Global Imaging Photometer Market Size, Share, Growth Analysis By Type (CMOS, CCD), By Product Type (Full Frame CCD, Interline Transfer CCD, Others), By Application (Display Test, Light Measurement, Surface Inspection, Keyboard Inspection, Automotive Solutions, Others), By End-Use (Consumer Electronics, Automotive Industry, Manufacturing & Industrial, Medical & Healthcare, Aerospace & Defense, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 28125

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

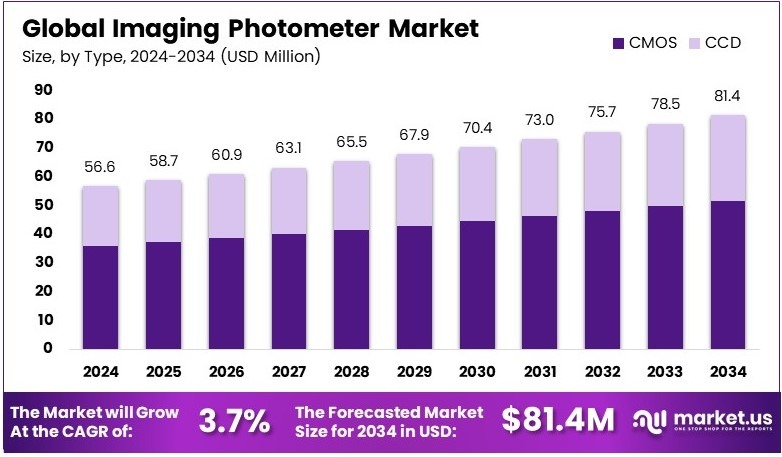

The Global Imaging Photometer Market size is expected to be worth around USD 81.4 Million by 2034, from USD 56.6 Million in 2024, growing at a CAGR of 3.7% during the forecast period from 2025 to 2034.

An imaging photometer is an instrument used to measure light intensity across a surface. It captures light data from various angles and calculates photometric quantities. These devices are commonly used in research, quality control, and lighting design to assess lighting performance and ensure compliance with standards.

The imaging photometer market refers to the industry that designs, manufactures, and sells these light-measuring devices. It serves sectors like lighting, automotive, and electronics. As industries increasingly prioritize precise light measurements for quality and safety, the demand for imaging photometers is growing, offering significant opportunities for market expansion.

The imaging photometer market is growing as more industries require accurate lighting measurements. As companies focus on product quality, photometers help ensure lighting systems meet industry standards. Additionally, industries like automotive, with its focus on headlight safety, rely on precise measurements for better performance. Consequently, the market is expanding to meet these needs.

The demand for imaging photometers is driven by technological advancements and stricter regulations. For example, the automotive sector’s demand for precise lighting measurements in vehicle design is growing. Moreover, as industries focus on energy efficiency and sustainability, imaging photometers play an important role in verifying lighting systems meet these standards, presenting further opportunities.

Despite this growth, the imaging photometer market remains moderately competitive. Several established companies dominate, but new entrants are emerging with innovations. These include better precision, ease of use, and integration with automation systems. Companies that adapt to these trends, such as improving energy efficiency, will be better positioned in the market.

On a broader scale, imaging photometers impact global industries by improving product quality and safety. For instance, in the automotive sector, photometers ensure vehicle headlights meet safety standards, preventing accidents. Locally, these devices are critical in lighting design for both commercial and residential sectors, ensuring energy-efficient and compliant lighting systems.

Key Takeaways

- The Imaging Photometer Market was valued at USD 56.6 million in 2024 and is expected to reach USD 81.4 million by 2034, with a CAGR of 3.7%.

- In 2024, CMOS dominated the type segment with 63.3% due to its superior imaging quality and lower power consumption.

- In 2024, Interline Transfer CCD led the product type segment with 41.2%, driven by its efficiency in image capture.

- In 2024, Display Test accounted for 37.8%, owing to the growing demand for high-quality display screens.

