Global Natural Graphite Market By Type (Vein Graphite, Flake Graphite, and Amorphous Graphite), By Applications (Batteries, Refractories, Castings, Lubricants, Friction Materials, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158106

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

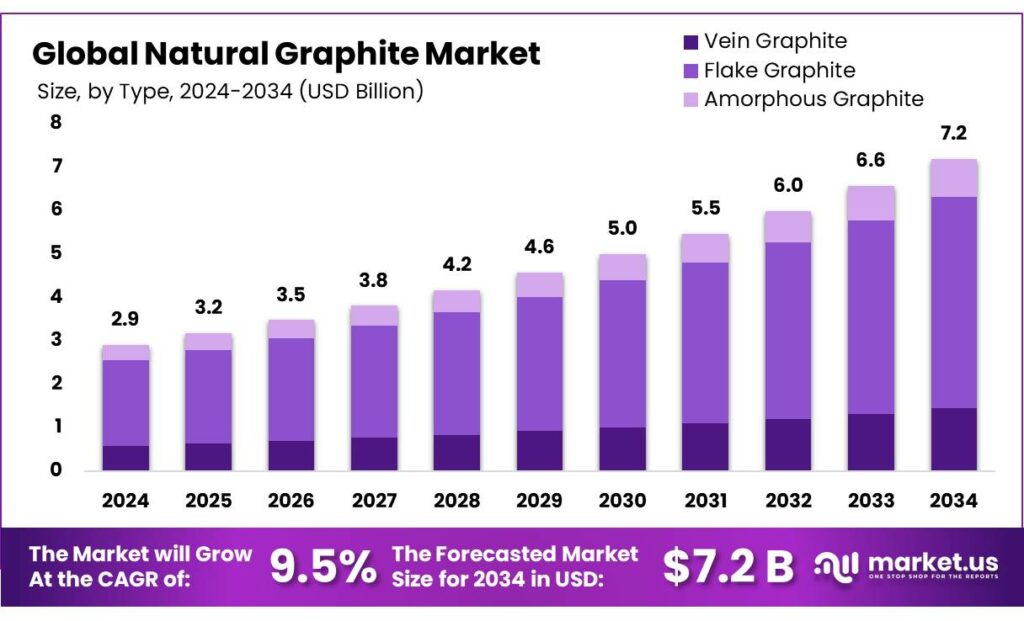

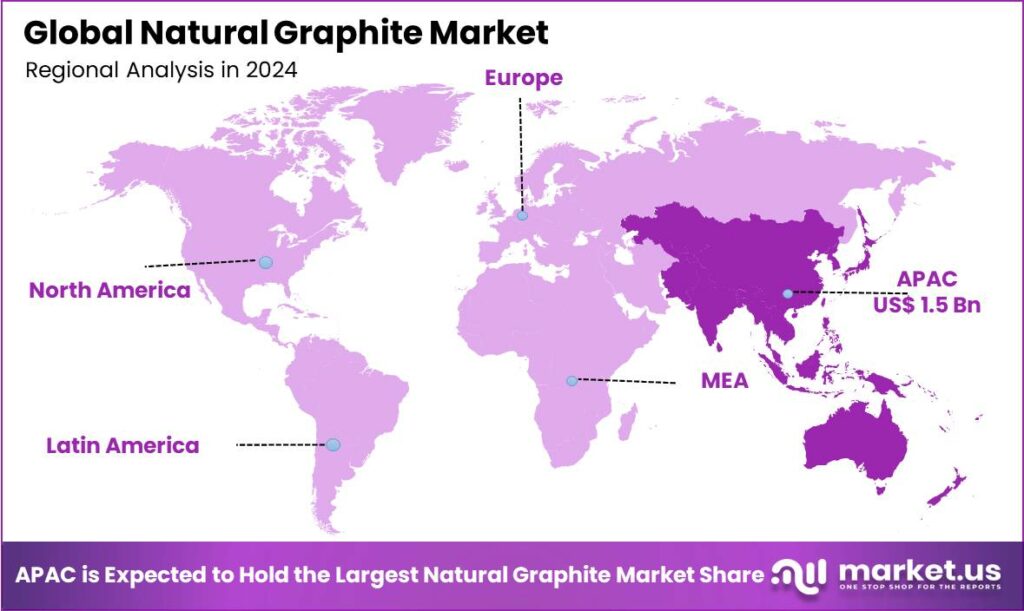

The Global Natural Graphite Market size is expected to be worth around USD 7.2 Billion by 2034, from USD 2.9 Billion in 2024, growing at a CAGR of 9.5% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 52.1% share, holding USD 1.52 Billion in revenue.

