (On Grid, Off Grid), By End-Use (Industrial, Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146261

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

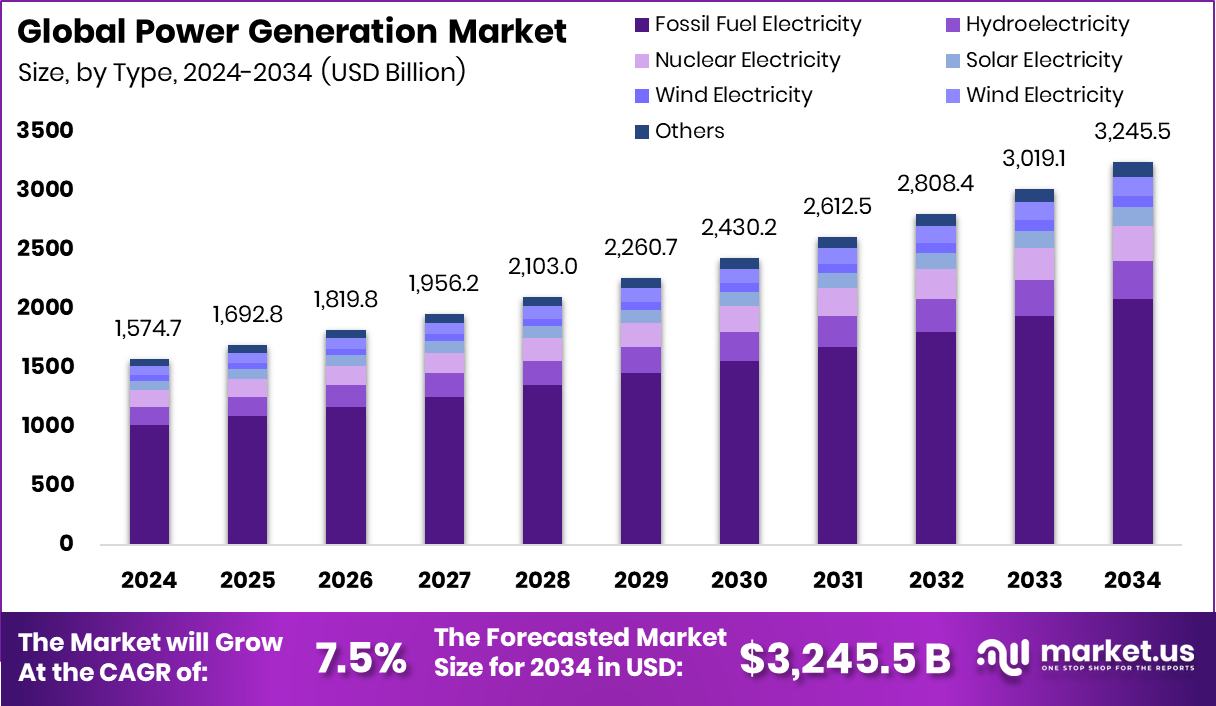

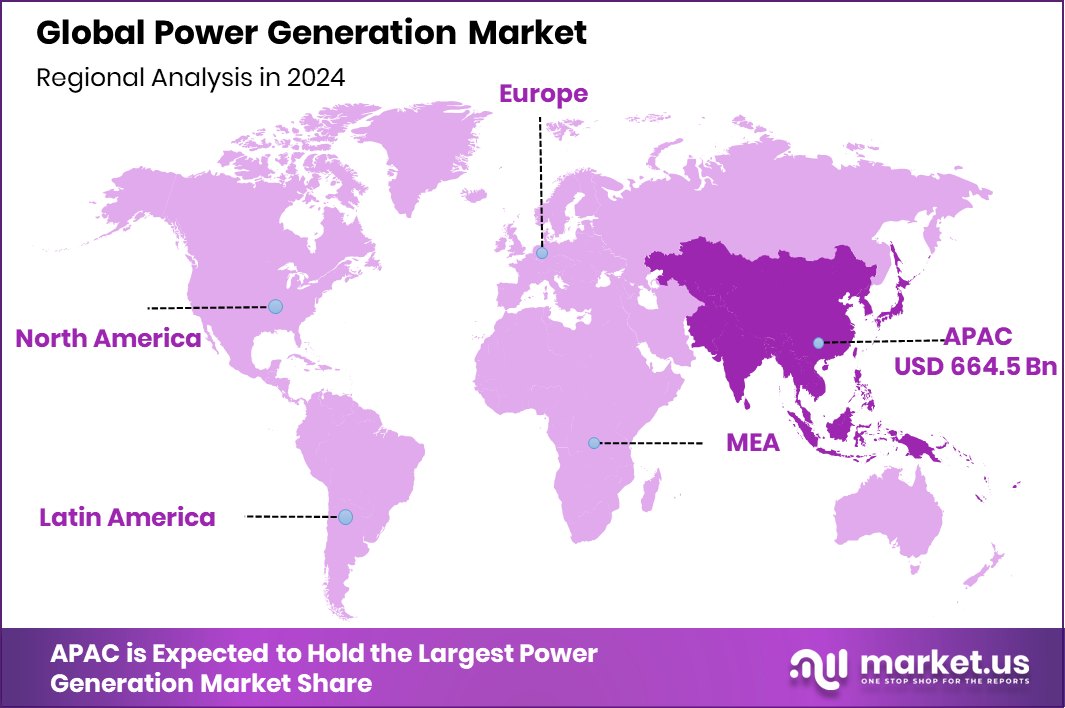

Global Power Generation Market is expected to be worth around USD 3,245.5 billion by 2034, up from USD 1574.7 billion in 2024, and grow at a CAGR of 7.5% from 2025 to 2034. The power sector in Asia-Pacific reached USD 664.5 Bn, securing 42.2% market leadership.

Power generation refers to the process of producing electricity from various energy sources such as coal, natural gas, nuclear, hydro, wind, solar, and biomass. This electricity is then transmitted through grids for residential, commercial, and industrial use. The process involves converting mechanical, chemical, or solar energy into electrical energy using turbines, generators, and other advanced technologies.

The power generation market includes all technologies, services, and infrastructure used to produce and supply electricity to end users. This market spans fossil-based and renewable sources, along with grid systems and transmission networks. It’s influenced by government policies, climate goals, fuel prices, and demand patterns. Countries worldwide are investing in upgrading their generation capacities to meet rising energy needs and transition toward cleaner energy sources.

The power generation market is growing due to increasing urbanization, industrialization, and electrification in developing economies. Rising global electricity demand, especially in data centers, electric vehicles, and smart infrastructure, is pushing investments in both centralized and decentralized generation systems. Policy support for renewables and innovation in hybrid systems also contribute to steady growth.

Population growth and lifestyle changes are significantly boosting electricity consumption. Emerging digital technologies like AI, IoT, and automation require uninterrupted and scalable power solutions. Additionally, electrification in transport and heating sectors is expanding demand. Rural electrification programs are also opening up new consumption pockets.

Key Takeaways

- Global Power Generation Market is expected to be worth around USD 3,245.5 billion by 2034, up from USD 1574.7 billion in 2024, and grow at a CAGR of 7.5% from 2025 to 2034.

- In 2024, Fossil Fuel Electricity held 64.3%, leading power generation due to established infrastructure dominance.

- On Grid systems accounted for 87.4%, reflecting strong reliance on centralized electricity distribution networks worldwide.

