India Malaria Diagnostics Market By Diagnostic Technique (Molecular Diagnostic Tests, Microscopy and Rapid Diagnostic Tests (RDT)), By Product (Malaria Diagnostic Kits, Reagents and Instruments) and End Use (Hospitals & Clinics, Diagnostic Centers and Academic and Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 138159

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The India Malaria Diagnostics Market size is expected to be worth around US$ 92.7 Billion by 2034, from US$ 59.2 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

The Government of India has introduced a series of strategic initiatives to enhance malaria diagnosis, driving significant growth in the market over recent years. Key measures include the deployment of rapid diagnostic kits on a large scale, the enhancement of diagnostic infrastructure, and capacity-building programs for healthcare personnel to ensure accurate detection.

The National Center for Vector Borne Diseases Control (NCVBDC) has prioritized high-burden areas, particularly in tribal and hilly regions, through targeted interventions. These efforts have bolstered early disease detection and timely treatment, creating increased demand for advanced diagnostic solutions and fueling market expansion within the Indian healthcare industry.

- The National Center for Vector Borne Diseases Control (NCVBDC) reports that about 95% of India’s population lives in areas prone to malaria, with 80% of malaria cases occurring among 20% of the population residing in hilly and tribal regions.

- According to Severe Malaria Observatory, India accounts for 1.7% of the global malaria case burden and 1.2% of global malaria-related deaths.

Technological innovations have significantly enhanced malaria surveillance efforts. Tools like the Mobile-based Surveillance Quest using IT (MoSQuIT) have automated data collection and reporting, streamlining processes and saving time. The National Malaria Case-Based Reporting App (MCBR) further improves efficiency by enabling real-time case tracking and effective resource allocation. These digital advancements ensure timely intervention by providing accurate and up-to-date information. Improved surveillance systems play a critical role in monitoring malaria cases, facilitating better control measures, and aiding India’s fight against the disease.

Enhanced diagnostic tools are transforming malaria management by offering greater precision and speed. Advanced Rapid Diagnostic Tests (RDTs) now deliver more accurate results, enabling quicker treatment decisions. Nanotechnology innovations, such as the Nanomal DNA analyzer, provide portable diagnostic solutions that detect malaria at a molecular level. These tools ensure early detection, which is critical in reducing disease progression and fatalities. Collectively, these advancements support healthcare providers in improving patient outcomes and reducing the malaria burden in India.

The integration of artificial intelligence (AI) and geospatial technology has revolutionized malaria mapping and prediction capabilities. AI-driven systems analyze large datasets to identify high-risk areas, enabling targeted interventions. Geospatial tools enhance disease tracking, allowing resource allocation to areas needing immediate attention. These technologies complement surveillance and diagnostics, creating a comprehensive approach to malaria control. By optimizing intervention strategies, India has strengthened its ability to combat malaria effectively and improve disease management outcomes.

Key Takeaways

- The India Malaria Diagnostics Market generated a revenue of US$ 59.20 Billion in 2024 and is predicted to reach US$ 92.68 Billion, with a CAGR of 4.5%.

- Based on the By Diagnostic Technique, the Rapid Diagnostic Tests (RDT) segment generated the most revenue for the market with a market share of 46%.