Natural graphite is a form of pure, crystalline carbon with a gray to black color and a metallic luster, mined from the earth. There are only two naturally occurring forms of pure carbon, namely, graphite and diamond. Due to its unique layered structure of hexagonal carbon sheets, graphite is a good conductor of heat and electricity, a good lubricant, and resistant to corrosion and high temperatures. The most used type of natural graphite is flake graphite for the production of batteries. It is one of the major drivers of the market. As there is a global shift towards a circular economy, there are many companies operating in the market of recycling graphite market.

Additionally, due to environmental concerns regarding fuel efficiency, there is a demand for components made from graphite, which are lightweight, from the automotive and aerospace industries. However, the graphite market may face challenges due to environmental and health concerns regarding the mining of the material. Similarly, the market might face challenges due to sustainable synthetic graphite.

- According to the United States Geological Survey (USGS), the world’s resources exceed 800 million tons of recoverable graphite, and in 2024, global graphite mine production reached about 1.6 million tons, out of which almost 1.3 million tons of graphite were produced by China.

Key Takeaways

- The global natural graphite market was valued at USD 2.9 billion in 2024.

- The global natural graphite market is projected to grow at a CAGR of 9.5% and is estimated to reach USD 7.2 billion by 2034.

- Based on product types, flake graphite dominated the natural graphite market in 2024, comprising about 67.8% share of the total global market.

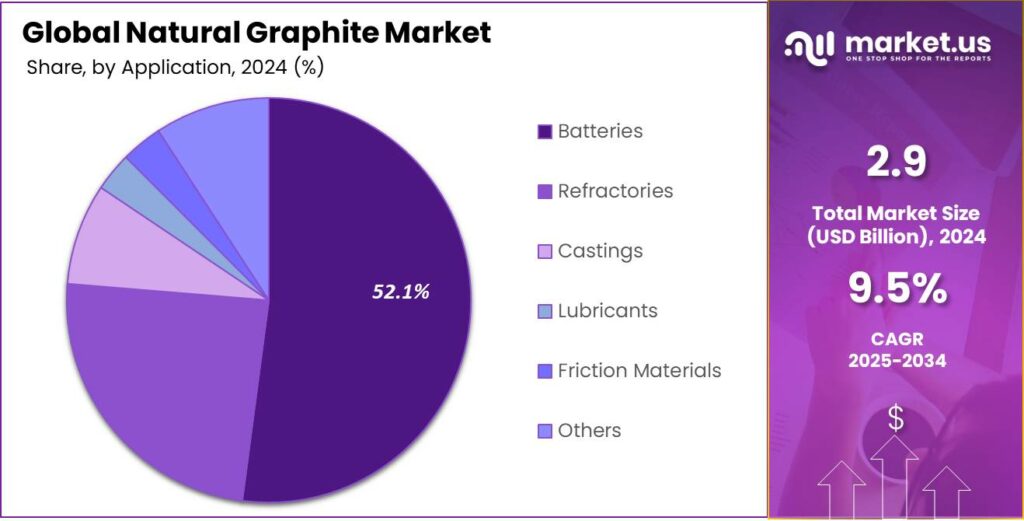

- Among the applications of natural graphite, the battery manufacturing industry dominated the market in 2024, accounting for 52.1% of the market share.

- Asia Pacific was the largest market for natural graphite in 2024 with a share of 52.1% owing to rapidly growing industrialization.

Type Analysis

Flake Graphite Dominated the Natural Graphite Market in 2024.