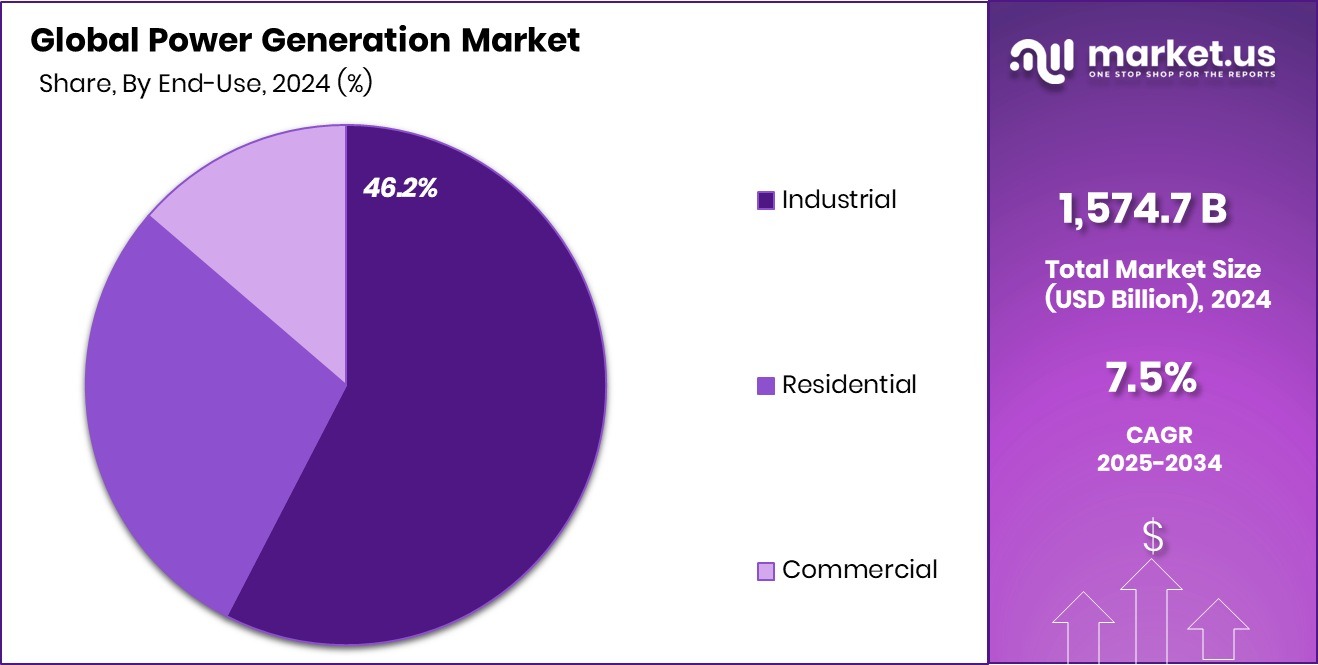

- The industrial sector led with 46.2%, driving electricity demand due to manufacturing, mining, and heavy-duty operations.

- In 2024, Asia-Pacific dominated power generation due to a 42.2% regional market share.

By Type Analysis

Fossil fuel electricity held a 64.3% share in the power generation market in 2024.

In 2024, Fossil Fuel Electricity held a dominant market position in the By Type segment of Power Generation Market, with a 64.3% share. This dominance was largely driven by the continued reliance on coal, natural gas, and oil-based power plants across several industrialized and emerging countries.

Despite the global shift toward renewable sources, fossil fuels remained the backbone for baseload power supply, particularly in regions with abundant fossil reserves and limited renewable infrastructure. The segment’s high share reflects the installed capacity and ease of dispatch associated with fossil-based systems.

While renewable sources are expanding, they face challenges such as intermittency and higher upfront investment. Meanwhile, fossil fuel plants continue to benefit from stable fuel supply chains and existing transmission infrastructure. Developing economies also prioritize fossil fuels to meet growing demand quickly.

Additionally, fossil-based generation supports industrial loads where consistent power is necessary. However, governments are gradually pushing for cleaner technologies within this segment by encouraging cleaner fuels and emission control systems.

By Grid Analysis

On-grid systems contributed 87.4% to the total power generation market.

In 2024, On Grid held a dominant market position in the By Type segment of the Power Generation Market, with an 87.4% share. This high market share reflects the widespread adoption of centralized power generation systems connected to national and regional grids.

On-grid systems have remained the backbone of electricity infrastructure across both developed and developing countries due to their ability to deliver stable, large-scale, and continuous power to urban, industrial, and commercial sectors. Utilities prefer on-grid solutions as they offer streamlined distribution, load balancing, and integration with national policies.

The 87.4% dominance was supported by increasing investments in transmission networks, grid modernization projects, and government efforts to strengthen energy access through grid extensions.

Additionally, on-grid systems allow for better energy trade between regions and support national-level planning. These systems also offer cost efficiency due to economies of scale, especially in thermal and hydroelectric plants.

By End-Use Analysis

Industrial end-use accounted for 46.2% in the power generation market.

In 2024, Industrial held a dominant market position in the By Type segment of Power Generation Market, with a 46.2% share. This significant share was primarily driven by the high and consistent power demand from manufacturing units, heavy industries, refineries, mining operations, and large-scale processing facilities.