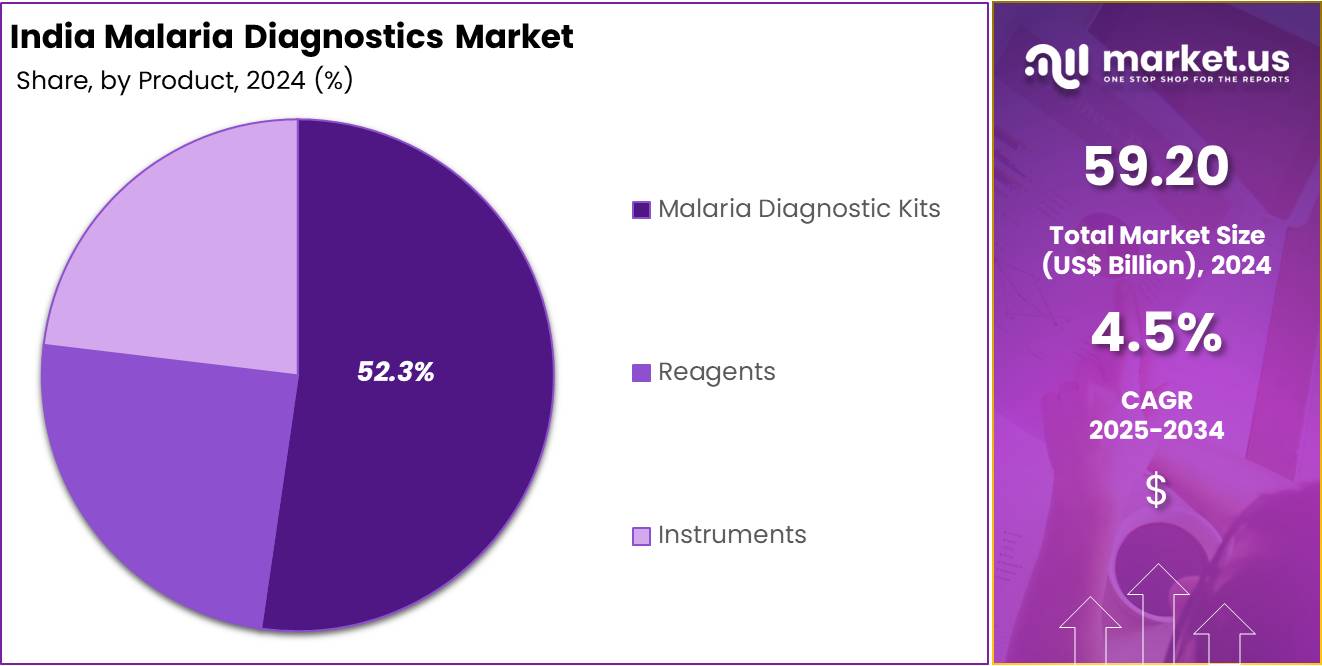

- Based on the By Product, the Malaria Diagnostic Kits segment generated the most revenue for the market with a market share of 52.3%.

- By End Use, the Hospitals & Clinics segment contributed the most to the market and secured a market share of 44.2%.

Diagnostic Technique Analysis

The India Malaria Diagnostics Market is segmented into Molecular Diagnostic Tests, Microscopy, and Rapid Diagnostic Tests (RDT), with the RDT sub-segment dominating the product type segment. RDTs are widely favored due to their cost-effectiveness, ease of use, and ability to provide quick and accurate results in resource-limited settings.

Their portability and minimal training requirements make them ideal for rural and remote areas, where malaria prevalence is high. Government initiatives to enhance diagnostic coverage and increasing awareness about early detection further bolster the demand for RDTs. The rising adoption of these tests underscores their critical role in India’s malaria control efforts.

The molecular diagnostic tests segment in the India Malaria Diagnostics Market is expected to grow steadily during the forecast period. Techniques like Polymerase Chain Reaction (PCR) and Loop-Mediated Isothermal Amplification (LAMP) provide high sensitivity and specificity, allowing for the detection of low parasite levels and accurate identification of Plasmodium species.

These features are crucial for early diagnosis, targeted treatments, and effective surveillance. Ongoing advancements in molecular diagnostics further support global malaria control efforts, improving disease management in India through timely and precise interventions, contributing to more efficient malaria eradication strategies.

Product Analysis

Malaria diagnostic kits have emerged as the leading product segment in India’s malaria diagnostics market, driven by their widespread use and adaptability across various healthcare settings. These kits offer a comprehensive solution by combining essential components like reagents, buffers, and testing devices into a single package, ensuring accuracy and ease of use. Their dominance is fueled by the increasing demand for rapid and reliable diagnostic solutions, especially in rural and remote areas where laboratory infrastructure is limited.

The ability to deliver quick results at the point of care has made these kits particularly popular in regions with a high malaria burden in India. Additionally, advancements in kit design, including enhanced sensitivity and specificity, have improved their effectiveness in detecting Plasmodium species. The distribution of these kits through government health programs and non-governmental organizations further strengthens their leading position in India’s malaria diagnostics market.

End Use Analysis

The Hospitals & Clinics segment led the malaria diagnostics market in 2023, capturing the largest revenue share of 44.2%. This dominance is largely due to the widespread adoption of Rapid Diagnostic Tests (RDTs), valued for their quick turnaround time, affordability, and accessibility. Clinics, with their manageable patient volumes compared to hospitals, enable faster diagnosis and timely administration of antimalarial treatments, significantly improving patient outcomes. Early detection and prompt treatment remain crucial in managing malaria and minimizing associated complications, underscoring the critical role of clinics in this segment.

