Global Immunodiagnostics Market By Product (Reagents and Consumables, Instruments, Software and Services) By Technology (Enzyme-Linked Immunosorbent Assay (ELISA), Chemiluminescence Immunoassay (CLIA), Fluorescent Immunoassay, Radioimmunoassay (RIA), Rapid Test) By Application (Infectious Diseases, Oncology and Endocrinology, Hepatitis and Retrovirus, Bone and Mineral, Autoimmunity, Others) By End User (Hospitals, Clinical Laboratories, Academic and Research Institutes, Pharmaceutical and Biotechnology Industry) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147895

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

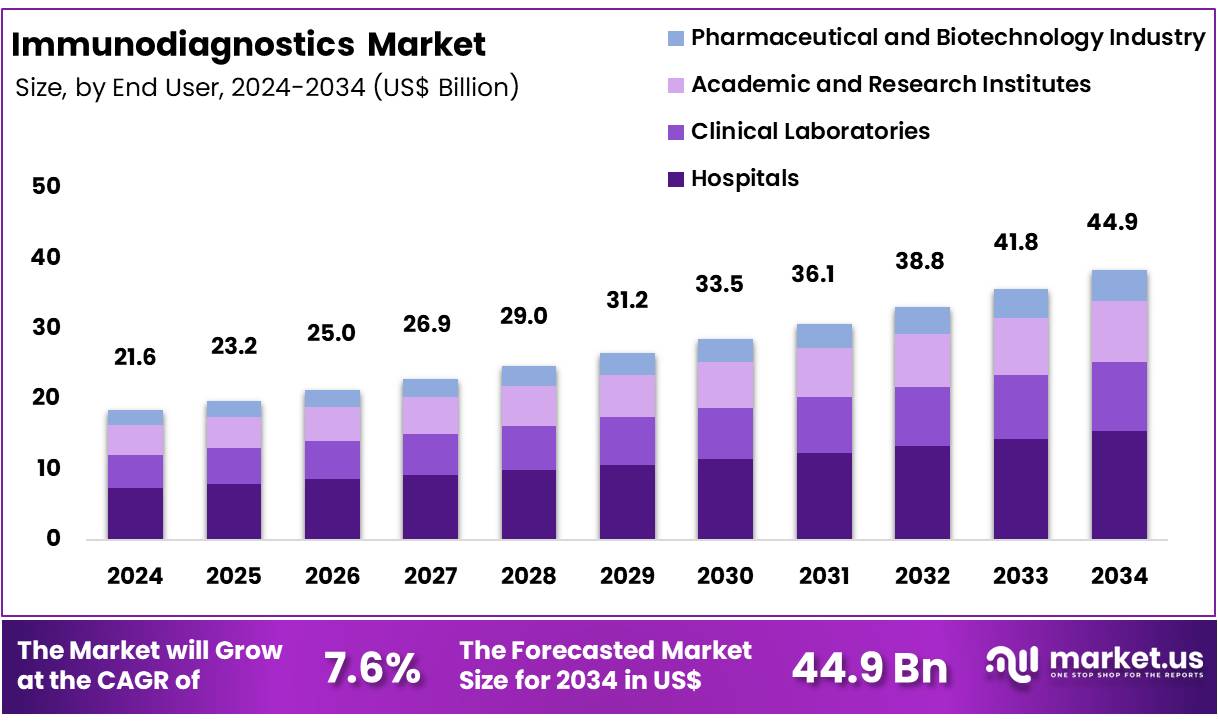

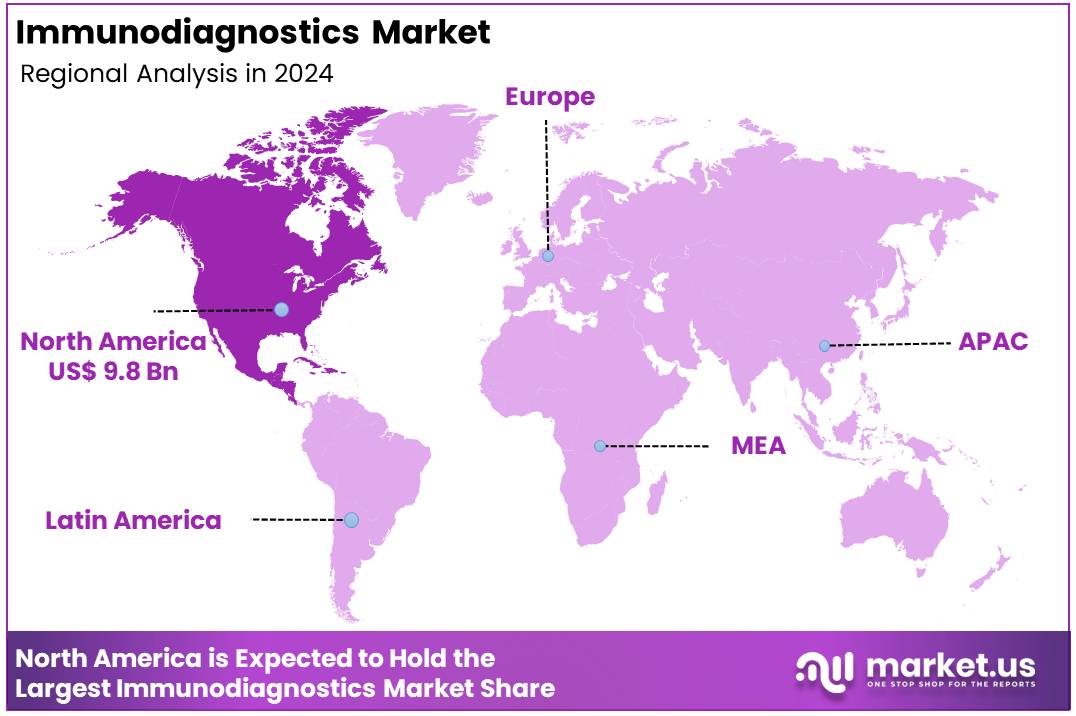

Global Immunodiagnostics Market size is expected to be worth around US$ 44.9 Billion by 2034 from US$ 21.6 Billion in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 45.6% share with a revenue of US$ 9.8 Billion.

The immunodiagnostics market is witnessing robust growth, primarily driven by continuous innovation in biotechnology and the development of advanced diagnostic techniques. Prominent technologies such as Enzyme-Linked Immunosorbent Assay (ELISA), Chemiluminescent Immunoassays (CLIA), and Fluorescent Immunoassays (FIA) are transforming diagnostic methodologies by accurately identifying antigen-antibody interactions, which are essential for detecting a wide range of diseases.

These diagnostic processes depend on various critical components, including fluorescent chemicals, enzymes, substrates, and buffer solutions. Their widespread application in hospitals, clinical laboratories, and research institutions underscores their importance in modern healthcare diagnostics.