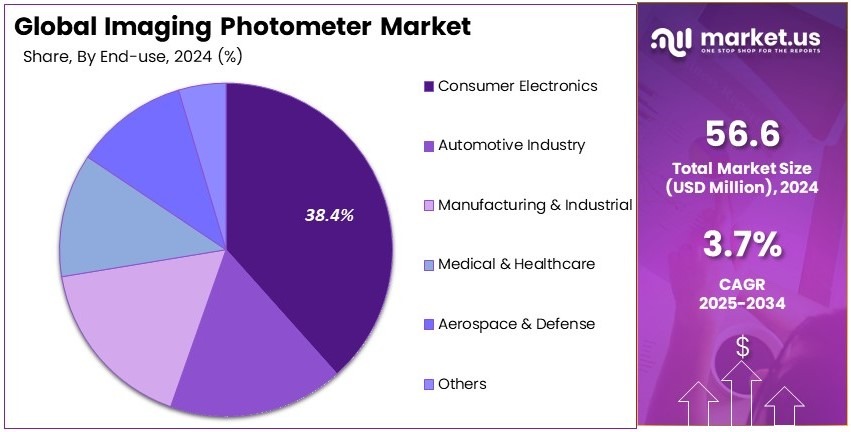

- In 2024, Consumer Electronics held 38.4% market share in the end-use segment due to advancements in display technology.

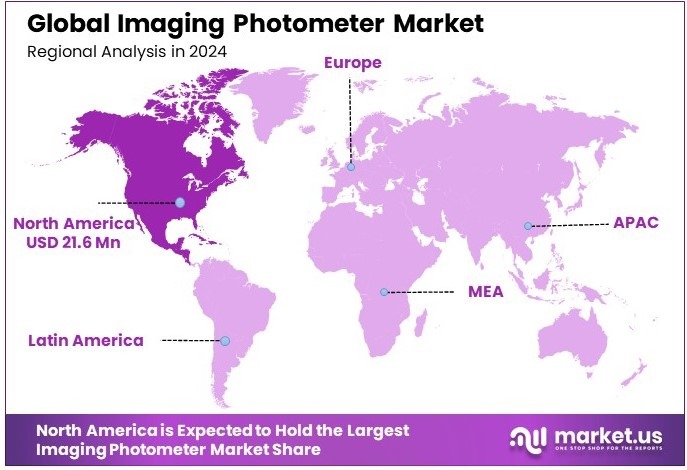

- In 2024, North America dominated with 38% and valued at USD 21.6 million, supported by the presence of key industry players.

Type Analysis

CMOS dominates with 63.3% due to its higher efficiency and low power consumption.

The Imaging Photometer market is mainly driven by the Type segment, where the CMOS (Complementary Metal-Oxide-Semiconductor) sub-segment holds the largest share of 63.3%. CMOS sensors have become the preferred choice in the market due to their significant advantages over other sensor types, especially in terms of power efficiency and the ability to integrate multiple functions on a single chip.

These benefits have led to the widespread adoption of CMOS in applications such as digital cameras, smartphones, and various industrial uses. CMOS sensors are also more cost-effective and have a faster processing speed, making them ideal for high-performance imaging tasks in industries like consumer electronics and automotive testing. This sub-segment’s growth is closely linked to the rising demand for portable and low-power devices, such as smartphones, where efficient imaging systems are essential.

On the other hand, the CCD (Charge-Coupled Device) sub-segment has a smaller market share. Although CCD sensors offer superior image quality, especially in low-light conditions, they are generally more power-hungry and costly compared to CMOS. As such, their use is more common in high-end applications like professional photography and scientific instruments. Despite these advantages, the higher operational costs and power demands limit their widespread adoption.

Product Type Analysis

Interline Transfer CCD dominates with 41.2% due to its excellent image quality in high-speed applications.

In the Imaging Photometer market, the Interline Transfer CCD sub-segment leads the Product Type segment with a share of 41.2%. These sensors are widely recognized for their ability to provide high-quality images in dynamic and high-speed environments.

They achieve this by storing image data in individual pixels and then transferring it quickly, making them ideal for applications like video surveillance, industrial inspections, and scientific imaging. The demand for such sensors has grown due to their capability to capture clear images even in fast-moving scenes, which is crucial in industries like automotive testing and medical imaging.