The diagnostics centers segment in India is expected to grow steadily during the forecast period. Rising awareness among the population has encouraged a shift towards specialized diagnostic providers for precise disease detection. These centers are equipped with advanced testing infrastructure, cutting-edge laboratories, and strict quality control protocols, ensuring accurate results. Additionally, government-led initiatives, including programs offering reimbursement for diagnostic services, are anticipated to further drive the growth of this segment.

Key Market Segments

By Diagnostic Technique

- Molecular Diagnostic Tests

- Conventional PCR

- Modernized PCR

- Microscopy

- Rapid Diagnostic Tests (RDT)

By Product

- Malaria Diagnostic Kits

- Reagents

- Instruments

By End Use

- Hospitals & Clinics

- Diagnostic Centers

- Academic and Research Institutes

Drivers

Growing Awareness and Increasing Government Initiatives

The Indian government has launched various initiatives to enhance malaria diagnostics and control. Programs like the National Strategic Plan for Malaria Elimination aim to eradicate the disease through improved surveillance, timely diagnosis, and effective treatment strategies. Additionally, schemes offering free or subsidized diagnostic services have significantly increased accessibility, particularly in underserved and rural areas. These efforts ensure that more individuals receive prompt and accurate testing, which is crucial for effective disease management.

Simultaneously, awareness campaigns led by government agencies and non-governmental organizations have played a pivotal role in educating the population about malaria prevention and the importance of early diagnosis. These campaigns emphasize the need for timely medical intervention to reduce complications and improve treatment outcomes. By addressing misconceptions and promoting the benefits of seeking professional healthcare, these initiatives have encouraged individuals to utilize available diagnostic services, thereby contributing to the overall reduction of malaria prevalence in India.

Restrains

High Costs of Advanced Diagnostics and Limited Healthcare Infrastructure

The high costs associated with advanced diagnostic technologies and the limited healthcare infrastructure in certain regions are significant challenges restraining the growth of the malaria diagnostics market in India. While innovations like molecular diagnostics and nanotechnology-based tools offer higher accuracy and reliability, their expensive nature makes them less accessible, particularly in rural and economically weaker areas.

Moreover, the lack of well-equipped diagnostic centers and trained personnel in remote regions further hampers the widespread adoption of standardized diagnostic practices. These limitations reduce the reach of effective malaria diagnosis, especially in high-burden areas, thereby impacting early detection and timely treatment. Addressing these barriers through cost-effective solutions and investments in healthcare infrastructure will be crucial for overcoming these challenges and expanding access to advanced diagnostics across the country.

Opportunities

Adoption of AI and Geospatial Technologies

The adoption of artificial intelligence (AI) and geospatial technologies is transforming malaria diagnostics and management in India by enabling more targeted and efficient interventions. AI-powered predictive modeling analyzes vast datasets, including climatic conditions, population density, and historical malaria trends, to forecast potential outbreak areas. This proactive approach allows health authorities to allocate resources strategically, ensuring timely interventions in high-risk zones.

Geospatial technology complements these efforts by mapping malaria hotspots with high precision. By integrating satellite imagery and geolocation data, this technology identifies regions where malaria transmission is most likely, facilitating focused surveillance and preventive measures. Combined, AI and geospatial tools enable real-time monitoring and decision-making, enhancing the effectiveness of disease control programs.

These advancements significantly reduce response times, optimize resource allocation, and improve outcomes. Their integration into public health systems offers immense potential to accelerate progress toward malaria elimination in India, particularly in rural and underserved areas.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a significant role in shaping the India Malaria Diagnostics Market. Economic conditions, such as GDP growth, healthcare funding, and infrastructure development, directly influence the availability and accessibility of diagnostic tools. During periods of economic downturn or stagnation, limited government budgets can reduce the allocation for healthcare programs, affecting the distribution and adoption of advanced diagnostic technologies. Conversely, economic growth and increased healthcare investment enhance the availability of better diagnostic solutions, supporting the market’s expansion.

Geopolitical factors, including regional political stability and international partnerships, also impact the market. Government health initiatives and collaboration with international organizations like the World Health Organization (WHO) are crucial in addressing malaria control efforts. In regions with political instability, access to healthcare, including diagnostic services, can be disrupted, impeding the timely detection of malaria. However, strong diplomatic relations and cross-border collaboration can promote the sharing of resources and expertise, improving diagnostic coverage.