The National Institute of Biologicals (NIB) plays a pivotal role in ensuring the quality and reliability of immunodiagnostic test kits. It conducts quality control testing for kits used in crucial applications such as blood donor screening. Regulatory oversight is provided by organizations including the Central Drugs Standard Control Organization (CDSCO) and the National AIDS Control Organization, which help maintain high standards of safety and efficacy.

Thermo Fisher Scientific Inc. is a key player in the in-vitro diagnostics landscape. The company offers a broad portfolio of diagnostic tests for conditions like allergies, asthma, and autoimmune diseases. With annual revenues surpassing USD 40 billion and a global network involving over 125,000 collaborations, Thermo Fisher significantly contributes to the expansion and innovation of the immunodiagnostics market.

The rising prevalence of chronic and infectious diseases is a major driver of market growth. According to the Centers for Disease Control and Prevention (CDC) in 2023, there were approximately 1.2 million people living with HIV in the United States in 2021, with a significant portion unaware of their infection. This emphasizes the urgent need for early diagnostic solutions. Similarly, the American Cancer Society (ACS) projected around 238,340 new cases of lung cancer in the U.S. in 2023, highlighting the increasing burden of cancer and the necessity for timely diagnosis.

Globally, the World Health Organization (WHO) reported that 18 million people were living with rheumatoid arthritis (RA), with women representing a substantial majority of those affected. The aging population and rising incidence of chronic diseases are driving the demand for more efficient and accessible diagnostic tools.