Industrial sectors often require uninterrupted and high-capacity electricity to maintain round-the-clock operations, making them the largest consumers of power generation resources globally.

Many industrial facilities either source power directly from the grid or operate their own captive power plants to ensure reliability and cost efficiency. In countries with unstable grid supply, industries increasingly invest in independent generation systems using fossil fuels or renewables.

The 46.2% market share also reflects the growing adoption of cogeneration technologies that allow industries to generate both electricity and heat from a single fuel source, optimizing energy use.

Key Market Segments

By Type

- Fossil Fuel Electricity

- Hydroelectricity

- Nuclear Electricity

- Solar Electricity

- Wind Electricity

- Geothermal Electricity

- Others

By Grid

- On Grid

- Off Grid

By End-Use

- Industrial

- Residential

- Commercial

Driving Factors

Rising Electricity Demand Across Industrialized Urban Areas

One of the biggest driving factors in the power generation market is the sharp increase in electricity demand from cities and industrial zones. As more people move to urban areas, the need for lighting, air conditioning, transport, and electronic devices continues to grow. At the same time, industries are expanding and using more machines and automation, which also adds to the power requirement.

This rising demand pushes governments and companies to invest in building new power plants and upgrading older ones. It also opens space for renewable energy projects, especially in fast-growing regions. The growing need for reliable, uninterrupted electricity is a key reason the power generation market keeps expanding year after year.

Restraining Factors

High Setup Costs for New Power Plants

A major restraining factor in the power generation market is the high cost involved in building new power plants. Whether it’s coal, nuclear, or renewable energy like solar and wind, setting up generation units requires a lot of money, land, and time. These projects also need approvals, trained staff, and advanced technology, which further increases costs.

Many developing countries face delays because of a lack of funds or infrastructure. Even private players hesitate due to long payback periods. This cost barrier slows down expansion, especially in remote or rural areas where grid connections are limited.

Growth Opportunity

Expanding Renewable Energy in Emerging Economies

A key growth opportunity in the power generation market lies in expanding renewable energy across emerging economies. Countries in Asia, Africa, and Latin America have strong sunlight, wind, and hydro resources that are still underused. These regions are now focusing more on clean energy to reduce pollution and meet rising electricity needs. Governments are offering subsidies, tax benefits, and land support to boost solar and wind installations.

With falling prices of solar panels and wind turbines, it’s becoming cheaper to set up green power plants. This shift creates new business opportunities for investors, technology providers, and developers. As more rural areas get access to clean electricity, the market is expected to grow faster in these developing nations.

Latest Trends

Virtual Power Plants Transforming Energy Management

A significant trend in the power generation market is the rise of Virtual Power Plants (VPPs). These systems connect various small energy sources—like rooftop solar panels, home batteries, and electric vehicles—into a unified network. By coordinating these resources, VPPs can supply electricity to the grid, especially during peak demand times.

This approach enhances grid stability and reduces the need for large, centralized power plants. VPPs offer a flexible and cost-effective solution for managing energy supply and demand. As more households and businesses adopt renewable energy technologies, the potential for VPPs grows, making them a key component in the transition to a more resilient and sustainable energy system.

Regional Analysis

Asia-Pacific led the power generation market with 42.2%, valued at USD 664.5 Bn.

In 2024, Asia-Pacific emerged as the dominant region in the global power generation market, capturing a substantial 42.20% share, valued at USD 664.5 billion. The region’s growth was fueled by rapid industrialization, urbanization, and the continuous expansion of grid infrastructure across countries such as China, India, and Southeast Asian nations.

Governments in this region also increased investments in large-scale power plants and renewable energy projects to meet rising electricity demands. North America followed with a stable market performance, supported by aging infrastructure upgrades and growing renewable energy integration. Europe focused on sustainability goals and energy transition efforts, with an emphasis on offshore wind and decarbonization.

Meanwhile, the Middle East & Africa region showed moderate growth due to expanding utility-scale solar and gas-based projects, particularly in Gulf countries. Latin America contributed with new hydropower installations and solar developments in Brazil and Chile.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global power generation market is witnessing significant contributions from key players like KEPCO, NextEra Energy Inc., and NHPC Limited, each playing a pivotal role in shaping the industry’s dynamics.