On the other hand, Full Frame CCD sensors, while known for their superior image quality, especially in low-light conditions, have a relatively smaller market share. This is because they tend to be more expensive and power-hungry compared to other options, limiting their adoption to more specialized applications like professional photography. The “Others” sub-segment includes specialized sensors tailored for unique use cases, but it remains a smaller part of the market due to its niche applications.

Application Analysis

Display Test dominates with 37.8% due to growing demand for high-precision screen quality.

The Application segment is led by Display Test, which holds a significant 37.8% market share. The rise in demand for high-quality displays, especially in consumer electronics like smartphones, televisions, and tablets, has fueled the need for accurate testing of display characteristics such as brightness, color consistency, and pixel quality.

Imaging photometers play a crucial role in this process, ensuring that displays meet the stringent quality standards required by consumers and manufacturers. As display technology continues to improve, particularly with the advent of OLED and MicroLED, the need for precise testing and quality control continues to drive the demand for imaging photometers in this application.

The Light Measurement sub-segment, while holding a smaller share, also plays a crucial role, especially in industries such as automotive lighting and architectural lighting. These sensors help measure light intensity and quality, ensuring that lighting products meet performance and safety standards.

The Surface Inspection and Keyboard Inspection sub-segments also contribute to the market, with surface inspection being particularly important in industrial and manufacturing sectors where precision and quality control are paramount. Similarly, the Automotive Solutions sub-segment is growing as the automotive industry increasingly incorporates imaging photometers into production lines for quality assurance of components like headlights and displays.

End-Use Analysis

Consumer Electronics dominates with 38.4% due to growing demand for advanced imaging technology in gadgets.

The Consumer Electronics sector holds the largest share in the End-use segment, with 38.4%. The need for high-quality imaging systems in everyday devices like smartphones, digital cameras, and televisions is a key factor driving growth.

Imaging photometers are used to ensure the accuracy of display quality, light intensity, and color rendering, which are all crucial in providing consumers with a superior visual experience. The demand for these devices is further fueled by the ongoing trends in smart technology and high-definition displays, which require precise imaging systems to meet the latest standards.

In contrast, the Automotive Industry, while important, accounts for a smaller portion of the market. The growing integration of advanced sensors in vehicles, particularly for safety systems and automated driving, is boosting the demand for imaging photometers in automotive applications.

Similarly, the Manufacturing & Industrial sector plays a significant role in the demand for precise imaging equipment used for quality control in production lines. The Medical & Healthcare sector also contributes to market growth, especially with the rising adoption of imaging technologies in diagnostics and medical devices. Other end-use industries, such as Aerospace & Defense, continue to use imaging photometers, but their share is smaller due to the niche and high-precision requirements of these sectors.

Key Market Segments

By Type

- CMOS

- CCD

By Product Type

- Full Frame CCD

- Interline Transfer CCD

- Others

By Application

- Display Test

- Light Measurement

- Surface Inspection

- Keyboard Inspection

- Automotive Solutions

- Others

By End-Use

- Consumer Electronics

- Automotive Industry

- Manufacturing & Industrial

- Medical & Healthcare

- Aerospace & Defense

- Others

Driving Factors

Growing Demand for Precision Drives Market Expansion

The growing demand for high-precision light measurement in various industries is a major driver of the Imaging Photometer market. As industries increasingly rely on accurate light measurement for quality control, product testing, and research, the need for advanced photometric equipment has risen.

Precision is critical in sectors such as electronics, automotive, and healthcare, where even slight deviations in light levels can impact product quality or performance. Photometers are essential in ensuring consistency, which is why their adoption is expanding.

Additionally, technological advancements in photometric equipment design are improving the accuracy and versatility of photometers, making them more valuable across different applications. The ability to measure light with greater precision has made imaging photometers indispensable in fields like environmental monitoring and material testing. As the demand for more reliable and sophisticated measurement tools continues to grow, the market for imaging photometers is poised for further expansion.