Another key factor contributing to the market’s growth is the increasing demand for point-of-care (POC) testing. Healthcare systems globally are shifting towards faster and more efficient diagnostic solutions that offer rapid results at the patient’s bedside, in remote areas, or outpatient settings. POC testing reduces dependence on centralized laboratories, enabling quicker clinical decision-making. This is particularly important for infectious diseases like COVID-19, influenza, and tuberculosis, as well as chronic conditions such as diabetes and cardiovascular diseases.

The integration of immunodiagnostic tests into point-of-care platforms is driving technological innovation in the sector. Advanced technologies such as microfluidic devices, biosensors, and AI-based diagnostics are revolutionizing immunodiagnostics, allowing for more accurate and timely results. These innovations are expected to continue expanding the market, enhancing the accessibility and reliability of diagnostic solutions globally.

Key Takeaways

- Market Size: Global Immunodiagnostics Market size is expected to be worth around US$ 44.9 Billion by 2034 from US$ 21.6 Billion in 2024.

- Market Growth: The market growing at a CAGR of 7.6% during the forecast period from 2025 to 2034.

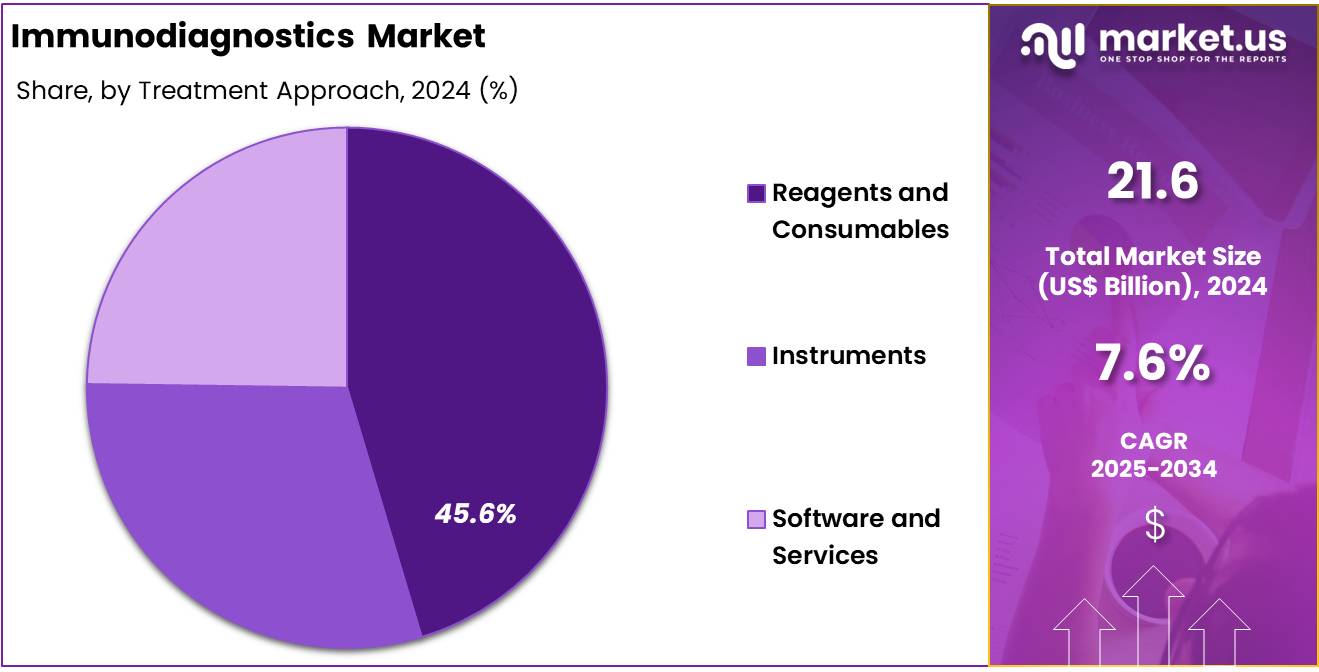

- Product Analysis: Reagents and consumables represent the largest segment, accounting for approximately 45.6% of the total market share in 2024.