Based on type, the natural graphite market is segmented into vein graphite, flake graphite, and amorphous graphite. Flake graphite dominated the market in 2024 with a market share of 67.8%. Flake graphite is more widely used due to its ideal properties for emerging technologies, such as lithium-ion batteries, and its high purity, which is achievable through processing. Almost 50% of natural graphite is found to be flake graphite. The large, well-defined flake structure of flake graphite is ideal for manufacturing the anodes in lithium-ion batteries, a rapidly growing market.

Additionally, it can be purified to very high levels through industrial processes such as grinding and flotation, making it suitable for demanding applications. Similarly, it possesses good thermal conductivity, lubrication properties, and oxidation resistance, making it useful in a wide range of industries, such as refractories, metallurgy, aerospace, and friction materials. In contrast, amorphous graphite is difficult to purify due to its tightly bound mineral content, and vein graphite, though high-quality, is scarce and expensive, limiting its widespread industrial use.

Application Analysis

The Battery Manufacturing Industry Dominated the Natural Graphite Market.

Based on applications of the natural graphite, the market is divided into batteries, refractories, castings, lubricants, friction materials, and others. The battery manufacturing industry led the market, comprising approximately 52.1% of the market share. The dominance of the segment is characterized by the demand for batteries from electric vehicles and energy storage systems, which has seen significant demand in the past decade due to the shift towards renewable sources of energy.

Graphite primarily serves as the main anode material in commercial lithium-ion batteries, due to its high theoretical capacity of around 372 mAh/g, electrical conductivity, and safe, low-voltage platform. In addition, its layered structure facilitates the reversible intercalation of lithium ions during charging and discharging, which is key to battery operation.

Key Market Segments

By Type

- Vein Graphite

- Flake Graphite

- Amorphous Graphite

By Application

- Batteries

- Refractories

- Castings

- Lubricants

- Friction Materials

- Others

Drivers

Demand for Batteries Drives the Natural Graphite Market.

The escalating demand for batteries is significantly driving the natural graphite market, primarily due to its critical role in lithium-ion battery anodes. Natural graphite’s superior conductivity and stability make it the preferred material for high-performance batteries used in electric vehicles (EVs), portable electronics, and renewable energy storage solutions. There is a global trend of electrification of vehicles, which demands a consistent supply of high-quality batteries.

- According to the International Energy Agency (IEA), electric car sales exceeded 17 million globally in 2024, where an additional 3.5 million units were sold compared to 2023.

Additionally, natural graphite’s application in grid-scale energy storage systems is increasing, driven by the integration of renewable energy sources and the necessity for reliable storage solutions. For instance, according to Eurostat, in 2023, renewable energy represented 24.5% of energy consumed in the EU, up from 23.0% in 2022. Similarly, according to the International Energy Agency (IEA), renewable energy supplied 30% of electricity in 2023.

- According to the statistics provided by the Indian government, as of March 31, 2024, the total estimated potential for renewable power generation in India stood at 2,109,655 MW.

Restraints

Environmental Concerns Might Hamper the Growth of the Natural Graphite Market.

The natural graphite market faces a significant challenge of environmental concerns, including dust emissions from mining, the use of strong chemicals such as hydrofluoric acid in purification that risk soil and water contamination, and significant CO₂ emissions from purification processes. The excavation of natural graphite releases fine, respirable graphite particles into the air and water. Processes such as beneficiation, spheroidization, and coating are energy-intensive, generating greenhouse gases. The entire graphite supply chain, from mining to surface modification, consumes large amounts of electricity, contributing to its carbon footprint, especially in the regions where the electricity comes from a coal-dominated grid.

Additionally, purifying natural graphite to battery grade requires strong chemicals, such as hydrofluoric acid, to remove impurities. The wastewater from these purification processes can contain acids and bases, posing a serious risk of contaminating soil and water sources and leading to acid rain. Furthermore, natural graphite is a non-renewable resource, and its extraction and processing contribute to the depletion of Earth’s natural reserves.