KEPCO (Korea Electric Power Corporation), South Korea’s largest electric utility, continues to be a central figure in the Asia-Pacific region’s energy sector. The company’s efforts are notably directed toward enhancing its technological capabilities and expanding its renewable energy portfolio. This strategic shift not only addresses the growing environmental concerns but also aligns with global trends toward sustainable energy practices.

NextEra Energy Inc., based in the United States, stands out for its aggressive pursuit of renewable energy expansion, particularly in solar and wind power. As one of the leading clean energy companies globally, NextEra Energy’s initiatives in battery storage and green hydrogen are setting benchmarks in the industry, promoting resilience and efficiency in energy networks. The company’s forward-looking strategies are crucial for driving the transition toward a less carbon-intensive power grid.

NHPC Limited, India’s premier hydroelectric power generating company, continues to capitalize on the country’s vast hydroelectric potential. NHPC’s focus extends beyond hydropower, as it explores diversifying into solar and wind sectors. This diversification is part of its broader vision to enhance energy security and support the national agenda of sustainable development.

Top Key Players in the Market

- Adani Power

- AGL Energy

- American Electric Power

- Centrica

- China Huaneng Group Co Ltd

- Datang International Power Generation Company Limited

- E.ON SE

- EDF Energy

- Electricite De France SA

- Endesa SA

- Enel SpA

- Engie

- Exelon Corp

- Guodian Corporation

- Hokkaido Electric Power Company

- Huaneng Power International, Inc.

- Iberdrola

- Inter RAO UES

- Kansai Electric Power Company.

- KEPCO

- NextEra Energy Inc

- NHPC Limited

- Power Grid Corporation of India Limited

- Reliance Power

- RWE

- Scottish Power

- State Grid Corporation of China

- State Power Investment Corporation

- Tata Power

- TEPCO

- Tohoku Electric Power Co

Recent Developments

- In November 2024, AEP secured an agreement for up to 1 GW of Bloom Energy’s solid oxide fuel cells. These will provide reliable power to data centers and large energy users, addressing the growing demand from the AI and cloud computing sectors.

- In September 2024, Adani Power, along with Adani Green Energy, secured a 25-year contract to supply 6,600 MW of power to Maharashtra. Adani Power will provide 1,600 MW of thermal power, while Adani Green Energy will supply 5,000 MW of solar power.

Report Scope

Report Features Description Market Value (2024) USD 1,574.7 Billion Forecast Revenue (2034) USD 3,245.5 Billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Fossil Fuel Electricity, Hydroelectricity, Nuclear Electricity, Solar Electricity, Wind Electricity, Geothermal Electricity, Others), By Grid (On Grid, Off Grid), By End-Use (Industrial, Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Adani Power, AGL Energy, American Electric Power, Centrica, China Huaneng Group Co Ltd, Datang International Power Generation Company Limited, E.ON SE, EDF Energy, Electricite De France SA, Endesa SA, Enel SpA, Engie, Exelon Corp, Guodian Corporation, Hokkaido Electric Power Company, Huaneng Power International, Inc., Iberdrola, Inter RAO UES, Kansai Electric Power Company., KEPCO, NextEra Energy Inc, NHPC Limited, Power Grid Corporation of India Limited, Reliance Power, RWE, Scottish Power, State Grid Corporation of China, State Power Investment Corporation, Tata Power, TEPCO, Tohoku Electric Power Co Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adani Power

- AGL Energy

- American Electric Power

- Centrica

- China Huaneng Group Co Ltd

- Datang International Power Generation Company Limited

- E.ON SE

- EDF Energy

- Electricite De France SA

- Endesa SA

- Enel SpA

- Engie

- Exelon Corp

- Guodian Corporation

- Hokkaido Electric Power Company

- Huaneng Power International, Inc.

- Iberdrola

- Inter RAO UES

- Kansai Electric Power Company.

- KEPCO

- NextEra Energy Inc

- NHPC Limited

- Power Grid Corporation of India Limited

- Reliance Power

- RWE

- Scottish Power

- State Grid Corporation of China

- State Power Investment Corporation

- Tata Power

- TEPCO

- Tohoku Electric Power Co