- Technology Analysis: The ELISA segment dominates this market, capturing approximately 36.4% market share.

- Application Analysis: The Infectious Diseases segment dominates, accounting for approximately 31.2% of the total market share.

- End-Use Analysis: Hospitals represent the leading segment, accounting for approximately 34.5% of the overall market share.

- Regional Analysis: In 2024, North America led the market, achieving over 45.6% share with a revenue of US$ 9.8 Billion.

Product Analysis

The immunodiagnostics market is segmented into four primary product categories: reagents and consumables, instruments, software, and services. Among these, reagents and consumables represent the largest segment, accounting for approximately 45.6% of the total market share in 2024. This dominance can be attributed to the recurrent demand for assay components such as antibodies, antigens, enzymes, substrates, and buffer solutions used in routine diagnostics and research applications.

Instruments comprise analyzers and diagnostic platforms used to automate and enhance the efficiency of immunoassays. This segment continues to grow due to the increasing adoption of automated systems in clinical laboratories.

Software plays a vital role in data acquisition, analysis, and laboratory workflow optimization. Integrated software solutions are becoming increasingly important in supporting diagnostics accuracy and compliance with regulatory standards.

Services include installation, maintenance, calibration, and training. As laboratories increasingly rely on complex diagnostics systems, the demand for value-added services continues to rise. Together, these product segments support the growing need for accurate, efficient, and scalable immunodiagnostic testing across hospitals, reference labs, and research facilities.

Technology Analysis

The immunodiagnostics market is segmented by technology into Enzyme-Linked Immunosorbent Assay (ELISA), Chemiluminescence Immunoassay (CLIA), Fluorescent Immunoassay, Radioimmunoassay (RIA), and Rapid Test. The ELISA segment dominates this market, capturing approximately 36.4% market share.

The substantial share of ELISA is primarily due to its high specificity, sensitivity, and extensive application across diagnostics for infectious diseases, autoimmune conditions, and allergies. ELISA’s adaptability for large-scale screenings makes it ideal for hospitals and clinical laboratories.

Chemiluminescence Immunoassay (CLIA) is another significant technology, valued for its rapid analysis capabilities, high throughput, and precise results, supporting growth particularly in hormone and tumor marker detection. The Fluorescent Immunoassay segment is increasingly adopted for its improved accuracy and quick turnaround time, especially in point-of-care diagnostics.

Radioimmunoassay (RIA), despite declining usage due to regulatory concerns associated with radioactive materials, remains relevant in specialized laboratories for endocrine and pharmaceutical testing. Rapid Test technology continues to witness growth, driven by demand for immediate diagnostic results, notably in infectious disease screenings and home testing applications.

Application Analysis

The immunodiagnostics market is segmented by application into Infectious Diseases, Oncology and Endocrinology, Hepatitis and Retrovirus, Bone and Mineral, Autoimmunity, and Others. The Infectious Diseases segment dominates, accounting for approximately 31.2% of the total market share. The growth of this segment is driven by the increasing prevalence of diseases such as COVID-19, tuberculosis, dengue, and malaria. Rising awareness and government-led disease management initiatives further boost the demand for reliable and rapid immunodiagnostic tests in this category.

The Oncology and Endocrinology segment also experiences significant demand due to increasing cancer incidence rates and hormonal disorders globally. Diagnostic advancements enabling early cancer detection and effective endocrine disorder management contribute to growth. Hepatitis and Retrovirus diagnostics are critical in managing viral hepatitis and HIV infections, maintaining steady market demand due to consistent global prevalence rates.

Bone and Mineral immunodiagnostics address conditions such as osteoporosis and calcium metabolism disorders, driven by an aging population. Meanwhile, Autoimmunity testing sees increasing adoption with the rising incidence of autoimmune diseases, ensuring steady growth. Other applications encompass allergies and cardiovascular diagnostics, which continue to expand due to improved diagnostic methods and patient awareness.

End User Analysis

The immunodiagnostics market is segmented by end-user into Hospitals, Clinical Laboratories, Academic and Research Institutes, and the Pharmaceutical and Biotechnology Industry. Hospitals represent the leading segment, accounting for approximately 34.5% of the overall market share.