Opportunity

Demand for Lightweight Components from Various Industries Create Opportunities in the Natural Graphite Market.

The growing demand for lightweight components in automotive, aerospace, and high‑performance industries is offering a strong tailwind for natural graphite, particularly in graphite‑ or carbon fiber-reinforced composites. Aircraft such as the Boeing 787 Dreamliner and Airbus A350 XWB use composite materials, including carbon fiber reinforced polymer and epoxy, for around half their airframes, such as wings, fuselage, tail, and interior, to reduce structural mass and improve fuel efficiency. These composites can typically reduce the overall structural weight by 20-50%, improving fuel efficiency. Additionally, they provide lower costs for assembling components because they require very few fasteners, bolts, etc., and in some cases, consolidate multiple metal components into one composite component.

Due to its advantages, automotive makers also incorporate graphite‐reinforced parts such as body panels, drive shafts, battery enclosures, and chassis reinforcements to improve vehicle range, handling, and braking performance. In addition, innovations in materials that combine graphite with graphene or other fillers are raising strength‑to‑weight and thermal and electrical conductivity, making them attractive for applications where both light weighting and performance are critical.

Trends

Global Shift Towards Circular Economy.

The shift towards a circular economy is increasingly influencing the natural graphite market, particularly through advancements in graphite recycling from spent lithium-ion batteries. Despite the lightweight, graphite constitutes approximately 10-20% of a battery’s weight, making its recovery crucial for sustainable practices. For instance, Altilium’s EcoCathode technology has achieved over 99% recovery of graphite from used EV batteries, facilitating its reuse in new battery anodes.

Similarly, in October 2023, Ascend and Koura announced the plans for the joint commercialization of the advanced graphite recycling process, which can produce 99.9% pure graphite that even exceeds battery-grade requirements. These initiatives are propelled by regulatory frameworks such as the European Union’s battery regulation, which mandates increasing percentages of recycled materials in battery production, thereby enhancing the demand for recycled graphite.

Moreover, the environmental benefits of recycling, such as reduced mining impacts and lower carbon footprints, further underscore its importance. As the industry moves towards a circular economy, the role of recycled graphite becomes pivotal, offering a sustainable alternative to mined materials and contributing to the overall reduction of environmental impacts associated with battery production.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Natural Graphite Market.

Geopolitical tensions are increasingly shaping the natural graphite market, creating both disruptions and incentives for change. Graphite supply, the only critical mineral used for anodes, is concentrated, with China responsible for 80% of mining and over 90% of refining. Such concentrations leave the market vulnerable to even the slightest geopolitical change. For instance, in October 2023, China introduced export permit requirements for various graphite products, including natural flake graphite and high‑purity synthetic graphite, citing national security concerns.

Such controls raise uncertainty for downstream industries, especially battery manufacturers, that have come to rely heavily on Chinese supply. Additionally, in July 2025, the United States imposed a 93.5% anti‑dumping duty on anode‑grade graphite from China after investigations showed it was being sold below fair value. Similarly, in March 2025, Japan imposed definitive anti‑dumping duties of about 95.2% on graphite electrodes from China.

These measures push industrial buyers to diversify supply chains. Furthermore, producers in Southeast Africa, such as Mozambique, Madagascar, and Tanzania, are gaining increased attention as non‑Chinese sources of flake graphite. The impact includes rising costs due to tariffs, greater risk for buyers reliant on Chinese sources, and new opportunities for miners and processors outside China to step in.

Regional Analysis

Asia Pacific was the Largest Market for Natural Graphite in 2024.

Asia Pacific held the major share of the global natural graphite market, led by China, with a 52.1% share of the total global market. The region emerged as the dominating region in the market, valued at an estimated revenue of USD 1.52 billion. The dominance of the region is attributed to the heavy production and rapidly expanding industrialization in the region, such as the growth of the battery sector for automotive and energy industry, the growth of the lubricants sector for machinery and auto parts, and the growth in the refractories sector.