Restraining Factors

High Costs and Complex Maintenance Hinder Market Growth

While the imaging photometer market benefits from increased demand, several factors are restraining its growth. The high cost of advanced imaging photometers is a significant barrier, particularly for small and medium-sized businesses that may not have the budget to invest in high-end equipment. These systems often require substantial initial investment, which can deter potential buyers.

Additionally, the complexity of calibration and maintenance procedures associated with imaging photometers adds to the overall cost of ownership. Companies must invest in specialized technicians or external services to maintain and calibrate the equipment regularly.

Moreover, there is a limited availability of skilled operators to manage and operate advanced photometric systems. This shortage of skilled professionals makes it difficult for businesses to fully leverage the potential of their equipment.

Finally, competition from alternative light measurement technologies presents a challenge, as some industries may opt for less expensive or simpler measurement tools, thus affecting the adoption of imaging photometers.

Growth Opportunities

Emerging Markets and Technological Integration Offer Growth Potential

The Imaging Photometer market offers several growth opportunities. One significant opportunity is the expansion of imaging photometers in environmental and sustainability monitoring. As industries and governments place increasing importance on environmental impact, the demand for precise light measurement in environmental testing and monitoring has risen. Imaging photometers play a key role in evaluating environmental factors like air quality and water contamination levels.

Furthermore, there is a growing demand for non-destructive testing in manufacturing processes, where imaging photometers help ensure product quality without damaging goods. Another opportunity lies in the adoption of smart imaging photometers for automated quality control. These systems can enhance manufacturing efficiency by automating the inspection of products in real-time, reducing human error and improving production timelines.

Additionally, the rise in government regulations on accurate light measurement standards creates a favorable environment for the growth of the imaging photometer market, as industries seek compliance with new regulations.

Emerging Trends

AI and Portable Devices Are Transforming the Industry

Several trending factors are shaping the Imaging Photometer market. The integration of artificial intelligence (AI) in imaging photometers is enhancing the accuracy and efficiency of light measurement. AI algorithms enable photometers to analyze data in real time, improving decision-making and predictive maintenance.

Another significant trend is the shift toward compact and portable photometric devices. As industries seek more flexible and space-saving solutions, portable photometers are becoming more popular due to their ease of use and convenience in various settings, including fieldwork and on-site testing. Moreover, there is increased interest in spectral imaging and multi-spectral sensors, which can provide more detailed and accurate measurements by capturing data across different light wavelengths.

These advancements in photonics are also improving sensor sensitivity, allowing for more precise readings in challenging environments. These trends are driving innovation in the market, leading to the development of more efficient and user-friendly imaging photometers that can meet the evolving needs of industries.

Regional Analysis

North America Dominates with 38.0% Market Share

North America leads the Imaging Photometer Market with a 38.0% market share, valued at USD 21.6 million. This dominance is driven by a high concentration of research and development activities, technological advancements, and the presence of key players in the optical measurement field. The region’s strong industrial base, particularly in sectors such as aerospace, automotive, and electronics, contributes significantly to its high market share.

The adoption of advanced imaging systems in North America is aided by a robust infrastructure, with leading research institutions and innovation hubs. These factors play a crucial role in pushing the demand for precision measurement tools like imaging photometers. Additionally, the market benefits from significant government funding and private investments, especially in areas of photometric testing and quality control, which further contribute to the region’s market leadership.

Looking forward, North America’s dominance in the imaging photometer market is expected to continue. The increasing demand for precise and efficient testing tools, along with the rise of automation in industries like automotive and manufacturing, will fuel the growth of the imaging photometer market. As technology evolves, North America will likely remain a key player, with the development of next-generation imaging photometers driving market expansion.

Regional Mentions:

- Europe: Europe holds a strong presence in the imaging photometer market, driven by high-quality standards and strict regulatory frameworks. Countries like Germany and France are leading the charge, with advanced manufacturing processes that require precise light measurement tools.

- Asia Pacific: Asia Pacific is rapidly growing, fueled by the increasing demand for imaging photometers in sectors like consumer electronics and automotive. Countries like Japan, China, and South Korea are seeing an expansion in industrial applications that require accurate photometric testing.