This dominance is attributed to the increased patient inflow, improved healthcare infrastructure, and widespread adoption of advanced immunodiagnostic tests for rapid disease identification and treatment planning. Hospitals rely heavily on immunodiagnostics for infectious diseases, oncology, endocrinology, and emergency diagnostics, driving steady market growth.

Clinical Laboratories constitute another key segment due to their role in handling high test volumes and specialized diagnostic services. Increased outsourcing of diagnostic tests from hospitals and growing private diagnostic lab chains support consistent expansion in this segment.

Academic and Research Institutes are notable for driving innovation and advancement through extensive research activities, clinical trials, and novel biomarker discovery, fueling moderate growth in immunodiagnostic usage.

The Pharmaceutical and Biotechnology Industry leverages immunodiagnostic technologies primarily in drug discovery, therapeutic monitoring, and regulatory compliance testing, supporting incremental growth through increasing drug development pipelines and rigorous safety evaluation mandates.

Key Market Segments

By Product

- Reagents and Consumables

- Instruments

- Software and Services

By Technology

- Enzyme-Linked Immunosorbent Assay (ELISA)

- Chemiluminescence Immunoassay (CLIA)

- Fluorescent Immunoassay

- Radioimmunoassay (RIA)

- Rapid Test

By Application

- Infectious Diseases

- Oncology and Endocrinology

- Hepatitis and Retrovirus

- Bone and Mineral

- Autoimmunity

- Others

By End User

- Hospitals

- Clinical Laboratories

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Industry

Driving Factors

Rising Prevalence of Infectious and Chronic Diseases

The increasing global burden of infectious and chronic diseases is a primary driver of the immunodiagnostics market. Conditions such as HIV, hepatitis, cancer, diabetes, and cardiovascular diseases require early and accurate diagnostic testing for effective treatment. According to the World Health Organization (WHO), noncommunicable diseases account for 74% of global deaths, highlighting the critical need for diagnostic solutions.Immunodiagnostic tests, such as ELISA and CLIA, play a key role in detecting biomarkers associated with these diseases. The demand for accurate, rapid, and minimally invasive diagnostics has intensified, especially in low- and middle-income countries. This growing healthcare burden continues to boost investment in immunodiagnostics technologies across hospitals, laboratories, and point-of-care settings worldwide.

Trending Factors

Shift Toward Automated and Point-of-Care Testing

A major trend in the immunodiagnostics market is the transition toward automation and point-of-care (POC) testing. Automated platforms improve test throughput, reduce human error, and allow for high-volume testing—critical in hospital and clinical lab settings. Meanwhile, POC immunodiagnostics enable rapid diagnostics at the patient’s bedside or in remote locations, significantly improving clinical outcomes and reducing treatment delays.Technological innovations, such as portable immunoassay analyzers and integration with digital health systems, support real-time decision-making and remote patient monitoring. These trends are further accelerated by the global push for decentralized healthcare models and the growing adoption of telemedicine. As a result, manufacturers are focusing on compact, user-friendly, and AI-integrated testing devices.

Restraining Factors

High Cost of Advanced Diagnostic Systems

One of the significant restraints in the immunodiagnostics market is the high cost of advanced testing equipment and reagents. Immunoassay platforms such as chemiluminescent immunoassay (CLIA) systems require substantial capital investment, which limits their adoption in low-resource settings. Additionally, the cost of high-quality reagents, maintenance, and skilled personnel adds to the operational expenses.Smaller clinics and diagnostic centers in developing regions may find these expenses unsustainable, leading to underutilization of modern diagnostic technologies. Reimbursement challenges and inconsistent insurance coverage further compound this issue, particularly in markets with fragmented healthcare systems. Consequently, affordability remains a key barrier to the widespread adoption of next-generation immunodiagnostic solutions across all geographies.