Moreover, India’s role in global health initiatives, such as the Global Fund and bilateral partnerships with countries in malaria-endemic regions, further influences the market. These collaborations ensure the continuous supply of diagnostic kits and technologies, driving growth. In summary, macroeconomic and geopolitical factors play a pivotal role in the development and distribution of malaria diagnostic solutions in India.

Trends

The India Malaria Diagnostics Market is witnessing several key trends, reflecting advancements in technology and shifting healthcare priorities. One of the most prominent trends is the growing adoption of Rapid Diagnostic Tests (RDTs) due to their ease of use, affordability, and rapid results, which are crucial for malaria control, particularly in rural and remote areas. The increasing availability of RDTs at the point of care is transforming the way malaria is diagnosed in India, contributing to faster diagnosis and treatment.

Another significant trend is the growing importance of molecular diagnostic techniques, such as Polymerase Chain Reaction (PCR) and Loop-Mediated Isothermal Amplification (LAMP), which offer higher sensitivity and specificity, enabling accurate detection of low parasite levels and precise species identification. These technologies are increasingly being adopted for more accurate diagnostics, particularly for asymptomatic or low-parasite malaria cases.

Furthermore, the government’s commitment to malaria eradication, through initiatives such as the National Vector Borne Disease Control Programme (NVBDCP), is driving the market. Increased funding and collaboration with international organizations are enhancing diagnostic coverage and accessibility.

Additionally, digital health solutions are gaining traction, with mobile platforms being used to facilitate real-time reporting and monitoring of malaria cases, improving surveillance and management. These trends are collectively shaping the future of malaria diagnostics in India, ensuring more efficient and timely disease management.

Key Players Analysis

The competitive landscape of the India malaria diagnostics market is characterized by the presence of global and domestic players offering a range of diagnostic solutions. Key companies focus on affordable and accessible products, such as Rapid Diagnostic Tests (RDTs), to cater to the high demand in rural areas.

Advanced molecular diagnostic tools and AI-enabled systems are increasingly being introduced to enhance accuracy and efficiency. Collaboration with government initiatives, non-governmental organizations, and healthcare providers is a common strategy for market penetration. Additionally, rising investment in R&D and the expansion of diagnostic networks are intensifying competition in this growing market.

Top Key Players in the India Malaria Diagnostics Market

- Siemens Healthineers AG

- Bio-Rad Laboratories, Inc.

- Beckman Coulter, Inc.

- Olympus Corporation

- ACCESS BIO.

- Premier Medical.

- MicroGene Diagnostic Systems (P) Ltd

- Nikon India Pvt Ltd

- BIOMÉRIEUX

Recent Developments

- In May 2024, the Serum Institute of India (SII) began distributing its R21/Matrix-M malaria vaccine in Africa, starting with the Central African Republic (CAR). Developed in partnership with Novavax and the University of Oxford, this vaccine is the second approved for use in children in malaria-endemic areas. The initial shipment to CAR includes 43,200 doses, part of a total allocation of 163,800 doses for the region. To date, SII has produced 25 million doses and has the capacity to scale up production to 100 million doses annually.

- In October 2023, St. John’s Research Institute (SJRI) in Bengaluru was selected as one of four international collaborators for the Point of Care Technology Research Network (POCTRN). This initiative, a collaboration between Cornell University and the National Institutes of Health (NIH), aims to accelerate the development, deployment, and commercialization of innovative point-of-care diagnostic devices.

Report Scope

Report Features Description Market Value (2024) US$ 59.20 Billion Forecast Revenue (2034) US$ 92.68 Billion CAGR (2024-2033) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Diagnostic Technique- Molecular Diagnostic Tests, Microscopy and Rapid Diagnostic Tests (RDT), By Product- Malaria Diagnostic Kits, Reagents and Instruments and End Use- Hospitals & Clinics, Diagnostic Centers and Academic and Research Institutes Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott., Siemens Healthineers AG, Bio-Rad Laboratories, Inc., Beckman Coulter, Inc., Olympus Corporation, ACCESS BIO., Premier Medical., MicroGene Diagnostic Systems (P) Ltd, Nikon India Pvt Ltd and BIOMÉRIEUX. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  India Malaria Diagnostics MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

India Malaria Diagnostics MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens Healthineers AG

- Bio-Rad Laboratories, Inc.

- Beckman Coulter, Inc.

- Olympus Corporation

- ACCESS BIO.

- Premier Medical.

- MicroGene Diagnostic Systems (P) Ltd

- Nikon India Pvt Ltd

- BIOMÉRIEUX