- Middle East & Africa: The Middle East and Africa region is emerging as a growing market for imaging photometers, particularly in the oil and gas and construction sectors. Investments in infrastructure development are driving the need for accurate light measurement solutions.

- Latin America: Latin America is experiencing gradual growth in the imaging photometer market, with rising demand for optical measurement tools in industries like energy and agriculture. The region is focusing on modernizing its industrial sectors, boosting the market’s potential.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Imaging Photometer market is shaped by several leading companies, with Admesy B.V., Gooch & Housego PLC, Irradian Limited, and Konica Minolta Inc. standing out as key players. These companies are recognized for their innovative solutions in photometry, providing advanced tools for measuring light and color in various industrial and scientific applications.

Admesy B.V. is known for its specialized imaging photometers and colorimeters that are widely used in display testing and quality control. The company’s products are valued for their high precision and versatility, catering to a range of industries including automotive, electronics, and lighting.

Gooch & Housego PLC offers a comprehensive range of photometric solutions, including imaging photometers designed for demanding applications in optics and photonics. The company has a strong reputation in the market for its robust, high-performance instruments used in scientific research, aerospace, and industrial settings.

Irradian Limited specializes in the development of high-precision imaging photometers that provide accurate and reliable measurements for various lighting and display applications. Its products are particularly popular in the LED lighting and medical imaging industries, where accuracy and consistency are critical.

Konica Minolta Inc. brings its expertise in optical technology to the imaging photometer market, providing high-quality instruments used for light measurement and testing. The company’s imaging photometers are commonly used in quality assurance, research, and development, especially within the automotive, healthcare, and electronics sectors.

These companies dominate the Imaging Photometer market with their focus on innovation, accuracy, and reliability. Their products support a wide range of applications across multiple industries, including display testing, lighting design, and scientific research, helping drive the growth and advancement of photometric technologies.

Major Companies in the Market

- Admesy B.V.

- Gooch & Housego PLC

- Irradian Limited

- Konica Minolta Inc.

- Novanta Inc.

- Opsira

- SphereOptics GmbH

- TechnoTeam Bildverarbeitung GmbH

- Westboro Photonics

- Instrument Systems

- OPTE-E-MA

- Everfine

Recent Developments

- Refeyn: In December 2024, Refeyn introduced StreamlineMP, a modular software platform aimed at automating the analysis of large mass photometry datasets. The platform standardizes workflows for key bioanalytical applications, thus enhancing consistency and reducing analysis time significantly. Its first module, the Antibody Stability Module, is designed to automatically characterize aggregation in extensive batches of antibody samples, reducing analysis time by over 80%.

- University of Florida’s College: In December 2024, researchers at the University of Florida’s College of Design, Construction and Planning announced the development of a non-destructive, on-site method for assessing window glazing deterioration using full-spectrum photometry.

Report Scope

Report Features Description Market Value (2024) USD 56.6 Million Forecast Revenue (2034) USD 81.4 Million CAGR (2025-2034) 3.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (CMOS, CCD), By Product Type (Full Frame CCD, Interline Transfer CCD, Others), By Application (Display Test, Light Measurement, Surface Inspection, Keyboard Inspection, Automotive Solutions, Others), By End-Use (Consumer Electronics, Automotive Industry, Manufacturing & Industrial, Medical & Healthcare, Aerospace & Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Admesy B.V., Gooch & Housego PLC, Irradian Limited, Konica Minolta Inc., Novanta Inc., Opsira, SphereOptics GmbH, TechnoTeam Bildverarbeitung GmbH Westboro Photonics, Instrument Systems, TechnoTeam, OPTE-E-MA, Everfine, Westboro Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Imaging Photometer MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Imaging Photometer MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Admesy B.V.

- Gooch & Housego PLC

- Irradian Limited

- Konica Minolta Inc.

- Novanta Inc.

- Opsira

- SphereOptics GmbH

- TechnoTeam Bildverarbeitung GmbH

- Westboro Photonics

- Instrument Systems

- OPTE-E-MA

- Everfine