Opportunity

Expansion in Emerging Markets and Home Testing

Emerging economies present significant growth opportunities for the immunodiagnostics market due to rising healthcare investments and growing awareness of disease prevention. Countries in Asia-Pacific, Latin America, and the Middle East are expanding diagnostic infrastructure to meet increasing demand for early disease detection. The growing penetration of health insurance and government-backed screening programs enhances market accessibility.Additionally, the trend toward home-based diagnostics and self-testing is opening new market segments. Immunodiagnostic kits for conditions such as pregnancy, COVID-19, and infectious diseases are now available over-the-counter, supporting decentralized healthcare delivery. With further technological advancements and cost reductions, the home testing market is expected to grow rapidly, especially in post-pandemic healthcare models.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 45.6% share and holds US$ 9.8 billion market value for the year. This leadership is driven by several key factors. The region has a well-developed healthcare infrastructure and high diagnostic testing rates. A strong presence of advanced hospitals and laboratories supports the use of automated immunoassay platforms. The region also benefits from higher healthcare spending per capita compared to global averages.

The rising burden of chronic and infectious diseases fuels demand for early detection. The U.S. Centers for Disease Control and Prevention (CDC) highlights that chronic diseases account for 70% of all deaths in the country. This makes immunodiagnostic testing critical in routine health management.

Widespread use of preventive screenings, favorable reimbursement policies, and continued adoption of point-of-care devices also contribute to market strength. Furthermore, government initiatives for disease surveillance and public health programs increase the uptake of diagnostic tests. These factors position North America as a key driver of growth in the global immunodiagnostics market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The immunodiagnostics market is characterized by the presence of several well-established manufacturers with strong global distribution networks. These players focus heavily on innovation, especially in areas such as automated immunoassay platforms and point-of-care diagnostic solutions. Investment in research and development is high, aimed at improving test sensitivity, specificity, and turnaround time. Strategic collaborations with academic institutions, hospitals, and research laboratories are common to enhance product pipelines.

Additionally, market participants are expanding their footprints in emerging economies by localizing production and distribution. Companies also focus on regulatory approvals to strengthen their portfolios in developed markets. With growing demand for home-based testing, some are entering the direct-to-consumer segment. Overall, the market remains competitive, driven by continuous technological advancements and expanding application in infectious and chronic disease detection.

Market Key Players

- Agilent Technologies, Inc.

- Thermo Fisher Scientific Inc.

- Becton Dickinson

- Illumina, Inc.

- Abbott

- Exact Sciences Corporation

- Diaosorin

- Guardant Health

- F. Hoffmann-La Roche Ltd.

- NeoGenomics Laboratories

Recent Developments

- Product Launches: In August 2023, a biotechnology company introduced a new chemiluminescence immunoassay analyzer, aiming to enhance diagnostic accuracy and efficiency in clinical settings.

- Mergers and Acquisitions: In December 2021, a significant acquisition occurred when a diagnostics firm completed the purchase of a clinical diagnostics company for $6 billion, expanding its portfolio in immunodiagnostic products.

- Strategic Partnerships: In September 2020, a collaboration was established between two companies to develop and commercialize diagnostic solutions that differentiate between bacterial and viral infections, enhancing the precision of immunodiagnostic tests.

Report Scope

Report Features Description Market Value (2024) US$ 21.6 Billion Forecast Revenue (2034) US$ 44.9 Billion CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Reagents and Consumables, Instruments, Software and Services) By Technology (Enzyme-Linked Immunosorbent Assay (ELISA), Chemiluminescence Immunoassay (CLIA), Fluorescent Immunoassay, Radioimmunoassay (RIA), Rapid Test) By Application (Infectious Diseases, Oncology and Endocrinology, Hepatitis and Retrovirus, Bone and Mineral, Autoimmunity, Others) By End User (Hospitals, Clinical Laboratories, Academic and Research Institutes, Pharmaceutical and Biotechnology Industry) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Agilent Technologies, Inc., Thermo Fisher Scientific Inc., Becton Dickinson, Illumina, Inc., Abbott, Exact Sciences Corporation, Diaosorin, Guardant Health, F. Hoffmann-La Roche Ltd., NeoGenomics Laboratories Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Agilent Technologies, Inc.

- Thermo Fisher Scientific Inc.

- Becton Dickinson

- Illumina, Inc.

- Abbott

- Exact Sciences Corporation

- Diaosorin

- Guardant Health

- F. Hoffmann-La Roche Ltd.

- NeoGenomics Laboratories