According to the International Energy Agency (IEA), China alone accounted for almost 82% of the world’s supply of graphite and roughly 93% of the world’s battery-grade supply. Additionally, the country was responsible for 80% of global battery cell production in 2024, which is a major end-user industry of graphite. Furthermore, the production of lithium-ion battery manufacturing equipment is also highly concentrated, with China, Korea, and Japan leading the market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

There are several global key players in the natural graphite market, such as Graphit Kropfmühl, Superior Graphite, Imerys, Asbury Carbons, BTR New Material Group, Nacional de Grafite, SGL Carbon SE, AMG Graphite, Tokai Carbon Co., Hexagon Energy Materials, China Carbon Graphite Group, and Elcora Advanced Materials.

AMG Graphite is a globally leading, vertically integrated producer of high-purity natural graphite and other graphite-based products, with operations spanning Germany, Sri Lanka, and China. As part of AMG N.V., AMG Graphite focuses on providing critical raw materials essential for reducing CO2 emissions and supporting modern technological applications.

Imerys, a global leader in mineral-based specialty solutions, operates Imerys Graphite & Carbon, which produces and markets natural and synthetic graphite powders. It has a significant international footprint, with operations, R&D, and sales offices across various countries.

Tirupati Graphite is a producer of natural flake graphite, focusing on its use in the energy transition and decarbonisation. The company operates mining and processing projects in Madagascar and Mozambique, developing high-purity graphite. It pursues a vertically integrated model, combining mining and processing with a focus on value addition in growing niche markets.

The Major Players in The Industry

- AMG Critical Materials N.V.

- Superior Graphite

- Imerys

- Asbury Carbons

- BTR New Material Group Co., Ltd.

- Mineral Commodities Ltd.

- Syrah Resources Limited

- Nacional de Grafite

- Qingdao Haida Graphite Co., Ltd.

- Tirupati Carbons & Chemicals Pvt. Ltd.

- SGL Carbon SE

- Tokai Carbon Co., Ltd.

- Hexagon Energy Materials

- China Carbon Graphite Group, Inc.

- Elcora Advanced Materials

- Other Key Players

Key Developments

- In July 2024, BASF SE and Graphit Kropfmühl, a subsidiary of AMG Critical Materials N.V., entered into an innovative agreement to reduce their product carbon footprint. Under the agreement, BASF will provide renewable energy certificates (Guarantees of Origin) to Graphit Kropfmühl’s Hauzenberg site, cutting the carbon footprint of its graphite production by at least 25%.

- In April 2025, Imerys, a global leader in specialty mineral solutions, introduced SU-NERGY, a breakthrough in sustainable graphite solutions that achieved up to 60% reduction in CO₂ emissions compared to traditional graphite from fossil fuel-based raw materials.

Report Scope

Report Features Description Market Value (2024) US$ 2.9 Bn Forecast Revenue (2034) US$ 7.2 Bn CAGR (2025-2034) 9.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Vein Graphite, Flake Graphite, Amorphous Graphite), By Applications (Batteries, Refractories, Castings, Lubricants, Friction Materials, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape AMG Critical Materials N.V., Superior Graphite, Imerys, Asbury Carbons, BTR New Material Group Co., Ltd., Mineral Commodities Ltd., Syrah Resources Limited, Nacional de Grafite, Qingdao Haida Graphite Co., Ltd., Tirupati Carbons & Chemicals Pvt. Ltd., SGL Carbon SE, Tokai Carbon Co., Ltd., Hexagon Energy Materials, China Carbon Graphite Group, Inc., Elcora Advanced Materials, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- AMG Critical Materials N.V.

- Superior Graphite

- Imerys

- Asbury Carbons

- BTR New Material Group Co., Ltd.

- Mineral Commodities Ltd.

- Syrah Resources Limited

- Nacional de Grafite

- Qingdao Haida Graphite Co., Ltd.

- Tirupati Carbons & Chemicals Pvt. Ltd.

- SGL Carbon SE

- Tokai Carbon Co., Ltd.

- Hexagon Energy Materials

- China Carbon Graphite Group, Inc.

- Elcora Advanced Materials

- Other Key Players